Good morning! 12.30pm: we're finished for today, cheers!

Macro comment

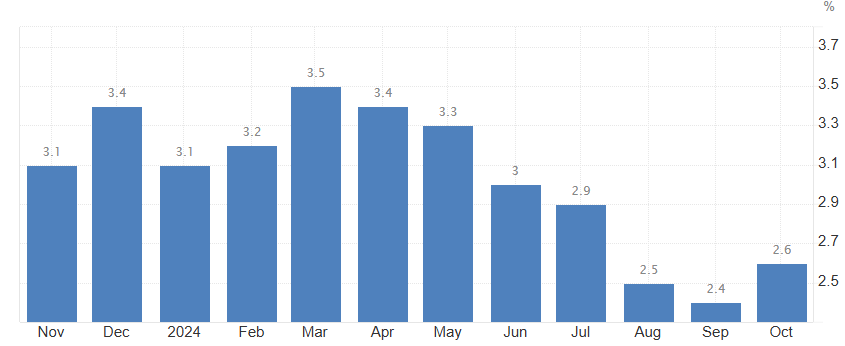

This afternoon (at 13:30 GMT) we'll have the monthly US inflation rate, and it's expected to come in at an annual rate of 2.7%.

If true, that would be a slight increase on the 2.6% recorded in October.

With thanks to TradingEconomics.com, here is the trend in CPI over the past year:

If November does come in at 2.7%, it will be seen as a short-term blow by many commentators. On the long-term, however, I think the progress in reducing inflation in the post-Covid era has been nothing short of remarkable - and while I hoped that it would happen, I had little conviction that it would.

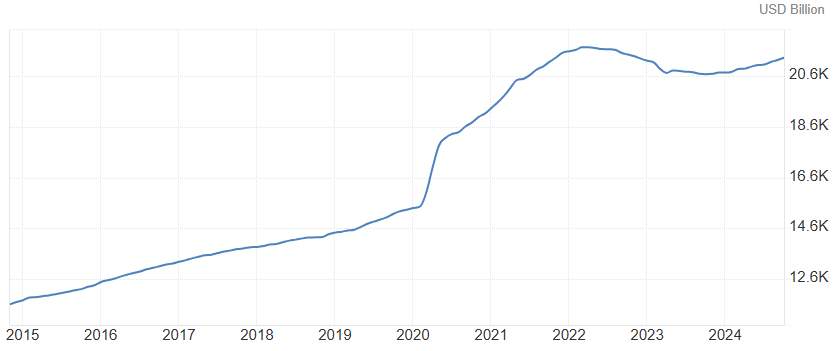

I don't think I'm alone in the naive belief that money supply feeds through to inflation. On that basis, with both US government debt (now $36 trillion) and M2 money supply soaring a few years ago, I had a genuine concern that it might not be possible to get inflation back under control in a reasonable timeframe. But that is what has happened.

Again courtesy of TradingEconomics.com, here is the US M2 money supply. Note that as soon as the rate hiking cycle began in March 2022, its growth did come to a halt. Perhaps this is still a relevant metric for inflation:

Turning back to the short-term, a CPI rate of 2.7% today is expected to accompany an annual "core" inflation rate (excluding food and energy) of 3.3%.

With the Fed's preferred measure, the PCE (Personal Consumption Expenditure) rate, also running above its 2% target, there do remain some lingering concerns that US inflation is not fully under control.

Nevertheless, 90% of economists polled by Reuters believe that another 25 basis points interest rate cut is on its way in December, reducing the Federal Funds Rate to 4.25%-4.5%.

That's not something that would be on the cards if the Fed was very concerned about inflation, so I interpret this as a sign that they think it's "good enough" at c. 2.7%.

What does it all mean for equities? I suspect it means more of the same: more all-time highs in the US equity market.

Other articles on Stockopedia:

The Case for Overlapping Value - my colleague Alex has written an article on how "Value" can be interpreted in many different ways.

Share Buybacks: are we getting value for money? The latest standalone article from Roland.

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day. We usually avoid the smallest, and most speculative companies, although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We have a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Add your own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing. Links:

Daily Stock Market Report: records from 5/11/2024 (format: Google Sheet). Updated to 10/12/2024.

Companies Reporting

Name/Mkt Cap | RNS | Status/ brief comment | Our view (Author) |

British American Tobacco (LON:BATS) (£66bn) | Trading Statement | Confirming FY24 delivery in line with guidance. | AMBER (Roland) |

Volution (LON:FAN) (£1.1bn) | AGM TU | Revenue growth 1.3% in first four months of the financial year. | |

Cohort (LON:CHRT) (£471m) | Half Year Results | Current year outlook unchanged. Stronger performance in H2, in line with previous experience. | AMBER/GREEN (Graham) |

S&U (LON:SUS) (£176m) | Trading Statement | Motor finance division: receivables down 10%, lending down 33% ytd, PBT down c. 50%. | AMBER/GREEN (Graham) |

Audioboom (LON:BOOM) (£56m) | TU | Ahead of expectations. 2024 Adj. EBITDA $3.1m vs. $2.8 forecast. 2025 rev to grow at least 10%. | AMBER/RED (Roland) |

Billington Holdings (LON:BILN) (£54m) | TU | 2024 PBT to be ahead of expectations. Confident of delivering 2025 expectations. | AMBER/GREEN (Roland) |

RM (LON:RM.) (£75m) | Full year TU | Adj. op profit 5% to 10% ahead of expectations. Net debt also finished the year ahead of exps. | RED (Graham) |

ProCook (LON:PROC) (£40m) | Interim Results | Q3 revenue +7.5% so far. Expectations for full year performance are unchanged. |

* Market caps at previous trading day’s close.

Summaries

Cohort (LON:CHRT) - up 4% to £10.63 (£495m) - Half-Year Results - Graham - AMBER/GREEN

This share rises today after a strong H1 result even though the full-year outlook is unchanged. Orders keep rolling in with the order book hitting an all-time high and the book-to-bill ratio staying over 1x. I’m happy to keep our mildly positive stance for now but will not do so indefinitely - if it keeps going at this rate, valuation will eventually be overcooked.

Billington Holdings (LON:BILN) - up 11% to 461p (£60m) - Y/E trading update - Roland - AMBER/GREEN

A material 16% earnings upgrade for 2024, but 2025 forecasts are left unchanged. This suggests earnings could fall back somewhat in 2025. Manufacturing efficiencies have improved profitability this year, but I wonder if falling steel prices have also helped. Notwithstanding this, Billington’s capex plans and confident approach to growth seems justified to me by its strong order book and decent balance sheet.

Audioboom (LON:BOOM) - up 5% to 355p (£58m) - Trading update - Roland - AMBER/RED

The podcast platform has upgraded 2024 EBITDA guidance for the second time in two months. I am encouraged by progress and the potential for positive free cash flow in 2025. However, risks remain and recent gains mean that the valuation already prices in significant further growth.

RM (LON:RM.). - up 8% to 96.5p (£81m) - Full year Trading Update - Graham - RED

It’s an excellent full-year update with adj. operating profit and net debt beating estimates. However, the company was not forecast to reduce net debt (vs. H1) in any meaningful way, and that needs to be the priority. A growing order book will hopefully help to reduce the leverage multiple (which I estimate at c. 4x currently). For now I’m cautiously staying RED on this.

British American Tobacco (LON:BATS) - up 0.8% at 2,993p (£65.7bn) - Trading Update - Roland - AMBER

The tobacco group confirms full-year expectations, despite mixed trading conditions and some pressure from cost-of-living and “illicit” vape sales. Market share remains strong in most key markets and I don’t see any near-term risks to the 8% dividend yield. However, leverage is a little high and the market is awaiting details of a major legal settlement in Canada.

Short Sections

S&U (LON:SUS)

Down 3% to £14 (£170m) - Trading Statement - Graham - AMBER/GREEN

I’m concerned that I may have jumped the gun slightly on this motor finance / property bridging company. I upgraded it to AMBER/GREEN in October having patiently stayed neutral on it until then, while the FCA carried out its review.

Today’s trading statement for the period since the beginning of August has the gloomy tone and the broadsides against authority that we are accustomed to, but it also includes some very poor numbers: motor finance receivables down 10%, loan advances down 33%, and PBT down by half. The recent Court of Appeal decision - which found that car dealers, acting as loan brokers, have a fiduciary duty to their customers - receives much of the blame. Other villains are claims management companies chasing compensation, and the government’s recent budget.

In contrast to motor finance, S&U’s property lender Aspen continues to grow at impressive rates with net receivables up 30% to £154m. It’s now more than half of the size of the motor finance division.

Graham’s view: despite the worrying numbers in today’s report, I’ll leave my AMBER/GREEN stance on this unchanged today. The key line for me in the statement is: Advantage's discussions with the FCA continue on a constructive basis as the s166 formal investigatory process draws to a close.

When the FCA gets out of the picture, which should be sooner rather than later, I’m hopeful that we’ll have something close to business as usual at S&U. And with the market cap discount to balance sheet equity (£233m) now quite material, I continue to think this is an interesting opportunity.

Severn Trent (LON:SVT)

Down 5% this week to 2576p (£7.7bn) - Reports of accounting scandal - Megan - RED

This week, the BBC’s Panorama has reported that £1.68bn of assets reported on the balance sheet of water company Severn Trent (LON:SVT) are in fact of no value to the business.

Panorama claims that the accounting trick used to report these assets has helped the business look more financially robust than it really is. Severn Trent sits on just over £14bn of total assets (most of which are long term) and has a total equity value of £1.86bn. Which would look very fragile if it wasn’t for the £1.68bn of assets highlighted by Panorama.

The details of the investigation can be read on the BBC. It’s complicated, but the overall takeaway is that there is an asset on Severn Trent’s balance sheet which seems to be made from numbers that are completely fabricated.

The reason this is interesting to private investors is that these assets have an impact on the company’s ability to pay dividends. Water companies are tightly regulated and their payout levels have to be agreed by Ofwat, based on the company’s earnings and investment in the service.

The £1.68bn of reportedly false assets contributes to the company’s retained earnings figure, which is taken into account when Ofwat agrees to the level of dividend payment. So the company may have been permitted by the regulator to pay out higher dividends than it can actually afford.

Since the anomalous asset was added to the accounts in 2017, Severn Trent Water has paid out £1.62bn to shareholders. Reported profits over the same period were £1.25bn, which means the company has paid more in dividends than it made in profit. Justifying this level of spending has relied on the balance sheet strength and retained earnings.

Megan’s view

Water companies are under the microscope at the moment for various misdemeanours. While Severn Trent rebuffs its accounting fraud accusations, unlisted (and perpetually unloved) Thames Water is defending the bloated pay of a senior executive. There are also swirling concerns about the regulated cost of water bills.

Only three of the UK’s water companies are listed and because the industry is so tightly regulated, all of them are held primarily for their dividends. But with pressure building on the industry from all angles, those payouts don’t look as safe as perhaps they once did. RED

Graham's Section

Cohort (LON:CHRT)

Up 4% to £10.63 (£495m) - Half-Year Results - Graham - AMBER/GREEN

Back in July we looked at Cohort’s excellent full-year results. We now have a fresh set of interims bringing us up to the end of October.

Revenue, adjusted operating profit and net funds are all “ahead of recent guidance”, but I’d treat this carefully as Cohort also says that the current year outlook is unchanged. An H2 weighting is anticipated, “in line with previous experience”.

So while H1 may have gone slightly better than expected, it’s not enough to cause a change in full-year expectations, at least from the company’s point of view.

In line with this, Equity Development have also left their forecasts unchanged today. For FY April 25 they estimate revenue of £240.2m, adj. EBITDA of £33m, and adj. PBT of £25.7m. These forecasts were last upgraded in November.

Turning back to today’s interims, I note that orders continued to roll in to the tune of another £139m, which is 1.2x revenue (i.e. book-to-bill is more than 1x, which bodes well for future revenue growth).

The order book closes at another record high, £541m. In an excellent achievement when it comes to revenue visibility, over 99% of consensus forecast revenue for the current financial year has been booked in. It’s true that there are only four months left, but my experience is that similar companies are often at this stage still uncertain as to how exactly they will meet full-year expectations. Whereas Cohort have it pretty much all booked in already.

H1 revenues are up 25% to £118m, while H1 adj. EPS almost doubled to 20p.

Net funds jumped up to £38m by the end of October, “well ahead of expectations due to working capital flows that included strong customer advances”. So we should be ready for this gain to potentially reverse as soon as working capital flows in the opposite direction..

Acquisition: Cohort is no stronger to acquisitions but its largest ever purchase was announced last month: the £75m purchase of the Australian company EM Solutions. EMS is a “developer and producer of high-end SATCOM terminals for global naval and defence customers”.

The deal was funded thanks to a combination of the existing cash pile, debt facilities and a placing for £40m (along with a retail offer for £1m).

Chairman comment reiterates some of the demand drivers that have been mentioned before:

The continued expansion of the order book is a strong indicator that we are offering competitive products in a growing market. On-order revenue is now deliverable out to the mid-2030's. The pipeline of order opportunities for the remainder of the year also looks strong. Demand for our solutions and services continues to be driven by heightened international tensions in the Asia-Pacific region as well as conflict in Europe and the Middle East. This backdrop is driving increased spending on defence and security. Overall, we continue to see a positive outlook for organic growth in the years ahead."

Graham's view

This is not a stock that is naturally in my wheelhouse but it is one that has impressed me every time I’ve looked at it in recent months.

My stance on it is driven more by an unwillingness to fight against momentum more than anything else: whether that’s momentum in CHRT’s order book or momentum in its share price:

Valuation has been punchy for a while. The stock trades at an adjusted PER of 24x (current year) falling to 18.5x for FY April 2026.

But there is clearly no shortage of demand for CHRT’s various high-tech defence products that span many different forms of communication and surveillance.

In addition to that you have a successful track record when it comes to acquisitions, which will hopefully be continued with the latest Australian deal.

I feel the need to put a rule in for when I might downgrade this to AMBER, as I can’t stay positive on it forever, regardless of how expensive it gets. Perhaps a simple rule could be; if the forward (adjusted) PER gets above 20-22x, then I should think about turning neutral?

I note that it passes three bullish stock screens but all of them are to do with momentum. The market demands that we pay up for this level of quality performance:

RM (LON:RM.)

Up 8% to 96.5p (£81m) - Full year Trading Update - Graham - RED

I see that Paul was concerned about the financial situation at RM in July.

As he noted at the time, the free float is very limited here, an important fact to be aware of as only around 21% of shares are likely to be available to trade at any given time. Some extra volatility could be expected:

Fortunately this is a good news update for FY Nov 2024:

Subject to completion of the FY24 audit, the Company expects FY24 adjusted operating profit to be £8.4 to £8.8 million, 5% to 10% ahead of market expectations, with adjusted EBITDA of £13 to £14 million. Revenue from continuing operations, which now excludes the Consortium business, is expected to be 5 to 6% lower than in FY23.

RM uses Investec, whose research notes are not widely available, but the company does helpfully let us know that prior expectations were for adj. operating profit of £8m.

I also appreciate the notification that results are trending 5% to 10% ahead of those expectations - wouldn’t it be great if every company did this, instead of leaving us to decode “broadly”, “slightly”, “significantly”, etc.?

The brief update continues with the following key points:

£100m of contracts won by Assessment during FY24, the “vast majority” of these contracts being recognised as revenue from FY25 onwards. Contracted order book 2.25x higher than a year ago.

Other divisions also saw improved profitability in FY24.

Net debt has finished the year ahead of market expectations, with the company staying within bank covenants during the period. The net debt market consensus for Nov 2024 was £53m, little changed vs. the figure at the end of H1.

CEO comment:

“This has been a year of transformation for RM, and the success of our strategy is reflected in the progress we have made driving profitability and growing our contracted order book. Our focus on the significant opportunities for Assessment has delivered a number of major new digital contracts, alongside operational improvements throughout the business. We are pleased with the progress that has been made and remain focused on reducing our net debt.”

Graham’s view

This feels like a special situation where you have to form a view on the solvency picture. The interim results had a very long going concern statement which concluded that the company had sufficient funds to meet its liabilities as the fall due. And so far, they are right and the company has complied with its bank covenants.

An important sense-check for me is to ask how long it would take for the company to pay off its debts, based on current profitability.

This is essentially what the net debt/EBITDA multiple (leverage multiple) is designed to assess, although in my view it does so in an overly forgiving way.

Using the latest full-year estimate, if I use a year-end net debt figure of £52m, I get a net debt/adj. EBITDA multiple of nearly 4x. This is unacceptably high, in my view.

I’m therefore inclined to leave this at RED as the leverage is still beyond a level that I consider to be reasonable for a company of this size. And that’s before we question the adj. EBITDA calculation itself and find out whether it's a reasonable approximation of cash profits.

However, given the increased size of the order book, there is hope that adj. EBITDA and real profits can increase sufficiently to make the debt load appear more manageable.

Valuation: the enterprise value (market cap plus net debt) is in the region of £130m, so that the EV/EBITDA multiple for the current year is c. 10x.

Bear in mind that in general, an EV/EBITDA multiple should be much, much lower than the PER. So the value of the equity does not strike me as particularly cheap, based on this year's earnings, but clearly the market must be expecting great things in FY 2025.

Conclusion: as the leverage multiple remains too high by my standards and the equity doesn't strike me as cheap yet, I going to leave this on RED. But if I see a leverage multiple of less than 3x, either due to lower debts or higher earnings (or ideally both), I'll upgrade it.

Roland's Section

Billington Holdings (LON:BILN)

Up 11% to 461p (£60m) - Y/E trading update - Roland - AMBER/GREEN

This structural steel group appears to be enjoying strong trading conditions and has today upgraded its profit guidance for 2024:

Continued strong delivery in the second half now results in Group profit before tax for the year ending 31 December 2024 ("FY24") is expected to be ahead of current market expectations.

The company says that its improved performance is the result of both strong trading throughout 2024 and capital expenditure to improve the efficiency (and profitability) of its manufacturing facilities.

Updated 2024 forecasts: improved profitability appears to be a key factor in this upgrade.

With thanks to house broker Cavendish, I can see this morning that revenue expectations have been left unchanged at £125m, but forecasts for adjusted earnings per share have been increased by 16.1% to 66.2p per share (previously 57p).

According to Cavendish, this upgrade has been driven by an improvement in gross margins. In addition to improved manufacturing facilities, I wonder if gross margins have also been improved by falling steel costs over the last year:

I don’t know how much exposure Billington has to steel prices (i.e. are its contracts fixed price or fixed margin?). This is an area I’d look at in more detail if I wanted to invest. But lower steel prices seem like they could be good for demand, especially given cost increases elsewhere.

Order book and Outlook: Billington certainly appears confident in the outlook. The Billington Structures business has recently taken on an extra shift at its Shafton location, while a new building is currently being constructed for the Tubecon business at the same location.

This appears to be justified by a strong order book across a range of high-value sectors:

The Group has a strong order book spanning multiple market sectors, and has been successful in securing a number of significant, good quality contracts for 2025 and into 2026, particularly in sectors that require more complex solutions such as energy from waste, high-tech manufacturing and data centres.

Billington says it’s “confident of delivering upon its market expectations for 2025.”

However, it’s worth noting that 2025 earnings forecasts have been left unchanged at this stage, which Cavendish attributes to the impact of higher planned capex. As a result, Billington’s earnings could fall sharply again next year if no further upgrades are forthcoming:

We may yet see upgrades to Billington’s FY25 forecasts if trading remains strong next year. But I’d imagine the risk of lower earnings in 2025 is the main reason why today’s share price rise has lagged behind the increase to FY24 earnings forecasts.

At the time of writing, Billington shares are now trading on a FY24e P/E of 7.0 and a FY25e P/E of 8.4.

The shares also offer a useful 4.3% dividend yield, which looks sustainable to me.

ISG Construction administration: I’m somewhat encouraged by Billington’s statement today on the recent administration of ISG Construction, which was until recently the sixth-largest construction firm in the UK.

Billington’s management say that while they’ve worked with ISG many times, all current contracts were “substantially complete” when ISG went into administration. Billington has already received an interim payout from its credit insurer and expects its financial exposure to be limited to the excess on its credit insurance.

I don’t know what the excess amount is likely to be, but this comment suggests to me that Billington is large enough and sufficiently well run to be proactively managing its credit risk – a perennial problem in this sector.

Roland’s view

This update is an interesting contrast from the profit warning issued by sector peer Severfield in November, which we covered here.

Billington’s strong performance makes me think that at least some of the issues at Severfield may be company specific, rather than sector wide.

In any case, I am encouraged by today’s update and also by the company’s focus on investing in its operations. My experience is that capital intensive businesses such as this one can often achieve worthwhile improvements in profitability and competitive positioning by ensuring their facilities are modern and well invested.

Billington’s profitability has certainly recovered strongly since 2021 and the business appears to generate attractive returns on capital employed:

I’m also encouraged by the company’s strong balance sheet. Net cash was £22m at the end of June and is expected to be at a similar level at year end.

Having cash on hand gives companies optionality to invest and manage their operations for long-term profitability. For a business of this kind, I think this can be a significant advantage.

Today’s update reads well to me and does not suggest any major concerns. I’m happy to maintain our AMBER/GREEN stance.

Audioboom (LON:BOOM)

Up 5% to 355p (£58m) - Trading update - Roland - AMBER/RED

It’s another earnings upgrade from this podcast platform today, following on from November’s upgrade:

...the Board now expects that Audioboom will generate an increased adjusted EBITDA(1) profit of at least US$3.1 million, significantly surpassing the recently upgraded market expectation of US$2.8 million.

Audioboom shares have risen by around 75% since early November, as the market has responded to evidence of improved profitability. However, this remains a painful shareholding for investors who bought during the pandemic – BOOM shares peaked at more than 2,100p in 2022…

Trading update: Audioboom now expects to generate adjusted EBITDA of “at least $3.1m” in 2024, up from previous estimates of $2.8m.

This follows a previous upgrade in November, so it seems that trading has picked up markedly during the latter part of the year.

The company says that improved profitability this year is being driven by a strong performance from its highest margin “tech-focused advertising marketplace” offering, known as Showcase.

Showcase revenue +53% so far this year

Record monthly brand advertiser count of 10,165, up 65% vs Nov 23

eCPM (revenue per 1,000 downloads) of $75.60, up 38% vs Nov 23

There is some context here which I think is worth considering. Audioboom’s record of revenue growth was broken last year when Apple introduced changes to its podcast software that drastically reduced the number of episodes that were downloaded:

Prior to the update, Apple’s podcast software would often automatically download entire backcatalogs of a series, regardless of whether the user had requested them. That’s no longer true and has had a predictable impact on podcast downloads.

This is significant for advertising-led services like Audioboom, which base advertising calculations on downloads and do not know if individual episodes are ever listened to.

Outlook: I’m not a fan of adjusted EBITDA as a measure of profit. Fortunately we have updated forecasts from broker Cavendish today - many thanks.

Cavendish analysts now expect Audioboom to report revenue of $78m in 2024, up from $73m previously.

Adjusted earnings are expected to drop out at 14.3 cents per share, an increase of 11.7% from previous estimates of 12.8 cents per share.

Perhaps most importantly, Cavendish believes Audioboom will breakeven at a cash flow level this year, opening the door to the possibility of positive free cash flow in 2025.

My sums suggest earnings of 14.3 cents per share converts to a FY24e P/E ratio of 31 after today’s share price gain.

Roland’s view

I recognise that if Audioboom can continue to scale up its activities, it could become far more profitable than it is at present.

However, Audioboom operates in a competitive market and it’s not clear to me that it has any significant competitive advantages versus rivals such as Acast.

Looking at the stock as a potential investment, I would argue that net cash of c.$3m does not provide all that much headroom for problems.

In terms of valuation, the P/E of 31 already seems to price in significant further earnings growth.

On balance, I think this remains a fairly speculative investment that could still suffer further funding problems. I’m going to maintain our stance at AMBER/RED for now.

British American Tobacco (LON:BATS)

Up 0.8% at 2,993p (£65.7bn) - Trading Update - Roland - AMBER

British American Tobacco has confirmed it expects to report full-year results in line with expectations, despite some headwinds in the US.

The company says US cigarette market volumes have fallen by 9% this year, reflecting cost-of-living pressures and illicit single-use vape sales.

In tobacco, BAT says it’s gained 0.2% of market share by volume in its top eight cigarette markets, but lost 0.2% of share by value. This implies that customers are switching to cheaper brands.

Vaping remains a key area of growth where BAT is closer to scale and profitability than UK-listed rival Imperial Brands (disc: I hold IMB).

In the US, BAT has faced tough competition from “illicit single-use Vapour products” and has been lobbying hard for enforcement to support sales of its legal products, sold under the Vuse brand.

These efforts appear to be yielding some results. BAT says Vuse now has a 40.3% share by value in its top eight geographic markets, rising to 50.7% in “US tracked channels”. I wonder how big the untracked channels are?

Outlook: Overall guidance for the year remains unchanged. BAT expects to report “low-single figure” growth in underlying revenue and adjusted operating profit.

However, the company admits that leverage is likely to end the year at the high end of its target range of 2.0x - 2.5x EBITDA. I don’t see this as a pressing concern, but personally would prefer a slightly greater focus on debt reduction here, given that net finance costs are expected to be £1.6bn this year.

Operating cash flow conversion is expected to be over 90%, providing continued support for BAT’s generous dividend:

Roland’s view

The big FTSE 100 tobacco stocks remain a popular choice with income investors – and with good reason. Large scale and sector consolidation (with zero new entrants) means that even in a shrinking cigarette market, they remain highly profitable and cash generative.

However, regulatory and legal risks remain and it’s not clear to me when the next step-change in market conditions might take place – either relating to vaping or perhaps tobacco demand.

On balance, BAT looks reasonably priced to me at current levels. While I think there’s some scope for upside, higher debt levels and as-yet the unknown impact of a major legal settlement in Canada prompt me to stay neutral for now. AMBER.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.