Pre 8 a.m. comments

A UK fund, called New Pistoia Income Ltd has this morning announced an increase to above 4% in Indigovision (LON:IND). So what, you may ask? What intrigues me is that this is a former >3% shareholder in the company, which sold out in Dec 2011. So here they are, as a fund that knows IND well, buying back in. Therefore it seems to suggest that New Pistioia share my belief that the turnaround strategy of the new CEO at IND is credible, and stands a good chance of delivering very much better performance this year & next year.

As I've mentioned before, the main risk with IND currently is that they need to achieve an H2 (6m to 31 Jul 2013) of more than double H1 in EPS terms, in order to achieve forecast full year EPS of 32.7p. Management are upbeat about the prospects for H2, due to projects in the pipeline, and new product launches, but I can understand some investors wanting to see the figures in the bag before relying on them.

Of course the shares will be a good bit higher if you do wait for confirmation, so personally I'm anticipating success, & hoping for the best. Investing is ultimately about backing management, and I don't recall seeing a more intensely focussed CEO than IND's, who is really leading from the front to improve the company's performance in many areas. That has to deliver better figures at some point.

Results for the year ended 31 Dec 2012 from Globo (LON:GBO) look very impressive on the face of it. Turnover (from continuining operations) up 67%to E46m, EBITDA up 42% to E24m, and profit before tax up 43% to E17.2m.

As mentioned before, this company uses aggressive accounting policies, including capitalising a large amount of development spending each year. So when you look at the cashflow statement, it shows a very different picture.

Net cash from operating activites was E13.2m, but E11.6m was spent on purchases of tangible & intangible assets - in previous years this has been overwhelmingly capitalised development spending, which are internal costs, so arguably should really be fully expensed through the P&L each year.

This year there is also a £6.7m cash outflow relating to the disposal of a subsidiary, which seems to suggest that they gave away that amount of cash with the disposal of their Greek operations? Seems a bit strange to me.

Furthermore, this company which is presented as being highly profitable and successful, once again had to support itself with a E12.1m equity fundraising (on top of the E20.6m fundraising in 2011). I just don't buy it. To be worth £140m, this business should be throwing off bucketloads of cash, not consuming cash. Also, the balance sheet shows pretty high levels of debtors + work in progress, which total up to E38m in current assets, plus E9.7m of long term debtors, which look very high relative to E46m turnover from continuing operations.

So there are enough potential red flags there to make me want to deploy my bargepole with this one, despite the apparently good performance presented.

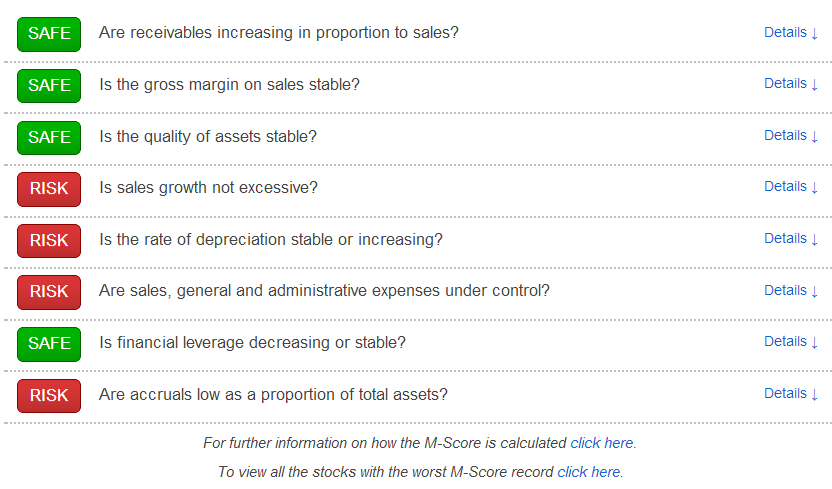

Note that GBO is showing a bad score on the Beneish M-Score - which flags up a risk of "earnings management". I've not looked into this system, but I know Ed at Stockopedia likes it, and told me it correctly predicted problems at Cupid, amongst others. Click here (or click on the screenshot) to view the relevant Stockopedia page on the M-Score analysis for Globo (this screenshot shows part of that page).

There was a positive write-up on Vislink (LON:VLK) in the FT over the weekend, highlighting the value in the company. I agree, and indeed used the sharp dip last week to 28p to top-up. This is a cash rich company which is on a growth strategy under new management, and also pays an excellent dividend yield. I covered the recent results announcement from Vislink in this column, so you can always just search by company name or ticker to look back. I think the shares are overdue a re-rating.

I'm surprised that Tesco (LON:TSCO) have failed in the USA, who face a bill of about £1bn to exit from their Fresh & Easy business in the USA, according to the Telegraph. Tesco have succeeded elsewhere overseas, so I'm curious as to why the USA didn't work for them.

Post 8 a.m. comments

Dutch and Polish publising group Mecom (LON:MEC) has put out a pretty grim sounding profits warning. I dropped this one from my portfolio quite a while ago, having done well on a re-rating, but I became concerned that their businesses were declining at a pretty alarming rate. That's continuing, with advertising down a huge 28% in Jan & Feb 2013 compared with the prior year. That has improved somewhat, but will still be over 20% declines in Mar & Apr. I wouldn't want to invest in any company that is contracting at that sort of rate, as it means that business is in terminal decline, once cost cutting can no longer keep up with declining turnover.

Interestingly, they refer to the economic situation in Holland as a crisis, one tends to think of only Southern Europe as being affected by the Eurozone crisis, but it's clearly wider than that.

Mecom is not one that I'm planning on revisiting. I see they are down 31% to 56p this morning, hardly surprising considering the statement ends by saying;

Taken together, therefore, if the adverse pressures described above do not reduce considerably from current levels, Group EBITDA is likely to fall materially short of current market expectations.

This might be a good time to look at shares in peat producer William Sinclair Holdings (LON:SNCL). They have issued a trading update today saying that exceptionally cold spring weather has caused a delay to the growing season, as you would expect. That's obviously a one-off, so shouldn't really affect how investors value the company. Which may possibly provide a buying opportunity?

It doesn't show on the above chart yet, but the latest price is down to 114p, so that looks to be a potentially favourable entry point, if you like the underlying business. It looks good value on a PER and dividend yield basis, but not enough to make me want to investigate much further, as I'm already over-committed with too many existing positions. There comes a point where you just have to reject every new share idea you come up with, unless they are amazingly cheap, which not many things are right now (although I'm still finding the odd one).

Findel (LON:FDL) issues a year-end (29 Mar 2013) statement which says that full year resuts should be in line with market expectations, that the financial position continues to improve, and net debt is lower than last year end.

I've never liked this company, and question whether it is really viable in the long run - it you total up the losses in the bad years, they seem to exceed the profits in the good years. Also it has all the headaches of running a massive extended payments debtor book to its customers, and hence carrying a load of bank debt to finance it. So there will inevitably be big write-offs whenever the economy tanks.

The number of shares in issue has increased 9-fold, in stages, since 2007 as they had to repeatedly raise money to stay afloat. It's low margin stuff, and they haven't paid a dividend since 2009. Looks pretty awful to me, but that's just my personal opinion, and DYOR as usual.

Maker of specialist optical equipment, Gooch & Housego (LON:GHH) issues a reassuring trading update. I like the way they have given it a title, to highlight the key message, namely, "Trading in line with expectations".

If done honestly, then a title like that is very helpful, because investors read every trading statement with one question in mind, namely, "is this good or bad?", and often mixed trading statements can take some time to decipher. So I like a simple title that conveys the key message, as has been done in this case.

I can't get excited about the valuation though, on a fwd PER of about 14, and a 1.4% dividend yield. It's difficult to see enough upside on those numbers to arouse my interest.

There's an interesting announcement from voice recognition software company Eckoh (LON:ECK). It's some sort of partnership agreement, but doesn't say who with. It appears to be with a payments company and the comments from Eckoh's CEO sound intriguing;

"We are delighted to have secured this strategically important agreement, which because of the financial commitment and the potential value of the opportunities already being discussed, we anticipate will generate significant revenue for Eckoh over the three year term. This partnership further extends our indirect sales channel, which has been a key focus for the business and this relationship has the promise to be the largest driver of partner activity in this new financial year."

Eckoh shares don't look cheap, on a forward PER of almost 20, but if there is stronger growth in the pipeline then it gets a lot more interesting.

I hope their voice recognition is somewhat better than Siri on my iPhone, whose jumbled results are often quite hilariously inept! I lost my rag with Siri the other day, and he responded by saying, "would you like me to look up "Offer Fox Sake" on the internet?!!!"

There is also a contract win from SCISYS (LON:SSY) to provide software to the BBC. Although a £1m contract over 3 years really shouldn't warrant a separate RNS, given that it doesn't look material to turnover of £40m p.a.

I looked at SSY a couple of months ago, and decided against buying any, as it looks a mature business, and mainly supplying public sector. Given that spending constraints are likely to be only increasing there for the foreseeable future, it's not an area I want to invest in. Although the share price has come down 62p, where a forecast PER of just 7.5 is looking attractive. Given that their operating profit is only about 4% of turnover, there must be a higer than usual chance of a profits warning here, so a low PER isn't necessarily a good thing if taken in isolation.

Well that's kept me busy this morning! See you same time tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in IND and VLK, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.