Good morning from Paul & Graham!

Mello Monday is tonight, with 3 interesting companies presenting, all of which I think are worthwhile for consideration by investors, depending on your investing style.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

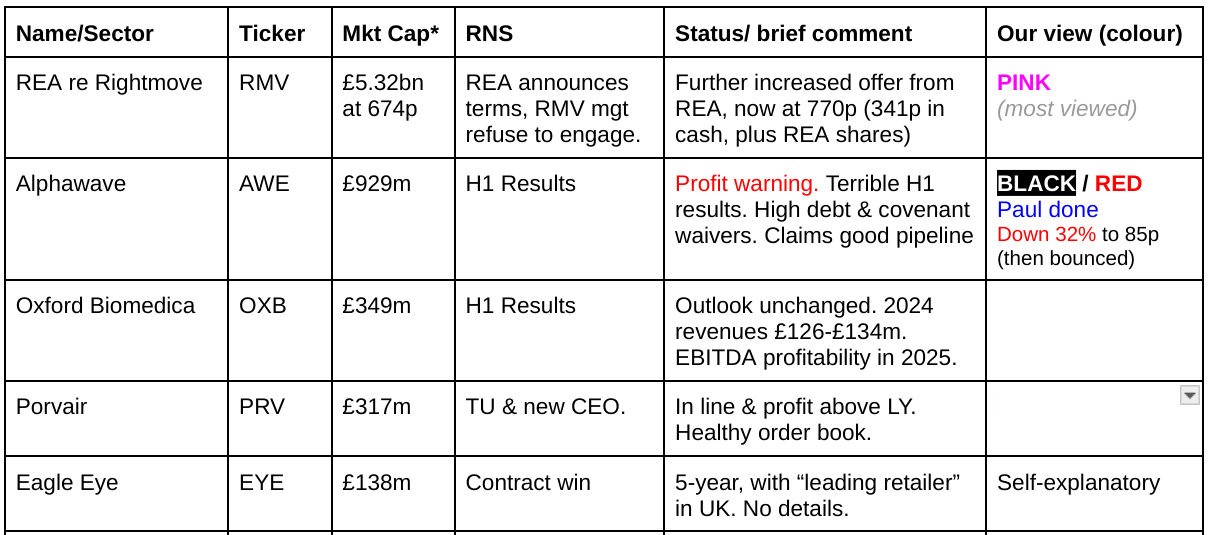

Companies Reporting

Summaries

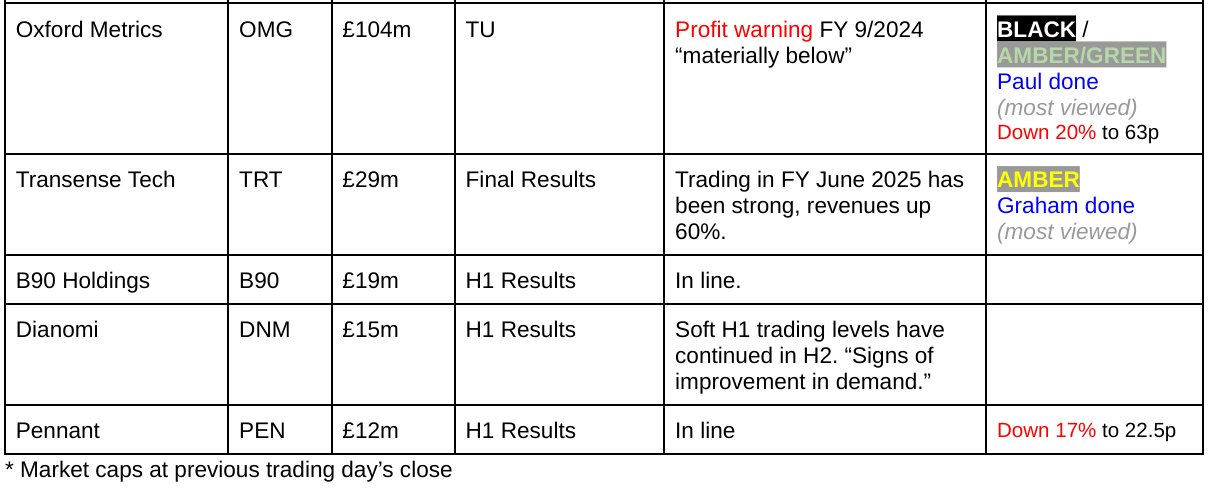

Oxford Metrics (LON:OMG) - down 20% to 63p (at 09:39) £84m - Trading Update [profit warning] - Paul - BLACK (PW), AMBER/GREEN (on fundamentals)

Misses its numbers for FY 9/2024, which surprises me since we were told in June that it had 90% full year visibility. Net cash pile of £50m is now well over half the market cap, sounds ear-marked for acquisitions - let's hope they do good one(s). Shares look attractive value to me now, possibly overshot on the downside?

Alphawave IP (LON:AWE) - down 30% to 88p (£647m) - Interim Results - Paul - BLACK (PW) / RED on fundamentals.

Shockingly bad H1 numbers, raise the question of whether this highly indebted company could be heading for zero? Total bargepole job for me, as mentioned 4 times previously this year.

Transense Technologies (LON:TRT) - down 4% to 182.7p (£28m) - Final Results - Graham - AMBER

Decent results from this company and they are accompanied by a very strong outlook statement. However, the group only has two trading businesses and they are both very small and early-stage. The outlook statement suggests that they are both about to have a great year but with revenues of only about £1m and £0.5m respectively, these are far too early-stage for me.

Paul’s Section:

Alphawave IP (LON:AWE)

Down 30% to 88p (£647m) - Interim Results - Paul - BLACK (PW) / RED on fundamentals.

One of my least favourite shares. The only thing I’m in AWE of, is how on earth did the brokers manage to get a multi-billion valuation at IPO in 2021?

Checking my previous notes, it’s been RED four times this year, so today makes it five.

23/1/2024 - RED (Paul) 134p - In line TU. But EBITDA doesn’t produce any actual real cashflow.

16/4/2024 - RED (Paul) 119p - Profit warning. Poor cashflow. Complicated accounts.

24/4/2024 - RED (Paul) 108p - Poor 12/2023 results. Weak bal sht. Are profits & cashflow real? Shares could be heading considerably lower.

1/5/2024 - RED (Paul) 114p - Clears out unsuitable NEDs.

On to today’s H1 results.

“LONDON, United Kingdom and TORONTO, Ontario, Canada, 23 September 2024 - Alphawave IP Group plc (LSE: AWE, "Alphawave Semi", or the "Company" and together with its subsidiaries, the "Group"), a global leader in high-speed connectivity for the world's technology infrastructure, announces its interim results for the six months ended 30 June 2024.”

What on earth does that mean?!

H1 numbers are terrible!

- Revenue down 51% to $91m

- Loss before tax in H1 of $(50)m (LY H1: $(6.6)m loss)

- NAV $439m, including $309m goodwill and $237m other intangibles, so NTAV is negative $(107)m

- Net debt up to $142m.

Bank covenants have been breached, but lenders have relaxed them.

Going concern is clean, although it’s totally dependent on lenders remaining co-operative, so not sure I’d place much reliance on this going concern statement. The company is clearly financially distressed, as it’s breached banking covenants. So I regard this share as high risk.

Outlook - it reckons things will improve in H2, and claims a large order backlog.

Cashflow - is negative again, a big concern of mine in the past. More than all of the operating cashflow is consumed by capex, including $34m capitalised development spend in H1 alone.

Paul’s opinion - I’ve seen enough to reinforce my negative view. It’s not at all clear if this is a viable business, the numbers suggest it isn’t. So everything now rests on it turning the talk of improved outlook, into cashflows.

Based on performance to date, this share could end up at zero, in my view.

Maybe it does have some amazing tech I don’t know, but the figures so far suggest it’s a basket case.

A total avoid for me, bargepole job. It could transform itself in future, who knows? Why would I want to guess about what the future holds, when the present looks so dreadful?

IPO investors were sold a dud at a crazy price. Hitting a new all-time low today, and could have a lot further to fall I reckon (to zero, possibly) -

Oxford Metrics (LON:OMG)

Down 20% to 63p (at 09:39) £84m - Trading Update [profit warning] - Paul - BLACK (PW), AMBER/GREEN (on fundamentals)

Oxford Metrics (LSE: OMG), the smart sensing software company, servicing life sciences, entertainment, engineering and smart manufacturing markets, today provides the following update on trading for the financial year ending 30 September 2024.

Orders are slower than expected -

“While the Group continues to have a healthy pipeline, the trend of more extended buying cycles has developed in the second half against a strong prior year comparative. Globally, we are seeing customers across our markets exercising greater caution and purchasing decisions are taking longer to conclude. A number of opportunities in the pipeline have now shifted into the new financial year.”

Hence revenue & profit guidance is reduced -

“The Group now expects to report revenues in the range of £40-£42million and is expected to result in Adjusted PBT* materially below current market expectations* for the financial year.”

*Oxford Metrics' compiled market consensus as at 20 September 2024 is as follows: FY24 Revenue £48.6m / FY Adjusted PBT £7.8m.

Now we have to guess what “materially below” means in numbers.

Looking back at its H1 results, it said >90% revenue visibility was in the bag for FY 9/2024, that was on 11/6/2024, which makes it surprising that it’s missed target revenues by c.16%. How come? Either some order(s) have been cancelled, or the previously mentioned visibility wasn’t firmly contracted. Either way, I think we need more information from the company as to what’s gone wrong.

Cash & acquisitions - the cash pile is c.half the market cap (probably more, once the share price has taken a likely hit today), so a key issue is whether management spend it wisely or not -

“The Group continues to have high gross margins and remains in a strong financial position with a robust current net cash position of c. £50 million, enabling the business to continue its active pursuit of a number of M&A opportunities within the smart manufacturing space to enhance our recent acquisition of Industrial Vision Systems ("IVS"). We are excited about the opportunities open to us to drive more applications into the smart manufacturing space to build the Group's position in this important market.”

Shares are down c.30% to 55p at 08:06. With 131.4m shares in issue, that’s £72m market cap, and with £50m net cash in the bank, the EV is only £22m. Surely it’s likely to attract buyers at that level I imagine? We’ll soon find out!

I can’t take the analysis any further at the moment, as I need a broker update to give revised forecasts.

However, I’m leaning towards seeing this as a value buying opportunity at 55p (since bounced to 63p), so will colour it AMBER/GREEN for now.

At a 5-year low today, and OMG pays divis too. Middling StockRank.

Transense Technologies (LON:TRT)

Down 4% to 182.7p (£28m) - Final Results - Graham - AMBER

Paul tends to cover this one but I’ll step up and have a look at it this morning for once.

It’s up about 80% over the past year:

Transense Technologies plc (AIM: TRT), the provider of specialist sensor systems, announces its final results for the year ended 30 June 2024.

At first glance this appears to be a “jam tomorrow” type of share. However, it is profitable and has a cash pile, which automatically means that it’s a cut above so many other AIM-listed tiddlers. Here are the final results highlights:

Revenue +18% to £4.2m

Adj. PBT +20% to £1.3m

Cash £1.3m (slightly higher, year-on-year).

Revenues and profits are “in line with the expected growth trajectory”.

There are three components to the business.

Tyre monitoring system - “residual royalty income” from Bridgestone until 2030.

SAWsense - “advanced sensor solutions based on proven, patent protected Surface Acoustic Wave (SAW) technology”.

Translogik - smart, connected commercial vehicle tyre inspection equipment.

Judging by the description of their customers, it sounds like this is a business that earns far more than £4m in revenue p.a.

However, Translogik revenue was only £1.1m (up 9%), making a small operating profit. They see an addressable market of $25m p.a.

For the year ahead, Translogik “is now positioned to convert new business for its tyre management products directly with fleet customers and has several large potential contracts under negotiation.”

SAWsense revenues were down slightly to £0.45m and the company made a net loss. Transense provides lots of detail on target markets for SAWsense and their plans to grow this business, but from my perspective it’s probably too small to be relevant for stock market investors. They do say that there is a “level of commitment by our customers to pursue full scale industrialisation” after current projects are completed.

Outlook - is very positive, with strong revenue growth:

Trading in the period since the financial year end has been strong, with revenues approximately 60% ahead of the corresponding period last year, profits showing good progress despite increased overhead costs, and net cash at 31 August 2024 increasing to £1.49m. The depth and scale of customer engagements across the Company's two trading segments is intensifying.

Graham’s view

My impressions of Transense are positive, but I’m afraid I don’t see how to value it. The market cap of £28m gives a seal of approval that the two trading businesses have good potential, and unsurprisingly the commentary from the commentary helps to make a good argument that this is the case.

But it’s just so early-stage. SAWsense had less than half a million pounds of revenues in these results. Yes, it might have great potential, but I would argue that’s a question for venture capitalists to figure out, not for people investing their pension funds - I assume that most of us here, like most stock market investors, are saving for our pension!

Translogik is further advanced but on a standalone basis it would also be far too small to justify a stock market listing, in my view.

The combined group has been given a market cap of nearly £30m, so the market is clearly intrigued by the potential here. But this goes firmly into my “too difficult” pile. Paul’s previous neutral stance on this one seems fair to me.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.