Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

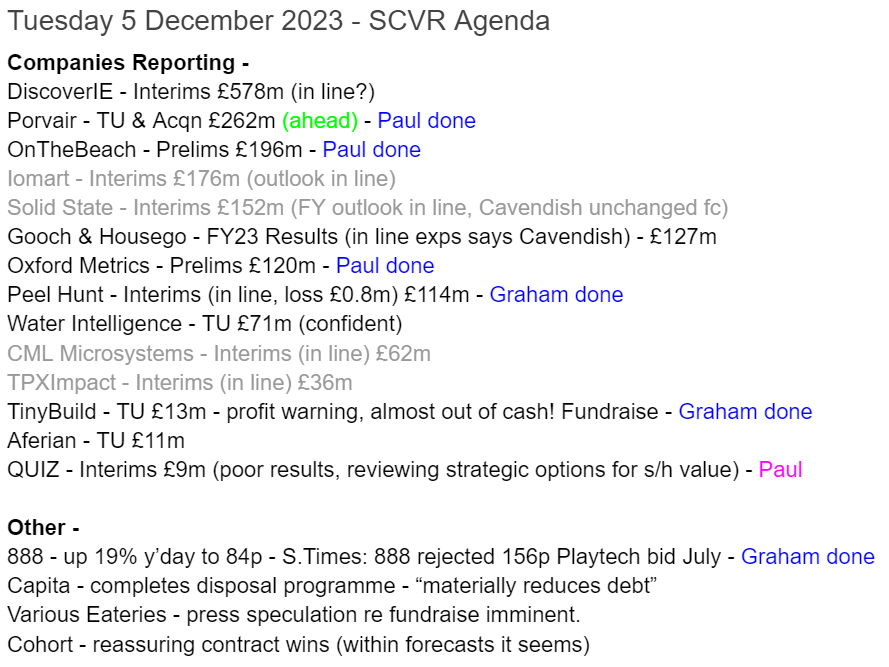

Very busy today, so we'll probably have to focus on things that are not just in line with expectations -

Summaries

On Beach group (LON:OTB) - up 15% to 135p (at 08:58) £225m - Preliminary Results - Paul - GREEN

Sparkling results for FY 9/2023, driven by continuing strong demand for holidays, and bumper finance income from the big cash pile. Outlook sounds really good too. Cash conversion not quite so good, due to heavy capitalised development spend, but is still enough to reintroduce divis shortly. I remain at GREEN, it's trading well, and looks reasonably priced still.

tinyBuild (LON:TBLD) - down 20% to 4.9p (£10m) - Trading Update and Litigation Settlement (profit warning) - Graham - RED

Another profit warning and this time it’s critical as it means that the company’s cash balance is running out. More funds are likely to be needed in January. It has been a shocking waste of shareholder cash. At least the CEO seems ok with the prospect of buying back in here.

Peel Hunt (LON:PEEL) - up 1% to 93.5p (£115m) - Half-Year Results - Graham - GREEN

Today’s interims seem more or less as expected with a small loss and no major change in performance. Cash reduces as the company pays off some loans. I remain positive on this with NAV of over £90m and well-placed to profit when sentiment and activity picks up again.

Oxford Metrics (LON:OMG) - Unch 91p (£121m) - Preliminary Results - Paul - AMBER/GREEN

Very good results for FY9/2023, and half the market cap is the net cash pile. An acquisition was made post year-end for £8.2m, leaving around £60m net cash for more deals, let's hope it's spent wisely. With an order book halved, and outlook comments that duck the question on FY 9/2024 expectations, I'm introducing a note of slight caution, going down from green to AMBER/GREEN - so still positive, but let's see how things progress.

888 Holdings (LON:888) - up 19% yesterday to 84p - Graham (I hold) - AMBER

No RNS but there are press reports - specifically from the Sunday Times - that Playtech (LON:PTEC) (market cap £1.3 billion) wrote to 888 with bidding interest in July. The indicative price was reportedly 156p for each 888 share, more than double last Friday’s closing price of about 70p and a significant premium to the share price in July (around 100p). Earlier this month, the FT reported that Draftkings ( DraftKings (NSQ:DKNG) , market cap £25 billion) also discussed a possible bid in July with some of 888’s top shareholders. 888 issued a profit warning in September that may have dented the valuation of any possible deal, and is carrying an enormous net debt position (£1.7 billion). However, its brands do have strategic value. If they are willing to rebuff both Draftkings and Playtech, then 888’s management and major shareholders must still be confident of the company pulling through this difficult period. [no section below]

Porvair (LON:PRV) - up 3% to 624p (£290m) - Trading update (ahead) & Acqn - Paul - GREEN

We commented here on 15/9/2023 that FY 11/2023 forecasts looked too low, so not a big surprise to get an ahead of expectations update today. Also news of a bolt on acquisition funded from self-generated cash. Nice business, reasonably priced I think, so I'm happy with GREEN.

Paul’s Section:

On Beach group (LON:OTB)

Up 15% to 135p (at 08:58) £225m - Preliminary Results - Paul - GREEN

About On the Beach

On the Beach Group plc is one of the UK's largest online beach holidays retailers, with significant opportunities for growth. Its innovative technology, low-cost base and strong customer-value proposition provides a structural challenge to legacy tour operators and online travel agents, as it continues disrupting the online retail of beach holidays. Its model is customer-centric, asset light, profitable and cash generative.

We reviewed OTB favourably on both 14/8/2023 (event: founder spent £2.5m on shares at 88p), and again on 13/9/2023 with a top end of range trading update FY 9/2023, good bookings, and better finance income on cash pile. I concluded it remained too cheap at 104p.

Looks like it’s going to be a hattrick for GREEN today too, with very nice results.

Key numbers FY 9/2023 -

Revenue up 19% to £170.2m

Adj PBT up 66% to £23.6m

Adj basic EPS up 81% to 11.6p (PER of 10.1x)

(I prefer diluted EPS to basic, so dilution from share options needs checking - just looked, it’s fine, diluted adj EPS is only slightly lower, at 11.5p)

Commentary says benefit from end of covid disruption, and that customers are protecting their holidays and cutting back on other things.

Big benefit from interest received on cash balances of £4.1m,vs only £0.3m LY, so OTB is a significant beneficiary from higher interest rates. Although it also had £1.5m of finance costs.

Marketing spend reduced as a % of revenue.

Outlook comments sound upbeat for next year -

Adjustments to profit are quite large, with some of these being questionable -

Balance sheet - looks pretty solid to me, with £94.5m NTAV (after writing off £73.7m of intangible assets).

Note that there’s £108.6m of customer cash held in trust account, but shown on the balance sheet, and is released to OTB when the customer has travelled.

Big numbers on both the debit and credit side within working capital, but a healthy overall position here with net current assets of £86.2m.

Note that it took a £2m bad debt charge, so it would be interesting to get more detail on what this was - an intermediary going bust would be my guess - an airline, or travel agent perhaps? I would ask management what this £2m charge is for, and what steps the CFO has taken to ensure it doesn’t happen again?

Cashflow statement - some concern here. It made £22m positive operating cashflow after tax, but before finance income in both years, but spent £12m on capitalised development spend in FY 9/2023.

Overall the net increase in cash was £11.3m, well behind PBT.

No dividends were paid, but are set to be reintroduced.

Whilst cashflow is well behind profit, there’s still enough to pay fairly decent divis in future, providing we don’t see any more pandemics. Divis were not particularly generous pre-pandemic, but were well covered by earnings.

Note that the share count has risen about 27% compared with pre-pandemic, something to bear in mind when drawing lines on charts, as you’re not comparing like with like.

Paul’s opinion - I remain bullish on OTB - it’s modestly priced, both on FY 9/2023 results, and particularly considering the positive outlook, hence likely to achieve maybe 14-15p EPS in FY 9/2024 - so anything below 150p/share still looks attractive value to me.

The balance sheet looks good enough, although cashflow is somewhat behind profitability due to heavy capitalisation of development spending.

Divis should resume, although it’s not been a generous payer in the past.

Overall the recent rise, including today up c.13% to 132p, seems fully justified to me.

One query is whether we should rate travel shares on a permanently lower rating, now we know how vulnerable they are to disruption from any future pandemic-type events. That’s for each investor to decide.

Anyway, it’s another GREEN from me today.

Following very large Director buys often works, so the £2.5m buy in Sept by the founder was a very strong signal, as we discussed here at the time, so I hope some readers have made a bob or two on this, following his lead!

I'm surprised at how low the StockRank is here. Maybe that's been skewed by the impact of the pandemic on the last few years' results?

Also note that zooming out on the chart, the recent rebound in share price is barely a blip - indicating possibly more upside, if it re-rates to a higher PER maybe?

Oxford Metrics (LON:OMG)

Unch 91p (£121m) - Preliminary Results - Paul - AMBER/GREEN

Oxford Metrics plc (LSE: OMG), the smart sensing and software company servicing life sciences, entertainment and engineering markets, announces preliminary results for the financial year ended 30 September 2023.

Impactful headlines at the top of this results statement -

OMG is one we follow closely here. It’s distinctly unusual, since it’s sitting on a very large cash pile, which is 54% of the market cap. That’s should now be earning very nice interest income, yet finance income is only £1.56m on the P&L, suggesting an average interest rate received of only 2.4%. So an obvious question for management, is why aren’t they doing a better job with internal treasury, and maximising the interest income? I seem to recall they previously said something about wanting to keep ready access to cash for potential acquisitions.

Vicon seems to have been the only operating division this year, after disposals, and an acquisition which has only recently been done in Nov 2023 (after the FY 9/2023 year end). It's clearly traded very well.

Given that Vicon has some exposure to Hollywood, I think there was investor worry about strikes possibly having an impact. There’s no sign of that in these results, with operating profit having almost doubled to £4.85m, then net finance income of £1.4m taking it up to statutory PBT of £6.25m. Adjustments are only £0.25m, to result in adj PBT of £6.5m.

Outlook - sounds encouraging, but having searched the announcement, I can’t see any direct reference to FY 9/2024 expectations, which they seem to have dodged, which introduces a little doubt into my mind.

Also the order book has more than halved, from £24m to £11.5m, said to be due to supply chains normalising. But even so, that’s less visibility than a year earlier -

Acquisition of IVS happened post year-end, in Nov 2023. It says this is earnings enhancing, and sounds as if it’s in a similar/same sector (so less risk of them buying a dud, probably).

Details are here. The price was £8.1m, paid mostly in cash, plus 1m new OMG shares. This leaves OMG with plenty of remaining cash firepower, c.£60m for more deals. Let’s hope it’s spent wisely, as blowing the cash on a duff acquisition is probably the biggest risk for shareholders here.

Paul’s opinion - the simplest way to view this share, is to just halve the market cap, taking off the remaining £60m cash pile. Is Vicon + IVS worth the remaining £60m then? Based on its FY 9/2023 performance, I’d say that price looks perfectly reasonable, attractive even - but it depends on what the future holds, which being a mere mortal, I cannot predict.

I’d like to know more about the background of the new CEO, Imogen Moorhouse. In particular, what M&A experience she has? That’s key here, as half the market cap being a cash pile, demands that it’s either preserved, returned to shareholders, or spent wisely on value-adding acquisitions.

I’m a little uneasy at the outlook comments ducking the issue of confirming full year expectations. So for that reason, I’ll shift down slightly from green to AMBER/GREEN - so still positive, but a little more cautious here.

Shares haven't done much in the last 5-years, although zooming out to 10-years below does show nice shareholder value creation -

Porvair (LON:PRV)

Up 3% to 624p (£290m) - Trading update (ahead) & Acqn - Paul - GREEN

Porvair is a group of specialist filtration, laboratory and environmental technology businesses. Its businesses design and manufacture a range of bespoke consumable filtration products that are used in a range of niche filtration markets. It operates in three divisions: Aerospace & Industrial; Laboratory; and Metal Melt Quality.

We like Porvair here at the SCVR, because it’s a good quality business, making decent margins, with a lot of repeating business from high end consumable filtration products. It got through the pandemic well, with no dilution, and has also self-funded various sensible acquisitions of complementary businesses over the years.

My only gripe with PRV shares is that they’ve almost always looked too expensive.

That changed here on 15/9/2023, when I finally went GREEN on it, having worked out that the FY 11/2023 forecasts were likely to be too low. So allowing for a future beat against forecasts, the share price then of 598p actually looked a tolerable price to pay a couple of months ago.

Sure enough, it has indeed today issued an “earnings ahead of market expectations” update for FY 11/2023, but with no indication of how much of a beat, or what market expectations are.

Current market expectations are 33.7p, but I estimated that something nearer 40p looked on the cards, based on 20p interims, and upbeat outlook a few months ago.

Other details today say (for FY 11/2023) -

Higher margins

Flat revenue vs LY

Some sectors up, others down

Net cash of £14m at 30 Nov 2023.

Acquisition of EFC, a complementary Belgian company, earnings enhancing, E10.5m revenues pa, turns £14m cash pile into a “modest surplus”, so vague on exactly what has been paid for EFC.

Paul’s opinion - I reckon Porvair might be on a PER of about 15x right now, which brings it into my possible buys arena. Given that the price is only up 3% today, it looks as if almost everyone else had also worked out that the forecasts were too low!

Nice, quality business, and at a reasonable valuation, so I’m happy to stick with GREEN.

Graham’s Section:

tinyBuild (LON:TBLD)

Share price: 4.9p (-20%)

Market cap: £10m

tinyBuild (AIM:TBLD), a premium video games publisher and developer with global operations, provides an update on trading and a litigation settlement.

It’s an awful update from this video games company this morning, with a profit warning and talk of an equity raise.

Checking back on my recent notes, in September I noted that the company was still forecast to finish the year with cash of $10-20 million, and resisted the urge to give the company the thumbs down. I hoped they would find a way to avoid burning their remaining cash pile and “spending themselves into shareholder oblivion” - but unfortunately it seems that they have continued to do so.

People will point fingers at the company’s current CFO (since June 2023) who was previously (since Feb 2021) their head of M&A, and before that was an equity research analyst in the City.

However, if misfiring M&A deals were the only problem here, the situation wouldn’t be nearly so bad.

Internal spending on software development at TinyBuild has been extraordinary: $36m in 2022, and $17m in the first half of 2023.

And these internal investments have also been very unsuccessful, leading to huge impairments.

In December 2021, the company reported net cash of $48.8m.

This had fallen to $26.5m by December 2022.

Today we learn that cash has fallen to just $5.7m as of the end of November, and is “expected to be below previous expectations of $10-20 million at end of December 2023”.

Here are the key points from today’s update:

Trading is below expectations, with FY23 revenues now expected between $40-50 million (note the wide range!). Previous consensus forecast was $49.9m.

Multiple “Versus Evil” games have been delayed into 2024.

“Company is exploring near-term options to strengthen the balance sheet”, with the CEO and founder expressing a willingness to underwrite a raise of up to $10 million.

A “cost reduction plan” has been accelerated, but it’s clearly too late now from the point of view of avoiding shareholder dilution.

Litigation settlement - the acquisition of Versus Evil by TinyBuild in 2021 has resulted in a dispute between the sellers and TinyBuild. The dispute is settled with a $3.5m cash payout to the sellers. The CEO and founder of Tinybuild has made a personal guarantee to make the payment, should Tinybuild fail to do so!

Cash position - is expected to decline further and to be in the “low single digit millions” at the end of the year. New funding is likely to be needed by the end of January 2024.

Outlook - “cautious”.

The Company expects continued pressure on discounting in a crowded market for new releases. The planned launch of certain promising games in 2024 gives reason for optimism and this coupled with a leaner cost base could translate into strong operating leverage in the event of a recovery in video games sales.

Graham’s view

In hindsight, I should have been “RED” on this share already, but the company’s fairly recent insistence that it would finish 2023 with over $10m of net cash swayed me from doing so.

The CEO still owns 38% of the shares, which was another reason for me to think that the company would be more careful with its cash balance and reduce spending before things got out of hand. Apparently not.

The CEO’s willingness to take part in a new equity raise is perhaps the explanation we need: he would be happy to increase his stake in the business again, at this derisory valuation.

This is another 2021 IPO that represents a large wealth transfer from stock market investors. Over £100m of shares were sold, now worth pennies on the dollar.

I have to be RED on this stock now, with an unknown but probably significant level of dilution on the way.

Peel Hunt (LON:PEEL)

Share price: 93.5p (+1%)

Market cap: £115m

This was another well-timed 2021 IPO, but at least Peel Hunt’s share price has been stable for the past year or so.

Today’s interim results show a small increase in revenue year-on-year, and a pre-tax loss of £0.8m (H1 last year: pre-tax profit £0.1m). This reflects “the challenging macroeconomic environment and inflationary increases in costs”.

As I’ve said before (e.g. October), I think shareholders should be satisfied if these investment banks can achieve breakeven in very lean years such as this one.

One of the main attractions here is the balance sheet: net assets are holding steady at around £93m, with capital “comfortably in excess of regulatory requirements”.

The cash balance falls to £22m, “largely due to the accelerated reduction of long-term debt by £6.0m during the period”.

CEO comment: “we are well positioned for when market conditions improve”.

Average headcount declined by 2% as the company stays ready for whenever we might see that improvement.

Current trading/outlook: refers to the current wave of “take-private” activity, as shares trading too cheaply get taken off the market by strategic buyers:

Trading in the first two months of our second half has been broadly in line with the first half. Since the start of the second half, macroeconomic and geopolitical concerns have continued to weigh on equity markets and, whilst there are some signs of positivity, market activity remains relatively subdued. IPO and private fundraising activity continues to be muted. Take-private activity continues as valuations for UK quoted companies remain attractive, particularly to strategic bidders, and we have been delighted to support our corporate clients in raising equity finance to fund M&A transactions during the period.

Graham’s view

No need to change my view on this one. I remain positive around these levels, with the company well-positioned for a future bull market (patience may be required) and with the net asset backing reducing the risk.

The company has paid one dividend since its IPO, in the middle of last year.

It will be very important for me to see Peel Hunt returning cash to shareholders whenever it does get back into the black and is able to do so. These banks do need to demonstrate they are shareholder oriented whenever they can. But for now, it’s just a waiting game.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.