Good morning!

We are wrapping up the report there, thank you.

Spreadsheet accompanying this report: link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Lloyds Banking (LON:LLOY) (£61.5bn | SR65) | Statutory profit before tax of £6.7 billion (2024: £6.0 billion). Return on tangible equity of 12.9%, or 14.8% excluding a charge for motor finance commission arrangements. 2026 guidance: return on tangible equity of greater than 16%. | ||

Glencore (LON:GLEN) (£59.4bn | SR38) | Achieved full year production volumes for key commodities within guidance ranges, “reflecting the ongoing benefits of our recently optimised and simplified operating structures”. | ||

Antofagasta (LON:ANTO) (£36.6bn | SR82) | Copper production was 9% higher in the fourth quarter. 27% reduction in full year net cash costs to $1.19/lb. As previously announced, full year copper production in 2026 is expected to be between 650,000 and 700,000 tonnes. | ||

3i (LON:III) (£31.3bn | SR56) | Increase in NAV per share to 3,017 pence at 31 December 2025. Total return of 20% for the nine months to 31 December 2025, including positive FX translation impact of 78p. | ||

St Jamess Place (LON:STJ) (£7.94bn | SR63) | Net inflows £6.16 billion, net investment return £23.64 billion, FUM rises from £190.2 billion to £220 billion. | ||

easyJet (LON:EZJ) (£3.61bn | SR60) | Q1 results in line with expectations. Load factor improved by 2 percentage points to 90%. FY26 outlook unchanged. | ||

Ocado (LON:OCDO) (£2.06bn | SR18) | Sobeys has decided to close its CFC in Calgary “largely due to the Alberta grocery e-commerce market's size and the rate of expansion being slower than originally anticipated”. Ocado to receive compensation of £18m, with fee revenue to reduce by £7m in FY26. | ||

Grainger (LON:GRI) (£1.41bn | SR88) | Construction has commenced on Grainger’s second BTR scheme at Guildford Station, delivering 179 new rental homes. £75m investment. | ||

Wizz Air Holdings (LON:WIZZ) (£1.34bn | SR61) | Load factor 89.8% (Q3 last year: 90.3%). Average seat kilometre capacity was 11.1 per cent higher year-on-year. Revenue +10.2%. Operating loss €124m. | ||

Greencore (LON:GNC) (£1.26bn | SR92) | Revenue +5.4%. Volume growth ahead of the market. “Robust profit conversion has continued”. Acquired Bakkavor on 16th January 2026. Enlarged business continues to trade in line with expectations. | ||

Fevertree Drinks (LON:FEVR) (£1.04bn | SR69) | FY25 revenue and adjusted EBITDA to be marginally ahead of market expectations (£372.4m and £44.4m, respectively). Comfortable with current 2026 market expectations (£409.4m revenue, £49.9m adjusted EBITDA). | ||

Renew Holdings (LON:RNWH) (£734m | SR91) | “Trading in the first quarter of the new financial year continues to give the Board confidence in meeting its full year expectations.” | ||

Alfa Financial Software Holdings (LON:ALFA) (£629m | SR54) | Revenue +15% to £126.5m, c.£2m ahead of market expectations. Operating profit growth of 17% to £40.0m, c.£3m ahead of market expectations. “Well positioned to drive overall growth in 2026.” | ||

Saga (LON:SAGA) (£629m | SR51) | FY January: underlying Profit Before Tax ahead of the prior year, and an improvement on our half year guidance. Net Debt to be marginally lower than the half year and significantly lower than the prior year, an improvement on previous guidance. Booked load factors and holidays booked revenue ahead of the same point in the prior year. | ||

James Halstead (LON:JHD) (£595m | SR74) | H1 sales will see a small reduction in comparatives, as noted at the AGM in December. Conservative approach to customer credit has not only affected revenue but profitability will also see a small reduction on comparatives for H1. Board remains positive for H2. | ||

Hilton Food (LON:HFG) (£462m | SR72) | 2025 adjusted financial results expected to be in line, but remain cautious on the outlook for the year. Now expects 2026 adjusted profit before tax to be within the range of £60m to £65m. Previously guided for 2025 adj. PBT of £72-75m, and said “profit progression [in 2026 would be] difficult”. | BLACK? | |

Rank (LON:RNK) (£426m | SR45) | Like-for-like Net Gaming Revenue of £419.8m, up 6% year-on-year. Underlying LFL operating profit increased 15% to £40.6m. “Strong H1 performance underpins our confidence in delivering full year performance in line with expectations.” | AMBER/GREEN = (Graham) [no section below] Today is the long-standing CEO's last day, with the CFO becoming interim CEO. He leaves shareholders with a pleasant half-year report, showing underlying LfL operating profit +15% to £40.6m, on 6% growth in LfL net gaming revenues. ROCE ticks up to an impressive 15.9%. The digital business (responsible for 29% of total revenue) will be seriously impacted by the forthcoming increases in remote gaming duty. But on the other hand, Rank's land-based business are benefiting from legislative changes that have allowed the installation of 850 additional gaming machines in Grosvenor venues. They continue to target £100m of annual operating profit in the medium term, and express confidence in the future with a 1p interim dividend (last year: 0.65p). Rank's profits have not been reliable in the past - wages, energy costs and tourism trends are just some examples of the factors that affect them, and that's before even considering the special taxes and regulations in the gambling sector. So I don't expect Rank to reach £100m of annual operating profit without the occasional step backwards. Even so, I think our moderately positive stance remains reasonable at a P/E multiple of 9x. The company reports an improved net cash position for Dec 2025 of £39m excluding leases (Dec 2024: £24m). | |

ITM Power (LON:ITM) (£414m | SR43) | Revenue £18, adjusted EBITDA loss £11.9m. Reiteration of full-year guidance: revenue £35-40m, adjusted EBITDA loss £27-29m. | ||

Crest Nicholson Holdings (LON:CRST) (£349m | SR35) | Full year results in line with November trading update. “Trading conditions at the start of the 2026 financial year mirror the subdued conditions seen in H2 2025…” 2026 adjusted PBT guidance £32 - 40m (2025: £26.5m). | ||

Property Franchise (LON:TPFG) (£323m | SR63) | Revenue +25%, or +9% on a pro-forma basis. Net debt £2m. Expects further growth across all divisions in 2026. | ||

Henry Boot (LON:BOOT) (£292m | SR82) | Full year profits to be broadly in line with market expectations. “While market activity remains subdued, the fundamentals of our three key markets remain compelling.” Net debt c. £108m. | BLACK (AMBER ↓) (Graham) [no section below] I’m going to knock this down by two notches all the way to AMBER, which I admit is partly out of irritation that we missed the FY26 profit warning here this morning. The company left the profit warning until the very end of the trading statement, with the CEO instead opening the announcement with a focus on FY25 being "broadly in line”, and observing that the company was positioned well for the medium term. The stock has traded at a noteworthy discount to tangible book value, which does make it interesting. Against that, it’s also carrying £108m of net debt and it admits today that gearing has risen “marginally above” their preferred range of 10-20%. Leeds-based housebuilder Stonebridge Homes saw its completions fall from all the way 270 (2024) to 185, which was blamed on softer trading conditions and planning delays. I don’t have any particular reason to doubt the company’s excuses, and the tangible NAV should support it, but this is still a “significant” profit warning and the manner in which it was delivered leaves a sour taste. | |

Luceco (LON:LUCE) (£227m | SR83) | Full year performance to exceed previously upgraded expectations. Revenue +12%. Adjusted operating profit +15% (at least £33.5m), ahead of the top end of market expectation. Revenue and adjusted operating profit expectations for 2026 increased, to comfortably exceed current market consensus. | AMBER/GREEN = (Mark) The strong LFL performance here is almost entirely due to the strongly growing EV charging business. However, that doesn’t take the shine off a strong update in difficult market conditions This remains a business that is executing extremely well, the rating is modest, the debt looks under control and momentum looks to be with the business, I see no reason to change our mostly positive stance. | |

ASA International (LON:ASAI) (£200m | SR73) | FY 2025 net profit is expected to be approximately USD 57m (2024: USD 28.5m). Loan portfolio +13% from September 2025 to Dec 2025, +37% year-on-year. Portfolio at risk (PAR) improved from 2% (September 2025) to 1.8% (Dec 2025). Cavendish: the FY25 result is 2% ahead of expectations, and the FY26 forecast is raised by 12%. | GREEN = (Graham holds) I could be wrong about this, but I find the value on offer here too tempting to ignore with profits doubling and consensus forecasts having struggled to keep up with the improving outlook. Microfinance institutions can and do collapse with regularity, but ASAI has been through many economic cycles and is, in my opinion, a highly credible operator in the space. | |

James Fisher And Sons (LON:FSJ) (£197m | SR85) | LFL revenue +4% to £395m, underlying operating profit, which is anticipated to be ahead of current market expectations at c.£28m (consensus £25.5m). Net debt / EBITDA maintained within target range of 1.0-1.5x. | ||

Smiths News (LON:SNWS) (£166m | SR98) | Trading for FY26 remains in line with market expectations. Will pay a final dividend for FY2025 of 3.8p and a special dividend of 3.0p bringing the total for FY2025 to 8.55p per ordinary share held. | GREEN = (Graham) | |

Pulsar Helium (LON:PLSR) (£149m | SR28) | Net Loss $9.6m (FY24:$20.3m loss). | ||

Tribal (LON:TRB) (£146m | SR89) | Expects to report a positive close to FY25, delivering revenue and adjusted EBITDA slightly ahead of the recently upwardly revised market expectations. Net cash position of £11.4m, significantly ahead of current market forecasts (FY24: net debt of £3.2m). Expects to deliver an adjusted EBITDA and cash performance in FY26 ahead of current market expectations. | ||

Scancell Holdings (LON:SCLP) (£139m | SR23) | £8.9m Operating Loss (2024: £10.5m loss), net liabilities £8.4m (30 April 2025: £3.8m) , Cash £8.6m (30 April 2025: £16.m). | ||

Berkeley Energia (LON:BKY) (£132m | SR22) | Metallurgical testing on representative samples from three diamond core holes during the quarter. Arbitration Tribunal with Spain continues, with Statement of Claim due to be filed in the coming weeks. | ||

Somero Enterprises (LON:SOM) (£127m | SR87) | Revenue $88.9m (2024: $109.2m), with H2 revenues up 23.4% on H1 to $49.1m. Adjusted EBITDA of $17.5m, in line with previous guidance and market expectations. Net cash $33.2m. “Customers are more optimistic about 2026 but remain cautious.” | AMBER/RED = (Mark) | |

Microlise (LON:SAAS) (£108m | SR42) | Revenue +4% to £84.0m, Adj. EBITDA -26% to £8.3m, in line with revised market expectations. Net cash £16.7m (31 Dec 24: £11.4m) | ||

accesso Technology (LON:ACSO) (£99.3m | SR65) | Revenue $155 million slightly ahead of market expectations, cash EBITDA margins approaching 15% due to cost-cutting. Net cash at 31 December 2025 was $30m. Tender offer to return £14.5m at £3.00 per share (15% premium to close). | RED = (Mark) [no section below] Slightly ahead for FY25 doesn’t overcome the fact that they issued a nasty profits warning for FY26 on 5th January. Cash flow for the year was strong meaning that they end with $30m and intend to return $20m of it via a tender offer at £3/share. Given the premium of around 15% it seems that most shareholders will tender, meaning that only a relatively small proportion of shares will be bought back from each holder. What shareholders are left with is highly uncertain. They have lost one customer and are in the process of updating the commercial agreement with another in order to keep them (presumably that will require them to accept lower fees). In this environment, any remaining customers will surely be threatening to leave in order to secure their own discount? This means the financials are so unknown that the brokers don’t seem to have been able to put any numbers on the impact, and we have to largely ignore any forward looking metrics in the StockReport. Until we have some clarity, it makes sense to keep our previously negative view. | |

Synthomer (LON:SYNT) (£89m | SR36) | Revenue -10% to £1.74bn, EBITDA in the range of £135-138m for the continuing Group (2024: £143.1m), in line with market expectations. Year-end net debt is expected to be c.£575m (H1 2025: £638.3m, FY 2024: £597.0m). Covenant net debt:EBITDA as at 31 December 2025 was 4.7-4.8x, well within the requirement of less than 5.25x. Expects progress in 2026 due to self-help (cost cutting). | AMBER/RED = (Mark) [no section below] | |

Atlantic Lithium (LON:ALL) (£83.7m | SR18) | Mining lease submitted, soil samples collected. Net cash used in operating activities A$967k, Net cash used in investing activities A$1,609k, Net cash A$5.4m, looking to raise an additional A$4.1m. | ||

Chapel Down (LON:CDGP) (£59.2m | SR7) | Net Sales +19% to £19.4m, expects Adjusted EBITDA to be in the range of £4.0m - £4.5m, ahead of market expectations. Net debt of £12.4m (FY24: £9.2m). Momentum continuing into 2026 but guiding further marketing spend and capex. | AMBER/RED = (Mark) [no section below] A strong harvest and decent sales over the Christmas period sees this English winemaker deliver record revenues and a decent beat on Adj. EBITDA. However, net debt is up again, showing a lack of conversion into free cash flow. The real issue is the £87m Enterprise Value incl. Lease Liabilities. This means that even in the best case this trades on 19xEV/EBITDA. Far too expensive for a business that looks to need increased marketing spend and capex to keep its momentum into 2026, and the StockRank of just 7 doesn’t give much confidence that this is anything but a rich person’s plaything. | |

Naked Wines (LON:WINE) (£49.2m | SR86) | Revenue -19% CCY in line with expectations. Average order value increased by 5% CCY. FY26: revenue £200-216m, Adj. EBITDA £5.5-7.5m. | ||

Seascape Energy Asia (LON:SEA) (£43.9m | SR25) | Keladi prospect upgrade to 423 bcf (+125%) with a 45% GCoS. | ||

hVIVO (LON:HVO) (£41.2m | SR44) | Revenue -26% to £46.7m, Adj. EBITDA margin low single digits, (FY24: 26%), Net cash £14.3m (FY24: £44.2m) “ahead of expectations”. High single digit revenue growth in 2026 | ||

Kavango Resources (LON:KAV) (£32m | SR4) | Total of 7,714m drilled (3,556m of RC drilling and 4,158m diamond drilling). 9 holes intersect mineralisation greater than 1g/t from 43-127m depth. | ||

Aptamer (LON:APTA) (£22.9m | SR30) | £190k of new fee-for-service orders and £80k of cash licensing receipts. | ||

KRM22 (LON:KRM) (£21.9m | SR13) | Revenue +11% to £7.5m, Adj. EBITDA -30% to £0.7m, Net cash £5.2m (FY24: £3.5m net debt) after £9.2m fundraise. | ||

Empresaria (LON:EMR) (£9.5m | SR52) | NFI -6% to £47.3 (flat CC LFL), Adj. PBT slightly ahead of market expectations. Net Debt £17.1m (FY24: £15.3m). |

Graham's Section

ASA International (LON:ASAI)

Up 5% to 210p (£207m / $286m) - Q4 2025 Trading and Business Update - Graham - GREEN =

(At the time of writing, Graham has a long position in ASAI.)

ASA International Group plc (LSE: ASAI), one of the world's largest international microfinance institutions, today provides a trading update including a business operations update for the three-month period ended 31 December 2025.

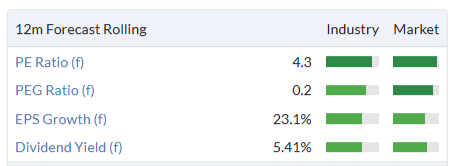

I’ve been building a small position in this large microfinance lender, tempted by the value on offer:

Here’s a link to my recent brief stock pitch.

Which brings us to today’s Q4 update.

Key points:

Full-year net profit c. $57m (2024: $28.5m) (ahead of expectations - more on this below).

Outstanding loan portfolio +37% year-on-year to $628

Portfolio at risk (a measure of arrears) improves from 2.2% (Dec 2024) to 1.8% (Dec 2025).

CEO comment:

2025 was another outstanding year for ASA International with the delivery of both strong operational growth and significantly increased levels of profitability. Profitability has doubled… It is encouraging to see that the refined strategy we adopted at the start of the year, alongside strengthened leadership layers and an expanded product suite, is already starting to pay off.

For Q4 specifically, he singles out Pakistan, Uganda, Tanzania and Kenya as demonstrating “growth across key markets”. In my stock pitch, I noted that the company does have high single-country exposure to Pakistan (2024: 380 branches out of 2,145 total).

Geographic spread

I think it’s important to understand how well (or not) the company is diversified geographically.

Figures published today show the company having 405 branches in Pakistan and 415 in The Philippines, these being the highest single-country exposures. The next-biggest are Nigeria (270) and Tanzania (244).

The total number of branches has grown 4% to 2,233. So Pakistan and the Philippines are each responsible for about 18% of the total.

In terms of the value of loans outstanding, measured in US dollars, the biggest exposures are Ghana ($142m) and Pakistan ($118m). Ghana’s loan portfolio is 23% of the total, and Pakistan is 19%.

So while ASAI is diversified among 13 countries, it’s fair to say that it does have outsized exposures to some of these.

Outlook

Looking ahead, the CEO says:

As 2026 progresses, our priorities remain firmly centred on sustainable growth, transforming the business through our digital agenda, creating further resilience across the organisation and driving operational excellence. At the heart of all of this remains our mission of increasing financial inclusion for underserved female entrepreneurs.

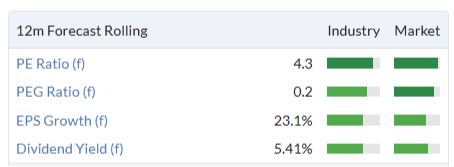

Estimates: Cavendish say that the FY25 profit result is 2% ahead of forecasts, and they have raised the FY26 profit forecasts by 12%. FY26 EPS is now forecast at 52.8 pence (69.7 US cents).

Graham’s view

Clearly this is a high-risk play. In my mental model, I’m treating it the same way I treated International Personal Finance (LON:IPF): an adventurous international lender, with geographic exposures that are in some way “exotic”.

Risk reduction comes from:

Business spread across various different countries (like IPF)

Individual loans aren’t large. In the case of ASAI, today’s figures give me an average loan per client of $226.

Low arrears rates, according to the company, with a “portfolio at risk” of only about 2%.

But at the same time there are clearly unavoidable dangers with this type of business, with the biggest one being the uncertain (or at least unknown, to me) political and economic situations in the countries in which ASAI operates. Hyperinflation, for example, is not all that uncommon.

Furthermore, microfinance institutions can and do collapse with regularity, or are shut down by hostile governments. My thesis when it comes to ASAI is that as a long-established and very large entity in the space, headquartered in the Netherlands, it has enough political credibility, along with much higher governance standards than its local competitors in each country.

But I’ve been stung before and I could very well be wrong about this one. For now I’m happy owning a modest stake in it.

If the numbers are real, it offers excellent value:

And not only have profits grown rapidly, but consensus forecasts have struggled to keep up with the improving outlook:

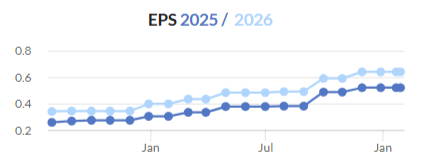

On a long-term chart you’ll see that is used to trade at a higher valuation, prior to the Covid crash:

Smiths News (LON:SNWS)

Up 1% to 67.8p (£168m) - Trading Statement - Graham - GREEN =

Smiths News is “the UK's largest news wholesaler and a leading provider of early morning end-to-end supply chain solutions”.

This is a simple “in line with expectations” AGM update.

But it contains a few other positive titbits:

The Company's strategy of maintaining shareholder returns alongside the development of additional revenue streams that leverage the Company's existing capabilities and networks remains on track.

Dividend: final divi planned of 3.8p, along with a 3p special. The total for the year: 8.55p. That’s nearly 20% higher than last year’s total dividends (7.15p).

CEO comment:

Smiths News has performed strongly since the start of the year, and I am pleased to report that we are on track to meet market expectations.

We continue to make progress in broadening our market reach, whilst ensuring we maintain our best class service across our newspaper and magazine activities.

Estimates: Smiths News follow best practice by publishing analyst consensus figures on their website and Canaccord Genuity have also published on the company today.

For FY August 2026, the consensus estimates are as follows:

Adjusted operating profit £37.2m (FY25: £39.1m)

Adjusted PBT £34.1m (FY25: £35.8m)

This AOP figure (£37.2m) is a slight increase on what I recorded in November (£37.2m).

Graham’s view

I’ve been consistently optimistic about this one, e.g. here.

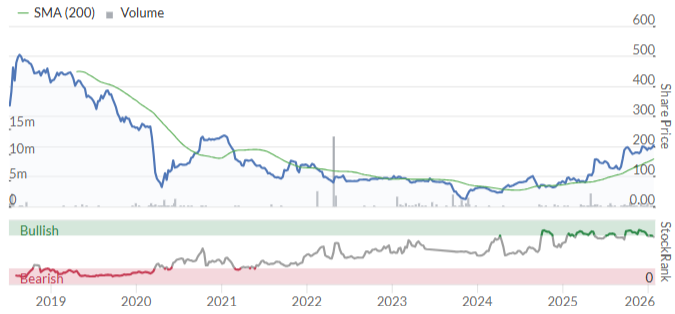

It continues to trade cheaply:

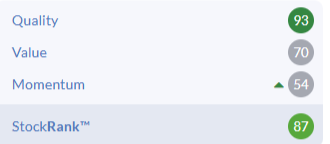

The StockRanks are enthusiastic, too - it scores 98.

At this point, it’s hard to say if its new services - final mile delivery, recycling collection, new categories in books and home entertainment - will be enough to offset the inexorable decline in newspaper circulation.

But its financial results and cash flows have been very clean, with the company moving into net cash as of the most recent full-year results, and it has been well able to afford these generous dividend payments. So I think I can keep my optimistic stance for the time being.

Mark's Section

Preamble

I’m finding the current markets incredibly difficult to call. We are seeing a surprising number of ahead statements given how weak end markets have been for many sectors. This is a clear sign that companies have either guided their brokers more conservatively than necessary, or they have responded by being more aggressive with cost-cutting. In many cases we are seeing double-digit percentage moves in stocks prior to trading updates or at what appears to be random times as investors presumably try to guess which company will deliver and which will warn. Then the responses to statements are hugely variable. We have seen ahead statements met with price drops and some in-line reporting has caused double-digit percentage rises in the share price.

Of course, the answer to this conundrum is that in many cases, the expectations of the average investor is different to the market expectations as indicated by the broker consensus. However, that makes it incredibly hard to gauge true sentiment, or know how to respond to news.

Such a market can feel frustrating, especially if you hold stocks that don’t appear to behave as expected on good news, or don’t hold the ones that respond positively to indifferent trading. However, in the long run, if investors hold a portfolio of stocks that are growing, conservatively financed and on cheap multiples, they will tend to do well, whatever the short-term market noise. It is worth keeping that in mind when tempted to chase short-term moves in expensive, risky enterprises.

Somero Enterprises (LON:SOM)

Down 6% at 220p - Trading Update - Mark - AMBER/RED

This update hasn’t been well received by the market, but that seems to be more about the dynamic described above in the run up to this statement rather than anything specific in it:

Revenue is said to be in-line, and they are quick to point out that this represents a strong recovery half on half:

It expects the Company to report FY 2025 revenue of approximately US$ 88.9m (2024: US$ 109.2m), in line with previous guidance and market expectations, with H2 revenues up 23.4% on H1 to $49.1m.

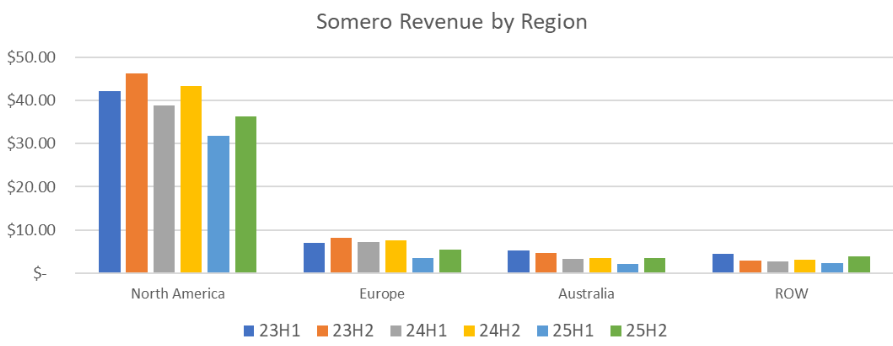

Regional Breakdown:

While this is a good recovery compared to the first half, the historical context suggests that H2 is still somewhat disappointing, being the second lowest revenue half in recent times for both their major regions of North America and Europe:

My own on-the-ground scuttlebutt suggests that there is no lack of competition in Europe and that Somero has been slow to adapt to the needs of a European consumer (battery powered operation, metric sizing and fitting on European trailer sizes being three of the major ones). While these may have been now addressed, and Somero maintains a brand-leadership position, they have let competitors exploit the lack of pace of their innovation in this market.

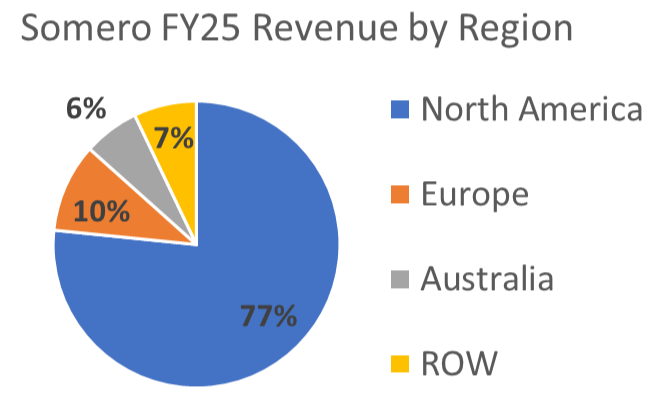

It is perhaps no surprise that revenue is increasingly dominated by the US. In FY25 77% of revenues came from this region, up from 75% in FY24 and 73% in FY23.

They say:

…Europe remains a priority international market. The Company is focused on strengthening its presence there through increasing market awareness, optimizing product and pricing for local markets, and expanding its dealer network.

However, they are at risk of becoming increasingly irrelevant in this market and being even more concentrated on US Boom Screed sales, despite efforts to diversify:

The Company's strategic initiatives, including expanding the product range to address the broader mid-range concrete contractor segment, are expected to make meaningful contributions to FY 2026 trading. Against this, sales of large-line Boomed Screeds have continued to trend down from the elevated levels in 2021, with large scale projects continuing to be adversely affected by interest rates, tariffs, and reduced warehouse sizes for final mile delivery.

We don’t hear anything in this trading statement about their more innovative products, such as SkyScreed, so the assumption is that these continue to struggle to gain traction at a level that makes any material difference to the sales figures.

Outlook

They say they expect “FY 2026 to be broadly similar to that of FY 2025”. “Broadly” of course, means slightly below. Frustratingly, Cavendish don’t provide any FY26 estimates, meaning that there are really no forecasts in the market. None of this is particularly inspiring.

Valuation

The Board expects the Company to report FY 2025 adjusted EBITDA of US$ 17.5m, in line with previous guidance and market expectations. Year-end cash is anticipated to be better than expected at US$ 33.2m, as a result of elevated advance customer deposits, the favorable impact of new US tax legislation, and lower than expected capital expenditures and interim dividend payout.

Cavendish had $18m EBITDA pencilled in so this is a slight (3%) miss on their figures. Cash is significantly ahead versus the $24m estimate. However, there are signs that this may be partially to do with customer deposit timing, and the broker not updating their model for the lower dividend payout.

In the past they have paid a supplemental dividend equal to 50% of the cash above $25m, which would see an addition $4.1m or 7.4c per share in addition to the 10.6c forecast for the FY. However, there doesn’t appear to be any commitment to this payout

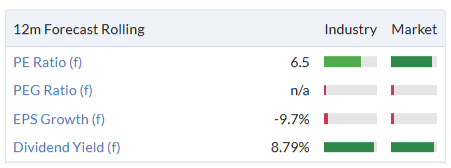

In terms of overall valuation, Cavendish say:

The shares have drifted until recently and currently trade on a FY25E P/E of 15.4x. We maintain our 260p target price offering upside to current levels (target P/E 16.5x, EV/EBITDA 9.3x).

Which again isn’t exactly inspiring. Especially, if they apply the same metrics to declining EPS in FY26, at which point they may end up with a price target below the current price, for what it's worth.

The continued strong returns on capital see the maintain its strong quality rank:

However, this company has not been able to deploy additional capital at anywhere near those rates to grow EPS. The Value Rank reflects historical figures, and with earnings set to decline in the near-term, this will be weaker going forward. The momentum is so so.

Mark’s view

This company remains largely a play on US non-residential construction. The investment case really comes down to whether one believes that the current downturn is purely cyclical, or there are structural aspects which mean that Somero’s ability to charge higher prices than competitors is being eroded. I must admit that I find this very hard to call.

The company is financially strong, giving it time to adapt to market conditions. However, there is little sign that any of their efforts at creating innovative products are actually generating meaningful sales. With FY26 looking to be lower than FY25, and Cavendish not being willing to even estimate any numbers for us, I can’t help feeling a (soon to be) historical P/E of 15 looks far to high, unless you are a strong believer in a great cyclical recovery just round the corner. Personally, I am in no rush to reconsider this as an investment until I see signs of those green shoots, nor change our previously AMBER/RED rating.

Luceco (LON:LUCE)

Up 5% at 148p - 2025 Full Year Trading Update - Mark - AMBER/GREEN

Luceco continues to outperform a relatively weak RMI market. Given its acquisitive nature, I have been critical in the past of the lack of like-for likes, so this is good to see:

Second half like-for-like revenue growth of over 6%, representing an acceleration over the 2% like-for-like revenue growth in the first half

EV charging sales is particularly strong:

EV charging sales up c.85% in the year to c.£18m (2024: £9.8m)

However, it is worth calculating what that means for the rest of the business. They did £132.9m revenue in 24H2, so +6% LFL would be £140.9m. EV charger sales were up from £5.5m in 24H1 to £9.7m in 25H2, an increase of £4.2m. This makes the LFL growth ex-EV charger sales 2.8%. Potentially less than inflation in the RMI segment, perhaps suggesting volumes have been flat in the rest of the business.

Still, you have to give them credit for buying into this growth market and successfully growing their EV charging revenue in a competitive market. It shows the quality operator that they are. And there appears to be plenty more growth to go for in this area:

Strong sales momentum entering 2026 and increasingly significant exposure to structural growth in the energy transition sector underpins outlook

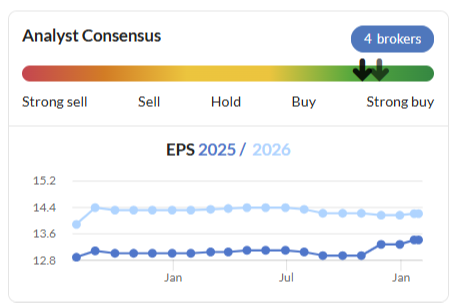

Which leads to an upgrade for FY26. This is what we like to see, with momentum leading to not just an ahead for the year just finished but an upgrade for the future. This is a little confused, as the trend for FY26 has been down recently:

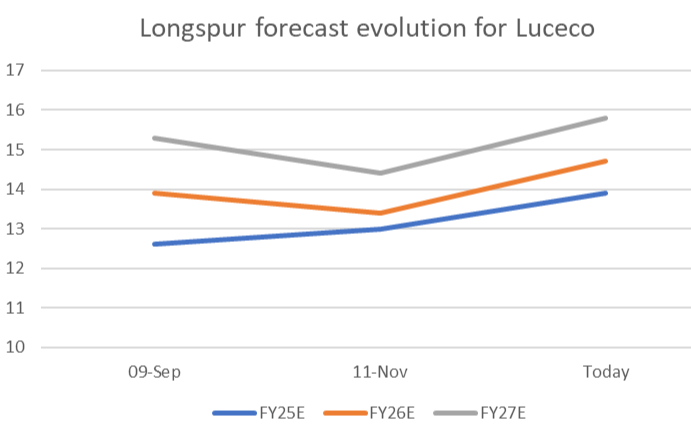

Here is the EPS forecast evolution for the only note we have consistent access to from Longspur:

So the overall upgrade is perhaps not as large as it first looks, but the key points, that it is an upgrade for all future years and today’s figure is higher than those in the middle of last year, remains.

Debt

The market has periodically worried about the debt levels here so this is also re-assuring:

Bank Net Debt at year end of c.£53m (2024: £68.6m), reducing Bank Net Debt:EBITDA leverage ratio to c.1.3x (2024: 1.6x), comfortably within the Group's target leverage range of 1-2x

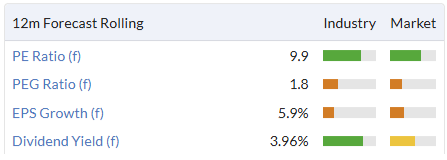

Valuation

This remains a modest P/E for a company that is performing well, and has the potential to see its core business return to growth if better RMI market conditions are seen:

With a 7-10% rise in forecasts, and a 5-10% rise in share price today, this remains on a similar rating.

However, with the net debt we need to make sure we adjust for that. Longspur calculate that the FY25 EV/EBITDA is 5.7, falling to 5.4 for FY26 and 5.0 for FY27. This will be slightly higher following today’s share price rise, but still looks good value for a company that continues to execute extremely well.

Mark’s view

Today’s trading update is undoubtedly good news, if tempered by the lack of LFL growth in their core RMI business. The rating is modest, the debt looks under control and momentum looks to be with the business, especially in their rapidly growing EV charging business. I see no reason to change our mostly positive stance here of AMBER/GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.