Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

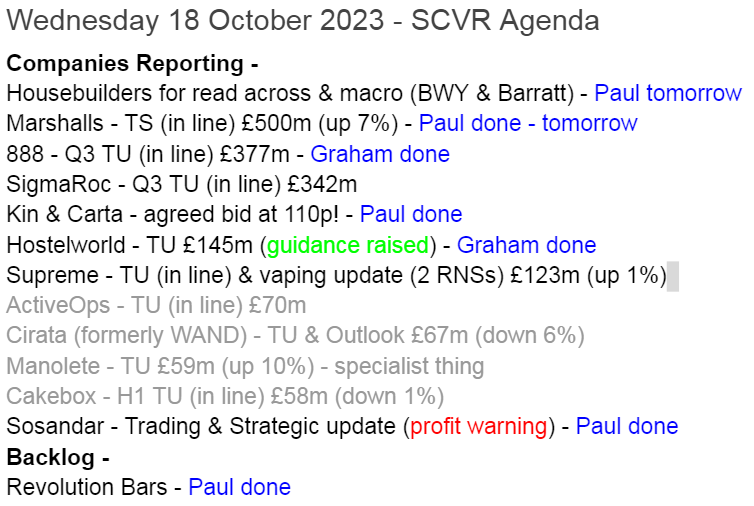

Summaries

Sosandar (LON:SOS) (Paul holds) - 17.75p (pre market) £44m - Trading & Strategic Update - Paul - AMBER

A big profit warning, dressed up to sound like a deliberate change of strategy. I'm not impressed. More detail below. Brace for a likely sharp fall in share price.

Kin and Carta (LON:KCT) - Recommended cash takeover bid (from Apax) at 110p, a 41% premium. Great news for shareholders, congratulations! [no section below]

Hostelworld (LON:HSW) - up 1.5% to 120p (£148m) - Trading update (ahead) - Graham - AMBER

More good news from this online travel agent. Gross transaction values and revenues continue to surge higher, and full-year adjusted EBITDA expectations are upgraded. The debt problem has been solved and my only remaining question concerns the valuation here.

Revolution Bars (LON:RBG) (Paul holds) - 3.2p (£7m) - Preliminary Results - Paul - AMBER/RED

I review the FY 6/2023 results published yesterday. The core chain looks in real trouble, and I think is heavily loss-making now. High risk, especially after a "material uncertainty" going concern warning. There are some positives though - good performance from Peach Pubs, and bank looks supportive, having relaxed terms. This could go either way, for risk-takers only. Best avoided for most investors I think.

888 Holdings (LON:888) - down 3% to 83.3p (£374m) - Trading Update (in line) - Graham - AMBER

After a profit warning last month, 888 has published its Q3 update without further changes in expectations. Revenues are under pressure due to variety of challenges in the Mid East and closer to home. Synergies and other cost savings hopefully keeping things under control.

Paul’s Section:

Sosandar (LON:SOS) (Paul holds)

17.75p (pre market) £44m - Trading & Strategic Update (profit warning) - Paul - AMBER (BLACK for spreadsheet - PW)

Lots of detail in this update, but for me it’s a profit warning, and I think the market is likely to take a similarly dim view.

Previous forecast (Singers) for FY 3/2024 was £58m revenues and adj PBT of £3.1m.

Today that’s been slashed to £46.8m revenues, and only £0.1m adj PBT! That’s a massive miss.

The commentary today tries to persuade us that this is a deliberate strategy to re-educate customers to pay full price, with long-term benefits. I don’t buy that, sorry. Why would you collapse your own profitability and sales growth? Also, what happens to the unsold stock, that still has to be discounted at the end of season?

Net cash of £7.0m looks fine, given that it’s probably near a seasonal low due to stocking up for the busy autumn season.

Poor results for H1 are indicated -

There’s lots more information, and if I’ve understood correctly, it sounds as if SOS is planning to open some of its own physical stores, is that right? Take it from me, running a network of physical stores will be a massive distraction from operating the online business. So I’m not sure that’s a good idea, although they will get amazing deals from landlords on empty shops. Could be a can of worms though, going down this route.

Paul’s opinion - this is clearly very disappointing. The share price has slipped a fair bit in recent weeks, maybe due to sellers who’ve tracked declining online traffic, which I know some investors do?

Unfortunately, we’ll need to adopt the brace position today, as I suspect another 20-30% fall is on the cards (writing this at 07:53).

Quite a few of us thought that the growth plans for this year looked too ambitious, given the relatively slow Q1, and that’s turned out to be correct, but I certainly wasn’t expecting anything like as bad as the revised guidance today. Oh dear.

Still, at least we don’t have to worry about the balance sheet. Slower growth means less pressure on cash, and there’s already plenty of cash, and they’re talking about breakeven in the FY (H2 is busier than H1 remember), so this is a setback, not a disaster.

Revolution Bars (LON:RBG) (Paul holds)

3.2p (£7m) - Preliminary Results - Paul - AMBER/RED

Peach acquisition delivering against a challenging trading environment

Overall result in line with expectations

Revolution Bars Group plc ("the Group"), a leading UK operator of 67 premium bars and 22 gastro pubs, trading predominantly under the Revolution, Revolución de Cuba and Peach Pubs brands, today announces its preliminary results for the 52 weeks ended 1 July 2023.

Sorry for the delay in typing up my notes on these results out yesterday.

I know people think I’ve been a perma-bull on this share share, but that’s not actually true. We’ve been highly critical here of the management, especially their decision to max out the overdraft to buy a chain of gastro pubs, Peach.

Also there’s been the small matter of the pandemic, lockdowns, energy crisis, and cost of living, in a sector which has been battered & bruised for years now. Hence any pre-2020 views are of course from literally a different world.

As the facts have changed so much, and just to clarify, I see RBG as a special (high risk) situation to trade, not an investment. Hence I’ve dipped in & out a few times in recent years, including a tiny current position (which is under 0.5% of my portfolio).

Here are my notes on the FY 6/2023 results -

Revenue up 8% to £152.6m

Adj PBT is a £(2.1)m loss, statutory loss (after big asset writedowns) is £(22.2)m, a deterioration from a small profit LY.

Very poor LFL sales of -8.7%. Bear in mind this is boosted by impressive +14.1% LFL sales at newly acquired Peach Pubs from Oct 22 to Jun 23. So I dread to think what the LFL performance of the core business is - probably well into negative % double digits - which is disastrous for a high gross margin, high fixed cost business. Is the core business actually worth anything now, is my main question? The market cap of £7m is saying not really, no.

Current trading - at least the sales fall is moderating, to -5.5% new year to date (from July to now), and -3.5% in the last 3 weeks. Given that average wages have recently overtaken inflation, then the squeeze on gross incomes has at least begun to reverse. Although of course higher stealth taxes from freezing personal allowances have eaten into net pay - I’d like to see some data on that.

Christmas bookings are good, up 18%, so we might see something of an upturn maybe? RBG needs it, very much so.

Outlook - confident of achieving FY 6/2024 expectations, which is another small loss, little changed from FY 6/2023.

Reasons for weak performance - obvious sector and macro factors, but I don’t buy management’s claim that younger people have been disproportionately impacted by the cost of living crisis. With minimum and low wages up the most (c.10%), I’d actually say the opposite. I think RBG has suffered because newer, fresher formats (eg Stonegate’s “PopWorld”) and the rapid growth in experiential leisure (e.g. XP Factory (LON:XPF) - I hold) is taking a chunk out of their market.

** Going Concern ** a major red flag, with a “material uncertainty” over whether it can keep within bank facility terms in a downside stress test. Normally I don’t risk any significant money on companies with going concern issues, because sometimes it ends up with a deeply discounted placing (RBG did 2 of them in the pandemic), or even insolvency. To be fair, plenty of companies successfully trade through going concern problems. But why take the risk?

Supply chain - it mentions 5 months of “severe disruption” to deliveries, I don’t recall this being mentioned before, so took me by surprise.

Playhouse format - hasn’t worked.

Bank debt - we’ve mentioned this prominently since the acquisition of Peach with debt a year ago. It was a crazy decision, just as the balance sheet had been sorted through 2 placings, to gear it back up again with this acquisition. Although some people have described it as a “life raft” for management, given how badly the core business has performed. It’s looking as if that was an accurate description.

The situation actually looks a lot better than I expected. The bank seem fully co-operative. Evidenced by the facilities being recently relaxed, with £30m available to Dec 2024, and covenants greatly relaxed (nothing related to profitability now, just a minimum liquidity requirement). I think that’s very good news actually, as the risk of an emergency placing looks to have receded, although we don’t know what discussions have gone on in private between the company and its bank.

Net debt of £23.2m at 15/10/2023 is clearly way too high, but remember it owns Peach Pubs, so in an emergency that could be sold off and get the bank back maybe half its money? Sell off a few key performing sites (eg Manchester), and the bank would probably get all its money back. But in that scenario, shareholders would probably end up with nothing. So a shareholder wipe-out here is a possibility in a downside scenario. Hence nobody should be risking money they cannot afford to lose on this share. If it pulls through and begins to flourish as the consumer squeeze ends, then there could be exciting geared upside to the shares. So make no mistake, at £7m market cap this share is now high risk: high potential reward. It could go either way, I don’t know which.

Balance sheet - huge deficit on the lease entries, which tells me they’ve got lots of heavily loss-making sites. Remember the leases were restructured during the pandemic, so things seems to be back to square 1. Maybe a CVA is needed to ditch the problem sites? However, as long as the bank facility remains available, which it seems to be, then I don't see any short term solvency or liquidity problems, it should be able to trade normally, paying suppliers & rents on time, etc.

Cashflow statement - it’s not cash generative. Borrowings were increased to fund the Peach acquisition.

Paul’s opinion - RBG is clearly high risk, possible high reward. As solvency risk is high, I have to mark it AMBER/RED, and that’s probably being kind. The only reason I didn’t go RED is because the bank situation seems a lot better than I expected, with greatly relaxed terms. That buys management time to trade their way out of the current problems with the core Revolution sites. Meanwhile the Peach Pubs are trading well, so maybe that acquisition might turn out to be the saviour of the group, who knows?

What happens next? No idea. Downside scenario - 1p emergency placing and heavy dilution, or insolvency. Upside scenario - trading begins to improve and we get a 3-bagger or more. Your money, your choice, although I imagine almost everyone reading this will be steering well clear, and I don’t blame you! This is for risk-takers only.

Years of misery for shareholders, and huge dilution from 50m to 230m shares too -

Graham’s Section:

Hostelworld (LON:HSW)

Share price: 120p (+1.5%)

Market cap: £148m (€171m)

This is an online travel agent which has seen a number of positive developments over the past year - surging revenues, debt reduction, and a lower interest rate on its debt facilities.

Today it upgrades guidance:

Based on our record revenue performance YTD, we now expect adjusted EBITDA to be in the range of €17.5m to €18.0m for FY23 (up from €16.5m to €17.0m communicated at our AGM in May 2023). This guidance is provided subject to any deterioration in the macro-economic environment, air travel disruptions, or any other material external factors in the balance of year.

Since the travel disruptions associated with Covid, Hostelworld has added a disclaimer to its forward-looking statements in this way. You can’t blame them for a little paranoia, after the disruption experienced in the travel sector!

An extra €1 million in adjusted EBITDA is a very nice indicator of positive momentum - although of course it is not the same thing as real bottom line profitability.

One of the reasons I’ve been hesitant to take an outright positive stance on these shares is an insistence on seeing real profits, rather than adjusted EBITDA. Consensus estimates suggest that Hostelworld will earn only a small net income in the current year.

Let’s get back to the trading update and see the other highlights. These numbers are year-to-date for the first nine months of the year:

GMV (gross transaction value of customer bookings) €496m (+38% year-on-year).

Revenue €75m (also +38% year-on-year).

5 million bookings (+43%).

As you can see, there is tremendous momentum currently. While this is still a function of the post-Covid recovery, it’s also true that results are trending significantly ahead of 2019 (the last pre-Covid year).

Total revenues in 2019 were €80.7m, while the consensus forecast (before today’s upgrade) suggested revenues of €91.3m in the current year.

Let’s round out our summary of today’s news:

Average booking value down slightly year-on-year (4%) due to a higher proportion of Asian bookings.

Net debt €13.4m (it was €22m at the start of the year, and €16m at the end of H1).

Interest rate on the debt reduces further to 2.65% over EURIBOR (it was initially 3.75% over EURIBOR, and then fell to 3.25% over EURIBOR). Net debt to adjusted EBITDA less than 1x.

Graham’s view

Once again, I’m tempted to turn green on these shares (see my comments in June and in August).

In June, the share price was 125p. In August, it was 134p. I’m surprised the share price hasn’t moved higher given the positive momentum and good news that Hostelworld keeps publishing:

However, perhaps the valuation is perhaps still a little punchy? Converted to Euros, the market cap is €171m, for an enterprise value of €184m.

With adjusted EBITDA running at €18m, the company is trading at ten times that. And we can reasonably expect a large gulf between EBITDA and net income.

So I think I need to maintain pricing discipline and stay neutral on these shares for the time being. An interesting company with lots of good news, but perhaps it’s still priced about right for its current stage of progress.

The StockRank still considers it to be overvalued:

888 Holdings (LON:888)

Share price: 83.3p (-3%)

Market cap: £374m

At the time of writing, Graham has a long position in 888.

888 (LSE: 888), one of the world's leading betting and gaming companies with internationally renowned brands including William Hill, 888 and Mr Green, today announces an update confirming its trading during the three months ended 30 September 2023

I covered this company’s profit warning last month in some detail.

With only a few weeks having passed since that warning, it would be strange if this Q3 update included any more nasty surprises.

Key points:

Revenue in the quarter of £405m, down 10% year-on-year.

UK & Ireland online: revenues down 10% “driven by ongoing impact of safer gambling changes and refined marketing approach, coupled with lower-than-expected betting net win margin from customer friendly sports results in September, particularly UK football”.

Retail (i.e. physical locations): revenue +1% year-on-year.

International: revenue down 19% year-on-year “with an ongoing significant impact from compliance changes in dotcom markets, particularly the Middle East”.

Problems in the Middle East with 888 failing to do its money laundering checks properly were responsible for a profit warning at the start of the year (and the former CEO left the company at the same time). The impact of this compliance issue appears to be dragging on.

The main positive takeaway that I am bringing from this update are:

Synergy delivery on track and significant cost savings being delivered - £100m of synergies were targeted from the William Hill merger, and if they are delivered then we have a good chance of seeing positive financial results before too long.

No change to Q4 revenue expectations (down mid-single digit) and FY 23 Adjusted EBITDA margin 18-19%.

Remember that the big-picture goals here are for £2 billion of revenue by 2025 and an adjusted EBITDA margin of 20%.

Assuming reasonable cash flow conversion, that would enable the company to pay its interest bill comfortably, reinvest in the business, and hopefully start to reduce its overbearing debt load.

I have no reason today to change my view on this company: it’s very high risk, but I am neutral as I do see significant upside if it pulls through. If trading continues to deteriorate, then it could well end up being a zero for shareholders.

The 2028 bond is trading at 93 euro cents, according to the Frankfurt stock exchange:

The September profit warning has hit confidence, but it’s far from panic in the bond market.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.