Pre 8 a.m. comments

Good morning! It's a busy day for results again, and this morning I shall first be looking at preliminary results for the year ended 31 Dec 2012, from a company whose shares I hold personally, KBC Advanced Technologies (LON:KBC). It is a software and consultancy business serving the oil industry, in particular helping oil refineries optimise profitability.

At 66p a share, and with 58.9m in issue, the market cap is £39m.

The recent history of KBC is that they encountered trading problems during 2012 with a soft H1, warned on profits, but then recovered rapidly after a restructuring & new management being brought in, such that they issued a series of positive trading updates later on in 2012. This is reflected in the share price gyrations in the last year:

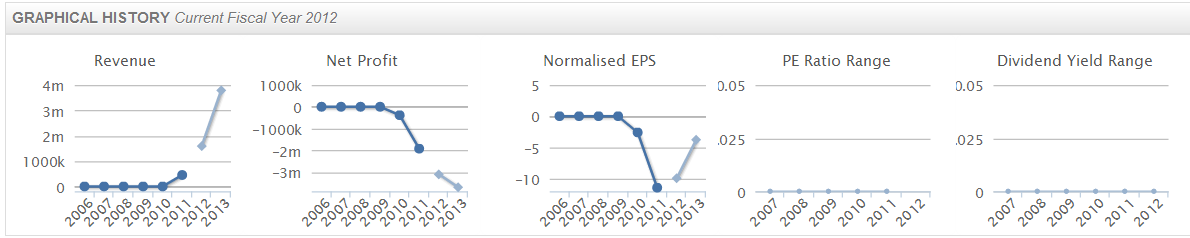

Results from KBC this morning are not the easiest to interpret, since they have had an enormous tax charge, which more than wipes out all profit, so clearly some one-offs in there, but also a problem in that they allude to having a tax inefficient structure - i.e. high profits in high tax countries, and vice versa. Action is being taken to restructure to minimise future tax liabilities, so I'm prepared to view that as a temporary factor.

This renders the EPS figures meaningless, as these show a loss due to the tax problem.

Underlying profits are £5.5m (against £6.0m last year), which seems a reasonable outcome given the poor H1. Cash has absolutely gone through the roof, given a large customer prepayment made near the year end. This resulted in year end cash of £21.1m, which adjusts down to £6.4m once that large customer prepayment is stripped out, less £5.4m in bank loans, takes them to a small underlying net cash position of £1m.

So a bit of a messy year, which ended well, with a "very strong final quarter". The all important outlook comments are positive.

In 2012, contract awards were £95.4m (2011: £44.9m), a record for KBC, resulting in an order book at the year end of £82.9m (2011: £48.7m) which, together with a large new software contract award in Japan, has contributed to a strong start to the year.

The exact timing of contract awards, particularly for software licences, will continue to affect results within any year. However, given the strength of the order book, the enhanced range of products and services and a restructured business that is better able to deliver profitable growth, the Board looks to the future with confidence.

They also say that it is the Board's intention to resume paying dividends in 2013, and that 2013 has started well:

2013 has started well and, together with the benefits of the reorganisation and restructuring, we are confident that the Group is well placed to deliver on its plans to grow the business profitably.

Therefore I see the 2012 results as a transitional year, and it looks like the prospects for 2013 are good. If the business is re-rated to a Price to Sales Ratio (PSR) of 1, which should be achievable once profit margins have been increased somewhat through restructuring, then the shares would roughly double from here. No guarantees that will happen of course, but that's the reason I'm in this share, and am happy to continue holding.

Post 8 a.m. comments

I'm a bit surprised by the negative market reaction to KBC Advanced Technologies (LON:KBC) results (currently down 9% at 61p), which seems a mistake to me - because underlying profitability of £5.5m was ahead of expectations, the balance sheet is strong with net cash (even after adjusting out a large customer prepayment), they state an intention to resume dividends in 2013, and the outlook is positive.

There is also a record order book. The problem is that they did not provide an adjusted EPS figure on a normalised tax charge, which they should have done (unless I missed it, if so please let me know in the comments). I've put a call in to the FD to clarify a couple of points, including the tax situation, so hopefully will be able to report back later.

The market cap is now down to only £36m with the shares at 61p, which strikes me as very good value for a business that looks on track to meet or beat 2013 broker consensus of 8p per share, so a current year PER of only 7.6. I'm tempted to average down, but might wait to see where the price settles, as selling tends to fuel more selling from market participants with short term horizons. That can create opportunities for investors such as myself who usually invest with a 1+ year horizon.

Moving on, next I'll take a quick look at Tracsis (LON:TRCS) who have today announced an agreed cash takeover deal for another small Listed company, Sky High (LON:SKHG). Having met management at an Equity Development investor forum in January, I was impressed - the CEO seems very smart, and shrewd. So TRCS has patiently built up a £8m+ cash pile, whilst looking for suitable acquisitions at the right price. As he quipped at the meeting, "with a Scottish CEO, and an FD who is from Yorkshire, we won't be over-paying for any acquisitions!"

TRCS is paying £3.3m for Sky High, and crucially says that it will be immediately earnings enhancing. It seems a good fit, being also engaged in the transport technology area, and also bolts on a decent level of turnover. It sounds like cross-selling opportunities are high on the agenda. The market likes the sound of this deal, and TRCS shares are up 6% to 184p this morning. It looks like a sensible use of some of their cash pile. Takeover deals often destroy shareholder value (look at how often acquired goodwill is written off later!), but infrequent and earnings enhancing deals are a good thing.

Delcam (LON:DLC) issues excellent results for the year-ended 31 Dec 2012, which look to be bang on forecast, with EPS at 58.2p, up a spectacular 65% on the prior year. At 1500p the shares are therefore on a PER of 25.8. Gulp! The outlook is positive, "we expect Delcam to make further good progress in 2013".

What is striking is that Delcam spend almost a quarter of their turnover on R&D, or £11.4m, which dwarfs their operating profit of £4.9m. Companies which spend a lot on R&D tend to do well in the future, for obvious reasons. Of course it depends how much of that R&D really is R&D, and how much is just ongoing costs which they happen to call R&D! Nevertheless, it's a very impressive company clearly going places.

The price is way too rich for me though, so good luck & well done to holders! I originally had some Delcam years ago, when they were around £2-3 a share, so obviously wish I'd stuck with them now they're £15!

It's difficult to know what to make of DP Poland (LON:DPP). The figures announced today are dreadful, but that's to be expected for an early-stage retail roll-out. The narrative sounds very bullish though, and like-for-like ("LFL") sales and gross profit are growing tremendously (up 37% and 51% respectively in 2012), continuing into 2013 with triple digit growth in LFL for January.

It is well funded, following a big fund-raising, and had £10.9m in cash at 31 Dec 2012, although since that is likely to be spent on new store fit-outs, and funding losses, then it's probably best to mentally write off the cash. They say that the cash should be enough to take them through to EBITDA breakeven.

Also noteworthy are the sector heavyweights on the Board - e.g. Chris Moore, the former CEO of Dominos main UK company is a Non Exec, as is the Chairman & CEO of Caffe Nero, Gerry Ford.

I can't bring myself to buy any shares in DPP just yet, as the figures are so awful - £1.8m turnover and £3.1m loss in 2012, but that's missing the point - it's a start-up, so it's not about current trading, but future potential. If the market cap came down a bit from its £22m level now then I might be more interested, but retail roll-outs are never cheap. There again this is only Poland, where disposable income is much lower than in the UK, so overall I'm not sure on this one. Potentially interesting though, but not at this price.

Cyprus / Eurozone musings

I remain of the view that the Cyprus situation could blow again into something very nasty - i.e. bank runs across Southern Europe. Now that the Eurozone have made it clear they have no issues with plundering bank accounts (indeed even referred to as a "template" by the Dutch Finance Minister, before the comment was retracted), then how can anyone with significant bank deposits in Southern Europe feel safe? Chances are that the smart money is long gone anyway, but why would anybody now keep deposits in Greek or Spanish banks? I'm amazed that the price of Gold hasn't shot up, and my hedge there is not working so far. Maybe US equities are a better hedge, as the chance of them being seized by the Government are nil.

It will also be interesting to see how Russia will retaliate against the EU, and in particular Germany. They're not going to take the theft of Russian depositors cash lightly, so I'm sure there will be payback of some kind.

So personally I'm staying long of Gold, as I suspect there's a good chance of things unravelling badly with Southern European banks. It couldn't have been handled much worse if they had tried.

Capital controls seem inevitable, which is a half way house to creating new currencies anyway. Although with the ECB providing so much of the funding for Southern European banks already, their losses would be on a catastrophic scale if Southern European Euros stopped being convertible at par with Euros elsewhere, and therefore devalued against Northern European Euros. I suspect that will be the most likely outcome of all this - i.e. the Euro breaking up into two zones.

Right, that's it for today. See you same time tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in KBC, a long position in Gold, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.