Good morning, it's Paul here, with Monday's SCVR.

It's very quiet for relevant news in my area today, so hopefully I should be able to get this done by late morning.

Update at 12:51 - today's report is now finished.

.

Carclo (LON:CAR)

Share price: 10.0p (up 29% at 08:14)

No. shares: 73.4m

Market cap: £7.3m

Update on refinancing and current trading

The Group is a global provider of value-adding engineered solutions for the medical, optical and aerospace industries.

This share is very high risk, because the group is burdened with way too much debt, and a nasty pension deficit. I wouldn't touch it with a bargepole personally. But there's nothing much else to report on today, so it fills the time.

Today's share price rise looks like a "phew it hasn't gone bust" relief rally.

HSBC has extended surprisingly large bank facilities. It's not stated whether any of this is using Govt gurarantee schemes?

The Board announces that on 14 August 2020, the Group agreed revised funding arrangements with the Company's main secured creditors, HSBC and the Pension Scheme, which provide access to ongoing bank facilities as well as visibility over repayment schedules through to July 2023.

As part of this agreement, new facilities have been entered into with the Group's lending bank, HSBC, which comprise a Term Loan of £34.5m and a Revolving Credit Facility of £3.5m.

In parallel to this, the Group reached agreement with the Trustees of the Pension Scheme in respect of both the actuarial deficit and the resultant deficit repair contributions to be made over the next three years; £2.8m (2021), £3.9m (2022) and £3.8m (2023).

Those pension recovery payments look extremely onerous, as does the bank debt, for a company with a market cap of only £7.3m. When debt dwarfs the market cap, you have to wonder if the equity might ultimately be worth little, or nothing? On the other hand, when companies do manage to recover from this kind of situation, then the % upside for equity can be very good. High risk, potentially high reward.

Looking back at previous announcements;

- The loss-making problem subsidiary, Wipac, was disposed of by putting it into administration late last year.

- Interim results to 30 Sept 2019 show performance on a continuing basis, i.e. excluding Wipac, of £56.1m revenues, and an underlying PBT of £2.1m. So it looks like there might be a fairly decent business, submerged under all the debt, and a huge pension deficit of £51.3m

.

Current trading - Q1 is Apr-Jun 2020. Revenues down 12% (seems quite good, given covid). Cost-cutting done. Job retention schemes used.

As a result of an effective response by the business, and more resilient demand conditions in certain segments, the overall trading performance in the first quarter of the Group's current financial year to 31 March 2021 was ahead of the Board's initial, Covid-19 adjusted, planning assumptions with both the Technical Plastics and Aerospace divisions recording encouraging performances.

.

Debt -very high still, especially when you consider there's a huge pension deficit on top of this;

Group net debt excluding IFRS16 lease liabilities as at 27 June 2020 was £24.2m (31 March 2020: £22.1m).

Outlook - no guidance due to uncertainty. July "broadly similar" to Q1. Cautious about near-term market conditions. More cost-cutting. Prelims on 25 Aug 2020. Positive commentary about medical sector, including "significant production volumes in future years" from new tooling orders.

My opinion - things are looking a lot brighter now that the bank facilities are buttoned down for the next 3 years. Although we're not told what bank covenants have been agreed, so if covenant breaches were to occur, then bank facilities could be withdrawn, although that's rare these days.

At some point, Carclo's balance sheet will need to be repaired with an equity raise. I think that puts a lid on how far this share can recover in the meantime.

The pension recovery payments mentioned above are very large, and that's likely to consume most or all of the company's profits, based on the H1 run rate of profitability. Hence it's difficult to see how the company will be able to pay down debt, after pouring millions into the pension scheme every year. Dividends? Forget it!

In conclusion, it looks a decent, and profitable business, but weighed down by excessive debt and a huge pension deficit. Which leaves shareholders at the back of the queue. At this stage then, this share is just a speculative punt. But the risk has reduced considerably today, with news of the new bank facilities.

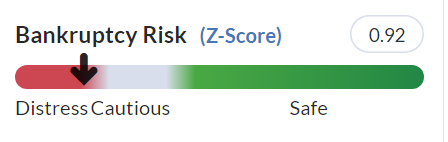

It's always worth checking the Z-Score (bankruptcy risk) on the StockReport, for every share. This is a long-standing, and statistically proven method of identifying companies which are at elevated risk of insolvency. Then obviously numbers need to be checked manually to confirm, as there might have been a more recent fundraising that fixed the problem, not yet reflected in historic numbers. It's flashing red here for Carclo;

.

.

Costain (LON:COST)

Share price: 54.6p (down 5%, at 10:04)

No. shares: 274.9m

Market cap: £150.1m

This relates to H1 ending 30 June 2020.

Costain is a contracting group that builds roads, and other infrastructure. I loath this sector, as it's low margin, and high risk. Many listed companies have gone bust or at least been financially distressed, usually due to complex projects going wrong, and too much debt. So why anyone would want to invest in these companies, perplexes me.

Costain raised £100m fresh equity earlier this year.

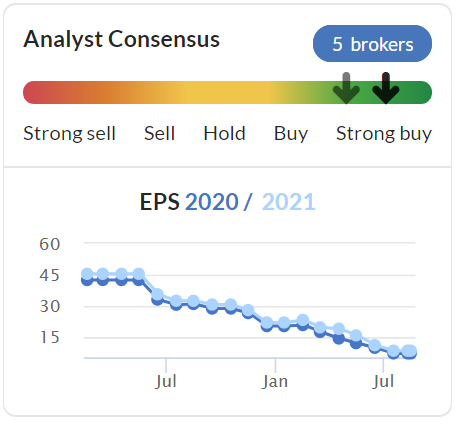

Earnings forecasts have been in steady decline well before covid;

.

.

Today's update -

Resilient performance in H1

Operating profit of £5.7m in H1, but excludes 2 problem contracts! (no indication given of the losses on those)

Outlook - sounds good;

The outlook in our core infrastructure markets remains positive with high levels of activity across our teams to secure new contract opportunities. Over £2 billion of contracts and frameworks were confirmed and secured in the first half comprising a greater proportion of consultancy and digital integrated services, in line with our strategic focus.

Our order book stood at £4.2 billion at the period end and, in addition, we now have over £1 billion of work on our frameworks. The order book includes £0.9 billion of secured revenue for 2021....

"We now have a strong balance sheet, over £2 billion of contracts and frameworks secured and confirmed in the period and continue to have a growing pipeline of opportunities. I am confident that we are well placed to deliver significant growth in profit in 2021."

.

Liquidity - this addresses one of my main concerns with contracting businesses (high debt). In a net cash position, this looks good;

Following our successful £100 million capital raise in May, we have a strong balance sheet, with net cash of £140.9 million as at 30 June 2020 (2019: £40.8 million), comprising £117.8 million of cash and £85.1 million share of cash in joint operations, less £62.0 million of drawn debt. Our strengthened balance sheet allows us to capitalise on further opportunities in the growing infrastructure market.

Problem contracts - this is the big issue. There's an arbitration decision due soon on the A465 road contract. There may be an opportunity to people to find out the arbitration decision online, before an RNS comes out. If the info is in the public domain, then it's not insider dealing to act on that information.

The other disputed contract is called P&H, and a £49.3m one-off charge is being taken in H1 results. Most of the cash impact has already been incurred.

In addition to working to resolve the issues with the A465 contract and the P&H contract, the Group has taken actions to address the type of risk arising from these contracts, including no longer pursuing Energy EPC contracts, focusing on long term investment programmes - not one off capital projects, and enhancing the strength of its overall contract management under the new Operational Excellence programme which is now in place.

That all sounds sensible, and could help reduce contract risk in future.

My opinion - neutral. I hate the sector. But Costain does look fairly well financed. The strategy to reduce contract risk sounds sensible. New contract wins sound good. The market cap is really low, for the size of the business. Could there be a buying opportunity here? Possibly, I don't know. Until the 2 big contract disputes are resolved, then it's impossible to value the share. Hence it's a bit of a punt at the moment, unless you've got an informational advantage from fully understanding & correctly predicting the outcome of the big contract disputes. If those issues are resolved satisfactorily, then the share could re-rate upwards.

There's a good update note from Liberum available today on Research Tree, worth a look.

.

.

Mti Wireless Edge (LON:MWE)

Share price: 36.5p (unchanged. at 11:43)

No. shares: 87.9m

Market cap: £32.1m

Results for the six months ended 30 June 2020

MTI Wireless Edge Ltd (AIM: MWE), the technology group focused on comprehensive communication and radio frequency solutions across multiple sectors, is pleased to today announce its financial results for the six month period ended 30 June 2020.

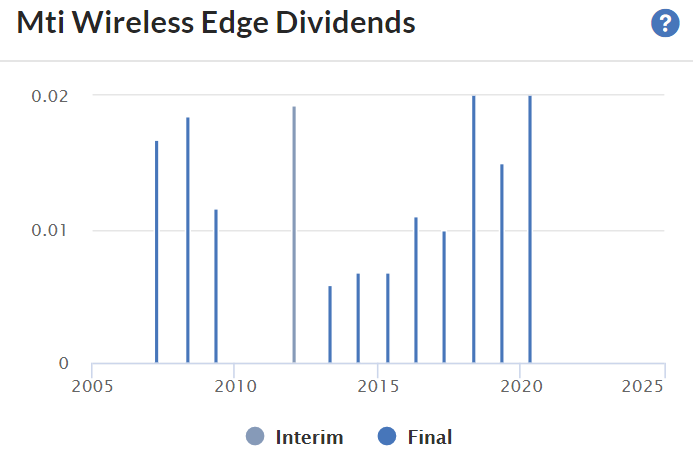

This is an overseas company, listed on AIM, which I tend to steer clear of, as so many go wrong. However, several readers seem keen on me looking at it, so here goes. It's been listed a long time, since 2006, and pays divis most years. Those 2 specific factors make me much more comfortable about it, despite being overseas/AIM.

Here's the Stockopedia divis chart (clickable for more details);

.

.

I hardly know anything about this company, but Graham wrote a nice review of the 2019 results here.

Outlook - this reads positively, given the circumstances;

Moni Borovitz, Chief Executive Officer of MTI Wireless Edge, said: "That MTI remains on track to meet market expectations for profitability for the 2020 financial year despite the closure of some of our key markets over part of the period and the general slowdown caused by COVID-19, I believe reflects extremely well on MTI. The COVID-19 pandemic did reduce revenue in certain areas and added to supply chain costs, in particular freight costs, however, this was offset by cost savings across the business and with its balanced diversification across three divisions and multiple countries.

.

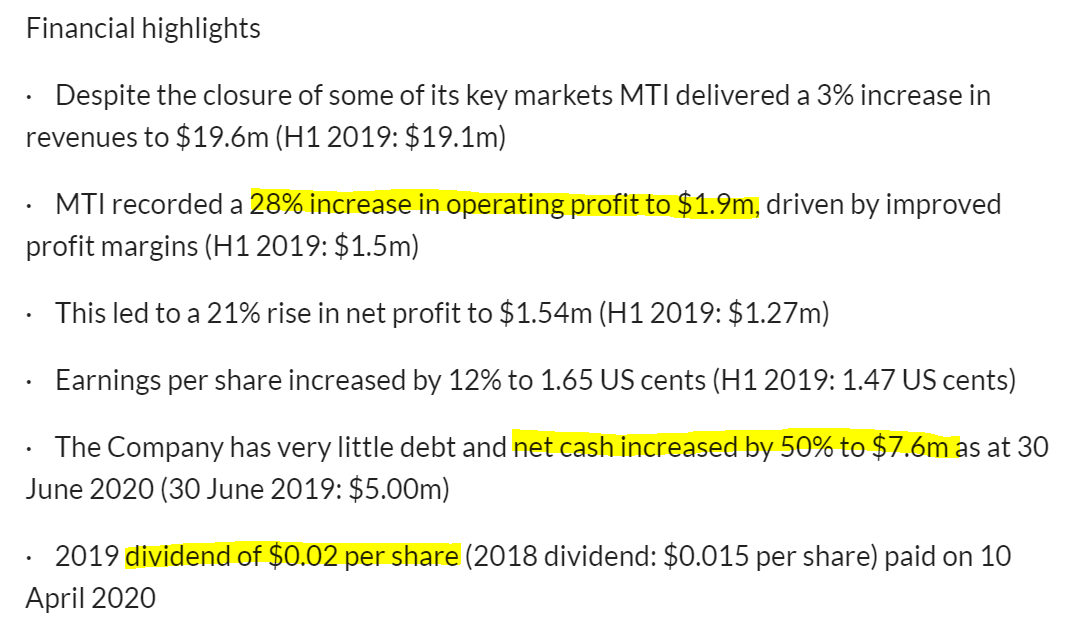

Interim results look good, but these are small numbers, it's only a £32m mkt cap company;

.

.

Both Graham and I have flagged previously the good dividend yield, and the strong balance sheet.

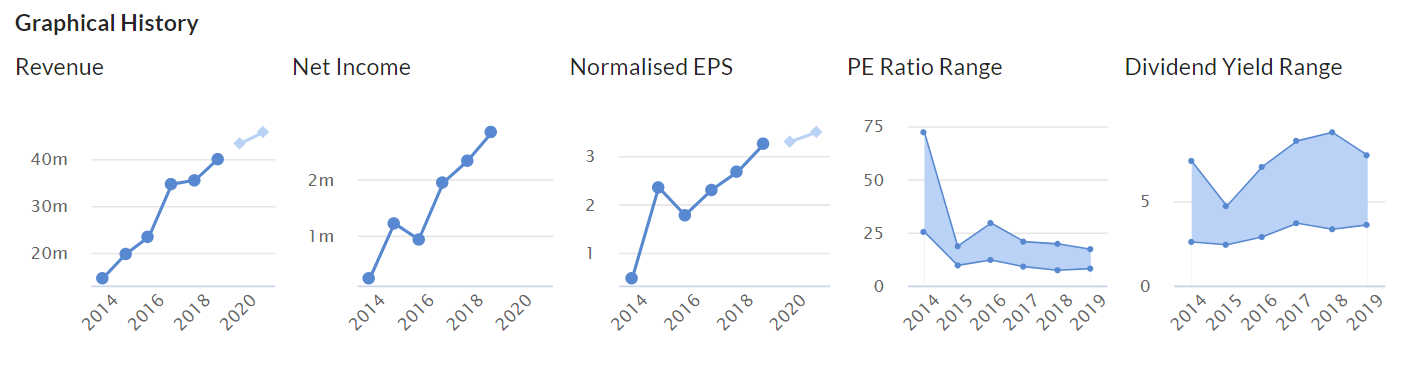

The track record looks good, with a nice progression in EPS over the last 6 years;

.

.

There was an InvestorMeetCompany webinar this morning, so I'll check out the recording later, once it's up.

Balance Sheet - looks great, with net cash. I can't see anything funny in it.

Cashflow statement - looks fine to me. It pays out most of the cashflows generated, in divis.

My opinion - as usual, this is just a review of the numbers. It's up to you to form a more detailed understanding of the company, and to predict its future. I can't possibly do that for the 500+ companies I cover.

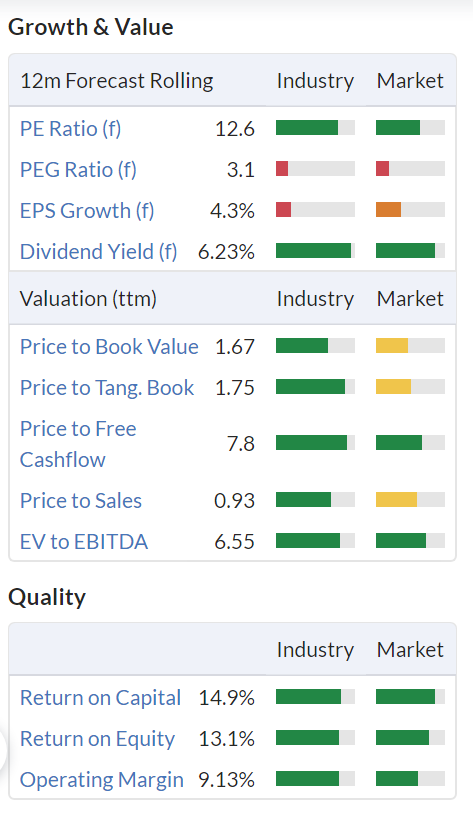

Since the company has today confirmed 2020 expectations, then we should be able to rely on the growth & value graphics. As you can see below, it's a sea of pleasingly dark green.

I can see why some readers like this share, it looks good.

.

.

That's me done for today. See you tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.