Good morning!

Now that all the excitement of the Election is out of the way, the stock market has breathed a sigh of relief, and rallied a bit. Although history suggests that the Tories will find it very difficult to manage with a wafer thin majority, and possibly no majority at all after a few by-elections.

Although we've certainly avoided a variety of scenarios which could have badly unsettled the markets, which is reassuring.

Conviviality Retail (LON:CVR)

Share price: 145p

No. shares: 66.9m

Market Cap: £97.0m

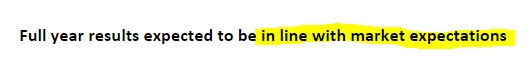

Trading update - I like the sub-heading (copied below), which makes it crystal clear what the key message is, and would like all companies to do this, to make it easier for us to quickly assimilate the core message of trading updates, without having to ponder & interpret lots of text;

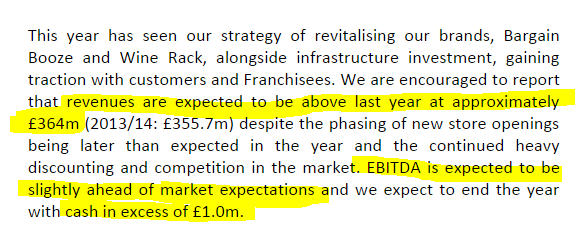

More detail is given;

That all sounds fairly encouraging.

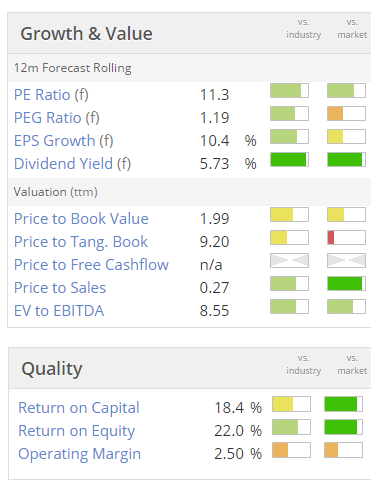

Valuation - the usual Stockopedia graphics look reasonably positive here, especially the generous dividend yield;

My opinion - I'm generally positive on this share - it ticks some value investing boxes - a reasonable PER, and good dividend yield, although the balance sheet is not particularly strong (but not a particular concern either).

I like the franchised business model - so franchisees bear the inventory risk (of theft by staff & customers), and it therefore requires little capex. Therefore the ROE and ROCE scores in the quality section shown above are quite high. Although the operating margin is tiny, at 2.5%, which puts me off.

Competition from the supermarkets is obviously intense, and likely to become even more so. Although the Bargain Booze and Wine Rack fascias run by this company are probably more used for impulse purchases by locals, I imagine.

Growth of about 12% in turnover & profit are forecast this year, due to additional stores acquired recently. Although note that there is no organic growth, with LFL sales down 1.7% for the main Bargain Booze stores. Lack of organic growth is a concern, and suggests they are only just holding their own against stiff competition.

Overall I think it's probably safest for me to avoid these shares, although the divis are appealing. There is also the worry of potential bad debt risk, if a major franchisee were to go bust at some point. Therefore on balance I think it's probably priced about right at 145p per share, based on information we currently have.

As with all recent floats, I think it's worth pondering why the previous owner wanted to sell? So many recent floats have warned on profits, that I think it's best to be extremely sceptical of all recent floats, as there's usually something wrong with them which motivated the previous owner to sell.

Note that the StockRank is very good, at 92.

Action Hotels (LON:AHCG)

Share price: 60.7p (up 3% today)

No. shares: 147.6m

Market Cap: £89.6m

Audited results - for calendar 2014 are out today. This is a growing hotels group, focussed on the budget and mid range sectors, in the Middle East. The company floated on AIM in Dec 2013.

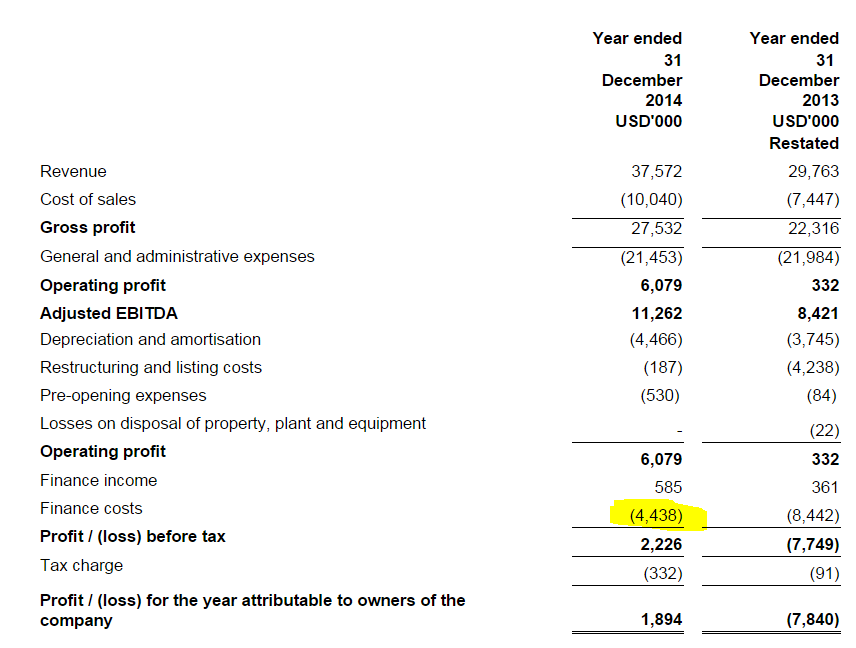

The P&L shows a useful performance improvement on last year. However, note how the debt interest charge (highlighted below) consumes the bulk of operating profit;

Therefore, as things stand at the moment, it doesn't seem to be generating anywhere near a satisfactory return on the substantial asset base of $286.2m (investment properties + property plant & equipment).

With net debt of $103.2m, the pedestrian return on the assets could potentially become a problem - so I'd want to find out what the bank covenants are, and the other terms of the bank borrowings.

Expansion seems rapid, with 8 hotels operating, and a pipeline of another 8 coming. So the fixed assets probably contain some amounts relating to properties under construction, and therefore not generating a return yet. So that might partially explain why performance so far has not been very good compared with the large gross assets.

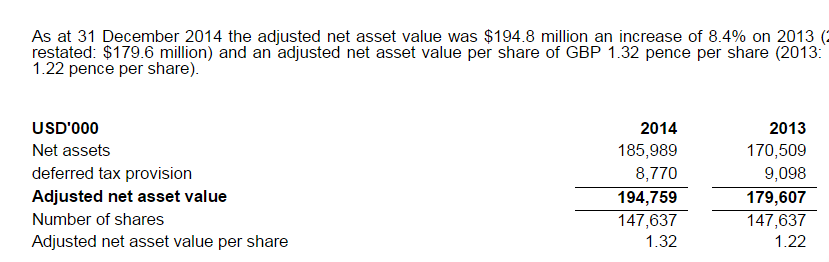

Net asset value - the company includes a table in the results, showing how it has adjusted NAV of $1.32. However, in narrative below they refer to NAV being GBP 1.32 pence per share, so there seems some confusion over the currency. As the Balance Sheet numbers are in dollars, then by my calculation the NAV is indeed $1.32, which is 85 pence in sterling.

Note that the hotel freehold assets are revalued annually, so any upside versus historic cost is already baked into the balance sheet numbers.

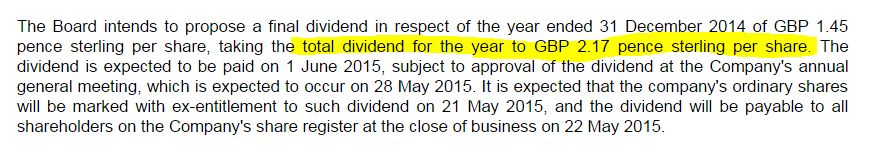

Dividends - the company seems to be declaring a divi that is far more than broker forecast. This seems an odd decision, considering the company is growing rapidly, is cash hungry, and has considerable bank debt.

My opinion - it looks potentially interesting, but you can't value the company at all accurately based on these historic numbers. The crux is what profits & cashflow the company will generate once it has built all the current hotels in the pipeline.

So more research is needed here, but it's one to possibly go on the watch list perhaps?

The track record of management is also vital, for growth companies like this. Have they managed big roll-outs before, and do they have the necessary skills? The CEO seems to be a former Hilton Hotels man. The Chairman is a Sheikh, whose name seems to possibly link him with the Saudi royal family? That's what a Google search is telling me anyway.

So far the shares have not impressed the market;

Have any readers looked at this company? If so please feel welcome to air your thoughts in the comments section below.

NATURE (LON:NGR)

Share price: 13.7p (down 5% today)

No. shares: 79.3m

Market Cap: £10.9m

Final results - for calendar 2014 are out today - far too late in my opinion - the figures should have been published in March, not May. That indicates to me a lack of financial control, something that is confirmed by a series of profit warnings from the company in the last year or two.

The P&L shows a loss before tax of £3.0m, although the highlights section of the narrative doesn't report this, instead highlighting the "adjusted" loss before tax of £1.3m. The difference seems to relate to fixed asset write-offs & other costs relating to the explosion at their Gibraltar facility a while back.

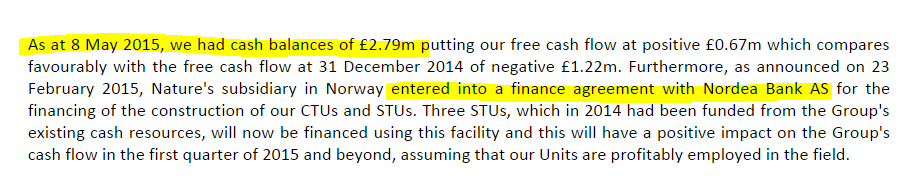

Balance sheet - cash is starting to look a bit tight, having reduced from £3.6m to £1.1m in the year, and the company also had £2.3m in bank debt, so I make that a net debt position of about £1.2m at end 2014.

The company reassures that action has been taken to improve cashflow since the year end, and they look to be in a better position now;

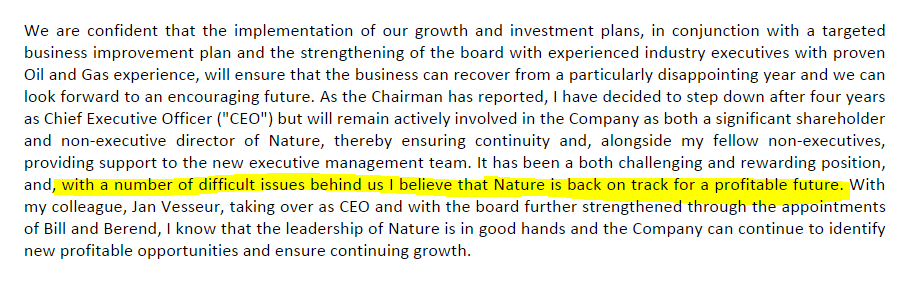

Outlook - the Directorspeak is generally positive, with the outgoing CEO commenting as follows;

My opinion - so many things have gone wrong in the past, and the company's activities seem difficult to forecast, therefore I don't think these shares can sensibly be seen as anything other than a complete punt.

That said, the company made profits of c.£1.5m p.a. between 2009 and 2011 inclusive. Note that management proved very shrewd sellers of a substantial number of shares in the spike up to the 50-85p range in 2011. Although they have been buyers (on a small scale) more recently.

With a poor recent track record, and nothing more than reassuring words from management for upside, I can't get anything like the level of comfort needed to consider buying shares here. It will be interesting to see if the new CEO (former COO, so not completely new) can turn it around or not.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.