Good morning! Thanks for the suggestions so far.

Stocks on my radar are as follows:

- Revolution Bars (LON:RBG) - interim results

- Gear4Music (LON:G4M) - trading update

- PCF (LON:PCF) - AGM trading statement

- IntegraFin Holdings (LON:IHP) - admission to Official List

- Harvey Nash (LON:HVN) - trading update

This list is subject to change!

Cheers,

Graham

Snow - a quick word on the brutal weather conditions, which have caused travel chaos and business disruption across the UK & Ireland.

It has personally affected me, as I was supposed to be flying to London today instead of writing this report! But I got a text message from Ryanair Holdings (LON:RYA) late on Wednesday evening, informing me that my flight would not be going ahead.

It would be risky business to trade shares based on short-term weather patterns, but I would guess this is going to have an effect on many companies - insurers and retailers spring to mind.

Anyway - take care, wherever you are!

Revolution Bars (LON:RBG)

- Share price: 163p (-4%)

- No. of shares: 50 million

- Market cap: £81.5 million

Many of you have already left insightful comments in the thread below, discussing this premium bar chain.

My views on it are as follows:

Like-for-like sales: I am ok with the company adjusting LFLs to include New Year's Eve, to get LFLs of +1.9% instead of +0.4%. I discussed this at the trading update last month.

New sites: site opening is on track. Four new sites opened, including three just before Christmas. Six planned for the full year, taking the estate to a total of 74.

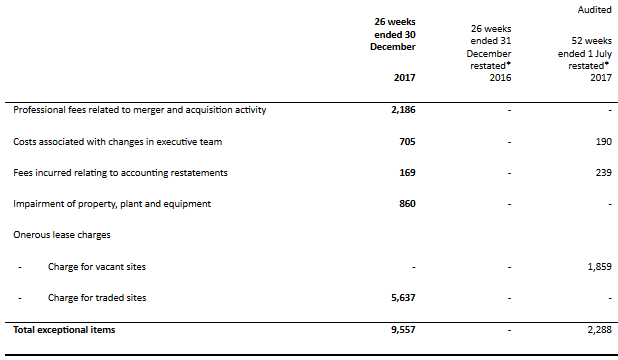

Adjusted Operating Profit: this is where it gets interesting, as the company claims to have achieved an adjusted operating profit of £6 million, versus a reported operating loss of £3.7 million.

This is what the "exceptional" items look like. You'll notice that there were £2.3 million of exceptional items during the entire previous year.

- Professional fees: "legal and corporate advisory fees, and registrar and virtual data room services provided in respect of the Board recommended offer from Stonegate and the merger proposals from Deltic".

While I accept that these fees are one-off in nature, don't they seem a little on the high side? Shouldn't Stonegate/Deltic have paid for the data room? What corporate advice did the company need in order to put the offers to shareholders? It seems like rather a lot of money to spend on fees, when you are the company being bid for.

- Changes in executive team: compensation and legal fees to do with the resignation of CEO & COO, and recruitment of a new CEO. While changing CEOs doesn't happen every single year, I would argue that it happens often enough that it is just a normal cost of doing business.

- Impairment: Not sure I would leave this out either, as these are real cash costs and were probably incurred recently. The company says that the changes "do not affect the Group's cash flows", but the expenses they relate to were certainly paid out in cash in the past. They have to be recognised as an expense somewhere along the line.

- Onerous lease charge: this is the big one, with £5.6 million in provisions. The company says:

Following a more robust analysis of the trading performance of the Group's bars, a small number have been identified as requiring an onerous lease provision, based on projected bar contribution and rental commitments. The adjustment will reduce rental charges in future periods; it does not affect the Group's cash flows.

Again, note that the company says it does not affect the group's cash flows.

However, the rental commitments will be paid in cash. And real losses will be incurred, based on the company's projections. What the company is doing is recognising the losses up-front. It will thus be able to recognise reduced losses in the future.

So I don't view this £5.6 million figure as being exceptional in any way. It is nothing more than trading losses being recognised up front.

Balance sheet: Revolution has made further restatements to its previous-period balance sheets. The result is that net assets for July 1st 2017 are shown as £35 million, while net assets for December 30th 2017 are shown as £29 million.

- Starting net assets: £35.2 million

- Total comprehensive loss: minus £3.4 million

- Share-based payment: minus £765k

- Dividend: minus £1.65 million

- Ending net assets: £29.4 million

Dividend: as you can see above, the company paid out another hefty dividend during the period, and today it announces that it will maintain its interim dividend at 1.65p.

Current outlook is mixed from the CFO. He is positive about the outlook for significant profits from the development of new venues, and also mentions the following:

Whilst recent sales trends have been below the norm, there is reason for optimism on costs given that labour scheduling software and processes should help to mitigate the impact of wage increases over the next two years and the step change cost increases arising from the 2017 rating revaluation of business properties and the introduction of the apprenticeship levy will slow appreciably from April 2019.

My opinion: Regular readers will know that I have been lukewarm towards this stock and the entire sector. As you can see from the outlook comment above, there are significant cost pressures facing the industry which are largely (though not entirely) beyond the control of companies.

With respect to this company in particular, my view is that the LFLs are ok - neither extraordinarily good nor bad.

2pm Edit: Having thought about it some more, and taking your comments into account, I agree that the company is currently making a small profit - the best thing to do is probably to ignore the onerous lease provision completely, both now and in future periods.

So we can say that the company made a profit of £1.9 million (reported loss £3.7 million with the onerous lease provision £5.6 million added back in) or £4.1 million if you also add back the M&A-related fees.

It remains the case the dividend is being paid through borrowing, as the company drew down a further £3 million during the period, taking the total to £10.5 million.

I thought the shares were approximately fairly valued when I covered the trading update recently (with the share price at 172p), but I would be a lot more cautious on the back of these results. I think the case for the "self-funding roll-out" is harder to make, given the onerous lease provisions made today.

Of course, the company might be worth more in the hands of Stonegate or somebody else, so we can't rule out another bidding war at some point.

£G4M

- Share price: 631p (-3%)

- No. of shares: 21 million

- Market cap: £132 million

Further progress by this distributor of musical instruments:

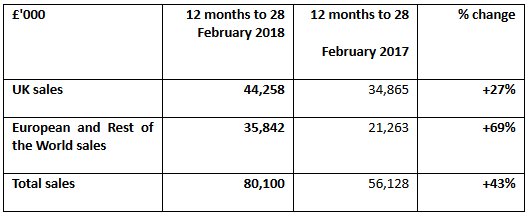

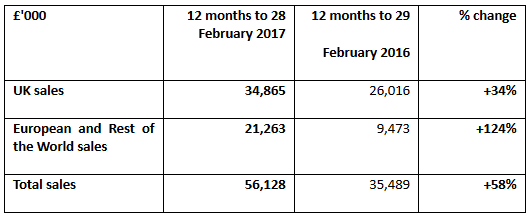

I am in the habit of checking the second derivative of sales, i.e. checking whether growth is growing or not. Let's see the same table from a year ago:

Ok, so growth was a bit higher a year ago. That's understandable, given the low base it has been rising from.

It's a similar story to when I covered it in January (with the share price at 740p).

At that time, G4M reported sales growth of 42%, compared with 55% in the corresponding update a year prior. Shareholders apparently expected more.

Coming back to today's update, we learn that customer numbers are up by 39% to 374,600.

Sales growth at 43% implies that sales per active customer increased a little bit - sounds good.

I am really interested in own-brand sales, as it's where G4M might achieve additional pricing power. The update says that own-brand sales "kept pace" with other-brand growth. So they are probably still around 25% of total sales, then.

CEO comment amounts to a small profit warning, I think:

EBITDA for the second half of FY18 will be ahead of the six-month period ended 28 February 2017, although as a result of the investments we have made during the year into our customer proposition, infrastructure, staff, systems and marketing, we expect EBITDA for the full financial year ended 28 February 2018 to be in line with our FY17 result.

Analysts had been forecasting EBITDA around £4.0 - £4.1 million for FY 2018, up from £3.7 million in FY 2017. So we have a cost over-run of about £400k.

My opinion: I don't see much reason to change my previously-stated view on this. However, given the share price weakness, it's considerably more interesting now than it was at 800p.

The question is: how many years of growth are you willing to pay for in advance? Remember that official forecasts have been for net income of £3.7 million in the year ending February 2020 (versus the £130 million market cap today).

If you have a lot of confidence in the company growing through 2020-2022 and taking market share to eventually become a much bigger business, then it would make sense to get involved.

The Stockopedia algorithms don't like it, calling it a "Sucker Stock". Clearly, there is an element of speculation when you are paying up in advance for future growth:

PCF (LON:PCF)

- Share price: 30p (+2%)

- No. of shares: 212 million

- Market cap: £64 million

(Please note that I currently hold shares in PCF)

After all I've just said about paying up for future growth, I am now going to talk about a stock which I have purchased for its future growth!

PCF Bank, previously known as Private & Commercial Finance, is a lender to both individuals and businesses, financing vehicles and plant/equipment.

What's interesting about PCF, and what makes it different from many of its rivals, is that it has succeeded in getting itself a banking license. That means it can take retail deposits, one of the cheapest forms of financing, and be less reliant on wholesale funding from other banks. It started taking deposits last July.

Today's AGM statement says that trading for the first five months of the year is in line with expectations.

Expectations have been high. New business originations have almost doubled to £54.5 million, while the entire lending portfolio is up 35% to £172 million, compared to a year ago (it still could not take retail deposits a year ago).

Retail deposits are up to £81 million, versus £53 million at the end of September. That means that growth slowed down after the initial three-month burst. I think management are comfortable with that, as extremely rapid growth in deposits might be difficult to match with new lending opportunities, particularly while the company still has a lot of wholesale debt outstanding.

Guidance is unchanged:

Our medium-term targets for the Group remain unchanged at 12.5% return on equity and a lending portfolio of £350m by September 2020, while asset diversification remains a goal and will follow in due course.

I wouldn't be concerned if there was only a small miss against that £350 million portfolio target, but I think that PCF has a great chance of achieving it.

Consider that it just recorded a 35% annual growth rate in the portfolio, despite not having bank functionality a year ago. If it maintained a 35% growth rate (compounded) for the next two years, it would be around £310 million in March 2020, and have six months left to get the last £40 million.

Its ambitions after 2020 are even grander, but I am happy for it to take things one step at a time and continue to grind out growth at the current rate.

While I do own this stock for its growth prospects, I don't think that I have overpaid for it.

You could argue that the market cap is too high against book value of just £39 million, but I think investors have to give credit for PCF's extremely efficient bank operating model and its growth opportunity as a small player with a banking license.

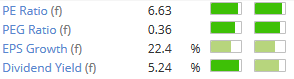

Relative to earnings, the company is not expensive:

As you can see, it pays a small dividend. I would be happy if the company paid no dividend at all and ploughed all resources into growing as quickly as possible. I know some shareholders do want a dividend, so I guess the small one is a fair compromise.

Talking about shareholders, the parent company owns nearly 55% of the shares, so there is a very limited free float.

Turning back to earnings, analysts are forecasting net income of £8.1 million in the year ending September 2020.

There is risk involved, not least in the potential for a general business downturn and in car sales.

So it's possible that the forecasts will turn out to be optimistic. But from the current share price, I am hopeful that we will see both earnings expansion and multiple expansion over the next few years.

IntegraFin Holdings (LON:IHP)

- Share price: 263p (unch.)

- No. of shares: 331 million

- Market cap: £871 million

Initial Admission - Official List

I thought I would mention this in passing as it's a new listing in the financial sector. It listed at 196p earlier this week and is now trading 34% higher, for a market cap of almost £900 million. The IPO raised £178 million for selling shareholders only, not for the company itself.

The company's homepage is here (external link). It's an investment platform used by over 5,000 financial advisers, helping them to manage client assets and put them into the right tax wrappers, funds, etc. The service has been around since 2000.

According to the prospectus, the company had revenues of £80 million in FY 2017, converting to net income of £30 million, i.e. a huge net profit margin.

It has paid a dividend and/or bought back shares every year since 2007, returning £85 million in total. The cash flow summary looks excellent, and it sounds like it has been profitable every year since 2003. The only negative is that it paid out a special dividend worth £11 million just prior to admission, which won't be available to new investors.

I haven't got the time to look into it in any more detail today, and it's a bit too big for this small-cap report, but I'm motivated to keep an eye on it going forwards.

Harvey Nash (LON:HVN)

- Share price: 86.5p (-0.5%)

- No. of shares: 73.5 million

- Market cap: £64 million

Back to the recruitment theme with this. We recently covered smaller player RTC (LON:RTC).

This stock is also offering plenty of small-cap value, as recruiters tend to do:

Today's update says that results for the full year ending January 2018 are expected to be in line with expectations.

Adjusted profit before taxation and non-recurring items is set to be up c. 22% compared to the prior year. That number was £8.6 million last year, so we can look for it to be £10.5 million this year (ending January 2018).

Thankfully, Harvey Nash has been reporting very few non-recurring items in recent years, so the discrepancy between the adjusted PBT and actual PBT has been tiny.

In FY 2018, it made two acquisitions and has undergone a "transformation programme", introducing the risk that we will have larger adjustments this year. But in my view, the numbers would still carry a great deal of credibility, since the adjustments have been small for a while.

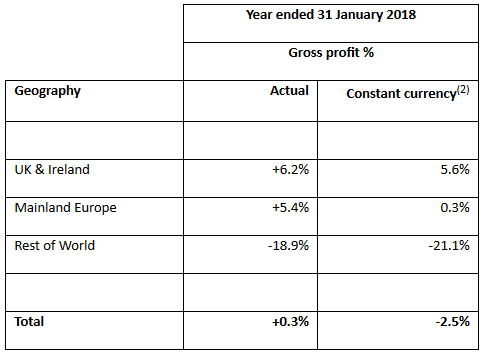

It's important to think about the performance at constant currencies, given Harvey Nash's geographic spread. Only 38% of net fee income was generated in the UK & Ireland, according to the interim results.

As this table illustrates, gross profit for the year just ended was a lot weaker at constant currencies, compared to actual exchange rates. So the adjusted PBT would probably be weaker, too.

UK & Ireland and Mainland Europe are both performing fine in terms of gross profit growth, while the rest of the world is shrinking back to core markets. The transformation programme has reduced headcount and shut down loss-making offices.

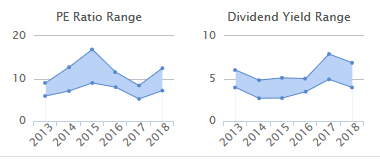

My opinion: It remains very cheap, even with £6.7 million net borrowings at year-end. Let's add that on to the market cap for an enterprise value (EV) of £70 million. It is forecast to earn adjusted net income of £10 million in the current year (FY 2018), putting it on an adjusted EV/Earnings multiple of just 7x (or a PE multiple of 6.4x).

While recruiters probably should have low earnings multiples, I think there is a point at which the economics of buying them for the dividend and earnings yield becomes compelling.

These charts show that in its recent history, the lowest PE multiple Harvey Nash has traded at is around 5.2x, while the highest dividend yield it has traded at is 7.9%.

Looking at the other extreme, the highest PE multiple it has traded at is 16.8x. So we are currently much closer to the low in historical PE than to the high.

If you can combine this knowledge regarding historical valuation ranges with the assumption that we are not at some sort of cyclical high in earnings, then I think we potentially have a really good argument in favour of investing in this!

That's all I've got time for today. Have a great weekend and stay warm!

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.