Torotrak (LON:TRK) has been trying to commercialise its revolutionary Infinitely Variable Transmission (IVT) for vehicles, which they claim can deliver 20% fuel savings (in urban driving), for almost the entire time I've been actively investing in the stock market (about 15 years). It never quite seems to achieve proper success, but always seems on the cusp of it. Hence I'm very sceptical about this company, especially as the founder departed not that long ago - if the founder throws in the towel, why should anyone else believe in it?

They seem to have branched out into other areas, and now also make variable drive superchargers (V-Charge), and mechanical kinetic recovery systems (M-KERS), which I assume must be some form of energy recovery from braking? Automotive things interest me, as I've always been a total petrol-head, and used to love dismantling and repairing cars.

There doesn't seem to be anything exciting in this morning's IMS. Looking back at the last set of accounts (interims to 30 Sep 2012), Torotrak had current assets, less total liabilities of £9.4m (of which £10.7m was cash), so they are in a strong financial position. Historically they lose on average about £2-3m p.a., so there should be enough money in the kitty for them to keep going for about 5 years, even if they don't make any commercial progress.

The market cap is £42m at 25p/share, which looks pretty aggressive to me, given the long-term failure to make any significant commercial progress with this product (although they have managed to get it into some niche vehicles). Personally I'd only be prepared to have a flutter on this if I was paying little more than net cash, so about a quarter of the current share price.

Incidentally, the RNS news service from Investegate which I have used for years, every morning to get company results, has been very unreliable of late, omitting a lof of RNSs first thing, then they appear later in the day. I asked on Twitter a moment ago for an alternative, and Dan from Shares Magazine helped me out by recommending DigitalLook as an alternative source for company news. Thanks Dan! Just shows how useful Twitter is to investors, it's a great way to communicate.

I should also add that Stockopedia have major upgrade plans in the pipeline for this year. I met with them yesterday to have a brain-storming session, and can see this site going from strength to strength. One area that needs upgrading, is to make company news real-time, instead of delayed as it is at the moment. It's going to happen, along with real-time prices too, so those will be massive improvements that I'm very keen to see.

I have no idea why there was such a muted response from a positive trading update from Norcros (LON:NXR) yesterday, perhaps people were expecting an out-perform statement, instead of an in line statement? Anyway, it shows that the business is doing well. People forget that good companies do well, even in economic downturns, because although their market might be static or shrinking, good companies gain market share from weaker competitors exiting the market. So that leaves a fewer number of leaner, fitter companies to enjoy a growing market again once economic recovery happens, which I am convinced is now happening (based on Mervyn King's fascinating analysis of the situation televised on Tuesday this week). The early stages of economic recovery never feel like a recovery, GDP growth has to get to 2%+ before it feels like a recovery.

Synectics (LON:SNX) (formerly Quadnetics) announce a "major contract win" of £2.7m to develop CCTV for Avon & Somerset Police. Use of the word "major" seems stretching things a bit, in the context of an £80m turnover group, this is only just over 3% additional turnover. I am meeting the Directors of Synectics on 27 Feb, for their results presentation lunch, so am looking forward to that. It looks an interesting company, which I've followed for quite a few years, but don't currently hold shares.

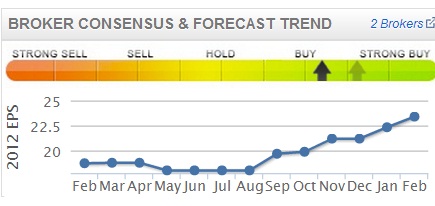

Synectics seem to be building profits (from a low base), and the trend of market consensus is rising (see chart to the left, from Stockopedia's StockReport), which is a good sign, although at 355p the good news looks priced in already (15 times est. EPS for year ended 30 Nov 2012), and 12.3 times forecast EPS for the current year.

IS Solutions (LON:ISL) reports a, "strong second half", and that results for year-ended 31 Dec 2012 are expected to be in line with market expectations, and will be released in the week commencing 25 Mar 2013. At first glance it looks quite attractive, with a 2013 forecast PER of 10, and 4% dividend yield, and they report net cash (which I suspect might be a seasonal blip, as they had net debt of about £1m at the interim stage).

I've had a quick look at the last set of results, and it's just a tad too small for me. Anything under about £1m p.a. profit (which they are just below) is getting into really very small businesses, which arguably shouldn't really be Listed - as the costs of Listing can be around £200k p.a., how does that possibly make sense for any company that is making under £1m p.a. in profit?

Although interestingly, I have heard CEOs of several AIM listed companies say that being Listed on AIM is a major commercial benefit - they are taken much more seriously by customers & competitors as a result of the perceived status of being Listed. Of course we all know that any old rubbish can (and does!) list on AIM, but that fact does not appear widely known in the country as a whole.

Canadian technology company Sandvine (LON:SAND) has announced its intention to cancel its dual listing on AIM, and that's hit the shares by 10% this morning. I never invest in companies with dual listings. It is inherently a bad sign in my view, and an unwise use of company money, to maintain two listings, in an attempt to achieve a higher share price by drawing on two sets of shareholders.

I also try to never invest in overseas companies listed on AIM, as it seems to me the motivation to List in one of least regulated smaller companies markets in the world, has to be questionable. Whilst there some very good companies on AIM, there's also a great deal of dross, much of it overseas companies.

However, I might try to find the time to look again at Indian entertainment rights company, DQ Entertainment (LON:DQE). Their trading statement this morning says that the company is on track to "meet its target" for year ending 31 Mar 2013. I looked at their accounts a while ago, and came to the conclusion that their accounting treatment of intangibles was far too aggressive, and that the EBITDA wasn't real cashflow at all. Hence the apparently cheap valuation seemed to me all smoke & mirrors. But I'll try to look at it again over the weekend, as if I'm wrong then it could be very cheap, and I do know one very smart investor who likes this company, so who knows?

Let's have a quick look at the top section of the Stockopedia StockReport, with my comments below:

1 Market Cap is only £8.27m, but Enterprise Value (market cap + net debt) is much higher, at £39.1m, so this instantly warns you that the company has high levels of debt.

2 Click here to see what other people have written about the company (which should include my archive posts from these morning reports), and to post a comment yourself about the company.

3 The growth & value section gives a quick visual impression of the key measures. Note that the "vs industry" and "vs market" colour-coded bars work on a traffic light system, so strong green is best, and strong red is worst, with various intermediate colours. Really handy to quickly identify value. In this case my immediate reaction to a PER of 1.59 is - too good to be true! Also bear in mind that very highly indebted companies often have a very low PER. Also note there is no dividend (a bad sign), and no asset backing - price to Tangible Book value is 94.2! (which means there's negligible net asset backing)

4 Note the weak share price chart - do other investors realise the company is no good, or does this present a buying opportunity?

I need to delve deeper into the accounts of DQE, but just wanted to flag up how the StockReport gives you a single page of info which instantly tells you a great deal about potential risk/reward, before you've even looked at the accounts. I will report back in due course on this company. To emphasise, the picture above is only about a quarter of the StockReport, but it was all I could fit into a screen grab!

Shares in serviced office company, MWB Business Exchange (LON:MBE) are up 59% today on an all-cash takeover offer at 100p. Seems an odd situation, as Regus are shown as holding 75.2% of the shares, with Pyrrho Investment (the party making the cash offer) holding 16.7%. There seems to be some kind of dispute over ownership, from glancing at the previous news.

There is also a recommended cash offer for Ffastfill (LON:FFA), which values it at £106m per the RNS, which seems a very full price based on the historic performance of the company. The bidder already holds 25% of the company, so maybe this is the start of a trend for large shareholders to buy out other shareholders? Another sign of a bull market, so very interesting.

OK, that's it for today. Just a last plea for charity donations for my Half Marathon, which is this Sunday! I'm nervous about it, but hopefully it will be OK. I just need to raise another £153 to hit my target of £2,000, so if you can spare a few quid for great causes (Macmillan cancer care and/or Sussex Beacon), it would be very much appreciated! Here is the JustGiving link.

Regards,

Paul.

(of the companies mentioned today, Paul holds shares in NXR only. He has no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.