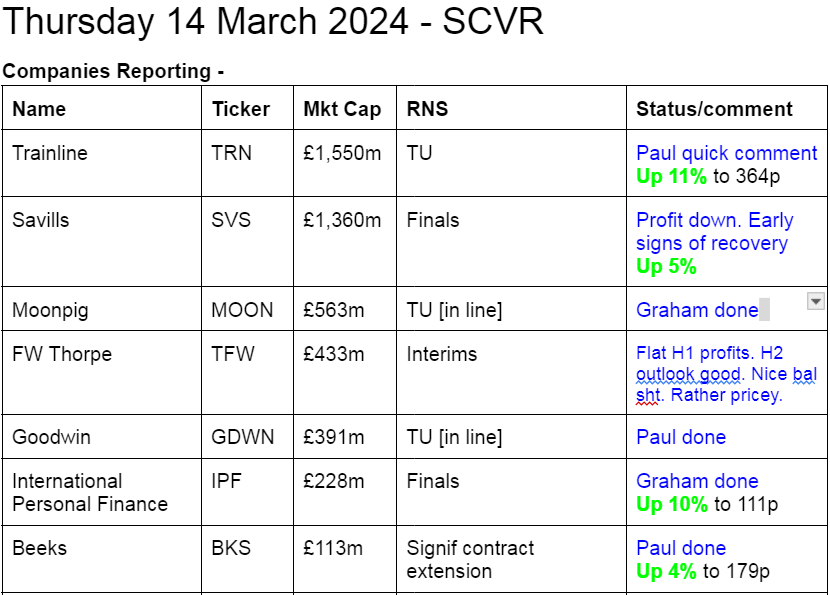

Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Paul's 2023 share ideas, with live prices.

New SCVR summary spreadsheet from July 2023 to date, updated at weekends (very useful quick reference tool, search for ticker using CTRL+F). Hover over cell for pop-up notes.

Frozen SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

(We can't cover everything remember!) ... EDIT: oh yes we can! It's a clean sweep today :-)

Other mid-morning movers (with news) -

Abingdon Health (LON:ABDX) - up 26% to 8.5p (£10m) - H1 Results (Dec 2023) - Paul - AMBER/RED

Well received results. H1 revs doubled to £2.4m. Loss halved to £(1.2)m in H1. Says H2 revs will be significantly higher than H1 (as they were LY). FY 6/2024 revs to be materially higher than £4.0m LY. Says it will reach breakeven in 2024 (calender, presumably? Not FY 6/2024). Says it won’t need another fundraise - they always say that! It’s still burning through the cash, with only £2.0m left at Dec 2023 (£20m cash was raised in the IPO), so I think it will need another fundraise. Still loss-making, and a disastrous 2020 AIM float at 96p, never turned a profit, so it has a lot to prove. Not of interest to me at this stage, even as a punt.

Pressure Technologies (LON:PRES) - up 7% to 36p (£14m) - Contracts & Disposal - Paul - AMBER/GREEN

“two major contracts, as expected” won by Chesterfield Cylinders, the core business. No financial info is provided. One is defence (Australian), the other in green energy - a pilot, using 48 large cylinders to store surplus energy via compressed air. If this takes off, could be exciting maybe? “Maintains outlook” for 2024.

Pending disposal of PMC division - has received “a number” of indicative offers (I dislike this ambiguity - 1 is a number! Surely “several” would be clearer, if it’s more than 1?). Looking to complete the process in Apr-Jun 2024 (Q3 of FY 9/2024).

Paul’s view - I quite like PRES, things seem to be moving in the right direction, but it’s still requiring heavy guesswork/inside info to know what the financial specifics are for contracts, and the possible disposal proceeds, hence what the shares are worth. But I’ll go up from amber to AMBER/GREEN. I’ve always liked the potential for Chesterfield Cylinders, but it’s had false dawns before, where surging profits later dried up. Nice to see activist institutions nurturing it back to health, after Lloyds Bank let it down, removing a tiny facility.

Vistry (LON:VTY) - up 5% to 1168p (£4.0bn) - FY 12/2023 Results well received. The newswire says it’s a profit beat, and higher production expected in 2024. Also a further £100m share buyback announced. Paul’s view - I really like Vistry’s differentiated, partnership model for building houses. It’s proven much more resilient than traditional house builders in this current downturn. Outlook comments are positive. Now trading at almost double NTAV, so maybe the shares are up with events now after a great run (up c.78% since last summer’s lows)? Political risk from a new Govt possibly worrying?

IG group (LON:IGG) - up 4% to 735p (£2.8bn) - Q3 Update - confirms trading is in line with expectations for FY 5/2024 (revenue and adj PBT). Big shake up of the Board, with the CFO and COO being presumably pushed out by the newish CEO Breon Corcoran, who friends tell me has an impressive track record, and kicks ass.

Osb (LON:OSB) - down 16% to 386p (£1.52bn) - specialist lender plunges 16% on FY 12/2023 Results - adj PBT down 28% to £426m (still an awful lot for a £1.5bn mkt cap though). Net loan book up 9% to £25.7bn. Net interest margin down from 303bps to 251bps. Adj EPS down 25% to 75p (PER 5.1x). New share buyback of £50m announced. 32p total divis, yield of 8.3%. Bal sht NTAV exceeds market cap.

Paul’s view - first time I’ve looked at this, and I’m intrigued. It’s a simple savings & loans bank. The cash mainly comes from retail deposits, of c.£22bn. So my main worry would be a risk of depositor flight, as we’ve seen in recent banking crises. I never invest in banks personally. But the 8.3% yield, and straightforward, seemingly sound finances at OSB do seem quite appealing. Also a mortgage broker told me recently that many lenders are deserting the buy to let lending space (OSB's niche), or offering lousy deals and requiring high LTVs. Hence maybe more business might come OSB’s way? Not many BTL borrowers default. Looks potentially interesting, I won’t give it a colour though, as I don’t know enough about the company or this space. I wonder if there’s regulatory risk that I’m not aware of? For sophisticated investors, bonds in banks are an interesting alternative to the equity.

Beeks Financial Cloud (LON:BKS) [Paul holds] - up 4% to 178p (£117m) - Contract Extension - Paul - GREEN

More reassuring news from this specialist cloud computing company, probably my favourite GARP share. “Significant extension” to its big contract with Johannesburg Stock Exchange - reinforcing the company’s “land and expand” strategy which generates ongoing organic growth, as customers start small, then do more business with BKS as they gain confidence in the service. Demand is higher than expected, and significant pipeline, are mentioned today. Forecasts for BKS were recently upped, so this deal seems part of that, not in addition to it, I think, as it “further supports” recent upgrades for FY25. Hence a modest share price rise today seems sensible. Also a possible second (backup) site for Johannesburg is mentioned.

Paul’s view - I see the bull case playing out very nicely here. The bear case seems to be backward-looking, pulling apart historic figures, but I’m not buying the past, I’m buying the future, which is looking very good. It doesn't pay to stubbornly stick to a wrong opinion, as we learn over time, often the hard way! The bears are wrong here, in my view, but I do like to hear what they have to say, so I can think about it.

Trainline (LON:TRN) - up 11% to 362p (£1.7bn) - Trading Statement - relating to FY 2/2024. Positive market reaction (up 11%). Revenue £397m, up 21% is slightly ahead of 15-20% guidance. It’s obvious from reading this TU that TRN is way too complicated for me to get into now. Also I am not given access to any broker notes or updates. An 11% share price update suggests that privileged info has probably been issued to professional & institutional investors, in this market that is rigged against PIs - no wonder some people are giving up and switching to US shares.

I don’t see anything attractive at all in the StockReport numbers & forecasts, so am not motivated to investigate TRN further. Maybe readers can explain the bull case here? It seems to talk about European expansion, but is still a mainly UK travel intermediary. I see reader comments are discussing the bull:bear views. Sorry I can’t add anything more, due to lack of information.

Summaries of main sections

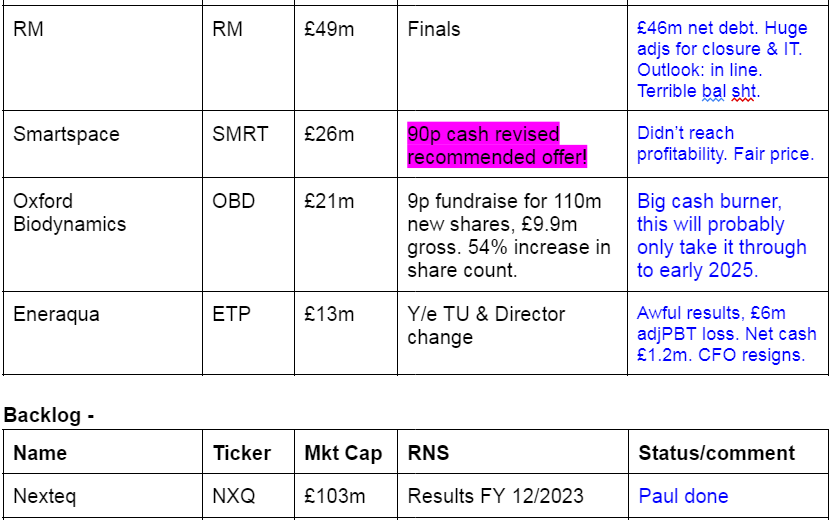

Nexteq (LON:NXQ) - 155p (£103m) - Audited Final Results -(y'day) Paul - AMBER/GREEN

Decent results, that beat expectations. Forecasts raised by the house broker for 2024. Amazing balance sheet, with ample surplus capital & cash, giving plenty of firepower for acquisitions. The wobbly, over-PR'd outlook statement spoils it for me though, with a soft H1 in 2024 now seeming likely, and it dodged the question of meeting 2024 profit expectations, instead only confirming revenues - which strikes me as deceptive, and introducing doubt. Very odd to be raising broker forecast at the same time as giving a wobbly-sounding outlook - this wasn't thought-through properly.

International Personal Finance (LON:IPF) - up 10% to 110.95p (£249m) - Final Results - Graham - GREEN

Uncertainty around Polish regulation has been partially lifted as IPF has been able to quantify the cost of recent news at £10m of annual PBT. For a stock trading at a low single digit multiple and for whom £10m is only a fraction of annual profits, it’s excellent news.

Goodwin (LON:GDWN) - up 1% to 5240p (£394m) - Trading Update - Paul - AMBER/GREEN

It's good to see this engineering group introducing more regular updates than before. It's in line with expectations, and

Moonpig (LON:MOON) - down 0.3% to 178.9p (£616m) - Trading Update - Graham - AMBER

Performance has been in line with expectations at Moonpig following Christmas, Valentine’s Day and Mother’s Day, and expectations are unchanged. Additionally, balance sheet concerns may be eased by confirmation that the leverage multiple is on track to reach 1.5x.

Paul’s Section:

Nexteq (LON:NXQ)

155p (£103m) - Audited Final Results -(y'day) Paul - AMBER/GREEN

Nexteq (AIM: NXQ), a leading technology solutions provider to customers in selected industrial markets, is pleased to announce its audited full year results for the 12 months ended 31 December 2023.

Revenues down 5% to $114.3m, but the gross margin has increased markedly (32.2% in 2022 to 36.3% in 2023), saving the day, with adj PBT up an impressive 45% to $14.7m - a healthy 13% PBT margin - which tells me this is a decent quality business, with some pricing power. Sure enough, the StockReport shows decent quality measures (these are historic, so the operating margin will go up once the 2023 actuals update) -

Adj EPS is only up 2% to 18.09c (ahead of consensus 16.4c shown on the StockReport), converting to sterling = 14.1p = PER of 11.0x - which seems decent value at first sight for a decent quality business. That’s despite this share being up more than 50% since the lows in Dec 2023.

EDIT: note that, as kindly pointed out by Snazzytime in the comments below, EPS growth was suppressed by a tax credit of $2.2m boosting the FY 12/2022 comparative earnings, compared with a reversal into a more normal $2.0m tax charge in FY 12/2023. This turned 47% growth in PBT into a 1% fall in PAT. End of edit.

Broker update - Cavendish helpfully confirms that the 2023 results are ahead of its forecast - actual 18.09c, forecast 15.9c.

It also ups 2024 forecast adj EPS from 16.8c to 18.1c (flat with 2023 actual, so hopefully they’ve left room for out-performance as 2024 progresses).

Outlook - this is perhaps why NXQ shares slipped slightly yesterday (after a very strong run in the last 3 months) - a more hesitant outlook.

“Slower order intake” so far in 2024, due to customer destocking.

Improvement expected in H2.

Visibility is good, due to “healthy order backlog”

"confident in meeting market expectations for 2024 revenues, with a second half weighting." - I’m more interested in profit than revenue, so dodging this point does not go unnoticed, and introduces doubt.

Organic growth opportunities “in the medium term” - again the wording introduces doubt about the short term.

More efficiency actions being taken to prioritise profitability.

Net cash expected to further improve as supply chains normalise, further building cash surplus - says acquisitions may be done.

Balance sheet - wow, this is superb! It’s got c.$60m in net current assets, including $28.4m cash. Negligible bank borrowings of c.$0.5m.

This is a lot of surplus capital for a business with a market cap of £103m. I’d say it has ample firepower to make quite big acquisitions, if it was prepared to take on a bit of debt too - up to say $15m net debt position wouldn’t concern me. So that gives it over $40m in potential acquisition firepower.

Dividends are modest, which is strange for a nicely cash generative company that’s sitting on a large & growing cash pile. Why are they so hesitant about shareholder returns?

Paul’s opinion - the outlook statement blew it for me, they’ve tried to be clever by twisting market expectations to cover revenues, not profit. I hate it when companies do that - do they think we’re stupid and won’t notice? All they’ve done is to introduce doubt, and that is worsened with the H2 weighting. So we’ve now been warmed up for probably disappointing H1 results.

If the outlook statement had been stronger, then this share would have had a clear road up to about 200p I think, but the wobbly outlook has put me off for now. Am happy to keep monitoring it though. The excellent balance sheet gives nice hidden upside though, if they spend it wisely on a decent acquisition or two.

Let’s go with AMBER/GREEN, due to very good fundamentals and modest valuation, whilst being aware that a soft H1 for 2024 sounds like it’s on the cards, so there could be a pullback in share price at some point, possibly.

Long-term it's been disappointing, and de-rated from a growth company to a value share - could there be an opportunity for perception to improve in the next bull market, I wonder?

Goodwin (LON:GDWN)

Up 1% to 5240p (£394m) - Trading Update - Paul - AMBER/GREEN

This is a family-controlled engineering group. I like the company, and included it on my top 20 shares ideas for 2023 at 3335p. It’s up 57% since then, and both Graham (SCVR 20/12/2023) and I (SCVR 11/8/2023) thought the price looked up with events, but were impressed with its large order book disclosures each time.

Reporting is sparse, and I note it doesn’t usually issue an update this time of year, so my initial worry in those situations is that it might be a profit warning.

A helpful note from Shore Capital today says that management has introduced quarterly updates to shareholders to keep investors better informed - bravo for that!

The first sentence of today’s update reassures us -

The Group's trading activity has remained in line with expectations and the profitability of the Group in the second half of the year will be similar to the first six months

That makes it easy to work out - H1 was PBT of £12.1m on £97.6m revenues, so a nice healthy margin. This profit benefited from a £0.9m profit on a SWAP derivative, so “trading profit” was £11.2m. It’s not clear which profit figure GDWN is referencing in today’s update.

In EPS terms, it was 115.7p in H1, so double that to 231p roughly in FY 4/2024.

The PER on that is 22.7x - not cheap, but I see this as a quality growth business -

Order book - which it called “current workload”, I assume that’s the same thing? Is large, at £252m. Yes it seems to use these terms interchangeably, as in the 20/12/2023 published H1 results, it disclosed a “current forward order book of £266m”. Today’s £252m is c.5% down, not enough to cause me any alarm, it’s still a big number, and well over a full year’s revenue.

Energy - it’s using more solar, and planting 500k trees to offset use of gas in its manufacturing.

Growth - I like this bit -

Following a record order input last year at Goodwin Steel Castings of £77.2 million, higher than the cumulative input over the last five years, the level of throughput at the foundry is increasing. Consequently, the foundry will be contributing a greater level of profits moving forward as a higher proportion of the work will relate to highly technical and specialist mission critical castings that are priced accordingly. Over the past five years nearly all of these components have been through a development process and have successfully been delivered to our customers. With activity levels continuing to increase throughout the year, the Board sees this as an exciting time for Goodwin Steel Castings going forward.

Turnaround at Easat is still pending -

We commented in the 2023/24 Outlook section of the Interim Report that we believed Easat Radar Systems, over the next six months, will be announced as the successful bidder of a number of contracts, though we have nothing further to report at this time as the tendering processes are still ongoing…

Balance sheet - looking back at H1 figures, the Oct 2023 balance sheet isn’t that great actually. It contained a fair bit of net debt at £54.6m, although the H1 commentary said this was expected to “reduce over time” as capex falls and working capital unwinds somewhat.

It would have been helpful to give an update on the net debt position today too, but that is not mentioned.

Forecasts - there don’t seem to be any, with Shore saying it intends to introduce figures in due course. But we have good guidance from the company today, which I’ve worked out as c.231p EPS this year, as above.

Paul’s opinion - a very interesting company I think. It seems to have successfully carved out profitable niches, and there’s been plenty of investor talk in the past of large contracts having potential to become very large and long-term - nuclear waste storage containers was I think (from memory) one of the mooted growth areas. This was a strategy to move away from its previous over-reliance on the oil industry. However, with oil & gas now seemingly firing up again over energy security issues, maybe we might see growth return in that area too?

My view is unchanged, I really like this business, but feel the share price is up with events again. So I usually colour-code those as AMBER/GREEN.

I know we have several readers who have studied this in much more detail than me, so I’m looking forward to hearing your views in the comments.

Twenty-bagger in 20 years, wow! Who said boring was bad?!

Graham’s Section:

International Personal Finance (LON:IPF)

Share price: 110.95p (+10%)

Market cap: £249m

I’m a long-time fan of this company, but I still find their self-description rather odd:

International Personal Finance is helping to build a better world through financial inclusion by providing affordable credit products and insurance services to underserved consumers across nine markets.

Markets served include various Eastern European countries, Australia and Mexico.

The good news is that these are solid results, with rising PBT despite some weakness in key metrics:

The PBT result (£83.9m) was “ahead of our internal plans”.

Remember that Poland has been the most difficult territory for IPF in recent times, as Polish regulators have clamped down on non-interest fees charged by lenders.

Last October, in the Q3 trading update, we learned that IPF’s lending in Poland was down 23% year-to-date.

Today we learn that the full-year result is even worse: lending in Poland fell by 29% for the year.

But the stats excluding Poland are perfectly fine:

Customer lending up 8% excluding Poland (it’s down 3.5% overall)

Net receivables up 12% excluding Poland (it’s down 0.2% overall at CER)

And the lending portfolio is performing well: the impairment rate did increase from 8.6% to 12.2%, but IPF’s long-term target is 14% to 16%.

CEO comment excerpt:

All of our businesses delivered good growth, with the exception of Poland where we anticipated a shrinkage as we adapt to new regulation and the rollout of our credit card product. We are now serving more than 130,000 customers with this exciting new offering and we continue to adapt and change our Polish business to customer needs and ongoing changes in regulation.

Regulatory update

Unfortunately this section does contain some bad news, from an IPF shareholder perspective.

The Polish regulator has written to all lenders to express its views on how the country’s new lending regulations should be interpreted. I won’t go into all the details but this is the result:

The Group estimates that if the expectations set out in the KNF letter are implemented in full in their current form, the non-interest fees generated by the Group's Polish credit card business could be reduced by approximately 30% - 40%. On an ongoing basis, after taking account of the Group's strong trading performance in 2023, this could reduce the Group's profit before tax by up to £10m per annum.

Outlook

The positive momentum from IPF’s strong overall performance in 2023 (presumably excluding Poland) “has continued in early 2024”:

Our actions over the last two years to maintain tight credit standards, improve revenue yields and drive cost efficiency have been very successful in improving the Group's returns towards our target levels. Credit quality is excellent, we have a robust balance sheet and strong funding position, and we are progressing with plans to refinance the Eurobond maturing in November 2025.

The refinancing of the large Eurobond (c. €300m outstanding) will be a key event for IPF. Note that this single bond is worth more than IPF’s market cap!

Graham’s view

The news from Poland is certainly a blow but in some ways it shouldn’t come as a shock that the regulator would want to shut down non-interest charges on credit cards, after they have already done this for home credit loans.

It does mean that IPF’s strategy - of seamlessly switching from home credit to a credit card model - has been hugely undermined.

The good news is that the IPF share price has been pricing in plenty of bad news:

Indeed, if a £10m hit to annual PBT is the last bit of bad news that is left to hit this stock, then shareholders should do extremely well from here.

The company reports an adjusted return on equity of 11.1% for 2023, slightly lower than the 11.5% achieved in 2022. And the adjustments seem reasonable to me (without the adjustments, it would have reported an even higher ROE in 2022).

This is a reasonable rate of return in my book, but the company still trades at a very steep discount to its balance sheet net assets of over £500m (tangible net assets £446m)..

For me, the bad news and the risk should be priced into the equity at this level. Although as I’ve said before, I think IPF’s debt instruments are also potentially very attractive investments and maybe even offer better risk/reward than the equity. For example, there is the 2027 retail bond (trading under the ticker IPF3 on the LSE’s retail bond platform) that pays a 12% coupon. If that could be bought around par, I might even prefer that to the equity.

Moonpig (LON:MOON)

Share price: 178.9p (-0.3%)

Market cap: £616m

Moonpig Group plc (the "Group"), the leading online greeting card and gifting platform in the UK and the Netherlands, today provides an update on its trading performance in the current financial year ending 30 April 2024.

Performance has stayed in line with expectations and expectations for the financial year are unchanged.

We’ve now had Christmas, Valentine’s Day and even Mother’s Day, so I guess that most people won’t need to buy cards again for a few months!

Balance sheet - Paul has been highly critical of Moonpig’s balance sheet (see comments last September) and the company is keen to reassure investors on this front:

The Group is highly cash generative and we remain focused on deleveraging. We continue to expect that we will reduce the ratio of net debt to Adjusted EBITDA to below 1.5x by 30 April 2024.

Checking the interim results (for the period ending October 2023), I see that the leverage multiple (“net debt to pro forma adjusted EBITDA”) had reduced from 2.45x to 1.83x year-on-year.

This was thanks to a £40m+ reduction in net debt year-on-year, down to £167m, combined with an increase in EBITDA.

Given the substantial reduction in the leverage multiple already achieved, maybe it’s reasonable to think that they can keep going and get it down to 1.5x in the near future, as planned?

I also note that Moonpig’s £167m net debt figure includes leases, which many investors would be happy to exclude from the calculation. Excluding leases, net debt was £149m.

Leverage of 1.5x is something which most companies should be able to manage comfortably, assuming that trading does not suddenly collapse.

New RCF: this also sounds like positive balance sheet-related news.

Moonpig previously had a £175 term loan, along with an £80m RCF. So total bank facilities were £255m.

These have been cancelled and replaced by a single £180m RCF.

For me, this new RCF is effectively proof that Moonpig do not intend to increase their bank borrowings any time soon. They had bank borrowings of c. £171m at the interim results, not far off their new upper limit.

Graham’s view

I think there is lots of positive balance sheet-related news for investors to chew on here.

We do still need to account for the debt when valuing Moonpig; adding on c. £150m of financial net debt to the market cap gives an enterprise value of £765m.

This isn’t a cheap stock:

Forecast net income is £35.5m for FY April 2024, rising to £41.2m for FY April 2025 (source: StockReport).

I do like this company a lot - the brand is very widely recognised and the customer experience seems good for most people (4.2 on Trustpilot). But perhaps the stock is fairly priced at this level? I’m neutral.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.