Good morning from Paul & Graham!

Holidays

Over the next fortnight or so there might be somewhat reduced coverage here, as we (Paul, Graham & Roland) all have holidays booked. I'll take my laptop with me, and do what needs to be done, but the time difference could be tricky (I'll be in Washington DC). It's not the sort of thing anyone else can cover, as I jealously guard our colour-coding system! Anyway we'll manage, but just don't expect miracles for the next fortnight. We work on a flexible basis here - that most days we deliver far more than required, but there might then be some other days where these's less content, that's just the way it is.

Videos

This was fun! I found a new bit of software that makes recording videos from my screen dead easy, and I made 2 of them, which seem to have gone down well.

Does the SCVR colour-coding work? (the short version is, yes, very well!). Thank you to Phil Hanson who crunched the data which I talk through in this video.

Update on our 2024 top share ideas - Graham and I are now neck & neck at c.+27% YTD, which we're obviously delighted with, for our fixed top 30 share ideas for this year.

For ad hoc stuff, making a quick video like these is so much more efficient than spending hours writing an article, so if people like them, I'll do more of these.

** EDIT at 11:44 - I've just recorded a new video here, demonstrating how to set up a simple stock screen to identify & sort broker upgrades **

Mello Monday

The popular online investor shows run by renowned investor David Stredder. Starts at 17:30 tonight, details here. I'm looking forward to hearing what Gervais thinks - let me guess, super-bulllish?! LOL. But he's right to be, as UK small-mid caps still have plenty of bargains on offer. Companies presenting include Impax Asset Management (LON:IPX) and React (LON:REAT) both of which we've written about here recently.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Summaries

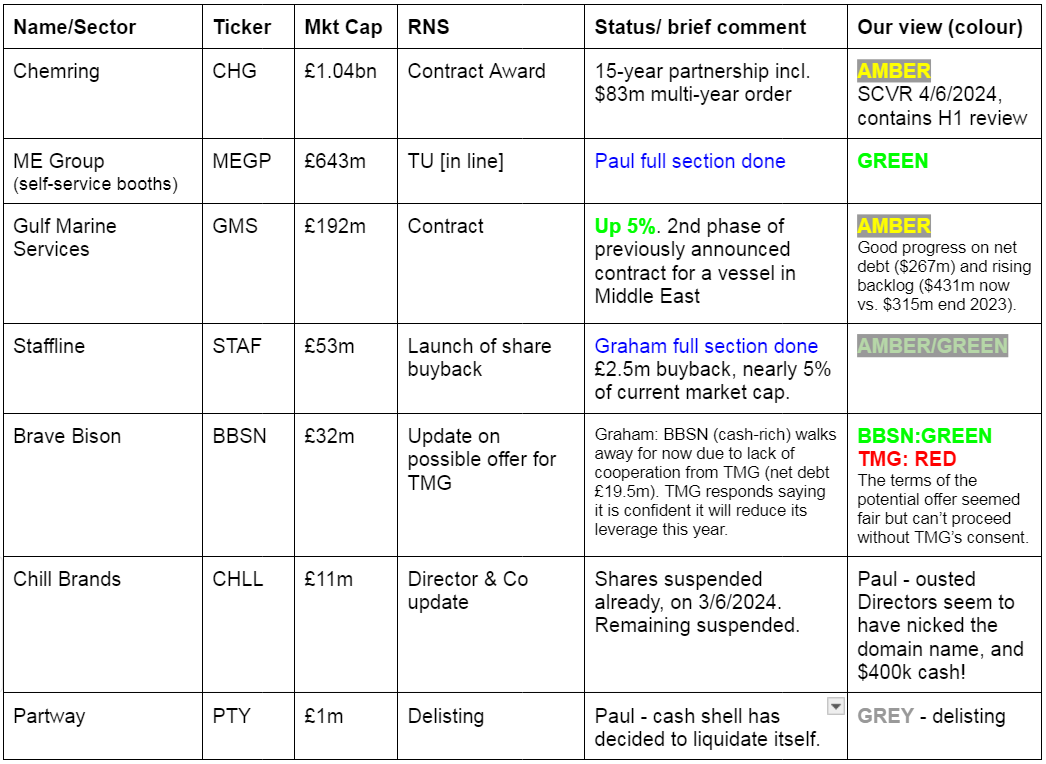

ME International (LON:MEGP) - down 2% to 168p (£629m) - Trading Update [in line] - Paul - GREEN

A confident, in line with expectations update for H1 to 4/2024. My view is this share remains under-appreciated, and seems a GARP share (growth at reasonable priced) wrongly priced as a value share. Maybe I've missed something negative, but I see further upside in due course, despite MEGP being up 32% YTD. This was one of my top 20 share ideas for 2024, and I remain keen on it.

Staffline (LON:STAF) - Launch of Share-Buyback - up 6% to 37.7p (£56m) - Graham - AMBER/GREEN

It’s a small (£2.5m) buyback but follows a £5m buyback last year. Staffline’s Chairman - a major shareholder - seems to be driving this agenda. The business itself remains average (or below-average?) quality but if it’s run sensibly for cash with a reducing share count then perhaps shareholders can do well.

Paul’s Section:

ME International (LON:MEGP)

Down 2% to 168p (£629m) - Trading Update [in line] - Paul - GREEN

ME Group International plc (LON: MEGP), the instant-service equipment group, announces an update on the Group's trading for the six months ended 30 April 2024 ("H1 2024").

Company’s headline -

Record number of Revolution laundry machines installed in H1; on track to deliver another year of record performance

Interesting that they’ve given prominence to the self-service laundry machines. Investors were slow on the uptake about how important the laundry division is becoming. As a reminder, I mystery shopped a ME Group laundry, when my washing machine had broken down, and wrote up a post about it here (Jan 2024). Broker notes now usefully split out the various divisions, and the laundries are a very good money-spinner, after the initial capex. A key point of difference from conventional launderettes being that they’re outside, typically in car parks, or a corner of petrol stations, so have little fixed costs. The core original business is photo booths, which are surprisingly perhaps, still very relevant for ID documents, as they can’t be tampered with, unlike smartphone photos. There are other smaller divisions too, but they’re not significant financially.

Impressive track record below, after an understandable hit from the lockdowns in 2020-2021 - yet MEGP shares remain good value, with a lowish PER and decent dividend yield. These were attributes that caught my eye last year, and why I put MEGP onto my 2024 top 20 share ideas, at 126p (it’s currently up 32% YTD) -

Another key thing I like is broker forecasts trending upwards -

We have low valuation figures below, and very high quality scores - what more could we ask for?! -

All resulting in a very high StockRank, and “Super Stock” classification from the Stockopedia computers -

Put all that together, and MEGP shares still look attractive to me, despite being up 32% YTD.

Laundry division - is enjoying good growth, and the roll out of new sites has accelerated into a 1200 rpm spin cycle! -

Wash.ME Revolution laundry operations is the fastest growing business area with revenue up 17.4% (19.6% excluding FX impact) compared with H1 2023, as the Group delivered on its rollout of Revolution laundry machines and built on its record performance.

The number of Revolution laundry machines in operation grew by 18% compared to H1 2023, with a record 420 Revolution machines installed in H1 2024. The Group continues to expand across its established partnerships in high footfall locations, such as supermarkets and petrol forecourts, and its installation pipeline indicates that it is on track to deploy a record number of Revolution machines during FY 2024.

H1 trading overall - note the impact of Japanese Yen (down 15% vs sterling) forex moves -

“Positive trading momentum continued throughout H1 2024 compared with the six months ended 30 April 2023 ("H1 2023"), with Group revenue up 4.6% (up 8.6% excluding FX impact) and profit before tax up 10.3% (up 13.6%, excluding FX impact). The Group remained focused on the continued growth of its core photobooth and laundry operations.”

Net cash - is broadly unchanged. I remember previously querying why it had large gross cash, partly offset by debt, and somebody here kindly asked management. The answer was that it locked in cheap borrowings, so no benefit to paying it off early. Although the figures below suggest it has paid off some of the debt -

“The Group remains in a well-capitalised and strong financial position, with high cash flow generation and long-term customer contracts providing the Group with good predictability and visibility on revenue streams. At 30 April 2024, the Group had a gross cash position of £82.9 million (H1 2023: £113.1 million), and a net cash position of £21.9 million (H1 2023: £24.4 million), excluding investments in convertible bonds of £4.7 million (H1 2023: £4.7 million).”

I haven't looked into the convertible bonds, do post a comment if you've looked into that. By calling them "investments" it sounds like this is an asset rather than a liability.

Overall this looks encouraging to me. ME is self-funding a rapid roll-out, has bolted on more photo booths in a Japanese acquisition, and paying decent divis, all with its self-generated cashflows. That’s impressive. You’re getting a growth share here priced like a value share.

Outlook - is in line -

Historically, the second half of the financial year is seasonally the strongest for the Group in terms of revenue and profits generated as well as the installation of machines across key locations. As the Group capitalises on the significant market opportunity for laundry and photobooth services, the Board is confident in delivering record profitability for the year, in line with market expectations.

It’s helpful when companies add a footnote stating what market expectations are, but this seems to have been overlooked here.

Cavendish put out a note on 23 Feb 2024, indicating 14.3p adj EPS for FY 10/2024. That ties in with broker consensus of 14.2p on the StockReport. Since we’re told it’s trading in line, that suggests a PER of only 11.8x - which looks good value to me still.

Paul’s opinion - MEGP shares strike me as under-appreciated still. It’s owner/managed with Serge Crasnianski owning an effectively controlling stake of 36.6%. We usually like owner/managed businesses here at the SCVR.

Whilst I’ve been writing this, the shares have slipped a little lower, which surprises me given that I read this update as confident and reassuring. Maybe I’ve missed something?

Am I still bullish on MEGP shares? Absolutely, it looks an excellent GARP share to me. So a continuing GREEN view.

Graham’s Section:

Staffline (LON:STAF)

Launch of Share-Buyback - up 6% to 37.7p (£56m) - Graham - AMBER/GREEN

Some pleasant news this morning for shareholders of this staffing and recruitment company as it’s announced that the company is launching a £2.5m buyback.

It’s not quite 5% of the market cap but it’s still a helpful boost to earnings per share.

Staffline’s explanation of the decision:

The Group remains disciplined in its allocation of capital with the main objective being to enhance shareholder value. We continuously assess our medium-term plans which take account of growth prospects, investment in the business, cash generation, net borrowings, and leverage. Therefore, the amount allocated to buybacks is based on our predicted trading cash flows and financing headroom.

Graham’s view

As pointed out by Paul in his coverage last year, long-term shareholders have suffered tremendous dilution here:

This has resulted in long-term shareholders being hopelessly diluted:

However, you may notice on the previous bar chart that the share count did drop back between 2022 and 2023. According to the full-year results for 2023, the company had a £5m buyback last year.

So today’s news is a continuation of that trend. If these buybacks are sustainable, perhaps we could start to get excited about the investment story here, if the share count keeps dropping and the business remains stable?

There are always a few things that need to be checked when studying any buyback: 1) can the company afford it? 2) Is the company buying back its shares at an attractive price? 3) Is the company neglecting other potential uses of its cash?

Tackling each of these questions in turn:

The company finished 2023 with net cash of £3.8m and balance sheet equity of £55m, although tangible equity is negative if you strip out intangibles. My initial impressions are that the balance sheet has moderate strength. There are some large working capital items and the company does need to use borrowing facilities.

The company is buying back its shares at around 10x earnings, so again the value on offer is moderately attractive for the recruitment sector where multiples tend not to get very high (best in class SThree (LON:STEM) trades at the same earnings multiple). Staffline’s ValueRank according to Stockopedia is 75, implying good value. These shares must come with the disclaimer that the profit figure is volatile: gross profits are £80m+ and small changes in costs can have a big impact on the bottom line.

3. Is the company neglecting other potential uses of its cash? No, I doubt it. Staffline has been around for a long time, is not growing particularly fast, and doesn’t have a good track record of earning a high ROCE or ROE. Blue-collar staffing is a mature industry. So I doubt that it should be reinvesting all surplus funds back into the business, or making acquisitions. Instead, I agree that it makes sense to send surplus funds back to shareholders.

Staffline doesn’t yet pay any dividends: it’s unusual for UK companies to choose buybacks over dividends.

I’m going to take an AMBER/GREEN stance on this company because while the business itself doesn’t excite me, I am intrigued by the Chairman’s views on capital allocation and how he might use the company’s cash flow.

This is what he said in the 2023 results. I’ve highlighted some sentences that stand out:

Net cash (pre-IFRS 16) was also a highlight in 2023. The year ended significantly ahead of original market expectations by £6.8m, our ongoing balance sheet strength maintained with net cash of £3.8m (2022: £5.0m). The litmus test of creating shareholder value on a long-term basis will be how well we use the profits generated by the business.

The elegant name given to such decisions is 'capital allocation'. In simple terms, the success of any business is how well management make decisions on retained cash and its reinvestment, as well as their choices about when and how to redistribute that cash to shareholders.

In 2023 the stock market gave us an excellent opportunity to repurchase 10% of the Company's outstanding shares at what we regard to be very attractive prices. Yet, this begs the question "What is a buyback?" and "Why do we think our remaining shareholders should like them so much?" Well, it's really very simple; a buyback is another form of capital distribution.

When companies choose to distribute a dividend, our investors receive an income payment from the company whether they want it or not. With buybacks, the company purchases shares from investors who want to sell them (perhaps because they need the money, or perhaps because they have forgotten the reason why they bought their shares in the first place). When cancelling these shares after purchase, their proportional ownership of the business grows for those who hold on to their shares, as well as their claim on any future cashflows.

What's notable is that during that process we were able to buy back those shares at an average purchase price of 30p. While we won't provide a running commentary on what we regard the intrinsic value of the Company to be, we will repurchase shares when they are trading at a substantial discount to what we believe they are worth.

We don't know exactly what 2024 will hold for the price of our publicly traded shares. What we can say though, is that we intend to generate more cash and if some of that cash is better used in the repurchase of the Company's shares, we will not be slow in doing so.

These words were spoken by the Chairman, whose company is the top shareholder and has recently been buying shares at 34.6p:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.