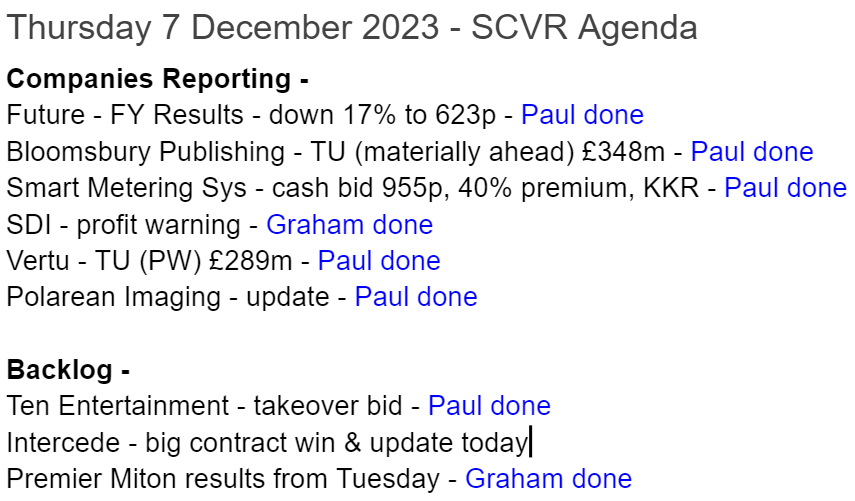

Good morning, Paul & Graham here. Catch-up day today.

We'll leave it there for today.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries

Premier Miton (LON:PMI) - up 2% 61.7p (£90m) - Full Year Results - Graham - AMBER

This has been one of the hardest-hit fund managers, being UK-centric and exposed to the outflows from UK shares and the weakness of small-cap and mid-cap valuations. I do think it will recover along with its peers, but I would like to see it develop some unique selling points.

Smart Metering Systems (LON:SMS) - 680p pre-market (£906m) - Agreed cash takeover bid - Paul - PINK (takeover)

Another takeover bid! This is agreed by management, at a 40% premium, 955p all cash bid. The buyer is American global investment firm KKR, which will put SMS within a $17bn fund focused on infrastructure investments. With the offer price being close to the all-time high, I don’t think anyone can complain that they’re being short-changed.

We’ve not covered this share in the SCVRs before, so don’t have a view on it. Well done to any holders here! [no section below]

Polarean Imaging (LON:POLX) - 5p (pre market) £11m - Company Update - Paul - RED

A long overdue update from this disastrous share, a cash-burning blue sky project that needs more funding. Today's update gives us some positive-sounding operational snippets, but nothing firm about how it's going to raise more cash (runway is getting short now, at Q3-2024). So purely for gamblers at this stage.

Ten Entertainment (LON:TEG) - up 32% to 409p y’day (£280m) - Recommended cash acquisition - Paul - PINK

US private equity has found yet another UK company to buy - at a 33% premium, all cash bid 412.5p. Yet again Harwood Capital is a major shareholder, with a history of taking this bowling operator private before. Well done to holders, with hindsight the value was obvious, sorry we didn't focus on this one enough.

Bloomsbury Publishing (LON:BMY) - up 10% to 465p (£378m) - Trading Update (materially ahead) - Paul - GREEN

Smashing news here, from one of our favourite value/GARP shares, book publishers Bloomsbury. It's materially ahead - profit for FY 2/2024, boosted in particular from strong sales of fantasy fiction. Valuation is still reasonable, strong balance sheet with plenty of net cash, high StockRank, it ticks all my boxes, so a continuing thumbs up.

SDI (LON:SDI) - down 18% to 90.65p (£94m) - Interim Results - Graham - AMBER

Material cuts to the revenue and PBT outlook here due to customer destocking and weak demand in China and Germany. Some of the factors are temporary but I’m moving my estimate of value territory for SDI down to sub-80p (previously sub-£1).

Vertu Motors (LON:VTU) - down 22% to 66p (£225m) - Trading Update (profit warning) - Paul - AMBER

A sudden, and sharp fall in used car prices has forced Vertu into a profit warning. I still like the strong balance sheet, and potential for a takeover offer. However, the deterioration in trading means we have to slip down from green to amber - reflecting that there are positives & negatives to this share.

Future (LON:FUTR) - down 18% to 613p (£716m) - Full Year Results FY 9/2023 - Paul - GREEN

In line FY 9/2023 results today, combined with a sharp fall in share price, make this look pretty superb value to me. Large and rapid debt reduction makes me relaxed about the weak balance sheet. Could this be a second bite of the cake for a former major multibagger? I think it could be, with the 85% fall from the peak looking way overdone. Mind I said that back in Sept 2023 too, and it's fallen since then, so maybe I've missed something? Well worth a closer look by you anyway. Let me know what you think!

Paul’s Section:

Bloomsbury Publishing (LON:BMY)

Up 10% to 465p (£378m) - Trading Update (materially ahead) - Paul - GREEN

This book publisher is one of our favourites here at the SCVR (and amongst readers too). We reviewed it positively here on 1 June, 18 July, and 26 Oct 2023, viewing it GREEN on all 3 occasions, which I’m happy to reiterate after today’s good news.

Today’s update relates to FY 2/2024 -

Revenue comfortably ahead and profit materially ahead of expectations…

* The Board considers that the consensus market expectation for the year ending 29 February 2024 is currently revenue of £274.2 million and profit before taxation and highlighted items of £32.9 million.

This follows exceptionally strong trading in the Consumer division for a number of titles and particularly Sarah J. Maas' 15 titles… "I am delighted to report a strong period of trading which is principally driven by the continued phenomenal demand for fantasy fiction…

Broker updates - nothing available. Crunching the figures myself, I get to FY 2/2024 EPS perhaps c.33-35p EPS. So on this morning’s 465p increased share price, we get a PER of 13.7x - still a very reasonable price, I’d say, for a group with a very impressive growth track record -

With its fragmented institutional shareholder base, I wonder if the Yanks might come along and bid for BMY next? After all, owning the publisher of what they call “Hairy Padder” might be a strong attraction?! So you’ve got a potential cherry on top of the value/GARP pie, in the form of a possible takeover bid.

Paul’s opinion - an excellent share we think. Today’s news is really encouraging, and the valuation still looks perfectly reasonable to me. So I remain keen, with another thumbs up, so GREEN it is again. Well done to holders, this has been a nice safe haven in a horrible small caps bear market. Also a 4-bagger in the last 10 years, and a 2-bagger since the covid lows in 2020. With divis on top too, as well as self-funded growth. You also have the comfort (and ability to make acquisitions) from a strong balance sheet last reported at £100m NTAV, with plenty of net cash. Very high StockRank too. So it ticks pretty much all my boxes!

Polarean Imaging (LON:POLX)

5p (pre market) £11m - Company Update - Paul - RED

This has been an alarming situation, where management seem to have been frozen in the headlights, and allowed the share price to collapse to almost nothing (down c.95% from the peak), whilst uncertainties remain over its funding situation. So yet another promising-sounding UK innovator, that is under-funded, and withering away. The stock market really is not the right place for this type of company, let’s hope that is reflected in the next wave of IPOs - we need proper, established, profitable companies listing in the UK, not more blue sky projects - hardly any of which actually work out successfully.

Today’s update says some positive-sounding operational things, but all I’m interested in at this stage is funding. It says -

The Company’s current cash runway is expected to last into Q3-2024. Management is continuing to evaluate all options for further financing… Whilst we are assessing various financing options, I am confident that we will be able to finance the Company for the medium term, and would like to extend my thanks to our strategic investors for their continued strong support”.

Paul’s view - the shares are just a gambling chip at this stage. All the power lies in the hands of whoever puts in fresh money, so existing small shareholders are powerless, and you could be all but wiped out in the next fundraising. Or it could be a multibagger, there’s no way of knowing at this stage.

My policy is to wait until the finances are sorted out, and only buy a cash-burning share like this if there’s at least 2 years cash in the bank, and even then just treat it as a punt. There’s nothing today to reassure that it’s any closer to a funding solution. I see management as having been negligent here, allowing the existing equity to wither away to almost nothing.

Ten Entertainment (LON:TEG)

Up 32% to 409p y’day (£280m) - Recommended cash acquisition - Paul - PINK

Announced yesterday, an agreed cash bid at 412.5p, a 33% premium.

The buyer, as usual, is a US private equity fund called Trive Capital Partners. Googling the name, it seems to only have $4bn of assets, which would make this deal large for the buyer. Although often these type of investment firms have various offshoots, so that $4bn figure may not be the whole picture maybe?

Note that Harwood Capital (Christopher Mills firm) is a 16% holder, and often agitates for buyouts. In fact, it bought TEG itself years ago, when it was called Essenden, then refloated it a few years later for multiples of the price paid.

Paul’s view - we took our eye off the ball here, and haven’t reported on TEG for a while, sorry about that. However, I can vaguely recall it being discussed by readers a while ago, with people saying they didn’t think the discount to Hollywood Bowl (LON:BOWL) in PER terms was justified - a very good call! Looking at the StockReport, it seems to have looked obvious good value at a forward PER of 8x, which has now gone up to 12x with the bid premium in it - not exactly a knockout valuation, but it looks to be a new all-time high for this share, so nobody can really complain, given the lamentable state of UK small caps markets.

Well done to holders! It gives you a fresh pot of cash to deploy in something else really cheap, so no complaining I’d say. This deal looks likely to go through, looking at the shareholder list, which is dominated by institutions who will no doubt relish the liquidity event, and the boost to their performance stats. It already has c.40% support, so likely to go through.

Vertu Motors (LON:VTU)

Down 22% to 66p (£225m) - Trading Update (profit warning) - Paul - AMBER

Vertu Motors, the UK automotive retailer with a network of 195 sales and aftersales outlets across the UK provides the following trading update for the three months ended 30 November 2023 ("the Period")...

a number of negative external market factors resulting in profitability for FY24 now expected to be lower than current market expectations.

This is Q3 of FY 2/2024.

Clearly a setback, as shares have this morning given up the gains of the last 3 months - still up nicely year-to-date though -

Used car values are falling - this echoes what Motorpoint (LON:MOTR) told us recently -

The Period has witnessed a material change in the used vehicle market with UK wholesale values experiencing a significant reduction in October and November.

This happened due to lower consumer demand, combined with increasing supply.

This rate of decline in used car values sounds considerable, and fast -

CAP1 have reported that values have fallen on average 4.2% in both October and November, representing record levels of monthly decline….

… the largest drops of 7% -11% per month arose in the premium brand segment.

So there you are, if you’re in the market for a jazzy nearly new car, it just got a lot cheaper!

Everyone knew that inflated used car prices would eventually correct, as supply normalises, but it seems to be happening a lot faster than expected.

Outlook for used car values -

The Board consider that UK used vehicle values are likely to continue to weaken above historic norms in the near term. Once the current pricing correction has eased, used car prices in the UK will be more affordable to the consumer and margins should stabilise. Reducing interest rates in the medium-term would also aid affordability and provide a further stimulus to a market benefitting from increased supply.

New cars - more detail is given, saying supply has increased back to normal, although this bit worries me -

Overall, new vehicle supply has started to exceed natural demand levels, leading to an increased pipeline of new vehicle inventory, which when combined with higher interest rates, has increased manufacturer stocking interest charges significantly above expected levels.

Aftersales - trading improved on last year, but is being held back by some supply chain problems for vehicle parts. I imagine this should sort itself out in due course.

Costs - well controlled. Mentions 9.8% increase in Living Wage as a cost headwind in FY 2/2025 - “low single digit £millions” above budget.

Outlook overall - volatile market conditions, so they’re cautious.

Broker updates - this is the most important part - guided by management of course, how much have the brokers downgraded forecast earnings?

Zeus helpfully publishes its thoughts with an update this morning. Given that we’re not far from the end of FY 2/2024, a downgrade of 17% in adj PBT is quite hefty, and £8.0m drop to £39.3m.

Zeus has only reduced FY 2/2025 by 6% to £48.6m, which immediately strikes me as not being enough. Can we assume that FY 2/2025 will be above FY 2/2024 at all now? I’d feel safer assuming that it might be the same or lower than FY 2/2024. Although there is a boost to earnings from the big acquisition made during this year, so a full year's contribution next year.

I prefer to work on adj EPS, which was forecast at 9.8p for FY 2/2024, but is now reduced to 8.2p.

FY 2/2025 is reduced from 10.7p to 10.0p. With volatile market conditions in demand and supply, it’s very difficult to make forecasts at all.

Paul’s opinion - I summarised the bull & bear points for Vertu here on 1 Nov 2023, which is worth revisiting. With hindsight, maybe I should have moderated my view to amber back then? Clearly the (expected) fall in used car values has happened much faster than Vertu and brokers imagined. I’ve also noted before that finance charges are shooting up on vehicle stocking loans, plus VTU has increased other net debt to make a series of acquisitions. Note on Zeus’s latest forecast, finance charges have doubled from last year, and now consume about a third of operating profit. So VTU will need to concentrate on reducing inventories I think.

There were some warning signs, both at VTU and others (eg Motorpoint (LON:MOTR) ) but even so, this downturn in trading has clearly taken everyone (including me) by surprise with its rapidity.

Also I think a lot of people will have probably decided to hold tight for potential bid interest, with VTU being one of the remaining UK listed dealers that had not yet been bid for. A drop in share price could actually make a bid more likely now. Competitors have been adding to their disclosable stakes too.

So as always, it’s your call really - stay in it for the bid potential, and the strong freehold property asset backing? Or ditch them as positive trading conditions have sharply & suddenly deteriorated?

I’m trying to be disciplined with my traffic lights, so given the deterioration in current trading & forecast falls, it has to be a move from green to AMBER, to reflect the mixed attractions of this share - some positives (which I still like), and some not so good now that trading has deteriorated recently.

Future (LON:FUTR)

Down 18% to 613p (£716m) - Full Year Results FY 9/2023 - Paul - GREEN

Long-serving CFO announces today she is stepping down, technically next year (due to 12-month notice period). Who knows what the real circumstances are, we can only speculate. Of course it raises eyebrows, coming on (poorly received) results day.

Background - as you can see from the 10-year chart below, Future shares were an astonishing major multibagger (c.40x!) - between 2017 and 2021. Graham and I did cover Future quite a few times when it was starting to take off, in 2018 & 2019, with our reviews typically saying that we haven’t researched it in detail, but it keeps issuing out-perform updates, some balance sheet concerns, and that the price usually looked up with events! Just shows doesn’t it, sometimes we need to discard our value hats, and look at growth companies in a more flexible way!

After Ed’s brilliant multibaggers webinar (the next part is coming up on Wed 13 Dec at 11am - you should have received an invitation message/email today), I’m looking back at previous multibaggers to see how they looked at the time, when the big move upwards was starting, as we’ve got an SCVR archive going back 11 years now, and it’s all in there. Here’s our archive for Future, when it was beginning its 40-bagger rocketship phase!

And remember that the next few years’ major multibaggers will be somewhere buried in recent SCVRs probably, but we just can’t tell you at this stage which companies they will be!

Moving on from the glory period, after peaking at almost 4000p per share, FUTR is now down to only 613p, having given up well over 80% of its previous stellar gains. So the share price has wound down 5-years, to prices last seen in early 2019.

This is either a bargain, for us to grab a second bite of a multibagger cake, or something serious has gone wrong and it’s best avoided. Or somewhere in between!

This year - having soared almost into space, FUTR crashed back through our artificial ceiling (£1bn market cap) here at the SCVR in May 2023.

I reviewed it here on 29 Sept 2023, when the shares put on a nice 16% daily spurt on an in line trading update, and also looked back at the H1 results. Overall, I quite liked it at 827p, looking cheap, but (as usual!) I moaned about the heavily indebted balance sheet. Concluding AMBER/GREEN due to what seemed an attractive valuation.

Moving on to today, the price is down heavily, and at 613p is now a good bit cheaper than last time we looked. Let’s check it out, as always with fresh eyes.

Future plc (LSE: FUTR, "Future", "the Group"), the global platform for specialist media, today publishes its results for the year ended 30 September 2023.

It owns Go.Compare and lots of online magazines.

I’ve quickly reviewed the results, and this looks good to me, given tough macro (when I would expect subscriptions and advertising revenues to have dropped somewhat, which they have, but not anywhere near enough to cause concern).

Some key numbers -

Revenue down 4% to £789m (but -10% organic)

Adj PBT down 13% to £221m - still a very impressive PBT margin of 28%

Statutory PBT is lower at £138m - I think the adjustments are mostly reasonable (being goodwill amortisation, so I’m happy to rely on the adjusted numbers [Graham probably wouldn’t be!]

Adj diluted EPS of 140.9p is down 14% (in line with market expectations), the PER is now just 4.4x - I had to double check that figure, but yes it’s correct!

Is it financially distressed then? I’d say no - net bank debt is considerable, but falling fast, at £327m (last year £424m, so 23% paid off this year from cashflows). Covenant leverage is 1.25x (LY: 1.48x) which looks quite comfortable I’d say, in the context of big & genuine cash generation. I’m usually the first person to sound the alarm & warn people to evacuate the building, but in this case I don’t see a problem with this level of debt, given how fast it’s coming down.

Share buybacks are underway, £13m done by 9/2023 year end, from a £45m programme. I like buybacks when shares are on a low valuation, and it’s another sign that the company is not financially distressed.

Going concern statement is clean.

Balance sheet - a bit scary for me, with a gaping hole due the huge intangibles from previous acquisitions. But actually there is value in the intangibles, and it could sell off titles and get some money back. Even so, NAV of £1,115m contains goodwill & similar of £1,054m + £586m, less deferred tax liability of £116m, reduces my version of NTAV to £(409)m - not a disaster given how cash generative FUTR is. So despite the weak balance sheet, it has to be seen in the context of fabulous cash generation.

Cashflow statement - looks very healthy, with £183m cash generation after bank interest & tax paid. Does it capitalise huge development spending? No, only £9.3m, which is fine. Tiny dividends, with more spent on buybacks. Cashflow has mostly paid down debt & funded more acquisitions.

Forecasts - nothing available, but the company says it expects to return to growth in H2 2024, and seems to be increasing spending to drive growth, rather than retrenching.

Paul’s opinion - if there’s anything wrong with these accounts, I’ve not found it. Well, other than a weak balance sheet with a lot of debt, but given the scale of the cash generation (despite tough macro), I don’t see a problem with this bank debt, and it’s rapidly reducing too.

Not everyone will agree with me here, but based on the valuation here of just 4.4x, and acceptable debt, I think this share looks really attractive.

Results seem to be in line with the broker consensus on the StockReport, so I have no idea why it plunged first thing today.

I’m not an expert on the company at all, but I'm tempted to buy at this very modest valuation, for a previous wonder-stock. So I’ll be a bit daring here, and shift up from amber/green to GREEN.

Graham's Section:

Premier Miton (LON:PMI)

Share price: 61.7p (+2%)

Market cap: £90m

Premier Miton Group plc ('Premier Miton', 'Company' or 'Group'), the AIM quoted fund management group, today announces its final results for the year ended 30 September 2023.

These results were published Tuesday. Key points:

AuM falls from £10.6 billion to £9.8 billion

Net outflows of £1.15 billion (previous year: £1.08 billion).

Adjusted PBT £15.7m (last year: £24.3m)

Actual PBT £5.9m (last year: £14.9m)

Nearly £5m of share-based payments are excluded from the adjusted numbers:

The full-year dividend reduces from 10p to 6p, but this is still an attractive c. 10% yield on the current share price.

Adjusted EPS is 8.8p so in this sense the reduced dividend payout is covered by earnings. However, actual earnings per share are only 2.5p.

Acquisition: in November (i.e. in H2 of the financial year), Premier Miton bought Tellworth Investments, bringing in another £559m of AuM.

CEO comment: the general backdrop remains challenging, but the CEO seems happy with fund performance (73% of funds in the first or second quartile since inception with their current managers). He reminds us that they are ready to manage more assets, whenever flows return. They are also increasingly looking at acquisition opportunities:

Our business has the operational infrastructure to manage a multiple of the assets it currently looks after and we have built the necessary distribution and marketing platform to capitalise on this opportunity. We will continue to assess opportunities that can add talented investment teams, or which allow us to access new markets or product capabilities."

Comments on market conditions/policy support - this fund manager, being UK-centric, is particularly affected by the very cheap valuations and the outflows from UK equities. They are endeavouring “to influence public policy decisions to address these structural issues in a positive way”.

Graham’s view

These shares are extraordinarily cheap by historic standards, reflecting the extraordinary current circumstances.

Based on the end-of-year numbers, £1 invested in these shares obtained about £109 of AuM. This is about the same as Jupiter Fund Management (LON:JUP).

Maybe the key challenge for these companies is differentiation, not demonstrating good historical performance of their funds relative to peers.

Good historic relative performance from existing funds is a basic requirement: I think fund managers need to go further and give investors a “why”. This could be a particular theme, or it could be ESG. For some fund managers, it will be providing access to hard-to-reach investments.

Historic relative performance against UK peers probably won’t be the answer in an environment where a random selection of US mega-tech stocks has outperformed almost everything.

I’m not sure what the answer is for Premier Miton. And there are several good options for those interested in investing in fund managers right now, not just this one. But I do see this recovering along with the rest if or when positive momentum returns.

SDI (LON:SDI)

Share price: 90.65p (-18%)

Market cap: £94m

This is a profit warning, at the end of a tough year for SDI shareholders.

SDI Group plc, the AIM quoted Group focused on the design and manufacture of scientific and technology products for use in digital imaging and sensing and control applications, is pleased to announce its results for the six months to 31 October 2023.

Here are the key bullet points:

Revenue +1.6% to £32m, including acquisitions.

Organic revenue growth 2.2% excluding Covid-related sales (i.e. organic growth would be negative if you included the impact of falling Covid-related sales).

Adjusted operating profit £4.4m (H1 LY: £6.9m)

Reported operating profit £3.4m (H1 LY: £6.5m)

The organic revenue decline including Covid-related sales is 18.4%.

Net debt is £13m with c. £15m additional headroom. The leverage multiple is 1.1x, which would be considered moderate.

Chairman’s comment:

Profits have been affected by some destocking, some of which is likely to be temporary, alongside a slowdown in China and Germany. We now expect to report FY24 adjusted profit before tax of between £7.9m and £8.4m.

At the AGM trading update in September, SDI said that market expectations were for FY adjusted PBT of £9.8m.

The new guidance therefore represents a cut in the adjusted PBT forecast of between 14% and 19%.

Covid comments - “the changes in customer behaviour the pandemic caused have continued into this financial year”, with OEM’s initially over-ordering and now apparently still destocking. We have seen the destocking explanation given by plenty of companies over the past year.

Tax rate is now 24.9% (H1 last year: 20%).

Outlook:

Alongside the reduced profit guidance, we get a reminder of SDI’s good long-term track record:

For over ten years SDI has consistently grown value by focusing on a clear and straightforward strategy. We acquire private companies at a significant discount to those on the quoted markets. These subsidiaries are then encouraged to grow for the benefit of all stakeholders. I am pleased to report that we have a number of new acquisition opportunities under review. So, despite the recent headwinds we look forward to the future with great confidence.

Estimates

I’m curious to see what the analysts are doing with their top-line forecasts. At Cavendish, the new revenue forecast for FY April 2024 is £65m (down from £72m) and the new FY April 2025 forecast is £70.4m (down from £77.1m).

These are significant cuts to the revenue outlook, particularly when you consider that H1 FY 2024 revenue (reported today) was already £32m. There is now almost zero growth pencilled in for H2 vs H1.

Graham’s view

Checking my notes in August, I was neutral on SDI but starting to get interested in the valuation (at 122p). One of my main concerns here, which I have mentioned probably on multiple occasions, is the lack of organic growth.

That concern remains valid today, as SDI’s organic growth remains below inflation and seems destined to remain so in the near-term (and that’s even if we exclude the collapse in Covid-related orders).

I previously said that below £1, I would consider SDI to be good value although that implicitly assumed that trading didn’t deteriorate further.

With a reduction in forecast adj. PBT of up to 19%, today’s fall in the share price by about the same amount does make sense.

Therefore I’m going to stay neutral, and move my estimate of value territory down to sub-80p.

Here are the value metrics as of last night:

The new adj. EPS forecast for the current year is 7p, so the new adjusted P/E multiple remains in the region of 13x.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.