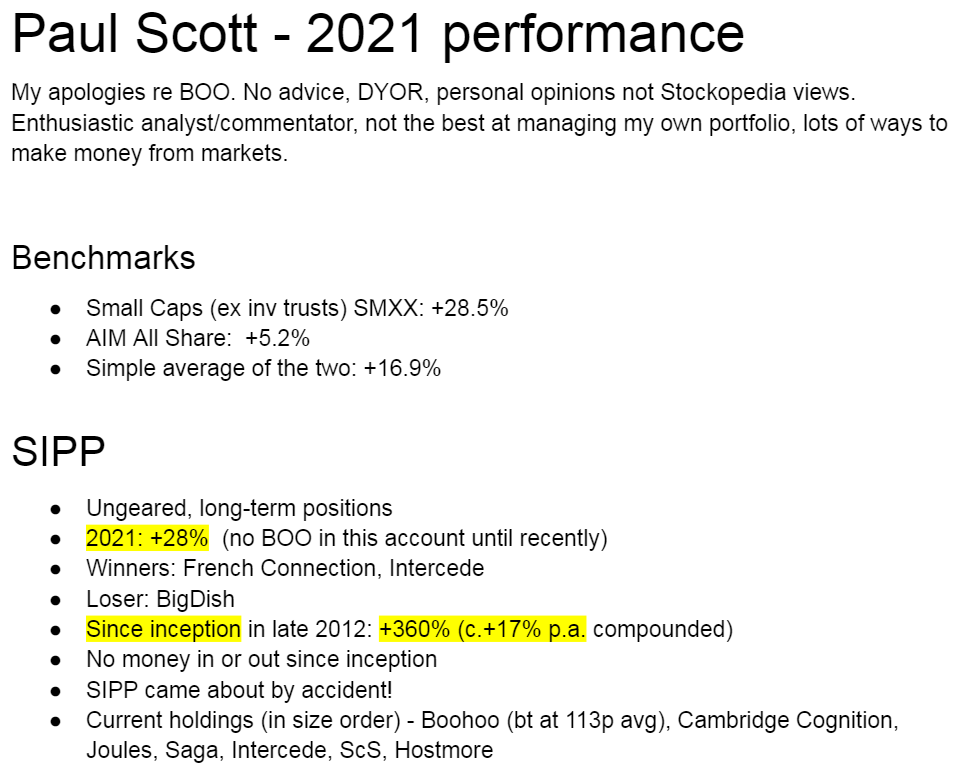

I normally type up lengthy year end reviews, but have decided this year to make a video instead.

It's a warts & all review of how 2021 unfolded for me, and what I've learned from my mistakes this year. I'll aim to do this every year from now on.

I hope you find this interesting! The slides are also copied below, if you don't have time to watch the video.

(I've just set up a vimeo channel, which is vimeo.com/paulypilot for my shares videos)

.

EDIT:

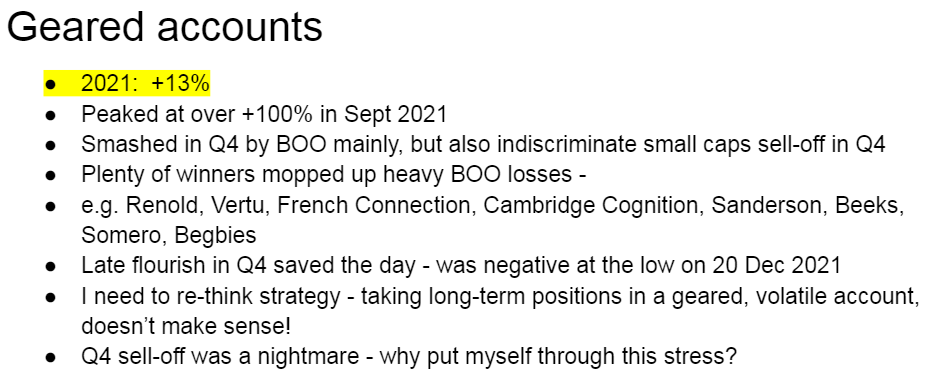

Something I forgot to mention in the video, was that my hedging strategy (shorting US indices when I'm nervous about the market overall) was a complete disaster in Q4 2021. It's worked really well in the past, especially in early 2020. However, this time, in Q4 2021, the nightmare scenario unfolded - my geared longs (UK small-mid caps) plummeted, generating heavy losses. At the same time, the US market soared to new highs, thus incurring heavy losses on my "hedges" (short positions on US indices).

Going forwards, I think the better idea is to just de-gear, rather than faffing around with so-called hedges, especially ones which don't have a direct correlation to UK small caps.

End of edit.

.

.

.

.

.

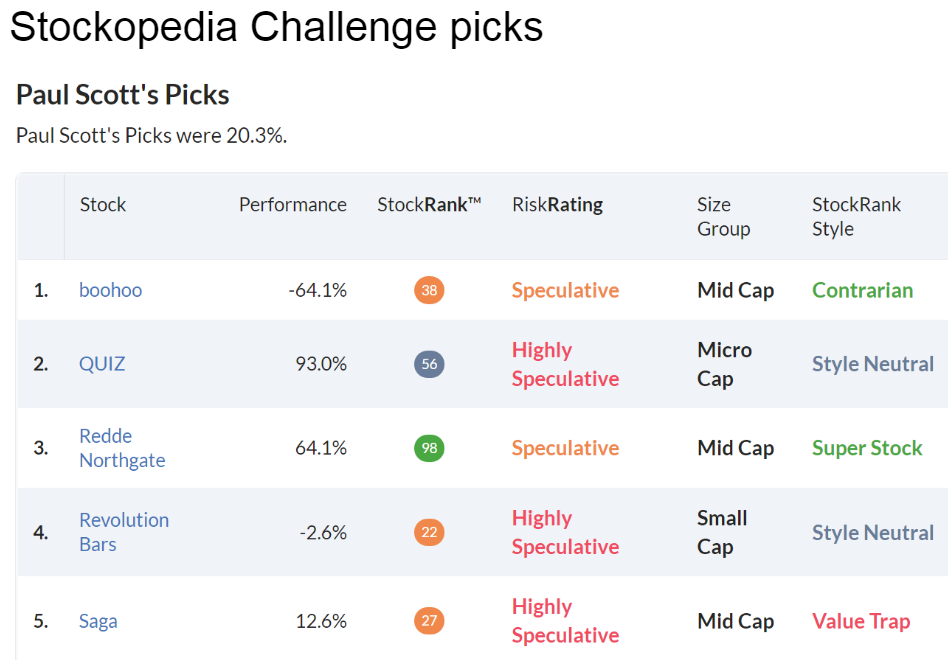

Boohoo

- Disastrous share price performance, but I remain of the view this is likely to be a much larger business in 5-years.

- Sector sell-off: Asos has fallen similar %, and other eCommerce businesses also de-rated (e.g. AO.com). Upside for sector in 2022-23 (possibly)?

- 1, or 2-year growth rates?

- Problems in 2021 look fixable - supply chain related, especially outbound freight cost. Overseas markets declined, due to long delays in delivery (7-10 days)

- Increased competition

- Overshot on downside in my view

QUIZ

- Strong turnaround underway - stores now trading at/near pre-pandemic sales, but with greatly reduced costs (on turnover rents after pre-pack administration)

- Last man standing with retail stores

- Sees 2-year boom in special occasionwear

- Experienced mgt, and long-standing online operations

- Strong balance sheet with net cash

- Overseas expansion via franchisees

- Tiny market cap

- Family still hold c.50%, and motivated to turn it around

Redde Northgate (REDD)

- Superb recent results

- Strong balance sheet

- Sector tailwinds

- Low PER & big dividend yield

Revolution Bars (RBG)

- Turbulent during pandemic (2 placings at 20p = heavy dilution)

- Now holds net cash, poised for major refurb programme & acquisitions

- New formats trialled - foundersandco.uk/ and something else (vintage games?)

- Once trading normally, should smash forecasts (as it did in re-opening)

- Valuation far too low, in my view

SAGA

- I believe market is fundamentally mis-pricing this share - worth far more

- Restrictions have delayed return to profits in travel division

- Cashed up, after 2 refinancings (equity & debt) - no solvency issues

- H1 results were fine - insurance division covers losses of mothballed travel division

- Highly volatile share price - often moves in tandem with airlines/cruise shares - ignores hybrid business model of SAGA

- Turnaround strategy - refocusing on customer service - led by founder’s son (former CEO)

- Long-term re-rating (I’m looking 2-3 years ahead)

.

Lessons learned/reminded in 2021

- Looking through temporary problems (e.g. supply chain) is not viable with geared positions

- Sell on first sign of trouble? (can always buy back)

- 100 Bagger book (coffee can) skewed my thinking

- A lot can happen in a year - business models change fast now

- When you start splashing the cash, it’s time to sell!

- I need to be more willing to sell, generally

- Covid - we don’t know what will happen, but it’s currently looking positive (John Campbell Youtube channel is excellent)

- Volatility means a cash pile is worth having, even if eroded by inflation

- UK small caps market does not seem rational - driven by traders & illiquidity? (irrational exuberance in Q1-Q2), indiscriminate sell-offs in Q3-4

- Lots of good companies now at attractive valuations - so I’m optimistic for 2022

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.