Good morning!

The wind-down to Christmas has begun in earnest, but we still have a healthy dose of results to review today.

All done for today, cheers! Spreadsheet accompanying this report (updated to 24th November): link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

GSK (LON:GSK) (£74bn | SR91) | Approved for twice-yearly dosing of severe asthma. Approval based on SWIFT trials showing significantly lower rate of annualised asthma exacerbations, | ||

Vodafone (LON:VOD) (£22.4bn | SR92) | Completed acquisition of German cloud computing company Skaylink for €175m. | ||

Bunzl (LON:BNZL) (£7.2bn | SR81) | SP -3% | AMBER = (Roland) [no section below] Distribution group Bunzl is the biggest faller in the FTSE 100 this morning. For many years this business was a watchword for reliable growth, but the engine has faltered slightly in recent years and the company issued a rare profit warning in April this year. Today’s update makes it clear the business failed to deliver any organic sales growth this year; the modest constant currency growth of 2% to 3% was due to acquisitions. I’d also argue that today’s FY25 operating margin guidance of 7.6%, is only barely within expectations – previous guidance in October was for “moderately below 8.0%”. Long-time CEO Frank van Zanten expects an improved year for acquisition in 2026 after a quiet period in 2025. However, today’s outlook guidance seems a little subdued to me, especially given the expectation of a further decline in margins. Bunzl shares are cheaper than in the past and currently trade on a forward P/E of 12, with a 3.5% yield. At that level I think some caution is already priced in, especially as quality metrics remain fairly strong. A return to stronger acquisitive growth could help to lift medium-term forecasts, too. I think an opportunity could be emerging here, but I’m going to remain neutral until I have a little more confidence in the outlook. | |

Diploma (LON:DPLM) (£7.2bn | SR78) | Wilson Ng appointed CFO. He has been interim CFO since August 2025 and was Group Financial Controller previously. | ||

Games Workshop (LON:GAW) (£6.5bn | SR81) | The Board has declared a dividend of 50p per share. This takes the total dividend so far for 25/26 to 375p per share (24/25: 265p). | ||

Serco (LON:SRP) (£2.5bn | SR89) | FY25 rev +3% to £4.9bn, adj op profit to be c.£270m at 5.5% margin. Free cash flow guidance increased to £170m, leverage of 0.9x EBITDA. 2026 guidance: rev c.£5.0bn, adj op profit c.£300m. | ||

Integrafin Holdings (LON:IHP) (£1.1bn | SR64) | Rev +8% to £156.8m, adj pre-tax profit +7% to £75.4m. FUD up 16% to £74.2bn, with net inflows of £4.4bn. FY26 outlook: well positioned, expect fee margins and cost growth to stabilise. | AMBER/GREEN = (Roland) [no section below] Adviser investment platform IntegraFin is the top riser in the FTSE 250 today, on the back of a strong set of results. As with AJ Bell and others, this business is benefiting from a structural shift of assets into UK private pensions and investments. IntegraFin is a little different to AJ Bell, in that it only serves financial advisers. I’ve previously wondered if this could put a cap on its growth potential, but my understanding is that there’s still a fairly long growth runway before that’s likely to happen – not least because most advisers who come onto the platform only transfer client assets gradually over time. The accounts here are quite complicated due to the inclusion of certain insurance-type products on the balance sheet. But I think last year’s underlying pre-tax profit margin of 48.1% (FY24: 48.7%) provides a good indicator of the quality of the underlying business. While the fall in margins is a useful reminder of headwinds from cost pressures and fee erosion, this remains a highly profitable and cash-generative operation. The share price reflects this, on a FY26E P/E of nearly 19, but if mid-single digit EPS growth is sustainable, I think this valuation still leaves room for gains. I’m going to leave my previous view unchanged today. | |

Greencore (LON:GNC) (£1.1bn | SR92) | The UK CMA has accepted Grencore’s undertakings re. certain facilities. The acquisition of Bakkavor (LON:BAKK) is now expected to complete on 16 January 2026. | ||

International Personal Finance (LON:IPF) (£455m | SR97) | “BasePoint has outlined the progress that it has been making on raising finance… and has asked the Board for a short extension to bring its financing arrangements to a conclusion.” | PINK (Graham holds) | |

Avacta (LON:AVCT) (£345m | SR36) | Preliminary data shows “clinically meaningful tumor shrinkage in patients with salivary gland cancers”. Combined disease control rate of 90% across Phase 1a and Phase 1b patients. | ||

Essentra (LON:ESNT) (£281m | SR39) | A family-owned US-based supplier of specialty cable protection devices. Paying $6.7m + up to $1.2m deferred, equivalent to 6.6x EBITDA multiple. Expect a ROIC of 15% within three years. | ||

Kenmare Resources (LON:KMR) (£212m | SR49) | Wet Concentrator Plant A project update and 2025 guidance update | As ore volumes have increased, issues have emerged relating to slimes management. Remedial work is underway but not expected to reach nameplate capacity until Q1 2026. 2025 ilmenite production now expected to be >830,000 tonnes (prev. 870-905,000 tonnes). | |

Enquest (LON:ENQ) (£187m | SR49) | Seligi 1b delivered gas in December, nine months ahead of schedule. Expect full production in January. FY25: group production to be at top end of 40-45 kboepd guidance range. | ||

Netcall (LON:NET) (£187m | SR63) | Momentum continued in the first half of FY26, trading in line with mgt expectations. Confident of progress in FY26. | ||

Springfield Properties (LON:SPR) (£143m | SR99) | Agreement with Scottish Hydro Electric Transmission plc to commence the delivery of almost 300 homes in the North of Scotland. Trading for H1 is in line with expectations. H1 revenue is expected to be c.£106m, with net bank debt of c.£40m (Nov 24: £62.9m). | AMBER/GREEN = (Roland) [no section below] I’m happy to see that I took a moderately positive view on Springfield in February when the company announced a major land sale. The stock has risen by over 20% since then. Today’s deal seems to be an unusual hybrid that will see Springfield build houses that will be leased to SSEN Transmission for four years (for project workers) before potentially being sold or re-let. More broadly, trading for the current year is said to be in line, with good growth in affordable housing completions. The majority of revenue for the year ending 31 May 2026 is now secured. With debt falling and the stock trading at a c.10% discount to its last-reported book value of 144p, I think it’s fair to retain my moderately positive view of this regional housebuilder. I note the algorithms share my optimism, with Super Stock styling and a StockRank of 99. | |

Record (LON:REC) (£107m | SR72) | NED left the main board and became Executive Director of Record Currency Mgmt Limited. A new NED is hired to replace him. Also, the CFO has decided to step down at the end of FY March 2026. The Chief of Staff is also leaving the Board but will remain with the company. | AMBER = (Graham) Staying neutral on Record as it did have a recent profit warning. And today's announcements, while increasing the overall expertise available to the group, do also include a CFO departure. His tenure is going to last less than two years in total, which is not ideal. | |

Jubilee Metals (LON:JLP) (£96m | SR56) | Production guidance: Copper for FY2026 is expected to be within the range of 4 500t to 5 100t depending on the extent of the current rainy season (FY2025 production: 2 211t). Company becoming a pure-play copper producer. | ||

Synectics (LON:SNX) (£52m | SR83) | “Solid” performance in FY 2025. “Group enters FY 2026 with a solid order book… FY 2026 will reflect the absence of the one-off gaming contract delivered in FY 2025; however, the Group continues to see solid demand and has good visibility on its new business pipeline.” | AMBER ↓ (Roland) Today’s commentary on the outlook for FY26 seems more mixed to me than it was in October. Unfortunately a change in broker (also in October) means we don’t have access to any live forecasts and may not be able to rely on FY26 estimates currently in the market. While the group’s large net cash position and modest valuation (based on FY25 forecasts) should provide a margin of safety, the lack of visibility on FY26 expectations means I’ve cut my view by one notch to neutral today. | |

Character (LON:CCT) (£47m | SR97) | Revenue -19% (£100.5m). Adj. operating profit £1.1m (last year: £6.5m). Statutory pre-tax loss. Net cash £12.6m. “Sales in the lead up to Christmas 2025 have been slow… The landscape in all the Group's markets is still looking unsettled, and we expect that conditions are likely to remain challenging for the rest of H1”. | AMBER/RED = (Roland) The reintroduction of forecasts is a positive step today that (finally) provides some guidance on expectations for the year ending 31 August 2026. However, I’m struck by the long-term decline in profitability of this business and management’s expectation that revenue will be flat this year – presumably because of the difficulty of replacing sales lost to US tariffs. While the balance sheet is genuinely strong, I’d prefer to wait for a post-Christmas update and reiterated guidance before turning neutral, so I’m leaving our cautious view unchanged today. | |

Victoria (LON:VCP) (£43m | SR26) | Revenue -7%. Underlying operating profit +48% (£11.4m). Underlying pre-tax loss and statutory losses. Net debt £1bn including leases. “The Board believe Victoria is well positioned to scale up output rapidly when demand strengthens.” | RED = (Graham) This looks like a probable zero to me. S&P has a CCC rating on the company's bonds, with CCC+ for the new senior notes (due 2029) and CCC- on everything else, including the 2028 notes that remain outstanding. I think this is really a question of who gets more out of a restructuring between the 2028 and 2029 noteholders, and other creditors. | |

Kropz (LON:KRPZ) (£11m | SR27) | A legal stay with the claimants had been agreed and would expire 31 December 2025. The stay has now been extended and will expire on 31 March 2026. | ||

Frontier IP (LON:FIPP) (£11m | SR15) | Placing, subscription by directors and retail offer at 15.5p (last night’s close: 16p). Cash is needed “for working capital to provide the Company with further cash runway”. The company also intends to raise further funds in early 2026. |

Graham's Section

International Personal Finance (LON:IPF)

Up 5% to 217p (£477m) - Extension of PUSU Deadline - Graham - PINK

(At the time of writing, Graham has a long position in IPF.)

This risks turning into a farce as the bid first announced in July continues to stall. The major consolation during this period is that the bid has increased (from 220p to 235p) and that dividends continue to be paid (3.8p in September, and up to another 9p early next year).

However, it remains unclear to me how real this bid is.

In October, I shared some of the public information that was available about the alleged buyer - which wasn’t all that much.

That buyer is still working on raising finance:

BasePoint has outlined the progress that it has been making on raising finance for the Further Revised Possible Offer to the Board and has asked the Board for a short extension to bring its financing arrangements to a conclusion. The Board, having considered the material progress made by BasePoint in respect of its financing… has…. requested… an extension to the deadline….”

My conclusions now are the same as those in October, except of course with another two months having been passed, it seems fair to be even more sceptical now than I was at that time. And my main conclusion is that Basepoint did not expect its bid to be accepted, or else it would have been better prepared (assuming it does really intend to buy IPF).

And why would they not expect their bid to be accepted - perhaps because it was too low?

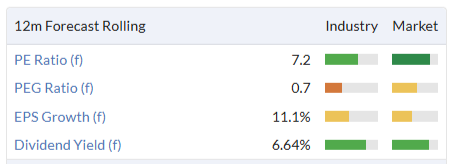

Value metrics as of last night:

Based on forecast earnings for next year, Basepoint are paying about 8x earnings.

However, the extension granted today is only for two weeks, which is unusual. Typically, these extensions grant an additional month. With only two weeks given on this occasion, perhaps this is intended to be the last extension that will be granted?

Graham’s view

While the IPF share price did originally trade near to the 220p bid in late July, it faded back as the saga unfolded. It has never traded close to the 235p bid:

However, the share price has nudged higher today on the statement that “material progress” has been made, which seems to raise the likelihood that the bid will at last materialise.

A PUSU deadline is supposed to mean something - to "put up or shut up"! The repeated granting of extensions, while common in the City, does somewhat defeat the purpose.

I’m continuing to hold my IPF shares as I personally don’t mind if this bid fails and if I therefore get to continue holding my IPF shares. Although I acknowledge that it looks like I’m in the minority with that view, as both IPF management and its major shareholders appear happy to call it a day at 235p.

Record (LON:REC)

Up 1% to 54.4p (£108m) - Directorate change - Graham - AMBER =

It’s a case of musical chairs at Record, but there is a deeper reason for it.

An overview of the changes:

A non-executive director (Dr Othman Boukrami) has taken on an executive role, relinquishing his seat on the main board. He previously spent many years in senior roles at The Currency Exchange Fund (TCX).

A new NED is hired to replace him.

The CFO has decided to step down, “to try something new”. He only joined in 2024. He will stay until March 2026 (the end of the current financial year) and support the search for his successor. He is thanked for his contribution.

The Chief of Staff is also leaving the main board “for personal reasons” but will continue to be a senior executive at the company.

That’s quite a lot of changes to be announced on the same day - what does it mean?

The Chairman:

Record is a Company in transition from being a currency manager alone to a more diverse asset manager providing a range of services to institutional investors. Reflecting current and future priorities, we continue to assess the senior management and board requirements of the Company, whilst always looking to take into account the personal circumstances of the executives involved in the business

Graham’s view

The net effect of the changes seems to be that more expertise will be available to the company, considering that a NED has now become an executive (in a newly-created role?), and a new NED has joined to replace him.

This is consistent with the Chairman’s statement that Record is becoming a more diverse service provider, so that its needs are changing.

As for our stance on Record, we’ve been neutral since the November profit warning:

I’m inclined to leave our stance unchanged today as that profit warning was still so very recent. Also, a CFO departure is rarely good news and in circumstances without a very clear explanation (e.g. retirement, or being headhunted) then I think it’s fair to interpret it negatively.

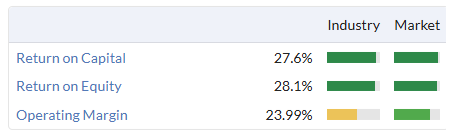

I’m therefore staying neutral on Record, although it’s a business I admire. It has the ingredients of a quality business, it just lacks the spark of growth:

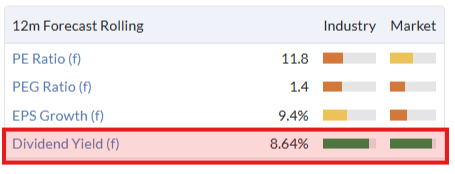

If investors own it purely for income rather than growth, they may be satisfied:

Victoria (LON:VCP)

Down 13% to 32.5p (£37m) - Half-year Report - Graham - RED =

This makes for grim reading and I’m relieved that we’ve been so sceptical of this one.

Financial lowlights:

Revenue down 7% (£528.7m)

Underlying operating profit up 48% to £11.4m.

Underlying pre-tax loss £15.4m.

Statutory after-tax loss of £139.4m.

This business has been an exercise in financial wizardry for a long time - but I think it’s time might be up soon.

There are £132m of “non-underlying items” in the six-month period. Quite impressive for a business with a market cap of less than £40m!

They say that there is no material uncertainty re: their ability to continue as a going concern, thanks to the recent bond refinancing, which converted 2026 and some of the 2028 notes into new first-priority 2029 notes.

That recent refinancing was classified as a “Selective Default” (SD) by ratings agency S&P, as it was considered to compromise the position of the 2028 noteholders, without their full consent.

And as things stand, €167m of 2028 Senior Secured Notes still remain to be refinanced.

S&P has a CCC+ rating on Victoria’s new 2029 notes, while all debts subordinated to those notes have a CCC- rating.

In S&P’s words, all the subordinated notes have “0% recovery prospects”, which means that noteholders are expected to receive almost nothing - less than 10% of what they are owed - in the event of a default.

A credit rating of CCC means:

As a general rule, issuers and issues that face at least a one-in-two likelihood of default will be rated in the 'CCC' category. The 'CCC' category may also be appropriate--even at a lower likelihood of default threshold of approximately one-in-three--if we expect a default within the next 12 months.

The half-year report published today provides the following information re: debt:

Net debt £1,004m

Leverage multiple 8.6x

Balance sheet net assets are minus £412m, or minus £604m if intangibles are excluded.

Chairman Geoff Wilding points to £20m being taken out of the cost base in H1, and looks forward to a recovery in demand:

…we remind investors that industry estimates are that flooring volumes across Victoria's core markets are some 20-25% below the long-term trend. Normalisation of demand would therefore imply a volume uplift of more than 25% from current levels. We express no firm view as to the timing of this recovery, only confidence that it will happen and that, in the meantime, we continue to execute internal initiatives to drive earnings.

Graham’s view

My experience following this share doesn’t make me any more inclined to invest in any company that provides floor coverings. But the main lesson is an even more familiar one: to avoid businesses which attempt to make boring industries more lucrative through debt-fuelled M&A. VCP looks like a probable zero to me.

Roland's Section

Synectics (LON:SNX)

Down 18% at 237p (£42m) - Full Year Trading Update - Roland - AMBER ↓

Today’s update suggests FY25 results should be in line with expectations, but concludes with a somewhat cagey 2026 outlook statement. A recent change of broker means we don’t have access to any current forecasts.

The market has delivered its usual verdict on evasion and uncertainty and Synectics’ share price is down by more than 15% at the time of publication.

FY25 update: the good news is that the year ended 30 November 2025 was a strong year. Guidance has been upgraded today:

FY25 revenue is expected to be around £68m (FY24: £55.8m)

FY25 adjusted pre-tax profit of at least £6.0m (FY24: £4.7m).

This is an upgrade on previous guidance of c.£67m and “no less than £5.7m” provided in October.

The FY25 result includes the benefit of a “significant, non-recurring gaming contract in South-East Asia”. This contributed c.£12m to last year’s revenue – about 18% of full-year sales (and an unspecified proportion of profit).

Net cash at the end of the year was £14.1m (more than a quarter of the market cap).

The full-year dividend will be lifted by 11% to 5.0p – although this is well below the 44% increase to 6.5p suggested by forecasts on Stockopedia.

FY26 outlook: looking ahead, the picture isn’t so clear.

Synectics’ order book was c.£26.5m at the end of November, down from £38.5m a year earlier. This reduction is said to “predominantly” reflect the completion of the gaming contract.

However, management says the order book has also been impacted by “global economic conditions delaying the timing of certain project approvals, particularly in oil and gas”.

The company describes the order book as “solid” and says it has “growing momentum in strategic execution”. But guidance for the year suggests to me there’s a possibility that revenue could fall in FY26:

FY 2026 will reflect the absence of the one-off gaming contract delivered in FY 2025; however, the Group continues to see solid demand and has good visibility on its new business pipeline. Recent contract wins in the renewables and decarbonisation sectors reflect early traction from the Company's strategic initiatives to broaden its market reach and diversify its end markets.

My impression is that profit margins may also come under pressure. In July’s half-year results, the company guided for “a step-up in operating costs in H2” as the business increased spending on product development and associated commercial capabilities.

Today’s update reiterates commentary about higher investment for the year ahead:

[...] increased investment is anticipated in line with the Group's long-term growth priorities, funded from existing cash resources, as the Group executes its strategic transformation and continues to build the capabilities required to scale.

CEO Amanda Larnder plans to provide “a more detailed view” of FY26 and future year expectations with Synectics full-year results in March 2026.

Broker forecasts: in situations like this I’d normally turn to Research Tree to see if any updated broker forecasts are available. But that’s not possible in this case. Synectics changed its sole broker from Shore Capital to Singer Capital Markets in October.

Thus far, Singer hasn’t shared any coverage on Research Tree. While July’s note from Shore remains available, its forecasts are no longer being maintained and may not be accurate.

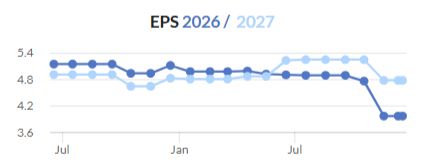

I don’t know if Singer has initiated forecasts for Synectics yet. But the FY26 forecasts shown on Stockopedia for FY26 haven’t been updated since February. Given the change in broker and the tone of today’s update, I think there’s a good chance these estimates are out of date:

Roland’s view

Synectics’ last trading update was in October. While some of the wording was similar to that used today, the company didn’t make any reference to the one-off benefit of this year’s gaming contract. Instead, management simply reported “good visibility” on the pipeline for FY26.

The change of emphasis today suggests to me that the company may now be less confident in replacing the revenue from last year’s big gaming contract.

Without updated forecasts, we are in the dark here until Synectics issues more detailed guidance with its full-year results in March.

The stock’s 18% fall this morning has left Synectics trading on c.10x FY25E earnings – potentially an attractive valuation, especially given the large net cash position.

However, while I don’t think today’s update can be seen as a full-blown profit warning, I think it does justify a more cautious stance than I’ve taken previously. To reflect this, I am downgrading my view by one notch to AMBER (neutral) today.

I note that Synectics featured in Mark’s article in November highlighting stocks whose momentum might be faltering…

Character (LON:CCT)

Down 7% at 245p (£43m) - Full Year Results - Roland - AMBER/RED =

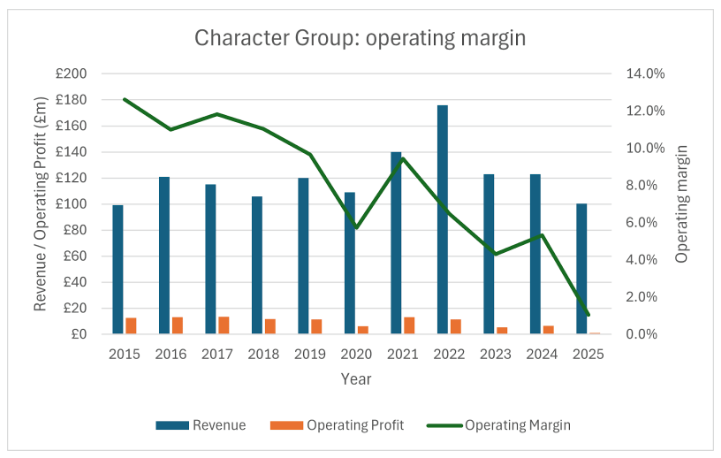

Toy producer Character Group has had its days in the sun in the past, but it has struggled to regain this form in recent years.

The 2022 supply chain crisis was tough for the business and broker forecasts were suspended in April when US tariffs were introduced.

Today’s full-year results report difficult trading and suggest to me that Mark was right to adopt a cautious view when he covered the company’s full-year trading update in October.

However, these results have also prompted the welcome return of broker coverage, with forecasts now available for FY26 and FY27. These estimates should soon make their way into the Stockopedia system, providing fresh data for an updated StockRank.

FY25 results summary

The second half of the year got off to a bad start when President Trump launched his tariff programme in April:

The US accounted for approximately 20% of the Group's turnover in the prior financial year and, with most of the Group's production sourced from China, our sales to the USA immediately stalled and remained weak for the rest of the financial year.

The headline financial numbers make for fairly grim reading, although the strength of Character’s balance sheet remains a highlight:

Revenue -18.6% to £100.5m

Adjusted pre-tax profit -81.8% to £1.2m

Reported pre-tax loss of £1.8m (FY24: £5.7m profit)

Adjusted EPS -81.2% to 5.59p

Dividend -68.4% to 6.0p per share

Net assets -14.2% to £33.1m

Net cash -4.5% to £12.6m

The market cap of £43m at the time of writing means that as with Synectics, above, more than a quarter of Character’s equity value is covered by net cash.

Indeed, strong cash conversion means Characters’ net cash balance would actually have risen last year, if the company hadn’t decided to spend £2m on share buybacks.

I guess these buybacks helped to support the share price, but I’m not sure how much real value they’ve created for shareholders. Based on today’s share price, I estimate Character has been buying back its shares on a P/E of perhaps 40x during the year.

Said differently, today’s adjusted pre-tax profit of £1.2m implies an effective rate of return of 2.8% by repurchasing its shares, using Next’s methodology for assessing share buybacks.

In terms of capital allocation, Character could potentially have generated higher returns by buying UK government debt than by repurchasing its own shares.

Of course, this maths could change if profits rebound to improve future earnings.

Profitability: the slump in profit last year appears to have been due to lower volumes rather than lower margins. Gross margins were stable at just over 26% and operating costs fell slightly due to lower distribution costs.

However, the bulk of the group’s overheads appear to be fixed and remained unchanged, despite lower volumes. This means the 18.6% drop in revenue resulted in a nasty dose of operating leverage, cutting the group’s operating margin from 5.3% to just 1.1%.

The opportunity here is that if sales start to recover from FY26 onwards, profits could rebound rapidly as positive operating leverage kicks in. However, today’s outlook commentary leaves me a little unsure as to how likely this might be.

Outlook & Estimates

Sales in the lead up to Christmas 2025 have been slow and have declined from the comparable period in 2024. The landscape in all the Group's markets is still looking unsettled, and we expect that conditions are likely to remain challenging for the rest of the first half of this financial year.

Despite this gloomy prognosis, management believes that “the launch of new product ranges together with enhancements to the ongoing ones” will support an improvement in H2 profitability.

While US revenue is expected to decline further, growth is expected elsewhere.

To the company’s credit, they do provide some explicit financial guidance for FY26:

“Overall annual turnover is likely to remain flat”

FY26 adjusted pre-tax profit is expected to “more than double”

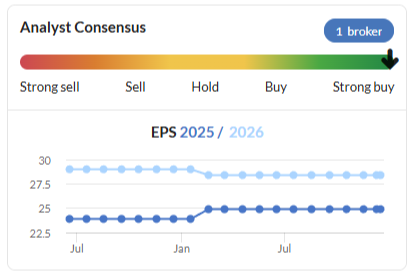

With thanks to Allenby Capital and Panmure Liberum for publishing on Research Tree, we have newly introduced FY26 forecasts today:

Allenby FY26E adj EPS: 14.1p

PanLib FY26E adj EPS: 11.3p

Panmure Liberum analysts emphasise that a return to sales growth “is critical for medium-term margin recovery” and have adopted a HOLD rating.

Roland’s view

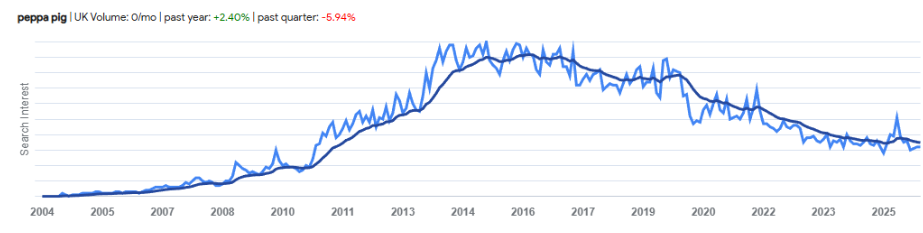

My feeling is that Character Group’s best years (in recent times) probably coincided with peak Peppa Pig mania – the popular porcine is one of the company’s licensed brands.

Sadly for shareholders, Google Trends suggests those days may now be past:

Source: Google Trends

Character’s sales and profits exceeded current levels 10 years ago. Given the impact of inflation and other factors in the meantime, it’s hard to avoid concluding the business has been shrinking. Profitability has also trended steadily lower:

My decision today is whether to leave Mark’s AMBER/RED view unchanged or switch to a neutral view, given the improved outlook and reinstated forecasts.

Forecasts for flat revenue in FY26 suggest to me that Character is struggling to find other markets with the potential to revenue lost from the US. That’s not surprising, given the country’s position as the world’s largest and most affluent consumer goods market.

Averaging the two forecasts above gives me an EPS estimate of 12.7p per share. That’s equivalent to a P/E of 19 at today’s share price.

Personally, my feeling is that Character stock is probably up with events at current levels.

I have to admit I’m also a little wary about the company’s prediction of improved profits without any revenue growth in FY26. It’s not clear to me whether this will be achieved by higher gross margins or cost cutting. I’ve not seen much evidence of either in the past.

I don’t see how Character can deliver a return to sustainable profit growth until it also starts generating real sales growth.

Perhaps out of an abundance of caution, I’m going to leave Mark’s AMBER/RED view unchanged today. I’d prefer to know more about Christmas trading and see management reiterate FY26 guidance before turning neutral.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.