Pre 8 a.m. comments

A fairly quiet day for results today, after an absolute deluge yesterday. As usual I'll take a quick look at the most interesting (to me) results and publish just before 8 a.m.. Then a more leisurely look at a few more companies between 8-10 a.m..

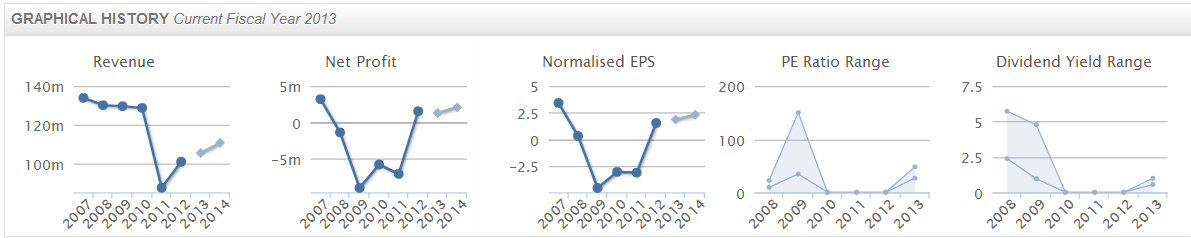

Given my retail background, I'm drawn to today's results for the 52 weeks to 26 Jan 2013 from Moss Bros (LON:MOSB). Performance is expected to be good, as the share price has already factored in rather too much recovery for a business that has struggled to be profitable for several years now.

At 66p and with 99.3m shares in issue, the market cap is £65.5m.

Basic EPS rose from 1.63p to 2.43p, so that puts them on a lofty rating of just over 27 times. The total dividend for the year has been more than doubled, but is still only 0.9p, for a yield of only 1.4%. Put another way, the quoted bid/offer spread would consume over 2 years dividends!

Although the 2.43p EPS figures seems to be well ahead of broker consensus forecasts of 1.88p.

MOSB have a particularly strong balance sheet, with £25.7m in net cash, although that is likely to be at/near a seasonal peak at the year-end date. Current assets total £44.2, and current liabilities are only £15.9m, so there is a very healthy working capital surplus of £28.3m. Long term liabilities are only £7.5m, so working capital less all liabilities is a very solid £20.8m.

This is important, as a strong balance sheet means the company is not likely to go bust - de-risking the investment for shareholders, and giving potential upside if something good is done with surplus cash (e.g. a special dividend, buybacks, acquisitions, etc). Cash also gives suppliers confidence, giving you the pick of the best suppliers & stock, and it means you can use your financial strength to increase profit, by e.g. paying suppliers cash on delivery if they give you a discount.

I note from the narrative that they are looking at refitting 90 stores over the next 5 years, so the business will be capex hungry, and cash could decline. Although it's also worth noting that EBITDA of £7.9m last year is considerably higher than PBT of £3.0m, which implies a fairly hefty depreciation charge of £3.9m. Therefore the business is generating more than enough cashflow to finance the store refits.

Group like-for-like sales were up 4.1% for the year, which is one of the best performances I've seen in 2012 from a conventional retailer. So they must be doing something right! Of course, MOSB is unique in having a formalwear hire operation, the market leader I believe, in addition to retail. They are also effectively embracing the internet, with E-commerce sales up 54%, and they operate click & collect.

It's very interesting how retail is changing rapidly in these tough economic times. It's clear that retail overheads are far too high, and rents can (and will) gradually fall - but because of the way the system works (typically 15 year leases, on upward-only 5-yearly rent reviews), then there is no scope for rents to reduce other than if the tenant goes bust, or when the lease expires. It's only then that the existing tenant renewing the lease, or a new tenant, can tear up the old terms, and negotiate fresh.

Even then, the landlord wants to establish the highest rent possible, in order to create a multiple of that in capital value for the freehold which he owns, as he might also be under financial pressure with his bank worrying about the loan to value ratio. Hence landlords tend to prefer paying an up-front cash inducement to new tenants (a reverse premium) or a long rent-free period. So for retailers who work this system shrewdly, they can expand at nil cash cost, with landlords effectively funding the shop fit-out.

Also it seems that retailers can still make things work if they embrace the internet, and hence use their shops as both places to sell, and also places to allow customers to collect internet purchases. The beauty of click & collect is that you can get the customer to try on the garments in the shop, to ensure they fit. This would drastically reduce the returns rate, which is typically 30-35% for mail order & internet sales of clothing.

MOSB say that they are confident of achieving market expectations in 2013/14, but given that forecasts are for only 2.3p EPS (less than what they achieved in 2012) then that's not a stretching target.

The outlook doesn't sound terribly good though - sales in the first 7 weeks of this year are "slightly below last year's levels, albeit on stronger gross margins. Like-for-like gross profit in the seven weeks to 16 Mar 2013 is 2.4% below last year". Although some could be weather related, as it has been particularly grotty this year. Hire bookings are also behind last year.

The three year chart shows that MOSB has significantly out-performed the small cap sector since Jun 2011, and in my view shareholders should consider themselves fortunate to have achieved such a high price now.

It's difficult to see how any further rise in the share price is justified, given that the outlook is not brilliant, and the share price is already fully valued in my opinion. So it's not of any interest to me as a potential investment. The operating profit margin is only 2.8%, so it's really not a particularly strong business, and I'm surprised the market has taken the shares up to a fairly toppy rating at 66p, which is only justified if you make some fairly aggressive assumptions about continued earnings growth. So it's not for me at this price, although it is good to see a traditional retailer adapt and cope with the changing world.

Post 8 a.m. comments

Next I'm taking a look at Judges Scientific (LON:JDG) who have today published results for the year ended 31 Dec 2012.

I really like this company, but unfortunately missed the opportunity to buy the shares in the early stages, and they have looked fully priced to me in the last year, although as with some other good growth stories, the price just keeps going up.

At 1242p a share the market cap is £66m. The business model at Judges is to make serial small acquisitions at low price multiples, of small companies in the scientific instruments sector. That in itself doesn't sound particularly interesting, but the fact is that the charismatic CEO David Cicurel has executed the strategy brilliantly, and not put a foot wrong with multiple acquisitions having worked well.

As he stated at a presentation last year, it's not about synergies, it's just about making shrewd acquisitions, and using their own cashflows to rapidly repay the debt to acquire them. This is done over & over again, growing the size of the business.

Headline EPS has risen strongly from 61p to 81.3p, although I note that exceptionals wipe out all of the headline profit this year, so will come back to that shortly once I've found out what the exceptionals are. So that puts them on a PER of 15.3, which is clearly an aggressive rating for a collection of small businesses that individually would command very cheap ratings.

The total dividends have risen 50% to 15p for the year, so a yield of only 1.2%.

Net debt is minimal, at £1.75m. The outlook statement sounds positive, saying "the new year has started well for the Group and a solid order intake is buttressing the visibility afforded by the satisfactory year-end backlog".

Turnover of £28m and operating profit pre-exceptionals of £5.9m demonstrated a very strong profit margin of 21.2%, so on that basis I'm becoming more comfortable with the valuation.

The £5.3m exceptionals relate to £3.3m amortisation of intangibles (fine, as it's non-cash), and £1.6m relating to derivatives (seems a lot, more digging is needed on this issue).

The balance sheet is nothing to write home about, as it has zero net tangible assets. Gearing looks fine though in relation to profitability & cashflow, although it's important to note that there is no buffer from balance sheet strength, should earning ever disappoint in the future.

There's no doubt investors have done brilliantly on these shares, and the CEO here is a real class act, in itself justifying a premium rating. But on the other hand, the growth is coming from acquisitions, so it has to keep running to justify a premium rating. So far it's worked brilliantly, but my worry is that at some point it will become increasingly difficult to find the (larger) acquisitions needed, at the right price, to keep EPS growing. Equity holders were diluted about 10% last year to help fund acquisitions, so if they have to pay more for further acquisitions (as you would expect given more bullish conditions for small companies), and issue more equity to finance them, then EPS growth is likely to slow.

On the other hand, Cicurel may continue delivering superb acquisitions, and I certainly wouldn't bet against him, but the PER of 15 looks high enough to me. Probably fairly limited percentage upside on the share price from here, but there again I thought that at 800p too, and it's now 50% higher! Although I do feel that some investors are being lulled into a false sense of security at the moment - valuations don't keep going up forever, and if they do have a long, unbroken rise, then banking some (or all) of the gains is a pretty good idea, in my opinion. There are always investing ideas out there, and having made a lot of profit, sometimes taking my foot off the gas, and sitting back to wait for better priced opportunities can turn out to be a wise move. But each to their own of course!

OK, that's it from me this week. Thanks very much for your comments, always good to get a discussion going, so please feel free to add your thoughts in the comments section below.

I have a 10 a.m. conference call now with an AIM company, so will report back if it looks interesting.

Have a terrific weekend, and see you for the (shortened) week on Monday.

Regards, Paul.

(of the companies mentioned today, Paul does not hold any long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.