Good morning from Paul & Graham!

Today's report is now finished.

Press reports say that the recent demise of Safestyle (double glazing), going into administration recently, has resulted in the administrator making 680 people redundant. A stark reminder that there's a human cost to failed investments. Let's hope they are re-employed if the operating business is sold to a new owner.

Graham's youtube link for today - covering UP Global Sourcing Holdings (LON:UPGS) , IG group (LON:IGG) and Elementis (LON:ELM)

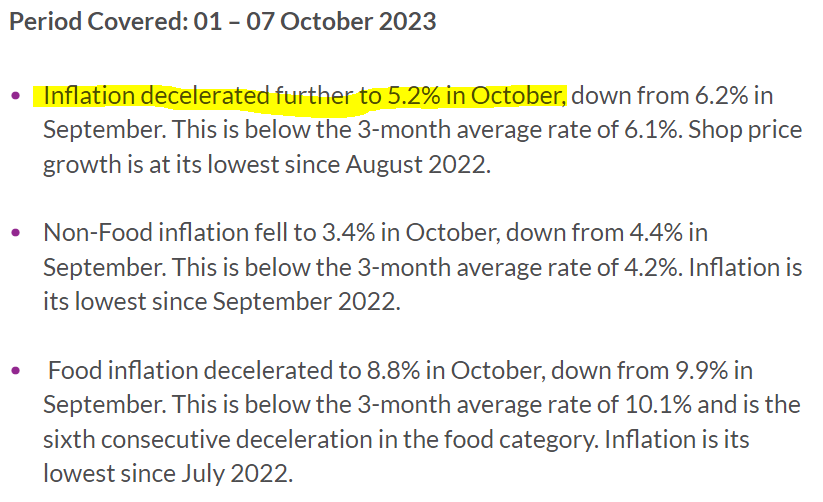

Inflation falling

Some positive-sounding data out today from the British Retail Consortium here, showing a sharp reduction in retail (shop prices) inflation - good news I think (but not sure what expectations were), and remember this is not the official ONS data that includes a wider spectrum of household costs beyond retail -

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries

Heiq (LON:HEIQ) - down 60% to 8.5p (£12m) - Late accounts published - Paul - RED

Restored from suspension today, after late accounts FY 12/2022 published yesterday, with H1 2023 accounts also filed. Hopeless numbers, with heavy losses. Going concern “material uncertainty”. I recall watching a webinar a while ago from HEIQ which was totally unconvincing, and completely put me off investing, thank goodness. All its grandiose promises have come to nothing. There’s another one imminent on IMC I believe, so maybe that might be a bit better, or failing that, might at least be entertaining? We were RED in Jan 2023, and remain at RED. [no further detail below]

Begbies Traynor (LON:BEG) - Up 1% to 116.7p (£184m) - Q3 Red Flag Report - Paul - AMBER/GREEN

Our quarterly dose of depression, courtesy of Begbies Red Flag Report, which I glance at below. It also seems a good time to review BEG shares, which have fallen recently, despite market conditions for insolvency practitioners improving, with a 25% increase in companies in financial trouble. Shares might be worth a fresh look maybe? Lowish forward PER, but little asset backing is the quick version.

Elementis (LON:ELM) - up 3% to 115.4p (£678m) - Trading update (in line) - Graham - AMBER

This specialty chemicals company has issued an in line trading update. Revenues are flat quarter-on-quarter and down year-on-year. Financial performance has been lacklustre but I’m intrigued by the possibility that we could see a takeover here in the near future.

UP Global Sourcing Holdings (LON:UPGS) (new ticker: ULTP) - up 5% to 120p (£107m) - Results for FY July 2023 (in line) - Graham - GREEN

These results are in line with expectations and the outlook for FY July 2024 is also currently in line. At about 8x earnings, with modest debt, I remain positive on this stock. It owns a few decent household brands and seemingly hasn’t put a foot wrong in recent years.

D4t4 Solutions (LON:D4T4) - 155p (£62m) - H1 Trading Update - Paul - AMBER/GREEN

An in line update from this interesting software company, that never quite seems to deliver on its potential, although is habitually (albeit unpredictably) profitable. Plenty of cash, on a safe balance sheet. I like it, and think it could become a bid target maybe? But tough macro could make it difficult to convert the pipeline maybe?

essensys (LON:ESYS) - up 5% to 28.25p (£18m) - FY 7/2023 Results - Paul - RED

essensys plc (AIM:ESYS), the leading global provider of software and technology to the flexible workspace industry, announces its audited results for the financial year ended 31 July 2023.

These are shockingly bad figures. Revenue up 9% to £25.3m, but a huge loss before tax of £(15.5)m (last year also a loss, of £11.1m). Staggering cash burn, with net cash down to £7.9m, from £24.1m a year earlier. The commentary says that it has cut costs, which looks vital for survival to me. So it reckons it can move to positive cashflow next year, FY 7/2025.

Paul’s view - the strategy so far seems to have been reckless in the extreme, re cash burn. Let’s hope management has cut costs deeply enough, and quickly enough, to save it from going bust. We’ll keep an eye on it, and if the facts & figures improve, happy to amend my view on it. [no section below].

Paul's Section:

Begbies Traynor (LON:BEG)

Up 1% to 116.7p (£184m) - Q3 Red Flag Report - Paul - AMBER/GREEN

Many thanks to this listed insolvency practitioners, Begbies for its Q3 Red Flag Alert Report which is out - here.

As no doubt we would all expect, financial distress at companies is worsening - up 25%.

It's a freely available, published report, so hopefully they won't mind me copying (with thanks) the top 10 most under pressure sectors, which ties in with the profit warnings we've seen in many small caps -

Looking at BEG shares, they've come down somewhat recently, which seems odd considering the macro picture appears to be worsening, due to aggressive interest rate hikes, thus improving the outlook for BEG. Could this be a time to take a fresh look at BEG shares I wonder? The valuation metrics are looking quite appealing again, so I think yes it might be worth a fresh look. Low forward PER of 10.9x. Although note there's no asset-backing to speak of.

As we've also mentioned before, both Graham and I don't particularly like the complicated accounts, with lots of adjustments.

D4t4 Solutions (LON:D4T4)

155p (£62m) - H1 Trading Update - Paul - AMBER/GREEN

D4t4 Solutions Plc (AIM: D4T4, "the Group", the "Company", "D4t4"), the AIM-listed data solutions provider, provides the following trading update for the six months to 30 September 2023.

A reminder that D4T4 is in the process of changing the group name to “Celebrus Technologies”, which is its lead product.

As a reminder, checking our previous notes here -

3/4/2023 - AMBER - down 16% to 190p on a profit warning caused by contract delays. Roland cautious, but Paul more upbeat. A quarter of mkt cap is net cash.

9/8/2023 - AMBER - up 8% to 210p - delayed contract now won. Strong pipeline. Vague outlook. Potentially interesting.

I’ve checked, but cannot see any price-sensitive news since then (unless shareholders are repelled by the new name?!), so I can only guess that the considerable fall in share price to 155p has been due to the general small caps market malaise? Could it be a buying opportunity, I wonder? Or is the price fall sensible caution over sector worries that customers might be less willing to commit to new software spending, which we’ve seen some signs of?

Here’s the latest news in yesterday’s H1 trading update -

This sounds OK, in the context of H1 being traditionally the slower half -

Results1 are expected to be in line with management expectations, with revenues of approximately £13.0 million (H1 FY23: £8.1 million) and adjusted profit before tax2 of approximately £0.2 million (H1 FY23: loss of £1.3 million).

2 Adjusted profit before tax is calculated before amortisation of intangibles, foreign exchange gains/losses, share based payment charges and one-off reorganisation costs.

It’s good when companies are open about unusual factors which benefit results, so I like this bit -

We have made progress as we continue to convert our improving sales pipeline, while the outcome was also assisted by the revenues related to the delays in contract signings at the previous year end, which were signed during this period.

Annualised recurring revenue has only increased a little in H1, from £16.7m at the start, to £17.4m. That’s about 54% of forecast revenues for FY 3/2024 - good, but not enough to make forecasts rock-solid. We’ve seen in the past that D4T4 is still heavily dependent on timing of individual contract wins/renewals for its profit outcome each year. That does introduce risk, and investor nerves, as we hold our breath and hope that the H2 weighting comes through each year as planned, which sometimes it does, and sometimes doesn’t. Hence the erratic profits, even before the pandemic -

Although I’m reassured it remained profitable, even in bad years, and throughout the pandemic, which together with a groaning cash pile, makes this seem erratic, but fundamentally safe, I reckon, if you’re prepared to accept shorter term volatility in performance and share price.

Cash - was £14.7m at Sept 2023, more than enough I’d say. Plus it’s now earning interest on that cash.

The last balance sheet looks fine, with about £17m on NTAV, including a £17.2m cash pile with no debt, so note the £2.5m reduction in cash pile in H1. About £850k cash outflow would be the 2.5p final divi from last year, paid in Aug 2023.

So even if D4T4 hit a poor patch of trading, which we have to consider for many companies in tough macro, there would not be any need for an emergency fundraise, or worries about covenants, etc., due to its healthy net cash position, and favourable working capital cycle (getting paid up front, see the deferred income line on the balance sheet to measure that).

Outlook - it says it has “continued to invest in Sales and Marketing” - does that mean higher spending? Sounds like it. The conclusion is -

These factors provide us with confidence of another year of progress and a full year performance in line with management expectations.

Paul’s opinion - a market cap of £62m (155p) doesn’t seem much for a software company that is always profitable, and seems to have considerable potential, and plenty of cash.

Could it be a bid target, I wonder? Wouldn’t surprise me. The shareholders are mostly well-known institutions, I can’t see any obvious blocking shareholders, like founder mgt, so a takeover deal would probably be easy to agree by a buyer prepared to pay a decent premium.

D4T4 always seems to be on the cusp of great things, but never quite gets there, in terms of stellar growth.

Today’s update isn’t madly exciting, but steady - which is fine by me, in tough macro. It must be hard to convert pipeline into sales right now.

I think AMBER/GREEN (mildly positive) feels about right to me, based on the facts, figures, and forecasts as they are today.

What do chartists think of the long-term chart?

Graham’s Section:

Elementis (LON:ELM)

Share price: 115.4p (+3%)

Market cap: £678m / $824m

This chemicals company has had a very mixed share price performance in recent times. Profitability has been weak for the past several years:

Today we have a brief in line with expectations trading update for Q3.

Key points:

Q3 revenue is down 7% at constant currencies against last year, but is similar to Q1 and Q2 of the current year.

Personal care: “sequentially stable, but below a strong prior year period”.

Performance specialties: “resilient performance”, with volumes weak but benefits from pricing and product mix.

CEO comment:

Despite the industry and macroeconomic conditions remaining uncertain, we remain well positioned to take advantage of growth opportunities across our market segments.

Unfortunately the financial performance of this large business - expected revenues of $700m+ in the current year - has been lacklustre since demand was hit during the Covid era.

Interim results published in July showed an adjusted operating profit of $53m, but after-tax net income was a much more modest $27m.

At this valuation, there are signs of possible value creeping in:

However, we also need to bear in mind that the company is carrying about $250m of net debt. So enterprise value (cost of equity plus debt) is $1 billion+.

Investor activism!

US fund managers Franklin Templeton have a 9.8% shareholding in Elementis under their “Small Cap Value” strategy.

Last month, they wrote a letter to the Elementis Chairman, urging him to arrange a sale of the entire company. Among other things, they said:

“the Company's capital allocation decisions have contributed to an extremely disappointing degradation in the share price” - pointing to large acquisitions in 2017 and 2018 which cost more than the current market cap of Elementis.

Return on capital has more than halved and the 17% operating margin target has not been met.

Elementis rejected takeovers at 130p and 160p, with management saying that fair value was 198-225p. But the share price remains far below that range.

In the end, they said:

We believe that the Company is not of a sufficient size to accomplish its targets. We contend it would benefit from being part of a larger organization to achieve economies of scale. The Company's revenue is half that of its next closest peer (and a quarter of the size of the peer median of $3B). However, as noted above, prior attempts to gain scale inorganically have yielded disastrous results.

Under these circumstances, a strategic merger seems necessary and, ultimately, inevitable.

Elementis did not say very much in response:

Our Board does not believe that Franklin's request to initiate an immediate sale of the Company is currently in the best interests of its shareholders given the substantial value still to be realised.

I’m not sure who I agree with: the fund managers are probably right that capital allocation has been poor and that the company should ultimately be sold to a larger peer. But they also seem rather impatient for the share price to go to fair value. A little bit of patience can go a long way.

Graham’s view

I’m tempted to turn positive on this one but I’d like to see a year or two of clean profits, and I’d also like to see more progress on debt reduction.

Of course, by the time that happens, the company might have already given in to a takeover offer. Or the share price might have already gone to where management said was fair value (198-225p).

Specialty chemicals is a sector that has treated many investors very well and maybe this one is worth looking at a bit more closely now, especially if shareholder pressure is making a takeover in the next year or two more likely.

This is also pretty much what I said in April - Elementis is worth a closer look.

UP Global Sourcing Holdings (LON:UPGS)

Share price: 120p (+5%)

Market cap: £107m

Ultimate Products, the owner of a number of leading homeware brands including Salter (the UK's oldest houseware brand, est.1760) and Beldray (est.1872), announces its audited results for the financial year ended 31 July 2023

I’ve been positive on this one - e.g. last time we covered it here, in August.

Today’s results are in line with expectations.

Revenue +8% to £166m entirely through volume increases (not pricing).

Slight increase in gross margin from 24.9% to 25.7%, “driven by online sales growth and the fall in global shipping rates”.

Adjusted PBT +6% to £16.8m

Actual PBT +4% to £16m

With less than £1m of adjustments, these look like clean numbers to me.

Borrowings - as previously announced (see the July SCVR), net debt finished the financial year at £15m, a nice improvement from £24m at the end of the previous financial year.

Gross debt is £20m and includes a mix of overdraft, term loan and invoice discounting.

Dividend - the total dividend for the year is 7.38p (last year: 7.12p), of which 4.95p is the proposed final dividend.

New Ticker - UP Global Sourcing Holdings plc is no more. From now on, this will be Ultimate Products Plc. The new ticket is ULTP.

Outlook - in line with expectations for FY July 2024.

Net debt is continuing to reduce as the Group de-levers following the transformational Salter acquisition at the end of FY21. In the current environment of higher interest rates, the Group's low net bank debt/adjusted EBITDA ratio, combined with its interest rate hedges, provides both a competitive advantage and growing optionality in the use of free cash flow.

Estimates - with thanks to Equity Development, here are FY July 2024 forecasts:

Revenues +6% to £176.3m

Adjusted EPS unchanged at 15.4p

Reading through the ED report, I see that slower forecast EPS growth in FY 2024/FY 2025 is attributed to higher UK corporation tax and possibly higher taxes in Germany (where ULTP has been focusing recent efforts). Of course most other companies have also faced the headwind of higher corporation tax this year.

Graham’s view

With another update that’s in line with expectations, there is once again little reason to change your prior view on this one. I remain positive on the stock for the same reasons as before - good management track record, modest leverage, and a cheap valuation.

Anecdotally, I’ve just realised that I own a Salter weighing scales! And a very nice one it is, too! The other key owned brand is Beldray and the Russell Hobbs brand (for non-electrical products) remains on licence at Ultimate Products.

I fail to see what is the catch with this at 8x earnings:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.