Good morning!

The agenda is complete.

Update 12.30: today's report is now complete. See you tomorrow!

Spreadsheet accompanying this report: link (last updated to: 5th September).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Next (LON:NXT) (£14.7bn) | Strong H1 2025. Total Group sales up 10.3% on the prior year, and pre-tax profits 13.8% higher. Guidance unchanged from the latest end of July trading statement, with full price sales growth expected to come in 7.5% higher for FY 2025. Pre-tax profit guidance also remains unchanged, reaching over £1.1 billion and up 9.3% on 2024. | AMBER/GREEN (Roland) Next’s H1 performance was boosted by favourable weather and the cyber misfortunes of rival Marks & Spencer. Sales growth is expected to moderate in H2, but in my view these are still excellent results that showcase all the qualities of this business – including strong international growth, now accounting for nearly a fifth of sales. Today’s numbers have received a downbeat reception from investors, perhaps in part because of CEO Lord Wolfson’s comments on the economic outlook and falling employment. With the stock still trading on a P/E of 16, I don’t see enough value for a fully-positive view, but I remain very happy to maintain our AMBER/GREEN view on this high quality retailer. | |

Renishaw (LON:RSW) (£2.3bn) | Preliminary announcement of results for the year ended 30 June 2025 | The company delivered record revenues of £713m in FY2025, representing 3.7% constant currency growth. Adjusted profit before tax reached £127.2m, with margins expected to improve in FY26 from ongoing cost-saving initiatives. | AMBER/GREEN (Roland) [no section below] Today’s results appear to be in line with expectations and suggest this specialist engineering group may be returning to growth. It’s a complex business with limited broker coverage, but I think it could potentially reward more careful research. The valuation is arguably up with events on a P/E of 24, but I note that significant cost savings are expected to feed through in FY26, which should help to rebuild the group’s operating margin towards a target level of 20%. The balance sheet is extremely strong too, with net cash of £274m. I am going to stick my neck out and upgrade our view to AMBER/GREEN today, reflecting the improving momentum and recovering quality metrics and expected top line growth. |

Seplat Energy (LON:SEPL) (£1.6bn) | Seplat confirmed that it is targeting 200kboepd of production by 2030 from its assets. The company will spend between $2.5-$3 billion of Capex on growth projects, drilling between 120-150 new wells. Company commits to paying 40-50% of free cash flow through 2026-2030 to shareholders, and targeting $1 billion in total dividend payments by 2030. Large reserves growth & potential asset sales also discussed. | GREEN (Keelan) | |

| Pets at Home (LON:PETS) | Board changes and profit downgrade (released at 08.19am) | SP -13% PW: CEO has left business with immediate effect but is thanked. FY26 profit guidance cut, now expect adj PBT of £90-100m (prev. £110-120m) | BLACK (AMBER/RED) (Roland) Today’s bombshell RNS was released after the market opened this morning and suggests that both the wider pet care retail market and the company's own retail operations have performed worse than expected so far this year. There seems to have been a particular drop-off in Q2. The company remains a market leader in this sector with around a quarter of the wider Pet Care market. I think a recovery opportunity could emerge in time, but I don’t think we’re there yet. My AMBER/RED view reflects the expectation of continuing profitability and the strong market share, but I think it makes sense to avoid the shares until greater clarity emerges – half-year results are due in November. |

Bytes Technology (LON:BYIT) (£979m) | The company expects to report revenues of around £1.33 billion in H1 FY26, with operating profits reaching no less than £33 million. Net cash position reached £82 million, after shareholder returns via dividends and share buybacks. | AMBER/RED (Roland) [no section below] Today’s update is in line with the downgraded H1 expectations provided with July’s profit warning, which we covered here. However, I’m a little disappointed by the lack of clear guidance for the full year. Instead, CEO Sam Mudd warns of tough comparatives with last year for the second half of FY26. An update on FY guidance has been promised with the interim results in October, but the half-year ended on 31 August. I would have hoped some comment might have been possible in today’s update. I acknowledge the current valuation could turn out to be attractive if the business does return to growth in H2, but today’s commentary doesn’t give me a high level of confidence on this. In the absence of FY guidance, I’m leaving my previous AMBER/RED view unchanged ahead of October’s H1 results. | |

Apax Global Alpha (LON:APAX) (£793) | Apax Global Alpha has officially been acquired by Janus Bidco. Following completion, Apax’s London Stock Exchange listing was cancelled effective 18 September 2025. | PINK | |

C&C (LON:CCR) (£599m) | H1 trading in line with exps. Adj op profit to be €41.5-42.0m, in line. Lower volumes in some categories. | ||

Judges Scientific (LON:JDG) (£418m) | Rev +15%, adj PBT +17% to £12.6m. Challenging conditions. Trading in line with FY exps. | AMBER (Keelan) | |

Griffin Mining (LON:GFM) (£342m) | Slowdown due to request from Chinese authorities. Necessary to gain permitting for Zone II. FY results to be in line. | ||

Pantheon Resources (LON:PANR) (£310m) | Equipment being mobilised, fracking w/c 29/9 for 2 weeks. Expect production to follow. | ||

Supreme (LON:SUP) (£215m) | “Solid start in H1 2026”, FY26 results to be in line with market expectations. | AMBER/GREEN (Roland) [no section below] Today’s update reiterates full-year expectations for this consumer goods group, but it’s worth remembering that the expectation is for a c.12% drop in earnings this year, based on broker consensus. This primarily reflects the impact of the recently-introduced ban on disposable vapes – vaping generates most of Supreme’s profits. I was neutral on Supreme following July’s FY results, but the shares have fallen since then and the recent bolt-on acquisition of a carpet care brand shows the group continuing to leverage its manufacturing and distribution skills in order to diversify and expand its business (it also owns Typhoo Tea and other drinks). With the stock trading on less than 10x earnings and boasting excellent quality metrics (and a StockRank of 95), I’m happy to leave Graham’s recent AMBER/GREEN view unchanged today. | |

M&C Saatchi (LON:SAA) (£205m) | PW: rev -7.7% with op profit -45% to £7.5m. Outlook: FY profit to be in line with prior year (prev. +13%) | BLACK | |

Begbies Traynor (LON:BEG) (£194m) | Q1 trading in line with exps. Confident of delivering FY26 forecasts. | ||

SRT Marine Systems (LON:SRT) (£182m) | A c.$200m contract from a new sovereign customer. But remains subject to completion and financing, not guaranteed and “likely to take many months”. | ||

Capricorn Energy (LON:CNE) (£142m) | Rev -26%, op loss of $2m. Net cash improved to $32m. FY production on track for 17-21kboepd. | ||

Journeo (LON:JNEO) (£87m) | £1.5m order from a Northern Transport Partnership for passenger displays. | AMBER/GREEN (Keelan) [no section below] | |

Inspecs (LON:SPEC) (£44m) | Rev -3%. PBT -8% to £2.4m. Outlook: H2 trading “slightly behind”, FY guidance unch. | ||

Maintel Holdings (LON:MAI) (£24m) | Rev -0.2%, adj PBT -44% to £1.8m. FY25 exps unchanged for rev £95m, adj EBITDA £7m. | ||

Sound Energy (LON:SOU) (£14m) | No longer getting vendor financing for mLNG project, has drawn $5m debt. H1 net loss $5.5m. |

Roland's Section

Next (LON:NXT)

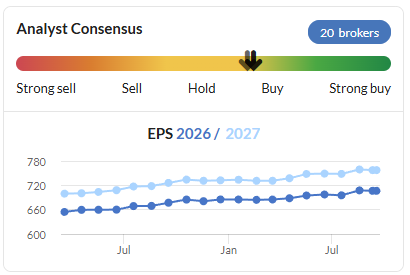

Down 4.5% at 11,454p (£14.0bn) - Half-Year Results - Roland - AMBER/GREEN

Today’s headline figures from Next look excellent to me and the company’s full-year guidance is unchanged.

Even so, the shares are down in early trading, perhaps because investors have picked up on downbeat economic commentary from CEO Lord Wolfson.

Of course, another plausible explanation for today’s drop might be that Next shares are arguably quite fully priced, as Graham commented recently. Investors may have been hoping for another upgrade and have been disappointed by today’s unchanged guidance.

Guessing the reason for share price movements isn’t always easy, which is why I prefer to focus on fundamentals and valuation.

H1 Results Summary

As usual Next’s reporting is a masterclass in investor communication and is highly educational for anyone seeking to understand how large modern retailers work. It’s also very long, at 79 pages!

I’ve selected some of the main points to include here to provide a flavour of the company’s trading performance and outlook.

The company benefited from favourable weather and problems at Marks & Spencer in H1, providing a boost to trading and prompting a broker upgrade earlier this summer:

Total group sales up 10.3% to £3,249m

Adjusted pre-tax profit up 13.8% to £515m

Adjusted earnings up by 16.8% to 330.2p per share

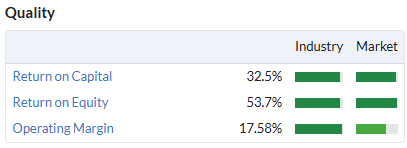

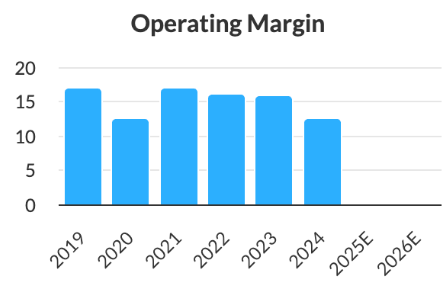

Profitability remained excellent, with a half-year operating margin of 17.6% (H1 25: 16.6%), supporting the excellent quality metrics we’ve come to expect from this business:

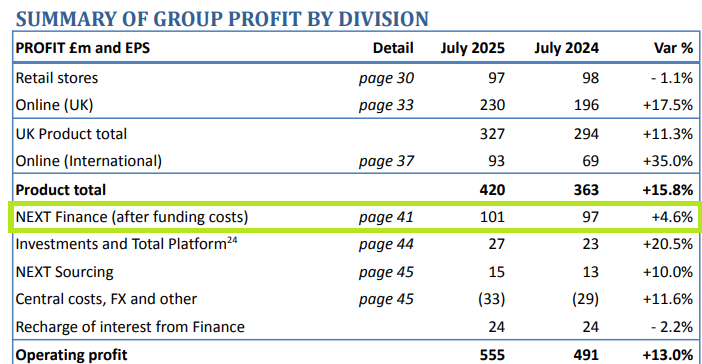

One of the reasons for this excellent profitability – higher than most other retailers – is the group’s finance business, which allows customers to buy on credit.

NEXT Finance contributed 18% of operating profit in H1:

Balance sheet: Net debt was less than 0.6x PBIT (effectively operating profit or EBIT) at the end of last year. Note how Next measures leverage after deducting depreciation and amortisation from its earnings, rather than using the more usual net debt/EBITDA multiple.

By deducting the ‘DA’ from profit before calculating leverage, Next raises its leverage multiple compared to the standard reporting we see from most companies.

However, I assume the company's policy is intended to recognise the reality that 'DA' usually reflects essential cash expenditure that's needed to maintain and develop a business. More companies should follow this example, in my view.

As things stand, of course, Next's leverage is low and does not concern me.

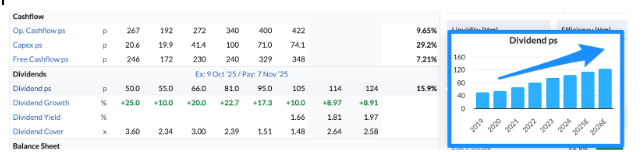

Dividend & Buybacks: As usual, there’s also clear guidance on shareholder returns, based on the company’s minimum requirement for an 8% pre-tax return from buybacks:

Interim dividend +16% to 87p per share (HY25: 75p)

No buybacks took place in Q2 as share price was above current buyback limit of c.£118/share

Currently has c.£351 of surplus cash, will be used for buybacks, a special dividend or acquisitions

Trading commentary

The company warns openly that its trading during the first half of the year was boosted by “favourable weather and competitor disruption” (a reference to Marks & Spencer’s cyber attack).

Our enthusiasm is tempered by the knowledge that the first half was boosted by factors that are unlikely to continue, and the belief that the UK economy is likely to weaken going forward.

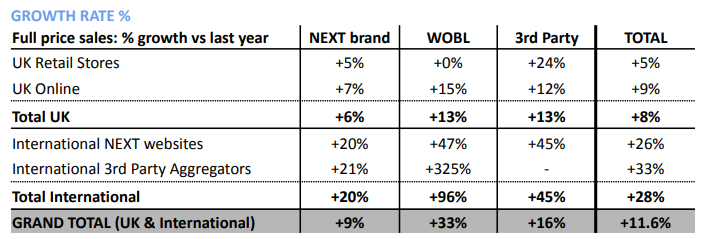

Reassuringly, sales growth was fairly broad-based in H1, with particular strength in the group’s international business, which generated 17% of sales in H1:

WOBL = wholly-owned brands and licences

Looking forward, Next is continuing to devote a lot of care to developing its portfolio of brands, both owned, licensed and third party.

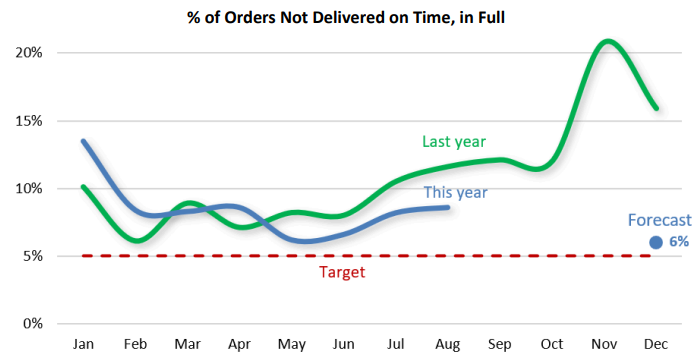

Alongside this, work is continuing to improve the infrastructure that underpins the group’s multi-channel operations. Areas highlighted in today’s report include international website functionality and progress with resolving delivery problems encountered last year:

Economic outlook

I wouldn’t normally get too deep into a company’s CEO commentary on politics and economics. But Lord Wolfson is often an accurate observer of underlying trends and the firm’s guidance often has a broader relevance for the UK consumer economy.

Today’s report includes some unusually pithy commentary, together with some potentially worrying data on employment trends.

Here’s a flavour of what’s included in today’s report:

There is another reason to be cautious. The medium to long-term outlook for the UK economy does not look favourable.

To be clear, we do not believe the UK economy is approaching a cliff edge. At best we expect anaemic growth, with progress constrained by four factors: declining job opportunities, new regulation that erodes competitiveness, government spending commitments that are beyond its means, and a rising tax burden that undermines national productivity.

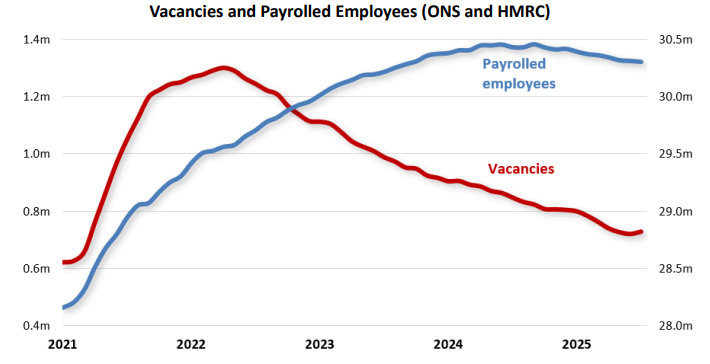

The company shares this chart drawn from government employment data…

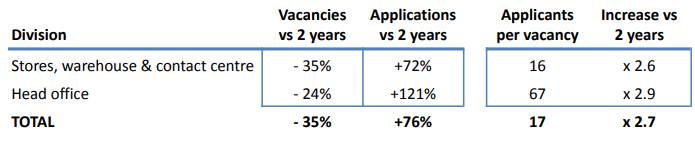

… and says that this is reflected in the company’s own experience in terms of job vacancies and applications. Next has seen reduced vacancies and a sharp increase in the number of applicants for them, suggesting the job market has tightened significantly over the last two years:

Lord Wolfson believes that entry level employment in particular is facing a mix of headwinds. Some of these sound like permanent, structural changes to me:

The problem appears to be that employment, particularly at the entry level, faces the triple pressure of rising costs, increasing regulation, and displacement through mechanisation and AI

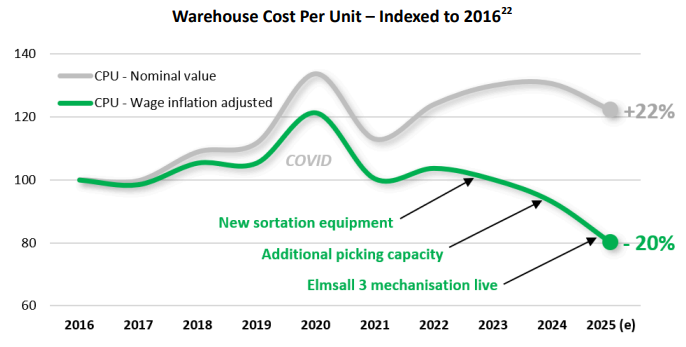

The company provides an example of how mechanisation has cut costs (and presumably headcount) at its own Elmsall warehouse, with unit costs adjusted for wage inflation:

Outlook

Sales growth in the second half of the year is expected to slow. The company expects full price sales growth of 4.5%, compared to 10.9% in H1.

However, the strong H1 result is enough to allow full-year guidance for the year to 31 January unchanged:

FY26 full price sales of £5.44bn (+7.5% vs last year)

FY26 pre-tax profit of £1,105m (+9.3%)

FY26 earnings per share of 714.1p (+12.2%)

We might speculate that there’s scope for further outperformance in H2, if trading is stronger than expected – Next has a track record of conservative guidance that’s quite often upgraded.

These forecasts leave Next on a forecast P/E of 16 after this morning’s share price drop.

Roland’s view

I view Next as a class act with sector-leading management and profitability. It also has good scale, with a sophisticated internet operation and well-managed (and profitable) store estate. International growth also seems to offer exciting longer-term growth opportunities.

As Graham commented in July, the shares are arguably at the upper end of a reasonable valuation range. As things stand the share price has now fallen below the company’s own limit for buying back shares, but the valuation remains relatively high for this business:

Personally, I’d still be a little reluctant to buy Next shares at current levels. But if I held the stock I’d be comfortable with the longer-term prospects and would not consider selling them based on today’s results.

I can’t be fully positive today given my view on valuation, but I’m quite happy leaving our AMBER/GREEN view unchanged following these results, reflecting the stock's High Flyer styling.

Pets at Home (LON:PETS)

Down 13% at 199p (£906m) - Board Change and Profit Downgrade - Roland - BLACK (AMBER/RED)

Commiserations to shareholders in this pets-and-vets chain, who have been caught by surprise today with the unexpected departure of the group’s CEO and (another) profit warning.

This morning’s RNS was only published at 08.19am after markets had opened, rather than in the usual 7am batch of news. This seems to suggest either bad organisation, or a decision that was only made very early this morning…

The market has not reacted well, with the stock down c.20% as I write:

Here’s a summary of what we know so far.

CEO Departure

Pets’ CEO Lyssa McGowan has “left the business with immediate effect”.

Despite this unscheduled departure, she is thanked “for her commitment to leading the business” since becoming CEO in 2022.

Non-executive chairman Ian Burke will take on the role of executive chair until a replacement CEO is recruited.

Trading update

The company has also provided an unscheduled trading update for FY26 today “reflecting our updated views on Retail trading and lowering profit guidance accordingly”:

Previous guidance was based on a central assumption of 1% market growth in Pet Retail this year;

PETS expected to outperform this market during the year, aided by recent investment in its online offering;

Unfortunately, the wider Pet Retail market has actually declined slightly so far this year;

While PETS’ retail performance has improved, the rate of improvement has been slower than expected;

This has been caused by a 5% decline in store sales, offsetting “double-digit digital sales growth”.

As a result, the company has downgraded its profit expectations for the year:

In light of the performance gap we have seen in Retail versus our plan, we now expect FY26 underlying PBT in the range £90-100m.

Vet update: the only possible bright spot from today’s update is that the group’s higher-margin Vet division is continuing to deliver “high-single digit sales growth”. Management says the Vet business is on track to open 10 new practices in FY26 and is expected to deliver another year of profit growth.

Of course, we still don’t quite know the final impact of the CMA review into the vet sector, so this may not be entirely without risk, either.

Outlook

We are fortunate that Pets at Home consistently provides actual profit guidance in its trading statements, not just vaguely-worded statements about expectations. This means that investors without access to broker output can also quickly assess changes.

Unfortunately, Pets at Home’s FY26 guidance has now been cut twice since May, with a total reduction of 21%:

May 2025: Underlying PBT expected to be £115-125m

July 2025: Underlying PBT expected to be £110-120m

September 2025: Underlying PBT expected to be £90-100m

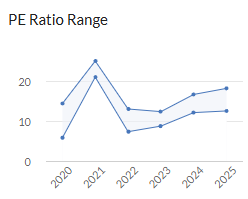

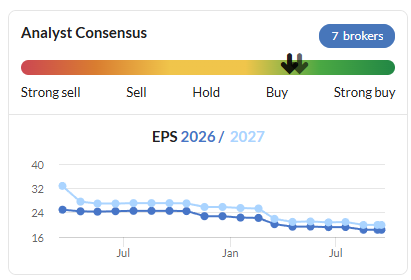

This has been reflected in the downward trend of earnings estimates:

My rough estimates suggest we could see EPS estimates cut by c.15% after today’s update, perhaps suggesting a revised FY26 figure of around 16p per share.

Roland’s view

Checking back to July’s Q1 trading statement (and profit warning), Pets at Home said that retail market growth has been slower than hoped, but was still expected to be positive over the full year.

However, the company’s commentary at that time seems to suggest that market conditions may have worsened markedly in Q2 (July-Sept):

Where we end up in our updated range is mostly dependent on the trajectory of retail market growth through the second half of FY26. Reaching the top end of guidance would require a step up in market growth, while the bottom end of guidance would imply a continuation of current subdued market trends through the remainder of the year.

Pets’ half-year results are normally published in November, so I am going to suspend further judgment until then.

I don’t think there’s enough information today to form an informed view on outlook or valuation – although the timing of this downgrade, alongside Next CEO Lord Wolfson’s cautious comments this morning – does seem discouraging.

For now, I’m going to downgrade our view to AMBER/RED. I’ve chosen this to reflect the worsening outlook, but also the fact that Pets at Home has a 24% share of the UK pet care market and remains profitable. The FY25 accounts showed a net cash position excluding lease liabilities, so I don’t think the business should be at risk of financial distress either.

At some point I expect this stock to become cheap and be worth considering as a recovery play. But I’m not sure we’re there yet.

Keelan's Section

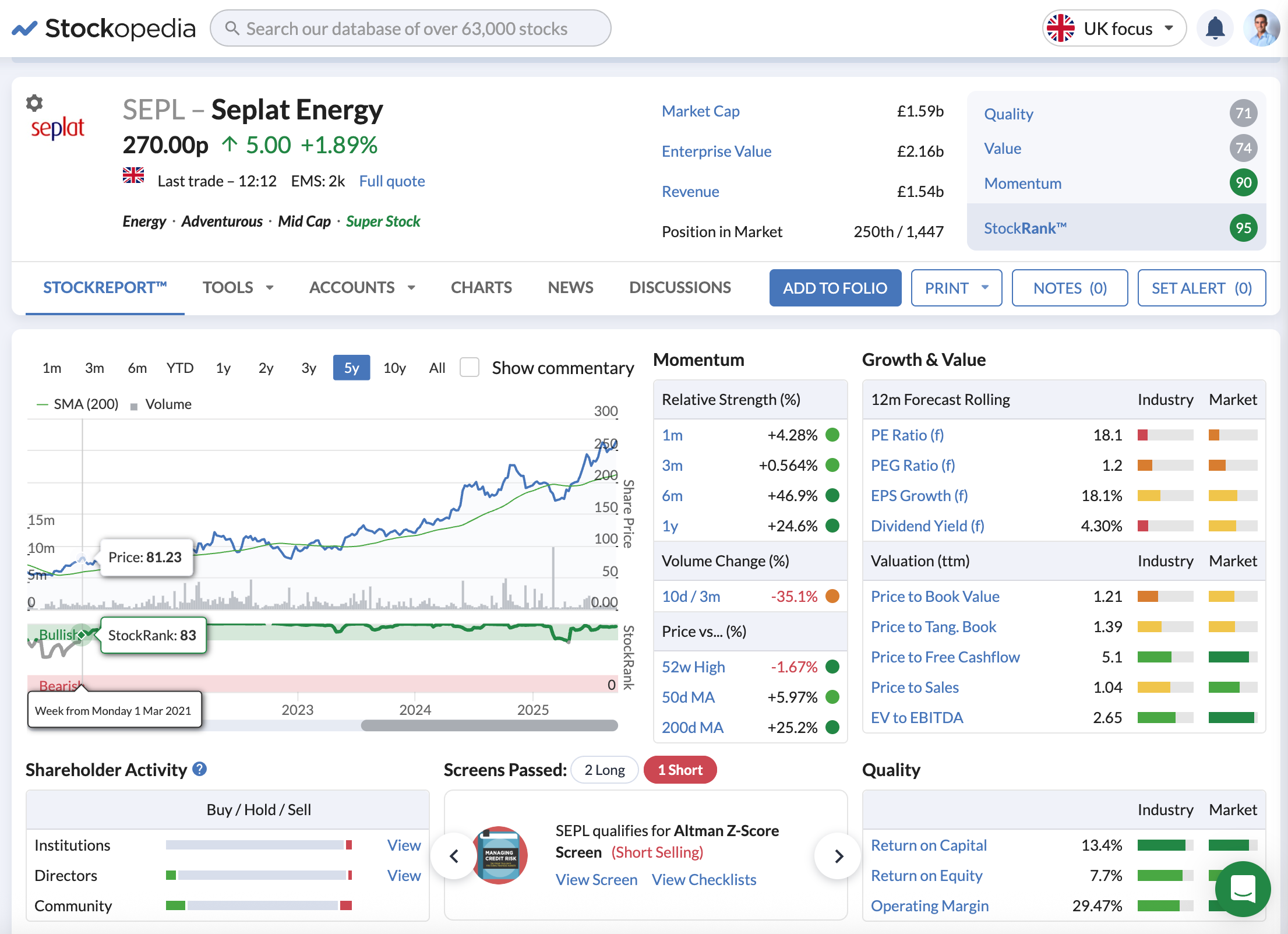

Seplat Energy (LON:SEPL)

Up 1.89% at 270p - Capital Markets Day Update - Keelan - GREEN

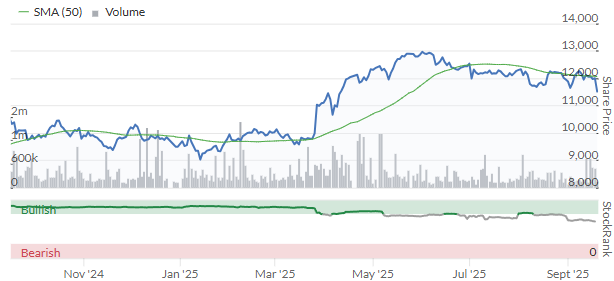

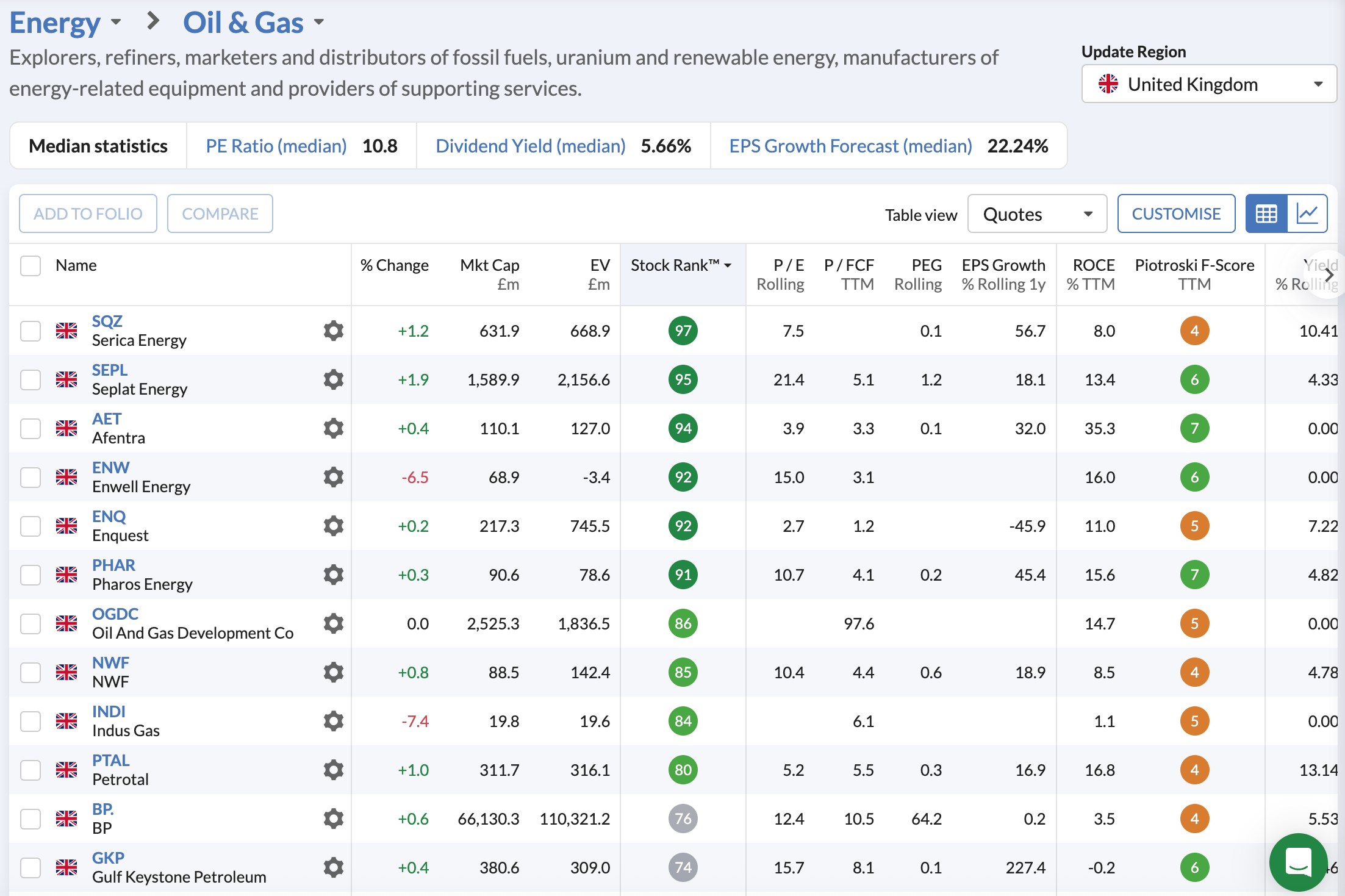

Seplat Energy has been one of the quiet success stories in the London market over the last few years. Since March 2021, when the shares traded at just 81p, the stock has rarely dipped below an 80+ StockRank. Fast forward four years, and despite plenty of macro and geopolitical shocks, the shares now sit at 265p, a 227% gain.

That consistency has made Seplat a regular in Ed’s NAPS portfolios. It delivered a stellar 56% return in 2024 and features again in this year’s selections, already up 35% year-to-date. For an Oil & Gas name, a sector often mired in volatility and somewhat unloved in recent years, that is a pretty remarkable run.

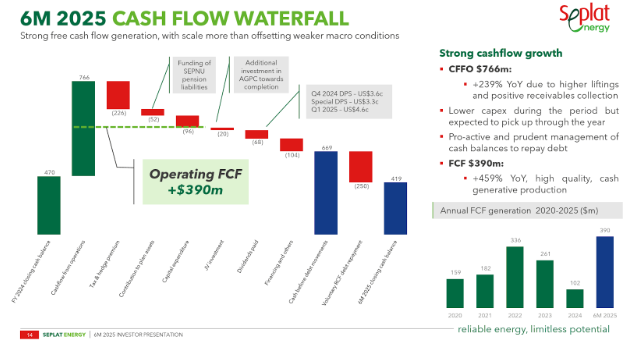

Source: Seplat Energy 6M 2025 results presentation

Today’s Capital Markets Day set out where the company plans to go from here. Management’s 2026 to 2030 roadmap targets production growth to around 200,000 boepd, cumulative operating cash flow of $5 to $6 billion, and a cut in operating costs towards $10 per barrel of oil equivalent (boe). Around half of operating cash flow will be reinvested, with 120 to 150 new wells and up to three new gas projects in the pipeline.

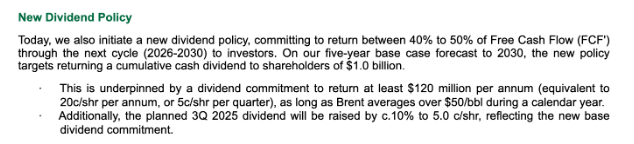

Another piece of good news from this morning’s announcement is that shareholders are firmly in focus, too. A new dividend policy commits to returning 40 to 50% of free cash flow over the cycle, about $1 billion by 2030. There is also a hard $120 million per year floor (20 cents per share annually) so long as Brent oil prices stay above $50, and the Q3 2025 dividend will be raised 10% to 5 cents per share

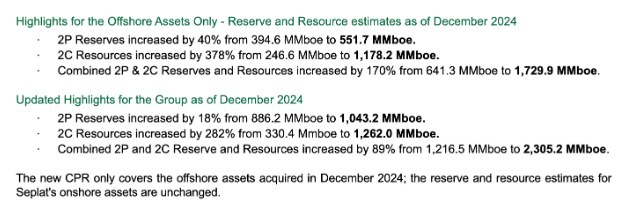

Providing further backing to all of this is a strengthened reserves picture. An updated Competent Person’s Report from Ryder Scott shows Group 2P reserves up 18% to just over 1 billion boe, while combined 2P and 2C volumes have nearly doubled to 2.3 billion boe.

CEO Roger Brown put it plainly: “The performance of our new offshore assets in the first nine months that we have operated them, provides a clear indication that we have acquired a fantastic group of assets along with a highly competent and skilled workforce.

"Today we set out our roadmap to 2030, our vision for the medium term which will see us materially grow production and cashflow to drive significantly enhanced shareholder returns.

Broker Capital Access also seems to share the optimism, noting after the H1 results: “We have rebuilt our financial model for the company and are now reinstating forecasts where we expect rapid growth in profit and cash flow. Most striking is the strength of free cash flow generation that could see the company debt free by 2027… Our forecasts confirm the transformational impact of the MPNU acquisition with revenue tripling and net cash flow quadrupling between 2024 and 2027, notwithstanding a likely weaker oil price background.”

We are not spoilt for choice when it comes to strong Oil & Gas stocks on the UK market. And while Seplat does operate in a more volatile geopolitical climate in Nigeria, and still contains notable debt on its balance sheet, the company stands out as one of the strongest all-round fundamental stories available. Seplat’s scale, reserves, profits, cash flows, and shareholder returns are all firmly moving in the right direction.

Keelan’s view

This is a solid update overall. It shows clear ambition from the management team and confidence in their ability to deliver on the new targets. It also keeps shareholders front of mind with a generous dividend policy, while providing further proof of the transformational impact of Exxon’s Nigerian assets.

You now have a company with an entirely different scale and growth profile compared to just a year ago. Despite the operational risks inherent in both the industry and the Nigerian operating environment, Seplat’s balance sheet discipline, substantial free cash flow generation, and upgraded dividend policy make a compelling case. From today’s update, I am going GREEN on this as the company embarks on a new phase of growth.

My primary concern remains external factors, particularly the oil price environment, in case of any demand or supply shocks. But on fundamentals alone, Seplat stands out as one of the strongest Oil & Gas names on the UK market.

Judges Scientific (LON:JDG)

Down 1.27% at 6200p - Interim Results - Keelan - AMBER

Judges Scientific is a buy-and-build specialist in the niche world of scientific instruments. It has built its reputation by acquiring small, profitable businesses, often still run by founder-engineers, and integrating them into a decentralised group.

That approach has delivered impressive long-term returns. Judges was featured as one of the UK’s top stock-market performers in our “Makings of a Multibagger” research study, delivering an 8.9x total return between April 2013 and April 2023.

Alongside names like JD Sports and Games Workshop, it stood out for its consistent model, strong returns on capital, and disciplined use of cash. Over that decade, Judges issued more “ahead of expectations” updates than most and completed 14 acquisitions, second only to JD Sports (if you’d like to learn more about this theme, you can watch Ed Croft explore these companies in more detail in our Multibagger webinar replay here).

That historic track record of success speaks to the underlying quality of the business, but the recent picture has been much more challenging. Since reaching a high of £12 a share in May 2024, the share price has nearly halved and is down 45.3% on a one-year relative strength basis. That’s a sharp drop down for a company that has been able to maintain a high Quality rank over this time period.

The pressure has come from macro headwinds. In 2025, a freeze in US federal research funding and delays to discretionary capital projects have weighed heavily on demand. North America, one of Judges' key markets, saw organic order intake drop 18% year-on-year in H1. The UK also softened, while only China showed some recovery, albeit from a low base.

This softness in orders is unfortunately feeding through to the financials. Today’s HY25 results show reported revenue up 15%, helped by FY24 acquisitions and Geotek’s coring project, but organic growth was just 7%. The organic order book has shortened to 17.4 weeks from 19.2 weeks at year-end, and year-to-date organic intake (excluding Geotek) is flat. Management has acknowledged that trading needs to improve.

Still, despite these headwinds, the group remains profitable and cash-generative. Margins are holding steady, and net debt is coming down. The group’s long-term strengths on cost discipline, strong cash conversion, and a lean balance sheet are still in place.

Profitability

Judges managed to grow revenues by 15% to £70.2m, with adjusted pre-tax profit up 17% to £12.6m. Adjusted EPS rose 14% to 141.4p, which would put it roughly on track to achieve the consensus full-year forecast from Zeus Capital of around 285p. Broker notes and profit forecasts seem to imply that the worst might be over. These are still solid numbers in a rough patch for the business, a credit to the group’s decentralised model and long-standing financial discipline.

Much of that uplift came from Geotek, which delivered a profitable coring expedition in Japan. Part of Geotek’s work serves oil & gas firms, for example, via core analysis and logging, but its customer base is quite broad, including universities, mining companies and offshore geotechnical users.

Strip out Geotek’s contribution, and the broader picture is more subdued. Organic growth came in at 7%, but profit contributions from several legacy businesses were down, with management openly acknowledging trading challenges in parts of the portfolio.

Margins held up well: adjusted EBIT margin was 20.4%, broadly flat on last year. While below historic highs, these are still healthy levels in the current environment.

Panmure Liberum summed it up neatly, commenting on the results this morning: “This is a highly unusual period for Judges, which has had such a strong record of long-term growth. Management is absolutely focused on controlling the controllables and improving the underlying performance of its businesses in terms of profitability and cash generation.”

Balance Sheet & Cash Flow

Judges’ cash generation remains a strength. Operating cash flow was up 59% to £12.3m, with conversion above 100% if you adjust for timing quirks around the Geotek contract (that came from a one-off marine coring expedition by Geotek).

Net debt (excluding leases) fell to £45.7m, down from £51.7m at year-end. Leverage sits at 1.5x EBITDA, a comfortable level for a business of this nature and well within the group’s comfort zone.

Dividends are rising in line with the company’s long-standing policy, though the overall yield is still low. The interim payout is up 10% to 32.7p, and the FY dividend cover for 2025 is 2.64 times covered by adjusted earnings, which means that there’s ample cover (and scope to increase in the future).

Despite the tougher trading backdrop, Judges has not paused its M&A ambitions. No new acquisitions were made in H1, but a new Group Acquisitions Executive has been brought in to refresh the pipeline. Weaker markets often create better buying opportunities, but if suitable acquisitions remain scarce, it will be interesting to see whether management considers returning more capital to shareholders through increased dividends or share buybacks.

Outlook

The tone from management in today’s announcement was steady rather than upbeat. Trading is said to be in line with consensus forecasts, which peg full-year adjusted EPS around 288.7p. As mentioned, Zeus Capital’s numbers remain unchanged at 285p.

But the order intake is a growing concern. The organic order book ended the half at 17.4 weeks, stable but trending slightly down from the 19.2 weeks seen at the end of FY2024. North America remains weak, with orders down 18% year-on-year. Elsewhere, there was better news, notably a strong bounce in China/HK, albeit from a low base.

The timing of the next Geotek coring contract is uncertain, and with funding delays still affecting US research budgets, visibility remains poor.

Still, Zeus makes the case that the current share price already reflects much of the downside: “The Group maintains a healthy order book, and a solid financial position… Judges is trading at a c. 20% historic forward PE discount and a c. 30% EV/EBITDA discount.”

A meaningful pickup in orders will likely depend on an improvement in the US federal research funding environment, which has been under pressure since 2023. Many of Judges’ subsidiaries rely on capital spending from universities, laboratories, and public research bodies, sectors heavily influenced by US government budgets and grant cycles.

The Biden administration’s push for science and climate-related funding has faced delays in Congress, with continuing resolutions and political gridlock stalling disbursement to key agencies.

Until those funding pipelines reopen, discretionary spending on new lab equipment is likely to remain soft. If Congress approves a full-year federal budget with increased R&D allocations, that could serve as a major tailwind for demand in 2026.

Other potential catalysts include the awarding of a new marine coring contract at Geotek, which could deliver a meaningful boost to both revenues and EPS. Zeus estimates an additional 50p of EPS could come from another Geotek expedition, but brokers are currently revising estimates in the wrong direction.

Additionally, a return to bolt-on acquisitions, if valuations remain attractive, could help underpin earnings growth, particularly given the group’s strong cash flow and modest leverage.

Keelan’s view

I’d like to see this serial acquirer get back to doing what it does best: buying high-quality businesses and compounding quietly in the background. But given the current market conditions, I’m not seeing enough of a short- to medium-term catalyst to get things moving again just yet, which is why I’ve gone with an AMBER rating.

If you're a long-term holder, the story still stacks up. Judges has weathered plenty of tough periods before, and the core model does not appear to be broken. But as a fresh entry point, with little near-term momentum in sight, I think the valuation still needs to come down a bit further before this becomes a truly compelling opportunity again.

That said, I have confidence that Judges will find its feet again once market conditions improve. Management has a strong track record, the balance sheet is in good shape, and the dividend continues to grow. For now, I’m on the fence. I’d rather wait for a clear catalyst and be willing to pay a bit more with momentum on my side, than jump in now and hope the tide turns.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.