Good morning!

Spreadsheet accompanying this report: In case you missed it, we have our spreadsheet up to date now.

Gold rally: gold has now soared through the symbolic $5,000 level.

Today's Report is complete - thanks everyone.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

GSK (LON:GSK) (£73.4bn | SR91) | The RSV vaccine, Arexvy, has been approved by the European Commission for use in adults aged 18 years and older. Enables European countries to make the vaccine available to all adults (previously ages 50+ only). | ||

Grainger (LON:GRI) (£1.4bn | SR87) | Connected Living London will forward fund and acquire a 195-home Build to Rent (BTR) scheme in West London to be developed in partnership by Barratt Redrow PLC. Purchase price £68.4 m. | ||

Thor Explorations (LON:THX) (£605m | SR99) | Douta gold project in Senegal: “PFS confirms a robust, long‑life gold project with strong economics, a substantial Mineral Reserve base, and a clear, accelerated pathway to development - underpinned by significant potential for further resource expansion.” | ||

Costain (LON:COST) (£432m | SR77) | Removal of dividend parity arrangement with pension scheme trustee; Costain plans to almost double dividends. Also intends £20m share buyback in FY26. FY25 adjusted operating profit in line with market expectations (£46.4m). “Remains confident of further progress in FY 26 and a step change in performance in FY 27 and beyond.” | GREEN ↑ (Graham) Tentatively upgrading this to fully GREEN as it appears to have multiple forms of momentum working in its favour (business, financial and in terms of its share price!). However, I’d be quick to pull back from this position if news flow turned negative, as this is a risky sector and I’m not sure its earnings multiple really should be much higher than the current valuation (after adjusting for net cash it's perhaps trading at 8x trailing earnings). | |

Gulf Marine Services (LON:GMS) (£251m | SR85) | New mid-class vessel to join the Group's 14 vessels fleet in the coming two weeks. Net leverage remains below 2.0x, excluding any EBITDA contribution from the acquired vessel. | AMBER/GREEN = (Mark) | |

Concurrent Technologies (LON:CNC) (£220m | SR72) | Kratos (32 Core) central processing unit (CPU) offers up to 60% more processing power compared to the original 20-core Kratos launched in March 2025. | ||

Orosur Mining (LON:OMI) (£147m | SR31) | $16.28m cash as of Nov 2025 (end of Q2). No revenues, $4.5m loss. | ||

Scancell Holdings (LON:SCLP) (£137m | SR23) | FDA has cleared its Investigational New Drug application for a registrational Phase 3 trial of its iSCIB1+ Immunobody® in advanced melanoma, with progression free survival as the agreed surrogate endpoint. | ||

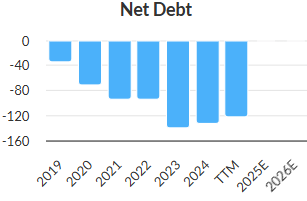

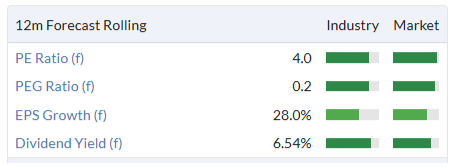

S4 Capital (LON:SFOR) (£130m | SR43) | 2025 is ahead of the revised guidance and above current consensus of net revenue of £664 million and EBITDA of £75 million. LfL net revenue to be down c. 8.5%, with operational EBITDA margin c. 12%. Net debt significantly below consensus £133m, and below previous guidance range £100-140m. Leverage multiple 1.1x vs. consensus 1.8x. | AMBER/RED ↑ (Graham) Upgrading this as solvency risk appears to be off the table (for now), and the long run of downgrades has ended (for now). However, I can't bring myself to upgrade our stance by more than one notch, considering that net revenue is only now going to meet what the company was promising prior to the November profit warning. Also, the financial results tend to be unclean: it remains to be seen how much of 2025's "EBITDA" will turn into real profits. | |

Venture Life (LON:VLG) (£83.2m | SR49) | Revenue £35.1m, +11% on a proforma basis after a change to accounting reference date (+1% price, +10% volume). 31 Dec Net cash £34.4m (30 Sep: £34.1m). Remains confident in achieving management's revenue and Adjusted EBITDA expectations for the seventeen-month accounting period ending 31 May 2026. | AMBER = (Mark) | |

Andrada Mining (LON:ATM) (£79.5m | SR26) | Grab samples returned grades exceeding 4% Li2O, with a peak value of 4.67%. | ||

Lendinvest (LON:LINV) (£49.3m | SR39) | FuM £5.44bn, AuM £3.61bn, Q4 lending totalled £360m. | AMBER = (Graham) [no section below] I’’m keeping an open mind on this property lender and platform, as detailed research would be needed to get comfortable with the risks involved. Checking the H1 financial statements (for Sep 2025), I note that net assets were some £73m, a nice premium to the market cap. It uses securitisation to get assets off its balance sheet but as of Sep 2025 did need £855m of borrowings to fund its balance sheet. The ability to earn platform/asset management fees is the most interesting aspect of this business to me, and today’s Q4 update suggests that it continues to generate solid overall growth. However, it appears to take very significant bets with its own capital, so I’m unable to take a more positive stance without a deeper understanding of how it manages this risk. | |

Van Elle Holdings (LON:VANL) (£39m | SR85) | H1 Revenue +16% to £73.4m, U/L EBITDA -7% to £5.7m, U/L PBT -14% to £1.9m, U/L EPS -7% to 1.4p. Net debt £2.1m (24H1: £2.1m). Orderbook +8% to £44.9m, remains confident in achieving market expectations for the full year (U/L PBT £3.0m). | AMBER/RED = (Mark) | |

Kavango Resources (LON:KAV) (£23.8m | SR3) | Total of 7,714m were drilled, comprising 3,556m of RC drilling and 4,158m diamond drilling. Results from the RC drill programme are expected to be released in the coming weeks. | ||

Sound Energy (LON:SOU) (£19.8m | SR27) | Both TE-6 and TE-7 wells have now been successfully and safely flowed to commission and their respective parts of the Gas Gathering System tested. | ||

Powerhouse Energy (LON:PHE) (£19m | SR2) | Leased a 1.98 acre serviced site at Silverwood Business Park, Ballymena, Northern Ireland, for 25 years. Applying for planning permission for a 40tpd waste to hydrogen plant. | ||

Nanoco (LON:NANO) (£16.8m | SR12) | No longer actively seeking a buyer. Instead, carefully investing its resources in existing high-potential business areas, while minimising the Group's operating costs to 300-400k/month. CEO leaves in February 2026, non-exec Chair becomes Exec Chair, CFO becomes Interim CEO. | AMBER/RED = (Mark) [no section below] | |

Oriole Resources (LON:ORR) (£16.7m | SR25) | Four holes returned gold intersections, incl. 16m at 2.5g/t from 160m. | ||

Harena Rare Earths (LON:HREE) (£10.7m | SR4) | Pre-feasibility study shows, post Tax NPV10 of US$249.6 million and Payback period of 4 years. | ||

Rockfire Resources (LON:ROCK) (£10.6m | SR21) | 4th drill hole completed, next commenced. Initial readings indicate 1.75m of 23% Zinc from 36m. |

Graham's Section

Costain (LON:COST)

Up 10% to 177.8p (£474m) - New Pension Scheme Agreement & FY25 Trading Update - Graham - GREEN ↑

Excellent news here as Costain’s strong balance sheet (e.g. £145m of net cash at the interim results) is being unlocked for shareholders, in agreement with the company’s pension scheme trustees.

The company raised £100m back in 2020, and has been cash-rich ever since.

Checking the FY2024 results to see what the position was last year, I find the following info:

“Dividend parity” required the company to make matching payments to its pension scheme, whenever its dividends (plus buybacks) were greater than its pension scheme contributions.

However, as the pension scheme was already considered to be fully funded, or close to it (“funding level on a Technical Provisions basis was more than 101%”), dividend parity was suspended for a year, from July 2024 to June 2025.

Today’s news is therefore a more permanent version of what the company already achieved in 2024.

Dividends have been slowly increasing, but can now ramp up much faster.

Adjusted EPS is forecast at 14p for FY25. Assuming dividend cover of 3x, the total dividend for 2025 could in theory be increased to about 4.67p. That would cost £12m at the current share count.

As noted by Costain, the full-year dividend could almost double as a result of this breakthrough. For 2024, the full-year dividend was just 2.4p.

And they say their intention of 3x dividend cover, if confirmed, “would commence with the final dividend for FY 25”. This would mean a generous final dividend. The interim dividend was only 1p, so they would need another c. 3.67p from the final dividend to hit their target.

Buybacks: on top of increased dividends, and in the absence of a “dividend parity” rule, the company is free to make whatever buybacks it chooses. And so, a £20m buyback is planned this year, which to me is a pretty impressive return of capital. At the current market cap, it would reduce the share count by about 4%.

FY25 update

Fortunately, it very much looks like Costain can afford to pay out these dividends and to make the planned buyback. 3x dividend cover is still a very conservative level of cover, and the cash balance is impressive and increasing.

Net cash of £171m was forecast for December 2025, but instead it came in at £190m:

FY 25 net cash ahead of market expectations, benefitting from working capital timing

Don’t read too much into the “ahead” statement: working capital will be volatile at any large contractor, and a “timing” benefit is only temporary. An average daily figure, along with a maximum and minimum, would be far more meaningful.

As for profits, adjusted operating profit is expected in line with expectations (£46.4m).

Large contract awards include utilities delivery at Sellafield, project controls services with EDF, decommissioning at the Trawsfynydd nuclear power station in Wales, and a place on the Eastern Highways Alliance framework contract.

Forward-looking guidance is not very specific at this stage, but is confident:

Given the strong market environment, substantial contract wins, the continued expansion of existing framework contracts and high levels of bidding activity, the Group remains confident of further progress in FY 26 and a step change in performance in FY 27 and beyond.

Graham’s view

Well done to Roland who upgraded our stance on this to AMBER/GREEN in October, when news of the £1bn Sellafield contract was published.

I’m going to treat the “real” net cash figure as £171m, as the actual £190m result sounds like a temporary win.

On that basis, the enterprise value today is about £300m or 114p per share. With 14p of adjusted EPS for 2025, that gives a cash-adjusted trailing P/E multiple of 8x. But do bear in mind that the stock would be much riskier without that net cash cushion. So "adjusting out the cash" is not something that should be done blindly!

Looking ahead, EPS is seen rising to 15p in the current year, and then 17p next.

I’m not sure if this is worth another upgrade to GREEN. In pure valuation terms, I don’t think it’s justified, as I think this type of business probably should trade on a single-digit earnings multiple, especially if we are adjusting out its net cash balance to calculate that multiple.

However, it’s enjoying lots of positive momentum right now:

Business momentum with that £1bn Sellafield contract, and “continuing to secure strong volumes of new work”.

Share price momentum (MomentumRank 75 before today’s news)

Financial momentum: the net cash balance has become so large that a £20m buyback is seen as a solution.

Therefore, I will tentatively upgrade this to GREEN, but it’s the type of situation where I’d be quick to pull it back again if news flow turned negative.

S4 Capital (LON:SFOR)

Up 32% to 25.55p (£171m) - Fourth Quarter Trading Update - Graham - AMBER/RED ↑

It’s a great update from this beleaguered stock whose market cap was previously measured in the billions:

S4 Capital plc (SFOR.L) confirms that 2025 full year trading was ahead of the revised guidance issued on the 24 November 2025 and is above the current consensus of net revenue of £664 million and operational EBITDA of £75 million. The Company expects like-for-like net revenue to be down circa 8.5%, with an operational EBITDA margin of circa 12%.

The November update was a profit warning and I downgraded our stance on it to RED (from AMBER/RED) that day.

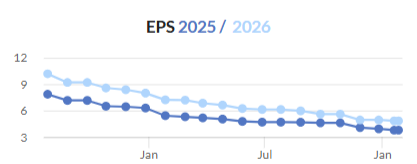

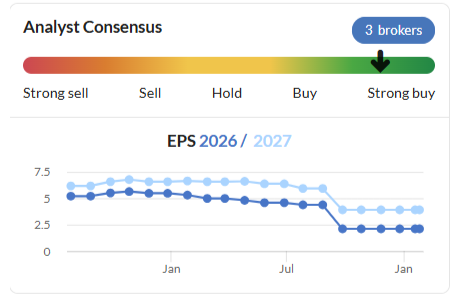

After a relentless decline in EPS forecasts, the market appears euphoric today that the run of downgrades has finally ended (for now):

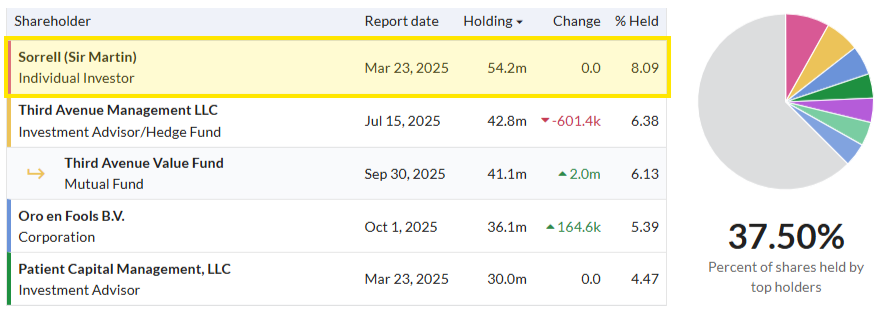

Martin Sorrell owns only 8% of this business, so there are plenty of other shares to be traded. In other words, today’s 32% gain is not just a function of illiquidity:

However, one factor that could be influencing today’s gains is the outstanding short positions. At least 1.2% of the stock has been borrowed.

Anyway, let’s turn back to the trading update.

In November we were warned that LfL revenue would be down by “just under 10%”, and EBITDA guidance was reduced from £81.6m to £75m.

Today the LfL net revenue guidance is improved to minus 8.5%. Based on last year’s net revenue figure, I’m going to interpret that as implying c. £690m for 2025, which is 4% above consensus.

Applying the EBITDA margin of 12% to that figure, I get a new EBITDA figure of almost £83m, 10% above consensus.

Please bear in mind that 2024’s net revenue and EBITDA were £754.6m and £87.8m, respectively.

The figures that I have come up with for 2025 (£690m and £83m) are still materially below those figures. But clearly not as bad as was feared.

What heightens the stakes is the debt situation, and there is good news on that front too:

Net debt will be both significantly below current consensus of £133 million and below the previously indicated range of £100-140 million, following a change in Treasury management and a consequent strong focus on working capital management resulting in an improvement in liquidity.

The net debt to operational EBITDA ratio at the end of 2025 is expected to be approximately 1.1x versus current consensus of 1.8x and well below the target of 1.5x.

I noted a few months ago that SFOR appeared to be in the unenviable position of having a net debt figure higher than its market cap.

Today that is no longer the case, and it’s not particularly close (net debt below £100m, market cap £171m).

That’s a big turnaround. The new leverage multiple is modest (1.1x) and even permits SFOR to plan to maintain its 1p dividend. Presumably short-sellers (and the market in general) suspected that this dividend might get cut?

Comments from Sir Martin Sorrell, Executive Chairman:

"Good to see both delivery beyond revised net revenue and operational EBITDA guidance and the significant improvement in liquidity. However, there is still much more to be done around net revenue and margin growth in 2026 and beyond which we will cover with the 2025 results presentation in March. The recommended 1p final dividend is an indication of the Board's confidence in continued improvement. In an increasingly volatile world, clients continue to carefully assess where they should expand geographically and how they can apply new technologies such as AI, Blockchain and Quantum to increasing efficiency."

Graham’s view

I can’t stay fully RED on this after the trend of falling EPS forecasts reverses in such a dramatic fashion.

Solvency does not appear to be threatened in the short-term, which is a major plus point.

But to state the obvious, it is still shrinking year-on-year.

Also, historical results have been messy with very large adjusting items, so I’m cautious as to how much of the EBITDA margin is going to convert into real profits. The improvement in the cash position does at least suggest that a portion of it will convert. But let me remind you:

2024: EBITDA of £88m turned into an operating loss of £303m

2023: EBITDA of £94m turned into an operating profit of £20m.

The adjusting items are not just amortisation and impairment, either: they have included large share-based payments and “restructuring and other one-off expenses”.

This makes me reluctant to take it back to neutral yet, even if it is “cheap”:

If I scroll back to the Q3 update (prior to the profit warning), I find that 2025 guidance was for “like-for-like net revenue” growth rate expected to be down by upper single digits”.

That is what the company is actually delivering (down 8.5%), but they have had a profit warning and now an upgrade in the meantime.

So although today’s news is excellent and the rise in the share price today is astounding, the best I can do is AMBER/RED.

Mark's Section

Van Elle Holdings (LON:VANL)

Flat at 36p - Interim Results - Mark - AMBER/RED =

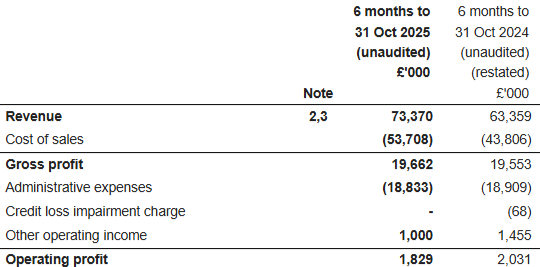

The recovery in revenue looks good, rising 16% to £73m. However, this isn’t enough to save them from declining profitability. Admin costs look well controlled, coming in at £18.8, for the half, versus £18.9m the year before. So all of the fall comes from declining gross margins. Gross margin was consistent in FY25 across both halves at 31%. Gross margin drops to 27% in these results, meaning that Gross Profit is flat despite the increase in revenue. Lower, other operating income therefore means that the Operating Profit declines:

That other operating income is R&D expenditure credit, which you have to feel must be lumpy, given that this isn’t exactly at the cutting edge of technology development in the UK.

The only comment they make on margins is that:

Underlying operating profit margin of 2.8% driven by product mix which is expected to improve in the second half with more higher margin, complex projects mobilising.

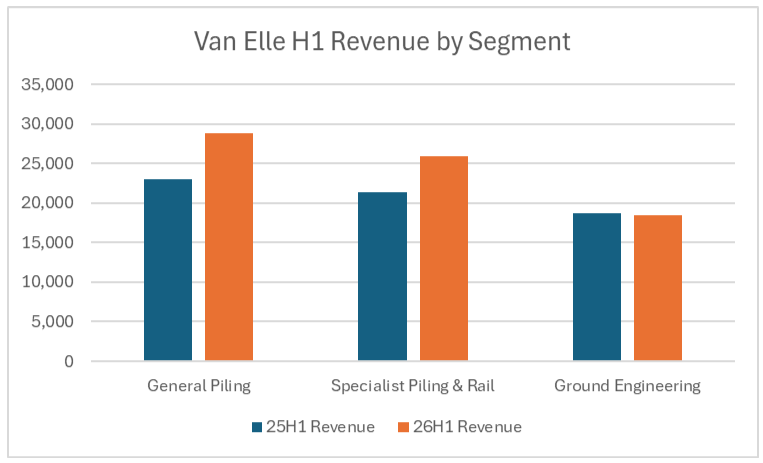

This mix effect must be at the project level, as there is no significant change in mix at the segmental level:

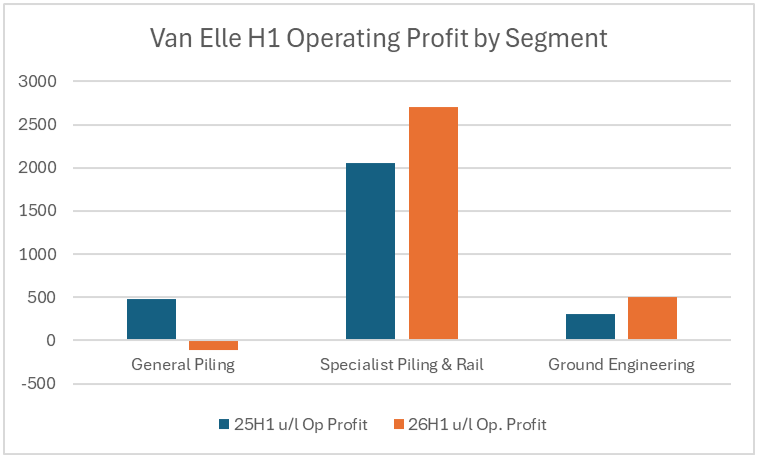

A decline in u/l operating profit in General Piling appears to be the reason for the fall:

The comment they make here is:

The division continues to be impacted by weak market conditions resulting in highly price sensitive opportunities.

This sounds like code for overcapacity in this sector leading to companies taking on business at a loss just to cover some of their costs. There are some signs that things may improve. However, these developments don’t sound like they are going to have an immediate effect on market conditions in this sector:

Residential sector revenues decreased further compared to a relatively low base in the previous year. This primarily reflects the continued delays to Building Safety Act approvals for high-rise residential buildings, particularly in London. Recent announcements by the government to put processes in place, including staged applications, to speed up decisions on new build schemes, is encouraging.

Regional Construction sector revenues increased significantly compared to the previous year, mainly due to the largest industrial project for several years currently being delivered at Forgemasters in Sheffield.

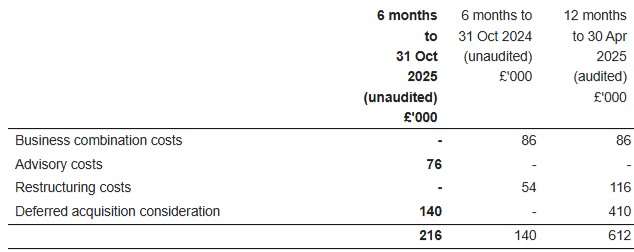

Adjustments:

The figures they disclose as exceptional are relatively minor and it is good to see that they don’t just book restructuring costs as exceptional in every period:

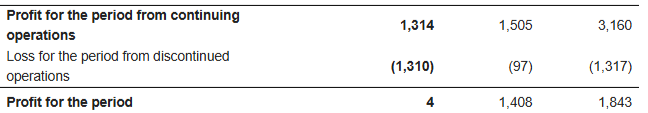

However, things are less good when we look at the discontinued operations, where they wouldn’t have barely scraped a profit if these were included:

This relates to the Canadian Rail Subsidiary. The sale was announced on 15th December and completed on the 19th December, so while the intention was clearly to discontinue this at the accounting date, it wasn’t actually discontinued at the 31 October. The maximum consideration they received for this is CAD4.7m, which is around £2.5m, less than the £2.6m of losses they have incurred here over the last 18 months. So while it is good that these losses won’t be in future periods (at least from 19th December), it is fair to say that operating in Canada hasn’t been a great move overall.

Outlook:

There is an increase in orderbook to £44.9m, but it is worth noting that this is less than half a year’s revenue, meaning visibility isn’t strong. And as today’s results show, revenue estimates don’t make much difference unless we also have some guidance on the margins achievable on that business.

The company re-assures investors that it is trading in line with expectations. So unsurprisingly, brokers leave their forecasts, unchanged, with Zeus saying:

Despite c. 63% cover at the adj. PBT level 6 months into the year, Zeus leaves forecasts unchanged this morning, remaining cautious over full year results due to poor weather in recent weeks impacting on activity.

However, it is worth reminding ourselves that EPS forecasts were halved in the Summer:

So hitting FY26 forecasts here shouldn’t be challenging.

Looking further ahead, the company is optimistic:

Growth in the rail and water sectors is also anticipated, as activity levels are expected to accelerate during the CP7 and AMP8 investment cycles.

The medium-term outlook for the residential sector is very strong, with the Government pledging 1.5 million new homes in the current parliament. For high-rise developments, the recent announcements by the Government to address Building Safety Act delays are encouraging where there have been significant delays to the commencement of numerous high-rise schemes, particularly in London.

And if this does lead to the recovery that brokers forecast, then this will trade at a P/E of less than 10. However, recent trends don’t give a huge amount of confidence that this has turned a corner.

It is worth looking at excerpts from the previous outlook statements:

January 2024:

Good progress is being made on the Group's strategies in the energy and water sectors, both of which are expected to deliver significant growth opportunities into the medium term. Several customer frameworks have been agreed in the Period and initial schemes are expected to commence in late FY2024.

The new build housing and residential sector is expected to remain challenging in the short term but there are early signs of market recovery, and the Board anticipates a return to higher volumes in FY2025.

The commercial and industrial markets show signs of increased confidence compared to the last 12 months, underpinning expected an increased utilisation in FY2025 in the General Piling division.

January 2025:

Housing is showing signs of recovery and, despite the slow start to Control Period 7, our rail activities are increasing due to our diverse spread of customer relationships and ongoing TransPennine Route upgrade works.

We expect several delayed projects in London and the South East to proceed once the Building Safety Act approval delays are unblocked during 2025.

Our strong position in energy and water is expected to yield materially increased volumes from FY26 onwards as current design phases develop towards project starts.

So their hopes of recovery in their end markets have been dashed on the rocks twice in a row. So I am a little sceptical that it is all going to change in FY27.

Balance Sheet

Things look better on an asset basis. Although they have net debt, the bulk of these are lease liabilities and they have net cash after bank borrowings and provisions. Current assets exceed current liabilities meaning that there are no short-term insolvency concerns.

Total equity has declined to £53.8m from around £54.5m in previous periods. While they have sold assets such as their transportation division and the Canadian rail subsidiary at book value, this has been offset by the exceptional losses. £4.5m of those assets are intangible, giving a £49.3m tangible book value. This compares favourably to a current £39m market cap. However, these assets have not been productive in the past few years.

Mark’s view

I downgraded this to AMBER/RED following the big profit warning in September. While that marked the third clear profits warning, and today’s trading update is in line, that is unimpressive given the scale of the previous downgrades. This in line also required classifying the Canadian Rail subsidiary as discontinued, despite it operating for the full half-year period. I don’t doubt the accounting treatment as this was subsequently sold post-period end, just from an economic standpoint this did impact their trading.

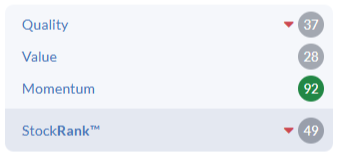

The StockRank isn’t too bad, and the balance between the Ranks actually sees this get a SuperStock moniker:

However, the lack of stand out rank actually puts me off as it doesn’t fit into any obvious category. It should be a recovery stock, but the declining EPS means that I struggle to see it as a Momentum play, and the typically single-digit ROCE makes me think its Quality aspects are limited.

The discount to tangible assets may still be attractive to some, and may yet lead to a competitor viewing them favourably as an acquisition target. However, over the last few years, they have been very positive about the medium-term outlook for the business, only to repeatedly profit warn due to weak end markets. There are political factors in the UK that may have affected this unexpectedly, and in cyclical markets they will be right one day. However, given all this, I don’t place very much faith in the forecasted strong recovery in 2027 and 2028 and hence it seems too soon to consider upgrading our view.

Gulf Marine Services (LON:GMS)

Down 1% at 21p - Vessel Acquisition - Mark - AMBER/GREEN

Recent contract extensions here have been well-received here, and although they didn’t contain any information about improved rates (which is key to making the assets here productive) they certainly help make the case that demand is strong in the sector. It is perhaps unsurprising then that management are keen to expand the fleet:

…has entered into an agreement to acquire a new mid-class vessel…This vessel is expected to join the Group's 14 vessels fleet in the coming two weeks and will enable GMS to capitalise on the current strong market demand.

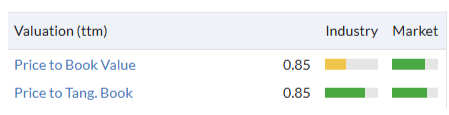

However, I can’t help feeling that this is the exact opposite of what shareholders would like to see. They don’t say what the paid for the vessel, although a $37.4m 90-day interim loan suggests it is in the region of this amount. Their broker Zeus say that their assumption is that the company has added cash to this for a total acquisition price of around $52m. Given that the market for maritime vessels is relatively liquid, I can only assume they paid the market value. Not an issue in itself, until you understand that despite recent enthusiasm for the shares, the company trades below tangible book value:

For the transaction to make economic sense versus buying back their own shares, we are left with two main possibilities:

The book value on the balance sheet doesn’t reflect market value.

The current corporate structure is suboptimal, with too few vessels to cover corporate overheads.

There is a third possibility that management prefer to empire build. Given the history, where management took on a huge amount of debt to buy assets in peak market conditions, this may be a little worrying. The company barely survived without wiping out the equity last time. Although, the issue with shipping is often the long-lead times on shipbuilding. At least they have bought an existing ship that can be operated almost immediately. Perhaps the time to worry is when they start ordering from shipyards!

A more simple explanation may be that the banking syndicate is currently able to block share buybacks, whereas they will lend against additional ships. Given the discount to Tangible Book Value, shareholders would still prefer they sold ships and allocated this cash to buybacks, rather than acquiring ships.

[As an aside, it is worth listening to this podcast on the difficulty for an activist shareholder to actually close a NAV gap. In this case, it was Avation in a different industry, but the learning is the same. There are often multiple complexities that external shareholders don’t understand, even when a value-creation option looks obvious (sell assets and buyback shares to close a discount to TBV).]

In terms of this vessel acquisition, the company says “Further announcements relating to backlog and revised adjusted EBITDA guidance for 2026 will be made in due course.” However, Zeus has had a stab at updating their numbers, saying:

If we assume the new vessel is received and placed on contract such that it can deliver a 75% utilisation rate for GMS in 2026, and use our current mid-size vessel 2026 day rate assumption, this implies that our 2026 EBITDA could increase to around US$120m (from our current US$113.0m)

So that’s assuming $7m additional EBITDA, and the company has paid 7.4x EBITDA for the vessel. Again, the issue is not the absolute figure, but that Zeus have them trading on 4.2x EV/EBITDA in 2026 on their existing fleet. This doesn’t seem to stack up compared to just buying back shares. Of course, if they can out this vessel on a long term contract at close to 100% utilisation, then this looks a bit better, but will still be at a premium to the existing fleet.

Mark’s view

The same concerns always come up when discussing this company:

Why do they have a preference for adding vessels and capacity versus paying out dividends and buying back shares?

How productive these assets really are and therefore how realistic the book value of the vessels would be if they were sold on the open market?

Will management fall for the same mistake and expand the fleet just as demand and rates are peaking?

The problem with today’s news is it underlines the risks of all three of these. They have purchased another vessel for what looks to be a premium to the value of their existing fleet on both assets and an earnings multiple, and done so before setting a consistent track record of paying shareholder returns.

However, these concerns are not new. So while today’s announcement isn’t ideal, and we can question whether it truly makes economic sense versus the alternative courses of action, it is only one ship out of 15. With the recent share price rise, it is getting closer to the level where we would have to assess how much upside remains, but with a discount to TBV (assuming asset values are realistic) and a forward EV/EBITDA still around 4, it isn’t there today. AMBER/GREEN

Venture Life (LON:VLG)

Flat at 66p - Trading Update - Mark - AMBER

Matters here are complicated by the sale of their operations and the change in year end. The key figures appear to be +11% proforma revenue growth driven by 1% increase in pricing and 10% volume. While it is comforting that their products appear to be in demand, there is a risk that they have little pricing power in a competitive market, and I would have preferred to see a more balanced mix between the two factors.

There is also a big variation in performance amongst regions:

Underlying this was strong performance in the UK where increased investment in advertising and promotion ("A&P") drove revenue growth of 20.7% to £25.7 million (FY24 proforma: £21.3 million). The international business declined 8.7% to £9.4 million (FY24 proforma: £10.3 million) and was attributable to order timing from partners.

They say the issues in international business are now resolved. When they sold their operations, a good chunk of the cash went into paying down debt. However, this also means that I think the current designation on the StockReport doesn’t reflect reality:

Which is reflected in the unduly low Quality Rank:

They now say:

As at 31 December 2025, the Company held a net cash position of £34.4 million (30 June 2025: £2.0 million) (30 September 2025: £34.1 million). The Company's share buyback programme that was announced on 30 September 2025 remains ongoing, and as at 31 December 2025 a total of £1.1 million had been returned to shareholders through the acquisition of approximately 1.7 million ordinary shares.

The good news is that the cash balance remains strong despite spending £1.1m on shares in the period. They also say they are trading in line. Cavendish have adjusted EBIT of £1.9m forecast which puts them on a forward EV/EBIT of 23. Not immediately cheap, even assuming that cash balance is used productively.

Things look much better if you take the future year forecasts, though. Cavendish have £4.6m EBIT for FY27 and £6.0m pencilled in for FY28. If this latter figure is accurate they would be an FY28 EV/EBIT of 5.2. This could be even lower if they can find suitable earnings-enhancing acquisitions to use that cash pile on.

Mark’s view

With the StockRank clearly going to be higher once the next set of results is included in the StockReport, it is tempting to take a more positive view. However, two things hold me back:

For the company to look cheap, it needs to deliver on forecasts two years ahead. The evidence is that broker forecasts are barely better than guesswork this far into the future. I don’t think this is a business where we can say there is a high level of predictability, and it is subject to how consumer trends develop in that time.

The record of companies where they sell their operations to focus on brands is patchy at best. Brand Architekts is the one that comes to mind for me. An initial investment boom from the cash that they received from their operations business appeared to be wasted, as they never really built sufficient scale. Their acquisition by Warpaint was partly a mercy killing! Venture Life is bigger and perhaps has more established brands, but they still leave themselves subject to the same trends. Which is why a potential lack of pricing power in today’s trading statement is concerning.

I’ll stick with AMBER, until there are signs they can deliver on earnings growth into FY27 not just on the less-challenging FY26 numbers.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.