Good morning, just Paul here today.

I've got a lunch in Oxford today, so will have to rush out this report early. I'm meeting Tom Benyon, founder of charity ZANE, to hear an update on the situation in Zimbabwe, which I believe is particularly grim at the moment with another outbreak of cholera, and continuing hyper-inflation. Many thanks to those of you who support ZANE with monthly donations, it's literally keeping vulnerable people alive. It also helps me put my own problems into perspective, when I hear about Zimbabwe.

Right, gotta dash! Today's report is now finished. Sorry this has been such a rushed job, but I covered everything on the list!

Tune in for tomorrow's next thrilling instalment of my weekly podcast!!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries

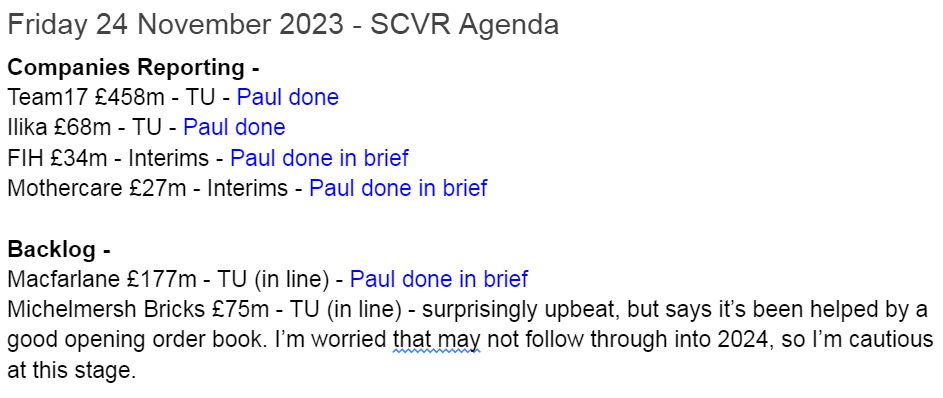

Team17 (LON:TM17) - 314p (pre-market) £458m - Trading Update (profit warning) - Paul - AMBER/RED on fundamentals, BLACK (profit warning) for spreadsheet

This looks like a profit warning due to various factors. I'm not keen on the computer games sector generally. Complicated accounts, and a lack of broker notes ended up making this quite difficult to untangle.

Ilika (LON:IKA) - Unch 43p (£68m) - Trading Update - Paul - AMBER/RED

Jam tomorrow batteries developer. Makes lots of encouraging-sounding noises, but it still hasn't commercialised anything. Could it be on the cusp though? I'm sceptical, but there's a chance it might surprise, just a complete punt at this stage.

FIH (LON:FIH) - unch 270p (£34m) - Interim Results - Paul - AMBER

Revenue up 17% to £26.7m in H1. Underlying PBT £0.6m (unchanged). There’s a heavy seasonal bias to H2 profits. Net debt of £3.6m (excl leases). C.£40m NTAV.

Paul’s view - a very peculiar group of companies. Not sure why it exists, or is listed anyway? Nicely asset backed though, and paying a 2.8% dividend. One for special situations investors maybe? [no section below].

Mothercare (LON:MTC) - down 4% to 4.5p (£25m) - Interim Results - Paul - RED

Better than I was expecting. H1 PBT £1.8m adjusted, or £2.0m statutory.

Balance sheet - big issues are bank debt, and pension deficit. So this is a special situation which hinges on them being able to refinance/reduce those liabilities. Hence high risk of dilution through a placing, if it’s possible to do one.

Paul’s opinion - a high risk special situation. Could go either way. I’ve been RED in the past, due to the high risk. I’m toying with easing that a little to amber/red, as there’s a possibility this might survive, and maybe even recover. Although on balance, I’ll wait until it’s refinanced before moving. So let’s stick with RED to reflect the high risk. [no section below]

Macfarlane (LON:MACF) - issued an in line update yesterday for FY 12/2023, despite weaker volumes and pricing. Mitigated through new business wins, management of pricing & costs, and 3 acquisitions (all performing well).

Sorry I don’t have time to review it in more detail, but see the archive for plenty of coverage. We like this share, good value/GARP business with conservative accounting. Shares never seem to go anywhere, but zoom out to the long-term and it’s been a 7-bagger in the last 11 years, and pays divis on top. I think this is an excellent choice for long-term investors.

Michelmersh Brick Holdings (LON:MBH) - see very brief comment in agenda above.

Paul’s Section:

Team17 (LON:TM17)

314p (pre-market) £458m - Trading Update (profit warning) - Paul - AMBER/RED on fundamentals, BLACK (profit warning) for spreadsheet

Graham normally covers this computer games developer, sounding mildly positive (but viewing it as AMBER) in updates on 29 March, and 6 June this year.

Today it says re FY 12/2023 -

Revenues expected to be “modestly ahead of current market expectations”.

However, sales mix has been less favourable, with lower margins.

“Too slow to address some project overspends”.

Cost-cutting will benefit next year.

Impairments to be made against some games in FY 12/2023.

New guidance for FY 12/2023 -

Consequently, the Group now expects to deliver full year adjusted EBITDA of at least £28.5m, which includes non-cash title impairments of up to £11.5m.

Annoyingly, it doesn’t provide the previous guidance, so I have to waste my time now trying to find out what change this is.

Adj EBITDA was £16.5m in H1, and the interim commentary suggested an H2 weighting was anticipated. So the new guidance today implies a fall to c.£12m adj EBITDA in H2, which looks like a miss of possibly upwards of £5m?

However, will they be adjusting out the non-cash impairment charge of £11.5m mentioned above?

EBITDA is usually a particularly useless and misleading measure in this sector, because the up-front development costs of new games are capitalised onto the balance sheet. Although doing a little digging, TM17 seems to state its EBITDA on a more conservative basis, and leaves in the amortisation charge of development spend, so it's actually OK in this case.

TM17 capitalised £18.3m of dev spend in H1.

On checking the 2022 accounts, I think it must state EBITDA after amortisation of development spend (yes, it does). Note 8 to 2022 accounts shows development spend of £26.0m, but an amortisation charge of only £9.3m, so profits are being boosted considerably versus cashflow, by this mismatch.

This is complicated, and I don’t have full information, due to lack of broker notes.

Stockopedia is showing a broker consensus of £35.9m net (after tax) profit for FY 12/2023.

I’ve manually recalculated it, and I’m coming out with a PAT of c.£28m, assuming 25% tax, and assuming that the £11.5m impairment charge is adjusted out.

So it looks like a c.23% profit miss, would be my best guess, using incomplete information.

At EPS level, that would mean the consensus of 25.8p currently dropping to around 19.9p. What PER to put that on? 10-15 perhaps, which means 199p-299p per share. I haven't looked yet at the live share price, but suspect it will drop into that range today.

We’ll have to wait until next week to see how the Stockopedia broker consensus figures change, so treat my estimates here as provisional, and based on incomplete information.

Cash - it seems to have plenty of headroom, with a £45.2m cash pile at 30 June 2023.

Overall its last balance sheet wasn’t great, with only £16m NTAV.

FY 12/2024 outlook -

The Group has an exciting schedule of high-quality new releases planned across the Group in 2024, while back catalogue investments will continue to support revenue growth. Management will provide greater clarity on FY24 at the full year results, but currently expects to see an improved underlying trading performance compared to FY23.

Paul’s opinion - I don’t have enough information to form a definite view, but this is definitely a profit warning, which I’ve estimated at about a 23% miss against broker consensus.

So expect shares to fall.

I’m not that happy with the business model, and this is a horrible sector with dangerous business models of up-front heavy development spend, then a short and unpredictable sales window to earn that money back. Although back catalogue sales do help.

Also we’ve seen from other profit warnings in the sector, that online distribution platforms have become less generous with their payments.

There have been takeovers though.

Overall, I’m avoiding everything in this sector, and with a profit warning today, I’ll go with AMBER/RED.

Update at 09:20 -a brutal share price reaction, down 42% to 183p at 09:21 - bad luck to any holders here.

Ilika (LON:IKA)

Unch 43p (£68m) - Trading Update - Paul - AMBER/RED

I’ve followed this innovative battery development company for many years. It floated in 2010, and has been promising great things ever since, racking up losses every year, and repeatedly raising fresh equity to burn.

The jagged share price below shows the impact of numerous upbeat-sounding updates, and short-lived booms in share price when a speculative frenzy takes hold from time to time, before fizzling out again every time.

The 2021 boom & bust was particularly pronounced, I wonder if that’s where some of the bounceback loans ended up?! Either IKA, or Bitcoin maybe?!

Today Ilika says -

Ilika (AIM: IKA), a pioneer in solid-state battery technology, provides an update on trading and notice of results for the six months ended 31 October 2023 (the "Period").

Shipment of batteries to customers have started (at long last).

“Key milestone” with licensing agreement (Aug 2023) - Cirtec Medical (USA), sounds like it’s limbering up to start production.

Goliath Programme - positive noises, but it doesn’t seem to have started production yet.

Prototypes going to car manufacturers next year for evaluation.

H1 revenue £1.3m higher due to grant receipts, not expected to repeat in H2.

H1 EBITDA loss of £(1.9)m

Cash looks OK for now, with £13.2m (although down by £5.4m in a year) - the company has a long history of continuous cash burn.

Paul’s opinion - it’s more of the same. Jam tomorrow, promising sounding progress, but nothing of commercial value yet.

I’ll go with AMBER/RED, due to the extremely slow development of these batteries. Unless you’re a sector expert in innovative batteries, then this share is just a complete punt.

Ilika sounds close to achieving commercialisation, but that’s always been the case in the many years I’ve followed this share.

£13m cash in the bank means another placing is not likely until 2025 or 2026, thankfully.

For people who like a speculative punt, this one could be quite fun! Personally I wouldn’t risk money on this unless I was relaxed about seeing it wither away. Although look what happened in 2021 - in a bull market, and supported by rampy-sounding announcements, this type of share can provide some excitement. The trick is obviously to bank the profits before the party ends. One day, who knows, it might commercially succeed, and the fact that credible third parties are backing it, means I think there’s some possibility of a favourable outcome here, eventually. So despite my dismissive tone above, there could be something interesting here maybe?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.