Good morning! I hope you had a nice weekend.

I've published a little overview of events in the gambling sector - link here. Hopefully it's useful as a place to compare how the different gambling stocks reacted to the recent Budget!

Right, on with today's news...

We are hanging up our pens there, thank you!

Spreadsheet accompanying this report (updated to 24th November): link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Hikma Pharmaceuticals (LON:HIK) (£3.4bn | SR72) | CEO Riad Mishlawi is stepping down as CEO with immediate effect. Executive chair Said Darwazah (a member of the founding family) will take over all CEO responsibilities with immediate effect. The CFO will also join the board and take on new responsibilities. 2025 guidance remains unchanged from Nov 6 update. | AMBER/GREEN (Roland) Today’s CEO departure marks the second time in four years that the company has parted ways with a non-family CEO. In this case, departing boss Riad Mishlawi is a long-time exec who’d been with the company since 1990 and appears to be retiring. On balance, I’m encouraged by the return of a family member to the leadership position, but what interests me most today is the possibility that Hikma shares have now fallen to a level where they could offer quite attractive value. To reflect this, I’m tentatively adopting an AMBER/GREEN view ahead of February’s full-year results. | |

Frasers (LON:FRAS) (£2.8bn | SR95) | Repurchasing shares to hold in Treasury in order to reduce the company’s share capital. | ||

MHP SE (LON:MHPC) (£540m | SR98) | Q3 revenue +29% to $1bn, adj op profit +15% to $177m. Ongoing war continues to affect this Ukraine-based company. | ||

Porvair (LON:PRV) (£362m | SR75) | Expect revenue growth c.1%, with op profit and margin ahead of the prior year. Adjusted earnings per share to be marginally ahead of expectations. Net cash of £23m on 30 Nov. | AMBER/GREEN = (Graham) A "marginally" ahead update isn't enough to budge me from our moderately positive stance. I like the business and I like its financial results, but it's fully valued here in my view. | |

Filtronic (LON:FTC) (£315m | SR63) | Received £7m authorisation to proceed for “next phase of a long-standing electronic sensor programme for a defence project”. Formal purchase order expected in Q1 26, expect total value of contract to be £11m over two years. | AMBER = (Roland) I’m encouraged to see Filtronic continuing to develop its defence business and also securing work for its new factory in Sedgefield. However, broker forecasts are unchanged today and Cavendish notes that revenue from this contract is likely to be weighted towards FY28. While I think Filtronic is doing the right things, a forecast P/E of c.40 and declining profits (vs FY25) mean I think the shares are up with events at the moment. My neutral view is unchanged. | |

| Gore Street Energy Storage Fund (LON:GSF) (£303m) | SR N/A) | Half-year Financial Report | NAV 90.1p (March 2025: 102.8p), primarily driven by adjustments to third-party forward revenue curves for GB and US markets. NAV total return for the period minus 10.6%. | AMBER (Graham) GSF has no control over what third-party researchers predict for the battery energy storage market, and it is these predictions which are used to predict future revenues and therefore to calculated NAV. So in that sense the decline in NAV in H1 is beyond management's control. It does make me question whether I can trust the NAV figure, and I'm inclined to not trust it, as the range of uncertainty around it seems very high. Given the large discount to NAV that is already priced in, a neutral stance seems fair to me. |

TT electronics (LON:TTG) (£236m | SR50) | SP -13% | PINK (Graham) [no section below] | |

Intuitive Investments (LON:IIG) (£225m | SR40) | Entered agreement with Helikon Investments to provide £30m in equity funding for Hui10’s paperless lottery rollout (in China). Will be drawn down in three phases when Hui10 reaches certain regulatory milestones. | ||

Amedeo Air Four Plus (LON:AA4) (£171m | SR77) | With less than 12 months until the end of leases on first two A380 aircraft, focus is entirely on maximising returns from liquidation of assets. Seems to be heavily dependent on any deal agreed with lessee Emirates. AA4 H1 revenue -3%, pre-tax profit £6.6m (H1 24: £(3.2)m. | AMBER (Roland) [no section below] This aircraft lessor’s 12% dividend yield and 40% discount to net asset value are eye-catching. Today’s results do seem to suggest cash flow support for the dividend in H1. However, I think it’s important to remember what lies behind this NAV. Amadeo’s main assets are six double decker A380-800 aircraft, two 777-300ER and four A350-900. The first eight listed are leased to Emirates, with the remaining four leased to Thai Airways. The elephant in the room is whether Emirates will choose to buy the A380s, two of which come off lease in 2026. While other airlines appear to have restarted A380 operations after mothballing them during the pandemic, commentary from Amadeo management today suggests to me that they see Emirates as the only likely buyer for these aircraft (the A380 is a discontinued model with no like-for-like replacement). The StockRanks flag this as a Turnaround and I agree there could be an opportunity here. But I can also see significant risk of losses if Amadeo is ever left owning A380s it can’t lease. Understanding the various permutations of outcomes here is beyond my pay grade and needs sector expertise, I’d argue. For this reason I’m going to adopt a neutral view. | |

Beeks Financial Cloud (LON:BKS) (£165m | SR27) | Multi-year Exchange Cloud contract with nuam, the regional holding company that integrates the stock exchanges of Santiago, Colombia, and Lima. Expected to go live in Q3 FY26, “further underpinning the Board's FY26 expectations…” | AMBER (Roland) [no section below] Another in-line new business update from Beeks, following last week’s similar announcement. As I discussed at the time, it’s reassuring to see the company making progress towards delivering on growth forecasts. However, the in-line nature of this update paired with a mid-20s P/E ratio and average profitability means I am going to leave my neutral view unchanged. I’d want to see evidence of a step change in profitability or growth rate to justify a more positive view. I note the StockRanks share my caution, with a Neutral view and SR of 27. | |

Cornish Metals (LON:CUSN) (£95m | SR19) | Final order from the Ontario Superior Court of Justice approving the previously announced re-domicile of the Company to the United Kingdom. | ||

Van Elle Holdings (LON:VANL) (£37m | SR76) | Disposal proceeds c. CAD $4.7m: initial cash CAD $2.7m, deferred cash c. CAD $2.0m. | AMBER/RED = (Roland) [no section below] The Canadian rail operations had previously been classified as a discontinued operation, so we knew they might be sold. The sale value appears relatively modest against the value of previously flagged contract awards, but it seems this work has been delayed. To me, this looks like a sensible exit from an operation where Van Elle lacked scale. While the stock’s value metrics and discount to book value may look tempting, I’m mindful of September’s big profit warning, which cut EPS estimates by 50%. Against this backdrop, I’m going to leave Mark’s AMBER/RED view unchanged today, ahead of the scheduled 1H26 trading update that’s due later this month. | |

Everyman Media (LON:EMAN) (£25m | SR38) | The Finance Director has informed the Board of his decision to step down to pursue another opportunity. | RED= (Graham) [no section below] Everyman issued a profit warning five days ago and now its CFO is jumping ship. He will stay until March which is some consolation, but I wonder if he’s getting out because he sees the writing on the wall? Everyman is chronically loss-making and heavily leveraged in terms of both leases (>£100m) and financial net debt (£24m). | |

Facilities by ADF (LON:ADF) (£18m | SR42) | Recruits Finance Director of Everyman Media Group plc with effect from March 2026. | AMBER/RED = (Graham) [no section below] Everyman and ADF have a few things in common: both companies are in the film industry, both are financially indebted, both posted losses at their recent interim results, both are capital-intensive with heavy depreciation charges, and both companies trumpet their positive adjusted EBITDA figures. So this looks like a smart hire. | |

Eenergy (LON:EAAS) (£17m | SR32) | SP -6% Now expects approximately £3m-£4m of previously anticipated FY2025 revenue to be recognised in H12026. Delays in the installation phases of existing signed contracts together with a number of anticipated significant investment grade contract signings being pushed into early 2026. | BLACK for FY25, but FY26 revised upwards. (Graham - no colour as no opinion on the stock) [no section below] More profit warnings should be like this: when a company warns on profits due to revenue shifting into a later period, that later period should (more often than not) see upward revisions rather than dowward revisions! But it rarely happens. In this case, upward revisions to FY26 mean that it's a less serious profit warning. | |

Goldplat (LON:GDP) (£16m | SR96) | Revenue -22% (£56.7m). Adj. PBT -55% (£2.7m). Cash increased to £6.1m. |

Graham's Section

Porvair (LON:PRV)

Up 3% to 800p (£368m) - Year end trading update - Graham - AMBER/GREEN

It’s just a two-sentence update from Porvair, “the specialist filtration, laboratory and environmental technology group”.

Its financial year-end is November:

The Group expects revenue growth to be around 1% (2% at constant currency), with both operating profit and margin ahead of the prior year and adjusted earnings per share marginally ahead of market expectations. Net cash at 30 November 2025 was approximately £23 million (2024: £13.7 million).

Checking the StockReport, revenue growth was forecast at just below 3% this year, which is likely to be a constant currency estimate. So perhaps revenue has slightly undershot expectations?

On the bright side, the adjusted EPS estimate was 39.6p so if they are marginally ahead of expectations, perhaps we’ll see 40p?

Last year’s EPS result was 38.6p (adjusted) and 35.8p (actual).

So it looks to me as though adjusted EPS will be up c. 4% this year.

Graham’s view

I don’t see any reason to veer from Roland’s moderately positive stance in June.

As Roland said at the time, while this does appear to be a highly reputable business - and I appreciate its very consistent profitability - its growth rates are not overly exciting.

That wouldn’t matter at a lower valuation, but at a high valuation it becomes more difficult to be outright positive on the stock.

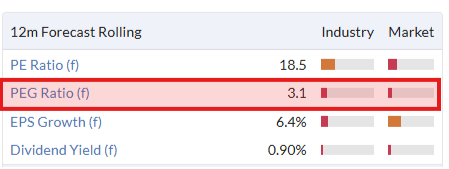

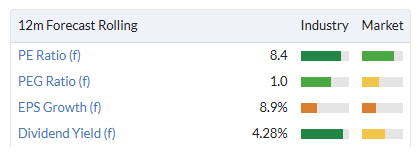

See the very expensive PEG ratio below (granted that today’s ahead-of-expectations update might cool it down a little). Essentially we have about 6% forecast EPS growth over the next 12 months (on “normalised” earnings) vs. a high PER of 18x.

Porvair is a truly international business with three divisions: Aerospace & Industrial, Laboratory and Metal Melt Quality. It’s not difficult to imagine the benefits of owning various filtration, water analysis and other scientific and industrial companies under one group structure. And it has been a very consistent performer.

So I like the story and am perfectly happy with our positive stance here… but given my value bias, I’m not going to get too excited about the opportunity at this level.

Gore Street Energy Storage Fund (LON:GSF)

Down 9.5% to 54p (£275m) - Half-year Financial Report - Graham - AMBER

I never cover this one but am happy to look at it on request from readers.

GSF is “London's first listed energy storage fund, with a diversified portfolio located across five electrical grids.”

NAV is 90.1p (September 2025), sharply down from the 102.8p recorded for March 2025.

So the share price is trading at a 40% discount to this currently.

The reduction in NAV was “primarily driven by adjustments to third-party forward revenue curves for GB and US markets.”

The company reports that NAV total return since IPO is 31.6%.

That 31.6% positive return figure includes dividends - the fund’s share price is materially below its 2018 IPO price.

Operational updates:

Huge increase in capacity to 643MW (March 2025: 417MW).

All assets under construction have been completed, but the one in Enderby, Leicestershire “is not yet fully operational and is not yet realising its full revenue potential due to technical issues, which are being addressed…”

Revenue measured in MW/year (i.e. scaled to the fund’s capacity) is down year-on-year.

And H1 revenue is only up 10% year-on-year despite the increase in capacity:

The GB market has seen a material improvement from the lows seen over FY24/25, however, both the delay in the Enderby asset becoming fully operational and the poor performance from the Texas market, which has underperformed expectations by as much as c.90% have weighed on overall revenue generation.

I’m not sure how you can have an underperformance of 90% of expectations; this needs further explanation. Here’s what I found:

During the period, the Texas BESS [Battery Energy Storage System] market experienced a significant downturn, with revenues falling c.90% below initial expectations. This decline was driven primarily by two factors.

Depressed gas prices reduced pricing volatility, limiting opportunities for batteries to capture high spreads through arbitrage. The second course was market saturation, with the rapid deployment of BESS assets in the state causing margins to compress and reduced ancillary service revenues.

Energy and batteries aren’t my area of expertise but my simplified explanation is that the poor performance was caused by a) lower energy prices, and b) excessive capacity and overinvestment in the energy storage industry.

Liquidated damages

GSF also says it’s pursuing “liquidated damages”, i.e. damages that were pre-agreed in its contracts to compensate it for breaches of these contracts by the other parties.

…the Company is pursuing further liquidated damages for delays to certain assets. These damages compensate for lost revenue and are calculated at an hourly MW rate. As these additional amounts are not reflected in reported revenue or dividend cover for the period, they remain outside the current figures. However, for illustration, if all liquidated damages considered owed were accrued, fund earnings would have supported a dividend of c.1.32 pence per share for the period.

This would have been a noticeable increase on the 0.69p dividend that has actually been declared for the period.

Graham’s view

Again I must reiterate that this isn’t my area of expertise, so I’m reluctant to express a strong opinion.

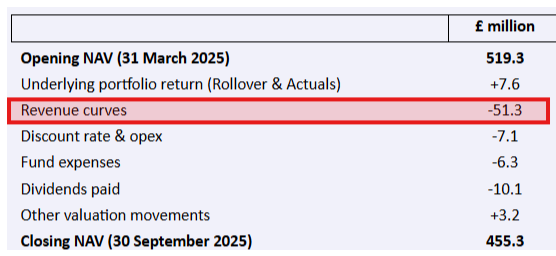

The main table seems to summarise what has happened:

Now if it hadn’t been for the delays and the overcapacity in Texas, I assume that the underlying portfolio return would have been much stronger.

But the main issue in terms of NAV performance has been the adjustments to the “revenue curves”. These are forward-looking expectations:

These revisions reflect updated third-party market expectations for ancillary service pricing and trading spreads, which have softened in the near term due to increased capacity and evolving system dynamics.

This sentence seems to suggest that other companies in the industry might also need to mark down their expectations:

The updated curves are more closely aligned with recent actual performance and are notably lower than the latest peer group disclosures.

For UK revenue curves:

This revision reflects the expected increase in installed battery capacity, further supported by the Long Duration Energy Storage Scheme (LDES) cap-and-floor mechanism in GB, which aims to procure significant BESS capacity under its framework. Approximately 28.7 GW of projects are under consideration for the second-stage of assessment, but OFGEM has yet to confirm how much capacity will be awarded in final contracts.

While a 40% discount to NAV would ordinarily get me interested in a fund, in this case I’m afraid I don’t have faith in the NAV. The value of battery energy storage systems depends on capacity in the sector, which is not something over which GFS has any control, and these results show that sector capacity is growing rapidly.

Indeed, on the IMC webinar, the CEO has said that they are a “victim of success” in the sector, as capacity continues to grow.

I think a neutral stance is fair as these shares do trade at a significant discount to NAV, but I’d need to have some sort of opinion on the outlook for continued capacity growth in the sector if I wanted to have any sort of positive conviction. That’s beyond my pay grade, sadly

Roland's Section

Filtronic (LON:FTC)

Up 3% at 147p (£323m) - Major European defence prime selects Filtronic for next phase of electronic sensor programme - Roland - AMBER=

This is the second update in two (trading) days from Filtronic – Graham covered Friday’s in-line half-year update here.

In today’s RNS, the company reports that it has been chosen by “a major European defence prime” to support “high-performance active components” for the next phase of a long-standing electronic sensor programme.

The company has received an authorisation to purchase for c.£7m that is expected to convert into a purchase order in Q1 2026. The total value of the contract is expected to be £11m, over two years stretching into FY28 (Filtronic has a May year end).

CEO Nat Edington’s comment suggests to me that this is a new win with an existing customer:

This latest win deepens our engagement with a key European defence customer and strengthens Filtronic's position in the defence sector, a growing market for the Group. As we invest in capability and capacity, Filtronic is increasingly well positioned to support long-term demand for advanced RF solutions in the defence market.

Production of these components will take place at Filtronic’s “new, secure, automated microelectronics facility in Sedgefield”. It’s good to see the company’s recent investment in new facilities being utilised.

It’s also good to see the company potentially reducing its dependency on key customer SpaceX, which generated 83% of Filtronic’s revenue in FY25.

Outlook

House broker Cavendish has left its forecasts unchanged today, noting that revenue from this project “will be weighted towards FY28E”.

As a reminder, revenue is expected to flatten out in FY26 after meteoric growth in FY25, driven by SpaceX. Profits are expected to fall sharply by c.50% in FY26, due to the increased cost base and changing mix of work:

FY25 actual adj EPS: 6.5p

FY26E adj EPS: 3.2p

FY27E adj EPS: 3.9p

These forecasts leave Filtronic trading on a fairly demanding rating:

Roland’s view

I think it’s encouraging to see the business continuing to develop its defence-related activities. Defence is a logical adjacent market to the company’s core space market and offers the potential for government-backed long-term growth.

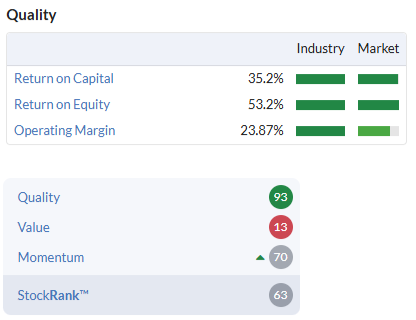

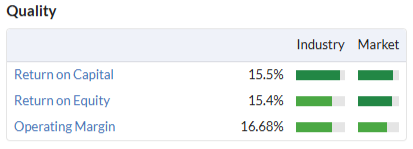

Filtronic’s excellent quality metrics (based on FY25 results) currently support a High Flyer styling, despite the company’s demanding valuation:

It’s also good to see momentum improving following the introduction of FY27 forecasts:

However, I would expect the stock’s quality metrics to fall somewhat when the H1/H2 FY26 results are issued, reflecting the more normal profitability expected this year. Cavendish forecasts suggest an adjusted operating margin of 15% in FY26, down from 27% in FY25.

Overall, I’m encouraged to see Filtronic continuing to develop its business and meet forecasts. However, my view remains that the share price is up with events, so I’m going to leave our neutral view unchanged today.

Hikma Pharmaceuticals (LON:HIK)

Down 1.5% at 1,494p (£3.3bn) - CEO change and Board appointment - Roland - AMBER/GREEN

Generic drug specialist Hikma Pharmaceuticals is currently the smallest company in the FTSE 100. Today’s CEO departure news has prompted me to take a fresh look at the value that might be on offer in this business after a prolonged decline.

However, I’d imagine the company’s sliding share price and risk of demotion from the blue chip index might have contributed to today’s news that CEO Riad Mashlawi will depart with immediate effect.

Mr Mashlawi has been CEO since 2023 and was previously the President of the group’s Injectables business. He had been with Hikma since 1990. He appears to be retiring – albeit suddenly – and is thanked today for his many years of service.

Mashlawi will be replaced as CEO by current executive chairman Said Darwazah. He’s a member of the founding Darwazah family, which still has a 27% shareholding in Hikma through its vehicle Darhold.

Darwazah was previously CEO from 2007 until 2018, and again from June 2022 until August 2023 (following the departure of an externally-hired CEO). I would tentatively conclude from this that Hikma has not had a terrific success rate at hiring non-family CEOs.

Outlook

Helpfully, the company has also reiterated its full-year guidance today, confirming that 2025 expectations remain unchanged from the update provided on 6 November:

Group guidance for 2025 remains unchanged from the 6 November 2025 trading update and Hikma will report its 2025 full year results on 26 February 2026.

Checking back, the guidance provided in November was:

2025 revenue growth of 4% to 6%;

2025 adjusted operating profit of $730 to $750m (FY24: $719m).

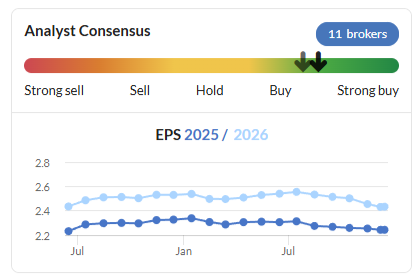

It’s helpful to know that further downgrades are unlikely, as consensus forecasts have drifted somewhat lower since the summer:

Roland’s view

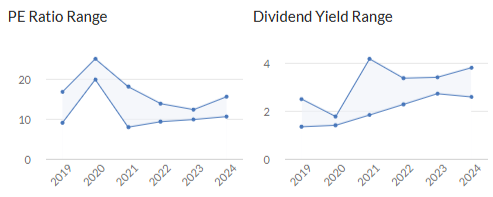

What caught my eye today was the increasingly modest valuation of this business. Assuming results are in line with 2025 estimates, Hikma shares are now trading on a modest single-digit P/E, with a useful 4%+ dividend yield.

A PEG ratio of 1.0 is another sign of potential value, given the expected return to earnings growth:

A P/E of eight for a well-established business with forecast earnings growth and decent quality metrics doesn’t seem expensive to me:

Generic pharmaceutical companies don’t have the same R&D risks as companies such as AstraZeneca, which are reliant on periodically creating new patent-protected blockbuster drugs. However, the flipside of this is that generics (cheaper copies of patent-expired medicines) are less differentiated.

Companies such as Hikma rely quite heavily on their distribution networks and commercial relationships to support growth. They also run the risk of periodic legal disputes or setbacks when trying to introduce new products.

Hikma has suffered its share of these issues over the years. But the company’s long-term share price chart suggests to me that on a technical view, the current valuation could be well-supported:

Valuation ratios also seem to support my view that some value could be emerging here. As we can see from the history charts on the StockReport, both the P/E and dividend yield are at levels which have proved cheap in the past:

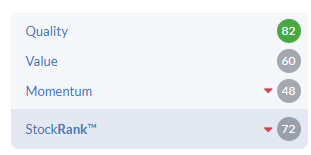

Hikma’s full-year results are due in February and will provide an opportunity for a more in-depth look. I note the StockRank is now quite high, despite a Neutral styling:

I’m going to leave this review here today as a placeholder ahead of the 2025 results. While there’s still a risk that these results will be accompanied by cuts to 2026 expectations, I am tentatively taking an AMBER/GREEN view to reflect my opinion that an opportunity could be emerging here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.