Pre 8 a.m. comments

A share which I held until recently, May Gurney Integrated Services (LON:MAYG) have today announced a recommended all-share merger with Costain (LON:COST), which will be renamed Costain May Gurney. They state that the combined group can make cost savings of £10m, so it seems to make sense for them to merge. Although I note that MAYG is on a lower PER, and has a better dividend yield than COST, so shareholders will need to sit down and crunch the numbers to work out whether the receipt of 0.8275 new Costain shares is a fair price or not for each May Gurney share.

EDIT: I flagged the value in May Gurney shares on my Blog 6 months ago when they were 138p. So following this morning's open 32% higher at 245p, that's a gain of 77% for readers who held until today. Naturally, as always, I sold too early a couple of weeks ago! My tag line should be, "good at research, rubbish at trading!"

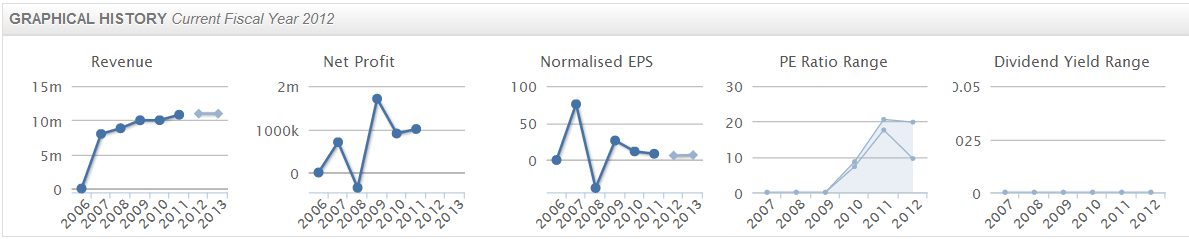

Results for the year ended 31 Dec 2012 from Instem (LON:INS) look interesting. The numbers themselves are pretty lacklustre, with revenue very slightly down, and adjusted operating profit down by a quarter to £1.5m, although they say this is in line with revised market expectations.

However, it's the outlook which is interesting. Instem had a slow 2012, but then signed some impressive contracts in Q4 and in 2013 with major customers. So it is reasonable to expect improved results going forwards, and as we all know investing is all about valuing future cashflows, not historic ones.

Instem seem to be a software company serving the early development pharmaceutical sector. Historic growth has been fairly pedestrian, but it's all about the new contract wins, including a very impressive US Govt contract win, which put a rocket under the share price a month ago.

Revenues are 70% recurring, and high margin, so there is considerable operational gearing from new contract wins, meaning that profits could rise significantly on these new contracts.

The shares look reasonable value to me on the historic numbers, so could end up looking cheap once the new contracts flow through. Basic EPS is reported as 8.9p although that is flattered in comparison with last year due to a lower tax charge. At 121p that puts them on a PER of 13.6 (not bad for a growth company). There is net cash, but I am disregarding that as it looks as if the cash really belongs to customers in the form of deferred income (i.e. up-front cash paid by customers), judging by the fact that there is a £700k deficit on net current assets.

Also there is a £3.2m pension deficit shown on the balance sheet, so this would need to be checked to ensure it's not the tip of the iceberg, as can often be the case under the totally unsatisfactory rules for pension fund accounting that exist at the moment.

I would be interested in finding out more about Instem's prospects, because at the moment it looks good but I cannot quantify what future EPS are likely to be. Broker consensus forecasts seem low, with £1.1m and £1.2m profit shown for 2012 and 2013 respectively. Perhaps some new broker notes will come out following these results, which I would be interested in seeing.

Post 8 a.m. comments

Stockbroker WH Ireland (LON:WHI) have issued their results for the year ended 30 Noc 2012 today. I take a particular interest not as a shareholder, but as a broking client. It's a tough sector, with fierce competition from online brokers, although personally I've always found that online brokers can be a false economy with smaller caps. Whilst they get a small price improvement, they are often locked in to a particular market maker, and may not get you the full range of potential market sources for shares. Also they won't spend the time ringing round the market makers to sniff out a cheaper line of stock.

Whereas having a proper telephone broker, where you can have orders "worked" for you by going onto the order book (i.e. trying to buy at the Bid price, instead of the Offer price!) if there is one, and leaving orders with a market maker good for the day (i.e. giving an order to a MM and then letting them go out and try to find the stock) can lead to dramatic price improvements - sometimes several percentage points off the price of micro caps.

I've done the sums and worked out that for micro to small caps, I save money overall by using a proper telephone broker compared with a "cheap" online broker, as the price improvements, and being able to get filled in one go, rather than having to repeatedly go back for little scraps of shares, more than offset the higher commission charged. You get what you pay for, as with everything in life.

Incidentally, if readers would like an introduction to my broker, just email me or message me through Stockopedia, and I'll see what I can do in terms of getting people onto my friends & family reduced tariff.

Cheap online brokers tend to be more cost efficient for mid to large caps, so I tend to keep several broking accounts, and use the most appropriate one for each situation.

Back to WHI results. They show an improvement, with turnover up 8% to £25.1m, and a loss-making situation having been improved to around breakeven. The balance sheet looks OK, and there is a 0.5p dividend.

Taking a simplistic view of the chart, this looks like it might be a good entry point now, possibly? (especially as market conditions are better now than they have been at any time throughout the last 3 years that this chart covers):

With small cap markets really having come alive since July 2012, I suspect broking might be a good area to look at - since IPOs are happening again, secondary fund-raisings are easier to get away, and new people are coming into the market as investors, it just all feels like a bull market again, and that of course is good for brokers. But they need to get out there and explain how their services benefit clients, as by default people will head for what looks like the cheapest option on the retail side.

Interim results from Plexus Holdings (LON:POS) are interesting. Turnover has risen from £9.3m to £11.3m, and operating profit is up from £1.5m to £1.8m. Those are six month figures of course. Guess what the market cap is? It's £180m!

OK that's it for today. I've looked at lots of other results, but nothing much of interest to me.

See you same time tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.