There has been a huge (83%) drop in the share price of Phytopharm (LON:PYM) this morning, as their Research Update looks extremely negative, in that their lead product in development, for treatment of Parkinson's Disease, called "Cogane", has failed to produce any efficacy in Phase II (i.e. tested in real life, on people) trials.

Phytopharm is reviewing whether to continue with Cogane (which seems unlikely given that it doesn't work), and reviewing its strategic options. They had £5.5m in net cash at 31 Jan 2013, and unless there are other promising products in the pipeline (which it seems there are not, otherwise the statement today would have switched the emphasis to them), then PYM looks dead in the water, and should probably be valued below net cash (to take into account closure costs), as opposed to the market cap before today of £34.7m.

This is a good example of why I never invest in drug discovery companies - the timescales are very long, they require multiple fund-raisings, hence diluting existing holders, and the vast majority of drug trials fail. Yet they often command premium valuations because it's easy for a good salesman to get investors excited over the potential if the drug were to be successful.

Moreover, a large pharma will swoop and buy them out once a worthwhile drug is developed. So risk/reward in this sector is all wrong, unless you are a scientist who is knowledgeable in the field, and find a particular company which is likely to succeeed. I don't see how an average investor can possibly assess risk/reward on this type of share, so it's really just gambling.

Also note that there's no downside protection, other than net cash. So when a drug discovery company with one lead product fails, then the outcome really is binary. So one needs major multi-bagger potential to justify risking almost 100% of your investment. It's not for me, but occasionally people get lucky and happen to be holding something that explodes on the upside. Also from time to time such shares become fashionable and command high ratings, so astute traders can make money on the uplifts in sentiment.

It's going to be a quiet day today, with very little company results or news this morning, and with US markets closed for President's Day.

Investegate.co.uk, where most of us get our RNS news from each weekday, seems to be working again, after glitches last week. Several people have asked what is the best alternative source of Stock Market news. I've found that the London Stock Exchange is the best bet. I've also found that doing a free text search on that site for the word "results" seems to select most trading statements, and interim & preliminary accounts, whilst stripping out the background noise of many less important announcements. Click here to see that search, and it might be worth bookmarking it if you find the results useful.

Self-storage company, Lok'n Store (LON:LOK) issues a pre-close trading update, for H1 of its current financial year ending 31 July 2013, which sounds pretty solid. They say trading was, "in line with expectations", those magic words which tell you all is well!

They also mention that there has been a sector change in VAT, which has been a benefit to them, since they already charged VAT to customers, whereas some competitors didn't, but are now required to. I've had a very quick look at the valuation, and only the dividend yield looks of interest. It's not a sector that interests me. There must be lots of empty warehouses which competitors could quickly convert for use as self-storage, so difficult to see how any one company could have much of an edge, and the forward PER of 27 seems very pricey to me. Lots of debt too.

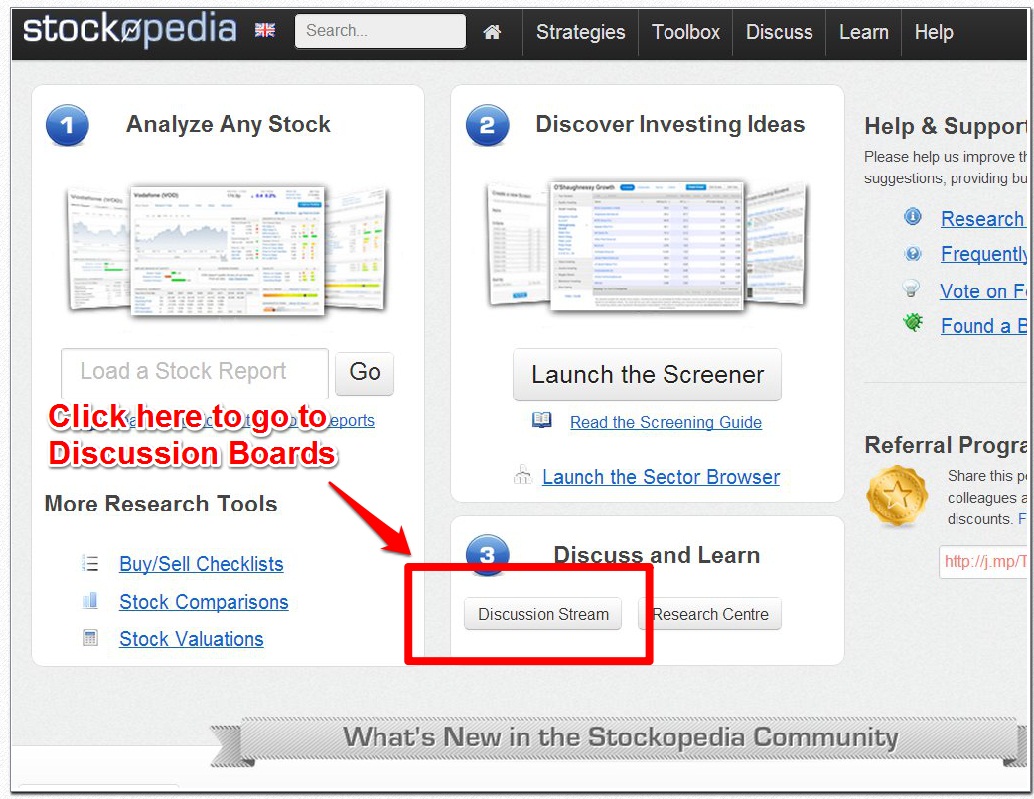

Stockopedia Handy Tips

Some changes have just been made to the Bulletin Boards here on Stockopedia, which makes them much easier to navigate & intuitive in my opinion, here's an explanation by screen shots that I've just taken using the excellent free web program called Skitch;

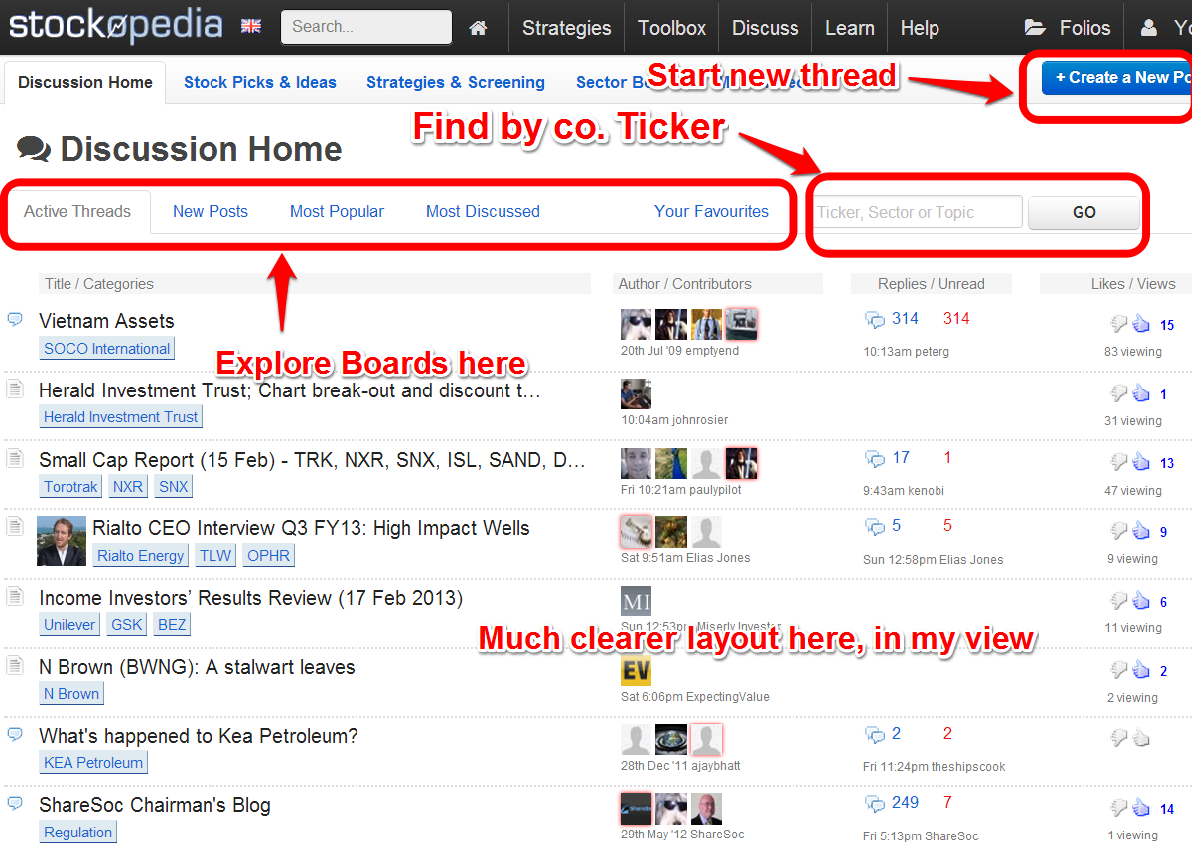

Then you get this (improved) screen, which should all be self-explanatory.

This is the easiest place to find the archive of my morning reports on specific companies, and note the various options for viewing threads, or just input a ticker to search for a company:

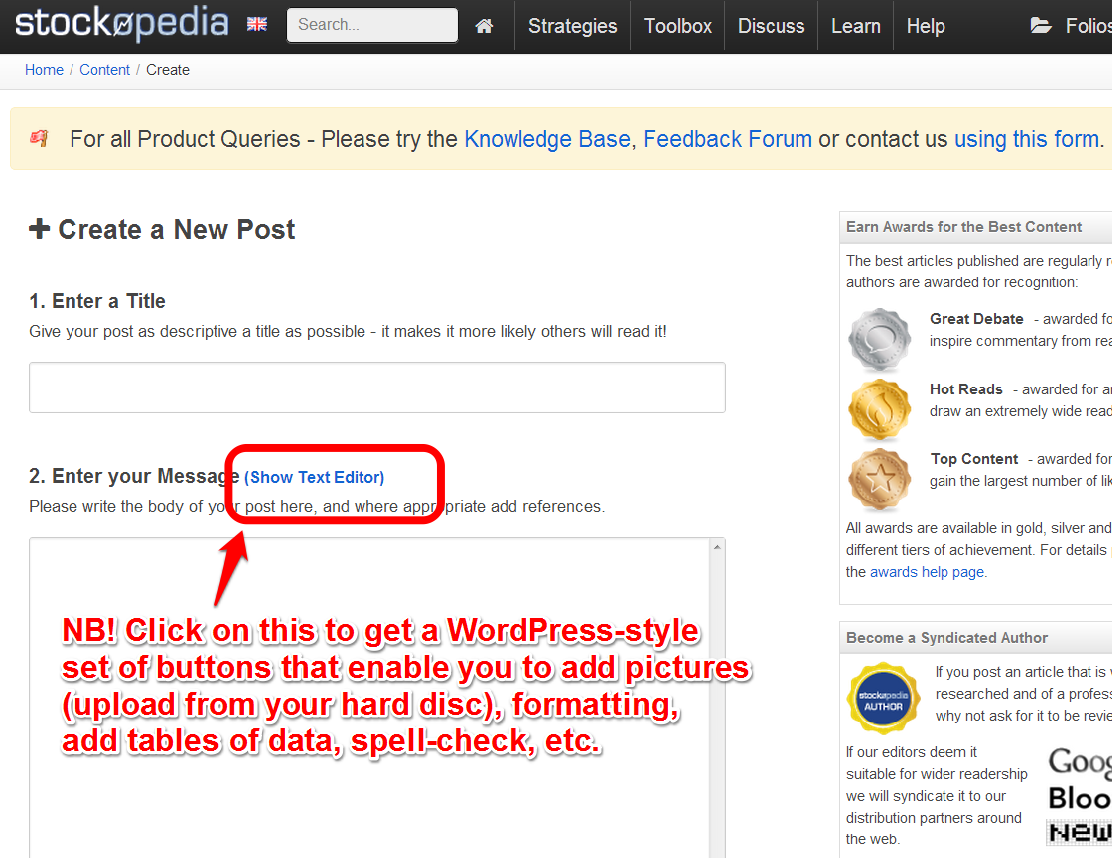

This is the crucial bit, for creating your own visually appealing & informative posts:

OK, that's it for today, sorry there was so little company comment, but there were hardly any company announcements within my remit today, so I use gaps like this to show you things I find useful on Stockopedia.

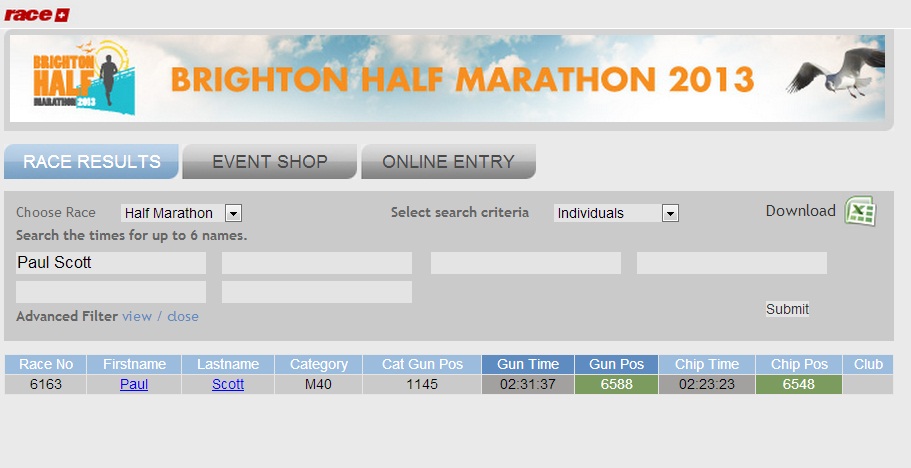

As an aside, I successfully ran the Brighton Half Marathon yesterday, 17 Feb 2013! It was my first ever, and went really well, on a gorgeous sunny day. I gently cantered round the 13.1 mile course in 2hr 23m, and I'd like to say a huge thank you to the many readers who sponsored my charities. We've raised over £2,500 for MacMillan Cancer Care, and Sussex Beacon (who organise the run). Anyone who wanted proof that I'd actually done it before donating, can do so here on my JustGiving page. Thanks again!

Regards, Paul.

(of the companies mentioned today, Paul does not hold any long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.