Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

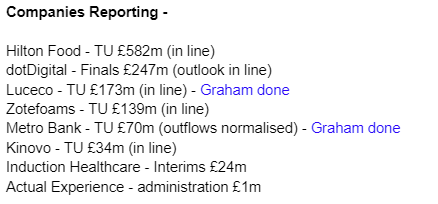

Summaries

Metro Bank Holdings (LON:MTRO) - unchanged at 42.45p (£73m) - Q3 Trading Update - Graham - AMBER

This challenger bank reports that deposit outflows have returned to “more normal ranges” following the announcement of its proposed fundraising package. I take the opportunity to review this package, concluding that it has treated equity investors well in the circumstances.

Luceco (LON:LUCE) - down 4% at 104.7p (£168m) - Q3 Trading Update - Graham - AMBER/GREEN

This electrical and lighting group confirms that trading is in line: expectations have already been upgraded twice in the current year. I’m more lukewarm on this than my co-writers as I find the sector too volatile, but I can also see the attractive features of this share.

Graham's Section

Metro Bank Holdings (LON:MTRO)

- Share price: 42.45p (unch.)

- Market cap: £73m

Continuing the coverage of this one from October, when the company admitted that it was considering a range of options including equity issuance, debt issuance, and asset sales.

Shortly afterwards, it announced a capital package worth £325m: £150m of new equity and £175m of risky debt (“MREL”) paying 12%. On top of that, it would refinance £600m of existing debt.

As far as the equity was concerned, £150m was to be raised at 30p per share (the share price was 37p on the day the company responded to press speculation).

The equity raise hasn’t gone through yet, so the share count remains at 172 million.

When it happens, it will result in the creation of an additional 500 million shares. That's a dilution of about 300%.

However, the share price in early October was already pricing in lots of bad news for the existing equity, and the proposed 30p fundraising price is not nearly as bad as it might have been.

Indeed, the share price is currently higher than it was when I covered the company in early October, before the fundraising was announced.

All of which brings us up to speed for today’s Q3 trading update.

The table of new data is as follows:

Over the three months to September 2023, we have a slight reduction in the loan to deposit ratio, i.e. this metric becomes slightly safer.

Deposits rose slightly over the three months. As speculation around the bank’s financial health mounted, outflows then rose, but:

As announced on 8 October, post quarter end Metro Bank noted an increase in deposit outflow rates in advance of the announcement of the capital package. Since the announcement, daily flows have returned to more normal ranges.

Ok, so perhaps this doesn’t mean “completely normal”, but at least it’s “more normal”.

We also learn in today’s update that Q3 saw “continued momentum in Personal and Business Current Account growth and customer acquisition as well as a modest statutory profit after tax.”

Graham’s view

There was a divergence of opinion here last time we looked at this one - I was the divergent opinion which didn’t want to put a “Red” rating on it, which was an unusual stance to take!

While acknowledging the risk of severe dilution for shareholders, I thought that the shares were already doing a good job of pricing this in: June 2023 net tangible assets per share were £4.42, ten times the share price! It was either going to zero or it was going somewhere else - and the “somewhere else” could be significantly higher than the current share price!

I also observed that the bank’s capital ratios - CET1 and Total Capital - were well above the minimum requirements, and it claimed to be profitable.

We now have the details of the planned fundraising. It doesn’t treat the existing equity too badly, in my view, especially considering that Tier 2 bondholders are taking a haircut as part of the deal.

Yes, we have dilution of 300% but based on the interim figures the shares would still be trading at a big discount to tangible book value, even after this fundraising. Of course it remains to be seen what level of impairments this balance sheet might ultimately inflict on investors.

In conclusion, I think it’s reasonable for me to maintain my Amber stance on this one. I have little temptation to invest in the stock myself, because there are many other financial stocks I prefer. And this one could still turn out to be a zero. But the axe hasn’t fallen yet, and there is still no guarantee that it will.

The company’s 2025 bond is currently trading at 86p, up from a low of 57p:

Luceco (LON:LUCE)

- Share price: 104.7p (-4%)

- Market cap: £168m

Luceco plc ("Luceco" or "the Group"), the supplier of wiring accessories, EV chargers, LED lighting, and portable power products, is pleased to provide the following update on trading for the three months ended 30 September 2023 ("Q3 2023").

This update is in line with expectations.

Key points:

Q3 revenues up 8.3% year-on-year.

Adj. operating margin just below 12% in Q3, vs. 10.7% in H1.

Net debt falls from £43m to £30.5m during Q3 (seems to be because of a working capital unwind).

Net debt ratio of 0.9x, below target range 1-2x.

CEO comment:

Whilst demand from energy saving professional projects continues its positive path; we are seeing some impact of reduced demand in certain of our end markets as the UK consumer continues to experience economic headwinds. Luceco's strong cash generation in the quarter was particularly encouraging, and with our low levels of net debt, the Group is well placed to invest in growth and enhance earnings in line with strategic priorities.

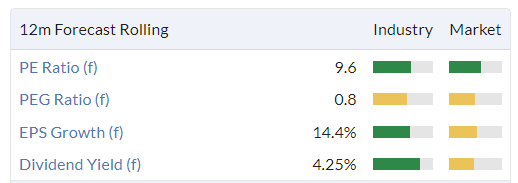

Estimates: with thanks to Research Tree, I see that Liberum has left its EPS estimates unchanged for this year and next (but it notes that these estimates have already been upgraded twice in 2023). The EPS estimate for the current year is 10.4p, rising to 11.7p next year. So the current PER is about 10x.

Liberum says “the strength of the balance should enable a return to value-adding M&A”.

Graham’s view

Roland covered Luceco’s interim results in lots of detail in September.

The last few years have been a rollercoaster:

In line with Roland’s view (and Paul’s view from July), I am warm or lukewarm on Luceco shares.

Profits are volatile but the company does have a track record of consistently generating at least some profits and dividends have been paid since 2019 (albeit with a dividend cut in 2022).

Quality is above-average according to the ROCE figures, and I note that there is plenty of alignment on the Board of Directors. The Chairman leads an investment company that is Luceco’s largest shareholder (22%), also apparently owning 6% in his own name. The CEO owns 18%.

However, electrical and lighting products aren’t a sector where I feel at home - companies in this space are vulnerable to spikes in demand, and I’m not sure what their sustainable competitive advantages might be.

I’m happy to defer to my co-writers and leave the stance here as Amber/Green. Valuation does appear to be reasonable, with a modest debt load relative to profitability and with post-Covid trading having normalised. So the outlook for shareholders should hopefully be quite good!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.