Good morning! It's not overly busy for results, given that it's a Thursday - companies are finally starting to wind down for Christmas, perhaps?

Today's report is now complete: that's all we've got time for today, thank you for reading and commenting.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Smiths (LON:SMIN) (£7.6bn | SR79) | The £1.3bn sale agreement announced in October is now binding, following a consultation process in France. | ||

Entain (LON:ENT) (£4.9bn | SR40) | CFO Rob Wood is standing down after 13 years with Entain. He’ll be replaced by Michael Snape, who is currently CFO at IDS (formerly Royal Mail). | ||

Drax (LON:DRX) (£2.6bn | SR95) | Strong trading, FY25 adj EBITDA to be at the top end of consensus estimates. Medium-term outlook unchanged. Considering building a data centre on site. | ||

Firstgroup (LON:FGP) (£1.03bn | SR86) | Acquired UK sightseeing bus operations of RATP Développement SA, trading as Tootbus for £17m. Comprises operations in London and Bath. Annual revenue c.£30m. | ||

Workspace (LON:WKP) (£721m | SR45) | Sales of two further low-conviction assets in London for £11.8m, in line with Sept 25 valuation and giving NIY of 5.7%. | ||

Serica Energy (LON:SQZ) (£658m | SR91) | Following receipt of NSTA consent, acquisition of PUL has completed for £14.5m (roughly equal to PUL’s unrestricted net cash). Lancaster field is currently producing c.5,900 boepd, expected to cease production in mid-2026. | ||

Avon Technologies (LON:AVON) (£541m | SR59) | Received European order for FM50 respirators and FM61EU filters via NATO procurement. Value approx $20.6m to be delivered in FY26/27. No change to expectations. | ||

Everplay (LON:EVPL) (£489m | SR74) | Acquired 20% stake in Super Media Group for £2.0m. SMG owns Bulkhead, a UK-based FPS developer that has been acquired from Tencent by Everplay, SMG and HIRO Capital. | ||

NCC (LON:NCC) (£440m | SR58) | Revenue ex-disposals -2.6% to £293.9m, with Escode +2.2% and Cyber Security -4.0%. Adj EBITDA ex-disposals -3.6% to £40.6m. FY26 adj EBITDA to be in line with expectations. | ||

PZ Cussons (LON:PZC) (£328m | SR74) | Received “significant levels of interest” but concluded that offers received did not reflect the value of the business. The previously-announced $70m sale of PZ Wilmar will complete soon, but the remainder of the Africa business will be retained and improved. | AMBER = (Roland) [no section below] Having spent 20 months trying to sell its African operations, PZC has decided not to. This decision follows on from the company’s decision earlier this year to retain the St Tropez fake tan business – another underperforming asset for which no suitable buyer could be found. Today’s RNS highlights some of the reasons why potential buyers might have been reluctant to make a generous offer for the group’s African operations. Management flags up the “historic volatility of the Nigerian business” and the “inherent risk” of operating in that market. To protect against this, “guardrails” will be put in place, e.g. on foreign exchange management and cash usage. It’s good to see the Board taking these risks more seriously after suffering more than £100m in cash currency losses in FY24. It’s also worth remembering that PZC does have some market-leading brands in Nigeria – a huge market. However, the new plan to “grow the Africa business” by further increasing its distribution reach and expanding into new product categories and countries is not without risk, in my view. Meanwhile, profitability remains low (at a group level) and I'd argue the company has yet to show it can address persistent weak growth in its existing businesses. Personally, I believe a new CEO is required here to improve execution and strategic judgement. However, the shares are priced at an undemanding level and there’s certainly some scope for a recovery at some point. To reflect this balance, I’m going to align with the StockRanks and leave my neutral view unchanged today. | |

Henry Boot (LON:BOOT) (£302m | SR85) | Group FD will be promoted to the new role of COO and join Exco. Various other management changes, with Hamer Boot assuming greater responsibilities in the commercial property development business. | ||

RWS Holdings (LON:RWS) (£285m | SR85) | Revenue -4%, adj. PBT -43% (£60.4m), due to lower revenues and martins and FX headwinds. Reported pre-tax loss £100m. Goodwill impairment £88m. Net debt £25m. Final dividend 4.6p (last year: 10p). “Trading in the early months of FY26 has been encouraging.” | GREEN ↑ (Roland - I hold) While these results contain some hefty adjustments, I am encouraged by underlying cash performance and I remain supportive of the company’s strategy. My impression is that CEO Ben Faes (ex-Microsoft) has a more effective grasp of the transformation that’s needed than his predecessor. I’m also encouraged by the return of 24% shareholder Andrew Brode to the chairman’s role. I think this stock has reached a situation where there are only two choices – RWS is seriously cheap, or the business is facing a terminal decline. In my view, the value story is credible, so I’ve tentatively decided to upgrade my view to be fully positive. | |

Anglo Asian Mining (LON:AAZ) (£263m | SR52) | Has started production from two new larger filter presses and an associated thickener at its Gedabek flotation plant. November was a record month for the production of copper at Gedabek. | ||

S&U (LON:SUS) (£226m | SR98) | “The turnaround in S&U's fortunes… continues apace.” Net receivables £491m (2024: £447m), accelerating month by month. Net borrowings rise to £241m from £180m at the half year. Seeking substantially larger but flexible medium-term facilities. | GREEN = (Graham) [no section below] I'm a broken record on this one, but I think my faith in it is justified by its revitalised strong performance. Receivables are growing strongly now that the company is free of regulatory intervention, and they seem set to embark on their next phase of growth once new, larger borrowing facilities are arranged. With the stock trading at around book value I continue to view this as offering good value, given its excellent track record and the strong sense of stewardship of management. | |

Hargreaves Services (LON:HSP) (£220m | SR85) | The Board remains confident of delivering full year results in line with market expectations (revenue of £270.9m, PBT of £24.2m and earnings per share of 53.3p). No change to forecasts from broker Cavendish. | AMBER/GREEN = (Roland) [no section below] Today’s H1 update is in line with expectations and looks fine to me. The Services business has remained busy with infrastructure projects, but it’s the Land business that seems the standout performer, achieving “an improvement in the expected result” following a “material sale” of land at the Blindwells residential development. The Land division also received payment for the first tranche of renewable energy land assets, leaving the group with net cash of £37.3m at 30 Nov 25 (excl. leases). While economic conditions are a little more challenging for the raw materials joint venture in Germany, I don’t see any reason to change my broadly positive view today. | |

Tristel (LON:TSTL) (£171m | SR67) | “Trading is in line with expectations and in the first five months we remain firmly on target to deliver revenue growth of at least 10% year-on-year.” | AMBER/GREEN = (Roland) [no section below] 10% annual revenue growth is quite respectable and I expect Tristel’s core UK and European markets to remain reliable. However, what’s caught my eye today is the comment on the US market – potentially massive, if Tristel can gain a foothold. CEO Matt Sassone says that sales of Tristel ULT (the core ultrasound disinfectant product) during the first five months of the year have already equalled the total contribution last year. As a result, YTD US revenue is up 510% compared to the prior period. Some context is required, as US revenue (in the form of high-margin royalties) only totalled £108k last year. Even so, I think this is encouraging. In my view, the question here relates to valuation. With the stock trading on 20x FY26 forecast earnings, I’d argue that the incremental growth of the more mature UK/Europe business is largely priced in. However, success in the US market could eventually justify a much higher valuation. The problem is that the US healthcare market is not an easy one to crack. To reflect this mix of circumstances and my opinion that this is fundamentally a good quality business, I’m leaving my previous view unchanged today. | |

Trufin (LON:TRU) (£116m | SR80) | Subsidiary Playstack successfully released Unbeatable, the highly anticipated anime-inspired rhythm-action adventure game, on 9 December. TruFin now expects 2025 to be materially ahead of expectations. Revenue, adj. EBITDA and PBT to exceed £60.3m, £11.2m and £7.0m respectively. | AMBER/GREEN ↑ (Graham) Upgrading our stance on this as earnings forecasts continue to get raised and the company appears to go from strength to strength, driven by the success of its game publishing division. Synergies with its financial subsidiaries appear non-existent to me but with the shares now trading on a forward PER of only 16x, and the company enjoying a very healthy cash balance, a neutral stance would be overly niggardly at this stage. | |

RM (LON:RM.) (£108m | SR50) | The Company expects FY25 adjusted operating profit to be c.£11.5m (market expectations for adj. operating profit profit from continuing operations was also £11.5m, so this looks in line). Net debt £50-51m. | ||

Ilika (LON:IKA) (£77m | SR29) | IKA has begun shipping its new 10Ah Goliath battery prototypes to customers across multiple industries. The Company has also created initial samples of larger 50Ah P2 cells for testing | ||

Atlantic Lithium (LON:ALL) (£55m | SR8) | The Parliament of Ghana has temporarily withdrawn the Mining Lease from consideration to allow for further consultation. The Company remains confident that ratification of the Mining Lease will be forthcoming. | BLACK (SP -25% yesterday) | |

Fairview International (LON:FIL) (£40m | SR9) | (Malaysian schools.) Both campuses operate with spare capacity, giving a “clear and immediate pathway for earnings growth”. Also has over three acres of commercially zoned land. | ||

Plexus Holdings (LON:POS) (£10m | SR42) | Financial performance for FY26 expected to be in line with market expectations. Loan facility of up to £2 million from trust connected to Chairman, interest rate 8%. | RED ↓ (Graham) [no section below] |

Graham's Section

S&U (LON:SUS)

Up 5% to £19.58 (£238m) - Trading Statement - Graham - GREEN =

S&U PLC (LSE: SUS), the specialist motor and property finance lender today issues its trading update for the period 5th August 2025 to 10th December 2025.

We’ve been GREEN on this and I’m pleased to see that the company is now once again going from strength to strength, in the aftermath of legal/regulatory uncertainty.

Group profit “continues to beat budget” (although this is as precise as they get in terms of earnings expectations).

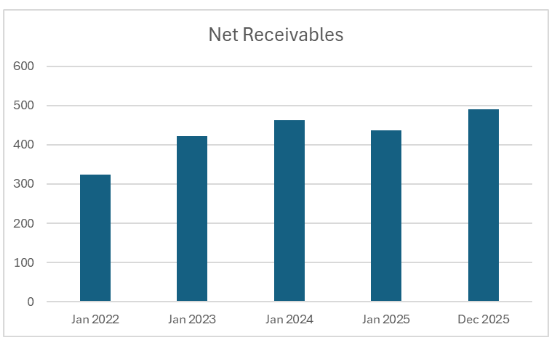

Net receivables: S&U call this “the life blood of future profitability”, whereas I think of it more as a measure of the total size of the business - and profitability will follow it, if underwriting standards remain high. Anyway, this figure has now grown to £491m.

Looking back at how this has progressed:

It was growing nicely until regulatory intervention, well, intervened.

And bear in mind that an increasingly important part of S&U’s business, Aspen Bridging, was completely unaffected and has been growing impressively during all of this time. The difficulties have all been at Advantage Finance (link).

Chairman Anthony Coombs is not officially the author of this sentence, but I’m fairly sure that it’s his. Referring to the recent growth in the loan book:

This surge clearly confirms the abilities of our businesses, once freed from the shackles of regulatory intervention.

An unnamed author or authors - possibly Mr. Coombs - also write:

…the performance of both Advantage and Aspen has been remarkably resilient given the chaotic and monumentally mishandled recent budget, and its dampening effect on consumer confidence in general and more specifically on the housing market

Mr Coombs is right up there with Tim Martin and Simon Wolfson when it comes to providing RNS announcements that I genuinely look forward to reading!

Let’s move on to some detailed info from Advantage Finance:

An upsurge in trading with monthly agreements of 2,500 versus 7,121 in the entire first half.

Collection rates for November are at a record 93.4% of due.

With reference to the upcoming redress scheme being drawn up by the FCA, S&U says “Advantage is only tangentially affected by this commission debate, having never employed discretionary commission”.

It says that only 2.4% of its customers “even potentially qualify for redress consideration under the proposed rules”.

Turning to Aspen: receivables have grown from £148m at the half-year (July) to £173m as of yesterday. Repayments are “ahead of budget” and the quality of the loan book “remains good with just 16 out of 240 loans beyond term”.

Funding: we have an intriguing indication of S&U’s growth ambitions. Group net borrowings have surged to £241m, up by over £60m since the half-year:

Whilst the existing funding capacity of £280m will meet our requirements for the immediate future, an exciting project is at present under way to confirm substantially larger, but flexible, medium-term facilities on a competitive basis. These will facilitate the expansion we foresee for both businesses over the next three years.

I wonder what form these medium-term facilities might take? A term loan?

Comment by Anthony Coombs:

"Recent months have undoubtedly confirmed that S&U has regained its "Va Va Voom"; to quote my predecessor's habitual phrase. It is also true that investors are increasingly aware of the value inherent in family-controlled SME businesses with rewarding dividend policies. With both Advantage and Aspen on the right track, we have every confidence in the good rewards for shareholders we anticipate in the years to come".

Graham’s view

I’m a broken record on this one: I’m GREEN. It’s a high-quality family-run and family-owned business with tremendous heritage and a strong sense of stewardship.

As someone who likes to study the financial sector and small lenders, it matters very much to me that lenders treat borrowers fairly, and by all accounts S&U/Advantage are some of the fairest lenders in the business. When customers have difficulty repaying, they are very understanding - and don’t just take my word for it, check out their Trustpilot score (if you trust Trustpilot!).

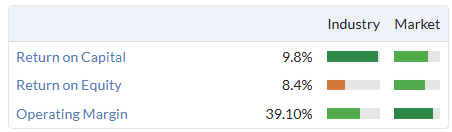

Net assets were £241m so the market is now effectively valuing it at book. But I do think it’s worth at least book; these quality metrics should improve now that it has been unshackled by regulators:

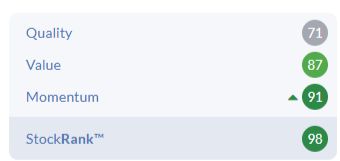

Despite the problems it has faced, it still has a StockRank of 98:

Trufin (LON:TRU)

Up 2% to 120p (£118m) - Trading Statement - Graham - AMBER/GREEN ↑

This is a brief but excellent update from Trufin.

Firstly they mention that they released a new game on 9th December, Unbeatable. This is an “anime-inspired rhythm-action adventure game”. If that sounds like your thing, here’s its website.

Despite only being released two days ago, Unbeatable’s strong launch is credited with helping boost the outlook:

As a result of strong performance across Playstack's back catalogue, combined with stronger-than-anticipated unit sales of Unbeatable, TruFin now expects its financial performance for the year ending 31 December 2025 to be materially ahead of previously guided market expectations. Group revenue, Adjusted EBITDA and PBT for the full year are now expected to exceed £60.3m, £11.2m and £7.0m respectively.

Cash will therefore be stronger than originally forecast, and the company hints at the potential for more buybacks:

The Board remains committed to allocating capital where it generates the highest return profile for shareholders, when balanced with the risk profile of the potential returns. The Board will continue to explore reinvestment opportunities, acquisitions, and the continual returning of excess funds in a disciplined and value-enhancing manner.

Unusually for a small and only recently-profitable UK company, Trufin has embraced the buyback: it announced a £4m buyback in May of this year, and then another one for the same amount in September.

Graham’s view

We’ve been a little cool on this one (e.g. Mark was neutral in August).

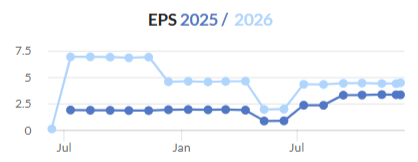

But earnings forecasts have been on the rise:

Speaking of which, this is what Panmure Liberum have to say about forecasts in today’s update:

The revenue upgrade (to £60.3m) is 7%.

The PBT upgrade (to £7m) is a remarkable 30%.

One thing to watch out for is that share-based payments have been adjusted out of the PBT forecast above. SBPs were £350k in H1 and £870k last year, so they could take a noticeable bite out of PBT. But if the interim results are anything to go by, the overall level of adjustments should be light.

Looking ahead, Panmure Limberum say they are “reducing the high levels of conservatism that have historically been implied within outer year estimates”. Allowing themselves to be more optimistic, they raise their FY26 and FY27 PBT estimates by 50% each, to £7.7m and £7.8m respectively.

The new cash forecast is £9.3m and borrowings should be minimal (£950k outstanding at June 2025), so it looks like another buyback could be affordable, if nothing else seems to offer a higher return.

What does this mean for our stance today? I’m happy to upgrade this, as it’s beating estimates and is cash-rich.

This might put value investors off:

But if you update for Panmure Liberum’s new EPS estimate (7.6p), the new forward P/E multiple is only 16x.

And you adjust this for net cash, it might be more like 15x.

What’s not to like? I do think the corporate structure is a little complicated: Trufin owns not just Playstack, but also a business called Oxygen Finance (the leading provider of Early Payment Programmes and a specialist in payments control and market insights in the UK”) and a fintech company called Satago.

I’m not sure what the synergies are between these financial businesses and a video games publisher - presumably there are none.

So that’s a little odd, but I don’t think it’s sufficient to prevent me from upgrading our stance. And I’m in good company: the StockRank has improved from 57 at the end of H1 to 80 now:

Roland's Section

RWS Holdings (LON:RWS)

Up 5% at 81p (£296m) - Final Results & Directorate Change - Roland -GREEN

(At the time of publication, Roland has a long position in RWS.)

Translation and localisation specialist RWS has issued two updates today. Together with its scheduled full-year results, the company has also announced a boardroom reshuffle. This will see the departures of both chair Julie Southern and the board’s long-serving senior independent director.

Ms Southern will be replaced as interim chair by 24% shareholder Andrew Brode. 84-year-old Mr Brode is a serial entrepreneur and dealmaker and was the architect of RWS’s past growth. After leading a buy-in of RWS in 1995, he served as executive chairman until 2023.

Having completed a sale of his other AIM-listed company – Learning Technologies – late in 2024, it looks like Brode has decided to take a more active role in trying to rescue RWS, which was previously one of the AIM market’s largest companies:

I am inclined to see Mr Brode’s decision to become chair as a positive factor. His past leadership was successful and his status as the company’s largest shareholder means that he’s highly motivated to achieve a positive outcome for shareholders.

As a shareholder whose position is underwater, I’ve also been looking forward to today’s results. Do they justify a more positive view – and should I average down and buy more?

Full-year results summary

Today’s results cover the 12 months to 30 September 2025. The headline numbers are not brilliant, but the shares have fallen by 50% over the last year. If these FY25 results represent a new baseline for the business, then I think there could be some value on offer here:

Revenue -4% to £690.1m

Adjusted pre-tax profit -43% to £60.4m

Reported pre-tax loss of £(99.7)m

Adjusted earnings -44% to 12.1p per share

Dividend -43% to 7.05p per share

Net debt of £25.4m (FY24: £12.9m)

Falling revenue is rarely good news in any business and it’s clear there were some issues last year. I’ll look at trading in more detail shortly but first I think it’s worth highlighting a few points from the accounts.

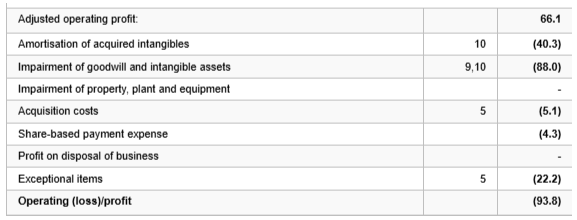

Profits & adjustments: these profits were always going to be heavily adjusted. The reality was worse than I expected; adjusting items for FY25 total £160m, up from £113m in FY24.

£160m is almost a quarter of the group’s revenue! In my view, a well-run and healthy business shouldn’t be adjusting its profits on this level. However, RWS is in the midst of a transition and is also about to get a new CFO – I am hopeful that future reporting will be a little cleaner.

In this case, the largest adjustment to profit is an £88m impairment charge relating to the company’s Language Services and Regulated Industries businesses. This is said to reflect the “market transition” in the core localisation (translation) business and the underperformance of the Regulated Industries business last year.

It’s not good to see value being wiped off these business units, but I tend to believe it’s best to be upfront about this and aim for a ‘cut once, cut deep’ approach, rather than piecemeal impairments year after year. Given the size of this impairment and the change of CEO last year, I’m hopeful we won’t face a repeat next year.

Another notable item is £22m of exceptional items. These relate to restructuring costs. Within this, £18.8m relates to “severance and termination payments (and related costs)”.

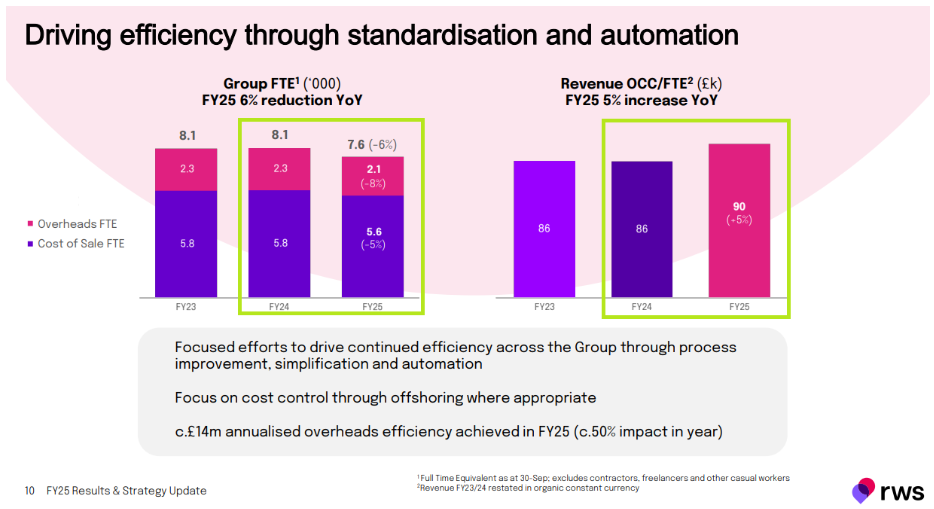

RWS has been making people redundant as CEO Ben Faes repositions the business to be a more tech-centric operation. Full-time equivalent headcount was cut by 6% last year, or around 500 people. This costly programme gathered momentum last year and is expected to complete in FY26.

While it’s difficult for the employees involved, my hope is that this will be a one-off programme that’s not followed by continuous further cuts to staffing.

One potential positive is that there was a useful 5% increase in revenue/employee last year. Hopefully the company’s claims of standardisation and automation will not result in any loss of service quality:

Dividend, free cash flow & net debt: As Mark commented in The Week Ahead, one important aspect of these accounts is how adjusted profits convert into actual free cash flow.

I’m quite pleased with the result here. My sums suggest FY25 free cash flow of £35.4m. This result was aided by a significant reduction in capital expenditure last year, to £25.6m (FY24: £43.1m).

While net debt rose by £12.5m to £25.4m last year, this was due entirely to the company’s decision to hold last year’s dividend at c.12p per share. Paying this resulted in a cash outflow of £45.9m.

For this reason, I support the company’s decision to cut the dividend today. The reduced payment of 7.05p per share should cost around £26m, so is genuinely covered by surplus cash generated within the business last year. As a general rule, this is how I prefer to see dividends paid.

While the reduction in income is a short-term disappointment for shareholders, a 7p payout still gives a yield of 8.7% at pixel time and should provide greater headroom for debt reduction and capex.

Last year’s free cash flow gives the stock a free cash flow yield of over 12%. If this level of cash generation is sustainable, then I think there’s a case to argue that RWS shares could be too cheap at current levels.

Trading commentary

RWS is restructuring its operations from today – see below. In this section I’ve summarised performance of each of the previous business units, providing comparability with previous reporting.

Language Services (revenue flat at £326.7m, adj op profit -41% to £23.4m): this unit accounts for nearly half group revenues and is the core translation business, working across a range of market sectors.

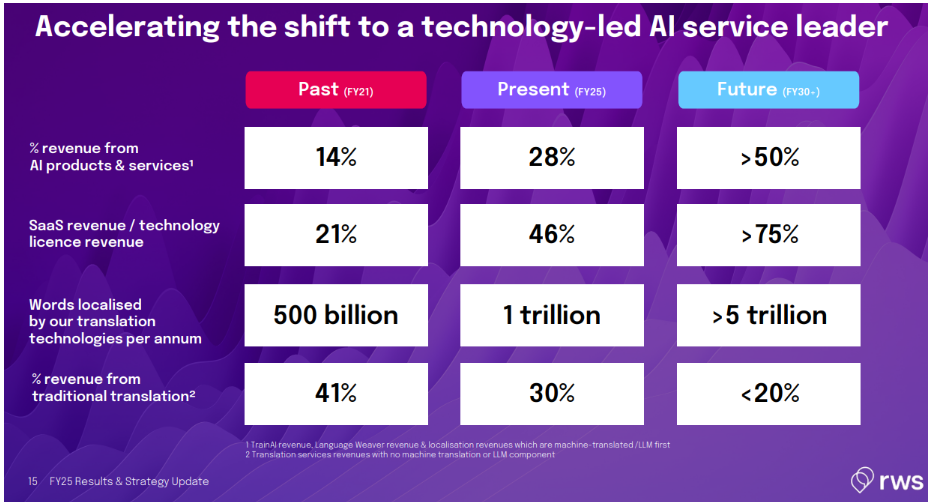

My impression from the commentary today is that the company has lost volume and margin as a result of some clients moving towards “initial LLM-first translation approaches” - i.e. cheaper, automated AI services.

However, the company says it’s diversifying its portfolio to help mitigate this and is seeing opportunities to act as a consolidator and to win new business from its TrainAI service. As an existing market leader, the company believes it’s well positioned to gain further share, especially in higher-value areas.

Regulated Industries (revenue -12% to £128.5m, adj op profit -53% to £9.3m): this unit specialises in three higher value areas; life sciences, legal and financial services. These require “highly specialised technical translations with a strong emphasis on quality and security”.

Despite three “major customer wins”, overall demand was subdued last year due to “reduced client outsourcing and tighter study budgets”. It’s hoped that an improved marketing operation will help to improve performance of this “critical operation” in FY26. I’d agree – this is a flagship business where the company needs to maintain leadership.

Language and Content Technology (revenue -3% to £138.4m, adj op profit -25% to £25.8m): this unit provides a range of technology products, such as machine translation, text-to-speech and content management solutions. It’s seen as a key drive of SaaS growth.

To give an idea of scale, RWS’s services translated more than a trillion words in 12 months last year..

IP Services (revenue -6% to £96.5m, adj op profit 28% to £19.4m): this is another of the company’s high-value services, providing patent translation services. Unfortunately, while there was growth in the patent renewal business, demand for new filings fell due to reductions in European Patent grant rates.

Highlights include client wins with three of the top 10 patent filers in China, which the company says was driven by the launch of digital patent renewal functionality within its IP Services platform.

Strategy update

RWS’s transition is still underway, but there have already been big changes in this business over the last few years:

Looking ahead, the company has refined its positioning to address three critical problems with generic AI services:

Data Deficit: generic AI is trained on public internet data. RWS clients want “domain-specific, clean linguistic data”.

Culture Deficit: generic AI mimics language but has no “emotional intelligence or cultural context”. RWS has a network of 43,000+ freelancers who are able to provide the cultural intelligence and brand authenticity clients require.

Trust Deficit: “advanced AI introduces complex, significant risks related to security, bias, privacy and compliance. Our ability to embed human validation and verifiable workflows is our enduring competitive moat and the foundation of enterprise trust.”

These are themes I’m seeing increasingly at the moment. My view is that for enterprise purposes, generic AI platforms such as ChatGPT are likely to become relatively commoditised. I think the real value will increasingly be created by service providers like RWS who provide domain-specific platforms on top of AI.

As part of this strategic shift, RWS is reorganising its business into three units:

Generate: Our content technology and TrainAI data platform businesses.

Transform: Our global localisation platform, integrating language technologies and specialised services.

Protect: Our mission-critical IP Services business.

The FY25 presentation contains a slide showing how all the current business units map onto this new structure, for anyone interested.

Outlook

Trading in the early months of FY26 is said to have been “encouraging”, but growth expectations for the year ahead are relatively modest:

Revenue: low single digit growth at organic constant currency

Profits: adjusted operating margin expected to rise by c.1%

Continued strong free cash flow conversion

What might this mean? I don’t have access to broker notes for RWS, but if I assume a c.3% rise in revenue next year, my sums suggest adjusted operating profit might rise by 14% to around £75m.

Based on today’s market cap and net debt, that’s equivalent to an EV/EBIT multiple of around 4.3x – potentially cheap, if cash conversion can be maintained.

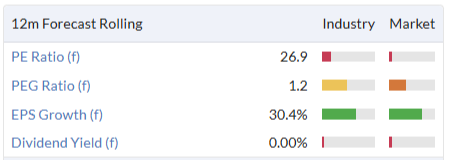

Consensus EPS forecasts prior to today seem to take a similar view, suggesting a c.15% increase in earnings to around 14p. That’s equivalent to a P/E of less than six.

Roland’s view

Even if I charitably use RWS’s adjusted operating profit for FY25, the profitability of this business still remains very average:

Adjusted operating margin: 9.6%

Adjusted ROCE: 7.5%

However, I think it’s credible to expect some improvement in margins as the company’s evolution continues, assuming it can achieve a return to revenue growth.

On this basis (and supported by cash generation), I have to conclude that RWS shares are cheap at current levels, unless the business is entering a terminal decline.

As a shareholder, I’m obviously biased. But I don’t think that’s likely. As I’ve discussed today and previously, I don’t believe generic AI can offer the kind of services commercial customers need. In my view, the company’s new strategy makes sense and correctly identifies the role and value-add opportunity for the business in an AI-enabled marketplace.

I think RWS has a decent chance of being able to maintain its historic role as one of the largest providers of localisation services in the world.

I could be wrong and – again – and obviously biased. But I’m broadly reassured by today’s results and I think RWS shares are (almost certainly) cheap. I intend to put my money where my mouth is and add to my position in the coming days.

I note the recent improvement in the StockRank and am going to tentatively upgrade my view to GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.