Will the coronavirus outbreak mark the start of a wider economic downturn and the end of the long-running bull market? I don’t know.

Personally, I won’t be selling anything. I bought shares for my own portfolio last week and feel confident that the prices I paid will look good value with the benefit of hindsight.

This week, it’s time for my rules-based SIF fantasy fund to deploy some of its surplus cash into the market. As a reminder, I mirror this fund with my own money, as a separate offshoot from my main portfolio.

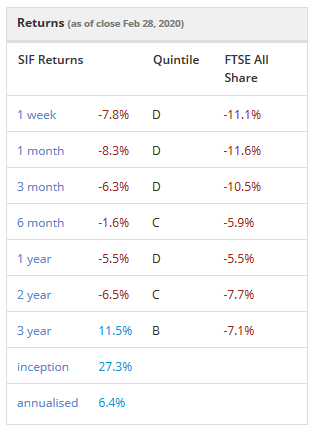

The SIF fund took a painful hit last week, but it wasn’t any worse than that suffered by the wider market. Indeed, SIF seems to have outperformed so far this year:

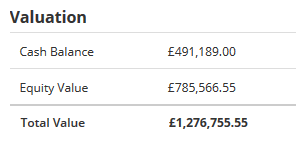

One reason for this may be the portfolio’s large cash balance. SIF didn’t buy anything in February but has continued to sell stocks on schedule. This has left the portfolio with just 14 holdings and a cash weighting of nearly 40%.

The fund’s last purchase was Finsbury Food on 21 January. However, last week’s sell-off has cut stock valuations and provided fresh feedstock for my SIF screen. As a result, my screening results have improved and there are now several stocks I can consider buying for SIF.

At the top of my screening results is an old friend, construction and regeneration group Morgan Sindall. The firm’s subsidiaries include Lovell, Muse Developments, Overbury and various investment and operating divisions of Morgan Sindall.

These companies are responsible for recent projects such as the 2018 Brixton Civic Space development and the Loftus Garden Village development in Newport.

I first added Morgan Sindall to the SIF fund in 2017, when the position generated a healthy 59% total return for the portfolio.

SIF Folio Morgan Sindall buy report (Feb 2017)

SIF Folio Morgan Sindall sell report (Nov 2017)

SIF no longer has any exposure to the UK construction sector, following last week’s sale of Michelmersh Brick Holdings. So now could be a good opportunity to correct this imbalance.

Morgan Sindall Group (LON: MGNS)

Stockopedia’s algorithms appear to share my view that this firm is one of the best stocks in the construction and engineering sector. The company currently boasts a StockRank…