Good morning! I hope you had a restful weekend.

Wrapping up the report there, thanks everyone!

Spreadsheet accompanying this report: link (last updated to: 5th November).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Diageo (LON:DGE) (£38bn | SR51) | Former Tesco boss Sir Dave Lewis has been appointed CEO of Diageo. He’ll take charge from 1 January. Lewis will also step down from his current role as chair of Haleon at the same time. | AMBER/RED (Roland) [no section below] Further to Mark’s comments on Diageo last week, I’m reluctant to upgrade our view on the strength of a CEO appointment alone. But I expect the market will be pleased with this hire. Dave Lewis is widely seen as having done an excellent job rebuilding Tesco after a difficult period. He also has deep global consumer goods experience from his previous career as a senior exec at Unilever (disc: I hold). I see this appointment as a positive development for Diageo, which remains a global market leader in many drinks categories. | |

JTC (LON:JTC) (£2.3bn | SR48) | SP-4% to 1300p | PINK (Graham) | |

Big Yellow (LON:BYG) (£2.2bn | SR59) | Blackstone Europe has requested additional time to evaluate BYG. The deadline for an offer has been extended to 5pm on 8 December 2025. | PINK | |

Chemring (LON:CHG) (£1.48bn | SR70) | FY25 adjusted operating profit to be in line with exps, with Energetics (explosives) stronger than expected. Strong outlook with order book of c.£781m at 31 Oct (FY24: £648m). Estimates compiled by the company: adjusted operating profit £73.3 - 77.4m, with consensus £75.8m. Company warns there will be a loss in discontinued operations and several one-off costs, of which c. £5m will be cash costs. Net debt c. £95m. Assessing strategic options for "Alloy Surfaces" -this is a US countermeasures business that will be reported as discontinued at FY25. | AMBER (Graham) [no section below] This provider of various military devices and systems has produced some good results in recent years, and its share price has re-rated higher during the period of tension and increased military spending that we've witnessed in recent years. On a long-term view, however, its bottom-line net profits have been rather hit-and-miss. Today's update is encouraging in terms of the AOP figure and hopefully any adjustments will be modest: for example, I'm sure that the £5m of one-off cash costs mentioned in a footnote today will be shrugged off by the market. As noted by Roland in June, it is the Energetics business that is really impressing at the moment, with other divisions remaining relatively weak. Chemring notes today that performance at Energetics is better than expected: but if results are merely in-line, this implies continued weakness elsewhere. The revelation that one of CHG's countermeasures businesses will be reported as "discontinued" in FY25 helps to confirm this (pending its disposal, presumably). This business has been "unable to secure sufficient orders to viably sustain continuous manufacturing operations". I might be slightly biased against this one due to experience many years ago as a shareholder here, but I do agree with Roland that it makes sense to remain cautious, especially considering the high rating at which it trades (PE 23.7x on the StockReport). | |

Great Portland Estates (LON:GPE) (£1.38m | SR34) | Camden Council has resolved to grant planning permission for the refurbishment of this 74,500sq ft “HQ building” in the West End. | ||

Kainos (LON:KNOS) (£1.11bn | SR84) | Rev +7%, adj PBT -16% to £32.0m. FY expectations unchanged despite H1 cost increases. Contracted backlog £397m (H1 25: £354m). | AMBER/GREEN (Roland) These results show an encouraging return to revenue growth, but this wasn’t enough to offset a larger increase in costs. Falling profits aren’t ideal, but having reviewed the commentary, I think it’s not unreasonable to expect some improvement in profitability over the next 6-12 months as revenue growth continues and some cost headwinds stabilise. It was a finely-balanced decision, but I’ve decided to leave my AMBER/GREEN view unchanged today. | |

Supermarket Income REIT (LON:SUPR) (£1.00bn | SR89) | Acquired Tesco Craigavon (NIY: 6.5%) and a portfolio of 10 Sainsbury’s convenience stores (NIY: 6.1%), entering the latter category for the first time. Both on 15yr leases. | ||

Hays (LON:HAS) (£922m | SR32) | CEO Dirk Hahn is recovering from surgery and is expected to return “early in the new year”. Chair Michael Findlay will become exec chair until Hahn’s return. | ||

M P Evans (LON:MPE) (£677m | SR99) | Strong pricing for CPO and palm kernels in H2 through October means revenue will be higher than expected, with “enhanced anticipated profitability”. | AMBER/GREEN (Roland) Broker Cavendish has upgraded its 2025 forecasts for the fourth time this year, today. Strong palm oil prices are boosting profits and MP Evans certainly seems to be trading well, reaping the rewards of past investment in acreage and new planting. Even so, I think it’s worth noting that overall production fell in H1 due to a cutback in purchases from third-party party producers. As far as I can see, this pattern has continued in H2. This means that profit growth is being driven primarily by higher commodity prices. While prices could remain stable (or rise further), I think it’s sensible to recognise that they could fall at some point, too. For this reason, I’m leaving our moderately positive view unchanged. | |

Applied Nutrition (LON:APN) (£455m | SR59) | FY25 revenue +24%, adj. PBT +17.5% (£30.2m). Outlook: despite a strong Q1 FY26… the Board believes it is prudent to maintain current market expectations for FY26. | AMBER/GREEN (Graham) I'm impressed by these results and therefore, on balance, I am going to break my IPO rule and upgrade our stance on this to AMBER/GREEN. Clean profit figures, exciting investment plans and impressive organic growth, available at a PER of less than 20x. Worthy of further research in my view. | |

Caledonia Mining (LON:CMCL) (£401m | SR85) | Gold production of 19,106 ounces, revenue +52%, PAT $18.7m (Q3 2024: $3.3m). One fatality. | ||

Ferrexpo (LON:FXPO) (£315m | SR50) | The supply of power to Ferrexpo’s operations in Ukraine has been affected. Production and exports will be interrupted. | ||

Avingtrans (LON:AVG) (£157m | SR77) | Clearance enables subsidiary Adaptix to enter the human healthcare imaging market in the United States. | ||

Ondo InsurTech (LON:ONDO) (£40m | SR12) | Westfield Insurance will begin by deploying 10,000 LeakBot devices in three US states (value not quantified in RNS). | ||

Insig Ai (LON:INSG) (£32m | SR4) | The client will use Insig AI's engine to automate benchmarking of disclosures against international standards (value not quantified in RNS). | ||

Medpal AI (LON:MPAL) (£30m | SR10) | Since 1 October 2025, Medpal Limited has dispensed 14,757 prescriptions. Continues to develop its AI-driven wellness app. | ||

Abingdon Health (LON:ABDX) (£18m | SR10) | Agreement with a US-based company for development and scale up to manufacture of a semi-quantitative, multiplex lateral flow test system. |

Graham's Section

JTC (LON:JTC)

SP-4.5% to 1297p (£2.23bn) - Recommended Cash Acquisition of JTC - Graham - PINK

This morning sees a recommended cash offer of 1,340p per share for JTC from the private equity giant Permira, valuing the business at £2.7bn.

This is the sixth offer from Permira, valuing JTC at 26x TTM EBITDA, and it’s a 49.4% premium to the undisturbed price before Permira’s first offer in August.

Irrevocable undertakings to support the takeover have been received from shareholders holding 7.3% of JTC, primarily from JTC’s CEO with a 6.4% stake.

We haven’t covered this stock previously as JTC is a little bigger than most companies we’ve covered in the past (we traditionally focused on companies below £1 billion market cap!) and fund administration tends not to be the most exciting sector.

However, this share has delivered excellent returns; perhaps I’ll need to give the sector more respect in future.

I will say that this morning’s recommended offer seems to have disappointed the market just a little bit and I find it hard to imagine that Permira will make a 7th offer now.

Checking archived StockReports, I see that JTC was trading at a forward P/E ratio of 15x and was considered to have a ValueRank of only 17 back in July - probably not helped by comparisons with companies in the “Investment Banking and Investment Services” Industry that deserve much lower P/E multiples than this.

So why is Permira so interested? A point highlighted in today’s announcement is the strong position that JTC has built in the United States, where (according to the 2024 results presentation) it has been generating 35% of revenues. Overall organic growth was 11.3% last year.

I would guess that this very solid organic growth plus significant US exposure are key ingredients in the premium valuation that Permira is willing to pay.

Interestingly, today’s announcement also says that JTC’s stock price has been too low for it to fund acquisitions through issuing shares, and additionally that “public market investors' more conservative appetite for leverage has had an impact on JTC's ability to embark on a more ambitious M&A strategy, including transformational deals”. So JTC has been unable to raise either the debt or the equity that it would like to.

On top of all that, JTC says that stock market investors are impatient - wanting a fast return on capital - which doesn’t work with JTC’s “long-term approach to growth”.

There is likely to be an element of truth to all of that, and perhaps Permira will now enjoy a fabulous long-term investment away from the eyes of public markets.

But stock market investors in JTC have done pretty well, too: an over 60% return in the past three years, for example.

Moving forward, I think it’s time for me to take the fund administration sector a bit more seriously.

Applied Nutrition (LON:APN)

Down 2% to 178.94p (£447m) - Final Results - Graham - AMBER/GREEN

This IPO’d in October 2024 at 140p. Early investors are winning so far:

I was initially sceptical about it in February 2025 (at 149p) before turning neutral in August (at 143p).

Before digging into today’s full-year results, please bear in mind that we already had the full-year update in August.

So we already knew that the company’s revenues would be up 24% (to £107m) and that adj. EBITDA would be up by around 19% (it’s up 18.8% to £30.9m).

Liverpool-based Applied Nutrition is “a leading sports nutrition, health and wellness brand”. It says it is “the UK’s fastest-growing sports and active nutrition brand”.

They are involved in a wide range of partnerships, have an exclusive deal with Colleen Rooney, and have AJ Bell co-founder Andy Bell as Chair of their board.

Let’s get the update on current trading.

They have “a clear opportunity to capture further share in both the UK and internationally”:

Outlook

The positive momentum experienced in the final quarter of FY25 has continued into the opening months of the new financial year, supported by strong consumer demand across our core categories and growing recognition of our brands both in the UK and internationally…

Our investment in additional capacity, automation and new product formats positions the Group to deliver sustained growth over the medium term…

While the trajectory of the business remains encouraging with a strong Q1 FY26, it is still early in the financial year; therefore our full year expectations for FY26 remain unchanged at this stage.

CEO comment:

With solid progress behind us and encouraging trading trends continuing, we are focused on key opportunities with a view to continuing our ambition to become the world's most trusted and innovative sports nutrition, health, and wellness brand.

I appreciate the absence of major adjustments: £30.2m of adjusted PBT becomes £28.5m of actual, unadjusted PBT.

And even the adjusted EBITDA has not been inflated too much, at £30.9m - only a couple of million higher than PBT!

I would therefore rate these accounts as very clean. The only real adjustment made is IPO expenses (£1.7m, which does not seem excessive for a company worth around £400m). There were no share-based expenses in FY25.

Depreciation and amortisation for the year are only £1.1m, implying a capital-efficient model. Checking the balance sheet, I’m very pleased to find only £2m of PPE (!), plus a few leases, in the “non-current assets” section.

They say that they currently have revenue capacity of £200m, having completed a manufacturing extension and found more efficiencies in their manufacturing processes.

They are also looking to invest another £2 - 2.5m, to increase capacity to £300m. And they are entering a lease for a new purpose-built warehouse to boost storage, and provide a new office and HQ.

Dividend: no dividend before FY27, “thereby retaining cash for investment in capacity, efficiency and potential M&A opportunities” - seems reasonable.

Cash: £18.5m at year-end, no debt.

Graham’s view: I was already warming to this in August, and these results have impressed me. I’m therefore inclined to break my IPO rule - the rule which says I have to be cautious on a stock for at least two years after IPO, or until the share price has fallen by at least 50%.

This has been listed for little over a year and so there is still, I would say, an elevated risk of something going wrong compared with a stock that has been listed for longer. However, there are multiple positives for me here:

The founder-CEO is the largest shareholder and the COO also has a very large stake. Together they own 39% of the business, so they are very well-aligned.

Rapid organic growth in a tough sector.

Clean, highly profitable accounts.

The company paid a large dividend (nearly £15m) before IPO, allowing early owners to take funds out before passing it on to stock market investors. However, future cash flow will be available for use by the company, which should be meaningful, and the investment plans outlined today all sound promising.

Therefore, on balance, I am going to break my IPO rule and put this on AMBER/GREEN.

Roland's Section

M P Evans (LON:MPE)

Up 6% at 1,372p (£721m) - Strong pricing during second half of 2025 - Roland - AMBER/GREEN

Today’s update is an upgrade, but also requires careful reading.

The company leads with a section on harvest volumes from its own managed plantations, which rose by 8% during the first 10 months of the year as previous new planting and land purchases bore fruit.

However, as reported in H1, this is being offset by a planned reduction in crop purchases from third-party producers in order to optimise capacity utilisation at the company’s mills. Purchase of third-party crops has been cut by 40% over the year to date.

Third-party crops are typically of lower quality, so it makes sense to focus on MP’s own crop. But the consequence of this strategy is that overall output has not risen. Indeed, total tonnage processed by the group fell by 4% during the first eight months of 2025.

My assumption from this is that the company doesn’t have sufficient spare mill capacity to maintain third-party processing while increasing its own production.

While management hasn't provided tonnage figures today, Cavendish says it has “reduced our FY25E [production] assumption to be consistent with YTD purchases”. This suggests to me that overall crop volumes handled by the business may be slightly lower again in H2.

Commodity price upgrade: today’s trading update makes it clear that this profit upgrade is being driven by higher commodity pricing for both Palm Kernels (PK) and crude palm oil (CPO):

Of more significance to the Group's results, the strong pricing environment for CPO and PK observed in the first half of the year has persisted through to the end of October and is continuing as the Group sells its output for November.

After a strong H1, prices have continued to increase in H2. As I understand it, normal seasonal trends often lead to weaker pricing in H2, but that doesn’t seem to be happening this year. MP Evans provides detailed pricing today for investors wanting to update their own models:

YTD (31 Oct) ex-mill-gate CPO price $869/t (H1: $868/t)

YTD (31 Oct) PK price of $756/t (H1: $747/t)

Strong pricing appears to have continued into November. MP Evans says it’s already tendering for November sales at average pricing of $850/t (CPO) and $780/t (PK).

The company also reports that it’s taken advantage of strong cash generation to repay its remaining debt of $20.9m, leaving the group debt free. Cavendish estimates a year-end net cash position of $88m.

Updated estimates

The company does not provide explicit new guidance today, merely commenting that revenue is expected “to be higher than previously envisaged”, with “enhanced anticipated profitability”.

Fortunately, house broker Cavendish has provided an updated note on Research Tree this morning, providing more concrete details of the change in expectations – many thanks:

FY25E adj EPS: 210.9 cents (+4% vs 202.8c previously)

FY26/FY27: no change, current forecasts suggest FY26E earnings of 154.3c, although I imagine these may be revised in the new year if commodity pricing remains strong.

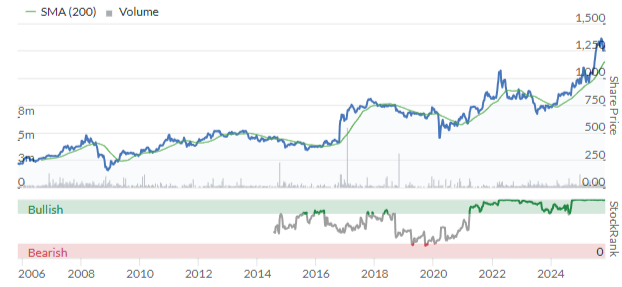

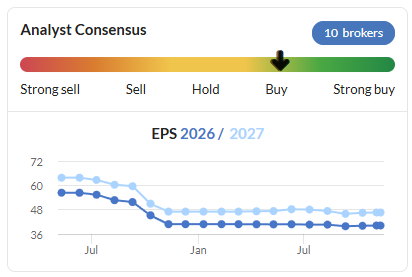

Cavendish notes that this is the fourth upgrade this year. The broker’s FY25 earnings forecasts are now 58% higher than they were at the start of the year. We can see this using the very useful analyst consensus trend chart on the StockReport:

Roland’s view

MP Evans is clearly trading well and appears to have invested wisely in its own acreage and planting. But I think it’s important to remember that the main driver of the repeated upgrades we’ve seen this year has been commodity pricing.

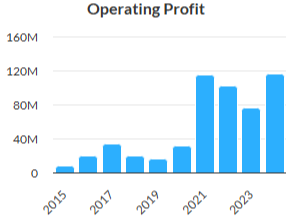

Zooming out to the long-term chart also suggests some cyclicality to past profits:

This view is supported by the 10-year profit graph:

I have no insight into the likely outlook for palm kernel pricing over the next year or two. Pricing rocketed between 2020 and 2022 and has not yet reverted to pre-pandemic levels. Perhaps it won’t.

It certainly seems possible to me that structural demand growth will mean prices stay high – palm oil has very high yields, producing more oil per acre than any other vegetable oil crop. Global demand is strong and MP Evans’ sustainability credentials – 76% of output was certified sustainable in H1 – may also be advantageous.

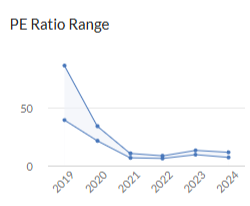

However, history suggests the possibility of a cyclical downturn in prices at some point. In my view, the stock’s modest P/E reflects this risk – the current P/E of c.10 is at the lower end of its historic range. This is commonly the case for commodity producers when prices are high.

In September, Mark moderated our view from GREEN to AMBER/GREEN to reflect the lack of output growth and the company’s exposure “to the volatile and rather obscure commodity pricing of palm kernels.”

I share these concerns. While I do admire MP Evans’ long dividend record, strong balance sheet and Super Stock styling, I’m going to leave our view unchanged today.

Kainos (LON:KNOS)

Up 0.5% at 932p (£1.11bn) - Interim Results - Roland - AMBER/GREEN

Checking back in the archives, I took a neutral view on IT services group Kainos in May, before upgrading to AMBER/GREEN in September, “to reflect the seemingly more positive outlook”.

The stock’s performance so far this year has reflected my upgraded view…

… but consensus forecasts have remained static all year:

Today’s outlook guidance is also in line:

We are maintaining a prudent outlook for profitability and expect Adjusted PBT to be in line with current consensus forecasts.

Do today’s half-year results contain enough good news to allow me to maintain a positive view?

Half-year results: sales up, profits down

The headline numbers for H1 seem a little mixed to me. Revenue rose by 7% to £196m during the six months to 30 September, driven by organic growth across all three of the group’s business units.

Looking ahead, bookings (new contracted sales) rose by 27% to £227.9m, while the company’s contracted backlog rose by 12% to £396.9m. While I don’t know the timescale on this backlog, consensus forecasts are for full-year revenue of £393m, so my feeling is that revenue visibility for the remainder of the year is probably quite good.

The profit outlook seems slightly less clear to me. Adjusted pre-tax profit fell by 16% to £32.0m, which management says was due to “previously anticipated” additional costs in H1. These included higher Workday spending, (see below), the increased use of contractors to meet short-term deadlines and the National Insurance increase.

Adjusted earnings fell by 16% to 18.9p per share, but management confidence in the outlook (presumably) was underpinned by a 5% increase in the interim dividend to 9.8p per share.

The company has also announced plans for a further £30m buyback. This will continue seamlessly from the end of the current buyback on 19 November.

Both buyback and dividend are also supported by H1 net cash of £105.5m, albeit this figure has fallen by 30% from £151.6m in September 2024.

Looking at the performance of the group’s individual segments provides some additional insight. Kainos’ business is divided into three units – developing products for the Workday ecosystem, providing IT services for public sector clients such as the NHS and providing Workday certified consultants to clients.

Workday Products (rev +14% to £39.2m, profit flat at £11.2m, 28.4% margin)

This is not the largest unit by revenue, but is the group’s highest-margin business and is a key growth area.

CEO (and 5% shareholder) Brendan Mooney is targeting £200m of annualised recurring revenue (ARR) from Workday Products by 2030. In H1, ARR rose by 19% to £77.5m, which the company describes as on track to hit an interim target of £100m of ARR by the end of 2026.

The Workday Products division now has more than 600 customers (H1 25: more than 500), but the average annual customer value in H1 was flat at £128k (H1 25: £127k). This apparent lack of pricing power may reflect competitive market conditions. In last year’s results, Kainos said the number of accredited Workday Partners in the market rose from 60 to 100 last year, leading to “aggressive pricing” from some competitors.

This increased growth is coming at a cost, too. Kainos expanded its relationship with Workday in July 2024 with an agreement for Workday sales teams to sell Kainos products. But this deal entails Kainos paying Workday “approximately £7.8m” per year for the unspecified “multi-year” duration of the agreement.

This extra cost contributed to a 61% increase in sales and marketing spending during H1, to £10m.

R&D spend also rose, by 12% to £8.6m. This does appear to be delivering results, though. Workday has selected Kainos’s new Pay Transparency product for a new service being launched ahead of the European Pay Transparency Directive that comes into force in June 2026.

A half year is probably too short a period from which to draw any conclusions. But the company’s increased investment in its relationship with Workday isn’t yet paying off, as far as I can see. Pricing pressure and higher upfront costs mean sales growth will need to remain strong to drive higher profits.

Digital Services (rev +6% to £103.5m, profit -10% to £23.4m, 22.6% margin)

This unit is the main revenue generator for the business and still commands attractive 20%+ margins.. Sales rose by 6% to £103.5m during H1, driven by a 33% increase in healthcare revenue to £29.6m.

Offsetting this, public sector revenue (UK, I think) fell by 3% to £59.7m. However, new contracts are expected to “lead to meaningful revenue growth in both sectors during the second half” of the year.

One highlight was North America, where revenue rose by 152% to £7.8m. Impressively, 139% of this growth was described as organic, suggesting it’s not just being driven by acquisitions.

M&A could become an increasingly important factor, though. The company acquired Canadian firm Davis Pierrynowski Ltd on 15 September 2025. This consultancy business has 120 staff and specialises in “addressing complex challenges for public sector and community organisations”. The two companies have worked together since 2022, so should already know each other well.

This division is highly dependent on public sector spending, but does appear to have reasonable scale and a good presence in markets such as healthcare, where I’d expect long-term demand to remain strong.

Workday Services (rev +4% to £53.4m, profit -13% to £9.1m, 17% margin)

We are the leading pan-European Workday consulting specialist and the seventh largest globally by certified consultant numbers.

The group’s Workday consultancy arm says it is making “good progress” in new markets including New Zealand and Australia. Opportunities are said to be emerging in Latin America and new sales bookings during the period rose by 35% to £54.0m.

However, the contracted backlog (contracted revenue yet to be recognised) only rose by 4.7% to £62.1m during the six-month period, perhaps suggesting that some of this work is short-cycle and backfilling to reverse the 12% decline in Workday Services reported in FY25.

Outlook

During the second half of the year, management expects to report “continued growth” in Workday Products and “a meaningful revenue increase” in Digital Services, aided by the recent acquisition.

Workday Services is expected to deliver “a return to revenue growth”, with improved results in core European and North American markets in addition to growth elsewhere.

FY26 outlook: full-year adjusted pre-tax profit is expected to be in line with current consensus forecasts.

A Canaccord Genuity note from September suggests an adj PBT figure of £66.7m for FY26E, which would be slightly ahead of the £65.6m the company reported for FY25.

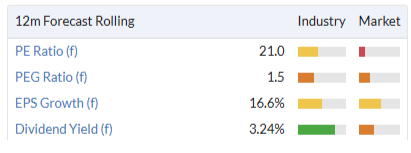

Assuming consensus earnings figures will also be unchanged, this guidance suggests adjusted earnings will rise by 5% to 40.3p per share this year. That puts the stock on a forecast P/E of 23, falling to a P/E of 20 in FY27, when earnings growth is expected to accelerate.

Roland’s view

This is a pretty mixed set of results, in my view. On one side, the return to revenue growth is positive.

However, it’s not yet clear if Kainos can deliver sufficient growth and pricing power to offset its rising cost base. The H1 operating margin fell from 16.8% last year to 13.3% in H1 26, as growth in both variable and fixed costs outpaced revenue growth:

Revenue up 7% to £196.1m

Cost of sales up 12% to £102.0m

Operating costs up 10.3% to £68.3m

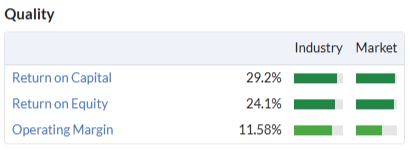

I’d guess we’ll see Kaino’s impressive quality metrics fall slightly when the H1 results are digested by the algorithms:

Some of this may reverse out over time as upfront spending delivers medium-term growth. But there’s a risk this won’t happen. I’m particularly concerned, perhaps, by the repeated warnings of tougher competition in the Workday Products market.

I need to decide whether to maintain my previous AMBER/GREEN view or reverse back to AMBER.

The stock is styled as a High Flyer and trades on a 20+ earnings multiple. For me, AMBER/GREEN could be justified if FY27 forecasts for EPS growth of c.16% remain valid.

I don’t have access to any updated broker notes today and there’s no explicit mention of FY27 guidance in these results.

However, I am encouraged by the top-line growth here and I think it may be reasonable to expect improved profitability over the next 6-12 months.

With the usual caveats relating to services businesses, my impression of Kainos is positive. I think it’s probably a fairly good quality business.

Tentatively, I’m going to leave my previous AMBER/GREEN view unchanged today.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.