After last week’s round-up of a successful year for the SIF portfolio, this week it’s back to business as usual. As it’s the end of the month, I’m looking at stocks which could be up for eviction after at least nine months in the portfolio.

This month’s stocks

No stocks were added to the portfolio in July last year, so none are nine months old. But I do have three stocks which were bought previously and remained in the portfolio after the March review. I need to check if these firms still qualify for the SIF screen:

Recruitment group Harvey Nash. Last week’s results contained some hefty restructuring charges. How have these affected the small cap’s screening performance?

Housebuilder Redrow - the SIF portfolio’s oldest stock looks set to hang on for another month

British Airways owner International Consolidated Airlines Group - a disappointing performer so far, but things could be changing.

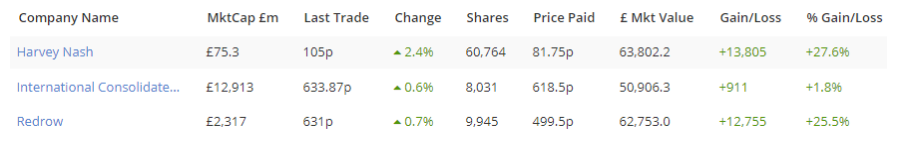

Here’s how these three stocks have performed during their time in the portfolio so far (excluding dividends):

Harvey Nash

One reason why I now hold stocks in the portfolio for a minimum of nine months is to ensure that at least one set of accounts is released during the holding period. Doing this means that a fresh set of figures is pushed through my screen while the stock is in the portfolio. This usually also results in updated broker earnings forecasts.

I believe this is useful as it tends to highlight the direction of travel for the business, at least over the short term. Are margins improving? Is earnings momentum slowing. Are sales stagnating?

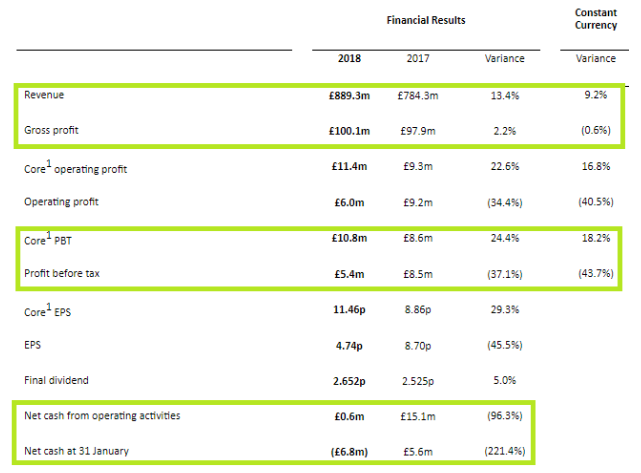

Harvey Nash’s results for the year ending 31 January were published last Friday, so are very recent. A 9.2% increase in constant currency revenue was marred by a fall in gross profit margins from 12.5% to 11.3% There were also some hefty non-recurring costs relating to the transformation programme and to acquisitions.

I’ve highlighted the relevant figures in the table below, which was taken from the results:

As Graham Neary pointed out in March, non-recurring items have been fairly small in recent years. So the company’s claim that last year’s costs are exceptional and should be disregarded carries some credibility.