Pre 8 a.m. comments

Good morning! Looks like it's either a very quiet day for announcements, or investegate is broken again!?

I have a small long position in Goldplat (LON:GDP), unusual for me as it's both overseas and in the resources sector (both of which are usually things I avoid), but rules are made to be broken. It makes steady profits from recycling/recovery of Gold from equipment used in Gold extraction. There's an unusual announcement this morning concerning the acquisition of a 10% stake in the company by Fidelity, which explains the unusually large reported trades that I noticed recently.

The stake was sold by Artemis, who retain 10.4%, and interestingly (and unusually) have entered into a voluntary 12-month lock-in with their remaining shares. That's quite an innovative solution in preventing the market worrying about how they might dispose of their remaining shares, and means they won't be dribbled out into the market piecemeal thus depressing the share price. By stating that, and signing a 12 month lock-in, Artemis are helping to prevent an overhang occurring. I like the creative thinking there, although one hopes it's not an April Fool, give the date of the lock in agreement?!

Goldplat have also slipped in a brief statement at the end of this announcement, saying;

Russell Lamming, CEO, stated: "The Company is delighted to welcome Fidelity to its shareholder register. Fidelity's notable investment in the Company endorses the Board's belief that Goldplat offers shareholders significant upside potential through its robust cashflow generation and ability to self-fund the sustainable growth of gold recovery operations in Africa while rewarding shareholders with progressive dividend and share buy-back policies."

Again, a bit of an unusual way of doing things, but there we go.

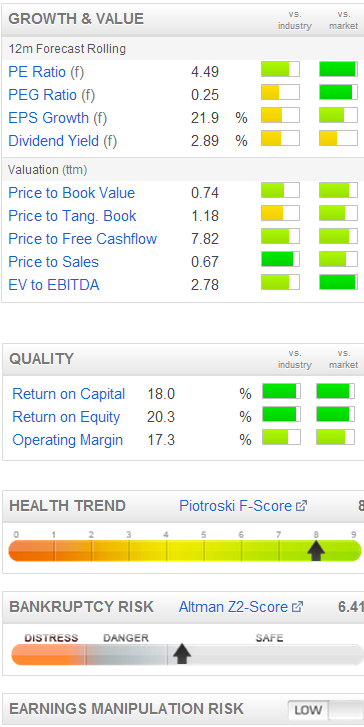

The shares certainly seem good value, with net cash, a decent dividend yield, and one of the lowest PERs I've seen in a while from a company with net cash.

Check out the valuation section of the StockReport (on the left).

Software Radio Technology (LON:SRT) has issued a trading update which says that results for the year ended 31 Mar 2013 are expected to be "ahead of market expectations". That doesn't seem to stack up, as by my calculations their £1.5m profit after tax figure stated today, works out at 1.3p per share EPS, whereas Stockopedia shows market consensus as 1.35p, so if anything it looks like a slight miss to me. So it would be interesting to clarify that with the company.

This puts the company on a PER of 15.7, which doesn't look good value to me, particularly given the accident-prone nature of the company, which has disappointed in the past. So it's not for me. Perhaps I am being unduly harsh though, as the company does claim to be at the "beginning of the growth path". They make beacons for ships.

They also report a year end cash position of £1.5m, and EBITDA of £2.2m. I haven't checked whether EBITDA excludes development spending or not? An innovative feature is that SRT say they will host a live web cast to answer investor questions on 17 Apr. Investors should applaud such efforts to connect by companies, and let's hope we see more of that kind of thing.

Intercede (LON:IGP) issue an in line with expectations trading statement for th eyear ended 31 Mar 2013. The only forecast I can find is for a loss of £0.6m for the year, so doesn't look terribly exciting.

Post 8 a.m. comments

Running a bit late today, my apologies.

A few more things to comment on. I note that Plastics Capital (LON:PLA) shares have risen 9% today to 88p, which is only getting them back to where they were in 2011, so I could see more upside on that price in the long term, but it's a slow burner. PLA is a collection of niche plastics companies, which throw off good cashflow that is currently being used to repay debt. Therefore the shares should just quietly re-rate as the debt is brought down to more manageable levels. The PER is undemanding, and is paying quite rapidly rising dividends (from a low base).

Regulars might remember that Plastics Capital was the company where myself and renowned investor David Stredder interviewed the Chairman, Faisal Rahmatallah in the first and (so far!) only Mellocast interview, by investors for investors. We had the video professionally made, and it seemed to be well received. It would be good to do an update with Faisal next time they issue results, I must give him a call.

We'd like to do some more CEO interviews (probably somewhat shorter next time), but Dave & I are very picky about which companies we will consider for interviews. However, if a company gets a positive mention in my reports here, then it would be suitable for an interview, so by all means get in touch if you are, or you represent such companies..

We're thinking about the possibility of trying it out by telephone too, as the format used by BRR Media seems to work very well, although the questions could be more searching perhaps.

I'm supportive of all efforts to get better information out to private investors, whoever is doing it.

It's interesting to note that whilst the FTSE100 has been having a sharp fall in the last few days, my portfolio of value shares has actually risen, which is encouraging. I do think you can sleep a lot more soundly in small caps with good value characteristics, and they don't tend to sell off much in downturns either, as the shareholder base thinks longer term, and buys the dips for the dividend yield.

OK, that's it for today. Last day of the tax year today, so no doubt everyone is busy juggling their portfolios to minimise their CGT liability, although I always feel that having a CGT liability is a nice problem to have, and 28% is a reasonable rate of taxation, so better to just cough up in my view. After all, public services have to be paid for somehow.

See you at 8 a.m. on Monday morning, and have a good weekend.

Regards, Paul.

(of the companies mentioned today Paul has a long position in GDP, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.