Good morning from Paul. Roland's with us again today!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Agenda

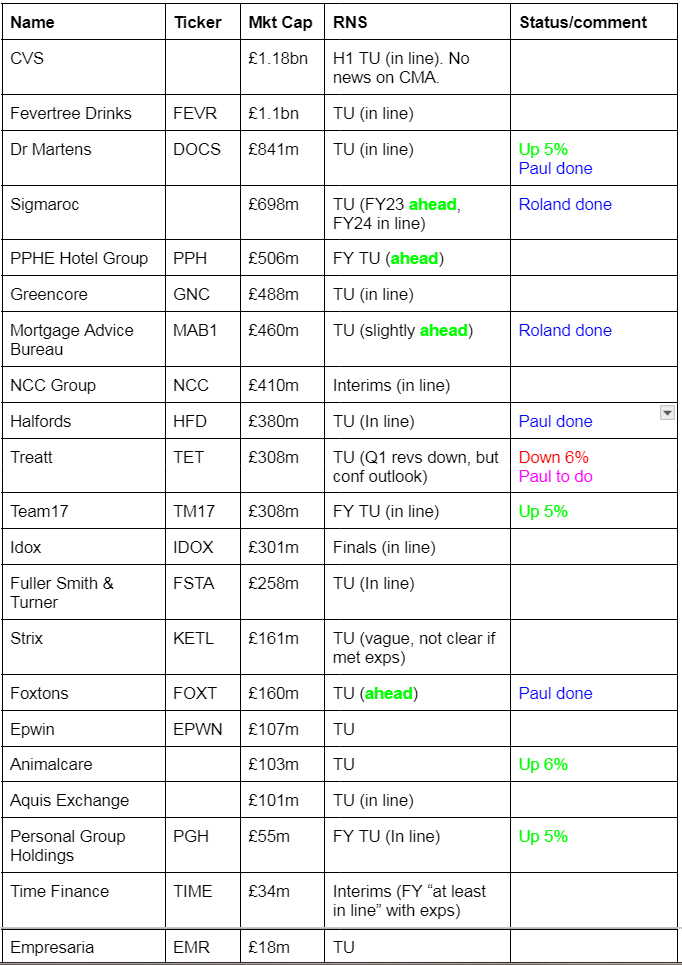

Crazily busy again today, but mostly "in line" -

Other mid-morning movers with news

(excl resources & sub £10m m.caps usually) -

Titon Holdings (LON:TON) - down 11% to 80p (£10m) - FY 9/2023 Results: £(0.8)m LBT down -33%. Outlook weak. V good bal sht though.

St James's Place (LON:STJ) - down 9% to 616p (£3.7bn) - FuM update.

IG group (LON:IGG) - down 8% to 712p (£2.8bn) - H1 PBT down 21% despite big increase in interest income on client funds (regulatory risk?). £1bn NTAV.

Summaries

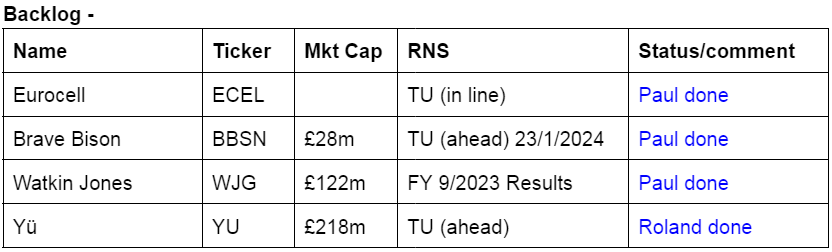

Brave Bison (LON:BBSN) - 2.15p (£28m) - Trading Update 23/1/2024 [ahead] - Paul - GREEN

I flagged this digital marketing company as interesting this time last year here 3/2/2023. My view remains positive, as it's profitable, has beaten market expectations for FY 12/2023 trading, has cash in the bank, and some impressive client wins under its belt. Looks worth a closer look, and the shares are almost 20% cheaper now than they were this time last year, despite a good performance in 2023.

Watkin Jones (LON:WJG) - 48p (£122m) - FY 9/2023 Results - Paul - AMBER

Shares have dropped 80% in the last two years for this build-to-rent property developer. At least there's no more bad news in these results not already known. Could it become a turnaround situation? Possibly, but legacy issues are still problematic & provisions will be a drain on cash. I'm leaning towards a positive view, and am reassured by the going concern analysis, and 97% NTAV support for the share price. Providing nothing else goes wrong, this could be good, but for now I will stick with AMBER until there's more evidence of a turnaround.

Eurocell (LON:ECEL) - 128p (£143m) - Trading Update (in line) 23/1/2024 - Paul - GREEN

In line trading update, following considerably lowered expectations in 2023. Strong balance sheet, starting £5m share buybacks, good divi yield. Looks attractively priced for a macro recovery. So thumbs up from me. Downside risk could be another profit warning before recovery begins?

Foxtons (LON:FOXT) - 52.6p (y’day close) £160m - Trading Update FY 12/2023 - Paul - AMBER/GREEN

An impressive 19% beat against market expectations is announced today. That's all the more impressive given how difficult the housing market has been. Foxtons has pivoted towards lettings in recent years, with acquisitions, so at 70% of revenues that makes it a lot less cyclical than before. I find the outlook comments reassuring, as it sounds as if a housing market recovery could now be underway, with mortgages below 4%. It's had a strong run recently, so not one I personally want to chase any higher for now.

Sigmaroc (LON:SRC) - unch. at 62p (£698m) - FY23 trading update - Roland - AMBER

A positive update from this European building materials group, which reports 2023 EBITDA ahead of expectations. However, a recent €1bn acquisition is still being digested. I think the valuation looks fair at the moment, but would like to see the 2023 accounts before taking a stronger view.

Mortgage Advice Bureau (Holdings) (LON:MAB1) - up 2% to 824p (£460m) - FY23 trading update - Roland - AMBER/GREEN

Q4 trading was better than expected at this mortgage broker. Trading so far in 2024 is said to have been encouraging and far stronger than January 2023. Although the valuation is up with events, I think the shares could remain attractive.

Dr Martens (LON:DOCS) - up 5% to 79p (£760m) - Q3 Trading Update [in line] - Paul - AMBER/RED

A poor update to Dec 2023, but as expected after a series of profit warnings in 2023. Peak period Q3 revenues down 21% says to me there are bigger problems than just macro. Balance sheet isn't great at £100m NTAV, with too much inventories & bank debt. Doesn't interest me at this stage, but it could be a turnaround potentially in future, who knows?

Yu (LON:YU.) - down 5% at 1,243p (£218m) - FY23 trading update (backlog) - Roland - AMBER

This business has delivered remarkable progress since 2022. This 2023 update suggests to me that momentum remained strong in H2 last year. The smart meter business could eventually become valuable, but I can see several financial risks to consider in the meantime. I suspect the shares are up with events, for now, at least pending the 2023 accounts.

Halfords (LON:HFD) - Down 3% to 169p (£374m) - Q3 Trading Update - Paul - AMBER/GREEN

Despite a tough Dec 2023, it seems to have made it up with decent Oct, Nov, and Jan, so reiterates within guided range of profit for FY 3/2024. Not seeing an immediate recovery in 2024, but I like the potential for an operationally geared profit recovery in time. Hence I'm leaning modestly positively towards this share, especially after the recent dip in price. Could it become a takeover target, as rumoured before?

Paul’s Section:

Brave Bison (LON:BBSN)

2.15p (£28m) - Trading Update 23/1/2024 [ahead] - Paul - GREEN

Brave Bison, the digital advertising and technology services company, is pleased to provide the following trading update for the year ending 31 December 2023 ("FY23").

Company headlines -

Results ahead of market expectations

Third consecutive year of growth in net revenue, EBITDA and EBITDA per share

I’m not interested in EBITDA, but it helpfully also tells us proper profit -

That’s pretty good for a £28m market cap company, I’m starting to get interested.

Net cash is also a big plus.

Nice client wins -

New clients won in 2023 include Pinterest, Purina, John Lewis Partnership, Holland & Barrett, ProCook, Monday.com, Patreon, The Army, Warner Bros., Aer Lingus, Markel Group, Asda, Team GB, Winparts , Fiskars and Molson Coors

Cavendish says adj PBT beat expectations by 13% (£3.6m actual vs £3.1m forecast). It did adj PBT of £1.5m in H1, so H2 is £2.1m, a nice progression. Note that the profit comes from adjusting out hefty restructuring & acquisition costs (in H1), so I'd like to see cleaner, non-adjusted profits in future.

Balance sheet - was only £2.1m NTAV on 30/6/2023, and note that intangible assets doubled in H1, due to an acquisition. So I’d say it’s an OK balance sheet, but not particularly strong. It doesn’t pay divis.

Paul’s opinion - this looks good. Interesting that a digital marketing company is trading ahead of expectations, when we recently heard a gloomy update from much larger S4 Capital (LON:SFOR) .

On the basis of these numbers, I think this share could be worth readers taking a closer look, with your own more detailed research. Hence I’m happy to stick with GREEN, same as this time last year. I’d want to learn more about how it’s achieving good profits, and whether that is sustainable? Whatever it's doing is clearly working!

Note there was some Director buying in late 2023.

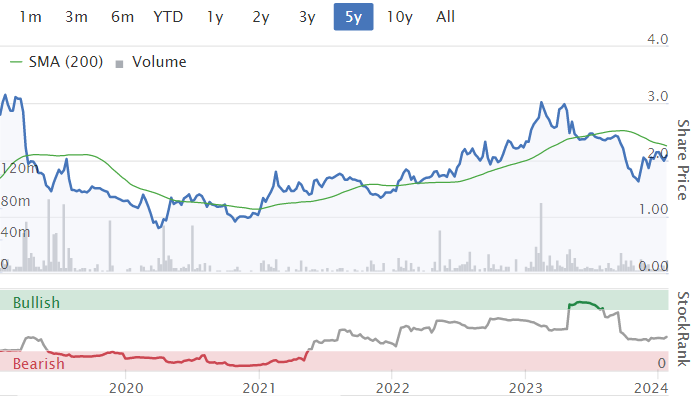

The stock market just doesn't seem interested -

Rather concentrated shareholder list, with Lord Ashcroft being the biggest holder -

Watkin Jones (LON:WJG)

48p (£122m) - FY 9/2023 Results - Paul - AMBER

Watkin Jones is the UK's leading developer and manager of residential for rent, with a focus on the build to rent, student accommodation and affordable housing sectors. The Group has strong relationships with institutional investors, and a reputation for successful, on-time-delivery of high quality developments.

The Group announces its annual results for the year ended 30 September 2023 ('FY23')

Well positioned to capitalise on a market recovery

Shareholders have really suffered here, with previously fairly reliable financial performance (c.£50m pa profit) falling apart as the pandemic, but more importantly big interest rate hikes, not to mention operational mishaps and remediation of faulty projects, have wiped out profitability -

This is obviously why the shares have plummeted. Note that there has not been any dilution, with the shares in issue static at 256m over its time as a listed company - so could this be a recovery opportunity I wonder?

Poor results for FY 9/2023, and note the small adjusted loss is much worse in the statutory numbers (due to an additional £35m building safety remedial provision, to be spent over 5 years). Also the plunge in net cash worries me -

No divis for now.

Outlook - I particularly like point 1 saying forward revenues cover the cost base for FY 9/2024, which reassures -

Any positive feelings from the above should be tempered by the company’s track record of being very unreliable with its forecasts previously for 2023, much too optimistic, with the bad news only slowly and belatedly released to the market -

Balance sheet - still looks fairly robust to me, especially the working capital (£311m current assets, less £134m current liabilities, giving £177m of net current assets).

Long-term debt is only £29m.

£118m NTAV overall is only a whisker below the £122m market cap.

Provisions do concern me, as they keep growing (this is for remediation work), so who knows if even more provisions will be needed? We've seen with other builders how the provisions tend to grow over time. There’s a £24m provision in current liabilities - which means £24m cash going out of the bank account this year, and another £41m in longer-term provisions. That could squeeze cash, and in the worst case scenario force a fundraise, although it does have £72m gross cash, so maybe I’m worrying too much?

Given that customers will be paying in large lumpy amounts I imagine, then the cashflow would need to be carefully managed here. It’s got additional headroom on the borrowing facilities though.

Going concern note - seems very thorough, and says bank facilities extended to Nov 2025, and that covenants have been met, and expected to be met through to 31 Jan 2025 (the going concern period, 12 months from now).

In a downside scenario, it says it could sell land assets, thus repaying the RCF and not needing covenant tests.

Overall, I think this is reassuring -

Based on the thorough review and robust downside forecasting undertaken, and having not identified any material uncertainties that may cast any significant doubt, the Board is satisfied that the Group will be able to continue to trade for the period to 31 January 2025 and has therefore adopted the going concern basis in preparing the financial statements.

Paul’s opinion - this is really tricky. We’ve seen a catalogue of problems with WJG in the last two years, which is why the share price has crashed about 80%. These latest results & outlook do at least not bring any fresh bad news. So should we be starting to think about a possible recovery? That would certainly be brave, but with the market cap now equal to NTAV, and a clean going concern statement with adequate funding it seems, then I could see a scenario where equity begins to recover, maybe quite strongly?

The downside risk is if the company is glossing over the negatives (as it has done before), only to deliver more bad news in future.

Institutional demand will probably be quite interest rate dependent, but there’s obvious end user demand for more rental property. If inflation and interest rates fall in 2024 and beyond, then it could conceivably start reporting more positive news. In the past WJG made £50m pa profit, which means any return to that level would be a share price maybe 3-5 times the current level. That’s obviously an optimistic view, but it’s nice potential upside.

Personally I’m leaning slightly towards a more positive view, but think it’s probably best if I sit on the fence for now with AMBER.

Eurocell (LON:ECEL)

128p (£143m) - Trading Update (in line) 23/1/2024 - Paul - GREEN

Eurocell plc, the market leading, vertically integrated UK manufacturer, recycler and distributor of innovative window, door and roofline PVC products, provides the following update for the year ended 31 December 2023.

ECEL had a profit warning on 5/9/2023, which didn’t unsettle the share price much at all. The strong balance sheet nicely underpins things, although timing of a recovery in trading is uncertain. Nevertheless, I like risk:reward here a lot, for a medium-term recovery, so ECEL was on my top 20 share ideas for 2024.

Share buybacks - £5m announced on 23/1/2024, began 24/1/2024 (28,456 shares)

Latest update for FY 12/2023 -

Year End Trading Update - Profits In Line with Expectations; Strong Cash Flow

Revenue £365m (down 4% on 2022)

Net cash £0.4m at 31/12/2023, improved from £14m a year earlier.

Reviewing strategy, will report in March 2024, with full year 2023 results.

Broker update - there’s nothing available to us plebs.

We have 11.8p EPS on the StockReport for broker consensus, which as you can see has been steadily lowered as the newsflow in 2023 got tougher due to macro trends -

Pre-pandemic, ECEL did about 20p EPS, and there has been roughly a 10% enlargement of the share capital since then (although that will come down by about 4% with share buybacks just started). So I’m going to adjust pre-pandemic normal EPS to about 19p now, if trading recovers to pre-pandemic levels, which it should (hopefully) given time.

For this type of business, with a strong balance sheet, I think a PER of say 12x is justified, so I see upside to 228p. That’s 78% upside on the current share price of 128p, with nice divis whilst you wait.

Obviously we have to watch carefully to be sure that earnings can recover to pre-pandemic levels over the next year or two, which it might not, there are no guarantees.

Paul’s opinion - ECEL is only valued at 10.8x 2023’s rather depressed earnings, and 6.7x my target recovery earnings of 19p. I think that’s very attractive. There’s lots more detail in the announcement, I’m just focusing here on overview.

The balance sheet is really good, so investors don’t have to worry, even if trading were to deteriorate further. That would just mean having to wait a bit longer for a recovery I think.

Overall, I think this looks one of the safest ways to anticipate a gradual recovery in building products, at a reasonable price. So it’s GREEN from me.

Downside risk would be a profit warning from continuing depressed conditions in 2024, which is an obvious possibility, but given excellent financial strength, I don’t think that would come anywhere close to being a crisis, so would be something to just ride out (and top up my position if I have one at that point).

Foxtons (LON:FOXT)

52.6p (y’day close) £160m - Trading Update FY 12/2023 - Paul - AMBER/GREEN

25 January 2024 - Foxtons Group plc (LSE:FOXT), London's leading estate agency, has continued to deliver against its operational turnaround plan and outperform the market1. For the year ended December 2023, both revenue and adjusted operating profit2 are expected to be ahead of consensus market expectations3.

Footnote 2 below shows that there have been quite big adjustments, so I would need to get comfortable what these are, and how valid they seem. Why does it include £1.4m of amortisation of acquisition-related intangibles, when these non-cash costs are customarily excluded from adjusted numbers?

2 Adjusted operating profit is defined as profit before tax for the period before finance income, finance cost, other gains/(losses) and adjusted items. 2023 adjusted operating profit includes c.£1.4m of amortisation of acquired intangibles and excludes c.£4.4m of adjusted items.

3 2023 consensus market expectations being the average of forecasts provided by analysts covering the Group for the year ending 31 December 2023 (revenue: c.£144.5m; adjusted operating profit: c.£11.8m).

This is a useful 19% beat, at £14.0m vs £11.8m forecast -

2023 revenue of c.£147m (2022: £140.3m) and adjusted operating profit of c.£14m (2022: £13.9m), both ahead of consensus market expectations.

Although operating profit is not really a valid number, as it excludes finance costs, which may also include lease finance costs. Companies should be quoting adj (reasonable only) PBT as the key profit measure. Not operating profit or EBITDA! Or give all 3 if you like. It wastes our time having to check if they’ve cherry-picked a favourable metric when companies report EBITDA or operating profit. As a general point, we really need some standardisation of trading updates, as in many cases it’s a minefield of PR-driven deception (which is counter-productive and undermines trust & credibility) at the moment.

Broker update - many thanks to Singers for an update this morning. This converts £14.0 adj op profit into £13.5m adj PBT, so thankfully not much difference, which is all the more perplexing as to why FOXT uses op profit as a KPI?

This comes out at 3.3p EPS, so the PER (pre market open) is 15.9x - that’s a fairly punchy rating for a sector that doesn’t tend to attract big valuations.

Divi forecast of 0.9p gives a yield of a modest 1.7%.

Following a series of acquisitions, lettings is now the bulk of the business, or at least revenues, at 70%. I’m not sure what the profit split is between lettings & other estate agent activities?

EDIT: I forgot to include the cash/debt position - which looks fine to me, a recurring revenue business can afford to take on a bit of debt, this looks modest -

Net debt at 31 December 2023 was c.£7m, and reflects £13.9m of acquisition related spend, c.£11m of working capital investment in Lettings growth initiatives (expected to normalise across 2024), £2.7m of dividends paid and £1.1m of share buybacks.

Outlook - here it is in full, as all interesting & potential read-across -

Lettings is expected to remain resilient in 2024 with the business continuing to display strong recurring and non-cyclical characteristics. As lettings supply and demand dynamics have largely normalised, rents are expected to stabilise and remain at historically elevated levels, whilst improvement in the supply of available rental properties provides a good opportunity to deliver further market share growth.

In Sales, the Group entered 2024 with an under-offer pipeline significantly ahead of the prior year despite weaker market conditions, which should support a good level of year-on-year revenue growth in Q1. Furthermore, continuing to deliver the Sales market share levels achieved in H2 2023 is expected to drive further Sales revenue growth through 2024.

In addition, buyer demand has grown as mortgage rates have begun to normalise, with good levels of growth seen in recent weeks as the first mortgage products are released with rates below 4% since the September 2022 mini-budget. Any sustained reduction in interest rates is expected to spur significant further growth in buyer demand.

Through 2024, the Group will continue its focus on delivering operational enhancements to drive further growth and continue to decouple earnings from sales market cycles. By doing so, the Group is well positioned for its medium-term growth ambition to deliver £25m to £30m of adjusted operating profit.

That all sounds pretty encouraging, for a gradual recovery in housing markets in 2024, and presumably then housebuilders and building products too? Although FOXT is very London-focused, which in a way is even more encouraging for wider read-across, as London properties are the most expensive.

Restructuring - here we are, this is what caused the substantial £4.3m adjustment mentioned above -

Annualised cost savings of c.£3m will be realised in 2024 as the Group delivers synergies related to the November 2023 acquisition of Ludlow Thompson and consolidates certain branches within the Foxtons network by leveraging lease exit events. These savings have resulted in a one-off restructuring charge of c.£4.3m in 2023, of which c.£3.3m is cash related and c.£1.0m is non-cash. The cash charge relates to branch closure and vacancy costs, the majority of which will be incurred over a 3 year period.

Paul’s opinion - this is impressive I think. Although the recent strong rise in share price has probably factored in most of the immediate upside, in my opinion.

Well done to holders, but personally I’m not interested in buying at this stage, but possibly on a future pullback, as it looks as if Foxtons is going places, and I like that target of £25-30m operating profit.

Dr Martens (LON:DOCS)

Up 5% to 79p (£760m) - Q3 Trading Update - Paul - AMBER/RED

The famous utility/fashion bootmaker updates us on peak trading to Dec 2023, within FY 3/2024.

The numbers look very poor, in particular Q3 revenues down 21% on LY Q3.

YTD (9 months to Dec 2023) revenues are down 12%, so it’s a worsening trend in Q3.

However the share price is up 5% today, so maybe the bad news was already in the bombed out share price, as it confirms Q3 as expected -

Our Q3 performance is in line with the updated full year guidance provided in November…

driven by a weak USA performance, as expected.

Note that the share price was 138p at the start of Oct 2023, now down to 79p, so a lot of bad news has already been taken into account.

They can’t blame macro for drops of this size in revenues. I recall there were logistics problems internally, but I think it must be more than that - clearly the product is not resonating as well with customers, why else would they be buying less?

Outlook - weasel words here perhaps, talking about product, not sales/profits? (like Dunkerton always does at SuperDry) -

We remain confident in our product pipeline for AW24 and beyond.

Other guidance is unchanged, so not getting any worse is a plus, although forex sounds unhelpful but not material overall -

The guidance provided at the time of our H1 results, for full year CC revenue decline of high single-digit percentage year-on-year, remains unchanged. All other guidance for FY24 also remains unchanged.

The appreciation of sterling since the end of H1 means that, if current FX rates persist, we anticipate a currency headwind to the P&L of approximately £5m, together with a non-cash Balance Sheet translation charge, also of approximately £5m.

Brokers notes - nothing for the plebs again!

Paul’s opinion - no strong view either way. Roland looked at its Nov 2023 profit warning, and decided to view DOCS shares as AMBER/RED.

I agree with that. Poor trading, and a weak overly indebted (and over-stocked) balance sheet with only £100m of NTAV, make me want to steer clear of this.

That said, it’s still profitable, and if it can return to growth, then there could be upside, who knows?

Can you tell it's a 2021 IPO?! -

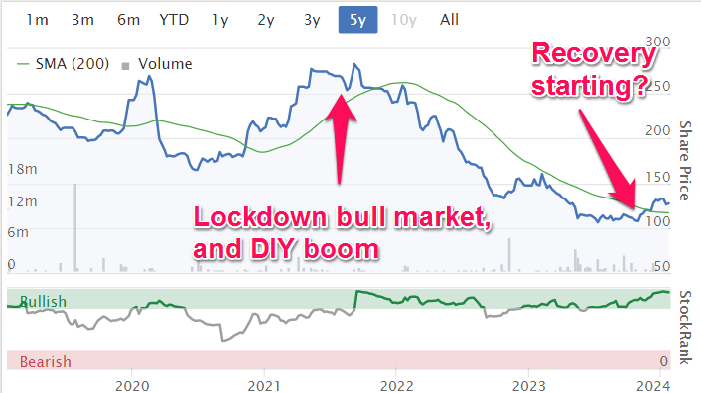

Halfords (LON:HFD)

Down 3% to 169p (£374m) - Q3 Trading Update - Paul - AMBER/GREEN

Upbeat sounding headlines, but that’s the point of headlines of course! -

Continued share gains and focus on motoring services drove resilient performance in Q3, despite challenging market conditions.

Cost savings ahead of expectations.

Strong start to Q4 trading, FY24 profit guidance maintained.

Halfords Group plc (“Halfords” or the “Group”), the UK’s leading provider of Motoring and Cycling services and products, today announces its Q3 Trading update for the 13 weeks to 29 December 2023 (“the period”).

Oct & Nov 2023 were strong, but Dec “much weaker”.

Q3 LFL revenues overall up 2% on Q3 LY, hardly a disaster - with retail being flat, and autocentres up 5%

YTD LFL sales up a respectable 6%.

Including acquisitions, total sales up 9.5% YTD.

Given that the share price has been weak of late,the outlook actually strikes me as sounding resilient, and still in line (within range) -

Outlook

The Group continues to deliver revenue growth in a very challenging consumer environment, highlighting the benefit of our strategic shift to needs-based, service-related revenues, focussed on motoring. Whilst our cost and efficiency programme continues to perform well and we continue to take share across all four of our core markets, the Cycling and Consumer Tyres market are performing significantly worse than anticipated and have weakened in Q3.

Notwithstanding this and assuming that markets do not weaken further in Q4, we continue to expect PBT to fall within the previously communicated range of £48m to £53m. Whilst Q3 sales were below expectations, a strong start to Q4 trading, further cost action and resilient areas such as B2B performing well, mean that we are confident in the Q4 outlook.

But no improvement expected in FY 3/2025 at this stage -

We remain cautious on market recovery in the short-term and we are not currently planning for a material improvement in our key markets in FY25.

Looking beyond FY25, we remain confident in the mid- and long-term future of Halfords and believe the business will be exceptionally well positioned when markets recover. Our scale, brand recognition and market leadership provide us with a platform that has significant competitive advantage. Given volumes in the Cycling and Consumer Tyres markets are below pre-pandemic levels by c. 28% and c. 14% respectively, a market recovery alongside continued delivery of the strategy gives us confidence in our ability to grow profit significantly in the future.

Paul’s opinion - I think this looks quite interesting, for a recovery, and it’s still making decent enough profits in a depressed macro situation.

Attractive value metrics, although it does have a slight whiff of a possible profit warning maybe?

There was bid speculation around HFD recently, which looks a possibility.

Balance sheet is adequate, rather than strong.

Taking a medium-term view, I’m leaning positively towards this, as a value/recovery/takeover situation. So I’ll go with AMBER/GREEN.

Roland’s Section:

Sigmaroc (LON:SRC)

62p (pre-market)(£693m) - FY23 trading update - Roland - AMBER

“The Group is expecting to report underlying FY23 EBITDA and EPS ahead of current consensus expectations”

This construction materials group has been following a buy-and-build strategy, acquiring assets with a view to building a “specialist lime and industrial limestone group” across Europe.

The company recently moved the needle with a deal worth up to €1bn to buy the European lime operations of CRH (LON:CRH) (disc: Roland holds CRH).

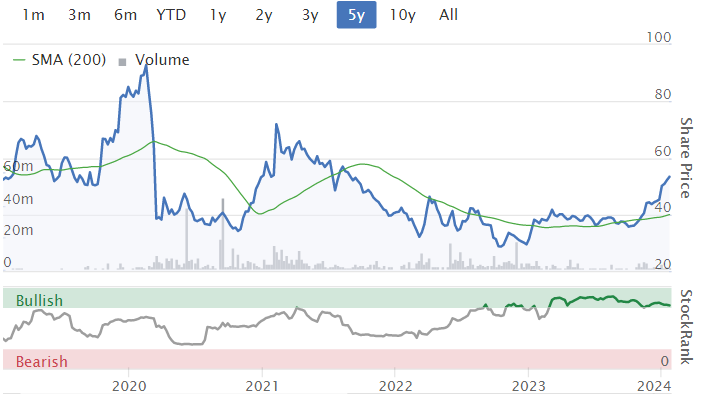

However, share price performance has been somewhat mixed and SigmaRoc has given up the gains it achieved during the pandemic:

Today’s RNS confirms that the first stage of the CRH acquisition was completed on 4 January. However, this update is mainly focused on performance in 2023, which has turned out to be ahead of expectations:

Revenue up 8% to c£580m (below consensus due to lower pass-through of energy costs)

Revenue up 2% LFL, despite 4% decline in volumes

Underlying EBITDA expected to exceed £116m, up 10% LFL

Underlying EBITDA margins improved to 20% (+1.1% year-on-year)

Underlying EPS “greater than 8p”, ahead of house broker Liberum’s estimates of 7.6p per share (updated note available on Research Tree)

Year-end leverage expected to close “below 1.6x” EBITDA, down from 1.7x at 30 June 2023

Trading: the company says it saw “good trading in most markets” during the second half of last year, although I note the 4% overall reduction in volumes.

Industrial minerals markets (43% of FY23 revenue): trading recovered from destocking earlier in the year. Sectors such as metals, environmental and agriculture are said to have remained “well supported”.

Construction markets (57% of FY23 revenue): Trading seems to have been supported by infrastructure markets, which represent over 60% of the group’s construction market revenues. This helped to offset the impact of softer residential markets.

Corporate: measures taken in the Nordics and UK should translate into annualised cost savings of c.£4m.

Newly acquired businesses are said to be “performing ahead of expectations” at the time of their acquisitions.

Outlook: SigmaRoc has left its FY24 guidance unchanged at this early stage in the year, perhaps sensibly.

An updated broker note from house broker Liberum confirms FY24 earnings estimates are unchanged at 8.2p per share, or 7.6p on a fully-diluted basis (many new shares are being issued as part of the CRH acquisition).

Roland’s view

SigmaRoc appears to be trading reasonably well and executing a successful buy-and-build growth model.

Trading on eight times forecast earnings, the shares do not seem too expensive, in my view.

However, the profit measures referenced in today’s update are all adjusted, potentially quite heavily. Depreciation and amortisation cannot be ignored in real life and we don’t know what the actual operating margin was last year.

Margin performance in recent years has been mixed:

Similarly, the 1.6x leverage multiple cited doesn’t tell us all that much about actual debt levels or free cash flow.

I’d prefer to wait for the 2023 accounts before taking a more decisive view on SigmaRoc.

Even then, it’s worth noting that the completion of the first stage of the CRH acquisition on 4 January means that the 2023 year-end accounts will no longer be representative of the business, unless a pro forma set of figures are also provided.

More broadly, I think it’s fair to say that the success of the CRH acquisition is not yet proven. I think it’s worth considering why CRH – which I see as a good capital allocator – chose to sell.

What return on capital employed will SigmaRoc be able to achieve on this €1bn deal? We don’t yet know.

There are a lot of moving parts here and shareholders have experienced significant dilution as SigmaRoc has used its shares to fund regular acquisitions:

The share count has doubled again to 1.1bn since the interim results, due to the issue of shares to CRH.

I think it’s worth noting how FY24 earnings per share are expected to be broadly flat on a fully-diluted basis, despite underlying growth.

Despite the negative tone of these comments, I think SigmaRoc is probably in reasonable shape and fairly valued at the moment.

But I think management still has much to prove and I would prefer to wait for the full-year accounts before taking a higher conviction view. For now, I’m going to go AMBER on SigmaRoc.

Mortgage Advice Bureau (Holdings) (LON:MAB1)

Up 2% to 824p (£460m) - FY23 trading update - Roland - AMBER/GREEN

“Actual trading was better than anticipated in Q4 2023 and the Board now expects the Group to report an adjusted profit before tax that is slightly ahead of the current market consensus.”

Graham last covered Mortgage Advice Bureau in July last year, noting “a gloomy update as far as the H2 outlook is concerned”.

He then went on to include this mortgage broker in his top 10 small cap ideas for 2024, earlier this month.

Today’s update suggests to me that Graham may have been right to stick with MAB in his 2024 choices, despite the increase in its valuation over the last 12 months:

2023 trading update: the company says it took a “cautious view” in September on expected activity levels for Q4. Happily, actual trading was better than expected.

Although UK gross new mortgage lending is said to have fallen by 28% to £226bn last year, MAB’s full-year revenue rose by 4% to £239m. This suggests to me the company may have gained some market share, which should deliver benefits when activity levels recover.

As a result of this stronger trading, adjusted pre-tax profit is now expected to be slightly ahead of consensus.

I can’t find a recent broker note for MAB. But consensus earnings forecasts on Stockopedia suggest a figure of 28.7p per share, so perhaps we can plan for a figure of c.30p?

That would put the stock on a P/E of 27. That is still high when viewed in isolation, but this is a capital-light business that was able to generate 40%+ returns on equity before the housing market slowed:

Owner-management is another attraction, for me, with CEO Peter Bordnicki controlling 18% of the stock.

Let’s see what Mr Brodnicki has to say about 2024.

Current trading and outlook: the underlying demand for home ownership and home moves is said to remain strong.

As the cost of fixed-rate mortgages has eased, MAB says it has seen “early signs of increased purchase activity as well as refinancing”.

Written mortgage volumes in January are said to have been “substantially higher” than in January 2023.

After a 4% fall in the total number of mortgage advisors last year, MAB says it expects some of its Appointed Representative firms to restart recruitment “earlier than planned” if momentum continues.

The company also expects to sign up new firms this year.

As yet, there’s no upgrade to 2024 guidance, but if momentum continues then I would imagine an upgrade might be possible:

Current trading is encouraging and in line with expectations.

Roland’s view

I share Graham’s positive view on this business, which I think is well run with an attractive business model and a sound financial position.

MAB’s past performance was highly profitable and cash generative. I don’t see any reason why this shouldn’t remain the case in the future.

Although I think the share price is probably up with events for now, the stock continues to support a useful 3.5% yield.

On balance, I think the potential rewards comfortably outweigh the risks here, so I’m going to go AMBER/GREEN on this one.

Yu (LON:YU.)

Down 5% at 1,243p (£218m) - Year-end trading update - Roland - AMBER

The Group's strategy continues to deliver with all key financial metrics performing ahead of expectations, which were raised three times in 2023.

Utility reseller Yü issued an update on Wednesday including a(nother) significant upgrade to profit guidance.

This stock has been a five-bagger since since 2022:

Profit forecasts have been upgraded repeatedly:

This isn’t a business I know well, so I’m keen to understand what I may have been missing so far.

Yü has two arms, energy supply and meter installation. The company focuses on corporate customers, rather than retail customers.

Upgraded 2023 guidance: full-year revenue expected to be around £450m (FY22: £279m), representing organic growth of over 60%.

EBITDA is expected to be “significantly ahead” of current expectations, although no numbers are provided.

Checking Research Tree – many thanks – I see that brokers SP Angel has increased its FY23 EBITDA forecast by 15% to £38m.

This is expected to drop through to give adjusted earnings of 166.6p per share, or 136.6p per share on a fully-diluted basis, including outstanding options.

This leaves Yü shares trading on around eight times forecast earnings:

Trading summary: Yü says that average monthly bookings rose by over 120% to “above £55m” last year (FY22: £24.5m).

The group has secured contracted revenues of £519.7m for FY24, which represents a 11% increase on FY23. Total contracted forward revenue is now £825.8m.

The number of meter points under contract to the company – presumably a loose proxy for customer numbers – is said to have shown a “significant increase” in FY23, but I couldn’t find a specific number in the RNS.

However, an updated Liberum note on Research Tree says the number of meter points has “more than doubled” year-on-year.

The half-year results showed the number of meter points up by 52% to 39.7k, so doubling year-on-year would be consistent with a similar rate of growth in H2.

Yü says it's focusing on customers with better credit and more predictable consumption patterns. The company says that 98% of bills raised during the year have been received in cash.

This level of collection may sound reassuring at first glance, but I think bad credit is a significant risk in this business – with an operating margin of c.2%, a small percentage increase in bad debt (from the revenue line) could easily wipe out a big chunk of profit.

Net cash: the company says net cash at the year end was £31.9m, down from £36.6m at the half-year point.

However, management says that a further £49.8m of cash is currently held on deposit with its trading counterparty as collateral for hedging arrangements on energy prices.

Volatile energy prices can lead to sudden increases in collateral requirements, even if the hedging ultimately delivers a stable result. More stable energy markets mean that much of this cash is now expected to flow back to Yü.

However, this situation could easily reverse again in the future. Given the nature of this business, my feeling is that a substantial cash position is a prudent operating requirement and may not (ever) be surplus to requirements.

Dividend: in situations such as this where shares appear very cheap but may not be, I find that dividend cover and yield can be a useful guide to what I view as the true underlying valuation.

In this case, we see a sub-1% dividend yield and forecast dividend cover of c.10x, according to updated broker forecasts.

To me, this supports my view that the company needs to maintain a large cash balance and might not be as cheap as it seems, at least on a near-term view.

However, this could change over time, I think, if the company’s Smart Meter business can successfully achieve scale.

Yü Smart (smart meter business): this relatively new business reached 8,000 smart meters installed by the end of 2023, after beginning the rollout in H1.

This is somewhat behind the 10k target stated in its half-year results, but a new MD has been appointed to help scale up this business.

Owning smart meters is a potentially attractive business with the potential to provide high levels of recurring revenue, probably index linked. It’s clearly early days for Yü, but I think that if this business can scale, it could become quite valuable.

However, one characteristic of this business is that returns tend to be back-end loaded. The initial rollout is likely to require debt and will not immediately generate strong cash flows. But over time, this balance could reverse, with debt falling and distributable cash rising fast.

The risk for investors is that they may need to remain patient through a long – and potentially indebted – rollout period.

I guess the model of success for UK investors in this area is AIM-listed Smart Metering Systems (LON:SMS), which has c.2.5m smart meters and has just received a takeover offer.

Roland’s view

I’ve only taken a brief look at Yü today. I would want to dig much deeper and look back at the firm’s history before forming a more considered view. I think there have been some problems in the past.

For some starter reading, Paul has previously commented on Yü here and here (FY22 results).

One positive worth highlighting may be owner-management – CEO Bobby Kalar appears to control more than 50% of the stock.

Although I’m encouraged by the theoretical potential of the smart meter business, it’s still very early days. Achieving a scale rollout won’t necessarily be easy.

Another potential concern for me is customer credit quality. Unlike households, businesses can go bust and disappear, making it difficult for unsecured creditors (which I assume includes energy suppliers) to recover outstanding debts.

On the positive side, there has been an exodus of competitors in the business energy market, as we’ve also seen in retail energy supply. In the half-year results, the CEO said he expected to see a “less competitive landscape” in the future, which should be a positive for Yü.

My initial view is that the Yü share price is up with events at current levels, at least pending a look at the 2023 accounts.

While I can see some interesting opportunities here, I also think the energy supply business carries significant risks that will always need careful management.

For now, I’m going to take an AMBER view on this business.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.