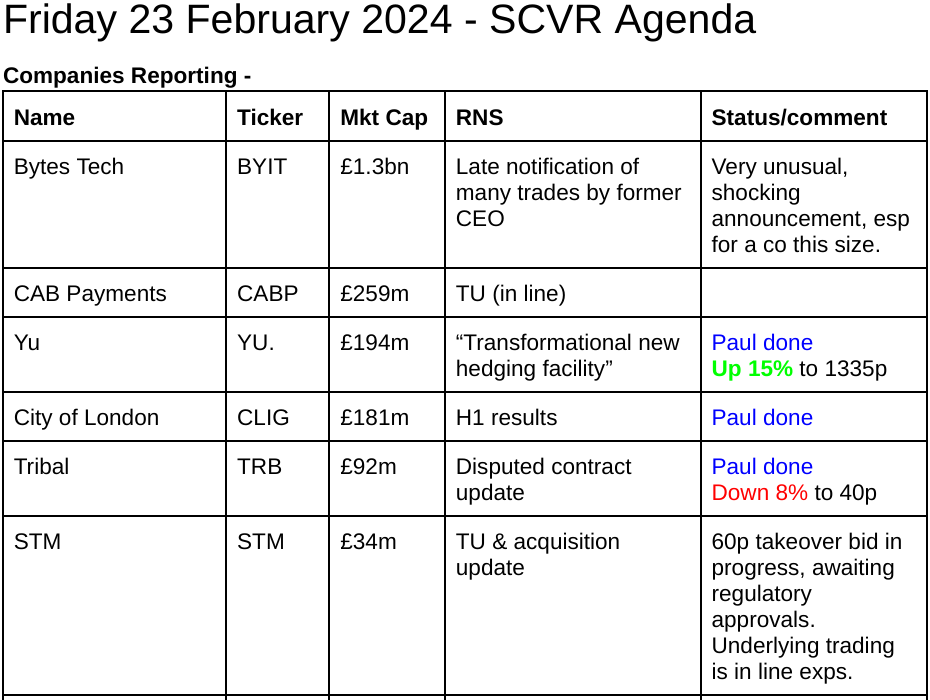

Good morning from Paul!

Director interview - I've resumed doing my audio interviews with CEOs. Yesterday afternoon I had an interesting update call with founder/CEO of Beeks Financial Cloud (LON:BKS) Gordon McArthur. Disclosure: I have a small position (<1% of my personal portfolio) and intend buying more at some point when funds are available. Remember the point of difference is that I approach companies I want to interview, and I don't charge any fees, so that it's independent, rather than PR. It went out on my podcast channel yesterday, or the web version is here. I thought it was very interesting, not just his points on Beeks, but also wider market comments. I've got 3 more company interviews in the planning stage! Ideally it would be great to talk to all 20 companies on my list of favourite 2024 shares, which has got off to a good start so far. So any company advisers who could facilitate this, please do get in touch.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Paul's 2023 share ideas, with live prices.

New SCVR summary spreadsheet from July 2023 to date, updated at weekends (very useful quick reference tool, search for ticker using CTRL+F). Hover over cell for pop-up notes.

Frozen SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Morning movers (with news) -

Hornby (LON:HRN) - up 35% to 28.5p at 14:18 (£48m) - Hornby welcomes Fraser (FRAS) as supportive strategic shareholder, FRAS ups its stake to 8.9%. This could get interesting! FRAS owns GAME, which sells Hornby products (model railways, and other heritage brands).

Note that Phoenix owns 72% of HRN, so is in the driving seat. I imagine Phoenix are probably delighted that key retailer/brand owner Frasers is taking an interest in HRN. Maybe this opens up an opportunity for Phoenix to sell down some of its shares in future? Trouble is, after years of attempting a turnaround, HRN is still heavily loss-making and has way too much debt. So on fundamentals it looks hopeless, but it looks as if traders might be having some fun on the Frasers news, in a very illiquid share with little free float. Could it be the next Games Workshop? Probably not, but FRAS involvement could be a catalyst for something more interesting to happen, who knows?

Saietta (LON:SED) - down 43% to 3.25p - almost game over. Puts itself up for sale, and says it has a week to arrange something, or it will have to consider going into administration. Looks like it's all over, almost. Everyone here knows my views on this company, so I won't twist the knife for any holders.

Summaries

Tribal (LON:TRB) - down 5% to 41.5p (£88m) - NTU Contract Update - Paul - AMBER/GREEN

The educational software group announces that its large disputed contract in Singapore is now entering mediation. The total claim against TRB is about £10.6m, so this is a big dispute, and TRB has a weak balance sheet (negative NTAV of £(26)m) so it's not clear how it would fund any substantial settlement cost. Although I wonder if entering mediation means a negotiated compromise might be the outcome? Cheap compared with a 74p cash bid last year, there could be a trade here maybe?

Yu (LON:YU.). - up 15% to 1,335p (£223m) - Transformational New Hedging Facility - Paul - AMBER

A very significant announcement that the market likes, saying that a new supply arrangement with Shell has released a large amount of cash collateral. I run through both the bull & bear views below, and end up sitting on the fence with AMBER. It's your choice how you see this share, there are compelling bull and bear points, and nobody knows how this will play out in future.

City of London Investment (LON:CLIG) - up 4% to 358p (£181m) - H1 Results & Board Changes - Paul - AMBER/GREEN

This niche asset management group has a long history and expertise in closed ended funds investing. It pays a 9.6% yield, which is the main attraction. It could also benefit from discounts to NAV narrowing, which might attract more AuM into its funds maybe? So there's also a possibility of a cyclical recovery in the share price too. Looks pretty good to me.

Paul’s Section:

Tribal (LON:TRB)

Down 5% to 41.5p (£88m) - NTU Contract Update - Paul - AMBER/GREEN

This is the key bit -

Further to the announcement on 2 May 2023, Tribal is now entering into a mediation process with Nanyang Technological University ("NTU").

This is a contractual dispute that has been muddying the waters with TRB shares for some time. NTU has also "updated" (presumably that means increased?) its claim -

NTU has updated its demand for damages allegedly incurred as a result of its purported termination of its contract (as previously announced) ("NTU Demand"). The updated NTU Demand is in the amount of SGD17,511,651 and USD377,724 on account of alleged damages, losses, costs and/or expenses. NTU reserves the right to update the quantification of its demand.

The Company has sought legal advice regarding NTU's Demand which it intends to vigorously dispute.

I initially thought this was only a small dispute, at $377,724. However, on checking the sterling to SGD (Singapore dollar) exchange rate, 1 SGD = 59 pence, so SGD 17,511,651 above translates into a hefty £10.33m. So this is a substantial claim. I had a figure of c.£10m in the back of mind as having previously been mentioned for this dispute.

Paul’s opinion - this dispute seems a significant size, although the market might see a mediation process as preferable to a costly dispute in court. It raises the question of whether a negotiated compromise might be achievable, drawing a line under this disastrous project?

I don’t rate TRB as a standalone business, because it’s had many slip-ups in the past, of which the disputed NTU contract is just one. However, it’s the value to an acquirer that interests me - software companies are often highly valued by acquirers, even if they seem poor businesses, we’ve seen some very surprising takeovers of serial disappointers from the UK market in the past (e.g. Proactis and Tungsten spring to mind). Tech valuations in the US, and in private markets, are very high of course. That's why cheap shares on AIM are receiving takeover approaches, often from the US and/or private equity.

Note that TRB shareholders rejected a 74p cash takeover bid last year. Then there was an ahead of expectations update recently on 2/2/2024. So the current share price of only 43p could have upside on it, as a trade, maybe?

That could get derailed though, if the mediation results in an onerous settlement that TRB might struggle to afford, as its balance sheet is weak - the last interims showed NTAV negative at £(26)m. It’s true that software companies usually don’t need any significant net assets, due to capital-light models and receiving cash up-front from customers. However, anything in negative NTAV territory is taking things too far, in my opinion.

TRB shares could go either way, I don’t know what the outcome will be. However, the price being so far below a recent takeover approach makes me lean towards the positive side, so I’ll stick with AMBER/GREEN as previously on 2/2/2024.

Yu (LON:YU.).

Up 15% to 1,335p (£223m) - Transformational New Hedging Facility - Paul - AMBER

Yü Group PLC (AIM: YU.), the independent supplier of gas, electricity, meter asset owner and installer of smart meters to the UK business sector…

Bulls are back in charge now, with a +15% share price reaction to this news -

…entered into a new structured trading agreement ("Hedging Facility") with Shell Energy Europe Limited ("Shell Energy") with an initial five-year term.

There seems to be a key improvement with this new facility, in releasing substantial collateral cash -

Further, while the Group meets its ongoing obligations in the Hedging Facility, Yü Group will not be required to deposit cash as collateral to support mark to market movements, due to energy price fluctuations, as has been required under the Old Facility. Finally, Yü Group will benefit from Shell's leading and considerable commodity trading access to liquid commodity markets, at market reflective prices.

The Hedging Facility fundamentally transforms Yü Group's working capital profile releasing cash that would previously have to be held on balance sheet to support the Group's robust hedging policy.

£52.25m of cash previously lodged under the Old Facility has now flowed back to Yü Group, with further material cash benefits to be realised over the next month.

That’s highly significant on the face of it, although without seeing all the small print of the old & new contracts, outside shareholders will never fully understand this. We just have to trust that management know what they’re doing, and haven’t taken on any hidden risk.

This is a highly risky sector - look at how many utility suppliers have gone bust during this energy crisis. YU also had a serious setback in 2018. However, it’s clearly played the more recent energy crisis extremely well, being a serious multibagger starting in 2021, but really taking off in late 2022 to date -

Releasing all that collateral cash opens up the possibility of faster expansion, more generous divis, maybe buybacks, acquisitions? I can see that it would open up a lot of options for management that have been restricted by the previous supplier/hedging contract -

The new hedging facility unlocks over £50m of cash currently posted as collateral and removes a material working capital constraint to the business lifting exposure to mark to market movements from future energy market fluctuations. This provides us with substantial strategic and financial benefits, enabling increased distributions whilst continuing to invest to deliver our ambitious growth agenda.

Paul’s opinion - I’ll do bull and bear -

Bullish view - this certainly sounds an interesting announcement today, I can see the benefit from releasing all that collateral cash. It also suggests that Shell must be comfortable with YU, to not require collateral.

On the upside, YU has produced stellar growth during the energy crisis, with profit soaring -

Broker upgrades have been astonishingly good -

Valuation on a PER basis is still more than reasonable - the StockReport shows a forward PER of only 7.1.

Bearish view - all the profits have come from the energy crisis, it made next-to-nothing beforehand. The number 1 question to ask for all investments, is “are profits sustainable?”. IF they’re not sustainable, then buying a cheap PER share that’s enjoying a temporary bonanza in earnings, could turn out to be an expensive mistake.

YU has previously come unstuck, and with the whole business model resting on management making correct (and sometimes lucky?) decisions on purchasing and selling prices, plus the all-important hedging. If they get that badly wrong, it could be disastrous, and how many management teams always get their hedging right? Hedging is meant to tie selling prices and buying prices together, to give guaranteed profit whatever happens to market prices, but how many companies actually hedge perfectly like that?

My previous concerns with YU’s accounts was a huge bad debt charge. It seemed to be selling electricity to small businesses that couldn’t pay their bills. That’s not good business! I think YU was addressing this issue though, so that might be OK now, it’s just something to check.

Overall - I can see why some investors will be excited about the superb performance YU is currently producing. Equally, I can see why other investors might see this as a flash in the pan, with super-normal profits likely to be competed away as markets normalise.

As I don’t know what the future holds, I’ll just sit on the fence with AMBER, but well done to bulls, it’s certainly been a terrific share so far.

City of London Investment (LON:CLIG)

Up 4% to 358p (£181m) - H1 Results & Board Changes - Paul - AMBER/GREEN

We didn’t look at CLIG during 2023, but Graham wrote a really interesting review recently here on 22/1/2024 reminding us what CLIG does - it’s a specialist asset manager, which invests client money in closed end investment funds. The attraction being that they’re experts in this field, and that attractive (for new investors!) discounts have opened up in closed end funds, providing possible future upside. Although it said some discounts narrowed in Q4 2023.

The main attraction of this share is a stonking dividend yield of almost 10%.

Doing some googling, this very interesting article from Maynard Paton’s blog came up, indicating the 32% major (founder) shareholder wasn't happy with the Board last autumn, although I see a new chairman is now in place.

How do today’s actual H1 figures compare with that guidance? I’d be very surprised if they’re any different, but actually the profit, and the cash figure do seem to be a little below what the H1 TU (issued 22/1/2024) previously stated -

Funds under management (FuM) up from $9.4bn (Jun 2023) to $9.6bn (Dec 2023) - TICK! (actual same as guidance)

Adj PBT $13.9m (flat vs H1 LY) - question mark over this, as the actual figures today say $13.3m underlying PBT, and give a different LY comparative of $13.6m. Sounds like this might be a slight miss against guidance? Looking again at the H1 TU, it did say $13.9m adj PBT was only an approximate estimate, which seems to have been missed by £0.6m.

Cash guided at $28.8m - the actual balance sheet shows cash of $25.9m, and no bank debt. So this also seems below guidance, by almost $3m, which is strange as cash should be the simplest figure to report! Maybe there’s a reasonable explanation, I don’t know. If anyone talks to management these discrepancies are worth querying.

Interim dividend 11p - TICK!

FuM latest figure post year-end is down slightly to $9.5bn at end Jan 2024.

This is the first year in which CLIG has reported in dollars, so make sure you note that when doing comparisons.

Balance sheet - looks robust, although it doesn’t support much of the market cap, so this is an earnings/divi based valuation for CLIG shares, rather than asset-backed.

NAV of $151m is mostly intangible assets of $126m, which look to be (see note 5) almost all goodwill and similar, relating to previous acquisitions. Deleting those, as is customary, gets NTAV of $25m, which is nearly all just the cash pile.

Overall, it’s fine. I see the commentary says the company has “never had debt”, not something I can recall any company saying before, although it’s probably also true of some of the very conservative, family owner/manager companies we like here.

Board changes - very minor, shuffling the NEDs.

Outlook comments - are interesting, more a strategy statement than outlook! This is from the Chairman -

The current very wide discounts in CEFs remind me of my early investing days. I first invested in an EM CEF in 1993, a very strong year for EM. During the year, that fund surged in value and moved to a 10% premium to net asset value at which point I sold it. When Alan Greenspan and the Fed began raising interest rates in early 1994, I was then able to invest in well-managed CEFs at 15-20% discounts at a time when emerging markets were in a severe correction. I called it buying a double-discount. Two years earlier, Barry Olliff founded CLIG to pursue a similar strategy. Little did I know then that savvy George Karpus had begun investing in discounted CEFs in the US starting in 1992. Our Founders Barry and George developed their investment processes and teams to buy low and sell high. Now in our fourth decade, this spirit of buying quality at discounts resonates strongly within the Group.

A talented investment manager we know describes his approach as investing under a cloud. He uses clouds (bad news and uncertainty) as markers for uncovering value below. Indeed, inflation, the ensuing interest tightening cycle and geopolitical headwinds are presenting opportunities. It is notable that emerging and international markets have substantially lagged the US market since the merger. Indeed, the S&P index has delivered a cumulative return of 49% in the 39-month period versus just 2% for EM and 23% for international markets. At the same time, rising interest rates have created opportunities for KIM's fixed income and municipals strategies. Relative valuations are much lower in the markets where the Group has the majority of its assets under management and discounts in our CEF portfolios are at compelling levels. Our teams are energised and we remain constructive on the outlook for performance at CLIG.

The CEO also has a rather quirky style outlook paragraph - I can't decide if this is charming or just annoying! -

In my CLIG outlook from the FY2023 Annual Reports and Accounts, I used the phrase "with a following wind" to reference that the foundations for growth have been laid, and the Group was poised for growth pending an improvement in the overall market sentiment. The wind has not yet shifted, as CEF discounts remain wide across multiple strategies. Despite a headwind versus a tailwind, the Group is positioned to go further together, with thanks and appreciation to our colleagues for navigating the rough seas.

Cashflow statement - is really simple. All the cash generated is spent mostly on paying divis, but also note $3m was spent last year on buying shares for the employee benefit trust, and $1.1m in H1 FY 6/2024.

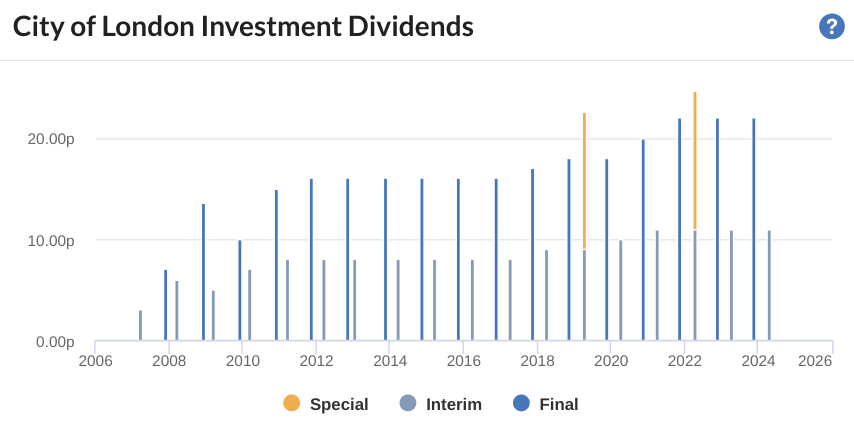

Paul’s opinion - I like this share, mainly for income seekers, with a 9.6% forecast yield that looks reasonably safe. Even if it came under pressure, I imagine the cash pile and no other need to retain capital, would mean divis reduced rather than cancelled, if earnings were to fall. This is confirmed by the dividend graphic below, which shows reliable divis, even through the pandemic - plus an occasional special divi on top -

There’s a lot to be said for letting CLIG do all the clever stuff, and just own its shares and collect in a 9.6% yield, as opposed to investing directly into choosing our own closed ended investment trusts - although I know some of the readers are experts in that field too.

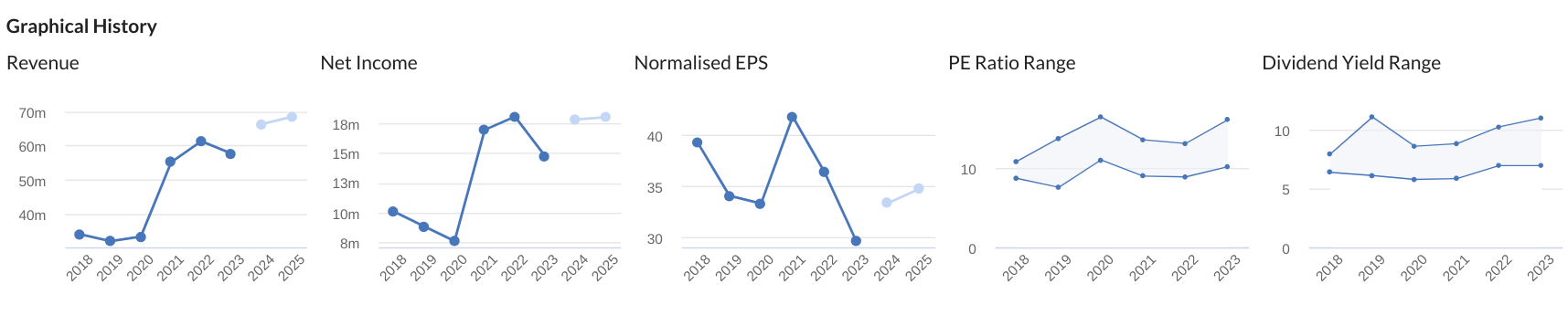

On the negative side, Graham did raise some valid issues about the downward trend of its margins, so investors need to reassure themselves that CLIG is not in structural decline. Nothing of that sort is jumping out at me from the graphical history -

In conclusion, I think AMBER/GREEN feels right to me, ahead of Graham’s amber view recently.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.