Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech). We might cover companies outside this range if they are big % movers on the day.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

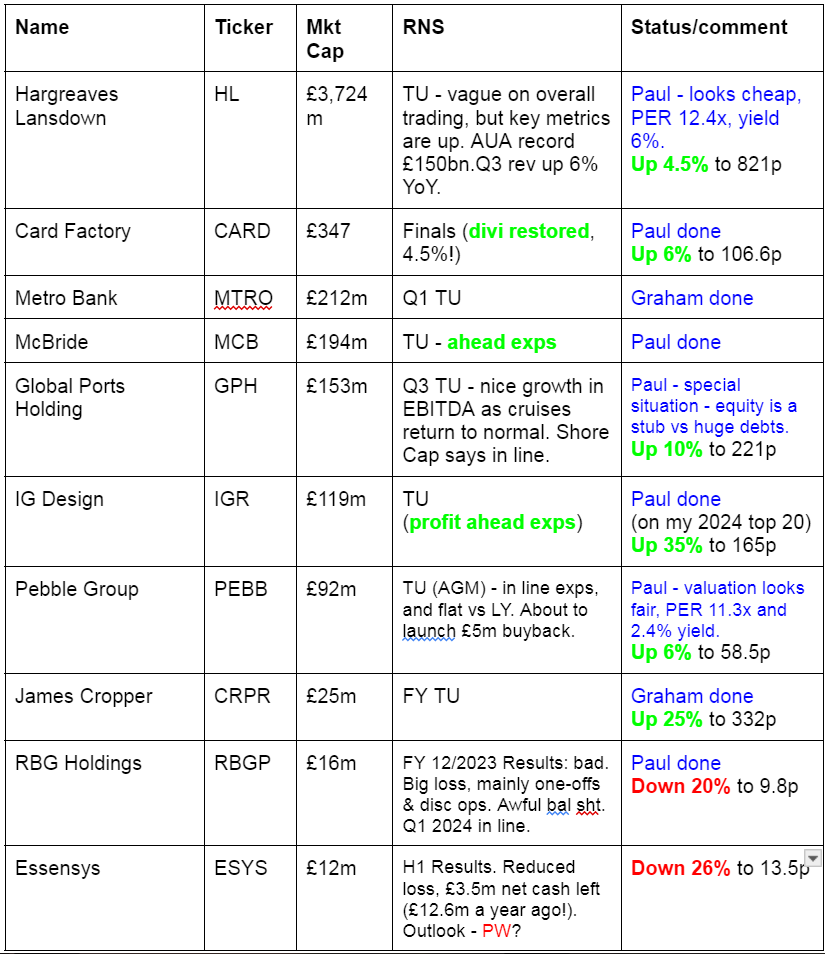

Companies Reporting -

Other mid-morning movers (with news) -

Northamber (LON:NAR) - up 14% to 40p (£11m) - Acquisition - Paul - AMBER

At last something is happening at this stagnant share (a distributor audio-visual equipment, and IT) that usually makes a small loss most years. Strong balance sheet is a plus, but 63% shareholder seems to do as he pleases. So high de-listing risk. Could things change now? Today it announces a relatively large acquisition, for c.£3m cash up-front, plus a few shares, and possible earn-outs.

Smarttech247 (LON:S247) - up 10% to 22p (£26m) - Interim Results - Paul - AMBER/GREEN

I looked briefly at this cyber-security company yesterday on the latest in a flurry of contract wins, which look impressive. H1 results show another loss, E601k LBT, but it has adequate net cash of E4.5m. Negative cashflow due to capitalising dev spend. Multiple contract wins is the main attraction, as these H1 numbers are not great by any means, so it's dangling a carrot of jam tomorrow. Hence shares impossible to value at this stage. Exec Chairman holds 70% unfortunately, so outside investors are just along for the ride, with no power or influence. Could be a reasonable punt maybe?

Transense Technologies (LON:TRT) - up 9% to 102p (£15m) - Joins Airbus Project - Paul - AMBER

As the notes to editors section points out, TRT's profit comes from "residual royalty income" that expires in 2030. So it doesn't make sense to value the share on a PER basis. Today's announcement says it will be involved in a research project with Airbus for landing gear development. No indications of how much of the £38m funding will flow through to TRT. Probably very little, would be my guess. I see very little prospect of TRT scaling up into a viable long-term business, having followed it for many years (it listed 25 years ago!).

SysGroup (LON:SYS) - up 16% to 35.5p - Trading Update - Paul - AMBER/RED

Over the top commentary of the day award - goes to the Exec Chair of SYS, who claims to have "totally transformed" things since he joined 9 months ago. Expects £2m adj EBITDA for FY 3/2024, but it already reported £1.6m in H1. Net debt of £3.4m unchanged from 6-months earlier. Last balance sheet is weak, at NTAV £(7)m, and it has to pay £1.8m in contingent consideration shortly. It had to pay an eye-watering £1.5m to get rid of previous CEO. Lots of talk of AI & machine learning in the commentary. Paul's view - sounds a bit rampy to me, with no real profits yet, so I reserve judgement until seeing the full numbers. For now though, I think it probably needs another placing, so will go AMBER/RED.

Summaries of main sections

McBride (LON:MCB) - 111p (£193m) - Trading Update [ahead exps] - Paul - AMBER/GREEN

Another ahead of expectations trading update, from this remarkable turnaround. I can't quite get my forecast figures to work below. Useful reduction in net debt, which is still substantial (but no longer an emergency), and don't forget the pension deficit consumes £4m pa in cash from the company. Overall, I like it, but wonder if supermarket customers might put the margin squeeze back on in future?

Metro Bank Holdings (LON:MTRO) - unchanged at 34.6p (£233m) - First Quarter Trading Update - Graham - AMBER/GREEN

I’m upgrading my view on this one as today’s update shows the bank winning low-cost deposits and adjusting its lending to focus on specialist areas. Metro is very well capitalised after last year’s fundraising efforts and trades at very cheap valuation multiples, but now it needs to prove that it can be profitable.

IG Design (LON:IGR) - up up 30% to 157p (£153m) - Trading Update - Paul - GREEN

An excellent ahead of expectations update today, but why did the company leave us in the dark on trading for 5 months?! I think today's rebound looks fully justified, as I crunch the numbers below. Strong balance sheet, so divis should be on the cards soon too. Looks good value still, so a continuing thumbs up from me.

James Cropper (LON:CRPR) - up 32% to 350p (£33m) - Full Year Trading Update - Graham - AMBER

The market is hugely relieved by this update as it suggests that the bad news flow from CRPR may have ended with profitability now set to slightly beat the hugely downgraded expectations. The company is discussing covenants with its bankers so it’s not yet completely in the clear.

Card Factory (LON:CARD) - up 7% to 107p (£372m) - FY 1/2024 Results - Paul - GREEN

Results look good, and the best bit is the 4.5p divi announced. So shareholders now receive an income whilst they wait for the Teleios overhang to clear. Balance sheet now sorted, with bank debt paid down to modest levels. Free cashflow isn't as good as I had expected, but I think it supports a potential doubling of the divis over time. It's good, and it's cheap, so has to be maintained at GREEN.

RBG Holdings (LON:RBGP) (Paul holds) - down 20% to 9.75p (£13m) - FY 12/2023 Results - Paul - AMBER/GREEN

Terrible 2023 results, and a diabolical balance sheet. However, turnaround actions have dealt with the main problems, and bank facilities renewed on reasonable terms. So I think there's a potentially good turnaround, possible multibagger here. It is higher risk though, not for widows or orphans.

Paul’s Section:

McBride (LON:MCB)

111p (£193m) - Trading Update [ahead exps] - Paul - AMBER/GREEN

McBride plc (the "Group"), the leading European manufacturer and supplier of private label and contract manufactured products for the domestic household and professional cleaning and hygiene markets, today provides a trading update.

It’s two months away from the current year end, FY 6/2024.

This has been a stunningly good turnaround, well done to bulls!

It’s more good news today -

Continuing trading momentum from operational delivery and strong demand levels.

Financial performance ahead of our expectations.

March & April trading ahead of expectations.

9m to 3/2024 - revenues up 8.2%, mostly from volume growth of +6.5%

Input costs - a bit mixed -

Input costs for chemicals and packaging remain at similar levels as at our last update in February 2024, with employment, general supplies and financing costs continuing to apply inflationary pressures. There are early signals that certain materials will see price rises as we progress into the second half of 2024, primarily in the more sustainable materials categories. Additionally, the Group continues to monitor and manage potential supply chain risks caused by heightened geopolitical tensions.

Upwardly revised guidance -

As a result of continuing strong trading performance, the Group now anticipates that adjusted operating profit will be c.10% ahead of current market expectations* and that net debt / adjusted EBITDA will be close to 1.6x by 30 June 2024.

* Group-compiled consensus of broker forecasts for FY24:

· Adjusted Operating Profit £61.0m

· Net Debt £132.0m

I can’t find any broker notes unfortunately. Stockopedia shows broker consensus as 19.6p for FY 6/2024, so I would assume that’s now heading usefully higher. Pity they’ve joined the new fashion for quoting operating profit, which of course ignored the large finance costs associated with its still heavy (but coming down nicely) bank debt.

It made £30.5m adj operating profit in H1, so H2 is now guided to be exactly the same, resulting in £61.0m for FY 6/2024.

Net debt has fallen from £145.7m at 31/12/2023, to £132.0m now, which is excellent progress. As I mentioned last time, net debt is no longer an emergency. It’s high, but coming down, and since EBITDA has risen so much, it’s looking manageable now.

Don’t forget there’s also a pension deficit to adjust for in your valuation calculations (£4m pa deficit repair cash costs currently, based on a 2021 actuarial deficit of £48.4m).

Adj PBT was £22.4m in H1, so double that for FY 6/2024, to £45m. Take off assumed tax of 25% (it was 27% in H1), gets PAT of £34m. Divide by 174m shares, and I get 19.5p adj EPS. Strange, as the existing consensus is 19.6p, so why isn’t my figure any higher when they’ve just reported op pr 10% up?

Paul’s opinion - I was slow on the uptake for this turnaround last year, but we gradually turned more positive as the trading updates improved. We were amber/green last time, on 27/2/2024. With continuing positive trading, ahead exps announced today, I’m happy to stick with AMBER/GREEN, although it was close re going fully green. We can’t ignore debt & pension deficit, hence my slight caution on valuation.

The forward PER is only 6.3x, and debt is now steadily reducing not just in absolute terms, but also relative to the value of equity. Market cap of £193m (pre-market) compares with £132m net debt. Expect that gap to widen in a good way for equity holders, as equity I think seems likely to continue rising, and over time, net debt is coming down usefully.

I still have reservations about how high the margins can go here, and whether this current boom in trading is necessarily sustainable though. Supermarket customers are likely to get to work on squeezing its margins back down again, once macro conditions have normalised. So far, so good though! Next step maybe 120-150p/share? Looks plausible to me.

Stunning turnaround -

IG Design (LON:IGR)

Up 30% to 157p (£153m) - Trading Update - Paul - GREEN

IG Design Group plc, one of the world's leading designers, innovators and manufacturers across various celebration and creative categories, provides an update on its financial performance for the year ended 31 March 2024.

IGR shares have been drifting down, probably due to the news blackout from the company. Management really need to address this issue, it’s left a yawning gap in reporting to investors - last updated on trading five months ago, on 28/11/2023. That’s ridiculous. A much more prompt reporting cycle is needed. Shareholders own the business, they want to know how things are going at regular intervals, not be left in the dark for 5 months!

When people see the share price drifting down, a lot of traders (as opposed to long-term investors) assume that insiders must know something, and are selling. Also, stop losses kick in, and people end up drifting away. Sometimes a falling share price is an indicator of poor trading, but sometimes (as in this case) it isn’t. Hence why clear, and frequent trading updates from companies are essential.

Anyway, all is forgiven with a 30% share price rise this morning on good news - and how marvellous to see a company using a meaningful reporting measure, of adj PBT -

The Group has continued to make good progress on its turnaround journey of improving operational efficiency and simplifying the business. These initiatives have resulted in significant growth in profit and margin for the year.

The Group expects to deliver adjusted profit before tax of $25.9m (FY23: $9.2m), which is ahead of market expectations. The Group's adjusted operating profit margin is expected to be c3.8% which is a further recovery of 200 bps on the previous year.

Revenue - is down 10% on LY to $800m, but I don’t care about revenues, this share is all about improving margins, which they’ve successfully achieved. It’s the sort of business where you want the company to be turning away low/zero margin business, and just focusing on profitable customers.

Financial position - was already good, with me flagging here on my top 20 share ideas for 2024 that IGR had NTAV of $286m, and that its bank debt was only for seasonal spikes in working capital (which is exactly what banks like lending for, as the risk of default is very low). Hence a strongly asset-backed situation is a good place to be, waiting for a turnaround, as the downside risk is only moderate even if the turnaround fails to make much progress. In other words, positive risk:reward, which is what we try to look for.

This is excellent, what it says today -

The Group closed the year with a net cash balance of $95 million (FY23: $50m), a $45m year-on-year increase which is well ahead of market expectation. The Group was average cash positive for the year despite its traditional seasonal cycle of working capital movements. This improved cash position was driven by increased profitability and continued improvements in working capital management throughout the Group.

Moving forward, the cash position of the Group is expected to continue strengthening due to its financial performance and sale of freehold sites following footprint consolidation in the DG Americas division.

Wonderful to see CARD joining the currently small group of companies which mention their average cash/debt position. This needs to become standard reporting for all companies, as year end snapshots of cash/debt are so easily window-dressed. It’s the average throughout the year that matters, but is rarely disclosed by most companies.

Historic issue re a potential liability of $5.5m is unwelcome news, but is easily drowned out today by the positive trading update.

Outlook -

The financial performance delivered in the year has been ahead of expectations and reflects the Board's aspiration to return to pre-Covid adjusted operating profit margins of 4.5% by 31 March 2025.

The increase in profitability came from both divisions, with the DG Americas division growing 132% (c$4m) and DG International growing 61% (c$12m). Whilst the Board expects momentum to continue into the year ahead; more of the profit growth should come from the DG Americas division. Management initiatives to underpin this track in line with expectations.

The Board is pleased with the operational progress and financial performance of the Group. As highlighted in our interim results, there remains caution in consumer shopping behaviour which holds down demand in certain markets and product categories. That said, actions taken over the past two years provide confidence in the delivery of the expectations for the year ahead, with the Group on track to deliver on its margin target for 31 March 2025.

That’s good news - indicating a margin improvement from 3.8% to 4.5% this year, FY 3/2025. That should translate to another decent rise in profit & EPS this year.

Valuation - Progressive has put out a note, commissioned by the company of course, so this is effectively the company’s forecast.

It shows 12.6c (10.05p) for FY 3/2024, which is now nailed down on the update provided today, so no guesswork there (subject to any audit adjs of course).

FY 3/2025 shows another big leap up, to 23.4c (18.7p).

I would value this share on maybe 10-12x FY25 earnings, not an aggressive valuation given the strong balance sheet, giving me a target share price of 187-224p.

It closed last night at 122p, so was ludicrously cheap with hindsight (but we didn’t know how the company was trading). At the time of writing (09:10) it’s up 28% to 155p - I think this rise looks fully justified, and once some profit-taking has happened, I could see IGR shares reaching 200p+ in due course (nice and vague on timing there, as obviously I have no idea when the market will re-price it fully).

Paul’s opinion - looks good to me. Not the most exciting company in the world, selling low margin products. It was badly hit by unexpected commodity price rises in the energy crisis, and supply chain problems. A big issue with IGR is that its products for Christmas, and other key times (eg Easter) become almost worthless if they’re late. So supply chain and warehouse/distribution management are critically important. Hence if talking to management I would want to know what key lessons, and changes, have been made as a result to prevent any similar supply chain problems in future causing another big upset.

However, as turnaround go, this one is now looking very convincing. Hence I see the share price rise today as fully justified, and there could be more fuel in the tank to take it back up to 200p+ the way I see things.

Both Graham and I were green on IGR shares late last year, and with news today that the turnaround is gathering strength, and shares still good value, I’m very comfortable reiterating GREEN today.

Lovely rebound today -

Card Factory (LON:CARD)

Up 7% to 107p (£372m) - FY 1/2024 Results - Paul - GREEN

cardfactory, the UK's leading specialist retailer of greeting cards, gifts and celebration essentials, announces its preliminary results for the year ended 31 January 2024 ("FY24").

The story here in a nutshell is that CARD was having problems before the pandemic, which then almost finished it off due to an over-geared weak balance sheet. However, the bank remained supportive, giving it time to trade out of difficulties, delivering an impressive turnaround under new management. Shares did very well, c.tripling in 2023 from late 2022’s lows, but momentum and investor excitement seems to have gone more flat lately. Not helped by major shareholder Teleios clumsily disposing of a large stake in dribs & drabs (and still holding 11%).

What are the numbers like then?

Highlights below look pretty good to me - main points being:

Healthy adj PBT margin of 12.2% - sign of a decent quality business.

Adj PBT growth of 27% also impressive (I’m fine with the adjustments)

Large reduction in net bank debt, now not even remotely a problem.

Adj EPS of 13.5p is slightly below the 13.7p broker consensus forecast on the StockReport

Biggest news is the return of divis, at a generous 4.5p (yield of 4.2%), and given the stronger finances & cash generation, I expect these payouts to rise in future.

Note that a much higher tax charge is the reason why EPS has grown more slowly than PBT.

To save me typing, here’s the outlook - not madly exciting, but OK I’d say -

The aspiration above, if achieved, works out at about 46% higher profit than FY 3/2024, over the next 3 years. That’s good, but not exciting, and suggests to me that the lion’s share of recovering earnings has already been achieved. So steady profit growth from now on, not stellar growth. That’s fine for a low PER stock.

Balance sheet - much improved in recent years. NTAV is now only negative £(15.6)m. That’s not a problem at all for such a cash generative business, and should swing into positive this year.

Lease liabilities are not a problem, being almost the same number as Right of Use Assets. The commentary says leases are short (average 5 years) and with 3-year break clauses, and that rents drop 20% on renewal. Due to the mess that is IFRS 16, this filters through more slowly in reduced depreciation charges relating to leases.

Cashflow statement - is OK, with the main focus on debt reduction. As that’s now down to a sensible level, the focus can change more to paying divis.

If I re-jig the cashflow to better reflect reality, its free cashflow the way I work it out isn’t actually that brilliant, at £27m. I was expecting it to be better than that.

Paul’s opinion - I was expecting to be a bit more positive on these numbers than I am. The PER is cheap at 7.9x, and with EPS likely to increase almost 50% in the next 3 years (if they achieve target) then there would be probably upside on the current share price.

Debt is no longer an issue at all, which has allowed it to start paying divis. The 4.2% yield on today’s 4.5p divi (earmarked as a delayed interim + final in the commentary) has upside scope. My figures suggest it could possibly double (over time) the divis, so the dividend paying capacity looks good. I’ve worked that out on my free cashflow calculations. So this share could once again become a high yielder income share.

The main downside with CARD is I think its almost complete failure to do anything successful online, when Moonpig (LON:MOON) has demonstrated what a high margin, lucrative market that is.

Bottom line though, is that CARD has done a terrific turnaround, and is now probably worth about 130-150p I reckon. Sooner or later than Teleios overhang should clear, and remove the cap on the current share price. From now on you’ll get divis too whilst you wait. So I’ll maintain my previous GREEN opinion.

RBG Holdings (LON:RBGP) (Paul holds)

Down 20% to 9.75p (£13m) - FY 12/2023 Results - Paul - AMBER/GREEN

This is a special situation/possible turnaround, with management clearing up the mess created by Nicola Foulston, the disgraced former CEO.

Looking at the 2023 figures, this looks like a company that is about to go bust! Awful losses, and a diabolical balance sheet.

However, the reason I recently bought some at around this price, is because the problem areas have been disposed of, realising a bit of cash. Plus it’s done a small placing, and HSBC has given it leeway with renewed & modified borrowing facilities on quite good terms.

The core businesses are long-standing, and successful legal practices, which should be able to generate cash to get bank borrowings down to a more sensible level. There won’t be any divis for the foreseeable future.

The main remaining problem is surplus leased property, with 2 big central London offices costing a combined £4m pa. They’re aiming to sublet, or surrender leases, targeting £1-2m pa savings.

Adj EBITDA margin is 12% now, which they said in the IMC webinar today has scope to be raised to “mid to high twenties”. Well if that happens, then this share would be a multibagger (that’s why I’ve bought some). Needs a recovery in equity and property markets to drive recovery faster.

Paul’s opinion - hideous numbers, but entirely due to one-offs that are now resolved. Bank has given it time to recover. Current trading in line. I think there’s a good chance that the bank to basics strategy should work over several years. There’s some risk, but renewed bank facilities and recent fundraisings mean cash headroom should be OK. There’s no scope for any more mistakes, or a trading downturn though, so this is higher risk.

On balance I think it’s quite appealing, for more risk-tolerant investors like me. I like turnarounds where the heavy lifting has already been done, and all you have to do is wait.

EDIT: note the going concern statement is clean (these have to be signed off by the auditors remember), key excepts being -

The financial projections performed form part of a three-year plan which shows positive earnings and cash flow generation and projected compliance with banking covenants at each testing date.

The Board confirm that they have a reasonable expectation that the Group has adequate resources to continue in operational existence for at least 12 months from the date of signing the financial statements.

Therefore I don't see any risk of it going bust, based on the facts as they stand today.

A disaster so far, but could the worm turn? Note share count has risen from c.80m to 129m now, so some dilution.

Graham’s Section:

Metro Bank Holdings (LON:MTRO)

Unchanged at 34.6p (£233m) - First Quarter Trading Update - Graham - AMBER/GREEN

This is probably the only mainstream bank which I cover from time to time. In November, when the Q3 update was announced, I reiterated a neutral stance, arguing that the bank’s fundraising package had treated its existing equity investors well. That package saw the creation of 500 million new shares, which meant 300% dilution, but it could have been a lot worse!

Today we have a Q1 update, with the following table:

Key points:

Deposits up £0.6 billion to £16.2 billion, “reflecting the continued success of the deposit campaign launched in the fourth quarter”.

Lending falls 4% to £11.8 billion “as the bank strategically repositions its balance sheet towards higher yielding Specialist Mortgages and SME/ Commercial lending”.

The lower loan-to-deposit ratio (73% now vs. 83% a year ago) implies quite a big change in the business over this time. But lending should pick up again as Metro builds on its new areas of lending focus. See the CEO comment:

“Following the successful deposit campaign launched in Q4, we have implemented our plans to reduce cost of deposits and optimise our elevated liquidity position... Lending activity levels are in line with expectations and the pivot to higher margin commercial and residential lending progresses, with lending balances reflecting the time lag between committing facilities and subsequent draw down…

Based on performance in the first quarter we remain confident that financial results will continue to improve throughout 2024 as we optimise funding, deliver on cost savings, continue our asset rotation and benefit from lower yielding fixed rate treasury and mortgage maturities.”

Graham’s view

Getting up to speed with Metro Bank’s most recent financial metrics, this is what I’ve found:

Balance sheet equity improved from £956m (Dec 2022) to £1,134m (Dec 2023), with only a slight change in total assets over that time.

The CET1 Ratio (a crucial measurement of bank safety) increased from 10.3% (Dec 2022) to 13.1% (Dec 2023). This would be considered a very normal and safe CET1 Ratio.

Including risky bonds and other sources of capital in the calculation, Metro’s total funding increased from 16.7% to 22% (see page 7 of the 2023 annual results presentation). Again, this should be plenty of funding to satisfy regulators.

I’m sorely tempted to give this one the thumbs up. It has raised the new equity and debt it needed to grow and to shore up its finances. It is winning low-cost deposits which are needed for profitability. And the new lending strategy (focused on Specialist Mortgages and SME/ Commercial lending) sounds promising.

So what’s the catch? I suppose the track record doesn’t inspire confidence:

Given the history here, and the general lack of interest in UK financial stocks, Metro trades at an extraordinary discount to book:

Since I think that Metro’s financial position is probably sound (you can never be 100% sure!), and since it is trading at such cheap multiples, I feel obliged to go AMBER/GREEN on this one.

I would probably come away with the same view if I studied the likes of Barclays (LON:BARC) and Lloyds Banking (LON:LLOY): they aren’t nearly as cheap as Metro when it comes to their value metrics, but they do have excellent track records of profitability and dividends.

James Cropper (LON:CRPR)

Up 32% to 350p (£33m) - Full Year Trading Update - Graham - AMBER

James Cropper PLC (AIM: CRPR), the Advanced Materials and Paper & Packaging group, is pleased to issue an unaudited trading update for the 52 week period to 30 March 2024 ("FY2024").

The headline is that FY2024 profitability is set to be “slightly ahead of expectations”.

Furthermore, “the outlook for FY2025 is encouraging, with a return to growth expected across both the Advanced Materials and Paper & Packaging businesses for the full year”.

We last looked at this stock in January when Paul studied its “bombshell” profit warning.

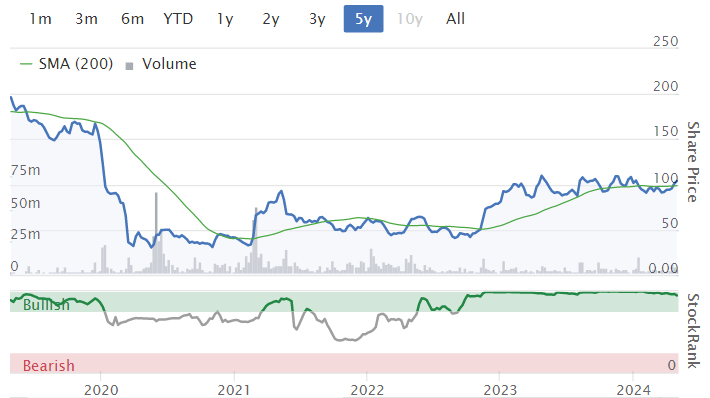

Therefore, while the stock price is up today, I should point out that the overall trajectory has been lower:

Let’s dig into the performance at each of James Cropper’s divisions.

Advanced Materials

The Advanced Materials business saw a year-on-year contraction in revenue, primarily reflecting the slowdown in fuel cell market demand.

For more info on James Cropper’s hydrogen fuel cell business, see here.

Excluding that business, Advanced Materials “was underpinned by growth in the aerospace and automotive sectors”.

The mid-term outlook “remains strong”. A new MD is joining at the end of July.

Paper and Packaging

Within the Paper & Packaging business, supply chain destocking compounded by the impact of high inflation on consumer confidence continued to be felt through the second half of the year.

This bit is more positive…

The future project pipeline is encouraging and forward indicators, such as order intake, point to early signs of market recovery throughout FY2025.

Net debt finished the financial year “better than expected” due to lower working capital and capex.

But beware, the company also says “it is currently seeking temporary covenant adjustments on its UK banking facility to ensure sufficient headroom is retained. Discussions with banks have commenced and a further update will be provided in due course.”

This does not mean that there has been a breach of covenants, but it does mean that the company is not entirely comfortable with the covenants for FY March 2025.

CEO's comment doesn’t contain any specific information.

Estimates from Shore Capital suggest that the company finished FY March 2024 with £16.5m of net debt. They see adj. PBT of only £0.6m for that year (previous forecast: £0.5m), and are waiting until July before they will publish forecasts for FY March 2025.

Graham’s view

Historically this company did generate small but consistent profits each year, although it never generated hugely attractive quality metrics, to my eyes.

Last year was unusual: a serious wobble in terms of profitability, not revealed until late in the year.

And it does seem to have an issue with its debt. Although that issue is unlikely to be fatal, it does mean I would want to treat these shares with additional caution.

Overall, I see this share as perfectly average, with a few (hopefully temporary) problems that I expect it to sort out.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.