There are no new stocks I can buy from my SIF screen this week. So as we’re coming up to the SIF portfolio’s third birthday, I thought it would be a good time to take a look at what’s gone wrong over the last three years.

In my experience, the importance of avoiding big losses is often overlooked and misunderstood by many private investors. I suspect this is partly rooted in the psychology of loss aversion and anchoring. Both are traits that make us want to hold on to stocks until they return to the price we paid for them.

Another reason why investors underestimate the damage caused by losses may be that some overlook the maths involved. A 50% loss requires a 100% gain to return to break even. Is such a stunning turnaround likely? Very often, the answer is no.

Steering clear of losers

One of my aims when I designed the rules for the SIF folio was to avoid stocks that would deliver big losses.

I took a two-pronged approach to try and protect my fund from disastrous investments:

Diversification and portfolio sizing: In an evenly-weighted portfolio of 20 stocks, a 50% loss on one stock will only result in a 2.5% fall in the value of the portfolio.

Avoid outliers: My rules specify a maximum P/E ratio of 30 and a minimum of 5. I won’t buy stocks with a market cap of under £50m or a spread of more than 4%. I also look for businesses with rising earnings, a dividend and stable or rising sales.

This approach is designed to help me to avoid value traps, momentum traps, and companies that need detailed research to be understood. Although it also means that I’ll miss out on some stunning successes, I think this is a good compromise for a portfolio where stocks are selected by screening.

The SIF approach won’t work for everyone, but it’s in line with the Stockopedia philosophy of letting proven investment factors work in your favour.

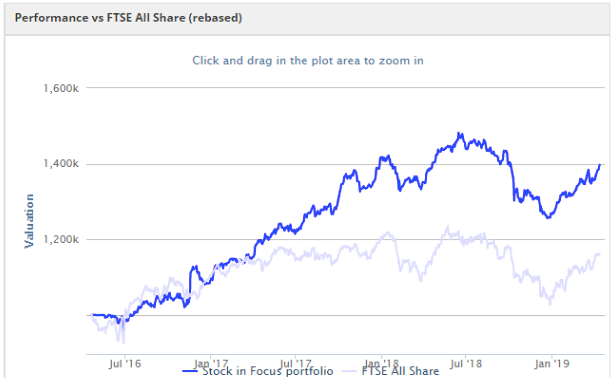

My rules have performed tolerably well for me so far:

SIF performance vs FTSE All-Share index April 2016 - April 2019

What’s gone wrong?

Over the last three years, the SIF folio has held seven stocks which have been…

.JPG)