Good morning! Mark and I are covering the news today.

Today's Agenda is complete.

Spreadsheet accompanying this report: link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Shell (LON:SHEL) (£163bn | SR62) | Q4 income $4.1 billion reflected unfavourable tax movements… lower marketing margins, lower realised prices and higher operating expenses. Net debt $45.7 billion. | ||

Anglo American (LON:AAL) (£41.9bn | SR63) | All continuing businesses delivered their full year production guidance for 2025. Forward guidance: Copper production for 2026 is revised to 700,000-760,000 tonnes (previously 760,000-820,000 tonnes). | BLACK? | |

Compass (LON:CPG) (£37.8bn | SR54) | Organic revenue growth +7.3%. Changing the trading currency for its shares from GBP to USD, from April 2026. Reaffirms 2026 guidance and continues to expect around 10% underlying operating profit growth (constant currency). | (No Colour) Graham [no section below] I'm a little taken aback by the news that a FTSE-100 member is changing the trading currency of its shares to US dollars. Looking into it, I've learned that since September companies have been eligible for inclusion in the FTSE series of indices even if they are quoted in euros or dollars. I'd be really curious to know what readers think about this - should we assume that readers are interested in shares quoted in USD or EUR? Historically, brokers have offered quite poor FX conversion facilities, and I've assumed that most UK-based readers do not want to read about shares quoted in other currencies. But perhaps this view is out of date? | |

Vodafone (LON:VOD) (£26.8bn | SR93) | On track to deliver at the upper end of guidance range for both profit and cash flow. From the analyst consensus figures on VOD’s website, adjusted PBT is currently forecast at €3.64 billion. | ||

BT (LON:BT.A).A (£20.4bn | SR71) | On track for financial outlook and guidance metrics for this year. Q3 revenue down 4%, Q3 adjusted EBITDA down 1%. | ||

Ithaca Energy (LON:ITH) (£2.99bn | SR85) | 2025 average production of 119 kboe/d (2024: 80 kboe/d), ”in-line with previously upgraded guidance of 119-125 kboe/d” (GN note: low end of the range). Adjusted EBITDAX $2 billion (2024: $1.4 billion). | ||

JTC (LON:JTC) (£2.23bn | SR42) | Trading was in line with the Board's expectations. Takeover of JTC at £13.40 per share expected in the third quarter of 2026. | PINK | |

Resolute Mining (LON:RSG) (£1.44bn | SR61) | The Council of Ministers has officially announced the award of the mining permit for the Doropo Gold Project in Côte d'Ivoire. The permit is valid for 14 years with the ability to extend. | ||

Playtech (LON:PTEC) (£868m | SR45) | Strong trading in H2 2025 driven by performance in the US and Mexico in Q4. Adjusted EBITDA for 2025 to be at least €195 million, significantly above the current analyst consensus (€150-187m, with a mean of €177m). The company remains confident in its outlook for 2026 and medium-term targets of €250-300m Adjusted EBITDA and €70-100m Free Cash Flow. | AMBER = (Graham) Staying neutral on this as the dispute with Evolution is stil an outstanding issue and today's updte, while positive on the 2025 result, does not appear to raise guidance for 2026. So it's not quite strong enough to budge me from my neutral stance. I do admire this business, however, and I don't consider it to be particularly expensive at this valuation (P/E multiple around 16x), given its important role in the gambling industry. | |

Future (LON:FUTR) (£483m | SR78) | Group performance in the first four months has been broadly as expected with the Group on track to achieve market expectations for FY 2026. H2 weighting as previously outlined. Consensus revenue £745m, adjusted EBITDA £224m, adjusted EPS 132p. | ||

C&C (LON:CCR) (£421m | SR61) | The new CFO is hired from Headlam. | ||

Secure Trust Bank (LON:STB) (£278m | SR97) | Adjusted PBT in line with consensus of £51.1m (+30% year-on-year). Loan book grew 2.9%. The completion of the sale of the Vehicle Finance business is expected in Q1 2026. | ||

Tungsten West (LON:TUN) (£232m | SR34) | Subscription for £29.29m, placing for £10.98m, and a retail offer of up to £3m. Issue price 18p vs last night’s close 29.9p. Proceeds to be used to deliver the 2025 Feasibility study, pay for financing and transaction costs, repay the Bridge Facility, and fast track production. | ||

Mkango Resources (LON:MKA) (£190m | SR21) | A U.S. rare earth magnet recycling and manufacturing company has announced the arrival of Inserma recycling machines at Intelligent Lifecycle Solutions, LLC facilities in South Carolina and Nevada. | ||

Afentra (LON:AET) (£110m | SR74) | 2025 NET Average Production (Working Interest): 6,324 bopd. 2025 revenue $114.4 million. In discussions to extend its existing RBL facility with Trafigura and MCB to provide near-term funding to support investment programmes. | ||

Kodal Minerals (LON:KOD) (£85.6m | SR38) | Full payment of US$27.25 million for first spodumene concentrate shipment of 28,735 dry metric tonnes received by KMUK's operating subsidiary following arrival of the vessel in Hainan, China. Second shipment of 20,000 tonnes of spodumene concentrate is currently being loaded at the Port of San Pedro, Côte D'Ivoire. | ||

Strategic Minerals (LON:SML) (£80.5m | SR35) | “We believe these results may have a positive impact on the forthcoming MRE update, subject to estimation outcomes.” | ||

Spectra Systems (LON:SPSY) (£71.5m | SR80) | CEO: "We are delighted to have finalized this important new contract as we continue our re-organization of the security printing business to boost profits through longer term contracts. With the first phase of the reorganization having been completed in the UK facility, we are confident that with this new prestigious contract win, we expect to see significant profits from CSP in 2026 and more so in 2027…” | AMBER = (Mark - I hold) [no section below] | |

EnSilica (LON:ENSI) (£49.7m | SR41) | ASIC developed under the design and supply contract awarded by Siemens AG, as announced on 12 September 2024, has successfully reached the production tape-out milestone. | ||

Headlam (LON:HEAD) (£34.6m | SR34) | Adam Phillips, Group Chief Financial Officer (CFO), has decided to leave the Group to take up the same position at C&C Group plc. He is thanked. | RED = (Mark) [no section below] Having lost its CEO in October last year, Headlam loses its CFO today. Unlike last time, it is an orderly hand over, as he leaves £34m market cap Headlam to join £420m market cap C&C. This means that we shouldn’t have any immediate worries about the accounting. However, it probably shows that he doesn’t see any return to former glories at Headlam any time soon, if ever. Since Graham last reviewed this we have had a debt refinancing, this was unlikely to be in doubt as the property assets give lenders security. But I have been critical in the past of their moves to sell freehold property and lease it back, as this really does just move one form of debt into another. We’ve also had the first in-line trading statement for quite some time. However, in that RNS, they forgot to mention that in line meant a net loss of some £30m. This may trade on 0.25x TBV, but unless they can stem these losses soon, that book value will simply be eroded away. Today’s loss of CFO doesn’t give much hope they have a credible plan to achieve this, so I’m staying negative. | |

tinyBuild (LON:TBLD) (£29.8m | SR67) | Revenue slightly ahead of expectations resulted in positive EBITDA for the second half of the year. Cash over $4m slightly above expectations, broadly in line with the level at 30 Jun. “The pipeline for 2026 and beyond is strong, it includes several larger-budget (above $1m), high-potential games alongside continuous investment in the catalogue, including updates, DLCs and platform launches…The evolving global macroeconomic situation, and the continued conflict in Ukraine, impose caution and vigilance in the medium and long term.” | ||

Medpal AI (LON:MPAL) (£21.2m | SR6) | Pharmacy operations dispensed 36,951 items during January 2026, representing growth of 10.5% compared to 33,433 items dispensed in December 2025. | ||

Vianet (LON:VNET) (£20.5m | SR73) | 26H1 EBITDA +10.5% to £1.88m, net debt in line with market forecasts. “However, we expect the profit for FY2026 to align with the previous year's performance.” Entered a long-term, multi-year agreement with a large full-service restaurant company. Will not impact current year financials. | BLACK? | |

Lexington Gold (LON:LEX) (£18.5m | SR12) | Now commenced the Mining Right application process for the Jelani JV Project. | ||

Tavistock Investments (LON:TAVI) (£18.5m | SR43) | “Despite strong opposition from Titan, the Court allowed Tavistock to add new causes of action to the existing proceedings in respect of Titan's Model Portfolio Service (MPS) for breach of confidence, alleged misuse of trade secrets and copyright infringement.” | ||

Rome Resources (LON:RMR) (£17.2m | SR10) | Initial on-site results from drillholes KBDD020 to KBDD023 include 2m @ 8.30% tin from 74 metres depth and 2m @ 2.23% tin from 181 metres depth and 2m @ 2.33% copper from 107 metres. | ||

CT Automotive (LON:CTA) (£16.9m | SR51) | FY25 Revenues at least $113 million, in line with current market expectations, with net debt at 31 December 2025 expected to be $7.7 million (ahead of market expectations). Adjusted profit before tax is expected to be at least $10.0m (consensus $10.5m). “Due to ongoing market uncertainty, the Board is taking a conservative approach to FY26 revenue and profitability which is now expected to be modestly ahead of FY25.” | BLACK (AMBER/GREEN) (Mark - I hold) It seems like the latest note is missing from RT, so it is hard to be certain, but I am marking this BLACK as profitability appears likely to be slightly behind forecasts for FY26. However, by focussing only on the forecasts, I think we risk missing the wood for the trees. Profits are growing here, in a very difficult automotive backdrop, and recent business wins mean that that positive momentum is likely to continue well into the medium-term. Cash flow is strong, despite the capex from recent program launches, and will improve further as inventory reductions are targeted in FY26. This means that the net debt is modest. Given this, and assuming there are no major issues that arise from the recent CFO resignation, a P/E of less than 3 just looks far too cheap. So I keep our broadly positive view on valuation and business momentum grounds. | |

React (LON:REAT) (£12.1m | SR60) | Revenue +20% to £24.9m (-9% organic), Ad. EBITDA +27% to £3.1m slightly ahead of expectations, Cash £1.2m (FY24 £1.8m). “Despite the usual seasonal slowdown over the festive period, early trading in the new financial year has been encouraging.” | ||

Verici Dx (LON:VRCI) (£11m | SR9) | FY25 Trading Update & Agreement with BCBS of Illinois for Tutivia™ | Revenue +15% to $3.8m, Cash $3.3m (FY24: $4.1m). “Agreement ensures that Tutivia is considered as an in-network benefit for patients which streamlines the claims process and ensures that patients receive testing at in-network rates.” | |

Arcontech (LON:ARC) (£11m | SR55) | H1 Revenue -4.7% to £1.44m, Adj. EBITDA - 24% to £341k, PBT -24% to £395k, Net Cash £7.8m (24H1: £7.2m). “We are now unlikely to make up the recurring revenue loss in the year which has been further impacted by lower levels of one-off revenue… With our strong pipeline we are confident that we will build back lost business and return to growth next year." | BLACK? |

Graham's Section

Playtech (LON:PTEC)

Up 4% to 290.5p (£898m) - FY25 Trading Update - Graham - AMBER =

A strong update from this provider of technology to the gambling industry:

Playtech plc (LSE: PTEC) is pleased to report strong trading in H2 2025 driven by performance in the US and Mexico in the fourth quarter. As a result, the Company now expects Adjusted EBITDA for the year ended 31 December 2025 (subject to audit) to be at least €195 million, significantly above the current analyst consensus.

Analyst consensus is helpfully provided as follows: €150 million - €187 million, with a mean consensus of €177 million across 8 analysts.

So this is a 10% beat against consensus.

Revenues are not specifically mentioned, but of course I do expect a revenue beat, perhaps also accompanied by lower-than-expected costs.

It’s a little unusual to see a 4% share price rise against a 10% earnings beat, but the outlook is cautious:

For 2026, the Company remains mindful of ongoing sector headwinds including the scheduled increase to gambling taxes in certain markets including the UK.

However, the Q4 revenue trends seen in the Americas mean that Playtech enters 2026 with good momentum, as returns on the Company's investments in recent years accelerate.

Looking ahead, Playtech is “confident in its outlook for 2026 and its medium-term targets of €250-300 million of Adjusted EBITDA and €70-100 million of Free Cash Flow.”

I would interpret this as an in-line statement for 2026, with strength in the USA and Mexico offsetting UK weakness given the recent hike in gaming duties.

A snippet from the CEO comment:

While we remain mindful of wider sector headwinds, I am excited by the momentum we are building and the significant growth opportunity ahead.

Graham's view

There was some big drama here in October, with Playtech being named in a defamation lawsuit by its competitor Evolution AB. There were allegations of murky dealings by Playtech with a private intelligence firm:

Subsequent reporting by Next.io said the following:

In the newly submitted court documents, it was revealed that Black Cube had signed two letters of engagement (LOEs) with Playtech as part of their relationship…

In the first letter, Black Cube was offered £150,000 if it found evidence of wrongdoing, £175,000 if an article was published in a major media outlet, £350,000 if a regulator began an investigation and £500,000 if one of the business’ licences was revoked.

Following the report’s release, Playtech paid Black Cube £675,000 in success fees for the satisfaction of the first three goals.

However, there has been little media reporting on the matter since then. It doesn't sound like we can expect a quick resolution: the trial may run for the rest of the year.

I expressed my view on the case back in October: I didn’t take sides, and I assumed everyone involved was in some way at fault. And I was neutral on Playtech shares.

Since then, we’ve had the announcement of higher gambling taxes in the UK. But as we’ve seen this hasn’t impacted Playtech 's outlook very much, thanks to its geographic diversification.

This leaves me in a bit of quandary: what view to take on Playtech shares today?

In October, I said that I would be AMBER/GREEN or GREEN if the lawsuit with Evolution was settled. I do like this business and I don’t consider it to be expensive here.

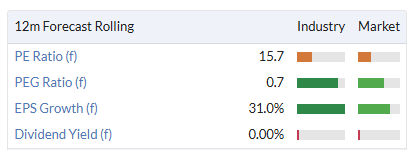

Value metrics as of last night:

It’s a close call, but on balance I’m going to stay neutral today. The Evolution lawsuit is still an outstanding matter and today’s update, while upgrading the 2025 result, has not explicitly raised guidance for 2026. For 2026, it is essentially “in line”.

So I’m not going to budge on PTEC shares today: I'm still neutral, but eager to find a good reason to upgrade my view.

Mark's Section

CT Automotive (LON:CTA)

Up 8% at 25p - Trading Statement - Mark (I hold) - BLACK (AMBER/GREEN =)

(At the time of publication, Mark has a long position in CTA.)

It’s a mixed update from this automotive supplier, and a slightly confusing one for me. They say:

As previously announced the Group expects to report revenues for FY25 of at least $113 million, in line with current market expectations, with net debt at 31 December 2025 expected to be $7.7 million. Adjusted profit before tax is expected to be at least $10.0 million.

And those expectations are given as:

Immediately prior to this announcement, the Company believes that market expectations for the year ended 31 December 25 were for revenues of $113m and adjusted Profit Before Tax of $10.5m respectively.

However, the last note from their NOMAD and sole broker, Singers, on Research Tree is from 6th August, which had $122m revenue. It did have $10.5m adj. PBT though, so I can only imagine when the company said this in their HY results in September, Singers cut the revenue forecasts, leaving PBT the same:

The Company remains on track to hit FY 25 market expectations for profitability . Market conditions, including uncertainty around tariffs, resulted in an initial level of customer caution and, combined with recent customer adjustments to program launch timing, revenues are now expected to be slightly softer. Crucially, latest customer information indicates no change to longer term production volumes to FY 26 and beyond.

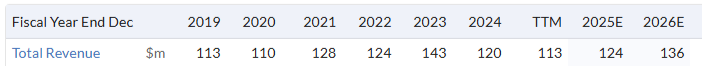

Adding to the confusion, Refinitive, who supplies Stockopedia’s data, appear to be picking up an even earlier note:

There’s no doubt that the trend in revenue forecasts has been down here, even if we are struggling to see all of those forecasts. This shouldn’t be surprising, global automotive volumes were undoubtedly weak in 2025.

In terms of profitability, it seems like they will come in very slightly below, having been hit by a few launch gremlins in Q4. However, they say these are now resolved. It also means that they did around $6m PBT in H2 versus $4.2m in H1, showing good momentum half-on-half.

The net debt comes in at $7.7m. In the video narrative, the CEO says that this is ahead of expectations. Without being able to see an updated note, it is hard to be sure. However, net debt at the half year excluding leases was $12.1m, so it seems that their operational cash flow has been particularly strong in H2, despite the capex burden of several new program launches. They say they are targeting lower inventories in 2026, so we can also expect a cash boost from this going forward.

Outlook

This is what they say:

Due to ongoing market uncertainty, the Board is taking a conservative approach to FY26 revenue and profitability which is now expected to be modestly ahead of FY25, with the benefits of recently launched programs contributing more fully as they mature through the year.

This means that the revenue forecast will clearly be behind previous forecasts, even if we don’t know what the current ones are. Profit forecasts may be slightly behind but are less severely affected.

Valuation

All of this forecast shenanigans perhaps underlines how as investors we often get caught up in a game of guess the number, rather than looking at the big picture. We miss the wood for the trees, as it were.

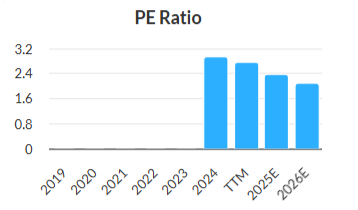

Even if we assume that forecasts are a bit behind the times here, we have a company trading on a P/E of between 2-3:

Net debt is under-control and reasonable, cash flow seems good and profits are growing modestly. Adding to this, the medium term outlook is actually quite strong:

Building on new contracts which CT Automotive has secured in H125 (and announced in our interim results in September), CT Automotive has secured a further 7 contracts in H225 with annualized revenue of approx. $10 million*. Program launches are scheduled for 2027 and 2028. This brings total new contract wins for CT Automotive in FY25 to 15 with an expected annualized revenue of approx. $47 million when all programs are fully operational by 2028. This is a significant improvement on new business wins in previous years (FY24: 8 new contract wins).

While there will be some attrition as historical programs end production, the increase in contract wins should see improving profitability throughout this period as they say “Our operations are positioned to accommodate increased production without additional cost pushing profitability directly to the bottom line.”

CFO Resignation:

The share price has been weak going into this update as it was announced last week that the Chief Financial Officer resigned from his role with immediate effect. This sort of thing is always a worry as you tend to fear the worst when a CFO leaves suddenly. IIRC there had been a few clumsy mistakes in the past, and I wonder if this has caught up with him.

Until we have a new CFO and audited accounts, this will always be a cloud that hangs over the business. I would have liked to have had some further statement on this today, even if it was carefully worded.

Mark’s view

The market appears to have had a bit of a relief rally this morning as nothing untoward has come out of the woodwork. I think we technically have to mark this as BLACK today, as FY25 profitability is slightly behind forecasts, and FY26 isn’t as strong as the last note we can see. However, with a price earning ratio of around 2, this is just stupidly cheap, even for an industry that will never be particularly highly rated. (The automotive industry tends to be highly competitive and capital intensive.) It is an industry that has good visibility of programs, which tend to be awarded several years in advance. So while the actual volumes and revenue suffer from variability in demand, the direction of travel for an individual company tends to be somewhat predictable. Here the medium-term trajectory is positive, with upcoming program launches through to 2028 likely to add directly to the bottom line. Assuming no huge skeletons appear in the closet from the CFO resignation, it seems very hard to lose money from today’s share price level. Positive business momentum and strong cash flow with a sub-3x P/E just seem like a puzzle that has to be resolved one way or another, so I am sticking with our broadly positive view of AMBER/GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.