Pre 8 a.m. comments

Today should be interesting, as the Cyprus banks apparently re-open, with capital controls. Given that bank deposits are no longer safe, there is no logical reason for anyone to leave money in any Cyprus bank, therefore surely a bank run is not avoidable, it's inevitable?

The only question is whether it spreads to other southern European countries. If I had money in a Spanish or Italian bank, I would have withdrawn it by now. If they can plunder bank accounts once, then they can do it again, and surely this is a dangerous development that seriously undermines the whole concept of banking - i.e. that deposits are safe? Anyway, I remain long of Gold, and am very surprised it has only traded sideways in the last couple of weeks.

Toy train company Hornby (LON:HRN) had problems with its supply chain (over reliance on one supplier who messed up production) about six months ago. They today issue an in line with company expectations trading statement, which isn't a lot of use because there don't seem to be any market forecasts for the current year ending 31 Mar 2013. Although it does suggest that things aren't getting any worse.

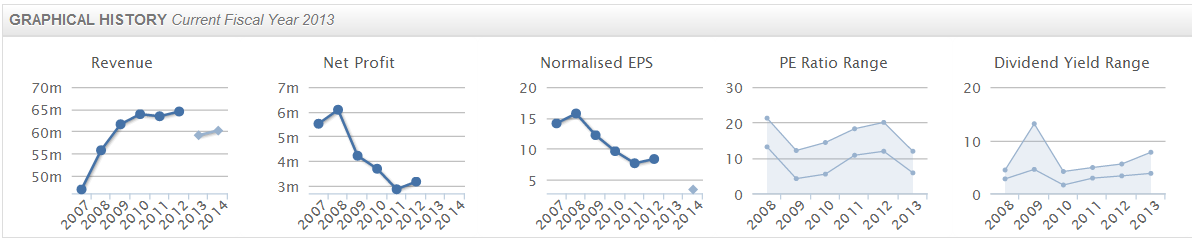

They also mention broadening of the supply chain, new products, and management succession planning. Without any forecasts I can't value it, so will have to wait for the results to be issued before I can comment further. The trend of profits has been steadily declining since 2008, so it looks like a turnaround plan is needed. These performance & valuation charts don't inspire me at a £30m market cap, plus about £6m in net debt:

I see that Regenersis (LON:RGS) has announced a Placing to raise £6.9m of fresh cash, at a respectable price of 209p, so clear Institutional demand there for the shares since there is no discount to the current share price, which has been very strong - more than doubling in the last six months.

Existing holders are also Placing 893,070 shares on top of the new shares being issued. There is not much dilution for existing holders, as the new shares only comprise 6.6% of the enlarged share capital, so nothing to worry about. The cash raised is for working capital & acquisitions.

This is a text book case of how to do it - perform well, grow the business, which drives the share price up. Then raise fresh cash for further expansion on the back of a much higher share price. Good stuff. I missed the boat on RGS, although it doesn't look expensive even now, based on forward earnings estimates.

Lo-Q (LON:LOQ) shareholders will be a bit more cheerful today then they were yesterday, as the company has issued news of a contract update to extend its virtual queuing system to another American theme park.

Post 8 a.m. comments

Just on a housekeeping matter, I have sold out of STV (LON:STVG) and Walker Greenbank (LON:WGB), which was necessary in order to raise cash to buy into new positions in Vislink (LON:VLK), Portmeirion (LON:PMP) and Fairpoint (LON:FRP). I'm fully invested at the moment, so if new opportunities crop up I have to weigh up what to sell, and only selling if I think the new things are better value than the old.

If you ever want to check what shares I currently hold, then just click here to see my current positions, which is kept up-to-date. Although it must be emphasised again, this is just a free Blog, to flag up ideas for people to research themselves. It is definitely not a share tipping service, so please bear that in mind, and please don't just blindly follow my trades, as I frequently sell at the wrong time & price!

Regulars will know that I think Earthport (LON:EPO) is a dreadful company (based on its long track record of promising wonderful things, but delivering dismal results, and burning up cash with repeated fund raisings over many years), and the market cap of £78m is completely ridiculous in my opinion.

It's more of the same from Earthport today, with interim results showing turnover of just £1.8m, and an operating loss of £4.5m (including a £772k share-based payment charge). This company has burned up a staggering £117m since inception, and yet still manages to find people prepared to pour fresh cash into it. They've got enough cash to continue going for another 18 months by my estimate, so good luck to them, and good luck to shareholders - you need it!

Laura Ashley Holdings (LON:ALY) annouces good results for the 52 weeks ended 26 Jan 2013. They performed well, with LFL sales up 2% for the year, which improved slightly in the first two months of the current year, to 2.7%.

EPS rose from 1.79p last year to 2.02p this year, and all the earnings were paid out in dividends, 1p interim and 1p final. So whilst the 6.8% dividend yield might look great, bear in mind that this is 100% of the company's earnings being paid out. The PER is not cheap at 14.5.

They have a decent balance sheet, with £34.6m cash at the year end seasonal high. The balance sheet also shows a pension deficit, it's only £6.6m but would need checking to ensure that's not the tip of the iceberg that can sometimes be the case.

I can't get excited at this valuation, it looks fully valued to me for the time being.

Fulcrum Utility Services (LON:FCRM) is not something I've heard of before. They seem to be a UK contractor for building connections to gas pipelines. It's been historically loss-making, and has issued a profits warning today. The shares are down 22%, and it doesn't look of any interest to me.

As an aside, we might see some unusual price movements in small & micro caps today and next week, due to people crystallising tax losses for the tax year end on 5 April to offset against gains elsewhere, and/or crystallising profits in order to use up their annual CGT allowance. So I'm keeping my eyes peeled for buying opportunities.

Scents maker (for perfumes, food, etc) Treatt (LON:TET) puts out a reassuring trading update, saying that they are confident of meeting expectations for the current year ending 30 Sep 2013. The shares don't look particularly cheap to me, and there is a fair bit of debt. There is a good, and growing dividend of almost 4% though.

Suggestion to Stockopedia

As a closing comment, I'm mindful of how inefficient each morning is for me - ploughing through numerous results announcements from tiny companies. Today was a good example - there must be around 50-60 results or trading announcements this morning, and yet I have no way to filter them.

So I have had to look up the ticker for every company, to see what the market cap is, and only then can I disregard it. Resource companies I usually avoid by just identifying from the company name that it's a resource company.

So here's a suggestion to Stockopedia - please could you develop a filtering system for the site, by which users can just screen out whole sectors, and companies under a (customisable) market cap.

Then give us a live news feed (I know it's in the pipeline!) which only shows announcements from the companies we want to see, sorted into logical sections (a bit like Mr Contrarian's very useful facility here, which I use every day - thanks again MrC!)

It would also be useful if we could have a check box on the StockReport to exclude individual companies from all functions on Stockopedia (stock screens, news filters, etc) if we don't intend ever investing in the company (.e.g if there is a dominant majority shareholder, which to many people would make that company uninvestable).

Another thing that I would love to see is a top daily movers percentage list of gainers & losers, but again only showing the companies that I want to see (over £xm market cap, and avoiding certain sectors). So the same filter could be used site-wide for everything - news, StockReports, stock screens, top movers, etc.

That single filtering feature across the site would dramatically improve the site's usefulness for me (and it's already very useful!).

OK, I'm done! Have a smashing Easter break everyone, and I look forward to the market opening on Tuesday morning (you know you've found your niche in life when you look forward to starting work again after Bank Holidays!)

Regards, Paul.

(of the shares mentioned today Paul has long positions in VLK, PMP, and FRP, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.