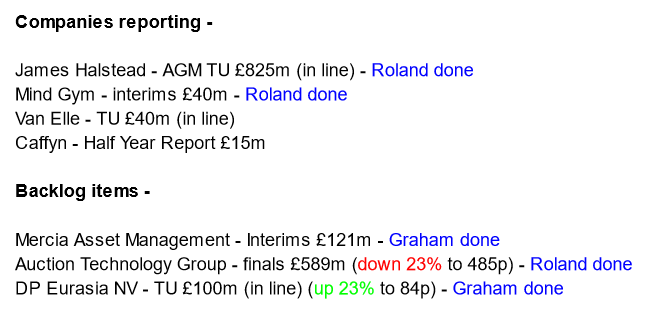

Good morning, it's Roland and Graham here with today's report.

The RNS feed is a bit quieter today, as it's Friday, so we're hoping to catch up with some backlog items from earlier in the week.

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions

on them as possible candidates for further research if they interest

you. Our opinions will sometimes turn out to be right, and sometimes

wrong, because it's anybody's guess what direction market sentiment will

take & nobody can predict the future with certainty. We are

analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or

serious problems, so anyone looking at the share needs to be aware of

the high risk. Sometimes risky shares can produce high returns, if they

survive/recover. So again, we're not saying the share price will

necessarily under-perform, we're just flagging the high risk.

Agenda

Summaries

Mercia Asset Management (LON:MERC) - 28.5p (£127m) - Interim Results - Graham - GREEN

This regional investor posted interim results this week. The investment thesis I set out at the start of the year remains intact, I think: Mercia offers a strong cash position, a healthy 3rd party fund management business, and a big discount to NAV. Share buyback now underway.

DP Eurasia NV (LON:DPEU) - 84.5p (£124m) - Interim Results - Graham - AMBER

Corporate drama as the DPEU’s majority shareholder wants to buy it for 85p per share, but they didn’t come to an agreement with DPEU’s “extremely disappointed” board before making the offer. The company is trading very well and I agree the bid is opportunistic.

Mind Gym (LON:MIND) - down 3% to 37.4p (£38m) - interim results - Roland - RED

This corporate training software group has reported a big H1 loss and significant cash outflows. The outlook for H2 is much stronger, but I think there’s still a risk Mind Gym could run short of cash before a turnaround can be effected.

Auction Technology (LON:ATG) - down 23% y’day (£589m) - final results - Roland - AMBER

Cautious guidance for the year ahead has triggered a cut to profit forecasts and a big share slump. But I think this previously overpriced 2021 IPO has some attractive qualities and could potentially be starting to offer some value.

Quick comment (no section below)

James Halstead (LON:JHD) - AGM Statement - 198p (pre-market) (£855m) - Roland - GREEN

Jjust a quick comment to highlight today’s AGM Statement from this AIM-listed, family-run, floorcovering business. Trading is said to be ahead of the prior year and the company will approve its final dividend today, marking an impressive 47th year of dividend growth.

This business is highly profitable, very cash generative and in my view extremely well run. The shares have 10-bagged over the last 20 years – just an example of the quality available (selectively) on the UK market. As Ed as highlighted in his recent multibagger research, supposedly boring companies can sometimes outperform more exciting options. That's certainly been the case here:

I think the shares look reasonably valued at 200p, given Halstead’s track record.

Graham's section

Mercia Asset Management (LON:MERC)

- Share price: 28.5p

- Market cap: £127m

This one has been in the backlog for a few days. Let’s cover it now at last.

Mercia Asset Management PLC (AIM: MERC), the proactive regionally focused, profitable specialist asset manager with c.£1.5billion of assets under management ("AuM"), is pleased to announce its interim results for the six months ended 30 September 2023.

The last time I wrote about this was in my Ten ideas for 2023, published back in January. The share price that day was 33.5p.

At 29p today, it hasn’t been a year to write home about in terms of share price performance:

However, the actual operating performance of the company continues to encourage.

Here are the highlights from the interim results to September, which were published this week:

Revenue £15m (H1 last year: £12.2m)

Adj. operating profit £5.5m (H1 last year: £3.6m)

Fair value of its direct investment portfolio: £142.5m

Cash position was £36.5m at the end of H1, rising to £60m following the sale of an investment (“nDreams”).

Net assets per share were 45.3p at the end of H1 (56% above the current share price). I think NAV was boosted by an additional penny by the sale of nDreams.

Mercia is both a 3rd-party fund management business and a direct investor. 3rd party funds under management are at £1.26 billion, little changed over six months, “with no redemptions”.

Buyback - there is a £5m share buyback, “reflecting strong cash position of the Group and confidence in the business”. Seems like a sensible move, especially considering the discount to NAV. The share count will be reduced by a few percentage points.

The Chief Financial Officer acknowledges that “relatively recent share buybacks in the specialist asset management sector have done little to positively affect share price performance and a resultant reduction in discounts to net asset value.”

CEO comment:

Mercia's competitive advantage comprises its people, geographic footprint, long-term investment performance, supportive stakeholders and broad capital deployment capabilities in the private markets, which continue to experience a healthy level of capital availability, in contrast to the public markets. Challenges in the private markets do exist however and relate to the cyclical nature of venture investing, based on sector and business stage.

Mercia will invest between £0.5m-£20m into a business: I like this range, where private market deals can offer excellent value. We have seen other successful investors deploying these small amounts before (think of the likes of Judges Scientific).

It is strategically looking to grow its 3rd party fund management business now, rather than focusing on its own investment portfolio.

It might even sell parts of its own investment portfolio and use the proceeds to fund bolt-on acquisitions for its fund management business:

…we are now taking a more cautionary approach to direct investing. Reflecting this caution, we have paused adding new companies to our direct investment portfolio, although we will continue to support the existing portfolio. In parallel, we will concentrate on accelerating the growth of our managed funds' operation, both organically and via very selective acquisitions, by utilising some of the proceeds from direct asset realisations, such as the post period end profitable exit from nDreams.

Long-term goals: in April 2021, the company set a target of total AuM (3rd party and own funds) of £1.6 billion by March 2024.

It won’t be easy to reach this but they are currently at £1.46 billion, so they did ok (AuM was £960m when they set the target).

They also wanted to achieve average PBT of £20m p.a. over the three years to March 2024. This is very unlikely to be achieved.

Outlook is positive:

There currently exists strong growth potential in Mercia's managed funds' operation across all three pools of private capital. With our focus on scaling the profitable delivery of our fund management operations, we anticipate continued momentum through the remainder of the current financial year and beyond.

Graham’s view

I continue to see this stock as offering a tremendous amount of value and potential at this price. It is cheaper than it was when I first spoke positively about it a year ago, but the company’s performance over the year strikes me as quite good.

I will acknowledge that the income statement shows a statutory operating loss of £1.3 million, not helped by a negative movement of £1.6m in the fair value of Mercia’s investments. Given the income climate this year, I think this could have been a lot worse! But the enormous cash balance, the dividend payment and the buybacks all suggest that the company is in rude health.

I also note that this stock passes a prestigious screen:

DP Eurasia NV (LON:DPEU)

- Share price: 84.5p

- Market cap: £124m

These shares have finally achieved a “bagger” status for anyone who managed to buy in at the lows:

Earlier this week, it was announced that Jubilant Foodworks was happy to pay 85p for the DPEU shares it does not already own.

Jubilant Foodworks:

was already a 49% shareholder of DPEU.

holds the Domino’s master franchise for India, Nepal, Sri Lanka and Bangladesh.

It didn’t take a great deal of wisdom to think that Jubilant wouldn’t mind owning 100% of DPEU, rather than 49%. This is something I speculated about before. But the eventual price was hard to guess at, especially considering that DPEU’s own finances have at times seemed precarious.

The offer is a 24% premium to the prevailing share price. Compared to the average premium we see being offered to prevailing share prices, I would say this is the bare minimum.

Interestingly, the board of DPEU don’t seem overly impressed by the offer. On the evening of the 28th, the day of the offer, they said:

The Offer is both unsolicited and unexpected. For the time being, shareholders are advised to take no action.

Jubilant has also started buying DPEU shares again, and has now brought its stake up to 53.5%.

DPEU’s board have been caught by surprise, and are still analysing the offer. Today they say (emphasis added):

DP Eurasia has worked openly and constructively with Jubilant Foodworks operationally and recognises the value that it brings. However, the Board is extremely disappointed that Jubilant Foodworks decided to proceed in this unsolicited and opportunistic way and without first seeking to reach an agreement on terms which the Board would be able to endorse as in the best interests of all stakeholders.

The Board is determined to protect the interests of the Company's minority shareholders and other stakeholders, continues to advise shareholders to take no action and will outline its position in a further update early next week.

Trading update

Coincidentally, the day of Jubilant’s offer also saw the publication of a trading update for the ten months to the end of October..

The number of stores (also including Coffy) is up 87 to 761.

System sales more than doubled to 6.2 billion Turkish lira.

After making accounting adjustments for hyperinflation in Turkey, system sales are considered to be up 38%, with like-for-like growth of 29%.

Liquidity: 402 million Turkish lira (£11m) and an undrawn bank facility for 523 million lira.

Outlook: in line with guidance.

Long-standing CEO Aslan Saranga provided a generous amount of commentary, here’s an excerpt:

"We are pleased to report sustained like-for-like growth well above inflation as well as achieving continued network expansion while navigating geopolitical and macro uncertainties. Our strategy enables us to combat the high levels of volatility in the regions in which we operate and, as Q4 progresses, we are seeing the impact of our efforts becoming increasingly visible in terms of volume generation and customer acquisition…

"This has been another excellent period for the Group, and we look forward to a strong end to the financial year."

Graham’s view

I’ve been following this stock for a long time, hoping to see the day when it would finally come good and become a quality Domino’s stock.

The strong trading update suggests that the day might be closer than ever, but it looks as if the majority shareholder has noticed the same thing and wants to enjoy the company’s success on its own.

Let’s do a quick comparison. There are 1,200 Domino’s in the UK and Ireland, and Domino's Pizza (LON:DOM) is worth £1.48 billion. That’s £1.2 million per store.

Excluding coffee shops, DPEU has about 700 stores and is valued at around £125m by this offer. That values each store at £180k.

Naturally we can assume that a store in the UK and Ireland is worth considerably more than a store in Turkey or Georgia. But is it worth six times more?

I would not be at all surprised if DPEU’s board and minority shareholders held out for more from Jubilant.

Roland's section

Mind Gym (LON:MIND)

- Share price: 37.4p (-3%)

- Market cap: £38m

“MindGym (AIM: MIND), the global provider of human capital and business improvement solutions, announces its half year results for the six months ended 30 September 2023.”

This software group appears to provide corporate training and performance management solutions, covering areas such as “WellWorking”, “Leadership development” and “Personal effectiveness”.

Today’s interim results are described as being in line with “recently revised expectations for the full year”. This refers to a profit warning issued in October, when revenue guidance was cut from £62.6m to £48.4m and profit forecasts were reversed into a full-year loss.

Paul covered the profit warning here and went RED on the stock, so I thought it would be useful to take another look to see if today’s accounts and commentary provide any additional information or highlight a turnaround opportunity.

H1 results summary: October’s profit warning was attributed to weakness in US markets. This seems to have been due to a slump in spending by US tech firms. That’s evident in today’s numbers, which cover the six months to 30 September 2023:

Revenue down 22% to £20.9m

US revenue down 33% to £11.1m

EMEA revenue down 3% to £9.8m

Reassuringly, trading in EMEA seems to have remained stable. The company says a £2.0m contract that was delayed in H1 was launched successfully in September and should deliver revenue in H2.

However, profit and cash performance for the half year was dire, despite an impressive-sounding gross profit margin of 85.4% (H1 FY23: 87.5%):

Adjusted EBITDA loss of £4.1m

Reported pre-tax loss of £13.2m

Cash at bank: £2.1m (31 March 2023: £7.6m)

Capital expenditure: £3.0m (H1 FY23: £2.2m)

As Paul commented, Mind Gym capitalises a lot of its software development spend onto the balance sheet. This capitalised spend represents real cash outflows during the reporting period.

We can see from the highlights above that Mind Gym burned through £5.5m of cash during H1. The cash flow statement shows us why:

Operating cash flow was negative for the period. In addition, the company spent (actual cash) £2.9m on software development that was capitalised. This gives us a total of £4.9m, reflecting the £5.5m reduction in cash during the period. (The remaining £0.6m reflects lease payments, which are reported further down the cash flow statement in financing activities.)

Cash position/spending cuts: Mind Gym says that it had £2.1m of cash on hand at the end of September and access to £2.0m of its undrawn £10.0m debt facility, “which it does not expect to utilise”.

In order to reduce cash burn, the company says it is planning big spending cuts:

Operating expenses will be cut by an annualised £4.5m, generating savings from H2, but incurring a £1.1m restructuring charge

Capex (i.e. capitalised software development) will be paused, except on digital assets that are already revenue generating. This is expected to reduce capex by £3.5m to an expected level of £2.5m in FY25.

The reduction in capex has triggered a £6.6m impairment charge, which is reflected in the pre-tax loss of £13.2m above. The impairment relates to software that was under development but has now been paused and is no longer expected to become part of an identifiable commercial product. This is one of the accounting requirements for capitalising software spend, hence an impairment charge was needed.

Personally, I am not entirely convinced that Mind Gym will be able to complete this restructuring process and return to profitability without running short of cash. However, the outlook for H2 does seem to be significantly improved.

Current trading & outlook: trading is said to be in line with the board’s revised expectations for the full year.

The company says that conversion of sales opportunities in the US “remains slow”. However, the picture in EMEA is brighter; there have been “several notable project wins” since the start of October.

H2 FY24 is also expected to see significant benefit from the Energy framework (the delayed £2m contract I mentioned earlier). Six-month forward bookings at the start of October were higher than the same position 12 months ago. As a result, management expect the business to be profitable during the second half of the year:

Combined with the impact of the revised cost base, this will enable a return to strong profitability in H2 FY24

However, this seems to refer to H2 profitability only, not full-year profits. An updated note on Research Tree today from Mind Gym’s house broker, Liberum - many thanks - confirms that a full-year loss is expected for FY24, with negative earnings of 1.7p per share.

Earnings are expected to rise to +2.2p per share in FY25, according to Liberum.

Founder-CEO stepping aside: until now, this business has been run by founder and 55% shareholder Octavius Black.

Mind Gym has now appointed a new CEO, Christoffer Ellehuus who will join in January as CEO designate. Mr Black will be stepping aside to become executive chairman.

Roland’s view

My reading of today’s results suggests that if everything goes exactly to plan in H2, Mind Gym might be able to scrape by without running out of cash.

Personally, I think there’s still a material risk of a cash crunch that could result in a fundraising or expensive short-term debt funding.

Investors with an in-depth understanding of the company’s pipeline may feel more confident than me, but personally I think this situation looks too risky to be appealing. I’m going to stay RED on this one until I see evidence the group is operating sustainably.

Auction Technology (LON:ATG)

- Share price: 498p (down 23% y’day)

- Market cap: £589m

Auction Technology Group plc ("ATG", "the Company", "the Group") (LON: ATG), operator of world-leading marketplaces for curated online auctions, today announces its financial results for the year ended 30 September 2023.

This is a specialist online auction group that operates in areas such as art and antiques, providing software that allows auction houses to sell to online bidders.

This was (opportunistically?) floated by private equity in early 2021 and became ludicrously overvalued during the pandemic, in my view.

This week’s slump seems to have been triggered by a slightly softer outlook than expected, but these interim results do not seem too bad to me. I wonder if the shares may be approaching a level at which they could start to offer value.

Graham previously covered this business in May. Let’s bring the record up to date with a look at this week’s final results.

Full-year results highlights: ATG’s full-year numbers seem to show some positive trends:

Revenue up 13% to £135.2m

Operating profit up 34% to £22.5m

Operating margin: 17% (FY22: 14%)

Adjusted earnings up 11% to 32.6p per share

Adjusted net debt down by 12% to £115.7m

Cash generated by operations up 17% to £57.7m

These numbers value the shares on a trailing P/E of 15 and seem to show positive cash generation and an attractive operating margin.

A quick look at the cash flow statement suggests to me that the business generated about £29m of free cash flow last year, excluding acquisitions. That looks like an impressive level of cash conversion, when compared to reported post-tax profit of £16.9m.

One possible concern is the rising cost of debt; the company’s weighted average interest charge doubled from 4% to 8% last year. However, net debt is falling and there’s no major refinancing due to 2026. I don’t see any critical concerns.

Trading commentary: Auction Technology Group provides a range of value-added services in addition to its core auction software. These include a payment gateway, shipping service, and digital marketing solutions.

Value-added services revenue rose by 27% last year and now accounts for 18% of total revenue. If the services are good, then I’d imagine that this revenue line could continue to grow at a higher rate than underlying auction activity.

The value of items auctioned on the group’s systems was fairly flat last year, with total hammer value (THV) up 3% at constant currency. Management says there was a small decline in H2, reflecting more normal conditions in Industrial & Commercial markets and softer conditions in Art & Antiques auction markets.

Acquisitions: the company acquired ESN during the period, which is described as “a leading US estate sales platform”. Integration is underway and the business is said to be “performing ahead of initial business case”.

Current Trading & Outlook: I haven’t seen anything in the company’s FY23 results to explain this week’s share price drop. So I have to conclude that the trigger for this fall is probably in the outlook statement.

The company is striking a cautious note at this stage:

THV and GMV growth have been impacted by macroeconomic factors over the course of the year. In the short term, the business continues to be impacted by underlying market growth which remains relatively uncertain.

However, continued growth in value-added services is still expected to support a 5% to 8% increase in FY24 organic revenue.

Total revenue growth in FY24 is expected to be higher than this, due to the contribution from ESN.

Management expects to maintain last year’s adjusted EBITDA margin of 47%.

There’s an updated broker note from Cavendish on Research Tree which helpfully provides updated earnings forecasts.

Cavendish has trimmed its FY24 earnings forecasts from 36p to 33.9p per share. This would still represent a small amount of growth from FY23 adj eps of 32.6p, but might explain the weak sentiment towards the stock this week.

Roland’s view

This week’s results do not seem too bad to me, while the more cautious outlook is unsurprising, in my view.

The updated broker forecasts price Auction Technology shares at around 14 times forecast earnings. This doesn’t necessarily seem too expensive to me, for a business with double-digit margins and reasonable cash generation.

If this business can continue to make steady incremental progress, then I think the shares could be approaching a level where they offer some value.

I’m not sure there’s any rush to get involved here, but I will be keeping a more interested eye on this business than I have done to date.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.