Pre 8 a.m. comments

Good morning! I'm struggling a bit to find relevant news, as due to the time of year, we're getting into the reporting season for large caps with 31 Dec year ends. Smaller caps tend to follow in March.

Animalcare (LON:ANCR) issues pretty decent looking interims to 31 Dec 2012 (so a 30 Jun year end). Their market cap is £29m at 139p per share.

Turnover is up 13% to £6.1m (rather low though, given the valuation), but margins are high, underlying operating profit of £1.5m (up 20%). Basic EPS is up 23% to 5.8p. Note how most companies are reporting a higher percentage increase in EPS than in pre-tax profits, because of the reduction in Corporation Tax. This should be noted, and adjusted for by investors, as it could lead to you over-paying for growth rates which are being flattered by reducing tax charges. So in this case, EPS has grown 23%, but the real underlying growth rate stripping out tax is actually 20%.

The interim dividend has been held at 1.5p, and net cash has risen 69% to £3m. So it all looks pretty good, and they confirm expectations for the full year. That is for 10.6p EPS, so at 139p the shares look priced about right on a PER of 13. So I can't get excited about this one.

Supplier of educational products, RM (LON:RM.) had looked a basket case in the past, but their results for year ended 30 Nov 2012 issued this morning look potentially interesting. Adjusted operating profit of £13.6m, and has net cash of £37.8m. It generated a staggering £33.5m of cashflow from operations. Bear in mind the market cap is only £66m at 70p per share, and this could be quite exciting.

On digging a bit further, most of the cash effectively belongs to customers, as there is a £26m deferred income creditor (to reflect cash paid up-front by customers). Also there is a big pension deficit. The 3p full year dividend is maintained, giving a nice yield of 4.3%.

Therefore RM (LON:RM.) is the one share this morning I would be focussing on to decide whether or not it's a buy, but it looks promising to me on an initial glance at the figures.

Post 8 a.m. comments

Having read some more of the results statement from RM (LON:RM.) I'm cooling on that one, as Tweeted at 8:11 a.m., as the outlook doesn't sound great. Inevitably they must be coming under pressure from Coalition restraint on public spending, so I'll pass on it for the time being, and maybe revisit when I have more time to go through the numbers in more detail. Although the 4.3% dividend yield looks appealing for long term investors.

It's also worth commenting on the difficulty in unravelling pension deficits in company accounts. There seem to be two methods of calculating the deficit. In the case of RM, the balance sheet shows a £20.4m pension deficit, which note 13 indicates becomes £15.7m after allowing for deferred tax. That doesn't sound too bad, in the context of RM's large net cash & cash generation.

However, on reading the accounts narrative, you then discover that there is a different, and much worse set of valuation figures for the pension fund, as follows:

The triennial valuation of the Scheme's position at 31 May 2012 for statutory funding purposes showed a Scheme deficit of £53.5 million (31 May 2009: £16.6 million). This significant increase in deficit was primarily due to a deterioration in market assumptions, such as government gilt yields, used to value the Scheme's liabilities. A deficit recovery plan over 15 years has been agreed with the trustees which includes provision of a parent company guarantee to the recovery plan, an initial payment of £5.0 million which was made in October 2012 and annual deficit recovery payments of £4.0m for the year to 31 May 2013, and £3.6 million subsequently. Total deficit recovery payments in excess of current service cost for the year were £7.2 million

So my point is that accounts presented using IAS 19 simply do not give an accurate picture of true pension liabilities, and the cashflows needed to rectify that deficit. This is something that the accounting profession needs to rectify urgently, as at the moment RM's accounts effectively seem to understate the pension liability by £33m, or about half the entire market cap of the company!

Therefore, there's no substitute for getting under the hood, and looking at the detailed pension fund figures. Ideally I avoid companies which have any final salary pension funds at all. In this case it has certainly put me off investing, along with the deteriorating trading outlook.

Pension deficits do perhaps present an opporunity at the moment though - as Gilt yields are now rising, which will push up the corporate bond yields which are used to calculate pension scheme liabilities. So rising Gilt yields will feed through into reduced pension deficits from now on, if that trend continues.

Also in a more bullish market, many investors tend to completely ignore pension deficits altogether, so there is an opportunity to find shares that have been beaten down on pension fund concerns, but are now rebounding. The big one was Trinity Mirror (LON:TNI) of course, but I sold out way too early last year sadly. Never mind, we more than doubled our money from the 25p lows, so can't complain!

Interesting to see that the FTSE 100 is down over 70 points this morning, but my portfolio of small value shares is flat. The good thing about value shares is that they attract more stable investors, who don't dart in & out, but tend to buy & hold. This should mean less volatility. Although lack of liquidity can create its own problems. Compare that with frothy, over-valued momentum shares, where corrections can be swift and painful as people try to trade the fluctuations.

OK, I'm just rambling now, so will wrap it up. Sorry, there just isn't much small cap news to report today.

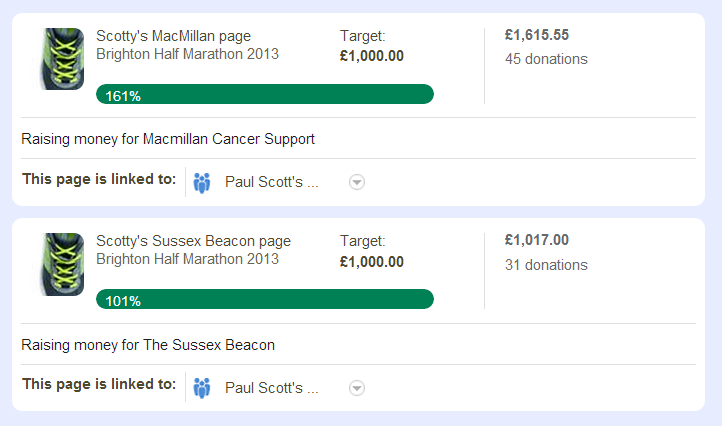

On a final note, I will shortly be closing my JustGiving page for my Brighton Half Marathon run last weekend. As reported here on Monday, it went really well, I ran all the way, in a time of 2hr 23m, and we beat my targets for charity fund-raising, with the grand total being £2,632 raised for MacMillan Cancer Care, and Sussex Beacon!

So a huge thank you to everyone who donated, as most of the donations came from people who read these reports. Of course if anyone would still like to contribute, that would be great.

I've signed up to raise money for Scope in the Royal Parks Half Marathon in October, and if any readers fancy joining me, we could run as a team!

See you same time tomorrow.

Regards, Paul.

(of the shares mentioned today, Paul does not have any long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.