Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

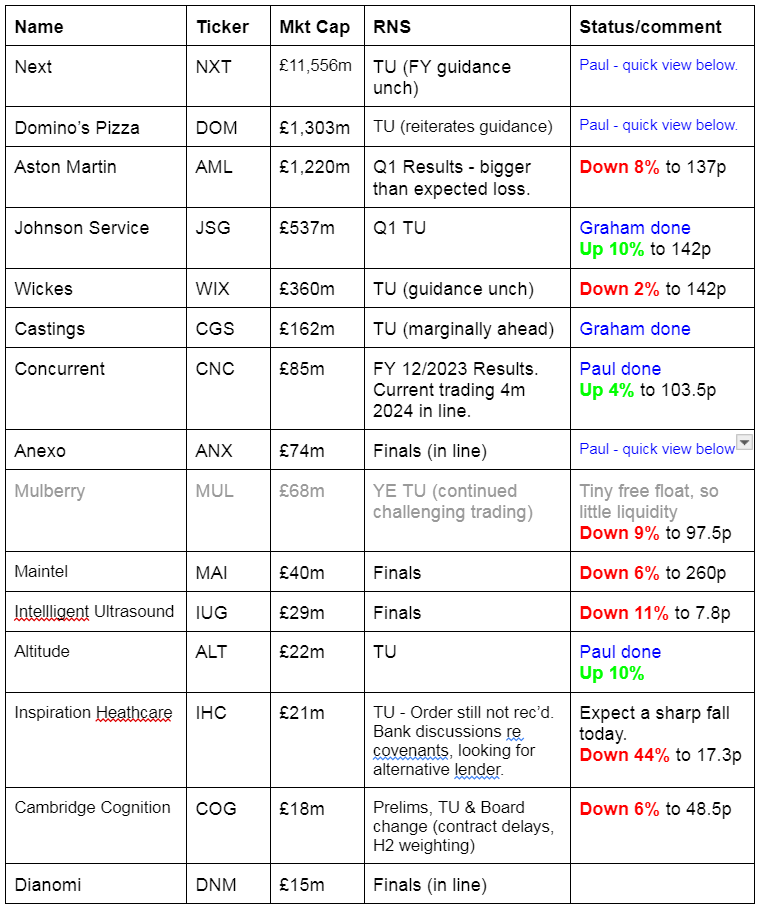

Companies Reporting

Other mid-morning movers (with news) -

Alpha Financial Markets Consulting (LON:AFM) - up 36% to 455p (£521m) - Possible offer - Paul - PINK (bid approach)

AFM is a specialised staffing group in the financial sector. As usual, Sky News breaks the story, and the company has since responded, as required.

Potential buyers are named by AFM as being Bridgepoint, a London-headquartered international investor managing £41bn according to a google search. Its website says it’s “Europe’s leading middle-market growth investor with E27bn of assets under management”. There’s another potential buyer mentioned, Cinven (global private equity, similar size to Bridgepoint), but no indicative offer has been received as yet. This could get interesting, if it becomes a bidding war. Bridgepoint has not yet done due diligence, so things are at an early stage. Takeover panel rules have kicked in, so it’s now in an offer period.

AFM names the parties without their consent -

“This announcement is being made without the consent of Bridgepoint and Cinven.”

Price - nothing mentioned, so it's now either guesswork or insider dealing.

Paul’s view - doesn’t really matter, but we’ve only looked at AFM here once, on 8/2/2024, when I concluded AMBER/GREEN, that it looked pretty good, and worth a closer look at 335p after a trading update. The 4.2% dividend yield, and growth plans impressed me.

Alphawave IP (LON:AWE) - Down 11% to 114p (£829m) - NEDs clearout - Paul - RED

A bizarre announcement today says its Board doesn’t have adequate expertise in AI or datacentres.

However, it’s not as bad as it sounds, as they’re only ditching 4 of their existing NEDs, 3 of whom are female, so that’s a blow for diversity & inclusion! Poor communications here, as the RNS should have made it much clearer that this is only a change in NEDs, not the operational management.

Paul’s view - as recently covered, I don’t like the numbers here at all, hence stick with RED. A clearout of unsuitable NEDs doesn’t really change anything in my view. Although there might be a background worry that NEDs might have asked awkward questions and didn’t toe the line, perhaps?

Altitude (LON:ALT) - up 16% to 36.5p (£26m) - Trading Update - Paul - AMBER

Altitude Group Plc (AIM: ALT), the leading end-to-end solutions provider for branded merchandise is pleased to provide this pre-close trading update, showcasing continued scale, growth and momentum.

Expects to “at least meet consensus expectations” for FY 3/2024. Helpful footnote says forecast is £26.1m, and adj EBITDA of £2.2m. Zeus kindly translates this into real money, it’s adj PBT of £1.2m. Zeus forecasts a rise to £2.0m in FY 3/2025. So the £26m market cap looks fair, providing ALT can achieve forecasts. The downside is ALT has been around a long time, and its business model has never really got off the ground, including several false dawns (look at the chart 2016-19!).

Cash has slightly improved, to a modest £1.3m, but it has an enlarged unused borrowing facility of $3.3m.

Outlook - says it’s early days, but confident trading will be in line for FY 3/2025, with a good start.

Paul’s opinion - I need to see the full accounts, due out on 30 July 2024. In the meantime I’ll sit on the fence. I doubt whether ALT has stellar upside potential, as it’s been trying for so long to commercialise the core product, and it hasn’t really worked. Although to be fair, there is strong revenue growth, and it has now broken through into the first year of profits. To a certain extent it’s trying other stuff now, like branded goods for colleges, which seems to be where the growth is coming from. That could be a nice niche. Why is it stock market listed? Doesn’t make sense to me. Hence on balance, I’ll sit on the fence with “don’t know”, AMBER.

Contract Wins/ Quick Comments

Renold (LON:RNO) - Military order book risen by £13.1m over recent months, mainly a £10.6m contract (over 6 years) to make flexible couplings for Canadian Navy. Already working on British & Australian naval programmes. “... further reinforce our Couplings business performance and shows the on-going benefits of our product development strategy combined with our manufacturing & engineering excellence”.

Paul’s view - sounds helpful, but doesn’t look material to c.£243m existing forecast revenues. So I’d say reassuring news, rather than significantly share price moving. Still one of my favourite value shares. GREEN.

Seeing Machines (LON:SEE) - extension of existing programme with N.American tier-1 customer. Will expand to 19 models and extended to 2023 (what was it previously? Not stated). Lifetime value estimated $26m - not a lot over 8 years, but high margin I believe (royalties from each unit manufactured by third parties). Mentions key European legislation which will force fitment of these safety devices (eye scanning cameras & software) where SEE is one of only c.3 significant players.

Paul’s view - much more positive after speaking to management (a dangerous thing sometimes!), who explained to me that the game-changer is this forthcoming safety legislation in Europe (and possibly elsewhere, eg America), which will force manufacturers to fit SEE’s technology. Very little credible competition, and deals are long-term once signed. Hence I think this share could do well, if expected demand does appear, as there’s now a catalyst to grow demand. Cash/debt position not great, but mgt reckon they can manage without another raise, so I’m now AMBER/GREEN.

Hostmore (LON:MORE) - temporary, immediate suspension of shares due to auditors requiring more time to “review non-cash items” in FY 12/2023 accounts. No reassurance on the figures being as previously indicated. Still nothing anyone can do, as the shares are suspended now.

Petrofac (LON:PFC) - shares also suspended, as previously announced, so no surprise there. Some other nano caps are suspended today, as they miss the end April deadline for publishing accounts.

Ra International (LON:RAI) - FY 12/2023 Results - improved from very bad in 2022 to just bad in 2023! Breakeven PBT of $0.2m, but that’s been boosted by $5.2m one-off income (see note 9). Underlying operating loss of $3.15m, and finance charges of $2.0m. Very low gross margin. Balance sheet is OK, but almost all the $16.8m cash is offset by $15.8m loan notes. Outlook comments vague, talk about new contracts, but order book is well down at $49m (2022: $83m). Says it has tenders in the pipeline. Paul’s view - looks a low quality business, why get involved? EDIT: the market likes it more than me, with a 17% rise to 8.75p at 11:49.

Next (LON:NXT) - unch at 9,022p (£11.45bn) - Q1 Trading Update - Paul - AMBER

Q1 sales slightly ahead of guidance. Interesting that all the growth came from online, and finance income, with physical stores sales flat vs LY.

Maintains FY 1/2025 profit guidance at £960m, equivalent to 606p EPS, a PER of 14.9x

Paul’s view - looks priced about right to me. Amazing business as we know, but in a very tough sector, hence EPS growth is fairly modest despite buybacks. I wouldn’t be a buyer at this level. It’s a great share to buy when there’s some big financial shock to the markets, as it always recovers!

Domino's Pizza (LON:DOM) - unch 326p (£1.31bn) - Q1 Trading Update - Paul - AMBER

This strikes me as a lacklustre update. It’s struggling to meet, let alone beat LY sales on an LFL basis. Although it says Q1 is in line with expectations, and leaves FY 12/2024 guidance unchanged. £4 lunch deal looks a bit desperate, I’ll mystery shop it & report back! Says April 2024 trading is “slower given the very strong comparative” LY.

Paul’s view - DOM has been growing revenues in the last 6-7 years, but EPS has been static. Hence a PER of 15x and yield of 3.5% looks high enough. Speaks highly of DP Poland (LON:DPP) where it’s taken a 12% equity stake.

Anexo (LON:ANX) - 63p (£74m) - FY 12/2023 Results - Paul - RED

Same problems as before - reports huge profits, which then just sits in debtors on the balance sheet, uncollected. Receivables absolutely absurd, at £234m. Gross borrowings of about £62m are fiendishly expensive, as I think it borrows from anyone at any price. Hence finance costs on P&L more than doubled to £17m.

Paul’s view - probably doomed to eventual collapse, in my view. Very similar to Quindell and Accident Exchange. They should try to sell it to some dumb Aussie lawyers! ;-)

Summaries of main sections

Castings (LON:CGS) - down 2% to 365p (£158m) - Trading Statement - Graham - GREEN

FY24 is set to be “marginally” ahead of expectations (estimates upgraded by 5%), but the FY25 outlook is unchanged given limited visibility over demand and the likelihood that temporary factors boosting demand may no longer be in force. However, Castings continues to seem a high-quality candidate for investment.

Johnson Service (LON:JSG) - up 3% to 134p (£555m) - AGM Statement - Graham - AMBER/GREEN

An encouraging update from JSG with the company flagging that based on current energy prices and the fixes it has in place, it sees upgrades to expected profitability. I review the history here (Covid & inflation) and come away with optimism that the future is bright. Plus, it’s always nice to see a falling share count.

Concurrent Technologies (LON:CNC) - up 5% to 104p (£89m) - Results FY 12/2023 - Paul - AMBER

Fantastic headline numbers, but closer scrutiny raises question marks over how real the profits and, and negligible cashflow. Strong balance sheet after a placing. I can see why people like it, and the future could be bright if strong growth continues. For now though, I think the price looks up with events, and I can't judge how likely the (necessary) out-perform updates are likely to be in future, so it goes in my "don't know" tray.

Paul’s Section:

Concurrent Technologies (LON:CNC)

Up 5% to 104p (£89m) - Results FY 12/2023 - Paul - AMBER

Concurrent Technologies Plc (AIM: CNC), a designer and manufacturer of leading-edge computer products, systems and mission critical solutions used in high-performance markets by some of the world's major OEMs, is pleased to announce its results for the year ended 31 December 2023.

Flagged by readers as something good that we should look at, thanks for that.

My first step with every company update is to quickly check my previous notes using a (CTRL+F ticker) on my summary spreadsheet. This shows I liked CNC shares last year -

17/7/2023 - forecasts raised 29%, bulging order book, I went GREEN, and made it a podcast mystery share (ie best idea of the week).

27/11/2023 - in line (previously raised forecasts) trading update. Very upbeat pipeline/orders. I moved down slightly to AMBER/GREEN due to news of some orders slipping into FY 12/2024. Noted to carefully check cashflow & bal sht when 2023 results come out.

Some terrific numbers here - but we were expecting impressive numbers, which is why the shares have almost doubled from July 2023 lows, and the market cap is now £89m -

Broker Cavendish had previously (17/1/2024) forecast 4.8p adj EPS, and its latest note today (many thanks) has upped the actual to 5.0p, so this looks like a handy beat against (previously raised) forecast.

Tax - bear in mind that 5.0 EPS is boosted by a negative tax charge of -£400k. If I normalise that to a 25% charge, it would be a £875k cost, so a £1,275k boost to PAT from the negative tax charge. I wonder if that’s R&D tax credits, brought forward losses, or a bit of both? Cavendish’s model shows zero tax charge in 2024, then a £0.7m tax charge in 2025, which suggests it’s currently benefitting from previous tax losses maybe? This needs more work, and should really be adjusted for in our valuation of the shares (ie. the PER in reality is higher than it looks, since EPS is being boosted by temporarily low tax charges).

Important point here - impressive profit growth achieved…

“...notwithstanding a significant investment in the cost base throughout the year to accelerate future growth.”

Headcount is up 18%.

Acquisition of Phillips Aerospace helped growth, and only cost £2.8m. More acquisitions planned.

Supply chain problems have eased.

Equity of £6.8m raised in Aug 2023.

Outlook - too vague, I would have liked clearer guidance -

We have achieved remarkable success in FY23, marked by a record financial performance, and have put in place the building blocks that will enable us to deliver long-term, sustainable growth. This is driven by significant design-in wins and strategic investment in the Systems divisions, including the acquisition of Phillips Aerospace.

During the year, there was a step change in how the Group invests in marketing, sales and partnerships to expand our market opportunities. Looking ahead, we will remain focused on leveraging the knowledge and the long-standing relationships the Leadership Team has developed to invest in a measured way to design boards and systems for a range of applications. FY24 will be about balancing our investment and mobilising to win and deliver systems to achieve our short-term financial targets.

Ah, there’s another outlook bit, which confirms current trading in line, but also includes the uselessly ambiguous “profitable growth” nonsense phrase that PRs like to think fools us! -

Forecast for FY 12/2024 from Cavendish is a modest increase in profit, but a slight fall in EPS from 5.0p in 2023, to 4.9p in 2024. Despite adj PBT forecast to go up from £3.7m to £4.4m. The reason must be increased share count from the equity raise in 2023. Sure enough, the share count used to be c.73m, and it’s now 85.6m, which has strengthened the balance sheet, but weakened the EPS due to dilution.

On a normalised tax charge of 25%, I calculate 2024 EPS at 3.86p. Put it on a PER of 20, and I get c.77p target share price. We’re well ahead of that, at 104p, so I’d say the share price has already run ahead of a conservative valuation (not that PER of 20x is particularly conservative)!

So the bull case will need to rely on CNC smashing forecasts for 2024. That’s possible, given the upbeat commentary, the stunning profit growth achieved in 2023, and that some quite large orders slipped from 2023 into 2024, giving 2024 a boost. I would have preferred an ahead of expectations current trading update though, given that the 2024 forecast is only for modest growth (versus a very strong LY).

Balance sheet - inventories stand out as being way too high, at £12.0m (up 20% on an already high 2022 year end). That’s huge actually, as cost of sales for the whole of 2023 was £16.0m, which implies is has inventories of 9-months sales. I would expect a figure of 1-2 months. So this is the no.1 area to query on any webinars from management. There could be a reasonable explanation - possibly hoarding scarce components due to supply chain problems (but they said that’s easing now). Note 15 gives more detail, and confirms it does have a problem with slow-moving inventories, with the provision having been increased by £544k in 2023. We need to know what the slow-moving stock is, and what management expects to sell it for? Write-offs are only required by accounting standards if the resale value is below cost. However, reducing inventories might involve sales at lower margins in future. Note that of the £12.0m inventories, £8.4m is raw materials, so hopefully that stuff can be used up in future production, releasing cash tied up in excessive inventories?

Cash has shot up, thanks to the equity placing during 2023, and sits at £9.1m (Dec 2022: £1.7m). There’s no debt. Working capital is very strong. Which does raise the question whether it really needed to do the equity raise last year? I’d say no it didn’t, which is a pity as it caused an unnecessary 17% increase in the share count from dilution.

Overall, at £23.5m NTAV, the balance sheet is strong, and could I think absorb more small acquisitions. Maybe they could take on a little debt too, for funding more small acquisitions without further dilution?

Cashflow statement - post-tax cash generation of £5.6m is much improved from 2022 (which suffered from adverse working capital movements, unlike 2023).

Physical capex was much lower in 2023 at £0.5m (2022: £1.5m), but the stand out number is a very large £4.0m in capitalised development spending.

After taking off lease costs, that means free cashflow is almost nothing, despite there being hardly any physical capex. That’s not good. The company is investing its cashflow in product development, which could pay off nicely in future, but as things stand now, this is not a cash generative company at all.

The £6.6m increase in cash all came from the placing which raised £6.4m after costs.

Am I saying that the profits aren’t real? In a way, yes. The main contentious area is capitalised development spend. £3.94m costs were shifted onto the balance sheet in 2023, but only £1.38m was amortised through the P&L, a net boost to profit of £2.56m. Given that adj PBT was only £3.7m, most of that profit came from this development spend policy.

Directors pay & shareholdings - see note 9, has risen 52% to £1.2m, which is a big chunk of the profits £3.7m adj PBT, so £4.9m before Directors pay - they’re taking 24% of the profit for themselves! That’s unreasonable. Highest paid Director got £571k, which is much too high for the size of company.

People moan about FTSE 100 Directors getting millions, but as a proportion of profit it’s not much. It’s these smaller caps where Director pay can often be a gigantic % of profit, as it is here.

Directors own miniscule amounts of shares, no wonder they want big pay packets instead. This needs to be addressed, they should be embarrassed to have so little personal commitment in the company’s shares, so their interests are clearly not aligned with investors -

Geographies - the FY 12/2023 Annual Report is already published, so I’m having a rummage through it, and this caught my eye - the stellar growth in 2023 came mainly from USA, and Germany, so it would be interesting to ask management for more colour on what these deals were, if they’re repeating or one-offs, etc -

Paul’s opinion - this section is likely to make me very unpopular with some readers, who might even go nuclear on me and say I haven’t done enough research and know nothing about the company! (that’s the usual one).

Remember I’m not trying to predict what the future holds, I’m just reporting the facts and figures as things stand now. It's your job to do a much deeper dive, and find the exciting future potential.

Positives -

- Superb growth in both revenues & profit.

- Bullish commentary.

- Strong balance sheet.

Negatives -

- 2023 profits have mostly come from capitalising internal costs for product development.

- It didn’t generate any cash in 2023.

- Directors took 24% of the profit in their own pay, and have negligible shareholdings.

- EPS flattered by negative tax charge.

- 17% dilution from an unnecessary placing in 2023.

Overall then, you have to weigh up whether these factors matter to you, or whether you’re happy to run with the momentum of rapid revenue & profit growth - which can often be the right thing to do. We often quibble over valuation here, only to see subsequent out-performance, and continued share price rises.

CNC shares have had a great run, and now look if anything a bit over-valued to me. But I also like the rapid growth, and investment in R&D that could pay off in future growth. If 2024 sees more upgrades to forecasts, then the future could be bright. Although for me, not knowing anything about the products or competitive landscape, this would just be guesswork.

Hence I think it has to be AMBER for me - in the “don’t know” tray for now. Good luck to holders!

Graham’s Section:

Castings (LON:CGS)

Down 2% to 365p (£158m) - Trading Statement - Graham - GREEN

Castings is “the leading iron casting and machining group primarily focused on the European heavy truck market”.

Paul reviewed its interim results very favourably in November.

Today's update for FY March 2024 says that the result is expected “marginally ahead of market expectations”.

Perhaps the company could consider disclosing market expectations in its RNS?

Fortunately, the company’s broker notes are available on Research Tree.

At Canaccord Genuity, the various profit estimates for FY 2024 are all upgraded by mid-single digit percentages, e.g. the adj. PBT estimate is now £21m (previously £19.9m).

They have not changed estimates for any other financial years, including the current financial year (FY March 2025), “given visibility on order intake is (typically) limited”.

This is what Castings has to say:

The underlying demand for heavy trucks (approximately 75% of group revenue) was particularly strong in the first half of the year. The backlog demand from the Covid period, and the well-publicised supply constraint issues, appears to have now been absorbed by the OEMs and forward schedules are now at a lower level.

In other words, this seems to be a temporarily heightened level of demand. So we shouldn’t get too excited about the prospects for FY 2025. Broker estimates suggest that revenues for FY March 2025 will be down by a few percentage points compared to FY March 2024.

Other points:

Input prices are “relatively stable”

“Balance sheet remains strong” - as discussed by Paul in November, the Castings balance sheet includes net assets of £127m and cash of £31m.

The update concludes:

The level of investment has been higher than in recent years and will continue to be so as the new foundry line progresses. Other investments have been focused on replacement equipment, robotics and AI, and sustainability initiatives including solar panels and energy efficient chilling systems in the machine shop.

Graham’s view

I’m happy to maintain Paul’s GREEN stance on this one as it continues to trade at a modest multiple despite having that very strong balance sheet and a proud history of profitability.

The StockRanks approve:

It also passes no fewer than seven bullish stock screens, including several which are personal favourites of mine: the Ben Graham Defensive Investor Screen, the Best Dividends Screen, and the Neglected Firms Screen!

In the short-term, we might now see Castings have a quiet year due to the previous backlog of demand having been met and with forward schedules currently “at a lower level”. But for long-term investors who are willing to wait that out, I expect that Castings remains a high-quality candidate for investment.

Johnson Service (LON:JSG)

Up 3% to 134p (£555m) - AGM Statement - Graham - AMBER/GREEN

It has been a little while since we last covered this textiles rental group.

The two categories served are workwear and protective wear (collectively referred to as “workwear”), and linen for hotels, restaurants and catering (this is referred to as “HORECA”).

Key points from today’s AGM statement:

Q1 revenue growth 16% to £114m

Organic growth is 8.9%: 0.5% in workwear, 13.5% in HORECA.

Workwear has traded in line with expectations, and HORECA volumes are in line with a predictable seasonal pattern.

The company’s new HORECA site in Crawley “remains on budget and is expected to begin test processing in the next few weeks”.

The transition to Crawley will negatively impact profits by £3.7m in 2024 (this was already known), but the site is expected to reach breakeven “during 2026”, and to ultimately generate a return “that comfortably exceeds the Group's weighted average cost of capital”.

Energy costs: transporting, cleaning and maintaining textiles is energy-intensive work and the cost of energy has been a hot topic for JSG during the inflationary period we have just experienced. The company’s approach to hedging is to use what they call a “little and often” strategy.

They have great news for investors on the energy front, with upgrades to expected profitability:

Based upon the market rates above and the energy fixes currently in place, we estimate that the impact on our forecast energy cost when updated for these figures, together with the benefit of ongoing operational efficiencies, would result in a potential positive effect on adjusted operating profit in each of 2024, 2025 and 2026 of £3.0 million, £7.0 million and £9.0 million, respectively.

JSG saved an aggregate £15.4m thanks to energy hedges from 2021-2023. With energy prices now lower than expected, hedges are currently expected to cause a total drag of £12m on profits from 2024-2026.

In aggregate, therefore, it looks like JSG’s hedging activities are likely to have boosted profitability over the entire period from 2021 to 2026. But that’s really not the point - the point is to manage risk and increase the predictability of financial results.

Changes in market prices in 2025 and 2026 could still change the above calculations.

Broker notes for JSG are not readily available to private investors but here are Stocko’s existing revenue and profit estimates:

Balance sheet: net debt increased by £11m in the three months to March 2024, to £73m. It is expected to grow further to £85m by June, before falling to £55m by December. Some nice transparency by the company to outline this expected path!

Given that after-tax net income for 2024, per the StockReport, is anticipated at £38.4m, plus the upgrades announced today, this quantity of debt wouldn’t particularly concern me.

I should mention that the company repurchased £35m of its own shares across 2022 and 2023, a move which I applaud.

Another factor that could impact debt levels is further M&A which can’t be ruled out:

We continue to see exciting opportunities to deploy capital organically and have a good M&A pipeline.

Last August, JSG bought Celtic Linen for €31.5m (about £27m). This is Ireland’s largest linen supplier to healthcare and the second largest linen supplier to HORECA.

Outlook statement is positive, here’s an excerpt:

…we expect to exit 2024 with strong progression towards previous levels of adjusted operating margin.

Furthermore, the Board is confident that, as energy costs stabilise at lower levels and Crawley builds volume and reaches its potential, combined with further operational efficiencies across the wider estate, divisional margins will continue to return towards those achieved in 2019, with an overall Group adjusted operating margin of at least 14.0% being achieved in 2026.

Graham’s view

This is another example of a stock which was battered first of all by Covid’s impact on the hospitality sector, and then by rampant inflation (particularly with respect to energy).

The stock still hasn’t recover to its former glory:

During the Covid era, the company raised £85m at 115p, to shore up its finances.

The resulting 20% increase in the share count will have been a drag on any possible recovery, but this has now been partially reversed by JSG’s buybacks.

I’d love to see the share count reduce further, but I’d also be inclined to trust the company’s M&A abilities. If it comes down to a choice between M&A and buybacks, they should be able to make the right decision.

While the stock’s pricing might be about right here, I do view this as a better-than-average business with the chance of some positive catalysts over the next year or two. Take your pick: clever M&A, more buybacks, or falling energy prices.

I will therefore upgrade my stance on this one to AMBER/GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.