Good morning - and welcome to the final month of 2025!

Finished for today, thank you!

Spreadsheet accompanying this report: link (last updated to: 10th November).

Companies Reporting

Melrose Industries (LON:MRO) (£7.5bn | SR58) | CFO Matthew Gregory intends to retire and will step down in 2026. Ross McCluskey has been appointed as successor and will join the company in May 2026. McCluskey is currently at Intertek Group. | ||

easyJet (LON:EZJ) (£3.8bn | SR54) | easyJet completed the required software updates on its aircraft over the weekend with no disruption to its flying programme. Outlook remains in line with exps. | ||

Serco (LON:SRP) (£2.6bn | SR90) | 12yr contract worth c.£500m to manage HMP Dovegate. Serco has operated Dovegate since 2001. New contract will include service enhancements. | ||

| Greatland Resources (LON:GGP) (£2.5bn | SR79) | Havieron Project - Feasibility Study | Confirms pathway to “world class” gold-copper mine. Update ore reserve of 38.5Mt at 2.63g/t Au. $1bn pre-production capex to be funded from existing $750m cash and other resources. | |

Plus500 (LON:PLUS) (£2.2bn | SR93) | PLUS is appointed as clearing partner for the new event-based contracts platform, FanDuel Prediction Markets. | ||

HICL Infrastructure (LON:HICL) (£2.2bn | SR78) | HICL withdraws from combination with TRIG. HICL board remains convinced of rationale, but lacks sufficient support from HICL shareholders. | PINK (see below) | |

Renewables Infrastructure (LON:TRIG) (£1.78bn | SR82) | HICL is withdrawing from the proposed combination with TRIG announced on 17 November 2025. TRIG’s standalone strategy remains unchanged, as per recent CMD. | PINK (AMBER=) (Roland - I hold) | |

Wizz Air Holdings (LON:WIZZ) (£1.21bn | SR40) | Wizz identified 83 Airbus A320 aircraft requiring software updates. These have now all been updated, with zero flight cancellations. | ||

SolGold (LON:SOLG) (£887m | SR33) | Jiangxi Copper Company made two possible cash offers for SolGold on 23 and 28 Nov. The latest was for an acquisition at 26p per share. Both offers have been rejected by SOLG’s board. Jiangxi currently owns 12.19% of SOLG. | PINK | |

Target Healthcare Reit (LON:THRL) (£600m | SR76) | Acquired 3 operating care homes in Scotland and committed to purchase a fourth that’s under construction for £45m (blended net initial yield >6%). All involve sale-and-leaseback deals with the same existing operator. | ||

Caledonia Mining (LON:CMCL) (£449m | SR93) | National Budget proposing increase in royalty from 5% to 10% when gold >$2,500/oz and change to tax treatment of capex. If implemented, changes would result in profitability below current expectations. | ||

Ab Dynamics (LON:ABDP) (£302m | SR48) | Ansible Motion awarded €9.7m contract with a major European OEM. Revenue exp H1 26/H1 27. Confirms that new group CEO Sarah Matthews-DeMers starts today. | ||

Impax Asset Management (LON:IPX) (£222m | SR92) | AUM -30% to £26.1bn, net outflows £13.0bn. Improving trend in H2. Rev -17%, PBT -43% to £27.8m. Cash reserves £64.7m. | AMBER ↓ (Graham) At the current valuation, investors are getting £127 of AUM for every £1 invested in the shares. This is a truly depressed level compared not just to the boom years but even to the more recent, challenged years. However, to reflect the fact that the company has missed its earnings forecasts for the year, and continues to suffer outflows, and also has seen another AUM forecast downgrade, I am going to downgrade our stance on this by one notch, to neutral. | |

Peel Hunt (LON:PEEL) (£129m | SR77) | Revenue +38%. PBT £11.5m (H1 last year: £1.2m). Headcount reduced over 15% from peak in 2023. Confident in meeting market expectations for the full financial year. | GREEN = (Graham) The company - which has a place on my annual watchlist - has already achieved more than 100% of its full-year net income forecast in H1 alone. So clearly, I'm going to want to stay GREEN here. Perhaps H2 will be extremely quiet, as implied by market expectations. But I think it's right for me to stay positive, especially considering that balance sheet asset backing has improved to over £100m. | |

Solid State (LON:SOLI) (£81m | SR49) | “Strong” trading in H1. Interim CEO appointed after the passing of the CEO. Directors confident in meeting full year consensus expectations. | AMBER/GREEN ↑ (Roland) We were neutral on this electronics business one year ago and the shares have gone nowhere since then. However, reading today’s results suggests to me that this is an increasingly well-invested business, with the potential to deliver medium-term growth in defence as well as an eventual recovery in industrial demand. Profitability is improving and the balance sheet looks fine to me. Taking the view above suggests to me that the stock could be worth a closer look at current levels, so I’ve upgraded my view by one notch today. | |

Topps Tiles (LON:TPT) (£79m | SR45) | New CFO will join in Spring 2026. She is currently Group Finance & Investor Relations Director at Watches of Switzerland Group Plc. | ||

Wynnstay (LON:WYN) (£75m | SR96) | Underlying trading results for FY25 to be modestly ahead of current market expectations with adjusted profit before tax of approximately £9.0m. Early trading in new financial year is in line. | GREEN = (Roland - I hold) Today’s update suggests operational and commercial changes being implemented as part of CEO Alk Brand’s Project Genesis turnaround plan may be helping to improve profitability. However, there’s not much evidence of underlying growth in my view, with cyclical/commodity market conditions remaining mixed. A big discount to book value and year-end net cash covering c.30% of the market cap give me confidence to stay positive here, as I think there’s significant potential for further re-rating if volumes improve as the implementation of Genesis gathers pace. The main risk I can see is that Wynnstay may be pushing on a piece of string – if its core markets are in structural decline or oversupplied, as I’ve seen suggested, then it could be difficult to ignite growth. | |

ECO Animal Health (LON:EAH) (£64m | SR98) | SP +3% Revenue +19%, adjusted EBITDA £3m (H1 last year: £0.4m). Cash £18.6m. Expects H2 weighting. Board confident FY26 will be in line with current market expectations (adj. EBITDA £7.7m). | AMBER = (Graham) [no section below] Mark gave this a detailed review in July. Today's results are said to be "ahead of guidance", but the full-year outlook is line, implying either that they are being conservative or that the outlook for H2 FY2026 isn't overly strong. This is a seasonal business and so perhaps the H1 results are not all that important in reality. I note that most of the H1 growth has occurred in China, where there has been "a return to more normal trading", and also in the United States. Looking ahead, they do anticipate the commercial launch of a new product in H2 of the calendar year 2026, but this will be after FY March 2026 has ended. Overall, I'm inclined to leave our neutral stance unchanged. The financial statements do cause a little concern - e.g. it's noteworthy that adjusted EBITDA of £3m turns into a total comprehensive loss of nearly £1m after FX losses and after minority shareholders (presumably in China?) take their share of the profits. Net cash from operations is negative and that's before capitalised spending of £1.9m. | |

One Health (LON:OHGR) (£32m | SR78) | H1 growth in-line with management expectations. Revenue +18%, underlying EPS -8%. Outlook: confident FY26 will be in line with market expectations. | ||

OPG Power Ventures (LON:OPG) (£24m | SR96) | Share Buyback Offer reduced from £11.4m to £9.9m so that the Family Concert Party might potentially own 84.97% of the company rather than 94.41%. | ||

Genedrive (LON:GDR) (£11m | SR4) | Pilot Programme Study Results underpinning NHS Implementation Guide for CYP2C19 Genotype Testing Presented at the UK Stroke Forum. |

Graham's Section

Peel Hunt (LON:PEEL)

Up 1% to 106p (£130m) - Interim Results - Graham - GREEN =

Peel Hunt Limited ('Peel Hunt', the 'Company') together with its subsidiaries (the 'Group') today announces unaudited interim results for the period ended 30 September 2025 ('H1 FY26').

This is on my 2025 watchlist, so I’ve been taking an especially keen interest in it!

Sentiment worsened during the early part of this year, but has since recovered:

And although the share price hasn’t moved much today, I think that the interim results do go a long way towards justifying the renewed optimism:

H1 revenue +38% to £74m (even a little better than was disclosed in the H1 trading update).

Adjusted PBT £18.7m (H1 last year: £4.6m)

PBT £11.5m (H1 last year: £1.2m).

I don’t think that the market really cares too much about the official consensus forecasts here, but for what it's worth the company is officially forecast to make a net income of £6.8m for the financial year ending March 2026.

But they’ve already made a net income of £8.3m in H1 alone! So as I said: I don’t think anyone cares about the official forecasts here.

One of the main reasons I’ve been bullish on the stock is the balance sheet, which I believe offers plenty of deep value for bargain hunters.

That value has risen with net assets of £100.7m now, up from £88.7m six months ago.

Checking the statements, I can confirm that there is almost nothing intangible included in that figure (less than £500k).

So the asset backing has improved significantly.

Cash: there was a £6.8m cash outflow in H1 which includes £3m spent on a loan repayment and a £2m cash outflow because the company is no longer a majority shareholder in Retail Book (though it does still have a stake of nearly 41%).

Even putting those two cash outflows to one side, you might wonder why the company didn’t make more cash in H1. The reason is simply that there were large shifts in working capital (more securities held for trading and more debtors). Working capital swings can be huge here over a short timeframe, and I don’t worry about them at all. The company assures us that “Capital and liquidity remain comfortably in excess of regulatory requirements”.

Cost control: I have made some mild criticisms of Peel Hunt in the past for being unable to reach breakeven in its bad years, which I think ought to be possible if employee pay is variable enough

Thankfully, there has been progress in terms of cost control, with the company reporting that headcount is down by 15% since the peak in FY23, and underlying fixed costs down by approx £5m in FY26.

Investment bank: revenues surged by 45.6%. “The most active investment bank for all UK ECM transactions in H1 with a market share of approximately 17”. In M&A, they are “third in the UK public M&A league tables behind only global investment banks”.

The total number of investment banking clients did fall slightly, from 147 to 143, but their average market cap has nearly doubled over the last three years. And the number of FTSE-350 clients has increased from 52 to 57 over the past six months.

Execution: revenue is up 56.8% year-on-year to £27.6m. The tariff-related volatility occurred in early April, i.e. during this H1 period. This was the “best half-year performance since the Covid lockdown period”.

Research & distribution: more stable here, revenues up just 2.2% year-on-year, with a new Middle East office in Abu Dhabi. And the quality of the research is good for the bank’s reputation generally.

Current trading and outlook:

The Group has made a strong start to the second half, successfully completing several sizeable investment banking transactions, and performance from our Execution Services business, although down from the highs of the first half, has been robust. Consequently, we are confident in meeting market expectations for the full financial year.

Graham’s view

The situation here vis-à-vis market forecasts is very odd. Peel Hunt is only supposed to earn net income of £6.8 this year.

Therefore, I think that they have already earned over 60% of the current full-year revenue forecast, and over 100% of the full-year profit forecast.

The revenue forecast on the StockReport today (£99.8m) can’t be right, with £74m already achieved in H1. Hopefully we will have that updated soon.

Overall, therefore, things aren’t quite adding up. The most logical explanation is that Execution revenues will collapse in H2, now that markets have calmed down (post-tarriffs), and that Investment Banking revenues will also be slower.

If we have a very quiet H2, then perhaps the company will fall back to breakeven or a small loss in the second half - but even then, it seems likely that they will outperform the profit forecast for the year.

Either way, I’m happy to stay GREEN on this. With asset backing of £100m+, it seems to me a no-brainer for a global investment bank to try to buy this out.

Even if that doesn’t happen, I believe that it’s logical for these shares to re-rate higher. Let’s see if H2 turns out to be as weak as is suggested by market expectations.

Impax Asset Management (LON:IPX)

Down 7% to 161.4p (£206m) - Final Results - Graham - AMBER ↓

(At the time of publication, Graham has a long position in IPX.)

Impax Asset Management Group plc…, the specialist investor focused on the transition to a more sustainable global economy, today announces final audited results for the year ending 30 September 2025…

I added some Impax to my portfolio late last year - and it has not worked out at all.

Thankfully, although I do run a concentrated portfolio, I tend not to be concentrated in new ideas - only in old ideas that have succeeded. Impax is just a rounding error in my portfolio at this stage.

But let’s find out just how bad these results are. Given the share price reaction, you won’t be surprised to hear that they are below expectations (using Equity Development as my source).

Main headline:

- AUM is down 30% to £26.1 billion (this was already known from the Q4 AUM update).

AUM was £25.3 billion at the end of H1; we have therefore seen a small increase in the last six months of the financial year, thanks to positive market movements and £1 billion that came in from an acquisition.

Net outflows were £10 billion in H1 and are £13 billion for the year as a whole. Impax says “Net outflows stabilising: improving trend in second half of the financial year”.

- Revenue for the year is £141.9m, down 16.6%.

- Adjusted operating profit is £33.6m, down 36.2% and missing the Equity Development forecast £35.9m.

Let’s compare full-year results with H1 results to get a sense of just how much weaker the H2 performance was.

Adjusted operating profit in H1 was £20.5m on £76.5m of revenues.

Therefore adjusted operating profit in H2 was £13.1m on £65.4m of revenues.

The adjusted operating profit margin has therefore fallen from 26.8% in H1 down to 20% in H2, as operational leverage works in reverse.

This is still not a very bad operating profit margin in my book.

Adjusted operating costs have fallen year-on-year by £9m, protecting the margin. Headcount was reduced by 15% “without materially reducing our capabilities or growth prospects”.

Dividends for the year reduce from 27.6p to 12p, reflecting the decline in profits year-on-year.

Comment by founder and CEO Ian Simm, pointing out how difficult it has been to beat the broader indexes and fight against investor uncertainty:

For around three years, equity markets have been driven largely by AI-related and other 'momentum' stocks, while investors are contending with greater uncertainty. Against this backdrop, we continue to invest in companies harnessing long-term, durable growth trends such as demographic shifts, technological advancement, and rising consumption. Stocks of these companies have often lagged generic indices, but many currently trade at compelling valuations with strong fundamentals.

The relative performance of Impax’s equity funds hasn’t been great:

In the final quarter… investor sentiment shifted back towards stocks with higher earnings volatility; this environment was less favourable for our investment approach, which emphasises high-quality companies with sustainable earnings, making relative outperformance more challenging.

Outlook: again highlighting that it has been difficult to outperform momentum-driven, AI-led indexes, but arguing that there are signs of a broadening market.

Also:

Encouragingly, at a time when many investment managers are retreating from our area of expertise, we are seeing growing interest from asset owners who want to partner with a specialist firm such as Impax.

Share buyback: Impax has been buying back its own shares under a £10m programme. This is nearly complete now.

Many people (including myself) will criticise companies who buy their own shares while their business is struggling and the share price is falling. However, I don’t personally object to this £10m buyback.

Firstly, the company is still very profitable (over £20m of net income for FY2025). Granted that profits might continue to retreat from this level, but a £10m buyback is modest in comparison.

Also, the company is financially strong: balance sheet net equity of £115m, or £90m tangible. Cash, including money market funds, amounted to £68m as of September 2025 (and that was after carrying out the majority of the buyback). So again, the size of the buyback is modest in comparison to that financial strength.

I therefore don’t mind the company buying back its own shares, even if the share price remains weak and falls below the average price it has paid.

Estimates: my thanks again to Equity Development for publishing on this share.

FY25 results are below their expectations, as noted above. EPS has come in 17% below what was expected.

Looking ahead, Equity Development have reduced their FY26 AUM forecast by only 2%, to £28.1 billion. This sounds achievable, given that it finished FY25 at £26.1 billion, but of course it’s impossible to predict what markets might do over the next year, and flows are highly unpredictable.

However, despite the lower AUM forecast, profit forecasts are doing a little better.

As margins are coming in higher than expected, the revenue and EPS forecasts are virtually unchanged (e.g. the EPS forecast moves from 18.2p to 18.1p).

This puts the shares on a P/E multiple of 9x, making no adjustment for the company’s balance sheet strength.

Graham’s view

Being prudent and considering the miss against FY25 expectations, I would assume that 18.1p of EPS will not be achieved in FY26.

However, I have no particular desire to sell my IPX shares. I’m really hoping to add to my position, when or if there are signs of stabilisation and renewed investor sentiment. But it’s too early for that now, probably.

Long-term, barring the total collapse of interest in sustainable investment strategies or some company-specific scandal, it seems to me that this could be a fine entry point for an investment in Impax.

At the current valuation, investors are getting £127 of AUM for every £1 invested in the shares. This is a truly depressed level compared not just to the boom years but even to the more recent, challenged years.

However, to reflect the fact that the company has missed its earnings forecasts for the year, and continues to suffer outflows, and also has seen another AUM forecast downgrade, I am going to downgrade our stance on this by one notch, to neutral.

I hope I’ve explained myself reasonably well: in the long-term, I love the valuation here. In the short-term, I acknowledge that it is seriously troubled and that the timing of any recovery is uncertain.

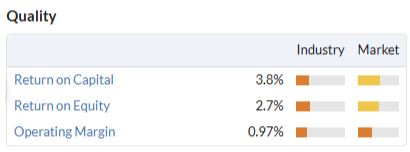

The StockRanks seem to agree with me, calling it Contrarian:

Roland's Section

Wynnstay (LON:WYN)

Up 7% to 345p (£80 million) - Trading Update - Roland - GREEN =

(At the time of publication, Roland has a long position in WYN.)

The Board expects underlying trading results for the year to be modestly ahead of current market expectations with adjusted profit before tax of approximately £9.0m

Today’s update from agricultural supplies group Wynnstay covers the year ended 31 October and makes for fairly positive reading. It has also prompted an earnings upgrade from house broker Shore Capital.

Here’s a summary of the main points:

Feed & Grain: improved year-on-year profitability despite lower volumes, thanks to improved margins and cost control.

Savings have been achieved by the closure of the Twyford Mill, while the expansion of the Carmarthen facility has added 20,000 tonnes of capacity and is largely complete.

Grain trading was affected by a weaker harvest and lower wheat prices, but the integration of all grain trading activities into the GrainLink model was completed on schedule.

Arable: profits increased year-on-year, with significantly higher blended fertiliser sales supported by the opening of the new Avonmouth blending facility. Margins have benefited from improved commercial discipline.

Stores: Like-for-like retail sales were “broadly unchanged”. I can’t find a LFL figure in last year’s results, but total sales last year were broadly flat (down slightly).

Balance sheet: net cash at the end of the year was £26.4m (excluding leases), down from £32.8m at the end of FY24.

Project Genesis: the design phase of CEO Alk Brand’s turnaround plan “is now complete” following a group-wide asset review. Integration activities are now underway.

One-off costs resulting from this process are expected to be from £5.4m to £5.9m in FY25, with a net cash cost of £2.0m to £2.5m. No further material restructuring charges are expected in FY26.

A HSE investigation following a fatality in January 2025 remains underway. A further update will be provided as appropriate.

Outlook

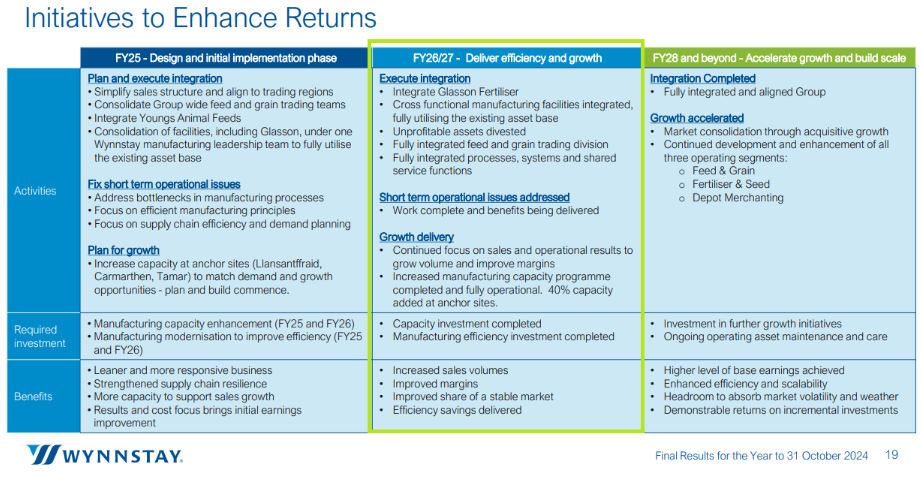

Trading so far in FY26 is “in line with the board’s expectations”. Focus remains on delivery of Project Genesis – I’ve highlighted the FY26/27 stage below (apologies for the small print):

Source: Wynnstay FY24 results

Updated estimates

Management guidance is now for FY25 adjusted pre-tax profit of “approximately £9.0m”. Checking back to July’s broker notes, previous expectations appear to have been for a figure of £8.5m.

Today’s update represents an increase of around 6%.

This is also reflected in house broker Shore Capital’s updated forecasts, which are available on Research Tree – many thanks:

FY25E adj EPS: 28.5p (+6% vs 26.9p previously)

FY26E adj EPS: 31.6p (unch)

These estimates put the stock on a P/E of 12 for the current year.

Roland’s view

The impression I get from today’s update is that profitability improved slightly last year, but there wasn’t much growth. As far as I can tell from the update, the only division that may have seen growth was Arable, where the company reports higher fertiliser sales and “a strong autumn grass season”.

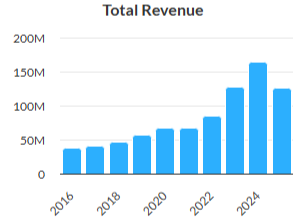

I don’t think this is necessarily a problem – to a large extent I suspect it reflects the cyclical and commodity-based nature of the business. A look at the long-term chart reminds us that these cycles have happened before:

It’s also fair to point out that the growth elements of Project Genesis are only really expected to kick in from FY26 onwards, as underlying structural and commercial changes are completed.

As a shareholder, I am content to remain holding and reassured by the continued deep discount to book value and net cash balance.

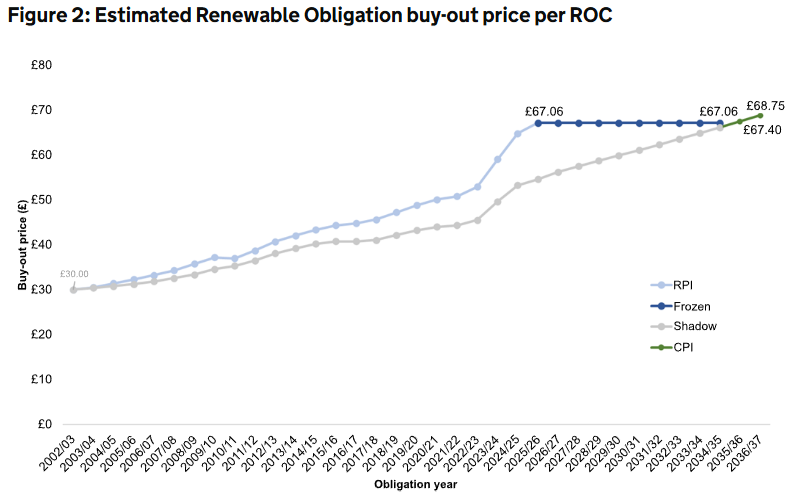

Together with a useful 5%+ dividend yield, this discounted valuation helps to offset the structural low profitability of this business:

If CEO Alk Brand can achieve his goal of a “higher level of base earnings” and “improved margins” and cyclical conditions improve, then I think Wynnstay shares could enjoy a re-rating.

Of course, these conditions are not assured and may not easily be achieved. My main concern is that Wynnstay may be pushing on a piece of string – if its core markets are in structural decline or oversupplied, as I’ve seen suggested, then growth could be difficult unless the company can displace weaker competitors.

The StockRanks have a very positive view, with Super Stock styling and a high StockRank, even ahead of today’s upgrade:

The strong balance sheet value on offer and attractive yield give me sufficient confidence to maintain my previous GREEN view.

Renewables Infrastructure (LON:TRIG)

Down 4% to 71p (£1.71bn) - Update on the Combination of HICL and TRIG - Roland - AMBER =

(At the time of publication, Roland has a long position in TRIG.)

It seems that opposition from HICL shareholders has forced the infrastructure investment trust’s board to abandon plans to combine its business with renewables group TRIG.

I reported on this plan previously two weeks ago here. It seemed fairly sensible to me as a TRIG shareholder, but apparently this view was less popular among HICL investors.

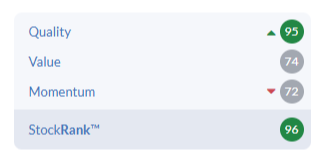

We don’t know exactly why HICL shareholders were opposed, but one possible guess is the recently announced government consultation on proposed changes to the pricing of Renewable Obligation (RO) and Feed-in-Tariff (FiT) schemes.

A key element of the scheme seems to be switching price indexation of RO and other subsidy schemes from RPI to CPI. The impact of this would be that subsidy rates would rise more slowly than previously expected. The purpose of the proposal is to reduce energy costs, as these subsidy costs ultimately feed through to consumer bills.

Two options have been suggested:

Option 1: an immediate switch from RPI to CPI pricing for future indexation

Option 2: freeze RO buy-out prices until they catch up with the level they would have been at if they’d always been indexed to CPI. The government’s own figures suggest this could mean RO buy-out prices remained frozen until 2034/35 – 10 years from now.

TRIG has not publicly commented on this, but its listed peer Greencoat UK Wind (LON:UKW) did comment and suggested that the two options under consideration could reduce UKW’s NAV per share by 1.7% or 7.4% respectively.

Roland’s view

At this stage, this is only a consultation and might not proceed at all – or only in a changed format.

It’s also worth emphasising that TRIG’s portfolio does not have the same mix of assets and subsidies as UKW, so we can’t assume the same impact on TRIG. But I think it’s fair to assume the potential impact could be in a similar ball park.

In my view, what’s likely to have spooked HICL shareholders is the whiff of retrospective change suggested by the government’s proposals. Markets hate uncertainty. The idea that the terms of a long-term arrangement could change unpredictably midway through is likely to be offputting for many investors, I’d imagine.

Where does that leave TRIG shareholders? Now that the company is no longer in an offer situation, I’d hope that its management might comment on the government’s proposals.

TRIG’s H1 results suggested to me that cash flow cover for its dividend is going to be very tight indeed.

My impression is that asset sales have been slower than expected this year. Prior to the HICL offer, TRIG was in the process of arranging a new financing facility, which I understand would be used to support growth investment and the repayment of its existing credit facility.

However, the company reiterated guidance for a 2025 dividend payout of 7.55p per share in its interim results, so perhaps this year’s distribution will be safe.

However, my feeling is that a cut may become necessary next year if weather and power pricing do not become more favourable over the winter.

One option that might provide more certainty for investors is if TRIG can secure further long-term corporate power purchase agreements (PPAs) similar to the one recently agreed with Virgin Media O2. This type of arrangement reduces exposure to both subsidies and power price volatility and should provide reliable cash flow with good visibility.

As a shareholder I am somewhat on the fence here. TRIG shares are now trading at what appears to be a record low of 71p – a 35% discount to NAV (30 Sept 25: 109.7pps):

Based on dividend guidance with the interim results, this price implies a 10.6% dividend yield.

However, my confidence in the security of this dividend is weakening.

Today’s update was brief with TRIG’s broad reiterating their confidence in the company’s standalone strategy and opportunities, but also suggesting further shareholder consultation is likely:

We are uniquely placed to capitalise on the demand growth for low carbon, reliable power and to capture the commercial opportunities as economies across the UK and Europe electrify and decarbonise. Doing so will allow us to deliver sustainable value and growth for our shareholders, with whom we will continue to engage on the path ahead.

I think we could see some consolidation in this sector over the coming years. Conditions are tougher and less certain than they were, but there’s clearly still a long-term opportunity and need for these assets, in my view.

I’m going to maintain my neutral view from November today in the hope that TRIG may soon provide a more concrete update to shareholders about its prospects and plans.

Solid State (LON:SOLI)

Down 1.5% to 140p (£80 million) - Interim Results - Roland - AMBER/GREEN ↑

We haven’t reported on this electronics group since late in 2024, when I took a neutral view on the interim results following a profit warning previously.

The shares have edged slightly higher over the last year but are largely unchanged, so it looks like my neutral view at that time may have been the right call.

H1 results summary

Today’s interim results show seemingly impressive growth, with revenue up 38.6% to £85.7m and adjusted pre-tax profit up by 96% to £4.9m.

However, this includes a heavy weighting from a defence communications order that was delayed in the previous year and contributed £23.3m of revenue. Stripping this out gives underlying revenue growth of only 3.6%, according to management.

This business is increasingly active in the defence sector, which seems to be helping to offset weakness in some areas from industrial customers. Trading commentary suggests a positive outlook in a number of areas:

Components: divisional revenue rose by 11.9% to £30m, with good demand from contract manufacturers in the Defence & Security (D&S) markets offsetting some weakness elsewhere. Post period end, the company has seen “an upturn in order intake” giving confidence of “stronger billings” in H2.

Systems: this division benefited from the delayed revenue in H1 but management says the company is investing in new capacity that will provide “significant capacity for growth over the coming years to 2030”. Upfront investment has diluted margins, but utilisation is improving – including through a new contract with the UK MoD.

Power: revenue up 26.9% to £17.0m, with deliveries building for orders secured last year from “key Tier 1 customers in the medical, drone and naval maritime sectors”.

Profitability: The group’s adjusted operating margin improved to 6.5% in H1 (H1 25: 5.1%). While I might quibble over some of the adjustments, there’s no doubt margins do seem to be recovering here.

Using broker forecasts operating profit for the current year, my sums suggest return on capital employed could improve to 10.2%. That’s still low, but would represent a convincing move back to historic levels of profitability:

The company has a medium-term margin target of 10% which sounds reasonable to me. Achieving this would be likely to drive a further improvement in returns.

Outlook & Estimates

Solid State is investing in its business to support the growth opportunities identified by management. The company admits this is holding back margins in the short term, but I agree that it should be the correct approach for longer-term growth.

Although some short-term economic headwinds in the US and UK are resulting in some delays or downsizing of orders, today’s commentary sounds confident in the outlook, particularly in D&S:

As a result of macro-economic uncertainty both in the US, with the impact of tariffs, and the recent UK budget, we have seen customers placing shorter orders and delays in placement of orders. Despite these headwinds, we are identifying promising opportunities, where we have seen a notable improvement in the project pipeline and contract awards within the D&S sector, as noted above as well as several important follow-on orders within the Components division. This reinforces our confidence in delivering Second Half performance in-line with the revised expectations.

Looking ahead to 2026 and beyond, the Group's initial communications order under project CAIN gives confidence that additional major projects and revenue opportunities will arise as the communications technology is adopted by a growing number of D&S users across the NATO alliance.

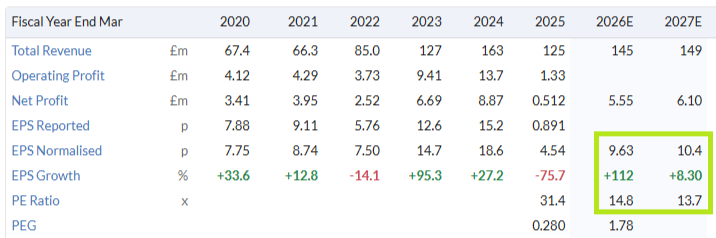

Broker forecasts I can see are unchanged today and closely mirror the consensus figures on the StockReport:

Roland’s view

A management transition is currently underway following the recent death of the long-term CEO, Gary Marsh, who led the company for 20 years. However, Solid State has also announced the appointment of a highly-experienced new chair today – the former CEO of Thales UK – who sounds well suited to lead the task of appointing a permanent replacement CEO.

I took a neutral view in December last year and based on near-term earnings forecasts alone, I might be tempted to do the same today. After all, a mid-teens P/E rating seems enough for Solid State based on recent performance.

However, I am cautiously optimistic about the recovery story here and encouraged by the company’s longer-term track record of growth:

Having spent more time looking at today’s results than I initially planned to, my feeling is that the business is putting itself in a good position to benefit from structural trends in defence-related areas, while also being able to benefit when more cyclical commercial markets recover.

On balance, I think Solid State could be worth a closer look at current levels on a medium-term view. For this reason, I’ve decided to upgrade my view by one notch and go AMBER/GREEN today.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.