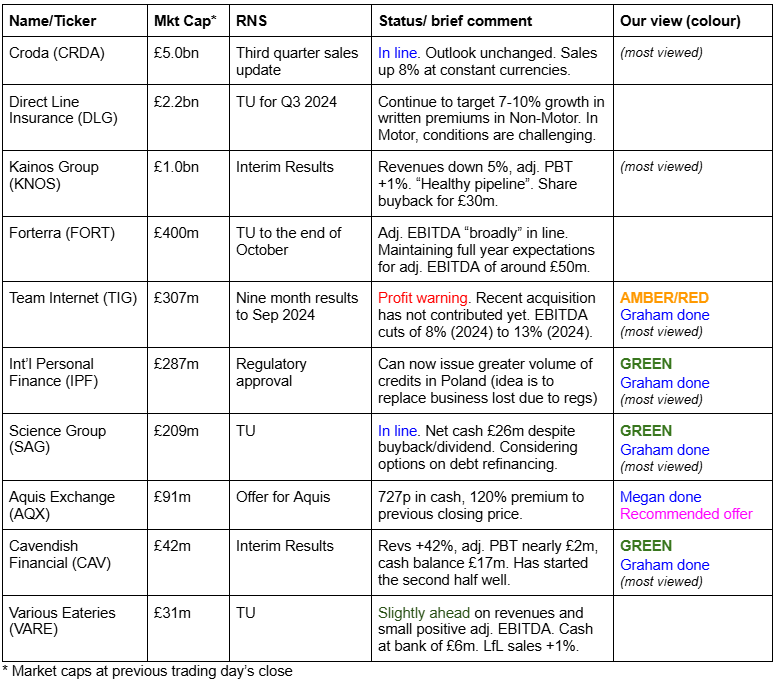

Good morning! Welcome to Monday's report.

And we're all done (1pm).

Cheers!

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day. We usually avoid the smallest, and most speculative companies, although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We have a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Add your own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Companies Reporting

Summaries

Cavendish Financial (LON:CAV) - up 7% to 11.8p (£46m) - 2025 Interim Results - Graham - GREEN

H1 revenues are up by over 40% year-on-year at this investment bank. Profitability remains weak with a result that’s only around breakeven. I’m happy to stay positive as I do think AIM can continue to strengthen from here.

Aquis Exchange (LON:AQX) - up 115% to 708p (£91m) - Offer for Aquis Exchange - Megan - PINK

Swiss stock exchange operator SIX has made an all cash bid for AQX which values the shares at a 120% premium to the previous day’s closing price. The bid has been recommended by the company’s directors and a cohort of its major shareholders, so this looks like a done-deal, which releases value for private investors after a lacklustre five years as a listed company.

Team Internet (LON:TIG) - down 16% to 99.7p (£308m / $397m) - Nine month results - Graham - AMBER/RED

It’s a profit warning with cuts to EPS forecasts of 13% and 18% for 2024 and 2025, respectively. A cheap valuation gets even cheaper. With $100m of net debt lingering, I’m reluctant to go back to neutral just yet despite some very low valuation multiples.

Short Sections

Cyanconnode Holdings (LON:CYAN)

Down 12% on Friday to 10.3p (£37m) - Interim Results - Graham - AMBER/RED

CyanConnode (AIM: CYAN), a world leader in narrowband radio frequency (RF) mesh networks, announces its unaudited interim results for the six months ended 30 September 2024…

Paul was unimpressed with this company’s full-year results (for FY March 2024), discussed here.

As predicted, it did need to raise new funds and it did so in September, issuing 60 million new shares at a price of 9p. This brought the share count up to nearly 360 million in order to raise £5.4m for the company before expenses.

The jump to nearly 360 million shares is not yet reflected this chart:

The most recent interim results show a decline in revenue (from £5.8m to £5.6m) and another operating loss of £2.1m, about the same as H1 last year.

Despite this poor outturn, the company says it is on track to meet ambitious expectations for the year that imply a radical change in fortunes: it is forecast to generate full-year revenues of £33m (!) and a pre-tax profit of £1.3m.

The reason for this optimism is an enormous increase in the company’s order backlog, with a large chunk due for delivery in H2.

The units in the order backlog are “Omnimesh RF Modules and associated products”, for use in Indian electricity smart meters (explanation here)

The track record here is truly awful but in light of the fact that it has recently raised funds (cash balance nearly £4m as of the end of September) and is apparently on track to deliver these orders in H2, I’m happy to upgrade my stance on this a little, up to AMBER/RED for now.

International Personal Finance (LON:IPF)

Up 1% to 133.7p (£290m) - Regulatory Approval - Graham - GREEN

We covered the Q3 update from IPF last month with news that the business had stabilised in Poland in terms of its year-on-year numbers.

This follows a traumatic period for IPF in Poland where new legislation reduced the cap on the non-interest cost of credit for consumer loans. The cap was reduced from 100% to 45%, with the result that IPF’s home credit business was forced to evolve very quickly - but job losses and a shrinkage of the business were inevitable.

Today’s news is that IPF has been granted a full payment institution licence in Poland, which means that it can expand its credit card business. CEO comment:

The customer response to our new credit card offering has been fantastic. With this new licence, we will be able to expand access to even more customers, allowing them to shop online, in retail stores or access cash through their customer representative or an ATM. Based on the success we have seen so far, we believe there's strong potential to introduce this credit card product to our other markets in the future."

Graham’s view - I had no reason to doubt that IPF would get this licence but the news is to be welcomed and provides a slight boost to my existing positive view on this stock. The company is exposed to a broad range of risks, which I believe are likely to be priced in at this valuation:

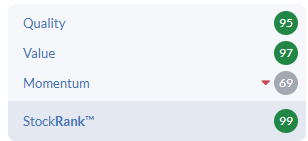

I also note that it carries a perfect StockRank of 99.

Please see here for my interview with the management team earlier this year.

Science (LON:SAG)

Up 1% to 469.5p (£211m) - Trading Update - Graham - GREEN

SAG is “an international science & technology consultancy and systems organisation”.

It provides “products and services to clients in the key vertical markets of defence, industrial, medical and consumer”.

Its year-end is in December, and we get the following trading update:

Trading in line with expectations for 2024.

NI contributions will go up by £0.7m; the company is planning how to mitigate this.

Net cash is £26m as of the end of October. It was £18m at the start of 2024 and the company has returned £7m to shareholders during the year (divis + buybacks), so net cash generation must have been robust year-to-date.

Loans: despite the large net cash position, the company has a term loan expiring in 2026 and a (currently unused) RCF. There was £13m outstanding on the term loan at the start of this year. SAG discusses in today’s trading update how it plans to refinance/renew these. It doesn’t sound to me as if it should have any difficulty at all refinancing, given its net cash position and solid trading.

The update finishes with a vaguely-worded hint of activity:

If concluded on satisfactory terms, these new, increased facilities with extended commitment periods, combined with the Group's existing cash resources, would strengthen Science Group's ability to continue to consider corporate opportunities which may arise.

Graham’s view

Back in March, Paul speculated on what deals SAG might be considering or working on behind the scenes.

This isn’t a sector I love but I’m happy to leave the GREEN stance unchanged for now given the company’s resilient trading, strong balance sheet, and murmurs of potential activity coming down the tracks. A £5m share buyback is ongoing.

Graham's Section

Cavendish Financial (LON:CAV)

Up 7% to 11.8p (£46m) - 2025 Interim Results - Graham - GREEN

This is a stock from my best ideas list that hasn’t done very well: it’s still down 7% year-to-date. But despite the lacklustre share price performance, there are signs that the bull thesis may play out.

From today’s interim results to September:

Revenues +42% year-on-year to £28m

Adj. PBT £1.8m (H1 last year: adjusted LBT £3.6m)

Cash of £18m

Unfortunately, share-based payments to management of £1.6m eat up nearly all of the adj. PBT.

Other adjusting items eat up the rest of it, so that the unadjusted result is only around breakeven.

Interim dividend increases slightly to 0.3p (H1 last year: 0.25) but this will only cost £1.1m so it’s not a huge commitment given the existing cash balance .

Outlook: H2 has started well, with the revenue run rate continuing at the same pace as H1.

As the leading broker on AIM, Cavendish’s comments on the state of the market are worth quoting extensively (emphasis added):

In the recent UK Budget, the Chancellor's announcement that shares in companies quoted on AIM will be afforded 50% inheritance tax relief from 5 April 2026 recognises the vital role played by this market in the UK's economic growth and removes any uncertainty about its future.

We believe this relief, coupled with the inclusion from 2027 of unused pension funds within inheritance tax, means AIM shares will become particularly attractive from a tax planning perspective.

Makes sense to me: with more investments subject to inheritance tax, even 50% relief is valuable. So there is still a good case to be made for AIM from an inheritance tax perspective.

They continue:

UK small and mid-cap markets are trading at historically high multi-decade discounts to their global peers. With interest rates reducing, a positive agenda for pension fund reforms, a stable political landscape and the uncertainty around AIM now resolved, we see the attraction of investing in the UK increasing and expect the headwinds that have been constraining our markets to abate, narrowing this discount. Furthermore, we do not expect that the modest increases to capital gains tax will impact levels of activity for public or private company transactions.

Graham’s view

I agree with Cavendish that taxes are not a hurdle to investing in AIM and that AIM is still attractive from a tax point of view.

While the recent changes do involve paying more tax on AIM shares, it remains advantageous to invest here vs. other exchanges.

And we should now be able to enjoy this clarity for the foreseeable future: it would be unthinkable for the new government to tinker with the rules around pensions and inheritance on an ongoing basis.

I don’t think taxes and political uncertainty have been the problem with AIM. I think AIM-listed companies themselves have been the problem: see the long-term AIM All-Share Index chart for proof.

If readers are aware of any other stock market indexes with a performance like this, please do share them.

While this chart does not include the positive effect of reinvested dividends, it does show an index that has failed to grow in value over a considerable period of time.

The last time that the market achieved a high valuation, in 2021, the brokers responded by dumping a wave of poor-quality IPOs onto investors, with the result that “2021 IPO” has become almost synonymous with “junk”.

What we’ve seen since then: another crash in the overall value of this index.

Of course interest rates also had something to do with the crash, but higher rates did not prevent the FTSE All Share Index and the FTSE 100 from making new all-time highs in 2024.

In my view, the biggest hurdle to investing in AIM is that the overall index can’t be trusted to generate a good return. It’s difficult enough to carry on investing in the UK when the US has provided such wonderfully high returns, but it’s made more difficult on AIM when the overall index is almost guaranteed to do badly.

That’s where the power of intelligent stock-picking comes in. Hopefully on Stockopedia, we’ve helped to demonstrate that it’s possible to create good portfolios and pick good stocks, even in difficult periods such as the last few years.

As for Cavendish itself, I remain GREEN as I wait patiently for the tide to turn.

Team Internet (LON:TIG)

Down 16% to 99.7p (£308m / $397m) - Nine month results - Graham - AMBER/RED

TIG is “the global internet company that generates recurring revenue from creating meaningful and successful connections: businesses to domains, brands to consumers, publishers to advertisers”.

It previously had the name “Centralnic” with the ticker “CNIC”.

See its wide range of services here - everything from domain name sales and digital advertising to consumer-focused product comparison websites (in French and German).

Its main online marketing products are from TONIC and ParkingCrew. Earlier this year it bought Shinez for $43m.

Today it publishes a profit warning with its interim results.

An overview:

For the nine-month period, revenue is up 1% to $615m, and adj. EBITDA is up 2% to $70m. There are slight increases in its gross profit margin and adj. EBITDA margin.

However, higher finance costs have taken a lump out of PBT, which falls 8.5% to £18.3m.

Net debt is close to $100m, which is up from $74m at the start of the year.

The leverage multiple is still ok at 1.2x.

I’m saddened to see that the company has been buying back its own shares despite its net debt position. Paul queried TIG’s buybacks here.

Outlook section is long, but I think this is the main point (emphasis added):

The Directors are pleased to report that Team Internet Group's core businesses remain strong and resilient. While our recent acquisition of Shinez has yet to contribute to EBITDA, we are actively adjusting its operating model and cost base to improve performance…

The Group remains on track to produce record profits in 2024 and 2025, albeit at more moderate growth rates than originally anticipated. The Group now expects to deliver approximately USD 97m adjusted EBITDA for 2024.

Estimates: thanks to Edison Research for publishing a note today that is freely available.

They argue that TIG’s core business has “performed creditably” in a difficult advertising market, but that Shinez has “significantly underperformed”.

Changes in forecasts:

For FY24, Edison cut the revenue forecast by 8% and cut EPS by 13%.

For FY25, they cut revenue by 21% and EPS by 18%.

Their new EPS estimates are in the region of 23p for both 2024 and 2025.

Graham’s view

The main reason that has prevented TIG from falling further today is probably the fact that it was already trading very cheaply on a PER basis.

However, I’m not sure I would be in a rush to buy here, even at the current lower levels.

TIG is complicated: it has some core assets which don’t seem to be growing very fast, it has an acquisition that is significantly underperforming vs. expectations, and then it has a wide range of non-core assets that are difficult to assess. The whole does not appear to be greater than the sum of its parts, and indeed it seems to have too many parts to make for a sensible investment.

The Board are aware that the stock market is sceptical, saying that they believe “the market does not fully recognise the value of this diverse asset mix and is committed to providing greater information…”

In addition to providing more information, one of their proposed solutions is “balance sheet optimisation”, i.e. more dividends and buybacks. But given given the large debt load, is that wise? At least the net debt position is forecast to reduce over the next year, according to Edison’s forecasts.

After today’s profit warning, I think a healthy dose of scepticism remains appropriate here and so I’ll leave the AMBER/RED stance unchanged. It might be very cheap but I’d like to see some stability and debt reduction before going back to neutral.

Megan's Section

Aquis Exchange (LON:AQX)

Up 115% to 708p (£91m) - Offer for Aquis Exchange - Megan - PINK

Swiss stock exchange operator SIX has made an offer to acquire London’s Aquis Exchange (LON:AQX) for an all-cash offer that values the company at £207m, or £225m on a fully diluted basis. The offer, which has been recommended by the group’s directors, will see shareholders receive 727p per share, a 120% premium to the closing price on Friday.

Aquis was founded in 2012 and listed on the London Stock Exchange in 2019, where its shares have never really gained much traction. The offer represents a slight premium to the highest price the company’s shares have ever achieved on the stock market of 720p per share back in September 2021.

That doesn’t mean the company has been an all-out disappointment. Over the last ten years it has grown to support the daily trading of about €2bn worth of European equities (a total of €40bn is traded on stock exchanges across Europe on a daily basis) through its four operating subsidiaries. British investors are perhaps most familiar with the Aquis Stock Exchange (AQSE), a growth market which hosts the likes of Shepherd Neame and Adnams. But the company operates order books covering over 6,500 European stocks across 16 markets.

Sales have risen by almost 500% since the IPO and the company has become increasingly profitable, last year reporting net profits of £5.2m, compared to a £3.4m loss the year before it joined the market.

But continuing to grow in the competitive world of trading has proven challenging. The directors have pointed to this as one of the reasons for recommending the offer, commenting today that: “the terms of the offer provide Aquis shareholders with an attractive opportunity to accelerate and de-risk future value creation and realise certain value of their holdings today in cash”.

SIX and Aquis have already received approval from shareholders representing just over a third of the share count, but the remainder of the shareholders will now also have the opportunity to vote. The takeover is expected to complete in the second quarter of 2025, at which point shareholders will receive cash in exchange for their shares.

Megan’s view: This looks like it’s pretty much a done deal. With the directors and major shareholders already bought in, it’s likely that the rest of the shareholders will follow and the takeover should be completed by the first half of next year.

Does it represent good value? An enterprise value of £194m is equivalent to 8 times sales and 37 times operating profits delivered in the last 12 months. That’s not far off the current valuation of the London Stock Exchange and a premium to the valuation the LSE placed on Refinitiv in its 2021 acquisition.

More significantly, this looks like a sensible strategic move for Aquis, which has grown from a minnow into a meaningful operator in the European exchange network, but is likely to struggle to make further inroads.

In our recent webinar, Ed and I suggested that a good way to respond to a takeover offer is often to sell half of one's holding, while awaiting potential further offers. As this is a recommended offer, it’s unlikely we’ll see higher bids at this stage. Therefore, selling out at 710p might be sensible for those shareholders who wish to free up some cash to be deployed elsewhere, if they don't wish to wait for the proposed 727p payout next year.

The big question really is why the company’s shares were trading so much lower than what has now been deemed fair value. London’s markets remain at a deep discount to other major global exchanges and there are value opportunities to be had.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.