Good morning from Paul & Graham!

A great call from Graham yesterday, holding his nerve re the vaping news, with Supreme (LON:SUP) shares actually ending the day up! He's updated us with the latest news below.

Time's up for today I'm afraid. With 22 companies on our to do list (the smaller ones won't fit on the page below), obviously we cannot cover everything.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Agenda 30 January 2024

Another mega news day! So we'll have to focus on aheads & profit warnings first. Then the more interesting companies. Probably won't be time for in lines, so do flag up anything that looks particularly interesting that we might otherwise overlook.

Graham flags up the user interest widget to me, so we're following your lead on this - I'll start off looking at HVO, then SAGA -

Summaries

Motorpoint (LON:MOTR) - 98p (£89m) - Q3 Trading Update - Paul - BLACK (profit warning flag) - AMBER on fundamentals.

Profit warning from this car supermarket chain was completely shrugged off by the market yesterday, despite Zeus slashing FY 3/2024 forecast PBT loss from £(3.2)m to £(8.7)m caused by plunging secondhand car prices. I've got some reservations below, but also think there's recovery potential.

hVIVO (LON:HVO) - up 6% to 27.75p (£189m) - Trading Update [ahead exps] - Paul - GREEN

Another very nice update from this clinical trials company, which has staged a remarkable growth spurt in recent years. Broker forecast for FY 12/2023 raised about 14%, leaving the PER still below 20, despite superb growth. Visibility and order book both very strong. Plenty of cash, which it receives up-front from non-refundable deposits. Annual divis to start. There's lots to like here, so I remain positive.

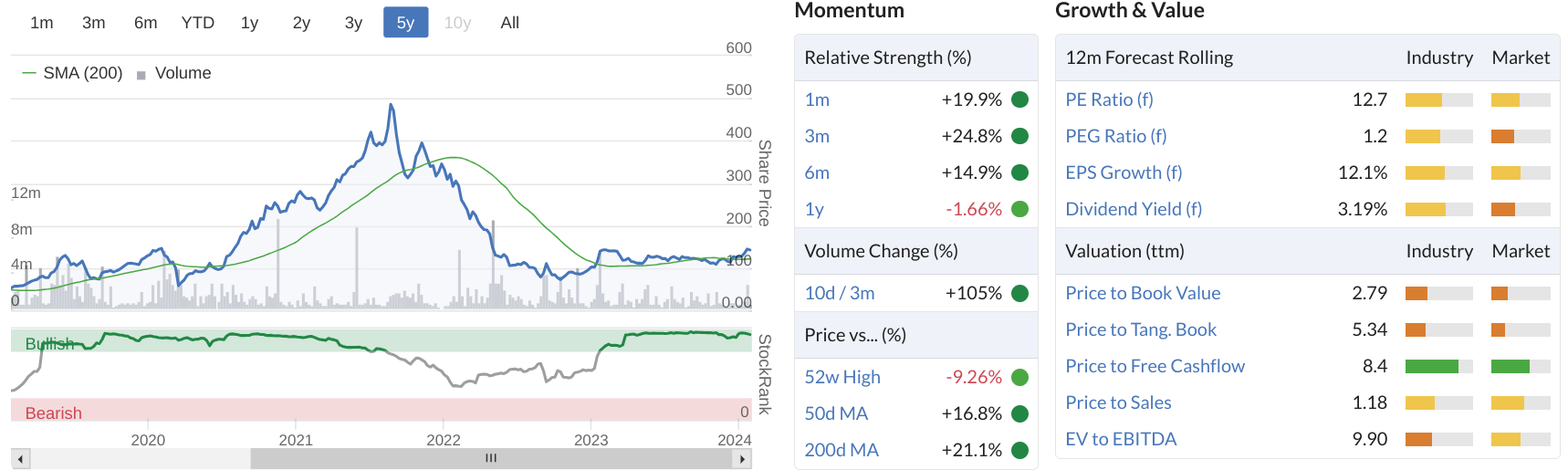

Supreme (LON:SUP) - up 10% to 116.5p (£136m) - Trading Update and Share Buyback [ahead exps] - Graham - GREEN

Late yesterday afternoon, Supreme issued a very confident update - beating expectations for FY March 2024 and arguing that FY 2025 would see benefits as retailers/consumers switched over to non-disposable vapes. A £1m buyback was thrown in for good measure.

Saga (LON:SAGA) - up 5% to 153p (£216m) - Trading Update - Paul - AMBER/GREEN

As usual, an unclear trading update that sends us round the houses a bit. It sounds moderately good though, with travel/cruise doing well, but insurance struggling. Outlook is more of the same. Potential restructuring intrigues me and could provide interesting upside & de-gearing maybe?

SThree (LON:STEM) - down 3% to 385.5p (£520m) - FY23 Final Results - Graham - GREEN

There are challenging market conditions across all regions, exacerbating the decline in permanent recruitment and holding back net fee growth for SThree. But the company remains highly profitable, cash-rich, and best-in-class, so I remain positive on it.

Luceco (LON:LUCE) - down 6% to 138p (£222m) - Full Year Trading Update - Paul - GREEN

I have a moan about it using adj operating profit instead of real profits throughout this update. In other respects though, I'm happy with everything - it's a slight beat after a good Q4. Net debt has come down nicely as the negative cashflow in H1 unwound. Valuation seems reasonable, and as the company says, there could be operationally geared upside to profits as macro factors improve. I'm upping us from amber/green to GREEN.

Speedy Hire (LON:SDY) - down 17% to 29.7p (£153m) - Trading Update (PW) - Paul - BLACK - AMBER on fundamentals.

Forecasts are slashed as a variety of fairly minor-sounding problems combine to cause a 35% drop in broker forecast earnings for FY 3/2024. I'm not worried about debt or solvency, and am even wondering if this dip today could be an entry point for a fairly solid company longer term? Nice divis.

Paul’s Section:

Motorpoint (LON:MOTR)

98p (£89m) - Q3 Trading Update - Paul - AMBER

Motorpoint Group PLC, the UK's leading independent omnichannel vehicle retailer, provides an update on its trading performance for the quarter ended 31 December 2023 ("Q3").

This has been a fascinating share to follow, with a seemingly quite good business model pre-pandemic - profitable car supermarkets. However, it’s struggled in recent years, when the traditional franchised dealers had something of a bonanza (and many attracted takeover bids). Maybe MOTR suffered more than most from the surge in new online-only secondhand car dealers? The latest mishap has been losses caused by the recent plunge in secondhand car prices, plus higher finance costs for car stocking loans now that the zero interest rate era seems to have ended.

Mix all this up, and it’s difficult to determine if MOTR is a business with good future potential, or if it’s a struggling format that’s going nowhere!

Q3 Trading Update (within FY 3/2024)

I’m amazed this share didn’t take a bath yesterday on this profit warning, which is quite nasty -

As a result of the pricing corrections in Q3, which was exacerbated by the timing of the Group's seasonal increase in stock, in addition to the disruption caused by the Derby store closure, profitability for FY24 is now likely to be £5m-£6m below expectations, even with an anticipated strong Q4.

Remember this comes after an update reviewed here on 23 Nov 2023 which told us that there had been a sharp 6% fall in used car values. I commented that this suggested a hit of up to £8.6m could be coming MOTR’s way in H2, which was not consistent with broker forecasts that at the time (strangely) assumed H2 performance would improve on H1. So my conclusion was that another profit warning seemed likely, which turned out to be correct.

Broker update - thanks to Zeus via Research Tree for crunching the numbers, it’s a big reduction in forecast losses in FY 3/2024, dropping from £(3.2)m old, to £(8.7)m new forecast.

Forecast for FY 3/2025 is left unchanged, at PBT of £2.4m.

Outlook - MOTR reassures about the future -

…the Board believes that the corrective cost and efficiency actions taken in FY24, combined with the positive signs that economic headwinds will ease in FY25, will ensure the Group is well placed to deliver an improved financial performance in FY25 as the market returns to a more normal trading environment….

"I have previously commented on Motorpoint's agility and resilience in difficult times, and that I am confident the Group will emerge from this depressed consumer environment a much more efficient business. Now, at last, there are signs that the macroeconomic headwinds are easing, leading to renewed consumer confidence. As a result, the market size is expected to increase as demand grows, and supply is bolstered by new car registrations feeding into the used car market.

The actions already taken to right size the business, protect cash and improve unit economics, mean that Motorpoint is well placed to seize the significant growth opportunity despite this correction in used car values. I therefore look forward with renewed optimism and am excited as to what the business can achieve in FY25 and beyond."

There’s no doubt that consumer confidence is on an improving trend (with thanks to GfK, 26/1/2024) - I hope it’s OK to include this chart & commentary -

.

When we factor in the 2% NIC cut happening now, and the large 8%+ increases in pensions, benefits & living wage in April 2024, on what is forecast to be much lower inflation (possibly within the 2% limit), then 2024 looks set to be a year for a possibly dramatic recovery in consumer spending, I think.

I can see why MOTR would be in a good position to benefit from that.

Paul’s opinion - this was a nasty profit warning, which the stock market has completely shrugged off, with the share price unchanged. That tells me that I wasn’t the only person who joined up the dots and realised a profit warning was on the way!

It also suggests to me that investors (so far anyway) are looking through the short term issue of lower used car prices, and seem instead focused on the improving outlook.

Given that we’ve had unrelenting bad news from MOTR, and this trend down in earnings forecasts below, it’s quite perplexing to see a share price that’s recovering!

Zoom out though, and this recent surge is little more than a blip in a big downtrend -

Paul’s opinion - I’ll stay on the fence with AMBER. Even though this is a nasty profit warning, there do seem reasons to anticipate that we might be at the bottom of the earnings cycle. Although personally I’d want to see more proof that profitability is on the cards again for the future. Moving from a £(8.7)m loss straight back into profit could be a tall order. Often profit recoveries take several years to gather pace.

Don’t forget finance costs are high now at MOTR, due I think to the cost of vehicle stocking loans, which it doesn’t include in net debt. So actually this is quite a highly geared company.

A share buyback of up to £5m (5% of the co) has also been announced, which seems strange given the balance sheet is not strong enough to do that, in my view. Although it might help clear out any remaining sellers in the market.

So yes I can see upside potential here, but also lots of headwinds before it gets there.

It wouldn’t surprise me if one of the well-financed internet-only challenger companies buys MOTR, in order to diversify, as the internet-only model they’re all pursuing looked a dead loss from the start.

hVIVO (LON:HVO)

Up 6% to 27.75p (£189m) - Trading Update - Paul - GREEN

hVIVO plc (AIM & Euronext: HVO), the world leader in testing infectious and respiratory disease products using human challenge clinical trials, announces an unaudited trading update for the year ended 31 December 2023.

Revenue up 16% to £56m (slightly ahead of Cavendish previous forecast £55m)

EBITDA margins of c.22% (2022: 18.7%)

Cavendish now forecasts £12.8m adj EBITDA (previously £11.5m), an 11% upgrade today.

This becomes forecast adj PBT of £10.5m (previously £9.2m), a 14% upgrade today.

Adj EPS is increased from 1.3p to 1.5p, a PER of 18.5x - looks very reasonable to me, given the strong growth trajectory.

Outlook - HVO guides £62m revenue for 2024, 11% increase. That looks a fairly soft target, so hopefully can be beaten.

Excellent visibility -

“90% of 2024 revenue guidance already contracted and good visibility into 2025”

“Weighted contracted orderbook of £80 million as at 31 December 2023 (31 December 2022: £76 million)”

“New medium-term target of growing Group revenue to £100m by 2028”

R&D tax credits look a useful contributor to profit -

…the Group also recognised Other Income relating to R&D tax credits of £2.6 million (2022: £2.2 million).

Cash - it gets paid a lot up-front, which is an attractive feature of this share (demonstrating pricing power, and client commitment) -

hVIVO is a highly cash generative business with cash of £37.0 million as at 31 December 2023 (31 December 2022: £28.4 million). This increase in cash generation is due to improved margins and the upfront non-refundable quarantine booking fee from new contracts.

Dividends - it says annual divis will commence, more details to follow.

New premises are coming on stream soon, which should help further growth -

The new facility will substantially boost our revenue potential and should lead to improved operational efficiencies and enhanced margins.

Paul’s opinion - this all reads very well I think. Despite a strong recent surge in share price, I think today’s forecast upgrade (FY 12/2023) and positive outlook makes the valuation still reasonable, and the visibility for 2024 looks excellent, with more earnings beats looking likely.

I’m struggling to think of another company that has established such a superb growth track record, yet is still reasonably priced.

Hence I’m more than happy to retain my positive view of HVO shares. Kicking myself for having got bored and sold mine in 2023, but never mind. Patience is the difficult bit with investing isn’t it, especially when shares are going nowhere for a while despite good news/figures - you start doubting your own judgement I find. We’re always learning!

HVO shares have been volatile in the past, but the hype of the past has now been transformed into very strong fundamentals, so this recent rise seems far better underpinned by reality - which is also reflected in the StockRank's dramatic improvement -

Saga (LON:SAGA)

Up 5% to 153p (£216m) - Trading Update - Paul - AMBER/GREEN

Saga plc (Saga or the Group), the UK's specialist in products and services for people over 50, provides the following update on trading covering the period from 1 August 2023 to 29 January 2024.

This is FY 1/2024.

Saga on track to deliver significant growth for the full year

The new CEO Mike Hazell says -

"For 2023/24, Saga remains on track to deliver significant growth in revenue, in addition to an underlying profit more than double that of the prior year1, exceeding our previous guidance.

[1] Refers to the 2022/23 financials, restated to reflect the adoption of International Financial Report Standard 17 'Insurance Contracts'

There aren’t any broker updates available to us, but the StockReport shows a consensus forecast trend that has stopped falling, even slightly risen in recent months -

As both davidjhill and rmillaree complain in the reader comments, SAGA sends us round the houses to work out figures ourselves, rather than just clearly stating the numbers that they have at their disposal - its investor communications are poor! That's surprising given that a lot of investors are also potential customers. If I were the new CEO here, I'd show my team the trading updates from Next (LON:NXT) and tell them: this is the gold standard - make sure ours are as clear & informative as these!

Underlying PBT was £21.5m last year, but it’s not clear if we use that number and double it, or need to adjust it for IFRS 17 as in the footnote above. Isn’t this ridiculous.

I’m just going to wait until broker consensus numbers have updated later this week.

Summarising other points -

Cruise & travel “outstanding year”, and “will return to profitability, in line with expectations”

Insurance - not good -

“Insurance, the market-wide inflationary environment and declining policy volumes are continuing to impact our performance.”

Outlook sounds like more of the same for each division, with insurance remaining challenging.

Cash/debt position - these numbers below exclude the ship loans -

Available Cash is expected to be in the range of £135-145m at 31 January 2023, excluding the £50m revolving credit facility and the £85m facility with Roger De Haan which both remain undrawn. Total Net Debt is expected to be slightly higher than at 31 July 2023, in line with guidance.

That means repaying the May 2024 £150m bond won’t be a problem.

Ocean cruise - this is the most interesting area I think. I touched on this in yesterday’s report here, commenting on press reports that SAGA was looking at various options to restructure the financing and maybe operations of its two owned cruise ships. That might include a sale & leaseback of the ships, or a partnership type deal where a third party operator manages & owns the ships? SAGA seems keen on capital-light options, which I like - we don't want to see another existential crisis if travel is locked down again, or a banking crisis makes credit conditions tight. Why take the risk, when it can be outsourced & eliminated?

As I mentioned yesterday, there’s considerable equity in the ships, above the loans. So if they could be sold for book value or above, then that would be transformative for SAGA’s balance sheet. No guarantees though as to the terms of any deals, we’re in the dark here.

The stock market has been very uneasy about SAGA’s debt in the past, so I think restructuring it from a position of strength (when the cruise ships are trading well) makes a lot of sense. Could this be a catalyst for equity to re-rate, I’m pondering? Later this year we could see a situation where the ship loans and the May 2024 bond are fully repaid, and SAGA could be in a very modest overall net debt position. Intriguing! That’s the upside case, and may not happen of course.

Paul’s opinion - only a quick review rather than a deep dive, but I think this is starting to look quite interesting again. We all know the history & poor performance in recent years, but it’s starting to look as if things are coming together now a bit better, as they should have done several years ago really - management have definitely not impressed, so let’s hope the new CEO can get things moving a bit now, which shouldn’t be difficult given much better circumstances post-pandemic.

Stockopedia is showing a fwd PER of 4.1x, which has obvious scope to rise if the debt issues are resolved.

As the newsflow began improving in 2023, I edged up from amber to amber/green on 29/9/2023, and that feels about the right level to stick at today, so AMBER/GREEN. I think risk has greatly reduced, and there’s now an improving trend on earnings (although still way below historic norms).

Luceco (LON:LUCE)

Down 6% to 138p (£222m) - Full Year Trading Update - Paul - GREEN

Luceco plc ("Luceco" or "the Group"), the supplier of wiring accessories, EV chargers, LED lighting, and portable power products, is pleased to provide the following update on trading for the year ended 31 December 2023 ("2023").

LUCE shares opened up about 5%, but are now down 6% on the day. This might be because of an unusual spike in price before today? Just to show it in context -

Company headline says -

Profitability ahead of expectations despite economic headwinds and challenging residential markets, continued growth and strong free cash flow generation.

This update uses adjusted operating profit throughout. So presumably the company thinks that its finance costs are going to be paid for by the tooth fairy? There was a £40m loan in non-current liabilities at the H1 stage, attracting interest costs which won’t be cheap. Operating profit ignores those finance costs, hence it is not a proper profit disclosure in my view, exaggerating the actual, lower profit after finance costs.

LUCE H1 results showed adj operating profit of £10.8m, and adj PBT of £9.4m, 13% lower. So it should be disclosing PBT, not operating profit. If anyone talks to management, perhaps you could challenge them on this point.

Anyway, Q4 was better than expected.

Full year 12/2023 it says -

The Group expects to report full year 2023 revenue of c.£209m and Adjusted Operating Profit in the region of £23.5m - £24m, ahead of expectations and shows good progress over 2022 despite the challenging economic conditions.

Liberum says (many thanks) it had forecast £23.0m, so this is a slight beat.

It goes up from 10.4p adj EPS, to 10.8p. That’s a PER of 12.8x - looks about right to me.

FY 12/2024 forecast is left unchanged at 11.8p, so a PER of 11.7x. Hopefully improving macro might see a beat?

Balance sheet - is claimed to be strong -

Our balance sheet remains strong, with our Covenant Net Debt ratio expected to be less than 0.6x - well below our target range of 1.0 - 2.0x EBITDA.

I’d say the balance sheet is adequate, rather than strong. NTAV was £44m in June 2023. Its healthy working capital position is part-funded through a £40m bank loan, which might be costing interest of say £2m pa, not far off 10% of operating profit.

Cashflow - note that all the cashflow was sucked into working capital in H1, so I’m flagging this as something to check in H2, that it’s unwound. It sounds like they’re on the case with that, saying today -

Cash generation was better than expected driven by higher operating profit and improving working capital efficiency, leaving the Group's net debt at circa £23m at 31 December 2023.

That’s down a lot from £37.6m net covenant debt in June 2023, so I’m happy with the debt reduction. All good, we have to check these things! Average daily net debt is the gold standard of reporting, so let's try to persuade more companies to reveal this figure. Year end snapshots are so easy to manipulate, we never really know if they're fair, or window-dressed to look good.

Outlook - interesting points, worth noting -

"Luceco has performed well in the second half, producing strong results despite ongoing macroeconomic headwinds in the UK and challenges in residential markets. As a result, we expect to report Adjusted Operating Profit for the full year above current market expectations. Further strengthening of the Group's balance sheet has been driven by the continuation of our track record of strong cash generation, leaving the Group well placed to invest for growth and enhance earnings in line with our strategic priorities."

Paul’s opinion - I’m happy with all of this. It’s a slight beat, the valuation looks reasonable, there’s been good de-leveraging, and it may well benefit from improving macro.

I also like owner-manager companies like this, which tend to do well, and avoid major pitfalls which hired hands sometimes succumb to.

Checking our previous notes, we improved from amber to amber/green as things progressed last year, with a series of modest earnings upgrades.

Given today’s news of excellent debt reduction, and a slightly better Q4, I think we should remove all restrictions, and up this to GREEN! Just our view on this day remember, we don’t know what will happen in future.

Note the big pandemic spike in share price was when the company, and stock market, mistook a temporary surge in earnings as structural growth. So a painful aftermath from that episode, which I think is now behind us. Good StockRank too.

Speedy Hire (LON:SDY)

Down 17% to 29.7p (£153m) - Trading Update (PW) - Paul - BLACK (PW) - but AMBER on fundamentals.

Speedy, the UK's leading tools and equipment hire services company, operating across the construction, infrastructure and industrial markets, provides the following trading update.

This is for FY 3/2024.

Profit warning, but no indication is given how big the shortfall is -

… with weakness in some of our end markets and seasonal product lines, and some delays in mobilisation of significant contract wins, the Board expects the full year profits to be below its previous expectations.

The tone of the detail provided doesn’t sound as if it’s a disastrous situation.

Although Liberum (as always, many thanks) has made quite a deep cut to forecast adj EPS in FY 3/2024 from previously 4.9p to 3.2p now, that’s a 35% cut. It’s often like this - I read an update and think oh it’s fairly minor, then you find the analyst has slashed the profits!

Is it in financial trouble? I’d say there’s no evidence of that, and the last balance sheet is fairly robust. Yes of course there’s debt, to part-fund the hire fleet, but it’s not excessive. Net debt has risen now to £117m, from £90m at H1 (30 Sept 2023), but it says that should come down in Q4 (Jan-Mar 2024).

Paul’s opinion - SDY strikes me as a fairly steady, unremarkable company. It seems to churn out 4-5p EPS most years, apart from the worst pandemic one, and now this year too - but shouldn’t we have been expecting a softer patch this year, due to well known macro factors curtailing the building sector? It might recover in 2024 or 2025 maybe? I doubt things will get much worse anyway, and SDY mentions new contract wins kicking in from April 2024.

So the contrarian in me is thinking this profit warning probably should have been anticipated by investors, and now might be a time to consider making a bargain purchase perhaps?

As long as nothing disastrous or structural is going wrong, then for value investors a lower share price can be a good thing, BLASH and all that (buy low and sell high).

The shares are probably now rated on about par with NTAV.

I vaguely recall there being a kerfuffle about light-fingered scaffolders stealing all their poles some time ago, which indicated poor internal controls. Or did I imagine that?!

I’ll go with AMBER - worth a closer look if you’re searching for cyclical recovery type shares. And the divis are generous (although may be cut after this warning).

Graham’s Section:

Supreme (LON:SUP)

Share price: 116.5p (+10% yesterday)

Market cap: £136m

Thanks to everyone in the comments for a lively discussion yesterday re: Supreme.

The company released an intraday update (2:42pm) in response to the news regarding the government’s proposed ban of disposable vapes.

Key points:

“Excellent trading performance” in the historically busiest quarter, and FY March 2024 is now expected to significantly outperform market expectations.

Revenue is now projected to be at least £225m (the forecast range was £210-225m) with adjusted EBITDA at least £38m (the forecast range was £32-35m).

The distribution of Elfbar will “significantly exceed previously issued guidance in FY 2024”. That guidance was for £60m of revenue and £7m of adjusted EBITDA.

So it’s set to be a barnstorming result for FY March 2024, but that’s on the back of ballooning disposable vape sales (remember that Elfbars are disposable). What does the proposed government clampdown mean for the company?

The company responds:

…Supreme welcomes this clarity and as a responsible business remains ahead of the curve, having already implemented a number of proactive measures, including narrowing and re-naming of flavours and tailoring packaging…

Supreme remains confident that vaping is, and will continue to be, the most credible and effective alternative to cigarettes. Supreme has an established suite of fully compliant rechargeable pod systems, produces over 60 million 10ml bottles of e-liquid annually and has already become a principal supplier to the UK Government's "Swap to Stop" scheme. None of these revenue streams are expected to be adversely affected by the changes proposed by the Government earlier today.

This is well-written but for me, it’s not directly addressing the challenge that c. one-third of Supreme’s current revenues look set to be eliminated by law. The company will address that a few paragraphs later.

£1m share buyback - the announcement of a buyback of less than 1% of the company’s market cap is unlikely to make a big difference to shareholder returns; I interpret it as being primarily a gesture of confidence.

FY March 2025 outlook:

The Company expects that approximately £75 million of its revenue (33%) and £9 million of Adjusted EBITDA (23%) will be derived from disposable vapes in FY 2024.

Note that the distribution of the 3rd-party Elfbar brand is lower-margin than Supreme’s other activities

Continuing (emphasis added):

Looking to FY 2025, the Board believes that the anticipated ban on disposable vapes by the end of 2025 is expected to cause a temporary increase in revenue as retailers roll-out replacement vaping devices such as pod-system vaping devices ("Pods") and refillable vape kits ("10mls"). The Company expects that more than half of disposable vape activity will permanently transition to alternative forms of vaping such as Pods and 10mls, and Supreme will work closely with its retail partners to manage this seamlessly. The Board will continue to evaluate the ongoing impact of new regulations within the UK e-cigarette market as more clarity, particularly in respect of timing, is published.

Graham’s view

As we discussed in yesterday’s report, Supreme can benefit from consumers switching over to non-disposable vaping systems. It’s hard to predict what might happen in the short-term; if the Elfbar business evaporated overnight, for example, there would have to be be a serious short-term negative impact (as >£60m of revenues and >£7m of EBITDA disappeared). But the medium-term and long-term opportunity in refillable vapes and “Pods'' would remain, and those categories would benefit from increased demand.

For me, the risks are priced in here.

Due to an Elfbar-related working capital movement, the company reported net debt of £5m in its most recent interim results. This is just a fraction of the company’s expected net profits for the year. Financially, the company should therefore be capable of withstanding some volatility over the next couple of years. So I’m happy to retain my positive stance on these shares at this valuation.

SThree (LON:STEM)

Share price: 385.5p (-3%)

Market cap: £520m

SThree plc ('SThree' or the 'Group'), the only global specialist talent partner focused on roles in Science, Technology, Engineering and Mathematics (STEM), today announces its financial results for the year ended 30 November 2023.

We tend to like this recruiter at the SCVR; I nearly included it in my 2024 list.

In December, I already covered the company’s full-year trading update, so I’ll try not to go over old ground in today’s report.

The main point is that collapsing fees from Permanent recruitment have dragged on SThree’s overall revenue growth, but Permanent recruitment now only provides 18% of total net fees. So this will be less of a factor from now on.

Contract recruitment, which is the strategic priority for the company, now provides 82% of net fees and rose 1% in 2023.

Net cash finished the year at £83m, as previously reported.

Outlook is mixed:

Contract extensions remain strong whilst new business activity continues to be subdued for longer than expected.

Productivity normalisation, as previously communicated, combined with the recognition of deferred TIP costs will temper the conversion ratio in FY24 from FY23 levels, yet we expect this will remain sector-leading.

Continued focus on sequenced rollout of the TIP across rest of the Group, strengthening the Group's position for long-term growth.

Explainers: the “conversion ratio” is how SThree refers to its operating profit margin (operating profit divided by net fees).

The “TIP” is SThree’s “Technology Improvement Programme”.

“Productivity normalisation” - the company says that current levels of staff productivity are unusually high and that barring any improvement in market conditions, productivity is expected to reduce in the short-term.

CEO comment excerpt:

Notwithstanding the broader challenging economic environment, our delivery this year has been resilient, especially against the context of a record prior year. Our unique model and strategic focus have benefitted us throughout the year, with our core areas of focus, STEM skills and flexible talent, benefitting from structural growth drivers and providing us with a strong platform both now and over the long term.

Chair’s statement: I noticed one interesting snippet here vis-à-vis capital allocation.

Maximising shareholder value through a disciplined approach to investment to deliver growth in net fees and margin, whilst maintaining a strong balance sheet and sustainable through-the-cycle dividend, remains a priority for the Board. Following a periodic review, the Group's capital allocation policy has been refreshed to reflect investments in business improvement alongside organic and inorganic growth as a key aspect of our strategy.

I’m generally not a fan of the recruitment sector, but one of the things that draws me to SThree is its quality metrics. They are remarkably good at generating strong returns:

Please note that the operating margin in the table above will be measured versus revenues, not versus net fees.

2024 ambitions

The company has long-term ambitions stretching from FY 2019 to FY 2024. The most financially relevant of these might be the conversion ratio, where the company has failed to hit its target of 21% or more. Thankfully the current 18% level still allows for a good return to shareholders.

Graham’s view

This has been marked down by a few percentage points which is probably fair, given the guidance on a reduced conversion ratio and challenging market conditions.

On the other hand, today’s update doesn’t give me any reason to change my long-term positive stance on this stock. It continues to trade at levels which don’t seem to demand much improvement in performance:

Note that with £83m of cash, the cash-adjusted P/Ratio would be even better than this, perhaps around 8.5x. For a best-in-class recruiter focused on the STEM sector, I must maintain my positive stance.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.