Pre 8 a.m. comments

The Budget yesterday contained a positive measure for small cap investors, in that 0.5% Stamp Duty is to be abolished for AIM shares. That's a useful step in the right direction, which I'm pleased about. We need to tackle ridiculously wide bid/offer spreads next, which is badly needed in order to create a small caps market that is attractive to investors. Wide spreads is by far the biggest problem for the UK small caps market.

Apart from that, the Budget measures seemed just more tinkering from the political class who have hardly any real world commercial experience between them, and who place more emphasis on presentation, tactics, and squabbling with each other, than with any sort of deep thinking about policies.

The two big mistakes made by this Coalition, in my opinion are;

1. They have crushed confidence by constantly talking down the economy and the prospects. Austerity isn't real austerity, since public spending is actually still rising. If you're going to talk tough, then be tough, and get the difficult decisions out of the way. Instead they have talked tough, but been weak, with the result that we have a continuous narrative of doom & gloom. This does affect the decisions of the public, and to a lesser extent, of businesses.

2. Companies (even quite large ones) find it very difficult or impossible to obtain secure, long-term funding from the Banks. Facillities are only renewed for 2-3 years in almost all cases, and the bottom line is that the Banks are still considerably under-capitalised, and are not lending in a way which is needed for sustainable economic growth. We should fully nationalise RBS and Lloyds HBOS, pour in however much money is needed, and tell them to get out there and lend long-term to people with sound business propositions.

Turning to individual company results, Peter Jones of TV's "Dragons Den" holds 42% of a small technology etailer called Expansys (LON:XPS). He gives the impression of knowing what he's doing as an investor, when he's busy crushing the aspirations of delusional members of the public on TV, but he certainly seems to have taken his eye off the ball at XPS. They've put out another profits warning, and it's a pretty bad one, where they say (my bolding added):

Trading to date in the second half of the financial year has been below our expectations with the result that we expect profits for the current year to be substantially below market estimates.

The Group has completed the cost savings forecast in the retail business and we will enter the next financial year with a lower cost base and an appropriate structure to support growth.

The Board is undertaking a strategic review in order to accelerate its objective of becoming an end-to-end solutions provider to MNOs, MVNOs and OEMs. This is not currently envisaged to involve a sale of the Company.

I hold a small number of these shares myself, as it came up on a value filter I did a while back, as having a strong balance sheet, being on a low PER, etc. However it's clearly not worked, and although the market cap has already fallen to only £9m, I am bracing myself for another 20-40% fall today. The last sentence sounds ominous, as to whether there is a viable future for XPS as a Listed company? Personally I only hold a tiny number of these, so it's barely worth bothering to sell them. Current market forecast is for a £2m profit this year, so it sounds like they will be nearer to breakeven perhaps?

Anyway, some investing ideas don't work, so in my view as long as you generally keep the mistakes small, then they don't do too much damage to one's portfolio.

Dismal performance of Expansys (LON:XPS) in the last year - note that the comparison line is the FTSE Small Caps Index, so XPS shares should have risen to 2.8p if they had tracked the market, but have actually fallen to 0.5p today.

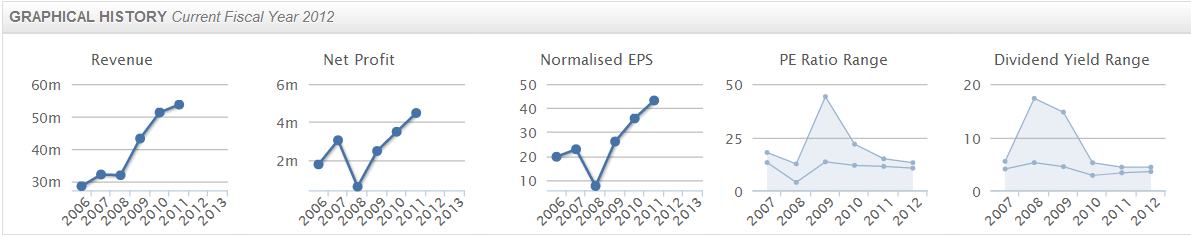

On a brighter note, Bloomsbury Publishing (LON:BMY) have issued an "in line with expectations" pre-close trading update today. This share regularly crops up on my value filters, and indeed I added it to my "Paul's Picks" shortlist on my Blog, which is just a little section where I note down potentially interesting value investment ideas, for further research. I noted it after they issued a positive trading statement previously on 16 Jan 2013.

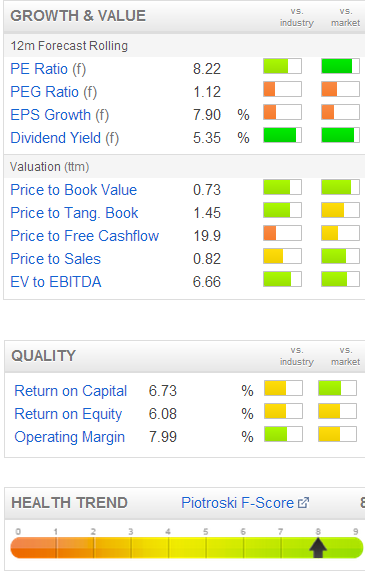

At 107p a share, BMY looks appealing, with Stockopedia's StockReport showing a forecast PER of 8.2, forecast dividend yield of 5.35%, and it also has a useful amount of net cash too. Those numbers look pretty attractive to me, although I'm really trying not to buy any new positions at the moment, as I think this market is overheated, market sentiment is far too optimistic, and I'd rather wait for a market correction & have some spare capacity to pick up bargains at lower prices.

Note that BMY also scores highly in the table on the left on the Piotroski score (it scores 8 out of 9), which the guys at Stockopedia are big believers in.

Personally I haven't done enough research on Piotroski to make an informed judgment yet.

Although I did mention it to a leading British academic, who did the email equivalent of foaming at the mouth, saying that he uses Piotroski in his lectures as an example of an intellectually flawed system which only out-performs if you include micro caps and exclude dealing costs, market spread, etc. So there are differing views on Piotroski, but at first glance I like the simple checklist basis for calculating a Piotroski score, and can see how it might well assist a stock picker when combined with other filters, to create a better shortlist of ideas to research.

The headline numbers for year-ended 31 Dec 2012 from Portmeirion (LON:PMP) look pretty good. Funnily enough, this is also on "Paul's Picks", as I liked their trading statement from 21 Jan 2013, and thought the shares looked cheap at 547p, a level they have slightly dropped from (to 537p currently), which gives a £56m market cap.

They report revenue up 3.6% to £55.5m (so a PSR of exactly 1), pre-tax profit up 6.6% to £6.8m (showing a decent profit margin of 12.3%), EPS is up 10.2% to 48.4p, that puts the shares on a PER of 11.1, which seems fairly good value to me. The dividend yield is attractive at 4.1% (based on 21.8p full year divis).

They also hold cash of £7.5m. The outlook statement is OK but not sparkling. There is a £5.0m pension deficit showing on the balance sheet, so I'd need to look into that in more detail before investing here.

Post 8 a.m. comments

I decided to buy a few Portmeirion (LON:PMP), and have just picked up a small number at 536p. Regulars will know that I often rant on about how inefficient the UK small caps market is, mainly because of wide bid/offer spreads, which is a catch 22 situation in that wide spreads cause illiquidity, in a vicious circle.

The quoted price for PMP is currently 525p Bid, and 550p Offer. So a pretty ghastly spread there of 25p, or 4.7% on the Bid price. However, the actual price that you can deal in small quantities (up to 1,000 shares, which isn't bad actually in this case) is 536p! So the market makers are quoting a price of 550p, when one of them at least is actually happy to deal at 536p. How does that make any sense at all?!

Do they not realise that quoting a wide spread will deter people from even trying to trade the share? Surely it would make more sense if the market makers just quoted the price they are actually happy to deal in, in the NMS? Instead of quoting a worse price than the one they will actually deal at?

It might be connected to the use of RSP machines by brokers, i.e. that the MMs perhaps want to show brokers a notional improvement on the quoted price. However, the quoted prices deter investors from wanting to deal, so they are creating an unecessary problem here.

So here's a plea to the Market Makers - if you want more business, you need to tighten the quoted spreads to the best price you're actually willing to deal at. This will greatly increase market liquidity, as investors are attracted to shares where the bid/offer spread is narrower. A concerted effort is needed on this, for market participants to co-operate, hence I think we need a meeting between investors, the LSE, and the Market Makers, to listen to each others' suggestions for ways we can improve the small cap market, and crucially make it more liquid, which will benefit everyone in the long run.

ShareSoc Tech Co Seminar

Many thanks to ShareSoc (which all private investors should support, as they do great work on a voluntary basis, to represent our interests) for organising (and FinnCap for kindly hosting) an interesting investor evening last night.

Three companies presented, and I'll give my very brief reaction to each presentation:

Escher Group (LON:ESCH) - this is a software company originating from Dublin, which has an incredibly impressive track record for having sold point of service software into postal services around the world. They seem the clear niche leader here (globally), and have recently won the business of the US postal service.

The financials are also incredibly impressive, with most recent revenue & adjusted EBITDA up 66%, and more growth expected. My main reservation is that over a quarter of revenue is one-off licence sales. If they could change their business model so that licences are sold as an annual recurring fee, then I would love to own some shares in it. But at the moment, not enough of the revenue is recurring to enable me to cough up the fairly steep market cap. That said, my hunch is that I could foresee this being the kind of company that I'll kick myself for not buying, in a few years' time.

Deltex Medical (LON:DEMG) - they sell a monitor and disposable medical probes for use in surgery. It sounds potentially interesting, but my main concern is that they are having difficulty getting hospitals to actually use it. So sales growth is limited, and they are not yet trading profitably. Although the disposable probes are high margin, so you can see that if useage does take off, then this could potentially have a strongly operationally geared upside. I'm just not convinced that the growth is likely to happen, and don't much fancy gambling on that happening, when I don't have the expertise to make a sensible judgment on that. I'd have a punt if the market cap was sub-£10m, but not at £26m market cap.

dotDigital (LON:DOTD) - a provider of email marketing software (similar to MailChimp) to a range of companies, including some big names (such as BP). I don't particularly like the product area they operate in, as email is the bane of most of our lives, taking up several (seemingly unproductive) hours per day just to read & absorb information, answer queries, etc. However there's no denying the company has an impressive track record of growth & profitability to date, and probably isn't over-priced either, if you expect growth to continue.

General comments about this Blog

I was chatting last night to several people about my Blog here, and one commented that I seem to change my mind on companies, often quite rapidly, the example being Inland Homes (LON:INL) yesterday, when the shares shot up 5p in the morning on publication of good results, and I sold at 31p as mentioned here at the time.

Firstly, investing is a dynamic process. I don't have a fixed view on any company, but a constantly changing view, where I'm weighing up what the market overall is doing - so how are my shares in valuation terms relative to the market? Also on results day, my view of a company can radically change - so if they issue good results, I may well try to buy more, and bad results, I may sell.

However, the over-riding consideration is always valuation. I'm not trying to necessarily buy good companies, I'm trying to buy under-valued companies. So once a share is fairly valued, I don't want to hold it any more (unless my instincts are that the market will run with the momentum & take it higher, but frankly I'm not very good at that, and always sell far too early in a rising trend).

So in the case of Inland yesterday, I crunched the numbers, saw that NAV had risen a bit to 28p, and that there is an additional 5p of off balance sheet NAV, so fair value is 33p. The shares had been 24p two days earlier, and spiked up to 31p (up 5p on the day) on the morning of the results. This seemed to me to be close enough to fair value, and I happily sold my Inland shares at 31p. As it happened, I timed it very well, and they subsequently slipped back to 27p. At that sort of price, I'm seriously thinking about buying back in, because the downside is asset-backed, and the upside is getting interesting again.

Above all, please remember that this Blog is just my personal opinion. Nothing written here is ever intended as, nor should be misconstrued as financial advice. Also, please bear in mind that this Blog is not subject to editorial control by Stockopedia, I have free rein to write what I like, so they may agree or disagree with what I write. So if anyone wants to sue me, please do so directly, and don't bother the chaps at Stockopedia. Seriously. Although you'll find that everything written here is fair comment, and if there is ever a mistake on facts, then I'll happily correct it with an apology.

See you same time tomorrow!

Regards, Paul.

(of the shares mentioned today, Paul has a long position in XPS, has bought some shares in PMP today, and has a tiny residual holding in INL, which he is keeping in order to be able to attend the AGM again)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.