Pre 8 a.m. comments

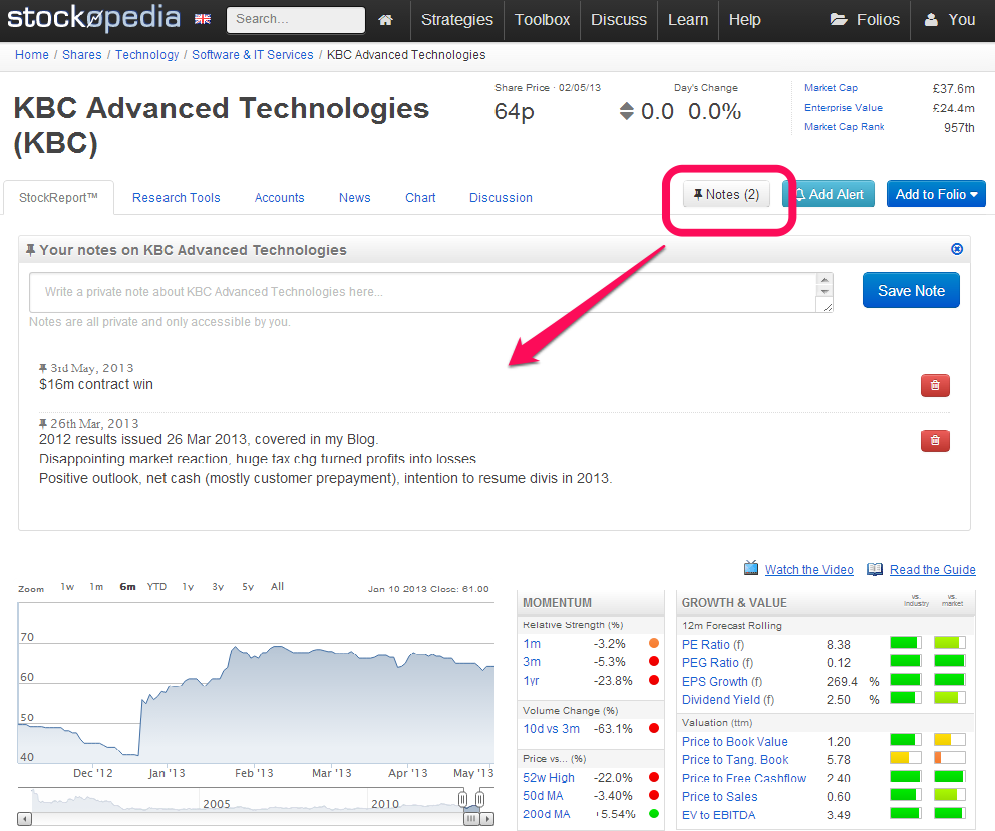

Good morning! Just one announcement from my portfolio & watch list, being a $16m software contract win (over 7 years) announced by KBC Advanced Technologies (LON:KBC). I've got mixed feelings about this company, and recently cut back on my long position in it, although I still hold some.

Whilst they have announced a series of positive contract wins & trading updates, there was unexpected bad news concerning a very high tax charge with the last set of results. Now arguably tax issues can be fixed, and it's the underlying performance of the business that matters more. On the other hand, they have net cash (although mostly up-front payments from customers), and intend to resume dividend payments in 2013.

As you can see from the massive screen shot below, KBC shows strong green bars (i.e. positive) on most valuation & growth measures. So if the broker forecasts turn out to be correct, then these shares should go up. However, I'm not convinced that broker forecasts are necessarily reliable, given KBC's tendency in the past to deliver nasty suprises.

Also note from the screen shot below how I'm using the "Notes" button to jot down my own thoughts on companies, which is a really handy way of keeping your info in one place & to hand, without having to keep separate spreadsheets, etc.

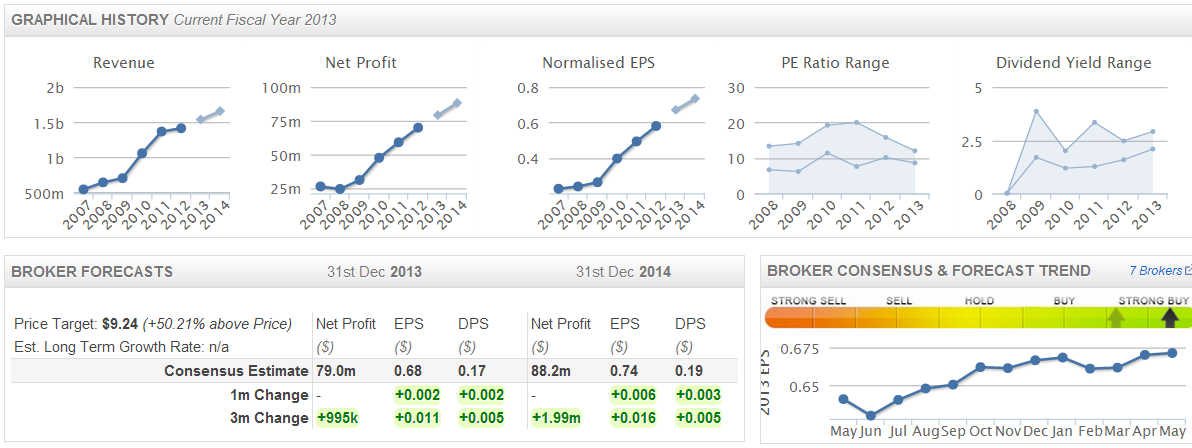

Kentz (LON:KENZ) is a much larger company than I usually look at, £465m market cap at 395p per share. However, it is looking interesting on several levels. Firstly, check out this superb track record, from the "Graphical History" section of the Stockopedia StockReport:

I really like the way profit & EPS are in a lovely smooth trend upwards, yet the valuation graphs actually show the PE range coming down, and the dividend yield range edging up. These graphs are a fabulous way of really quickly absorbing a company's track record & valuation in a couple of seconds.

NB. Please note that Kentz reports in US dollars, so the charts above are shown in dollars!

The forward PER of 8.9, and dividend yield of 2.8% look good value to me (these are correctly converted into sterling by the way!).

Their IMS this morning looks really good - mentioned a "very positive start to 2013". I might have to nip in & buy a few of these at the opening bell.

Superglass Holdings (LON:SPGH) have announced that their rescue refinancing has been successful, subject to shareholder approval (which is probably a formality). They are consolidating the shares from 2p to 50p, and have fixed their problems with bank debt, with about half of it being switched into convertible shares.

I was toying with the idea of nipping in to buy a few shares, but the trouble is I don't know how much profit the restructured business is likely to make. So without that information, it's not something I could buy, yet. But at least the downside risk now looks to have been eliminated.

Post 8 a.m. comments

There's not really a lot else to report on from the small cap space this morning. Most of the trading announcements today are from mid to larger caps.

I've had a quick look at Telit Communications (LON:TCM) which makes communications modules that allow equipment to communicate with each other wirelessly. Sounds an interesting space, but they don't seem to have made any significant or repeated profits historically, despite turnover rising strongly.

So I'm taking their trading update today about turnover being up 17% in Q1 with a pinch of salt.

As a post-script, the market has reacted fairly positively to the contract win from KBC Advanced Technologies (LON:KBC), with their shares up 3.5% to 67p. I remain a holder there.

I managed to buy some Kentz (LON:KENZ) early at 405p, they then rose to 416p, but are back down to 410p now, and at that price I think they look good value, and are well worth a look - although as always, please do your own research, and please remember this Blog is just my personal opinions & should definitely not be misconstrued as financial advice.

I hope you enjoy the long weekend. I have my best friend from home visiting me here in Hove, so will be spending most of the weekend in eateries & drinkeries around Brighton, and on the beach if it's warm enough!

Bye for now, and see you back here on Tuesday morning at 8 a.m.

Regards, Paul.

(of the shares mentioned today, Paul has long positions in KBC and KENZ, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.