Pre 8 a.m. comments

Good morning! Four days with no adrenaline shots from the markets has been a struggle, but we've survived and thankfully things are about to get going again!

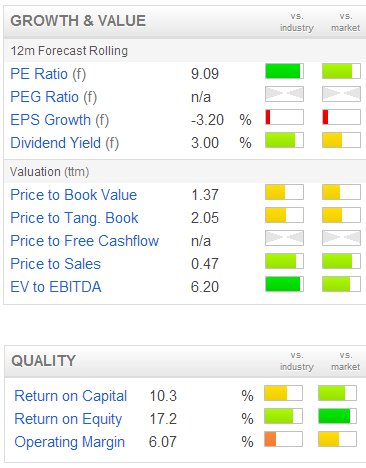

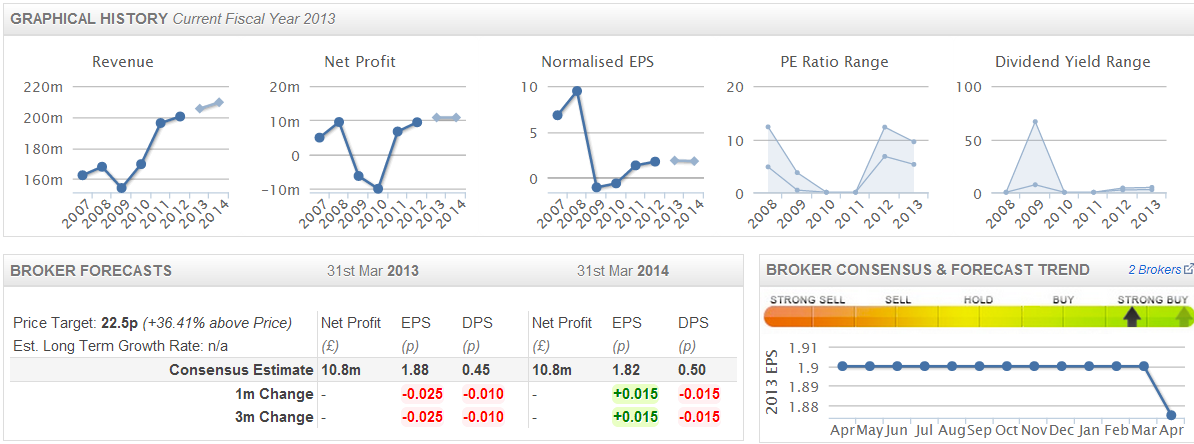

A share I have been keen on for some time is showers, tiles & adhesives group Norcros (LON:NXR). Why? Because it's cheap (low PER, decent dividend yield, and a solid balance sheet - once you find the freehold property that more than offsets the pension deficit, and see that net debt is only 1.1 times EBITDA).

They have announced an interesting acquisition this morning, financed by debt, therefore it is obviously earnings enhancing. The multiple paid seems reasonable, and the business (called Eurobath International Ltd) is an obviously good fit with Norcros - being a manufacturer and global distributor of bathroom fittings such as taps, mixer showers, etc.

The initial cash consideration is £11m, plus debt assumed of £0.9m, with additional performance-based deferred consideration of £4.1m. I like the look of this deal, since Eurobath (which is based in Somerset) has delivered compound revenue growth of 16% p.a. in the last three years, and produced the following results for year-ended 31 Dec 2012: turnover £25.6m, EBITDA £2.5m, PBT £2.1m. So if we assume just over 20% tax, then I make that earnings of about £1.6m, and a PER of 7.4 (based on initial cash consideration plus debt assumed, but ignoring deferred consideration because that will pay for itself based on performance targets, I assume).

So it looks to me as if Norcros have bolted on some growth at reasonable price (GARP) with this deal, which makes Norcros more of a GARP share itself.

I am surprised that Norcros have been able to extend their already sizeable debt facility from £51m to £70m on existing terms, so clearly the Bank(s) have a lot of confidence in them, probably helped by the freeholds owned. It's clearly a good deal, but I think Norcros will need to reassure the market that the level of debt is manageable. Although I note that they only had £20.2m net debt at the last reported date of 30 Sep 2012, and as mentioned before this represented only 1.1 times EBITDA. So the enlarged facility seems to give them plenty more headroom.

I remain very keen on Norcros, as the shares look really good value to me, based on a low PER of only about 8, and a fairly good dividend yield of 3.1%. I also like the way they have traded well through a prolonged downturn, and there must be pent-up demand for their products, since fewer people will have been refitting bathrooms in the downturn of the last five years. I can foresee a pretty decent, operationally geared increase in EPS once the UK economy is recovering more sustainably.

As you can see from the snippet of data from the Stockopedia StockReport, Norcros has traded well in the last couple of years, after almost going bust in the credit crunch, because it floated at the worst possible time, and with too much debt. A rescue rights issue was needed, but that's history now, yet perhaps the company has not yet shaken off the baggage of that close shave? Personally I cannot see any reason why it's trading on a PER of less than 12, which implies upside to 25p a share (which is the price target in a recent very detailed Charles Stanley note) based on current trading, let alone any improvement from a cyclical recovery.

Lo-Q (LON:LOQ) issues an AGM statement, which summarises previous news about contract wins, its acquisition of Accesso, and repaying its acquisition loan notes with bank debt. They state that they remain "well positioned to perform in line with current market expectations for the financial year as a whole".

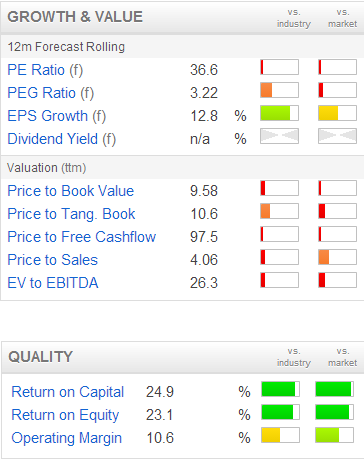

On this valuation (of 38 times this year forecast EPS) I would be looking for an out-perform trading statement, but as a LOQ shareholder pointed out to me recently, most of their business is dependent on seasonal theme parks, so trading cannot be forecast accurately until late on in the year. There's no room for anything other than a strong trading performance here, at the current rating - I remain of the view that the price is very rich.

Post 8 a.m. comments

A nice clear trading update has been issued today by Renew Holdings (LON:RNWH). It's a boring company, doing engineering and construction, on wafer thin margins. The trouble with that type of business, is that it only takes one major contract to go wrong in some way, and the losses can wipe out profits on many other contracts, and even threaten the survival of the business as a whole.

That said, RNWH does look good value, and has paid a steady 3p dividend every year for the last five.

They say that, "The Board continues to anticipate meeting its full year results expectations", which for the year ended 30 Sep 2013 are likely to be 13.5p EPS, so at 89p the price is an undemanding PER of 6.6. There could be some upside on that, but I'm not that keen due to the low margins & high risk.

I'm scratching my head over the valuation of Digital Barriers (LON:DGB), which is valued at almost £80m at a share price of 178p (down 7p today), despite reporting heavy losses expected at £7.6m for the year ended 31 Mar 2013. They operate in the security markets, with some interesting-looking products, including a scanner that can detect concealed weapons under peoples clothing.

One of their acquired companies is Coe, which used to separately listed, and was very much an "also ran" in the digital CCTV market.

Personally I wouldn't touch it with a bargepole - an £80m market cap company making heavy losses just sounds like an accident waiting to happen, in my opinion. So why take the risk?

I'm much happier with my value play in the digital CCTV sector, Indigovision (LON:IND) which is part-way through a potentially exciting turnaround under the new CEO. That has a £25m market cap, is profitable and on a forecast PER of just under 10, and a dividend yield of 4%, with a very robust balance sheet. Much more my sort of thing.

Continuing the security & CCTV theme, £C21 has issued its results for the year ended 31 Dec 2012.

This company has a specialised niche of digital CCTV products for public transport. The figures look quite good, with profit before tax up 24% to £1.8m, and EPS up 14% to 1.45p. That puts the shares on an undemanding PER of 10, with the price currently up 6% to 14.35p (for a market cap of about £13m).

They also have a solid balance sheet with net cash of £1.7m at the year end, which has since risen to £2.75m. They propose a maiden dividend of 0.7p, giving an excellent yield of just under 5%.

There's a lot to like here. My only concern is whether performance is sustainable, given that they are selling large contracts to a small number of clients. Once CCTV is fitted to a bus or train, it stays in service for years. Although they are developing other products too.

This would be a good company to get along to a meet the management event - organisers please note!

That's it for today, same time tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in NXR & IND, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.