2017 was an excellent year for many of the 60 guru-inspired investment strategies tracked by Stockopedia. In the UK, there were 30 percent-plus returns in strategies inspired by legends ranging from Buffett and Graham to Dreman, Driehaus, Kirkpatrick and Piotroski. Throughout the year it was clear that Growth strategies - particularly in small-cap stocks - were setting the pace. But while Growth and Momentum were ultimately the big winners in a bullish market, Value strategies roared back to life in the fourth quarter.

In the United States, there were also strong returns in a number of Guru Strategies, but none of the overall styles managed to beat the S&P 500. The main index is still being driven by a handful of very large, very high performing stocks, and that’s putting a number of stock-selection strategies in the shade. By contrast, the strategies had a stunning year in Europe, where Growth and Momentum were the most profitable approaches.

Index / Strategy Composite | 1 Year Performance | Q4 2017 Performance |

+7.1pc | +4.3pc | |

+8.5pc | +4.2pc | |

+14.3pc | +4.3pc | |

+11.9pc | +2.0pc | |

+31.9pc | +5.9pc | |

+24.6pc | +5.5pc | |

+18.4pc | +6.1pc | |

+5.9pc | +0.3pc | |

Guru Strategy Composite | +23.9pc | +4.8pc |

+33.8pc | +3.8pc | |

+27.0pc | +4.7pc | |

+25.9pc | +10.4pc | |

+21.5pc | +5.8pc | |

+20.8pc | +5.4pc | |

+13.5pc | +0.6pc |

About the Guru Strategies

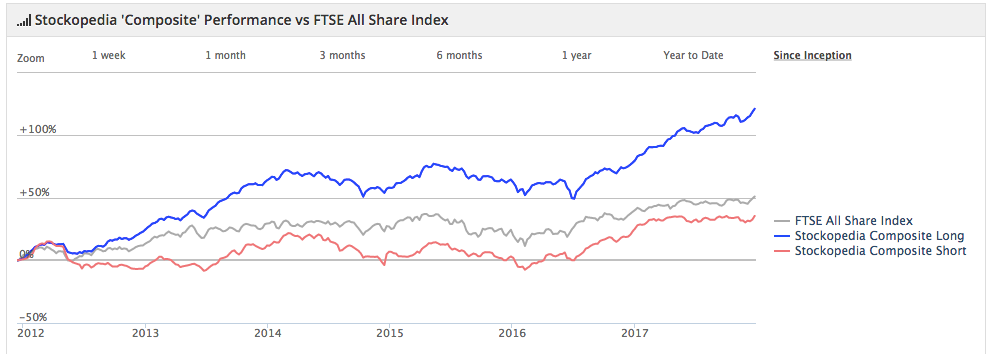

We’re now moving into the seventh year of tracking the Guru Strategies in the UK, with slightly less history for Europe and the States. Over time, these models have become a useful way of seeing what’s working in the market, and how different styles react to different conditions.

Not only do they show what’s working, but they also show when trends start to change. They cover a range of approaches used by some of the world’s best known investors. Each one is classified under a specific style - ranging from Quality, Growth, Value, Bargain, Income and Momentum.

In terms of the mechanics, each strategy has its own set of rules, and we constantly screen the market for companies that meet them. At the end of each quarter, those passing the rules are held in a portfolio for each strategy, which we monitor. One word of warning though, is that the models aren’t always realistically investable, and sometimes there may not be many companies that meet the rules of some of…