Good morning!

Spreadsheet that accompanies this report: link.

11.15am: Roland and I have made a clean sweep of today's announcements. See you tomorrow!

US Jobs Report

The collapse of the Trump-Musk relationship has been dominating news headlines in recent days, but the actual economic data so far - in particular the US jobs report - has been far less explosive than the headlines might suggest.

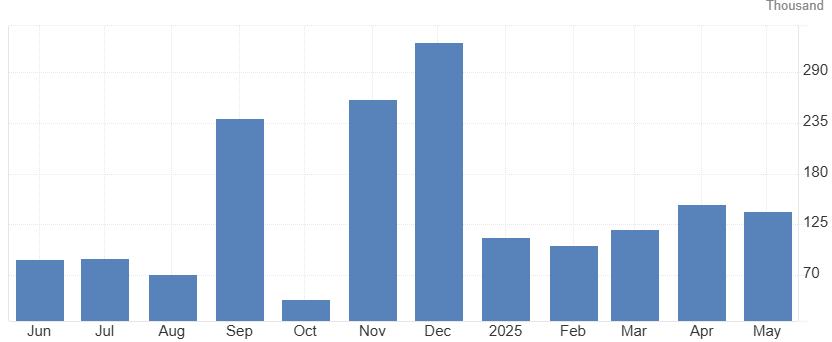

On Friday, the May jobs report came in slightly better than expected, with 139,000 jobs added, vs. 130,000 forecast.

This is not very strong growth - it's lower than April, and there are of course major concerns about the potential impact of tariffs. But for now at least, it seem inarguable that the US economy continues to perform reasonably well. Overall jobs growth has occurred despite sizeable cuts at the Federal government itself, which has been cutting jobs since January.

According to CNN, it is the 53rd consecutive month that the US economy has added jobs. This is the second-longest string of employment growth ever recorded.

US Non-farm payrolls. Source: tradingeconomics.com

The US unemployment rate is unchanged at 4.2%, which I interpret as "full employment".

So despite all of the dramatic headlines we've seen in recent days - and recent months - the economic reality when it comes to the domestic US economy is, for now, remarkably tranquil. Investors who have ignored the news continue to do well!

S&P500. Source: stockopedia.com

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Alphawave IP (LON:AWE) (£1.1bn) |

Alphawave has agreed a recommended cash offer of $2.4bn from Qualcomm (NSQ:QCOM). This is equivalent to $2.48 per share, or 183p. Shareholders can opt to receive Qualcomm shares instead. This offer gives a 59% premium to the six-month average price prior to bid speculation. | PINK (Roland) Today’s offer still leaves AWE shares trading c.50% below their 2021 IPO price. On a near-term view, the valuation of the bid looks strong, especially given the group’s debt position and negative free cash flow. However, on a longer-term view, my impression is that this business may have been approaching an inflection point for growth, so there’s probably still some value here for Qualcomm. In any case, this deal looks certain to go through in my view, given that four insider shareholders control over 45% of the stock. | |

Empiric Student Property (LON:ESP) (£685m) | Retracts statements it made at a meeting with an investment analyst last week. | PINK (Roland) [no section below] Today’s update is a little embarrassing for Empiric’s management, who appear to have made speculative remarks about the potential impact of a takeover by Unite (LON:UTG) in a private meeting. The company now acknowledges that these remarks were not supported by adequate analysis or regulatory dialogue. Despite being officially retracted by the company, the relevant statements are reproduced in today’s RNS so they’re available equally to everyone, not just the recipients of the related analyst note. | |

SRT Marine Systems (LON:SRT) (£166m) | $21.4m guarantee from Ocean Infinity replaced by Barclays supported by UK Export Finance. | AMBER (Graham) [no section below] Good news that there is no longer the threat of dilution from warrants issued to Ocean Infinity (SRT’s largest shareholder) as part of their contract guarantee. Note that there are still no published estimates for this stock from broker Cavendish, not even for FY June 2025! I’ve never trusted this company’s forecasts, and the lack of any estimates seems to confirm that I’ve been right to be sceptical. Based on current projects, profitability should take off from here. There is a $213m contract in Kuwait and another for €167m in Indonesia. | |

Synectics (LON:SNX) (£57m) | Comfortably in line. Solid order intake, ongoing new business momentum, strong cash position. | AMBER/GREEN (Roland - I hold) Today’s update sounds fairly confident and leaves full-year forecasts unchanged. I remain positive here, but I’d like to see improving profitability and perhaps an upgrade to forecasts to justify a fully green view. | |

Petra Diamonds (LON:PDL) (£39m) |

Tenders 5&6 saw 613,682 carats sold for $53m (avg $86/carat). YTD sales $239m, 27% below the equivalent figure of $329m from FY24. Pricing assumptions for FY25 remain under review. | RED (Roland) [no section below] Conditions in the diamond market are very tough at the moment, due to weaker demand and the growing popularity of lab-grown diamonds. Petra shares trade at a deep discount to book value, but the group is also heavily loss making. An even bigger concern for me is $258m of net debt (Mar 25), with $231m of notes due for refinancing in 2026. Shareholders were heavily diluted in a 2021 restructuring and I think there’s a risk this could happen again. I completely agree with the StockRank’s view of this stock as a potential Value Trap. One to avoid without specialist sector insight, in my view. | |

James Cropper (LON:CRPR) (£27m) | £15m facility, matures in March 2030. Quarterly instalments are made smaller at the start and larger at the end. Shore Capital estimate: net debt £13.5m as of March 2025. New CEO as of Jan 2025. | AMBER/GREEN (Graham) [no section below] | |

Revolution Beauty (LON:REVB) (£23m) | Confirms Frasers (LON:FRAS) is one of the parties doing due diligence on a possible offer. | RED (Graham) [no section below] I’ve been consistently RED on this given various red flags and especially as I believe their funding situation is serious (see here). Net debt finished FY Feb 2025 at £26m; they have admitted that “cash management has been tight” and that they’d benefit from “a more robust capital structure with additional capital”. In my view, shareholders are relying on a bidding war between rival suitors and while that is a possibility, it strikes me as a speculative foundation for an investment. | |

Cordel (LON:CRDL) (£18m) | SP -21% | RED (Graham) This doesn't strike me as the worst pick, if I had to choose a speculative nano-cap. But as it's very small, barely profitable, and has issued a profit warning at this very late stage in its financial year, I think RED is fair. | |

Petards (LON:PEG) (£4.7m) | £0.3m contract to supply roadside ‘NASBox’ ANPR systems to a UK police force in the current year. | AMBER/RED (Roland) [no section below] Today’s contract win is only equivalent to 2% of FY25 forecast revenues, so is not that significant in itself. I’m a little concerned that Petards has still not announced FY24 results, especially as FY23 and H1 24 showed operating losses. This could be a value trap situation, as suggested by the StockRanks. Delisting risk is also a consideration. However, this small-cap boasts management ownership and has been profitable in the past. It might be worth a second look for micro cap investors when the FY24 results are (eventually) published. | |

Totally (LON:TLY) (£0m) (suspended on Friday) | No return to shareholders is expected. | RED (Graham) [no section below] As suggested by Roland, shareholders face a total loss of their investment. |

Graham's Section

Cordel (LON:CRDL)

Down 21% to 6.4p (£14m) - Trading Update - Graham - RED

I’ve not said too much about this one in the past. In October, I was AMBER on the basis that it was still such an early-stage company, and I didn’t wish to take a strong view on it.

The company provides “AI-powered railway inspections”.

Today, unfortunately, it issues a profit warning.

The new revenue forecast for FY25 is £4.7-5m, well below the existing forecast of £6.2m.

FY25 is the financial year ending June 2025, i.e. this month. I’m surprised that the profit warning wasn’t issued already - did they only just realise that they were going to miss the sales target for the year?

An excerpt from the CEO comment:

We have made excellent strategic progress in FY25 though are expecting to report a lower than forecast full year revenue result, hence this early update on the likely outcome for FY25. Economic uncertainty, particularly in the USA, has unfortunately led to protracted sales cycles and delayed revenue, which has impacted our normally strong second half revenue. Sales momentum has recently recovered, though the majority of the revenue from new contracts is now expected to be recognized in the next financial year (FY26).

So much for my comments on the strength of the US economy - US economic uncertainty is having an impact here, apparently!

The CEO also says that the closing cash position will be improved vs. the prior year. With thanks to Cavendish, I can see that there has been no change to the cash forecast at £1.1m.

Key forecast changes:

FY June 2025: no change to the adjusted PBT forecast (a loss of £0.4m), thanks to reduced operating expenses.

FY June 2026: a reduction in the adj. PBT forecast, from £0.6m down to breakeven, as the revenue forecast for that year has also been adjusted lower from £8m to £6.2m.

Graham’s view

I haven’t got a strong view on Cordel’s technology, which would require deeper research, but consistent with Stockopedia’s stock market philosophy I should take a RED on this now, to reflect the fact that profit warnings tend to be followed up by further disappointments.

This did not have strong numbers to begin with:

The company does have some attractive features, including an impressive client list in the rail industry and a balance sheet that according to forecasts will maintain a (small) net cash balance.

Therefore, as far as speculative bets are concerned, this doesn’t strike me as the worst pick. But to reflect what I perceive as high risk, I’ll take a negative stance. All companies of this size and profile (small and barely profitable) are risky, and when profit warnings are involved, that’s just one more reason for caution. But I will be glad to revise and hopefully upgrade my stance if future trading updates are on track.

Roland's Section

Synectics (LON:SNX)

Up 2% to 328p (£59m) - Trading Update - Roland - AMBER/GREEN

At the time of publication, Roland has a long position in SNX.

Synectics plc (AIM: SNX), a leader in advanced security and surveillance solutions, is pleased to provide an update on trading for the six months ended 31 May 2025 ("H1 2025").

This small-cap technology group has issued a half-year trading update today following its 31 May half-year end.

Reassuringly, management confirms that trading for the year ending 30 November is “comfortably in line with market expectations”.

Use of the word “comfortably” can perhaps be read as a sign that there’s scope for full year results to be ahead of expectations, if H2 progresses well.

Management’s commentary today emphasises healthy order flow so far this year from new and existing customers. An example of the latter is last week’s casino win.

Synectics says the order book for this year “remains strong” with “a number of sizeable projects” due to be delivered in the remainder of this year. Hopefully none of these will be delayed and trigger a profit warning.

Outlook: the company helpfully includes FY25 market expectations in its update today for the benefit of investors without access to broker notes:

FY25E revenue: £65m

FY25E adjusted PBT: £5.3m (before share-based payments of c.£0.5m)

Forecasts from house broker Shore Capital are unchanged today, suggesting earnings could rise by 15% to 24.9p per share this year. A similar increase is pencilled in for FY26, leaving the shares trading on a fairly modest earnings multiple:

Roland’s view

We’ve covered this small-cap security and surveillance technology firm quite a few times over the last year:

Synectics seems to be a relatively prolific RNS poster, often flagging contract wins even though these appear to be business as usual and have not altered forecasts. The outlook has been largely stable over the last 18 months, except for an update with the FY24 results:

Contract win RNS’s can seem a little promotional, but I don’t think there’s necessarily anything wrong with this for a smaller company that is trying to build a broader investor following.

Synectics does appear to be rebuilding its business quite effectively following a pandemic-era crash in sales and earnings:

The company didn’t issue shares during the pandemic and boasts a healthy balance sheet, with net cash. My main concern is that quality metrics – profitability – are pretty average here:

However, using the statutory figures in the chart above, we can see that operating margins are now higher than when profits peaked previously in 2017.

I’m hopeful that continued growth may provide some operating leverage and drive a further improvement in profitability – I’d really like to see some of the quality figures above rise over 10% in order to justify a potential re-rating.

Synectics is a current member of the SIF folio and I hold the shares myself. I’m reassured by progress so far this year and happy to be holding alongside CEO Amanda Larnder, who has a 6.6% stake.

I am quite comfortable maintaining our AMBER/GREEN view, but I’m holding back from full GREEN for the reasons mentioned above – average profitability and no recent upgrades to forecasts.

Alphawave IP (LON:AWE)

Up 23% to 183p (£1.4bn) - Recommended Acquisition - Roland - PINK

The boards of Qualcomm Incorporated ("Qualcomm") and Aqua Acquisition Sub LLC ("Bidco") and the board of Alphawave IP Group plc ("Alphawave") are pleased to announce that they have reached agreement on the terms and conditions of a recommended acquisition by Bidco of the entire issued, and to be issued, ordinary share capital of Alphawave.

Another UK stock is being taken out by US money, in this case a much larger trade buyer.

Today’s recommended offer from Qualcomm values Alphawave at $2.4bn, or $2.48 per share (c.183p).

Alphawave shareholders will also be given two alternative offers:

0.01662 new Qualcomm shares for each AWE share

An offer involving two classes of newly-issued, unlisted Qualcomm Exchangeable Securities

The company notes that shareholders representing 50.1% of voting rights have already given irrevocable undertakings to support the deal – so it’s pretty certain to go through.

Qualcomm believes Alphawave’s connectivity IP and custom silicon design capabilities will be highly complementary to its capabilities.

From my limited understanding of Alphawave’s technology, it has products and IP that can be used to provide high-speed connectivity in data centres and 5G infrastructure - growth areas that are relevant for AI.

Today’s proposal also indicates that the buyer expects to strip out some costs and headcount as Alphawave is integrated into its wider operations. I’d guess this could accelerate Alphawave’s progress towards meaningful profitability.

Valuation: given the group’s mixed track record but seemingly stronger outlook, I think it’s quite hard for individual investors to take an informed view on the valuation of this deal.

Alphawave has been loss-making for the last two years and was trading on nearly 60x FY25 earnings prior to today, with nearly $200m of net debt (10x FY25E EBITDA!).

In September 2024, the company issued a profit warning and noted that its bankers had agreed to relax the company’s lending covenants. As Paul commented at the time, cash flow was negative and the business looked potentially at risk as a going concern.

However, (adjusted!) earnings were expected to double in FY26, perhaps suggesting that Alphawave may have been approaching a turning point in terms of profitability:

On these numbers, today’s offer values Alphawave on the following multiples:

FY25E P/E 70x

FY26E P/E 33x

Roland’s view

Alphawave was one of the notorious 2021 crop of UK IPOs,floated at high valuations that often proved unsustainable. That’s certainly been the case here – even at today’s offer price, Alphawave shares are still 50% below the price at which they started trading in May 2021!

There’s been a shocking loss of value for investors who were persuaded to take part in the IPO:

Investors who bought into this stock hoping for a long-term multibagger will be disappointed. However, the company’s founders and other key shareholders have done much better. They sold down some of their shares in the IPO and are now in line for another large payout:

This offer seems almost certain to go through given the support from insider shareholders.

Is today’s offer a fair price? In theory, I suppose the combination of a much larger trade buyer and a founder/management sale ought to result in a reasonably fair offer.

In reality, I’m not sure we can know. Alphawave’s last accounts looked shaky and highly-geared to me. Revenue actually fell slightly last year, while operating losses increased.

While forecasts for FY25 and FY26 appear much more bullish, there’s no guarantee this would have translated into positive cash flow and more sustainable financials.

Alphawave could have been a multibagger-in-waiting, but the company could also have been flirting with financial distress. This is the nature of equity markets – there are always two sides to each situation, and private investors rarely have access to all the facts about a company

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.