Good morning from Paul & Graham!

Today's report is now finished. I'll do some more sections tonight, ready for first thing tomorrow morning again.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Agenda

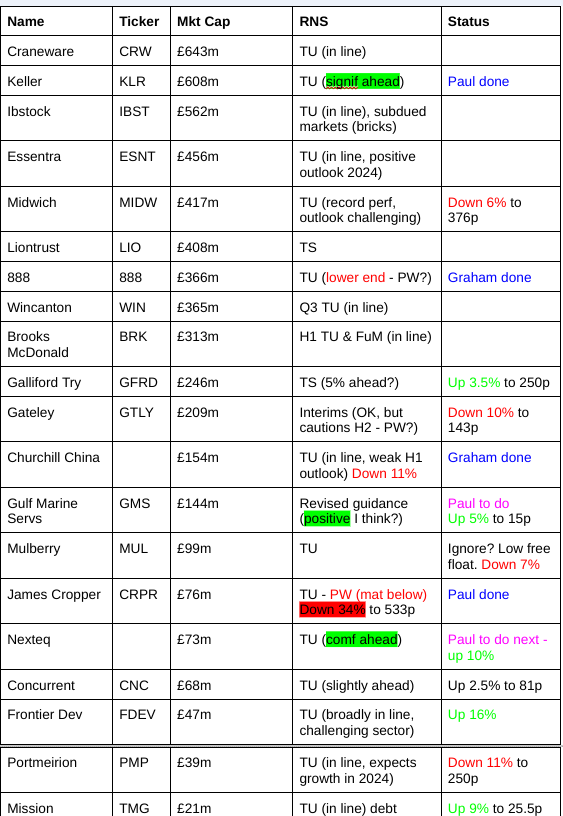

A crazily busy list today. We might need some help from readers, so do flag up any particularly interesting ones (above or below expectations), or strong value/GARP characteristics, for us to prioritise! Thanks.

Backlog Items -

- Spirent - Paul done

- Audioboom - Paul done

- SuperDry - Paul done

Other mid-morning movers (with news) -

Oxford Biodynamics (LON:OBD) - down 23% to 26.3p - results - negligible revs, £10.2m op loss. £5.3m cash left at 30/9/2023, after raising £15m in year. Looks like it will need to do yet another placing soon, but on what terms? Its products sound interesting, but that's of no interest to me until it has enough cash to reach breakeven.

Summaries

Spirent Communications (LON:SPT) - up 11% y’day to 128p (£741m) - Trading Update - Paul - AMBER

An 11% rise yesterday caught my attention. It had a terrible 2023, when years of profit growth collapsed. However, upbeat outlook comments in the latest update make me wonder if a turnaround might be starting? Plenty of cash, and it's used some to reduce the share count with buybacks. Could be worth a look, I know very little about the company.

Superdry (LON:SDRY) - down 15% y’day to 25p (£25m) - Sky News report - Paul - RED

Shares clobbered again with a report from Sky saying that it has called in accountants PwC to "review debt options", following a disastrous profit warning in Dec 2023. Given that it's already using non-standard, higher cost lenders, it's difficult to see what more debt options are available, that wouldn't involve some form of insolvency procedure, and probably heavily dilute or wipe out existing shareholders. Existing equity could easily end up worth nothing. Super high risk.

Audioboom (LON:BOOM) - down 18% this week to 270p (£44m) - FY 12/2023 Trading Update - Paul - RED

This week's trading update is more of a PR release, talking up what positives they can find. Q4 an improvement on Q3 though. Reality is that it's burning cash, not helped by a major mistake with a loss-making contract that runs until 2025. I think it's a weak business model, although mkt cap is now low, and we've seen mad speculative frenzies in this share before, so it might appeal to traders/punters in the next bull market? Profit-takers are sensible, given recent 100% rise I think.

Keller (LON:KLR) - up 3% to 853p (£622m) - Trading Update - Paul - AMBER/GREEN

Ahead expectations trading update. Very low PER, and 5% yield. Balance sheet just about OK, although a fair bit of debt. Looks interesting!

888 Holdings (LON:888) - down 9% to 73.6p (£330m) - Trading Update (profit warning) - Graham holds 888 - AMBER/RED

A mild profit warning from 888 as 2024 EBITDA is expected at low end of range. Net debt/EBITDA remains too high but they do have a few years to improve before the debt will need to be refinanced. I’m neutral on the outlook for the stock but it’s certainly very high-risk.

James Cropper (LON:CRPR) - down 34% to 530p (£50m) - Trading Update (profit warning) - Paul - BLACK for spreadsheet, AMBER on fundamentals

This is a bad profit warning, with FY 3/2024 anticipated profit almost entirely vanishing, due to project delays and customer de-stocking. Surely this should have been flagged earlier, rather than a bombshell huge drop in forecasts? I can't muster any enthusiasm for this share, but seeing as it's probably got adequate funding (although it would be worth checking the bank covenants to be certain), then I'll reluctantly go with amber. Long delays mean little chance of a rapid bounceback in profits, which calls into question the company's strategy.

Churchill China (LON:CHH) - down 6% to 85p (£136m) - Trading Update (poor outlook) - Graham - AMBER/RED

Churchill China confirms that 2023 profit is in line, as efficiency gains offsets flat revenue. Looking ahead, the company sees continued weak demand in H1 2024. I remain neutral on this stock: it’s highly rated but performance doesn’t seem to be going anywhere fast.

Paul’s Section:

Spirent Communications (LON:SPT)

Up 11% y’day to 128p (£741m) - Trading Update - Paul - AMBER

Spirent Communications plc ("Spirent", the "Company" or the "Group") (LSE: SPT), the leading provider of automated test and assurance solutions for next-generation devices and networks, today issues the following Trading Update for the financial year ended 31 December 2023, noting all financial results are subject to external audit.

Interesting to see this share rise 11% yesterday. I know very little about it, but Roland covered its nasty profit warning here on 4/10/2023, concluding that it might be a decent recovery candidate, but wasn’t sure, so sat on the fence with amber. Remember that in these reports we’re mainly reviewing what’s actually happened, and flagging up the range of possibilities of what might happen next, then giving an overall opinion. So when things are uncertain, sitting on the fence makes sense, until a clearer picture emerges.

Previously Spirent made big profits but it’s run into a lean patch in 2023, OR something bigger might have gone wrong, we don’t really know yet.

2023 was a seriously painful year for Spirent shareholders -

About 5 years growth unravelled in one fell swoop last year -

The latest update is in line with expectations - so good to see things have not deteriorated further -

Outlook comments sound quite encouraging -

Whilst we continue to see softness and customer spending delays in the telecommunications sector, we are accelerating our focus on non-telco end markets, and we have seen good growth in order intake for our Positioning business and from Hyperscalers. We also closed a strategic, and significant sized deal with a world leading Financial Services organisation representing a new end market for us. We are building an order pipeline for these end customers…

We are pleased to have started the new financial year with a growing orderbook. We are well positioned to deliver strategic and operational progress, with growth opportunities in our non-telco end customer markets whilst we continue to invest in our leading technology solutions across our portfolio which will position us well in these markets as and when they recover. Overall, the Group remains well-placed for the year ahead.

Cost-cutting has been done, with an 8% headcount reduction, avoiding cuts to core activities.

Cash - sounds healthy still, a key point Roland mentioned in his Oct 2023 review -

We maintained our strong balance sheet and disciplined investment policy. The Group's cash position closed at $103 million supported by our effective working capital management. $72 million of shares were repurchased during the year. We remain well placed to take advantage of investment opportunities as they arise.

Paul’s opinion - not a company I know at all, so I’m just looking at the numbers only. The forward PER is hardly cheap, at 18x, but that’s based on forecasts which have unwound all the growth and gone back to 2017 levels.

So the investment case seems fairly simple - bulls imagining that earnings could recover in future. Given the upbeat outlook comments, that strikes me as a reasonable probability event, so it might pay to carefully watch the trend of broker forecasts in the coming year, or anticipate increased forecasts, if you feel that's likely.

It’s always good to have a nice balance sheet (as this does, I’ve just checked), so management are clear to focus on a turnaround (H1 results were poor), without having to worry about funding or solvency.

Looking at the average share count, share buybacks have been accelerated in 2023, with the total in issue falling from 606m to 579m now.

For turnaround hunters, this looks worthy of further research, based on just a cursory review from me. So I’m happy to retain Roland’s AMBER view.

Superdry (LON:SDRY)

Down 15% y’day to 25p (£25m) - Sky News report - Paul - RED

This news from Sky clobbered the shares yesterday afternoon -

“The fashion retailer, which has a market value of just £30m, has drafted in advisers to examine further debt-raising options following a pre-Christmas profit warning, Sky News learns.”

As regulars will know, we’ve been ringing alarm bells (at various volume levels) for a long time, over the deteriorating position of this struggling brand. It offered some hope after the IP sale in 2023, and various refinancings (debt and a little equity), but all that seems to have been overtaken by greatly deteriorating trading.

The last profit warning on 19/12/2023 was horrendous, with one broker now forecasting a £45m loss. It looks like the broker consensus (2 brokers) is diluting this with an unrealistic figure from the other broker.

As a sector expert friend has said to me, what debt restructuring options are left to SDRY, given that it’s already been ditched by conventional lenders, and is now financed by Hilco and Bantry Bay? Convertible loans that dilute existing holders maybe? Debt for equity swap - these are not usually on favourable terms for existing equity. A dilutive equity raise, or a combination of these? Who knows. Founder Julian Dunkerton might take it private, but why do that when it's in such a mess? A pre-pack administration seems more likely to me, similar to what Next did with the founder at Joules, leaving outside shareholders with nothing.

Paul’s opinion - it gives me no pleasure to say this, but I cannot see any value in the equity. Anything could happen next, but trading now seems to be so bad, that SDRY must be burning through cash, and as mentioned before, I doubt it gets to the end of 2024 in its current form. Just for gamblers, because one way or another, debt providers look likely to end up owning the business. It needs to ditch the onerous leases, so that needs some form of insolvency, eg CVA, which should have been done a long time ago, but wasn’t. Also the collapsing sales from wholesaling is telling us that customers don't like the product/value proposition. It's obvious why, when you look at the prices in their shops - expensive, for unremarkable products. That said, the IP sale shows that the brand does still have value.

A pre-pack administration would likely leave small shareholders with nothing, so one way or another, a zero outcome now looks a high probability.

Audioboom (LON:BOOM)

Down 18% this week to 270p (£44m) - FY 12/2023 Trading Update - Paul - RED

My initial skim of the update on Monday morning seemed quite positive, but shares fell 10% by Monday’s close, and again on Tuesday. Maybe some profit taking after a >100% rally from Oct 2023 lows of c.133p? We’re seeing a lot of profit-taking in big risers at the moment.

Long-term BOOM has been a disappointment, punctuated by two large speculative frenzies, as you can see -

To be fair though, current management did take a basket-case a few years ago, then achieved big revenue growth, resulting in around breakeven trading now (in a depressed market for advertising, so it might recover in better conditions maybe?) -

Is it a good business model? No, in a word. It does podcasting, and the trouble is that financially successful podcasters then shop around for the best deal. So it seems to me that BOOM has poor sustainability of profits, which can easily disappear (as they have done).

It’s not a tech business, it’s an advertising business which operates through the digital output of podcasts. There are still a load of costs associated with that, and lots of competition, so it’s nothing special in my view.

Management seem greedy too, with excessive share options awards that snatched all the profit away when it did make some profit - see the P&L in previous accounts.

Latest news -

Audioboom (AIM: BOOM), the leading global podcast company, is pleased to provide a trading update for the year ended 31 December 2023.

Q4 return to revenue growth, EBITDA profitability and cash generation

Q4 revenue $19.2m moving in the right direction, up 5% on last year Q4, and up 37% on Q3 2023.

Q4 scraped a small adj EBITDA “profit” (so not really profitable) of $0.2m

Cash is up by $0.7m in Q4, to $3.7m, plus $1.8m undrawn bank facility. Adequate? It doesn’t mention that cash was higher at $5.3m at the interims in June 2023. So cash has actually fallen in H2.

It also doesn’t mention that a huge $8.9m loss was booked in the H1 results, for onerous contracts. That’s going to drain cash in future, running to July 2025. See note 9 of the interim results for more detail.

Full year 12/2023 numbers aren’t good - revenue $65.0m, down 13% on LY.

Worse, it’s loss-making for the year at $(1.5)m - this is adj EBITDA. So the real loss will be larger. That’s a big deterioration from 2022, which saw a positive $3.6m adj EBITDA.

I’m rapidly losing interest, and didn't have much interest to lose in the first place. We’ve established that it’s not very good. Is there are brighter future ahead?

Outlook - $47m contracted ad revenue already booked for 2024 - which is good.

I like this too -

The Company anticipates record revenue in 2024, with operational improvements (including the significant reduction in minimum guarantee obligations) and a return to adjusted EBITDA profitability

Although this won’t include the heavy losses on the onerous contract, as that’s already been booked to a balance sheet provision. However, it’s still cash going out of the door, so in the real world, I think it’s likely that BOOM continues burning through the little cash it’s got left. Or it might not, if there’s a big pick-up in advertising revenues, if its markets improve.

Paul’s opinion - I’d forgotten about the onerous contracts, which was a disastrous misjudgement by management. It’s not really profitable, and the FY 12/2023 results are likely to look grim, as the interims were.

Is there upside though, given that it might see a cyclical recovery in ad revenues? Possibly, I don’t know. Also the market cap is only £44m now, so you could argue it’s very cheap compared with previous speculative bubbles in the valuation.

Overall, I have no idea what the share price is likely to do, but I can see that the fundamentals are weak at this point in time. So it has to be a continued RED from me, I’m afraid, despite management’s best efforts to put a good spin on things in this week’s PR release (sorry, trading update). I don’t blame people for banking their profits this week.

Keller (LON:KLR)

Up 3% to 853p (£622m) - Trading Update - Paul - AMBER/GREEN

Keller Group plc ('Keller' or 'the Group'), the world's largest geotechnical specialist contractor, issues a post close trading update for the year ended 31 December 2023.

Checking our previous notes for background;

17/5/2023 - 653p (Paul - GREEN) - Good TU, confident FY 12/2023. Good order book. Decent value.

23/10/2023 - 771p (Graham - AMBER) - Mat ahead TU. Low quality, but cheap.

As you can see, I tend to view KLR more positively than Graham.

The StockReport is showing a very low PER, and decent yield. Normally for a PER this low, there’s something wrong, usually high debt, pension deficit, or declining sector.

The long-term, 20-year trend has been sideways, within a wide range -

However, the main attraction is the divis - a lovely track record below -

The story is explained well in the 5 graphs -

Low margin, but improving, on very large revenues. Something went wrong in 2018, but profit has been recovering since. Strong performance in the current year, and tends to be rated on a low PER, with divi yield c.5% most years.

Today’s update - sounds very good to me -

The positive trading momentum and strong operational performance seen in the first nine of months of the year continued in the fourth quarter, with a particularly strong end to the year.

Accordingly, we now expect to report an underlying operating profit for the year significantly ahead of current market expectations1. The underlying operating profit margin for the year is expected to be significantly ahead of recent years.

1 Analyst consensus underlying operating profit for 2023: £150m.

Broker updates - nothing available as yet. Liberum have published notes in the past, so hopefully something might filter down to us pond life! "significantly ahead" suggests that forecasts will be obviously be going up. So the PER might get even cheaper than 6.2x.

Companies often report operating profit, if they have heavy finance charges, so let me check the debt/finance cost situation at the last interims.

This looks OK - in H1, operating profit was £37.7m, and net finance costs £5.0m, so PBT was £32.7m.

Bank debt is high, at £245m June 2023 interims, although this is mainly for funding fixed assets, as it’s a capital-intensive business. Also working capital is large, with enormous receivables - the company needs to be sure it’s not acting like a bank for its customers, extending them too much credit. I would like to see the average daily net debt, rather than just period end snapshots, as with all companies.

Overall the balance sheet looks just about OK to me, although I would like to see it reduce bank debt by tightening up on receivables collection.

Looking through the interims, 2023 looks like being an exceptionally good year in its large US business, which is mopping up weakness in other geographies. So the risk is that 2023 is a one-off good year, which could be why the market is giving it such a low PER?

Outlook - this sounds slightly contradictory to me, mentioning “one-off” profits in 2023, yet still being confidence about 2024 -

"We are very encouraged by the Group's strong progress in 2023. The combination of management actions to improve operational performance in project execution, commercial agility in the face of a dynamic market, and the one-off benefits in North America will result in Keller delivering a record performance in 2023 that has significantly exceeded our original expectations. The fundamental strengths of the business, together with the continued positive outlook and our strong order book, give us confidence in further progress in 2024."

Paul’s opinion - I don’t really understand the business, but the numbers look attractive to me. Maybe Graham and I should compromise at AMBER/GREEN.

I like situations like this, where you have huge revenues, and low but improving operating margins. That can give big upside to profits, if it’s an establishing trend, not just one-off.

It could be worth readers taking a closer look at Keller, and doing some proper research, based on my positive initial review.

Looks like it could be a bid target from USA too, given that it’s cheap, and much of its operations are in the USA.

James Cropper (LON:CRPR)

Down 34% to 530p (£50m) - Trading Update (profit warning) - Paul - AMBER

James Cropper is a market leader in Advanced Materials and Paper Products, centred around four market audiences: Future Energy, Technical Fibres, Luxury Packaging and Creative Papers.

A purpose-led business, built upon six generations of the Cropper family, James Cropper has a 600+ international workforce and an operational reach in over 50 countries.

Established in 1845, the Group manufactures creative papers, luxury packaging and advanced materials incorporating pioneering non-wovens and electrochemical coatings.

Coincidentally, CRPR came up on one of my screens the other day, and I noticed how peculiar the recent chart looked - with repeat buys seemingly walking the share price up a little every day. That’s all reversed in one fell swoop today though, so bad luck to any holders here, we can all commiserate with the sinking feeling of profit warnings, which is just part of small caps investing, and cannot be avoided altogether, however hard we try - hence why we should probably diversify, to spread the risk -

What’s gone wrong then? Financial year is FY 3/2024. It’s project delays -

… the Advanced Materials business has seen expected projects in hydrogen being delayed, partly as a result of inflation and higher interest rates feeding through to higher project costs. In addition, funding decisions by governments have impacted end customer project plans and scheduling. As a result, customer expansion plans saw a noticeable change with major market growth now expected to be pushed back to calendar years 2026 to 2028.

Oh dear, the timescales there are much longer, so this is not just a temporary, fixable problem, it seems.

The Advanced Materials divisions' revenue trajectory will be impacted in FY2024 as a result and the Board now anticipates a slower ramp-up in demand than previously expected across calendar years 2024 and 2025. Nevertheless, the longer-term outlook for the hydrogen business remains strong…

I can’t see the market quickly forgiving this.

Although -

Pricing across the business has been resilient, underpinned by strong customer relationships which has protected margins.

Paper products division is also suffering -

As a direct result of ongoing high inflation impacting consumer confidence, compounded by supply chain destocking, demand in the Paper Products business continued to soften to an even greater extent during Q3.

Recovery sounds on the cards (haha!) for this part of the business though -

Whilst near-term revenues have been affected, the future project pipeline remains strong and in the meantime the Group will aim to keep efficiency high through tactical use of free capacity.

The final quarter of the year is expected to show some recovery in volumes in Paper & Packaging and demand is expected to further recover throughout FY2025.

Revised guidance -

As a result of the above trends, the Group now expects full year FY2024 revenues to be not lower than £103m. FY2024 adjusted PBT is expected to be materially below prior management expectations, with the Board now expecting to report a small adjusted profit before tax for the year.

Shore Capital (many thanks) gives us more precise guidance, and it’s grim - revenue forecast dropped from £122m to £103m. Adj PBT crashes from £5.9m previous forecast, to just £0.5m now! EPS is now only 4.1p - giving a PER of 129x

So clearly the share price now factors in a major recovery of profits from this pretty disastrous performance in FY 3/2024.

That’s not an unreasonable assumption, given the historic profits pre-pandemic of £2-5m post-tax -

Balance sheet - there was about £30m NTAV when last reported. Although note long-term borrowings of £24m, although about half offset by cash. So bank covenants might need to be considered. It mentions slower capex in today’s profit warning.

Someone mentioned it has freehold property, so I’ve checked the 3/2023 annual report, which shows £7m freehold property at cost, so there’s a chance that might be worth above cost maybe, given that it’s an old, family-controlled company? Does anyone know if there’s upside on property value? If so, that could mean we don’t have to worry about the bank debt.

Paul’s opinion - we didn’t review CRPR in 2023, so we’re overdue a fresh look, unfortunately after a very nasty profit warning, almost wiping out all profit this year. That naturally raises quite big questions about the direction the business is going in.

I’d need a lot of convincing to want to bottom fish at the current price.

It’s difficult to decide whether to go with amber, or amber/red. Since I don’t have any worries over solvency, then I think AMBER is best. Although this is a big profit warning, and I’m not seeing value in this share, so amber is probably generous.

Graham’s Section:

888 Holdings (LON:888)

Share price: 73.6p (-9%)

Market cap: £330m

(Graham has a long position in 888)

888 (LSE: 888), one of the world's leading betting and gaming companies with internationally renowned brands including William Hill, 888 and Mr Green, today announces a post-close trading update for the three and 12 months ending 31 December 2023…

The revenue figures for 2023 aren’t very good, but this had already been pencilled in. The consensus revenue forecast according to Stockopedia was £1,712 million, and the actual number coming through is £1,711 million (down 8% year-on-year).

So this is no surprise:

Mitigating, the company points to 5% year-on-year growth in the number of active customers.

The main reason given for the revenue decline is “a proactive mix shift away from dotcom markets, which impacted revenues by approximately £80m during FY23”.

That would indeed account for the majority of the decline, and then there are also “customer mix changes in the UK as a result of additional safer gambling measures, alongside the change in the Group's marketing approach to focus more on sustainable revenue and profitability”.

So in a nutshell, the company now has more customers than it did before, but they have a different profile than before and they generate less revenue on average.

A noteworthy change is that while international revenues fell 16%, retail revenues (i.e. William Hill store revenues) were up 3%. So there are far fewer customers from international unregulated markets, but there are more customers making small bets in physical UK shops.

2023 EBITDA margin will be “approximately 18%” (previously indicated range: 18-19%).

Cost savings/synergies:the disastrous - for shareholders - William Hill takeover required lots of cost synergies to have any chance of working out; the company says that the full £150m synergy target will be delivered this year.

Cash: available liquidity £275m. Remember that net debt is c. £1.8 billion.

Management team: the company hired a new CEO as of October 2023. The company also has a new CFO joining next month, and has a range of other new appointments - Chief IT Officer, Chief Product Officer.

As we have previously discussed, 888 had some regulatory problems in the Middle East, leading to the departure of the previous long-standing CEO.

Outlook for 2024 - this contains a mild profit warning.

888 reports a positive outlook for revenue growth from current levels, along with a new £30m cost savings programme.

Cost savings will be allocated to marketing:

Cost savings to support an increase in marketing spend in 2024, with superior returns supported by a more effective customer and product lifecycle management plan.

The above initiatives will enhance long-term profitability, but the additional investment means the Group currently expects 2024 Adjusted EBITDA to be at the low end of consensus range.

The consensus range is given as £340 - £397m, quite a wide range and it’s unfortunate that we’re going to be at the lower end of this.

Graham’s view

As a long-suffering shareholder, I am fine with the strategy to focus more on taxed and regulated markets (now responsible for 95% of revenues), instead of exotic unregulated markets where the outcomes are less predictable.

I am also happy with the strategy to focus on customers who will bet smaller amounts but hopefully stay with the company for longer - this is more or less required by regulations anyway. Hopefully the company will still attract high rollers in cases where the individuals can afford to be high rollers. I am a strong believer in the principles behind Safer Gambling.

(As an aside, I was only reading the other day about Keith Gillespie, a footballer I used to follow, who was declared bankrupt in 2010 despite earning over £7m during his playing career. He threw it all away on the bookies - a sorry reminder that sometimes even those who bet big can’t really afford it.)

Getting back to 888, I remain deeply concerned about the situation here, but I still haven’t sold my small stake in the business.

Net debt/EBITDA, using figures suggested today for 2024, is c. 5x. It’s still too high and so it appears that shareholders are still at least two years away from seeing the leverage approach a reasonable level.

It is tempting to sell here - I will have to give it more consideration as to whether I’m willing to wait even longer for the company to fix its balance sheet. I would be gutted if the company agreed to a takeover soon, and I had already sold out (we discussed the possibility of a takeover in December).

Most of the debt matures in 2027 and 2028, so there are still a few years to sort things out.

Investors in the 2028 bond don’t seem to be panicking yet:

I have a neutral stance on this stock, although for the purposes of our colour system a RED warning might be justified.

Churchill China (LON:CHH)

Share price: 1185p (-6%)

Market cap: £136m

Churchill China plc (AIM: CHH), the manufacturer of innovative performance ceramic products serving hospitality markets worldwide provides an update on trading for the year ended 31 December 2023.

This is a much-loved Stoke-based business, but today’s announcement is a little cautious.

Firstly, the good news:

The Company is pleased to announce that margins have continued to improve throughout the year and as a result profitability for the year is expected to be in line with analyst forecasts. This is particularly pleasing given a more challenging sales backdrop in H2 of 2023.

Revenues of £82.1m are below last year and significantly below the forecast suggested on the StockReport (£89m).

Fortunately, the profit result was saved by “improving manufacturing yields” and “a further reduction in agency staff in Q4”.

Now here is the weak outlook:

The macro-economic situation in UK and Europe remains challenging and we expect demand to remain weak for at least the first half of the year. Cost increases, including the national living wage will have an impact on margins in 2024 which will in part be mitigated by further efficiency improvements and increased prices.

It’s the second time this week I’ve seen a company mention the national living wage, and I guess we’ll be hearing a lot more of this. The increases are significant and start from 1st April 2024.

Chairman Comment:

"We are pleased that we have delivered a good result in 2023 and have continued to improve profitability and levels of efficiency despite the difficult trading conditions. Churchill China is a resilient business and whilst the outlook for 2024 remains challenging, we are confident that our long-term strategy positions the Company well to benefit when demand improves."

Graham’s view:

Paul and I have both been neutral on this one, due to concerns around costs and also due to its high earnings multiple:

The stock has a below-average ValueRank, and an above-average QualityRank, which makes perfect sense to me. It does earn good ROCE/ROE and has an admirable track record of profitability and dividends over very many years.

However, I do struggle to get excited about it at the current level. Where is growth going to come from? European hospitality customers aren’t exactly booming, and energy/staff costs continue to drag on performance despite the company’s best efforts to be as efficient as possible. Energy hedges have expired so maybe there is a chance for the company to benefit from falling prices in 2024?

I do admire the company’s long record of success, and I note the continued presence of the Roper family on the shareholder register. But I wouldn’t be in any rush to get involved at this valuation. So far, the market agrees:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.