Pre 8 a.m. comments

French Connection (LON:FCCN) have appointed Adam Castleton as their new Finance Director. Coming so quickly after the unexpected departure of the old FD, this suggests that it was probably being arranged before the previous FD left. I stumbled across this article about the old FD's departure, which suggests that trading is still poor at FCCN. They've got time to turn it around, due to the big cash pile, but I'm not as confident as I was about the odds of a turnaround being successful, so I've trimmed back on my personal holding in the company, which is now only small. I've usually found that an FD leaving any company can be a sign of trouble, but we'll have to see what their next trading update says.

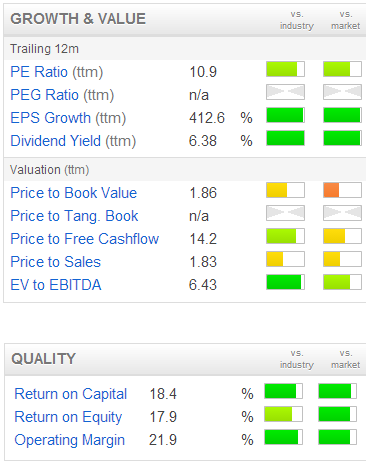

GVC Holdings (LON:GVC) has issued an AGM trading update, saying they are in line with market expectations, and are busy integrating the Sportingbet brand, which they acquired in March. GVC shares have doubled in the last year, but at 289p they still look good value against broker forecasts.

I can't find any forecasts on Stockopedia, but on Morningstar they show EPS of 37.4p for 2013 and 54.6p for 2014, which is a PER of 7.8 and 5.3 respectively. Although I would need to double-check that those forecasts have been converted from Euros (the company's reporting currency) into sterling.

The company has historically paid generous dividends, and the forecast yield is 7.6%, rising to 10.2%, again those figures would need to be checked, as they look unusually high, so as always please do your own research. But if those PER and yield figures are correct, then it certainly seems good value.

I think we might have one or two GVC shareholders amongst members who read these reports, if so please feel free to comment in the comments below.

Post 8 a.m. comments

Going back to GVC Holdings (LON:GVC), I've had a couple of chats & emails with friends who have kindly provided me with useful information on the company.

Broker forecasts for calendar 2013 and 2014 are for E44.1c and E64.3c respectively. Converting those into sterling at today's rate of E1 = £0.8465 gives us forecast EPS of 37.3p and 54.4p.

At a share price of 293p those forecast EPS figures generate a forecast PER of 7.9 for 2013 and 5.4 for 2014, which certainly looks cheap.

That's a big jump in EPS from 2013 to 2014, so I'd want to get into the detail and find out why the broker thinks such a large increase in earnings is on the cards. It's probably connected with the acquisition of Sportingbet, which again is something that needs looking into, as I'm not sure what level of debt was taken on, etc. So it needs more work, but looks potentially interesting.

As I've also been discussing with other investors, there are big regulatory issues to think about in the online gaming sector. As we saw some years ago, when the USA shut off foreign online gaming companies, and their shares plummeted, these are unusual risks in this sector, which can destroy a previously good business model overnight if a Government decides to do something aggressive.

Another sector risk is the fact that poker sites in particular rely on player liquidity. Poker is all about playing against other people, and the house just takes a rake. So you need plenty of players at all times and at all levels, to make a poker site viable. If a tipping point is reached where there are inadequate players at all times, then the site can quickly implode, as players have little loyalty to individual sites, and often play on multiple sites.

On the conventional gambling side (where people play against the house), then there is constant attrition of users, as they basically run out of money. So they have to keep advertising to recruit new mugs who are happy to give their money away.

Hence lots of risks, but even allowing for that a 2014 forecast PER of just 5.4 looks pretty interesting.

Interesting to see that despite beating on its headline numbers, Quindell Portfolio (LON:QPP) shares have sold off after yesterday's results, and are down another 11% this morning to 10.75p.

It's clearly the Debtors figure which has spooked people, and rightly so, because it's huge. A large & long-dated debtor book can hide a multitude of sins, and in the past this was the un-doing of companies in the same sector, e.g. Helphire and Accident Exchange.

On the other hand, bulls of QPP tell me that their business model is different, and they co-operate with the insurers, and have contracts with them, whereas ACE and HRR fought against the insurers.

Also, I feel that one of my comments yesterday should be corrected - I commented that the Debtor figure was larger than the entire year's turnover, so it looked like they hadn't collected in any cash. As a reader pointed out, in actual fact QPP had made a series of acquisitions during 2012, and therefore the full Balance Sheet figures for the acquired companies will appear on QPP's year-end consolidated balance sheet, but the Profit & Loss account might only show a small impact from a few weeks or months trading of the acquired companies.

Of course he is absolutely right on that point, as we discussed in the comments section after yesterday's report, but just in case anyone did not see the comments then thought I would flag it up here again today.

On balance, QPP is still a bargepole share for me, for the following reasons;

- Expansion happening too quickly & with considerable dilution.

- Debtors still far too large - possible future write-offs?

- Operating profit margin looks too high to me to be reasonable and/or sustainable.

- Rampy-looking presentation of results.

- Concerns over the CEO - track record controversial, visionary or maniac, or somewhere in between?!

- The City doesn't seem to buy the story - few Institutional holders - why?

If the bulls are right, then they could be on course to double or triple their money as the business model is proved up. If the bears are right (I understand it's being shorted by Evil & Lucien) then they will clean up. From my point of view (I'm neither long nor short), there are just too many things that make me uneasy to make it a share that I would be comfortable investing in.

A company that I've mentioned here before, where I'm waiting for the results of the latest fund-raising, is 2Ergo (LON:RGO). In my opinion it's too risky to invest in at the moment, in particular because the last fund-raising when the shares were 42p, was completed at 10p! So another deep dilution could be on the cards.

A rather worrying statement was put out at 4pm on Friday, which included this sentence:

However, no further assurance can be given on the future of the Group until it is able to ascertain the quantum and terms of funding available, which it expects to be able to announce by mid May.

Therefore I am certainly steering well clear unless & until a refinancing is announced. It looks like their last chance saloon, and I wouldn't be surprised if the next refinancing is at another deep discount, or worse. The shares are now down to 6.5p.

I'll sign off now for today, very little other news for small caps today.

Tomorrow will be a shortened report here, as I shall be dashing for a train to London as I'm attending the London Value Investor Conference. I might even try to write some commentary whilst on the train via my iPad. Also, I'll be doing a write-up here on the most interesting presentation from the conference.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in FCCN, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.