Good morning! We have a section from Mark on CLIG to kick us off today.

1.30pm: That's all for today. Cheers!

Spreadsheet that accompanies this report: updated to 14/2/2025.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

ConvaTec (LON:CTEC) (£5.1bn) | Full-year Results | Rev +7%, op profit +23.7%. Leverage lower. Confident outlook, FY25 guidance reiterated. | |

Hikma Pharmaceuticals (LON:HIK) (£5.1bn) | Final Results | Rev +9%, ahead of exps. Core op profit +2% to $719m in line with exps. “Strong” 2025 outlook. | |

Rathbones (LON:RAT) (£1.9bn) | Full-year Results | FUMA +3.7% to £109.2bn, PBT +73% to £99.6m. Cost savings ahead of target. H2 bias in FY25? | |

Morgan Sindall (LON:MGNS) (£1.7bn) | Full-year Results | “Record” year, rev +10% and PBT +19%. Improved daily net cash. 2025 to be in line with exps. | AMBER/GREEN (Graham) [no section below] This construction share has doubled since we gave it the thumbs up in 2023. Led by founder and 6% shareholder John Morgan it continues to go from strength to strength. The outlook is in line despite economic uncertainty. I adjust our stance lower to reflect the much higher valuation now attached to the shares. May still offer value considering year-end net cash of nearly £500m. StockRank 96. Great emphasis by management on profit margins and ROCE targets. |

Hammerson (LON:HMSO) (£1.4bn) | Final Results | LFL gross rental income +1.6%, adj earnings £99m (FY23: £116m). EPRA NTAVps 370p, LTV 30%. | |

| Pets at Home (LON:PETS) (£1.2bn) | Media reports - FT. Also see City AM. | SP up 14% Rumours of private equity interest. Separately, there are suggestions by Jefferies that the CMA probe into vet services will have limited impact. | AMBER (Graham) [no section below] A spokesman for the private equity firm has told the FT that the speculation is "totally incorrect". It's hard to know what to believe. I was neutral on this share in January (at 220p) and am not inclined to change my stance at 260p in February based on rumours. If the CMA probe has no impact that will be a definite positive and I could think about turning AMBER/GREEN. For now I'll wait to receive more solid information. |

Chemring (LON:CHG) (£1.0bn) | AGM TU | FY25 outlook in line with exps. Order book 30 Jan 25 £1,351m (Jan 24: £991m). £40m buyback. | |

Aston Martin Lagonda Global Holdings (LON:AML) (£1.0bn) | Full-year results | Rev -3%, op loss of £99.5m. Net debt +43% to £1,163m. Exp +ve adj EBIT in FY25. | |

Brickability (LON:BRCK) (£198m) | TU | Resilient performance, good order visibility on y/e 31 March. FY25 adj EBITDA to be ahead of exps. | GREEN (Roland) |

Seeing Machines (LON:SEE) (£187m) | TU | H1 25 revenue flat at $25.3m, LBITDA $9.5m-$10m. Net cash $39.6m, cars on road +90% YoY. | |

International Personal Finance (LON:IPF) (£176m) | Final Results | Pre-exceptional PBT £85.2m, ahead of guidance (£78-82m). New £15m buyback. | GREEN (Graham holds) |

Tracsis (LON:TRCS) (£120m) | TU | Slow start to CP7 impacting RCM. Successful conversion of pipeline needed for FY25 to be in line. | |

Avingtrans (LON:AVG) (£116m) | Interim Results | Revenue +21%, in line. “Solid visibility” over H2; Board “confident about the Group expectations”. | AMBER (Roland) |

Water Intelligence (LON:WATR) (£63m) | TU, acquisitions, strategic update | In line. EBITDA +12% ($15m). US acquisitions: $1.2m & $3m. New water monitoring partnership. | GREEN (Roland) |

Angling Direct (LON:ANG) (£30m) | TU | FY Jan 2025 rev, adj. EBITDA slightly ahead of exps. UK like-for-like store sales +6%. | |

Empresaria (LON:EMR) (£13m) | Strategic Update | Strategy: will focus on core in UK/US and Offshore Services (India). Exits to eliminate net debt. | AMBER/RED (Graham) [no section below] Accelerating the slim-down to focus on only three divisions. Moves to a single brand in UK and US. I was AMBER/RED last October due to the level of borrowings involved and net debt was higher still at £15m as of Dec 2024. Recruitment conditions remain poor and it’s reasonable to worry that there are structural problems with the sector. Decision action is welcome. I’ll leave my stance unchanged until I see what values are achieved in the forthcoming disposals. |

Silver Bullet Data Services (LON:SBDS) (£9m) | TU | Revenue £9.4m (LY: £8.3m) Positive EBITDA run rate in Q4, anticipated to continue in 2025. | AMBER/RED (Graham) [no section below] Understanding the product set is a challenge: digital transformation for businesses with an emphasis on improving the customer experience (CX). Positive EBITDA run rate is positive and £6m of revenue has already been booked for 2025. However, the word “cash” isn’t mentioned today and I’m not convinced that the company has very much, so I’ll take a moderately negative stance. |

Backlog

City of London Investment (LON:CLIG)

Flat yesterday at 356p - HY Results - Mark - AMBER/GREEN

Funds under management are down slightly on the half year. However, it is the average that matters for fees, and here, the trend is positive:

They say FUM at the end of January are also up and stand at around £10.1b.

This sees an increase in fees:

That feeds through to the bottom line:

While there is quite a way to go before they return to 2021 highs, these are at least moving in the right direction (something not many asset managers can say at the moment.) Importantly, for many holders of this high-yielder, there is improved dividend cover. Here are the company’s own assumptions for this:

Their investment strategy of investing in closed-end funds trading at a discount also seems to be doing well across the board, which perhaps bodes well for outflows to turn into inflows over time. They give some more detail than usual with these results:

(Apologies for the picture; they don’t appear to allow text to be copied out of their interim report.]

One of the risks here is that the returns from good performance end up going out as bonuses to the managers rather than to shareholders. This is something the company had an issue with in the past, with the founder stepping back in to get costs under control. Since handing over to the current team, there is little sign of this, with employee costs up less than 3% over the last year. One to watch out for when annual bonuses are accounted for at the end of the year, though.

Until then, the forward P/E looks a little high, given the lack of long-term growth:

But given that almost all these earnings turn into free cash, it enables them to pay the market-leading 9% dividend yield. Unlike many asset managers at the moment, this is covered by earnings and cash flow.

Mark’s view

This is very much a steady-eddy compared to many asset managers. Its relatively low-risk strategies appear to be outperforming, and the fees earned cover the 9% dividend yield, so I can easily see this being attractive to income-focused investors. AMBER/GREEN

Graham's Section

International Personal Finance (LON:IPF)

Up 4% to 132.6p (£288m) - 2024 Final Results and Accounts - Graham - GREEN

At the time of publication, Graham has a long position in IPF.

IPF is a home credit company, online lender and credit card provider. It operates in various European countries, Mexico and Australia.

I had the privilege of speaking with IPF’s CEO Gerard Ryan, CFO Gary Thompson and Investor Relations Manager Rachel Moran this morning.

I’ve also been listening to their results webcast.

Below are the notes from my Q&A. Please note that I didn’t record the meeting - I took handwritten notes and typed them up here. So if there are any errors they are mine alone!

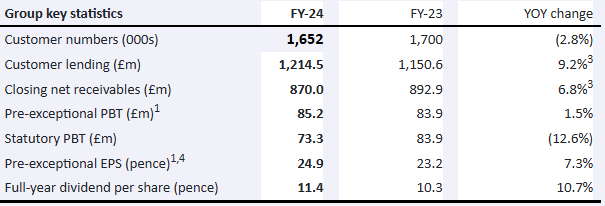

First, let me post the key statistics table so you can have a big-picture view of the results:

The outlook statement says:

Our strong operational and financial performance in 2024, together with our strong balance sheet, lays the foundation for accelerating the rate of growth and the pace of change in 2025 as we continue to execute against our Next Gen strategy.

In Poland, the receipt of the full payment institution licence enables us to accelerate its return to growth whilst in Mexico home credit, where we have upgraded our IT systems infrastructure, we anticipate strong demand to fuel growth and geographic expansion. Following an excellent performance in 2024, we expect IPF Digital will continue to build scale and deliver further strong growth in 2025, particularly in the very attractive Mexico and Australia markets.

Now here are my notes from the Q&A!

1. Exceptional costs.

Background: In 2023, pre-exceptional PBT and statutory PBT were both £83.9m, i.e. there were no exceptionals.

In 2024, IPF generated “pre-exceptional” PBT of £85.2m in 2024, while statutory PBT was £73.3m.

My question related to the outlook for exceptional costs - would they calm down or remain at a higher level?

Answer: about half of the exceptional costs were related to the refinancing of IPF’s Eurobond, and that is done now. That bond is now trading at a yield of 8.5% (it was issued at 10.75%!).

The other half of the exceptional costs relate to the restructuring in Poland, an area which can now start to grow again. Historically IPF was a siloed organisation. Moving forward, there will be more shared services between different countries. To the extent that exceptional costs are needed in future it should have more to do with natural attrition than particular countries that need to be restructured.

2. Impairment rate.

Background: the impairment rate has fallen from 12.2% to 9.6%, far below the target range of 15-20%. What explains this?

Answer: The quality of the portfolio. IPF’s customers have access to jobs and higher incomes than they did before. Due to cost of living challenges they need additional finance but they are able to repay from their income. Secondly, regulations have forced IPF to find customers with proof (documentation) of their income, rather than operating in the cash economy. This also sends IPF higher up the quality spectrum in terms of customer credit quality.

Successful execution by IPF’s employees is another key factor in driving the low impairment rate.

Follow up question on impairments: should the target range be adjusted, given how far below it the actual impairment rate is?

Answer: it could be adjusted lower but they are happy to leave it where it is for now. In 2025 they are planning to gain a lot of new business and lots of new customers will inherently bring a higher risk. Also, growth in Mexico was slower than expected in 2024. The impairment rate in Mexico is 30% and as this region grows it will raise the impairment rate.

If they did lower the target impairment rate, they would also want to lower the target revenue yield (i.e. they would expect lower revenue at a lower impairment rate).

3. Regulations

Background: Poland had a major restructuring after an interest rate cap was brought in. As this is such an area of concern for investors, have there been any developments in terms of regulations since we spoke last?

Answer: Nothing new here. There are Europe-wide regulations that apply. In terms of specific countries, there is still no rate cap in Czechia and that may come in at some point. A new cost of credit cap came into force in Romania in November (not material).

4. General question on collateral

Background: It was put to me by a subscriber that IPF suffers from not having access to collateral. Its customers do not have much collateral to put up and if they do, other lenders will have first claim to it. Would IPF like to address this?

Answer: this reflects a misunderstanding of the business model. The average loan amount is £900 in Europe and only about a third of that in Mexico. IPF has no interest in repossessing a customer’s television to repay a loan, and does not want to keep people in debt. What they do is help people by extending contracts at no cost to give them the time to repay. Collateralised debt is not their business model and never will be.

Historically, the stability of their impairment rate (without collateral) has been incredible. Collateralised lending brings its own set of risks, e.g. the value of 2nd hand cars can fall.

5. Buybacks

Background: IPF has announced a new £15m buyback having just completed one in H2. I like companies at cheap earnings multiples buying back their own shares. Is it reasonable to think that IPF could very meaningfully reduce its share count in the years ahead through the use of buybacks?

Answer: For us, buybacks are not about ego. It’s about being disciplined. If we have a surplus that we can’t use effectively to grow, then we will deploy it on buybacks. The exceptional tax credit (£17.4m) that we gained in 2024 was unexpected, and we are happy to return it to shareholders.

Summing up: we think investors should be pleased with these results. They include a successful refinancing, meeting and beating historic guidance, our pre-exceptional return on required equity (RoRE) hitting our target range (15-20%), and carrying good momentum into 2025.

Graham’s view

I need to move on and look at other companies now, but I’m glad I had the chance to look at this in detail. IPF was on my 2025 watchlist and I’m now a shareholder in the company.

All lenders carry risk but personally I think the risks are priced in here:

The StockRanks love it, too:

It’s not every day that I find a company at a very cheap earnings multiple that is buying back its shares (£30m in total announced across two buybacks, more than 10% of the market cap), and appears to have good growth prospects. It’s too good of an opportunity for me to pass up and I’m hoping to add to my position.

Roland's Section

Brickability (LON:BRCK)

Up 6% to 65p (£210m) - Trading Update - Roland - GREEN

It’s good news this morning for shareholders in this building materials distribution group:

the Board now anticipates delivering adjusted EBITDA modestly ahead of market expectations for the year ending 31 March 2025.

The company helpfully specifies a market consensus for FY25 adjusted EBITDA of £47m prior to today.

Estimates: I can’t find any updated broker notes this morning, but I would guess that use of “modestly ahead” suggests an increase of around 5%.

On that basis I estimate today’s update may suggest FY25 adjusted EBITDA of perhaps £49m.

My number crunching suggests this could equate to adjusted earnings of just under 9p per share, compared to previous consensus of 8.5p. That would leave Brickability on a FY25E P/E of seven.

Trading commentary: Brickability notes the “challenging market backdrop” but says its diverse revenue streams have supported revenue growth over the period.

During the four months to 31 January 2025, revenue rose by 12.3% on a like-for-like basis, with growth across all of the company’s divisions. These highlight more diversity than we might expect from a company with Brick in its name:

Bricks and Building Materials & Importing: strong revenue growth, but pricing has become “increasingly competitive” due to softer demand

Distribution: H1 trend has continued with strong demand for Solar PV products from the Upowa business

Contracting: building safety remediation continues to support demand for cladding and fire remediation services. Divisional margins “significantly ahead of the Group’s blended average”

Outlook: trading during the first 10 months of the year ending 31 March has been “resilient”.

Current momentum and good visibility on orders for the remainder of the year are said to support today’s upgrade to EBITDA guidance.

Brickability CEO Frank Hanna believes the business is well positioned “to benefit quickly” when new housing volumes start to rise, but cautions the pace of this recovery “is still uncertain”.

Roland’s view

Given Brickability’s stable trading, I think a cautious outlook is probably already reflected in the share price, which has sold off sharply over the last year:

My only slight qualm here is net debt, which was £56m at the end of H1 and is expected to be £60m at the end of March (according to a Cavendish note from Dec 24).

Given that this is a low margin business, I wouldn’t want to see borrowing climb much higher than this. But I don’t think there’s too much to worry about at current levels, which suggest a net debt/EBITDA multiple of perhaps 1.2x.

With the stock continuing to trade at a modest valuation with a well-covered 5.5% dividend yield, I’m happy to maintain my GREEN view from November.

Water Intelligence (LON:WATR)

Up 5% to 385p (£67m) - 2024 Trading Update & Partnership with StreamLabs - Roland - GREEN

Today’s update from this “leading multinational provider of precision, minimally-invasive leak detection and remediation solutions for both potable and non-potable water” is a triple header:

Water Intelligence plc … is pleased to provide (i) a trading update for the year ended 31 December 2024, (ii) announcement of two acquisitions to kick-off 2025, and (iii) update to the Group's Strategic Plan especially highlighting a partnership with StreamLabs Inc. (www.streamlabswater.com) that will add to organic growth and drive brand differentiation across the US.

Let’s start with a look at the company’s 2024 trading update to provide a base for our expectations.

2024 summary: Graham has previously commented on the need for stronger revenue growth here to drive expansion of the business. Water Intelligence appears to be delivering on this, with double-digit revenue growth in 2024, which the company says is in line with expectations:

Revenue up 10% to $83.3m

Franchise revenue -3%, US corporate locations +11%, reflecting franchise buybacks

Adj EBITDA up 12% to $15.0m

Adj PBT up 4% to $9.1m

Reported PBT up 1% to $6.3m

Clearly there’s some leakage in margin between EBITDA (up 12%) and adjusted PBT (up 4%). We may have to wait for the full-year results to find out why. However, today’s update does reveal an increase in total debt and leverage during 2024:

Net bank debt: $11.1m (2023: $1.3m)

Total net debt of 1.48x adj EBITDA (2023: 0.53x)

Total net debt includes deferred franchise acquisition payments. Based on the EBITDA multiple provided I estimate total net debt may have been c.$22m at the end of 2024, up from $7.1m at the end of 2023.

Again, we’ll have to wait for the FY results to learn the cause of this cash outflow over the last year. I know the company has previously described itself as “under-levered” and has been making acquisitions, so this may not indicate any problem with cash conversion.

Acquisitions: two more acquisitions have been made “to kick-off 2025”, including another reacquisition of an American Leak Detection franchise (ALD is WATR’s subsidiary):

a small plumbing business in Connecticut (acquired for $1.2m or 4x profits)

An ALD franchise in Georgia and S. Carolina (acquired for $3m or 5.5x profits)

Both companies are said to serve “high-end residential homes” and are a good fit for StreamLabs products – Water Intelligence’s new strategic partner.

StreamLabs Water partnership: StreamLabs is a US company that’s owned by US insurer Chubb and appears to offer complementary services to Water Intelligence:

a US company with various high quality water monitoring products and a strong insurance channel pedigree.

ALD plans to launch a preventative maintenance line of business supported by StreamLabs products. This is expected to drive organic growth through the company’s existing insurance company relationships – insurers are said to have an increased focus on preventative maintenance.

Outlook: no financial guidance has been provided today, but Executive Chairman (and 28% shareholder) Dr Patrick DeSouza sounds confident about the outlook:

We had a strong 2024 and during Q4 seriously developed our plan for market leadership in Preventive Maintenance for water loss because of aging residential and commercial infrastructure. We executed two more national insurance accounts preparing the way for our StreamLabs partnership signed recently. We are ready financially and operationally for our next phase of accelerated growth and we look forward to the rest of 2025.

Consensus forecasts prior to today suggest WATR’s earnings could rise by 15% in 2025.

Roland’s view

Water Intelligence appears to be trading well and taking logical steps to expand its reach and broaden its service offering.

The shares continue to look reasonably priced to me, given the outlook for earnings growth.

I look forward to seeing the full-year figures, but have no qualms about maintaining Graham’s previous GREEN view today.

Avingtrans (LON:AVG)

Up 4% to 364p (£119m) - Interim Results - Roland - AMBER

Engineering group Avingtrans supplies equipment and services to customers in the energy, medical and industrial sectors.

Today’s results cover the six months to 30 November 2024 and appear to support an unchanged outlook for the current financial year.

With a strong first-half performance and a pleasingly robust order book, the Group is well-positioned to meet market expectations for the full year and the Board views the future with confidence.

Mark commented on a recent Avingtrans contract win on 13 Feb, giving a taste of the way this group owns and improves niche engineering businesses.

Today’s interim results provide a bigger picture view of the group’s performance. Let’s take a look.

H1 results summary:

Revenue up 21.2% to £79m, in line with expectations

Adj PBT stable at £4.5m (H1 24: £4.4m)

Reported PBT up 13.5% to £3.8m, mainly due to an absence of acquisition costs

Adj EPS up slightly to 12.0p (H1 24: 11.7p)

Net debt exc. leases of £8.9m (H1 25: £6.1m)

These headline numbers look strong in terms of growth, but it may be worth remembering that Avingtrans’ profits fell sharply last year. So this year’s performance might be seen as a return to growth – earnings are not expected to exceed FY23 levels until FY26.

Profit margins either improved or worsened, depending on your preferred metric:

Gross margin down 1.6% to 30%, due to a greater proportion of OEM sales

Operating margin rose by 0.2% to 5.7%

Both the company’s two main reporting segments delivered double-digit revenue growth last year:

Advanced Engineering Systems (AES): revenue rose by 21% to £76.8m, with adjusted operating profit up 41% to £7.8m, giving a useful 10% margin.

Management comments on the strong performance of the Hayward Tyler subsidiary, driven by data centre growth and transport electrification.

Medical Imaging: revenue rose by 49% to £2.2m. However planned spending saw this division report an increased operating loss of £2.6m (H1 24: £1.1m loss).

The company says Adaptix product sales (3D X-ray technology) have commenced, with “multiple initial distributors” appointed in the US and UK. EU distributors have also been identified.

Magnetica (“next-generation” MRI technologies) has also appointed a distributor for the USA.

This division is still at an early stage of growth but appears promising and could be worthy of further research for interested investors.

Outlook: the company says it is “confident about achieving market expectations for FY25”, given the strength of its order book:

Order book in AES secured to achieve 95%+ of the FY25 market expectations, providing strong visibility and confidence in meeting targets

In addition, Avingtrans says it has secured over £100m in orders for future years.

Estimates: with thanks to Singer Capital and Cavendish, updated broker coverage is available on Research Tree today.

Analysts at both companies have left their forecasts unchanged today. FY25 earnings estimates of 14.3p (Singer) and 14.8p (Cavendish) bracket Stockopedia’s consensus figure of 14.5p per share, implying a forecast P/E of 25 for the current financial year.

Earnings growth is expected to pick up in FY26 with both brokers offering estimates of 25.9p per share, equivalent to a P/E of 14.

Roland’s view

I’m not hugely familiar with Avingtrans, but as a niche engineer I’ve always been a little surprised that profitability isn’t a little stronger.

In fairness, I imagine this situation could improve if AES can maintain growth and if the Medical Imaging division can achieve a profitable scale. These assumptions don’t seem unreasonable to me, given the company’s track record:

The shareholder register shows chairman Roger McDowell with a sizeable holding and reveals that fund manager Harwood is the largest shareholder. This suggests to me that there’s both smart money in AVG and boardroom alignment with external shareholders.

I can see that this could potentially be an interesting long-term investment that would reward further research, beyond the scope of this report.

However, the valuation seems up with events to me, based on FY25 estimates. Any upside seems dependent on a strong upturn in earnings next year.

At this stage I’m going to maintain our neutral view, but if trading improves as expected I could see myself taking a more positive view later this year. AMBER.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.